Home / Labor Law / Payment and benefits / Wages

Back

Published: 03/03/2016

Reading time: 7 min

0

1676

One of the varieties of the tariff system of remuneration is piecework. It provides for the calculation of payment to an employee with a focus on accounting for his labor costs: the number of products produced, actions performed or services provided to the client.

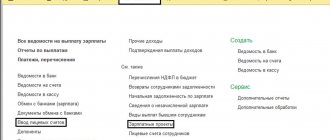

- Features of piecework payment

- Advantages and disadvantages

- Options for piecework wages Simple

- Piece-bonus

- Piece-progressive

- Indirect piecework

- Chord payment system

What is said about employee salaries in the labor legislation of the Russian Federation?

So, according to the Labor Code of the Russian Federation, wages (wages) are the employee’s remuneration for his work, in other words, this is the cost of the enterprise’s labor resources. Article 129 of the Labor Code of the Russian Federation states that the totality of components - the qualifications of an organization's employee, the complexity and volume of his work, the quality and working conditions - determine the level of remuneration of the employee. Labor legislation includes incentive and compensation payments as components of wages, as well as payment of wages for time not worked.

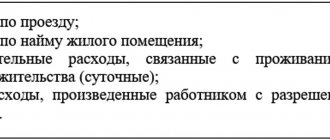

What applies to compensation payments? The following types of compensation exist:

- for unused vacation upon dismissal;

- for main, additional and study leave;

- for severance pay upon dismissal.

About methods of calculating wages and its minimum amount

Currently, the following remuneration systems take place in the Russian Federation remuneration system:

- Piecework;

- Time-based.

Piecework wages are characterized by the number of works performed, or products manufactured, and their size directly depends on these indicators.

There are the following types of piecework wage systems:

- direct piecework;

- piecework-bonus;

- piecework-progressive;

- indirect piecework.

Regarding the minimum wage for employees, it is important to note that regardless of the remuneration system used, the amount of remuneration should not be lower than the federal minimum wage (minimum wage). To ensure that this threshold is not underestimated, there are indicators such as a minimum monthly rate or a minimum hourly wage. All employers in the Russian Federation are required to pay wages not lower than the minimum wage, with the exception of cases of combined work and part-time work.

Salary calculation

If you start reading a book on payroll calculation, you will probably find in it a description of such remuneration systems or methods of calculating wages: time-based, piece-rate, time-based bonus, bonus, commission, etc. These systems are not described in legislation; they exist in expert articles and opinion pieces. An employer can adopt its own remuneration system, fix it in its local regulations and apply it in the organization. If an employee works on a 40-hour schedule, then usually the main type of accrual is salary. In this case, the amount that is paid to the employee for a fully worked month is established. If an employee has not worked in full for a month, then calculations are made in proportion to the time worked.

Please note => Repair work in an apartment building in 2019

Comparative characteristics of piecework and time-based wage systems

When developing employee remuneration schemes, the company administration, and, in particular, personnel management, must take into account two important points:

- What method to choose so that the work of workers allows them to achieve the desired level of labor productivity;

- How to provide every employee with the opportunity for professional development and self-realization.

Below, in the table, we will compare two remuneration systems in order to understand when it makes sense to use one or another system.

| Remuneration system (WSS) | Criteria for the use of one or another SOT | ||

| Ability to measure the amount of work being done | What is more important: quality or quantity? | Does the quality of labor change as its quantity increases? | |

| Piecework SOT | It is possible to measure the work of an employee. | There is a need to increase labor productivity | Quality does not deteriorate as the amount of labor increases |

| Time-based COT | The employee's job responsibilities are varied and cannot or are almost impossible to quantify. | The quality of labor is prioritized over the quantity of labor, since the cost of an error can be too high, this applies, for example, to work in laboratories with hazardous substances | When work is creative in nature or when it is impossible for an employee to influence the quantitative characteristics of work |

Disadvantages of the collective system

When the salary of the entire team depends on each employee, this helps to achieve good results in labor productivity. But on the other hand, such a system has a number of disadvantages. One of them is that the ability to work and diligence are not taken into account for each individual employee. For example, despite different productivity, two workers with the same qualifications and the same amount of time worked will receive the same wage. In order to correct this, the KTU (labor participation rate) is introduced. They take it equal to one, and depending on the work of each individual worker of one team, they change it up or down. The CTU is established for each employee by decision of the entire team or the team council.

On cases of application of the piecework wage system and fines for wages below the minimum wage

To increase employee productivity, a piece-rate wage system is being introduced; it is also important to note that the use of this system, as a rule, is typical for employees who create wealth, which primarily includes factory workers. That is, this COT motivates employees to create as many products as possible. However, it is important to make a reservation: work that requires high precision and care, scrupulousness, the use of this system is undesirable, as the likelihood of defects increases.

The following rules apply for piecework wages:

- When an employee works full-time and works for a full month, the salary of this employee should not be less than the minimum wage established by the state. This rule applies to all types of piecework COT;

- If an employee’s salary is below the established minimum wage, then there is a need for additional payment to the minimum wage level;

- When paying wages below the minimum wage level, administrative and criminal liability is provided*.

What liability is provided for violating employers? According to Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation, a fine of 1 thousand rubles is provided for individual entrepreneurs and heads of organizations. up to 5 thousand rubles, and for a legal entity - from 30 thousand rubles. up to 50 thousand rubles. In case of repeated violation, according to Part 4 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation, the fine for an individual is from 10 thousand rubles. up to 20 thousand rubles. or temporary disqualification from one to three years. And for a legal entity – from 50 thousand rubles. up to 70 thousand rubles.

Key issues related to documenting piecework wages

Question No. 1. Is it important to warn the employee about changes regarding the payment of wages, in particular about the wage system applied to him?

Yes, it is important; these changes must be reflected in the employment contract with the employee or in an additional agreement to it.

Question No. 2. Where is it important to reflect standard piece rates or, for example, a percentage of sales or the amount of material assets produced?

These prices must be specified in a regulatory act, for example, in the Regulations on piecework wages, or in a collective agreement.

Question No. 3. If piece rates are atypical and varied, then in what documents should they be written down?

When individualizing rates for piecework, it is necessary to specify such rates in the employment contract with a specific employee (or in an appendix to it). This will avoid disputes with the labor inspectorate. There is also a need to keep records of production, which will be discussed in detail in the next paragraph.

The procedure for determining the amount of piecework wages

Piece-rate payment of workers is a procedure for calculating wages in which the main indicators are the volume of work performed and the timing of its completion. Today it is not used very often, since the optimal areas for its use are production, the indispensable part of which has become manual labor and the creation of products of the same format and functions in large quantities. The most important act in the case of this system of payment for the amount of work performed was the so-called “piece work order”. It contains all the necessary data that may be required to pay salaries to employees. It is after its closure that we can talk about fulfilling our assumed responsibilities.

Please note => When will the cost of a preferential square meter increase?

Direct piecework wage system

To calculate wages with a direct piece-rate wage system, the following formula is used:

ZP = Rza units. cont. * Qproducts,

- Where ZP is the amount of wages,

- Rza units cont. – cost (piece rate) per unit of products produced/work performed,

- Qproducts – volume (quantity) of manufactured products/work performed.

The cost (piece rate) per unit of product produced/work performed is a value established by the employer, and these prices are indicated in local documents, for example, in the regulations on wages, in a collective agreement, in an employment contract, etc.

Example 1. A direct piece-rate wage system has been established. The cost of processing one part (R per unit of prod.) is 5 rubles. per piece, and assembly of the machine - 400 rubles. a piece. In June, employee M.V. Odintsovsky processed (Qproducts) 7 thousand parts and assembled 50 machines. So, in June, employee M.V. Odintsovsky earned: 7,000 pcs. * 5 rub./pcs. + 400 pcs. * * 50 rub./piece. = 55,000 rub.

Main types of piecework wages and calculation procedure

The basis for calculating piecework wages is the amount of remuneration that is provided for the employee performing a certain operation or for producing a unit of product. Today, several methods are used to calculate piecework wages, which depend on its type. It is important to pay attention to the fact that when implementing piecework payment for general labor, in most cases it is piecework prices that are determined - this is the total amount of earnings for just one unit of all work performed or manufactured products. In addition, piece rates are also determined primarily on the basis of standard established grades for work, tariff rates, as well as production standards (or, to be more precise, temporary standards).

24 Dec 2021 marketur 159

Share this post

- Related Posts

- Categories of citizens for preferential allocation of land

- Conclusion on the nature and working conditions of the employee

- State registration number of property rights where to look

- If your birth certificate is lost, how to recover it?

Piece-bonus wage system

To calculate wages under a piece-rate wage system, in addition to the salary, the employee receives a bonus, and the procedure for calculating wages under a piece-rate wage system is similar to the procedure for calculating wages under a direct piece-rate wage system; a distinctive feature is the presence of a bonus as part of the employee’s salary. This remuneration system motivates employees to create quality products.

Example 2. A piecework-bonus wage system has been established. The Regulations on Bonuses indicate that the absence of defects in the production of products guarantees the payment of a bonus to employees in the amount of 12% of the piecework wage. Creating one part costs 10 rubles. In August, Ordzhonikidze’s employee I.Yu. produced 1,700 parts without defects. So, for August, Ordzhonikidze’s employee I.Yu. will receive a salary in the amount of: 1700 pcs. * 10 rub./pc. * (100% + 12%) = 19,040 rub.

Collective form of payment

Payroll will be calculated for a separate team. The salary of an individual worker in such a team will depend on the following indicators:

- Developments of the entire brigade;

- The time it took the team to complete the task;

- Worker qualifications.

Such a payment system can only be used if there is proper organization of labor. In this case, we are talking about the distribution of income between all members of the team, and it is necessary:

- Assess the qualifications of each worker;

- It is optimal to select the composition of the team so that the qualifications of the workers correspond to the level of work performed. As a rule, the most productive teams are those in which workers can combine related professions. When distributing work among such workers, the load will be maximum.

- Keep time records for each team member.

Piece-progressive wage system

To calculate wages under a piece-rate progressive wage system, it is also important to pay for production in excess of the norm, which is calculated at increased prices, so the wage consists of two parts:

- first part: payment for products that were produced within the norm (at standard prices);

- second part: payment for products that were produced in excess of the norm (at increased prices).

Example 3. A piece-rate progressive wage system has been established. For the production of one part, an employee earns 2 rubles/piece. The production rate has been set at 10 thousand parts per month. Each part that is manufactured in excess of the specified norm costs 3 rubles/piece.

In September, Ordzhonikidze’s employee I.Yu. manufactured 17 thousand parts, that is, he produced 7 thousand parts above the norm (17 thousand - 10 thousand). So, for August, Ordzhonikidze’s employee I.Yu. will receive a salary in the amount of: 10,000 pcs. * 2 RUR/pcs. + 7,000 pcs. * 3 RUR/pcs. =41,000 rub.