Determination of the amount of sick leave benefits in 2021.

Sick leave in 2021 It will be correct to calculate using the following formula, which is provided for in Article No. 14, paragraph 1 and Article No. 1, paragraph 2 of Federal Law No. 255:

The amount of benefits due to temporary disability in 2021. = Salary (average daily) for calculating sick leave benefits in 2021. X Percentage, which depends on the employee’s length of insurance (60-100%) X Number of calendar days of illness.

Read on the topic: Examples of calculating sick leave in 2020

Minimum wage: essence and purpose

The minimum wage (minimum wage) is a value determined by a separate federal law. It is used to regulate the amount of minimum earnings, as well as calculate sick leave and other benefits, pay for rest days and business trips.

As a rule, the calculation of the minimum average earnings from the minimum wage is used at the final stage of accounting manipulations. This usually happens when:

- in the billing period the employee has no earnings or is less than the federal minimum wage;

- insurance period is less than 6 months;

- the hospital regime was violated, etc.

Employers must take into account the established minimum wage when forming their tariff schedules and base salaries. Moreover, the State Duma regularly increases this indicator.

Also see “Average daily earnings for calculating sick leave in 2021.”

How does the amount of sick leave benefit depend on the employee’s length of insurance?

Reason for temporary disability

| Employee length of service | Amount of benefit, % of average salary | Base | |

| Own illness | more than 8 years | 100% | Article No. 7 of Federal Law No. 255 |

| within 5-8 years | 80% | ||

| less than 5 years | 60% | ||

| Occupational disease/work accident | not installed (any) | 100% | Article No. 9 of Federal Law No. 125 of July 24, 1998. |

| Outpatient care for a sick child (child must be under 15 years old) | more than 8 years | 100% - first 10 days of incapacity for work, 50% - subsequent days of sick leave | Article No. 7, paragraph 3, subparagraph 1 of Federal Law No. 255 |

| within 5-8 years | 80% - first 10 days of incapacity for work, 50% - subsequent days of sick leave | ||

| less than 5 years | 60% - first 10 days of incapacity, 50% - subsequent days of sick leave | ||

| Inpatient care for a sick child (age less than 15 years) / outpatient care for an adult family member | more than 8 years | 100% | Article No. 7, paragraph 3, subparagraph 2, Article No. 7, paragraph 4 of Federal Law No. 255 |

| within 5-8 years | 80% | ||

| less than 5 years | 60% |

It is worth noting that the amount of benefits for employees who have worked for less than 6 months is limited to the minimum wage when calculating for a full calendar month (the regional coefficient should also be taken into account, if it is provided for a given area). This fact is stated in Article No. 7, Clause 6 of Federal Law No. 255.

If the hospital regime is violated

The employer has the right to limit the amount of sick pay for a full calendar month to the minimum wage if the employee, without good reason (Part 1, Article 8 of Federal Law No. 255-FZ of December 29, 2006):

- violated the hospital regime - from the day the violation was committed;

- did not show up for an appointment with a doctor or for a medical and social examination - from the day of failure to appear;

- fell ill or was injured due to alcohol, drug, or toxic intoxication - for the entire period of incapacity.

We'll tell you how you can limit the amount of benefits using the minimum wage.

Example of limitation of sickness benefit in case of violation of the regime

A.G. Petrov brought a certificate of incapacity for work to the accounting department for the period of illness from July 11 to July 28, 2021. However, the sick leave note contains a note about violation of the regime on July 18 (the employee did not show up for an appointment with the doctor for an unexcused reason). In such a situation, sick leave benefits until July 18 must be calculated according to general rules, based on their average earnings. And from July 18 to July 28 (that is, 10 days from the date of violation), benefits can be paid based on the minimum wage. In the region where A.G. works Petrov, the regional coefficient has not been established. His insurance experience is eight years. This means that he is entitled to a benefit in the amount of 100 percent of his earnings (Part 1 of Article 7 of Federal Law No. 255-FZ of December 29, 2006). The maximum average daily earnings for July, calculated from the minimum wage, will be 251.6129 rubles. (7800 RUR/31 days)

The amount of the benefit for July 18-28 (that is, for the period of violation of the regime) will be: 2516.13 rubles. (RUR 251.6129 × 10 days). Before the date of violation, benefits can be calculated according to general rules (not from the minimum wage).

How to calculate average earnings for accrual of sick leave in 2021?

The average salary should be calculated taking into account payments for two calendar years that precede the year of occurrence of insured events. In this case, the insured event is the moment the illness begins.

In this case, if the employee becomes ill in 2021. The average salary is calculated taking into account payments for 2015. and 2021 Also, payments included in the calculation include wages, bonuses, travel allowances, vacation pay, and financial assistance in the amount of more than 4,000 rubles. By the way, these should be the amounts from which insurance premiums were paid to the Social Insurance Fund of the Russian Federation.

The formula for calculating the average salary for benefits due to temporary disability can be found below:

Average daily wage for calculating sick leave benefits in 2021. = income for 2021 (the maximum limit has not been set for today) + income for 2015. (maximum limit 670,000 rubles) / 730.

This formula is approved by Article No. 14, clause 1 of Federal Law No. 255, Regulations (clause 15(1)), approved by Decree of the Government of the Russian Federation No. 375. By the way, the number 730 does not need to be adjusted in any way, since it is a fixed value, regardless of whether it falls on a leap year or not. Also, in this situation there are no excluded periods.

The average daily wage that was actually calculated must be compared with the minimum limit. It can be determined based on the minimum wage in the manner prescribed in paragraph 15/3 of Regulation No. 375. Minimum limit of average daily wage for calculating sick leave benefits in 2021. is 246.57 rubles (7500 rubles X 24 months / 730 days). After comparing the actual average daily earnings and the minimum limit for its size, the amount that is larger is assigned to payment.

If there is no earnings at all in the calculation period

If during the billing period (2015-2016) the employee has no earnings at all, then to calculate benefits, instead of “zero”, one should take the earnings calculated by the minimum wage, which was established at the time of the insured event. This situation can occur if the employee did not work at all during the pay period and does not have the right to replace the years of the pay period. Let's give examples.

Sickness benefit: example of calculation after July 1

P.S. Trishin was sick from July 3 to July 12, 2021 (that is, 10 calendar days). He had no earnings in the billing period (2015-2016). Experience – 5 years and 1 month. P.S. Trishin works full time. In such a situation, the accountant should take the average daily earnings calculated from the minimum wage, namely 256.44 rubles. (RUB 7,800 × 24 months / 730).

Employee experience more than 5 years. This means that he is entitled to 80 percent of average earnings (Clause 2, Part 1, Article 7 of Federal Law No. 255-FZ of December 29, 2006). Therefore, the daily allowance will be 205,152 rubles. (RUR 256.44 × 80%). The employee was sick for 10 calendar days. During this period, the amount of benefits due to him will be 2051.52 (205.14 rubles × 10 days).

Below we give an example of calculating maternity benefits in a situation where there was no earnings in the billing period.

Maternity benefit: example of calculation after July 1

A.V. Nikolaeva wishes to go on maternity leave from July 28, 2021. The billing period is from January 1, 2015 to December 31, 2021. There was no earnings during the billing period. Insurance experience - 7 months. The regional coefficient does not apply. The minimum average daily earnings is 256.44 rubles. (7800 rubles × 24 months) / 730. Daily allowance – 256.44 rubles. (RUR 256.44 × 100%). As a result, the amount of A.V.’s benefit Nikolaeva for 140 calendar days of maternity leave, calculated from the minimum wage, will be 35,901.6 rubles. (RUR 256.44 × 140 days).

Please note: an employee who is assigned sickness benefits, maternity benefits or child care benefits has the right to contact the accounting department and ask to replace one or both years of the pay period with other years. To do this, she will need to write a statement. In this case, the accountant will have to replace the years while simultaneously meeting 3 conditions:

- a woman wants to change the years in which she was on maternity leave or parental leave;

- the years selected for replacement precede the billing period (letter of the Ministry of Labor of Russia dated August 3, 2015 No. 17-1/OOG-1105);

- As a result of changing years, the benefit amount will become larger.

Thus, before calculating benefits from the new minimum wage, it makes sense for the accountant to check whether the employee has the right to change the years of the calculation period.

Calculation of sick leave benefits using an example

Manager A.A. Petrov has been on sick leave since January 15, 2017. until January 21, 2017 inclusive (that is, seven full calendar days). The employee’s insurance experience is more than 8 years; for this reason, he is entitled to receive benefits due to temporary disability in the amount of 100% of the average salary.

The average daily wage for calculating benefits is 723.29 rubles. Thus, the amount of the benefit for the first three days of illness, which should be paid to the employer, is 2169.87 rubles (723.29 rubles X 3 days).

The benefit for the remaining days of illness must be paid at the expense of the Social Insurance Fund of the Russian Federation; its amount is 2893.16 rubles (723.29 rubles X 4 days).

The total amount of the benefit is 5063.03 rubles (2169.87 rubles + 2893.16 rubles).

Determining the amount of maternity benefit in 2021.

To calculate the amount of benefits due to pregnancy and childbirth, you should apply the appropriate formula (according to Article No. 14, paragraphs 4, 5 of Federal Law No. 255).

Amount of maternity benefit in 2021 = average daily wage X number of days of maternity leave.

The formula according to which it is necessary to determine the average daily wage for calculating maternity benefits in 2021 can be found below:

Average daily wage for calculating maternity benefits in 2017 = income received in 2021 (maximum limit not established) + income received in 2015 (maximum limit is 670,000 rubles) / 731 days (excluded days should be subtracted).

It should be recalled that 731 is the number of calendar days in the billing period (in other words, 365 days in 2015 and 366 days in 2016). In addition, certain days, if any, must be subtracted from the specified period. Accordingly, from the income the amounts that were accrued for these days. Which days are excluded are presented in the table below.

| № | Periods excluded from the calculation of average daily wages |

| 1 | Period of temporary incapacity for work |

| 2 | Parental leave |

| 3 | Leave due to pregnancy/childbirth |

| 4 | Days on which a woman was released from work in accordance with the laws of the Russian Federation, with the condition of full or partial retention of wages (if contributions to the Social Insurance Fund were not paid from the wages that were saved) |

The resulting average salary should be compared with the maximum permissible limit. If the calculated result turns out to be greater, this amount should be taken into account for calculating benefits. This is stated in Article No. 14, paragraph 3.3 of Federal Law No. 255.

If your earnings are less than the minimum: what to do?

The accountant should ensure that employee benefits are calculated correctly. This will make it possible to reimburse benefits from the Social Insurance Fund without any problems even after July 1, 2021. Let us explain what to pay attention to.

Let's assume that the insured event (illness, maternity leave or the start of parental leave) occurred in July 2021. The calculation period will be 2015-2016. To calculate the benefit, the accountant needs to determine the average daily earnings using the following formula:

When calculating temporary disability benefits, the number of days should be substituted into this formula - 730. If you are calculating maternity or child care benefits, then the number of days may be less, since days of illness, maternity leave, child leave and release from work are excluded from the calculation period with preservation of earnings (clauses 3 and 3.1 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ).

Based on the results of this calculation, the average daily earnings cannot be less than the amount calculated from the minimum wage. That is, from July 1, 2017, the average daily earnings cannot be less than 256.44 rubles per day.

Keep in mind that when determining the minimum average daily earnings, you must take into account the minimum wage on the date of the insured event. Accordingly, if an employee gets sick or if an employee goes on maternity leave before July 1, 2021, then use the minimum wage in the calculation at the same rate – 7,500 rubles. In this case, the minimum amount of daily earnings will be 246.58 rubles. (RUB 7,500 × 24 months / 730 days). If the insured event occurred on July 1 or later, then focus on the new “minimum wage” of 256.44 rubles. (RUB 7,800 × 24 months / 730 days).

For clarity, we will consider the amount of benefits from July 1, 2021 using the example of payment for a period of incapacity (illness). Also see “Electronic sick leave from July 1, 2021: how it will happen.”

An example of calculating benefits after July 1, 2021 from the minimum wage

O.V. Lopatina was sick from July 3 to July 17, 2021 (14 calendar days). Her insurance experience is 2 years and 4 months. The amount of payments in her favor for the billing period (2015 and 2021) amounted to 161,320 rubles.

Under such conditions, the actual average daily earnings of O.V. Lopatina is equal to 220.99 rubles. (RUB 161,320 / 730).

However, the average daily earnings, calculated from the minimum wage, is 256.44 rubles. (RUB 7,800 × 24 months / 730). This amount is higher than O.V.’s actual earnings. Lopatina: (256.44 rubles > 220.99 rubles) Therefore, to calculate sickness benefits, the accountant should take the value calculated based on the new minimum wage.

Since the employee’s work experience is less than 5 years, the amount of her benefit will be 60% of average earnings (clause 3, part 1, article 7 of the Federal Law of December 29, 2006 No. 255-FZ). As a result, the amount of sickness benefit will be 2154.096 rubles. (RUR 256.44 × 60% ×14 days).

So, using an example, we can trace the increase in benefits from July 1, 2017. After all, if the minimum wage had not been increased, then the accountant would have needed to use the average daily earnings in a smaller amount - 246.58 rubles - as the average daily earnings.

Please note: if a regional coefficient applies in your area, multiply the minimum benefit calculated from the minimum wage by it. That is, if in the area where O.V. is occupied. Lopatin’s coefficient was set at, say, 1.7, then the amount of benefits due to her would be 3,661.96 rubles. (RUR 256.44 × 60% × 14 days × 1.7).

Reflection of benefits in accounting

All benefits are not subject to personal income tax, with the exception of sick leave benefits. This tax should be withheld from the entire amount of this benefit in accordance with Article No. 217, paragraph 1 of the Tax Code of the Russian Federation.

As for social benefits, according to Article No. 9, paragraph 1, subparagraph 1 of Federal Law No. 212, as well as Article No. 20.2, paragraph 1, subparagraph 1 of Federal Law No. 125, they are not subject to insurance contributions.

In accounting, during the calculation of benefits, the following entries should be made:

D (20,26,44...) K 70 – benefits are accrued (on sick leave, for the first three days of the employee’s incapacity for work), which is paid at the expense of the company/organization.

D (69) K 70 - the benefit has been accrued, which is paid from the funds of the Social Insurance Fund.

D (70) K (68) – withholding of personal income tax from benefits due to temporary disability.

D (68) subaccount “Calculation of personal income tax” K (51) – payment of personal income tax, which was withheld from benefits due to temporary disability.

D (70) K (51, 50) – payment of benefits to the employee.

It is worth noting that under the simplified tax system, only that part of the benefits that is not reimbursed by the Social Insurance Fund can be taken into account. In other words, this is only a benefit due to temporary disability for the first three days of illness. Therefore, the amount for these days can be included in the tax base under the simplified tax system. If the object is “income minus expenses”, then it is included in the expenses of the “simplified”, and if the object is “income”, then in the tax deduction line. This is approved by Article No. 346.16, paragraph 1, subparagraph 6 and Article 346.21, paragraph 3.1 of the Tax Code of the Russian Federation.

A sick leave certificate is a document in the form established by law issued by a medical institution to a citizen to confirm his absence from work and failure to fulfill his duties due to temporary disability.

According to the law, only employees who work full time on the employer’s premises have the right to payments under this sheet. Those working under a civil contract also do not have the right to claim sick leave.

Incapacity for work on vacation days at your own expense, as well as arrest, are not covered by payments.

For example, if an employee took a week of unpaid leave, but two days before returning to work he opened a sick leave. He stayed sick for a few more days, thus “extending” his vacation. In this case, benefits for the first two days of incapacity will not be accrued to him; in the calculation, only the days when he should have been present at the workplace will be taken into account.

Even citizens who quit their job less than a month ago can receive a small amount of money after illness. The benefit is available to all insured citizens of Russia, as well as foreigners living in the Russian Federation and even stateless persons. But provided that before the citizen fell ill, the policyholder regularly paid contributions to the Fund for six months.

The reasons for obtaining sick leave from a medical institution may be:

- Own illness (injury);

- A relative has an illness as a result of which he or she requires care;

- Approaching birth, postpartum period for women;

- Quarantine.

Until recently, the FSS was strict about whether a medical institution had an expert license, but after a series of lawsuits they lowered the requirements for certification.

An employee is required to submit a sick leave certificate to the accounting department at his place of work no later than six months after his recovery.

Limitation of sick pay days

In certain situations, the law provides for restrictions on the maximum period of illness for which benefits can be received.

Let us list the main cases.

| Happening | Maximum duration of one paid sick leave | Maximum paid days per calendar year |

| Caring for a sick child under 7 years of age (of any degree of relationship) | – | 60 days (for each child) Exception: a number of diseases approved by order of the Ministry of Health and Social Development N 84n - 90 days |

| Caring for a disabled minor | – | 120 days |

| Child care 7-15 years old | 15 days | 45 days |

| Caring for any other family member | 7 days | 30 days |

| For disabled employees | 120 days | 150 days |

| Continuation of treatment in a Russian sanatorium | 24 days | Not limited |

| Singleton pregnancy | 140 days | Not limited |

| Multiple pregnancy | 194 days | Not limited |

| Complicated childbirth | 156 days | Not limited |

The employer himself is obliged to keep records of paid periods for each employee. If an employee presents a sick leave certificate after his absence, but he has already received the permissible maximum payments for this calendar year, then the document becomes a certificate confirming a valid reason for the leave.

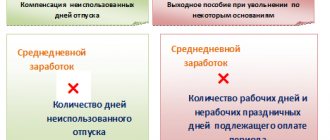

Minimum earnings for the billing period

In general, the employer should calculate sick leave, maternity and some child benefits from the employee’s average earnings for the pay period. The calculation period is the two calendar years preceding the onset of illness, maternity leave or parental leave (from January 1 to December 31). Accordingly, if an employee gets sick in 2021, then the billing period will be 2015 and 2021 (Part 1, Article 14 of Federal Law No. 255-FZ of December 29, 2006).

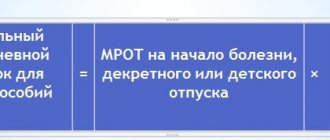

At the same time, earnings for the billing period should not be less than a certain amount. The benefit can be determined based on the minimum allowable earnings. It is determined by the following formula:

Minimum earnings for the billing period

Minimum wage x 24

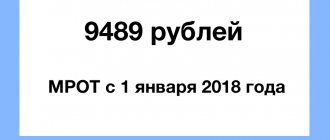

Therefore, if an insured event (illness, maternity leave or parental leave) occurred after July 1, 2021, then the minimum earnings for the billing period will be 187,200 rubles. (RUB 7,800 × 24 months). Before July 1, the minimum wage from the minimum wage was 180,000 rubles. (RUB 7,500 × 24 months).

Rules for filling out sick leave

A certificate indicating a period of incapacity for work is filled out by a doctor, however, the employer is obliged to check the authenticity of the document and the absence of errors in it.

An incorrectly drawn up sheet sometimes becomes the reason for the FSS’s refusal to reimburse benefits. Errors in names and dates are especially common.

Basic filling rules relevant for this year:

- The doctor can leave the “place of work” field blank, then the employer must enter the correct name using a gel pen with black ink;

- Corrections made by a doctor are not permitted. Therefore, if he made a mistake when filling it out, he is obliged to immediately issue a duplicate;

- The document must bear the seal of the medical institution. The law does not establish any requirements for its type;

- Technical design flaws (stamps falling on fields to be filled out) cannot become a reason for the FSS not to accept the sheet, provided that the main condition is met - the text is readable and there are no factual errors in it.

Calculation of sick leave

Before paying an employee for the period of his illness, the amount of payment must be correctly calculated.

Let's divide this stage into several steps:

Step 1. Calculate the citizen’s total salary for the two previous calendar years.

Even if he goes on sick leave at the end of 2021, the calculation will be based on his salary from January 1, 2015 to December 31, 2016.

Only payments from which contributions to the Fund were paid can be taken into account. If an employee joined your organization less than two years ago, you will have to obtain a certificate of income from the previous place of work, or request it from the Pension Fund.

Here we also encounter limitations. The Social Insurance Fund has determined the maximum value to be insured. In 2015 – 670,000 rubles, in 2021 – 718,000 rubles. An employee's income exceeding the limit will have to be rounded to the maximum possible amount.

Step 2. Calculate average daily earnings.

Divide the value obtained after the first step by 730 (this is a constant average number of days in two calendar years).

The result can be anything, but for further calculations you should make sure that it is greater than the minimum equal to the minimum wage (in 2017 this is 246.58 rubles per day). This value is the same for all regions of Russia and is valid until the summer of 2021. If the amount turns out to be less or even zero (the citizen did not receive earnings subject to insurance contributions), the value of 246.58 rubles is used for further calculations.

At the beginning of 2021, the minimum average daily earnings is 246.58 rubles. Maximum – 1901.37 rubles.

The minimum wage will increase to 7,800 rubles starting in July of this year; accordingly, the minimum daily wage will increase to 256.44 rubles.

Step 3. Daily earnings must then be adjusted according to the employee’s insurance coverage.

The longer a citizen’s experience as an insured person, the greater the amount of benefits that he can receive after illness.

Calculation of length of service for sick leave is done according to the following scheme:

- The number of full calendar years, months, days that the citizen worked in each place where contributions to the insurance fund were paid for him is calculated;

- The values are added up separately by full year, month, and day;

- The resulting terms must be rounded. The sum of months is more than 12 - converted into years, and if there are more than 30 days, they are converted into months. Thus, the length of service is rounded up to years, and the remainder of incomplete months and days is discarded.

Exception: workers with difficult and harmful conditions, or injured at work through no fault of their own - for them the benefit is paid in full.

For caring for a sick child (this does not have to be a son or daughter; a younger brother or sister, nephew or grandson can get sick), according to the table below, only the first 10 days are paid, the next - 50%.

| Employee's insurance period | Benefit amount relative to average salary |

| More than 8 years | 100% |

| 5-8 years | 80% |

| Less than 5 years | 60% |

| An employee who left the organization less than 30 days ago (for any length of service) | 60% |

The length of service is restored according to the work record book, certificates from previous places of work or upon request to the Pension Fund.

Step 4. Multiply the value obtained as a result of the third step by the number of days during which, according to the certificate, the employee was incapacitated.

When counting days you need to be extremely careful. As practice shows, this is where the most common mistakes lie. For example, a sick leave opened on April 1, and closed on April 16 is equal to 16 days (not 15!).

Only some days are not taken into account, which are exceptions:

- The employee was suspended from performing his duties in accordance with the law (for example, for a violation), or was released from work with continued pay;

- The employee was taken into custody and was under arrest;

- Period of the forensic medical examination;

- Days of downtime.

Step 5. Subtract personal income tax (13%).

The tax amount must first be rounded to the nearest ruble. The resulting value will be the amount of the benefit issued.

New minimum earnings for calculating benefits

Sickness, maternity and child benefits, in general, should be calculated from the average earnings for the billing period, that is, for the two years preceding the onset of illness, maternity leave or vacation of the year (from January 1 to December 31). Accordingly, if an employee fell ill in 2017, then the billing period will be 2015 and 2021 (Part 1, Article 14 of Federal Law No. 255-FZ of December 29, 2006). However, earnings for the billing period should not be less than a certain amount. The state guarantees the calculation of benefits based on the minimum allowable earnings. It is defined as follows (using the example of “sickness” benefits):

It turns out that if an insured event (illness, maternity leave or parental leave) occurred after July 1, 2021, then the minimum earnings for the billing period will be 187,200 rubles. (RUB 7,800 × 24 months).

Before July 1, the “minimum wage” for the billing period was 180,000 rubles. (RUB 7,500 × 24 months).

Another value that will be required to calculate benefits is the minimum average daily earnings. To find out the minimum average daily earnings for calculating benefits, the accountant needs to divide the resulting value by 730. The following formula is used:

Accordingly, from July 1, 2021, the minimum average daily earnings is 256.44 rubles per day (187,200 rubles / 730 days). From July 1, 2021, the average daily earnings for calculating benefits cannot be less than this value.

Until July 1, 2021, the average daily earnings were 246.58 rubles per day (180,000 rubles / 730 days). That is, the average daily earnings increased by 9.86 rubles (256.44 rubles - 246.58 rubles).

| Minimum average daily earnings from the minimum wage | |

| until July 1, 2021 | after July 1, 2021 |

| 246.58 rubles | 256.44 rubles |

Who pays for sick leave?

Initially, the employer pays the benefit to the sick person, then, after all the documents are completed and submitted to the Social Insurance Fund, he is compensated for part of the amount - payments for the fourth and subsequent days of incapacity for work.

This situation, which is costly for the entrepreneur, applies in cases where a subordinate was absent from the workplace due to his own illness or injury.

For other cases (for example, caring for a sick relative), the Social Insurance Fund reimburses sick leave starting from the first day.

Already now, in certain regions of the country (for example, in the Samara region), there is an experimental system in place where sick leave payments are credited directly to the employee’s individual account by the Social Insurance Fund.

At the all-Russian level, it is planned to introduce a similar system from January 2021. That is, the Social Insurance Fund will not compensate the payment to the employer, but will independently accrue it to the insured person.

Maximum amount of sick leave in 2021

The maximum amount of payments for sick leave for the billing period, subject to contributions to the Social Insurance Fund, has not only a minimum, but also a maximum limit.

The maximum limit of average daily earnings for calculating sick leave benefits for 2021 is 718,000 rubles.

The maximum limit of average daily earnings for calculating sick leave benefits for 2021 was 670,000 rubles.

If actual earnings are greater than the calculated base, equal to 718,000 rubles, then sick leave must be calculated according to the maximum amount.

Let's calculate the maximum average daily earnings for sick leave benefits in 2021. So, in 2021 the maximum limit was 670,000 rubles, in 2021 – 718,000 rubles. This means the average daily earnings will be: (670,000 rubles + 718,000 rubles): 730 days. = 1901.37 rub.

Documentation

To reimburse funds spent on sick leave, an entrepreneur must provide to the Social Insurance Fund at the place of his registration:

- An application containing the details of the entrepreneur and the amount of benefits paid;

- Calculation (form 4-FSS) indicating the average earnings, period and cause of incapacity for work of the insured citizen, his length of service;

- A copy of the certificate of incapacity for work.

Documents are reviewed on average no more than 10 working days.