What is a bank draft and why is it needed?

A bank draft is a written commitment from a bank to pay the amount stated on it. This is a kind of promissory note drawn up in a certain form.

What does it look like

The document is filled out according to strict rules.

- The title must contain the word “Promissory Note”.

- The text indicates the amount of debt, time and place of settlement. If the payment period is not specified, it is considered equal to 1 year from the date of signing. The text may also state that payment is made upon presentation. In this case, there should be a clarification: “But not before...”.

- The signatures of the head and chief accountant of the bank are placed below. They are certified by a seal.

- There may also be an aval in the document. This is equivalent to guaranteeing a debt. The person who supplied it (the avalist) undertakes to fulfill the obligations under this security in the event of their failure to be fulfilled by the main payer (in our case, the bank).

Economic significance

The bill is evidence of the right to receive the amount specified in it. For the holder, this is the same asset as stocks, bonds, or real estate.

They can, for example, pay a counterparty. In this case, the right to receive money passes to the new owner. Another popular use is to use it as collateral for a loan.

Peculiarities

A bank bill is just a promissory note. It does not perform the functions of an agreement and should not contain either the details of the transaction or the circumstances of the issuance of the document. The bank draft specifies only the amount of debt and the payment procedure.

Another feature of working with a bill of exchange is the impossibility of recovery. So, if it was lost or stolen, the rightful owner will only be able to get his money through the court. In this case, most likely, you will have to wait for the expiration of the statute of limitations on this bill (3 years).

This requirement allows the bank to avoid double payments, since after three years it has the right to refuse repayment (if someone suddenly finds the original and tries to cash it).

The absence of at least one mandatory detail on a bank bill is grounds for invalidating it. It will not lose its value, but will turn into an ordinary promissory note.

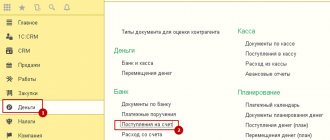

Purchase

Individuals and legal entities can buy bills of exchange; to do this, the client fills out an application form based on the sample at a bank branch. Next, a release agreement is concluded - one-time or for a long term. After concluding the agreement, the client is required to fully pay the issued bill - only after that it will be transferred to its holder.

For individual entrepreneurs and legal entities of various organizational and legal forms, payment is allowed only in non-cash form. The date when the funds transferred as payment were credited to the deposit is considered the date the bank issued the obligation, and it must occur only after the date of signing the agreement.

Types of bank bills

The legislation provides for two types:

- simple;

- translated.

They differ in the recipient of the payment.

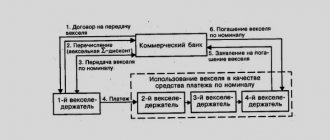

Downtime involves returning the money directly to the lender. If he decides to transfer his rights to another person, a transfer inscription - an endorsement - is placed on the back of the document, and the security itself is transferred to its new owner. However, the former holder of the bill is jointly and severally liable for this bill.

A bill of exchange (draft) is more of an order to a borrower to pay an agreed amount to a third party. In other words, the drawer is not the payer of the draft. With this paper, he only gives an order (for example, to his bank) to make a payment in favor of a third party.

In this case, the bank itself must confirm its consent to the payment. Such confirmation is a special mark on the front side of the draft - acceptance.

Features of the bill - it is important to know

We have already found out, considering the term “bill”, that this is one of the types of securities. However, unlike stocks and bonds, these IOUs are not kept in a depository and most often do not have an electronic version. Therefore, to return your own funds, it is important to keep the correctly signed bill.

IMPORTANT!

The details that must be indicated in the security are approved at the legislative level. They must be completed correctly for the document to be considered valid.

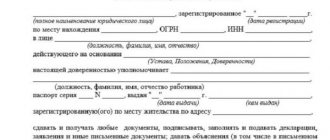

A promissory note is a security under which a debt is returned to the holder of the bill. When issuing it, it must be indicated that this is a bill of exchange. The document itself states an obligation to pay a specific amount within a certain period of time without specifying the conditions for its fulfillment.

There are also a number of additional data that must be indicated in the promissory note - this is the place where the payment is made, the name of the party to whom the amount is paid, the date of the draft, and after all, the drawer must sign.

When filling out a bill of exchange, you must also indicate the name of the payer and recipient of the amount of money.

Accounting for bank bills

In practice, a situation may arise when the holder does not have the opportunity to wait for the maturity date. One option is sale. But bank bills are not equity securities that are traded on stock exchanges. Finding a buyer for it is not always possible.

In this case, there is another option - accounting.

Discounting a bill is its purchase by a bank at a price lower than its face value. This difference (discount) will allow the bank to make a profit from this operation.

Kinds

Promissory notes issued by Sberbank are:

- Interest - contain in their description the percentage accrued on the face value of the document. When purchasing it, the client is required to deposit into his account an amount equal to its face value;

- Discount – contain in their text only the face value. The profit on it is determined as the difference between the price at which it was sold to the owner and its nominal value.

Advantages and disadvantages

Like any financial instrument, a bank bill has advantages and disadvantages. Which of these is more important is up to you to decide.

Advantages:

- Simplicity of design. You don't even need to open a bank account to purchase.

- Wide application. They can be used to pay, leave as collateral, sell, or give as a gift.

- Profitability is determined in advance.

Flaws:

- Low profitability. Reliable banks are unlikely to offer a rate higher than for a regular bank deposit.

- No guarantees. The securities do not participate in the deposit insurance system. The money invested in them is not protected by anything.

Financial bill

If a company has free cash, it can invest it in purchasing bills. The purpose of such a purchase is to receive income in the form of interest or discount.

Acquisition costs

Having purchased a bill of exchange, the company must take it into account in account 58 “Financial investments” at its original cost. This cost is determined by one of two methods provided for by PBU “Accounting for Financial Investments” (PBU 19/02).

The first method is that the cost of the bill includes its purchase price and all other costs associated with its acquisition. For example it could be:

- payment for consulting and information services that the company used when purchasing the bill;

- payment for intermediaries, etc.

Such expenses are accounted for by posting:

DEBIT 58 CREDIT 76

– expenses associated with the purchase of the bill are reflected.

note

The cost of the bill (including the costs of its purchase), depending on its maturity, is indicated on line 1240 “Financial investments (except for cash equivalents)” of Section II of the Balance Sheet or line 1170 “Financial investments” of Section I of the Balance Sheet. The cost of the bill also includes the amount of VAT on it.

PRIMERAO "Invest-Project" purchased a bank note in December for 500,000 rubles. At the same time, the company took advantage of the advice of a brokerage firm, paying it 2,360 rubles. (including VAT - 360 rubles). The accountant must make the following entries: DEBIT 58 CREDIT 76 - 2000 rubles. – consulting services are reflected; DEBIT 19 CREDIT 76 – 360 rub. – VAT included; DEBIT 76 CREDIT 51 – 2360 rub. – money was transferred for consulting services; DEBIT 58 CREDIT 19 – 360 rub. – VAT is written off; DEBIT 76 CREDIT 51 – 500,000 rub. – money for the bill is transferred; DEBIT 58 CREDIT 76 – 500,000 rubles. – the bill has been received. The company plans to repay the bill within 6 months. Therefore, in the balance sheet of Invest-Project for the reporting period, the value of the bill is equal to 502,360 rubles. (500,000 + 2000 + 360), must be reflected on line 1240. The cost of the bill includes the amount of VAT on it.

However, you can use the second method, in which account 58 takes into account only the amount paid to the seller of the bill. The remaining costs for its acquisition are classified as other expenses.

This accounting method can be used, for example, if these costs are insignificant compared to the price of the bill, that is, they do not exceed 5% of the transaction price.

Such costs can be taken into account by posting:

DEBIT 91-2 CREDIT 76

– expenses associated with the purchase of the bill are reflected.

In this case, expenses for the purchase of bills of exchange are reflected in line 2350 “Other expenses” of the Statement of Financial Results.

EXAMPLE In November, Finanstorg LLC, through an intermediary, purchased a bill of exchange worth 400,000 rubles. The intermediary's remuneration amounted to 1,180 rubles. (including VAT - 180 rubles). The company's accountant considered that the amount of remuneration was insignificant compared to the price of the bill. Therefore, he must make the following entries: DEBIT 76 CREDIT 51 - 401,180 rubles. (400,000 + 1180) – remuneration and funds for the purchase of the bill of exchange are transferred to the intermediary; DEBIT 58 CREDIT 76 – 400,000 rubles. – bill received; DEBIT 91-2 CREDIT 76 – 1000 rub. (1180 – 180) – intermediary services are reflected; DEBIT 19 CREDIT 76 – 180 rub. – VAT is taken into account; DEBIT 91-2 CREDIT 19 – 180 rub. – VAT is written off. The company plans to repay the bill within 9 months after its receipt. Line 1240 of the balance sheet asset will indicate the cost of the bill in the amount of 400,000 rubles. Expenses for the purchase of a bill of exchange in the amount of 1180 rubles. should be reflected on line 2350 of the income statement.

You can record the bill of exchange valuation method you choose in your accounting policy, although PBU 19/02 does not require this. Therefore, you can use another method - draw up an accounting certificate in each specific case.

Generating income

The drawer pays a fee to the company that purchased the bill. The company receives this reward either in the form of a discount or in the form of interest. In accounting, interest and discount are treated differently.

Interest on a bill must be included in other income for the period in which the company has the right to receive it.

In the Statement of Financial Results they are reflected in line 2340 “Other income”.

EXAMPLE On August 19, Topaz PJSC purchased a bill of exchange for RUB 200,000. Under the agreement with Topaz, the drawer is obliged to pay monthly interest to the company at the rate of 18% per annum. The payment deadline is no later than 5 days after the end of each month. In August, Topaz’s accountant made the following entries: DEBIT 76 CREDIT 51 - 200,000 rubles. – money for the bill is transferred; DEBIT 58 CREDIT 76 – 200,000 rubles. – bill received; DEBIT 76 CREDIT 91-1 – 1183.56 rubles. (RUB 200,000 × 18%: 365 days × 12 days) – interest accrued for 12 days (from August 20 to 31). The seller of the bill transferred this amount to Topaz on September 3. On this day you need to make a posting: DEBIT 51 CREDIT 76 - 1183.56 rubles. – interest received for August. Line 2340 of the financial results report will indicate the amount of interest on the bill – 1183.56 rubles.

The discount, like interest on a bill, is included in the company’s other income. Discount income is generated if a company purchases a bill at a price less than its face value.

This means that by repaying the bill, the company will receive more money than it paid for the purchase. The resulting difference can be taken into account in one of two ways.

The first way is to reflect the discount amount as a lump sum when repaying the bill.

In this case, the bill is reflected in the balance sheet at the purchase price.

EXAMPLE LLC "Nereida" purchased a bank bill for 90,000 rubles in June. The maturity date of the bill is November, its nominal value is 100,000 rubles. In June, the company's accountant must make the following entries: DEBIT 76 CREDIT 51 - 90,000 rubles. – money for the bill is transferred; DEBIT 58 CREDIT 76 – 90,000 rub. – a bill of exchange has been received. In November, the postings will be as follows: DEBIT 91-2 CREDIT 58 – 90,000 rubles. – the bill is written off; DEBIT 76 CREDIT 91-1 – 100,000 rubles. – income from the repayment of the bill is accrued; DEBIT 51 CREDIT 76 – 100,000 rubles. – money was received for a repaid bill of exchange. Line 2350 of the financial results statement will indicate the purchase price of the bill of exchange – 90,000 rubles. On line 2340 of the financial results statement, you need to reflect the nominal price of the bill - 100,000 rubles.

But you can take into account the amount of the discount in income evenly throughout the entire period from purchase to repayment of the bill (clause 22 of PBU 19/02).

In this case, the book value of the bill is gradually increased by the discount amount.

On November 12, Pride JSC purchased a bill of exchange for 140,000 rubles, which will be repaid in 180 days. The nominal value of the bill is 152,000 rubles. The postings in November were as follows: DEBIT 76 CREDIT 51 - 140,000 rubles. – bill paid; DEBIT 58 CREDIT 76 – 140,000 rub. – the bill was capitalized. The chief accountant of the company decided that he would reflect the discount on the bill evenly throughout the entire circulation period of the bill. In November, a discount for 18 days (from November 13 to 30) must be included in other income in the amount of: (RUB 152,000 – RUB 140,000) × 18 days. : 180 days = 1200 rubles. In this case, you need to make a posting: DEBIT 58 CREDIT 91-1 – 1200 rubles. – discount is taken into account. In December, this amount will be: (RUB 152,000 – RUB 140,000) × 31 days. : 180 days = 2066.67 rubles. Thus, by the end of the year the book value of the bill will be 143,266.67 rubles. (140,000 + 1200 + 2066.67). It must be reflected on line 1240 of the annual balance sheet. At the same time, line 2340 of the financial results statement will indicate the discount amount - 3266.67 rubles. (143,266.67 – 140,000).

You need to make your own choice of how to calculate the discount on a purchased bill of exchange and consolidate the chosen method in the company’s accounting policies.

Are there any analogues

Eat. But these will be different instruments with their own characteristics.

For example, to raise funds, a bank may issue bonds. But for this it is necessary to carry out serious preparatory work, which is not always advisable. In addition, not all potential investors have the opportunity to trade on the stock exchange.

Another option is a bank deposit. However, investments in it do not have liquidity. They cannot, for example, be sold. And with early withdrawal of funds, the investor loses almost all profits.

Step-by-step instructions for cashing bills

To cash a security, its owner needs to contact a bank branch. The institution that purchased it is required. The scheme by which the object will be cashed out is similar for all financial structures.

The individual will be required to:

- general passport;

- the bill itself;

- statement.

If an organization intends to cash out, a larger package of documents is required:

- power of attorney for the right of transfer;

- identification card of the person who acts on behalf of the organization;

- bill of exchange;

- statement.

Plus, when transferring, the authorized person or the owner himself fills out the transfer and acceptance certificate.

Procedure:

- At the appointed time, you must visit the bank branch and contact the manager with a request to cash out the Central Bank.

- A bank employee will check your passport and remove the bill of exchange for examination. In return, he must provide a receipt of acceptance. This procedure is not always carried out.

- After verification, the object will be cashed out, and the owner will be given an amount equal to its value.

Money is provided to choose from:

- cash;

- transferred to a newly opened account;

- transferred to a bank card.

The holder independently chooses the option that is convenient for himself.

The final amount received depends on the interest rate and profitability. The first is installed individually. It depends on the national currency exchange rate and storage period. It is impossible to calculate profitability in advance. In addition, it depends on:

- the bank’s profitability on the day when the owner asked to cash out;

- inflation level in the Russian Federation.

How to sell

The holder does not have to wait until the agreed date to cash the bill. It can be sold to a third party. There are no restrictions for individuals and organizations regarding purchase and sale in the Russian Federation.

You can sell in the following ways:

- Use as a means of payment in barter transactions and as a contribution for mortgage lending. For example, Alfa Bank accepts them when concluding loan agreements.

- Pay them for goods or services received.

- Pledge it to the bank as security.

- Exchange for other securities.

- Put up for sale on the securities market.

When purchasing a bill of exchange, an agreement is concluded in which all the buyer’s details are indicated. Next, he generates a payment order and transfers funds to the owner. Within one day after the transfer, a purchase and sale agreement is drawn up. Considering that tariffs change over time, sometimes you can make decent money on a deal.