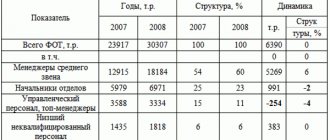

Methodology for calculating average earnings

Let's say there was a case at your company in which you must calculate the average earnings to pay an employee. To determine this indicator, proceed according to the algorithm below:

Stage 1. Determine the period for calculating average earnings

This period is called the settlement period, and in general it is 12 months. For example, if an employee was absent from work due to a donation on 04/15/17, then the billing period in this case is 04/01/16 – 03/31/16. The Labor Code provides for certain cases when the billing period is 730 calendar days (2 years). This period should be taken into account for payments for pregnancy and child care up to 1.5 years.

Step 2: Consider excluded periods

When determining the pay period, take into account the days the employee is absent, for example, due to:

- vacation at your own expense;

- illness according to the certificate of incapacity for work;

- caring for a disabled child;

- business trip;

- downtime.

These periods should be excluded from the calculation. Also excluded are days of maintaining average earnings (days of participation in judicial proceedings, forced absenteeism, etc.). You can find a complete list of excluded days in the Labor Code.

Step 3. Determine the employee’s income for the pay period.

If the billing period is a calendar year, then you will need to sum up the employee’s entire income for this period. In this case, income means all payments within the remuneration system, including bonuses, compensation, bonuses, allowances, etc.

To determine the types of payments taken into account when calculating average earnings, follow the Regulations on Remuneration adopted by the enterprise.

Step 4. Calculate the employee's average daily earnings. To calculate, use one of the formulas below.

If an employee has worked all the days of the pay period, that is, he has no excluded days, then calculate the average earnings as follows:

SrDnZ = SrGodZ / 12 / 29.3,

- where Average daily earnings;

- SrGodZ – average earnings for the billing period (annual earnings);

- 29.3 is a fixed indicator of the average monthly number of calendar days.

If during the year an employee was sick, absent from work due to a medical examination, etc., then to calculate the indicator, use the formula:

AvgDnZ = AvgDnZ / (ColDn1 + ColDn2),

- where KolDn1 is the number of calendar days in months that the employee worked in full;

- ColDn2 – the number of calendar days in the month in which there is an excluded period.

Calculate days in “full” months (the employee was present at work all days) as follows:

ColDn1 = NumberMon * 29.3,

- where NumberMons is the number of months during the year that the employee worked in full.

Calculate the number of days with excluded periods as follows:

ColDn2 = 29.3 / (DnMons *DnPr),

- where DnMes – the total number of calendar days in a month with an excluded period;

- DnPr – the number of calendar days in a month minus the excluded period.

After you have calculated the average earnings, proceed to determining the payment amount. In this case, it all depends on the number of days for which the employee is entitled to payment.

If an employee underwent a medical examination and was absent from work for 1 day, then he is entitled to payment of average earnings for 1 day (average earnings indicator * 1 day).

Categories

On the basis of what document is the procedure for calculating average earnings determined?

Article 139 of the Labor Code of the Russian Federation for all cases of determining the size of the average salary provided for by the Labor Code of the Russian Federation establishes a uniform procedure for its calculation.

This procedure is mandatory for use by all enterprises, institutions and organizations, regardless of organizational, legal forms and forms of ownership.

The procedure for calculating the average salary established by Art. 139 of the Labor Code of the Russian Federation, determined by Decree of the Government of the Russian Federation of April 11, 2003 No. 213 “On the specifics of the procedure for calculating average wages.”

In what cases does the Procedure apply?

The procedure for calculating the average wage determines the Procedure for calculating the average wage reserved for employees who are in labor relations with institutions, organizations and enterprises in the following cases:

– the employee’s stay on leave (annual, additional, educational) (Articles 115, 116, 117, 118, 119, 173, 174, 175, 176 of the Labor Code of the Russian Federation);

– payment of compensation for unused vacation upon dismissal (Article 127 of the Labor Code of the Russian Federation);

– assignments on a business trip (Article 167 of the Labor Code of the Russian Federation);

– payment of severance pay upon dismissal and subsequent payments for the period of employment (Article 178 of the Labor Code of the Russian Federation);

– elections to trade union bodies and commissions on labor disputes (Article 171 of the Labor Code of the Russian Federation);

– transfer to another permanent lower-paid job (Article 182 of the Labor Code of the Russian Federation);

– referrals for medical examination (Article 185 of the Labor Code of the Russian Federation);

– reinstatement of the employee at work by decision of the state labor inspectorate or court (Article 178 of the Labor Code of the Russian Federation);

– in other cases when employees, for one reason or another, provided for by the Labor Code of the Russian Federation, retain their average earnings.

Does the Procedure apply to all cases?

The procedure does not apply to cases where other rules for calculating average earnings are established by law, namely when:

– assignment of pensions (Law of the RSFSR dated November 20, 1990 No. 340-1 “On state pensions in the RSFSR”);

– determining the amount of compensation for damage caused to the employee’s health (Rules for compensation by the employer for damage caused to employees by injury, occupational disease or other damage to health related to the performance of their job duties);

– determining the amount of benefits for state social insurance (Regulations on the procedure for providing benefits for state social insurance);

– determination of unemployment benefits (Law of the Russian Federation of April 19, 1991 No. 1032-1 “On employment in the Russian Federation”, as amended and supplemented);

– in some other cases.

How is the average monthly number of calendar days 29.60 determined?

The average monthly number of calendar days 29.60 is annual and is determined on the basis of a seven-year cycle, taking into account a six-day working week, taking into account weekends and holidays, a reduction in working hours on pre-holiday days, as well as the transfer of days off that coincide with holidays to the working days following the holidays days.

Can the amount due to an employee for a month be less than the minimum wage?

In all cases, the monthly salary of an employee on the day of payment, due to an employee who has worked the full standard of working time in the billing period and fulfilled labor standards (labor duties), cannot be lower than the minimum wage established by federal law (Article 133 of the Labor Code of the Russian Federation ).

However, if in accordance with Art. 93 of the Labor Code of the Russian Federation, by agreement between the employee and the employer, the employee is assigned a part-time working day or a part-time working week, then remuneration in these cases is made in proportion to the time worked or depending on the amount of work performed by the employee.

Accordingly, the average salary retained by the employee (for example, for the period of the next vacation) may be lower than the minimum wage. However, part-time work does not entail any restrictions on the duration of annual leave for employees.

What payments with the release of the Order are taken into account when calculating average earnings?

To calculate average earnings, all types of payments provided for by the remuneration system that are used in the relevant organization are taken into account, regardless of the sources of these payments, which include:

a) wages accrued to employees at tariff rates (official salaries) for time worked;

b) wages accrued to employees for work performed at piece rates;

c) wages accrued to employees for work performed as a percentage of revenue from sales of products (performance of work and provision of services), or commission;

d) wages paid in non-monetary form;

e) monetary remuneration accrued for time worked to persons holding government positions;

f) fees accrued in the editorial offices of mass media and art organizations for employees on the payroll of these editorial offices and organizations, and (or) payment for their labor, carried out at the rates (rates) of the author's (production) remuneration;

g) wages accrued to teachers of primary and secondary vocational education institutions for hours of teaching work in excess of the reduced annual teaching load (taken into account in the amount of one tenth for each month of the billing period, regardless of the time of accrual);

h) the difference in the official salaries of employees who transferred to a lower-paid job (position) while maintaining the amount of the official salary at the previous place of work (position);

i) wages, finally calculated at the end of the calendar year, determined by the remuneration systems (counted in the amount of one twelfth for each month of the billing period, regardless of the time of accrual);

j) allowances and additional payments to tariff rates (official salaries) for professional excellence, class, qualification category (class rank, diplomatic rank), length of service (work experience), special conditions of civil service, academic degree, academic title, knowledge of a foreign language, working with information constituting state secrets, combining professions (positions), expanding service areas, increasing the volume of work performed, performing the duties of a temporarily absent employee without exemption from the main job, leading a team;

e) payments related to working conditions, including payments determined by regional regulation of wages (in the form of coefficients and percentage bonuses to wages), increased wages for hard work, work with harmful and (or) dangerous and other special conditions labor, for night work, payment for work on weekends and non-working holidays, payment for overtime work;

l) bonuses and remunerations, including remuneration based on the results of work for the year and one-time remuneration for length of service;

m) other types of payments provided for by the remuneration system.

What are “other types of payments provided for by the remuneration system”?

Such payments, for example, include monthly bonuses to the official salary of employees:

– for the complexity of the work;

– for the intensity of work;

– those involved in working with ciphers used in state and government, departmental and interdepartmental encryption communication networks, and a number of others.

What is excluded from the calculation period for calculating average earnings?

When calculating average earnings, time is excluded from the calculation period, as well as amounts accrued during this time, if:

a) the employee retained his average earnings in accordance with the legislation of the Russian Federation;

b) the employee received temporary disability benefits or maternity benefits;

c) the employee did not work due to downtime due to the fault of the employer or for reasons beyond the control of the employer and employee;

d) the employee did not participate in the strike, but due to this strike he was not able to perform his work;

e) the employee was provided with additional paid days off to care for disabled children and people with disabilities since childhood;

f) the employee in other cases was released from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation;

g) the employee was provided with days of rest (time off) in connection with work beyond the normal working hours under the rotation method of organizing work and in other cases in accordance with the legislation of the Russian Federation.

How to correctly determine the calculation period when calculating average earnings if an employee goes on another vacation?

Both the Order that came into force and Art. 139 of the Labor Code of the Russian Federation, the calculation period is three calendar months (from the 1st to the 1st day) preceding the employee’s departure on annual leave, study leave and other leaves with which the corresponding payment is associated. So, if an employee goes on vacation, for example, from April 4, 2005, then his pay period will be three calendar months - January, February, March.

If the employee worked at least one day in the pay period

(for example, in the billing period of January, February and March, only one day was worked - February 7, and the remaining days the employee was on sick leave or was absent for reasons provided for in the Procedure), then all calculations are made based on the accrued wages for that day (on in this case - February 7).

Incompletely worked months that fell within the billing period (for example, in the billing period January, February and March, the employee was sick from January 13 to January 19 and from February 14 to March 22) or months in which there are no days worked (for example, in the billing period January, February and March, the employee was sick throughout March and received disability benefits), other months

, not provided for by the billing period,

are not replaced

.

For other cases (except for vacation and compensation for unused vacation), the calculation period for calculating average earnings is 12 months preceding the moment of payment.

Article 139 of the Labor Code of the Russian Federation stipulates that the collective agreement may have other periods for calculating average wages, if this does not worsen the situation of workers.

It should be taken into account that changes in the billing period (for example, 12 calendar months, 6 calendar months, 3 calendar months, etc. (for all or certain categories of employees)) must be agreed upon in the prescribed manner with employee representatives. Coordination must be carried out either in the process of conducting collective negotiations on the development, conclusion and amendment of the collective agreement of the organization with the inclusion in the concluded collective agreement of provisions governing the use of the billing period for calculating average earnings in the organization, or by adopting the corresponding legal act of the organization, agreed upon with representatives of employees ( Article 2 of the Law of the Russian Federation of March 11, 1992 No. 2490-1 “On collective agreements and agreements”).

The decision made to change the billing period must be reflected in the local regulatory act of the organization.

Is the time an employee is on a business trip excluded from the calculation period?

Regarding business trips, it should be borne in mind that in accordance with Art. 167 of the Labor Code of the Russian Federation, posted workers retain their place of work (position) and average earnings throughout the entire period of the business trip. Therefore, the time spent on a business trip is excluded from the calculation period.

Sometimes, if an employee is sent on a business trip for 2 days, then working days are entered on the timesheet. Is it possible?

This is illegal and contradicts Article 167 of the Labor Code of the Russian Federation.

The billing period includes the time when the employee was sick. Is this time included in the billing period?

The time during which the employee received temporary disability benefits, as well as maternity benefits, are excluded from the calculation period.

Based on clause 6 of the extended and not inconsistent with the Labor Code of the Russian Federation, when determining the average daily earnings in all cases (including when calculating vacation) provided for by the Procedure for calculating average earnings, non-working holidays established by the legislation of the Russian Federation are excluded from the calculation period.

The employee was ordered to work on a day off. Is this day counted towards actual hours worked?

No. Days are taken into account according to a five-day working week schedule (except for vacation pay). The accrued amount for work on that day is included in the calculation of average earnings.

How to determine average earnings if there is no actual accrued wages or actually worked days in the billing period, or if this period consists of time excluded from the billing period?

Clause 5 of the Procedure provides that if an employee during the billing period did not have actual accrued wages or actually worked days, or this period consisted of time excluded from the billing period in accordance with clause 4 of these Regulations, the average earnings are determined based on the amount wages actually accrued for the previous period of time equal to the calculated one.

Here we can consider the following cases.

The employee goes on regular leave from October 3, 2005. The billing period is three calendar months - July, August and September.

1. July worked out in full and total wages accrued, conditionally, are 3,000 rubles. August and September - the employee was absent (for example, he was on a business trip and was sick). August and September are not replaced by other months. Average earnings are calculated based on one month - July (3000: 29.6).

2. July and September - the employee was absent (for example, he was on vacation at his own expense, on a business trip and was sick). August - the employee worked only 1 day, and for this day he received a total salary (taking into account the established ones: official salary, allowances), conditionally, 250 rubles.

Only one day was worked in the billing period, which means that average earnings are calculated based on this one day worked - 250 rubles. : 1.4,

where 1;4 is the converted working day to the calendar.

3. July, August and September - the employee was absent (for example, on a business trip, on vacation at his own expense, or sick).

The beginning of his long continuous

absence

was from October 17, 2004.

In this case, the calculation period will be three calendar months - not October (the beginning of the month of continuous long-term absence), September and August 2004, but

September, August and

July 2004

Since the event - going on another vacation - occurred in 2005, the above-mentioned resolution of the Government of the Russian Federation and Art. 139 Labor Code of the Russian Federation. In this regard, the accrued amount for September, August and July 2004 will be divided by 3 and by 29.6 if the billing period is fully worked or the number of calendar days in months not fully worked is calculated by multiplying working days according to the calendar of a 5-day working week per hour worked by a factor of 1.4.

If the employee’s absence from the workplace is not continuous

, and at least 1 day will be worked, for example, April 20, 2005, then the calculation of average earnings will be based on this one day worked.

During this long absence, will there be a subsequent increase in average earnings with an increase in the organization's tariff rates, official salaries, monetary remuneration, bonuses for qualification rank (class rank, diplomatic rank), bonuses for special conditions of public service?

Yes, with an increase in the organization (branch, structural unit) of tariff rates (official salaries, monetary remuneration), the amount of allowances for the qualification category (class rank, diplomatic rank) and for special conditions of public service, the average salary increases in the manner provided for in paragraphs 15 and 16 Order.

How to determine average earnings if there is no actual accrued wages or actual days worked in the billing period and before the billing period?

Clause 6 of the Procedure is provided for cases where the employee did not have actual accrued wages or actually worked days during the billing period and before the billing period. In this case, the average earnings are determined based on the amount of wages

, actually accrued for the days actually worked by the employee in the month of the occurrence of the event that is associated with the preservation of average earnings.

For example, an employee was hired according to an order from the organization on September 12 with a salary of 1000 rubles. He received an additional payment for holding multiple positions in the amount of 50% of his official salary in accordance with the established procedure. The employee worked for a week - 5 working days, or (translated into calendar days) 7 calendar days 5 x 1.4 = 7). For the week, he was accrued a total of, conditionally, 450 rubles, and based on a preliminary agreement with the administration, he was immediately granted leave for 14 calendar days.

In the example given, the average daily earnings to pay for vacation will be determined as 450 rubles. : 7 and multiplied by the duration of vacation in calendar days - 14.

How to determine average earnings if in the billing period, before the billing period and before the occurrence of the event that is associated with maintaining the average earnings, there is no actual accrued wages or actually worked days?

If an employee during the billing period, before the billing period and before the occurrence of an event that is associated with the preservation of average earnings, did not have actually accrued wages or actually worked days in the organization, the average earnings are determined based on the tariff rate

the rank established for him,

official salary

, monetary remuneration.

Example 1

The employee started work on September 12 with a salary of 1000 rubles. He took leave without pay for two weeks in accordance with the established procedure, and at the end of it - from September 26 - the employee was sent on a business trip for 5 working days.

In this case, the amount of average earnings retained by the employee will be determined as follows.

Since the employee in the billing period and before the event did not have earnings from which the average earnings should be calculated, it is determined from the official salary established for him:

1000 rub. : 22 days x 5 days = 227 rub. 25 kop.,

where 22 is the number of working days in a five-day working week in September;

5 - days on a business trip.

Example 2

The employee started work on August 1 with a salary of 2,000 rubles. But on August 1st he fell ill and was on sick leave for 3 months. After the end of the illness, for example, he was immediately sent on a business trip for 5 working days.

In this case, the amount of average earnings retained by the employee will be determined as follows.

Since the employee in the billing period and before the event did not have earnings from which the average earnings should be calculated, it is determined from the official salary established for him:

2000 rub. : 21 days x 5 days,

where 21 is the number of working days in a five-day working week in November;

5 - days on a business trip.

We calculate average earnings

In order to understand in more detail the procedure for calculating the amount of payment based on average earnings, we will consider examples of typical situations.

The employee was on a business trip

Korpus JSC Housekeeping Department Specialist K.D. Spiridonov sent on a business trip to Astrakhan to conduct an inventory. The business trip period is 5 days (10 – 14.07.17), including days of departure and arrival. The billing period for Spiridonov is 07/01/16 – 06/30/17. During this period Spiridonov:

- underwent a medical examination for 1 day on 02/08/17;

- took out a vacation at his own expense for 3 days (05/20–22/17);

- was sick for 5 days (03 – 04/07/17);

Spiridonov’s salary did not change during the specified period (RUB 27,620/month). For the days he was on a business trip, the accountant of JSC Korpus calculated Spiridonov’s payment based on average earnings:

- Spiridonov's average annual income was 331,440 rubles. (RUB 27,620 * 12 months).

- Number of days in months that Spiridonov worked in full: 9 months. * 29.3 = 263.7.

- Number of days in months with excluded periods:

- CalDnFebruary 2021 = 29.3 / (28 *27) = 28.3;

- CalDnMart 2021 = 29.3 / (31 *28) = 26.5;

- CalDnapril 2021 = 29.3 / (30 *25) = 24.4;

The total number of days in months with excluded periods is 79.2. Spiridonov's average daily earnings: 331,440 rubles. / (263.7 + 79.2) = 966.5 rub. At the end of July 2021, the accountant of Korpusa JSC paid Spiridonov:

- Salary calculated based on the number of days actually worked;

- Travel allowances, including compensation for travel and accommodation expenses;

- Average earnings for 5 days of a business trip: 966.5 rubles. * 5 = 4.832.5 rub.

An employee donated blood (donation)

Locksmith of Standard Plus LLC Kononenko V.R. was absent from work due to blood donation on the following days:

- 01.17 – 1 day;

- 02.17 – 1 day.

For the above-mentioned days, Kononenko is entitled to payment based on average earnings. Kononenko’s salary is 19,870 rubles. For January 2021, Kononenko was paid a bonus for fulfilling the plan - 3,120 rubles/month. To calculate the average earnings for Kononenko donation, the Standard Plus accountant determined the following billing periods:

- for payment for 01/19/17 – 01/01/16 – 12/31/16;

- for payment for 02/08/17 – 02/01/16 – 01/31/17.

Kononenko worked out each of these periods completely. Next, the Standard Plus accountant calculated the amount of annual income:

- for the period 01.01.16 – 31.12.16

RUR 19,870 * 12 = 238,440 rubles;

- for the period 02/01/16 – 01/31/17

RUR 19,870 * 12 months + 3,120 rub. = 241.560 rub.

Kononenko’s average daily earnings are calculated separately for each period:

- for payment for 01/19/17

RUR 238,440 / 12 / 29.3 = 678.2 rub.

- for payment for 02/08/17

RUR 244,680 / 12 / 29.3 = 687.1 rub.

These amounts were taken into account by the Standard Plus accountant when calculating Kononenko’s salary for January and February 2021.

The employee has taken leave

In November 2021, an employee of JSC Kontur, Platonov, took part in his annual leave - 10 days (07 – 16.11.16). The period for calculating vacation pay for Platonov is 01.11.15 – 31.10.16. Platonov’s salary is 17,330 rubles. From 06/01/16, Platonov was given an increase in the amount of 1,420 rubles/month.

In April 2021, Platonov took advanced training courses, and therefore was absent from work from April 11 to April 15, 2021 (5 days). The Kontur accountant calculated the amount of Platonov’s vacation pay as follows:

- Platonov’s total income for the period:

RUR 17,330 * 12 months + 1,420 rub. * 5 months = 215.060 rub.

- Number of days in months that Platonov worked in full:

11 months * 29.3 = 322.3.

- Number of days in months with excluded periods:

CalDnapril 2021 = 29.3 / (30 *25) = 24.4;

- Platonov’s average daily earnings:

RUR 215,060 / (322.3 + 24.4) = 623.9 rub.

- Amount of Platonov's vacation pay to be paid:

623.9 rub. * 5 days = 3,119.5 rubles.

Vacation pay was paid to Platonov on 11/01/16.

Calculation rules

To do it correctly, it is necessary to take into account absolutely all types of payments from any sources. These include:

- Wages, including coefficients and allowances (based on tariffs, salary, piecework, non-monetary, for example, payment for food, % of revenue, etc.);

- Rewards and bonuses.

The calculation does not include the following payments: financial assistance, benefits, gifts.

The amount of average income is affected by the time worked during the calendar month and the salary accrued to the employee.

Main mistakes when calculating payments based on average earnings

Let's look at the most common mistakes made by accountants when making payments based on average earnings.

Mistake #1. Payments until employment.

An employee of JSC “Marshal” Karpov was dismissed on January 16, 2017 due to the liquidation of the enterprise. 03.13.17 Karpov got a new job. For the period of employment, Karpov was paid benefits for the 1st month (01/17/17 – 02/16/17). The benefit was calculated on the basis of average earnings (531 rubles/day), based on the number of working days in the period (01/17/17 – 02/16/17, 23 working days).

Due to the fact that Karpov got a job on 03/13/17, he was not paid any benefits for the 2nd month of employment (02/17/17 – 03/16/17). In this case, the management of Marshal violated labor laws. For the 2nd month from the date of dismissal, Karpov must be paid benefits until employment (02/17/17 – 03/12/17, 15 working days):

531 rub. * 15 days = 7.965 rub.

Mistake #2. Taking into account annual bonuses when calculating average earnings.

An employee of Saturn JSC Kapustin was on a business trip from January 11 to January 13, 2021 (3 days). During this period, Kapustin retains his average earnings. Kapustin’s salary in the billing period (01/01/16 – 12/31/16) amounted to 17,320 rubles/month. 01/09/17 Kapustin was awarded a bonus based on performance results in 2021 - 10,540 rubles. Since the bonus was accrued after the expiration of the billing period, the Saturn accountant did not take this amount into account when calculating average earnings.

The indicator was calculated based on the salary:

RUR 17,320 * 29.3 = 591.1 rub.

For the period of the business trip, Kapustin was accrued the average salary for 3 days:

591.1 rub. * 3 days = 1.773.3 rub.

Despite the fact that Kapustin’s bonus was accrued outside the pay period, it had to be taken into account when determining average earnings. According to the law, annual bonuses are taken into account in the calculation regardless of the date of accrual. The Saturn accountant had to determine Kapustin’s average earnings as follows:

- Income for the billing period:

RUR 17,320 * 12 months + 10.540 rub. = 218.380 rub.

- Average daily earnings

RUR 218,380 / 12 months / 29.3 = 621.1 rub.

During the business trip, Kapustin’s average earnings were:

621.1 rub. * 3 days = 1.863.3 rub.

Mistake #3. Payments to pregnant women.

A pregnant employee of JSC Chemical Plant No. 4, Streltsova, applied for a transfer to a less hazardous job. Streltsova made a statement based on a medical report. Since there is no such vacancy at the enterprise, Streltsova’s transfer was refused.

The management of Chemical Plant No. 4 violated the Labor Code regarding Streltsova’s labor rights. Since the management of the enterprise cannot transfer Streltsova to another position due to the lack of vacancies, the employee had to be removed from harmful work. Until a corresponding vacancy appears, Streltsova must be paid benefits based on average earnings (from the moment of removal from work until the day she returns to work).

Payments taken into account when calculating average wages

Information on salary calculation is contained in the Regulations on the specifics of the procedure for calculating average wages. Based on this regulatory act, in order to correctly calculate wages, an accountant must take into account all payments. Labor legislation also speaks about this. When calculating average earnings, the following are taken into account:

- salary accrued according to tariff rates;

- piecework salary;

- wages paid in the form of interest on products sold;

- salary that does not have a monetary form;

- material rewards paid to employees in government positions;

- fees and rewards;

- teachers' salaries;

- the difference that arose when an employee was transferred to a lower-paid position while maintaining the average salary;

- bonuses to the basic salary;

- other payments provided for by law.

Average earnings: what is it, why is it needed and how to calculate

- One-time, monthly, quarterly, semi-annual bonuses are taken into account if accrued in any of the months included in the calculation.

- The bonus based on the results of work for the previous year is taken into account in any case, regardless of the month of accrual.

- Premiums accrued for a period exceeding a year are taken into account in the amount of the monthly portion for each month of the billing period. For example, a premium for a 3-year project will be included in the calculation for each month in the amount of 12/36.

- The quarterly bonus is taken into account in full if the quarter for which it is accrued is fully included in the billing period and it is accrued taking into account the actual time worked within this period.

- If the period for which the bonus was issued is not fully included in the billing period, then the bonus must be included in the calculation in proportion to the time actually worked in the billing period.

However, the 12-month period can be changed in the agreement or local act. For example, the Regulations on Average Earnings may state that its amount is calculated for 3 months, and not for 12. But there is an important nuance: in the end, the employee should not suffer, that is, his situation cannot be worsened as a result of changing the period.

- , wages are calculated based on it .

- The indicator serves as the basis for calculating some payments , for example, severance pay, compensation for unused vacation, compensation for downtime due to the fault of the employer.

- Based on average earnings, the limit of the employee’s financial liability .

- A new employee was hired and immediately sent on a business trip. Average earnings must be calculated based on the tariff rate or salary.

- The employee was hired on the 1st and sent on a business trip on the 15th of the same month. The calculation is made for the period from the date of entry to work until the business trip, that is, from the 1st to the 14th.

- The employee returned from maternity leave and immediately went on annual leave. During maternity leave, she received payments based on average earnings, so this period is not included in the calculation. It is necessary to calculate the average earnings for the period preceding the start of maternity leave. Accordingly, the same as for calculating maternity benefits.

When are average earnings applied and the procedure for calculating them (Misnikovich L

Example 1. From July 1, 2014, a restaurant employee was granted another paid vacation for 14 calendar days. His salary in the billing period (from 07/01/2013 to 06/30/2014) was 50,000 rubles. In July 2013, the employee was on a business trip for 21 calendar days (for 10 calendar days worked, he received 16,129 rubles), the remaining 11 months of the billing period were fully worked.

Let's calculate the amount of vacation pay. The number of calendar days in July 2013 for calculating vacation pay will be 9.45 days. (29, 3 / 31 x (31 - 21)). The average daily earnings will be 1706.49 rubles. (50,000 rub. x 11 months + 16,129 rub.) / (29.3 days x 11 months + 9.45 days). The calculation does not include the amount of average earnings saved for the period of the business trip and the period of the business trip itself. The amount of vacation pay is 23,890.86 rubles. (1706, 49 RUR x 14 days). In accordance with current labor legislation, an employee has the right to payment not only for the time worked, but also for individual hours and days not worked by him. In this case, payment is calculated based on average earnings. Also, an employment (collective) agreement may provide for additional cases of payments to an employee for unworked time or establish increased amounts of these payments compared to those established by labor legislation.

Let's consider in what cases, in what order, public catering establishments need to calculate average earnings and what payments should be taken into account. The types of payment for unworked time, which is calculated on the basis of average earnings, in particular, include payment for: - the period the employee is on a business trip, as well as the days he is on the road (Article 167 of the Labor Code of the Russian Federation, clause 9 of the Regulations on the specifics of sending workers to work business trips ); — annual and additional leaves (Chapter 19 of the Labor Code of the Russian Federation); — educational leaves (Chapter 26 of the Labor Code of the Russian Federation); - retained at the place of main work for employees involved in the performance of state or public duties (Article 165, Chapter 25 of the Labor Code of the Russian Federation); — days of medical examination (examination), blood donation and rest provided after each day of blood donation (Article 186 of the Labor Code of the Russian Federation); — downtime through no fault of the employee (Article 157 of the Labor Code of the Russian Federation); — time of forced absence (Article 394 of the Labor Code of the Russian Federation); — additional paid days off for caring for disabled children (Article 262 of the Labor Code of the Russian Federation). ——————————— Approved by Decree of the Government of the Russian Federation of October 13, 2008 N 749. Example 2. From July 14, 2014, a sports bar employee was granted another paid leave for 14 calendar days. In the billing period (from July 1, 2013 to June 30, 2014), as well as in the period preceding the billing period, she had no days worked.

In July 2014, before going on another paid leave, the employee worked 13 calendar days, and for these days she was accrued a salary in the amount of 22,580.65 rubles. In this case, the procedure for calculating average daily earnings established by clause 7 of Regulation No. 922 is applied. The number of calendar days in July 2014 for calculating vacation pay will be 12, 28 days. (29.3/31 x 13). Average daily earnings - 1838.82 rubles. (22,580.65 rubles / 12.28 days). The amount of vacation pay is 25,743.48 rubles. (1838, 82 rubles x 14 days).

When is the average salary paid and how to calculate it

The calculation takes into account all types of payments that are included in the remuneration system: wages; bonuses and additional payments for professional skills, class, length of service (work experience); regional coefficients, bonuses for work with harmful and other special working conditions; overtime; production bonuses; payment for work at night, on weekends and non-working holidays. The calculation takes into account only the time spent working for the current employer and the payments made by him. Salary from a previous job cannot be included in the calculation.

Moreover, if an employee was fired and then rehired by the same employer, average earnings are calculated only for the period of work under a new employment contract. Premiums accrued for a period exceeding a calendar year are taken into account in the amount of the monthly portion for each month of the billing period. In other words, if you were paid a bonus upon completion of a project that lasted 3 years (i.e. 36 months), then in calculating your average earnings, such a bonus will be taken into account in the amount of 12/36 for each month included in the calculation.

The quarterly bonus is taken into account in the calculation in full only if the following conditions are simultaneously met: The calculation period does not include time already paid according to average earnings: previous vacations, days on business trips, on sick leave, etc., as well as unpaid periods, during which the employee did not actually perform his work duties (vacation without pay, absenteeism, etc.).