During its work, any business entity (individual entrepreneur or LLC) acquires a huge number of documents: registration, accounting, reporting, personnel, permits, supporting and confirming documents. And although this is the 21st century, and electronic document management has long been integrated into business practice, documents in paper format are still an irreplaceable value. The shelf life of some of them is 75 years, as they say, manuscripts do not burn.

We are, of course, not concerned about the historical value of the organization’s documents, but about the fact that the lack of the necessary papers, especially for accounting and personnel, can create difficulties when passing inspections and lead to financial sanctions, in other words, fines. To avoid financial losses, we advise you to check the complete set of all necessary documents from time to time or entrust this check to specialists:

Free business audit

The obligation to collect and store documents of an organization is established by Law No. 125-FZ of October 22, 2004 “On Archival Affairs in the Russian Federation.” According to it, organizations and individual entrepreneurs are obliged to ensure the safety of archival documents, including personnel documents. The list of archival documents is given in the Order of the Federal Archive of the Russian Federation dated December 20, 2021 N 236, it consists of 12 sections and contains 657 items.

Not all of them are related to entrepreneurial activity, so we suggest that you check your documentary baggage with the necessary minimum that organizations and individual entrepreneurs must have.

What were your guidelines before the new Rules came out?

Before the approval of the new Rules, the archives of state authorities, local governments, organizations (hereinafter referred to as the archives of organizations) were guided in their work by the Basic Rules for the Operation of Organizational Archives[1], and some archives of organizations used a very old document - the Basic Rules for the Operation of Departmental Archives[2] . Both documents were not normative documents, but defined their status as a normative and methodological document. At the same time, the Basic Rules of 1985 actually had the status of a normative document, since they were approved by order of the Main Archive, and the Basic Rules of 2002 were not approved by the Federal Archive, therefore they did not have the status of a normative document.

For what reason, in the presence of the Basic Rules of 2002, did it become necessary to develop a new, and specifically regulatory, document on organizing the storage of documents in the archives of organizations?

The fact is that in 2004, the Federal Law of October 22, 2004 No. 125-FZ “On Archival Affairs in the Russian Federation” (hereinafter referred to as Federal Law No. 125-FZ) was adopted, which introduced many innovations in the organization of archival affairs in the country :

Extraction

from Federal Law No. 125-FZ

Article 13. Creation of archives

1. State bodies, local self-government bodies of a municipal district and urban district are obliged to create archives[3] for storing, compiling, recording and using archival documents generated in the process of their activities.

2. Organizations and citizens have the right to create archives for the purpose of storing archival documents generated in the process of their activities, including for the purpose of storing and using archival documents that are not state or municipal property.

Article 17. Responsibilities of state bodies, local governments, organizations and citizens engaged in entrepreneurial activities without forming a legal entity to ensure the safety of archival documents

1. State bodies, local government bodies, organizations and citizens engaged in entrepreneurial activities without forming a legal entity are obliged to ensure the safety of archival documents, including documents on personnel, during their storage periods established by federal laws and other regulatory legal acts of the Russian Federation. Federation, as well as lists of documents […]

Also, this Federal Law introduced the concept of ownership of archival documents (documents can be in state (federal, property of constituent entities of the Russian Federation), municipal, private property (non-governmental organizations and individuals)).

In addition, by order of the Ministry of Culture of Russia dated January 18, 2007 No. 19, the Rules for organizing the storage, acquisition, recording and use of documents of the Archival Fund of the Russian Federation and other archival documents in state and municipal archives, museums and libraries, organizations of the Russian Academy of Sciences were approved (hereinafter referred to as the Rules 2007).

These two circumstances, as well as the fact that the Basic Rules did not have the status of a normative document, forced us to turn to the development of a normative document defining the procedure for storing documents in the archives of organizations.

Storage periods for documents in the organization’s archive: table

| Document type | Shelf life, years (minimum) |

| Personnel | |

| Personnel documents: | |

| 75 |

| 50 |

These deadlines apply in particular to:

| |

| Other HR documents (time sheets, lists, travel documents). | 10 |

| For more information about this, see the article “What is the storage period for personnel documents in an organization?” . | |

| Occupational Health and Safety (OH&S) | |

| Lists and time sheets of workers in special working conditions (harmful, dangerous, difficult) | 75 |

| Acts on occupational diseases, investigation materials | 75 |

| Documentation of accidents (acts, registration logs, investigation materials) | 45 |

| Logs of preventive work and training on TB | 10 |

| Statements for issuing special clothing and special food | 1 |

| See the article “What are the storage periods for occupational safety documents?” . | |

| Accounting and taxes | |

| Annual accounting | 5 years |

| Reporting to the Social Insurance Fund: | |

| 50/75 |

| 50/75 |

| Reporting to the Pension Fund: | |

| 50/75 |

| 75 |

| Information about the income of individuals | 5 |

| Tax returns and registers | 5 |

| Accounting policies, including appendices thereto | 5 |

| Primary accounting and registers | 5 |

| Cash documents | 5 |

| For more details, see the material “What is the shelf life of cash documents?” . | |

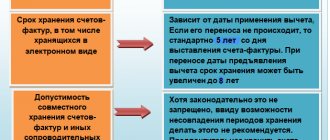

| Invoices | 5 |

| For them, read the publication “What is the shelf life of invoices?” . | |

In the table we have given only the most basic shelf life. If you have access to ConsultantPlus, you can always find in it the storage period for any document you need. If you don’t have access, you can get trial access for free and look at the storage period directory, as well as find any information that interests you.

“What comments will there be?”

During the development of the draft new Rules, the document was widely discussed twice among archivists:

- the first time - by employees of archival management bodies in the constituent entities of the Russian Federation, state and municipal archives;

- the second time - by employees of federal executive authorities.

More than 400 comments came from state and municipal archives alone. All comments received were carefully considered, and at the final stage - by a temporary working group, which included specialists from Rosarkhiv and VNIIDAD. It should be noted that many comments were caused by the desire of archivists to describe in as much detail as possible the individual processes of archival technologies used in ensuring the preservation, recording, acquisition and use of documents in the archives of organizations, which, in principle, was impossible to do, given the status of the new Rules as normative document.

At the same time, some comments were of a fundamental nature, for example, the remark that in the “Acquisition” section of the draft new Rules, the issue of examining the value of documents is not presented consistently enough, in particular, due to the fact that provisions related to the nomenclature of cases were excluded. Considering that at present the form of the nomenclature of an organization’s affairs and the procedure for its development are set out only in a document of a methodological nature - Methodological recommendations for the development of instructions for office work in federal executive bodies[4], when finalizing the draft of the new Rules, it was decided to include in the section “Completing” the main provisions on the nomenclature of cases, including the form of the nomenclature of cases (consolidated and structural units).

Nuances of calculating shelf life

The first thing you should pay attention to when “bookmarking” a document in the archive is the moment from which the storage period begins to be calculated. Thus, for some personnel documents it starts immediately from the date of preparation, and for primary accounting documents - at the end of the reporting year.

For tax purposes, the storage period begins after the reporting period in which the document was last used to calculate taxes and participated in the generation of reporting.

About the storage periods for documents on depreciable property, read the material “From when should the storage period for primary assets be calculated?” .

The second important nuance is that the retention period established for one document by different legal acts may vary. If this is the case, you need to choose the maximum one.

Let us explain both nuances with an example.

An example of determining the storage period for a work acceptance certificate

Let’s say the act was drawn up on March 29, 2017. Let's determine its shelf life:

- As a primary accounting document confirming the accounting of expenses, it must be stored for 5 years from the end of the reporting year 2021, i.e. from 01/01/2018 to 12/31/2022.

- As a document confirming the fact of acceptance of the results of work for VAT purposes - 4 years from the end of the first quarter of 2021 (VAT tax period), i.e. from 04/01/2017 to 03/31/2021.

- As documentary evidence of income tax expenses - 4 years from the end of the “profitable” tax period of 2021, i.e. from 01/01/2018 to 12/31/2021.

We choose the latest date - 12/31/2022. After this, the document can be destroyed.

For information on how to do this in accordance with all the rules, read the article “Destruction of documents with expired storage periods (act)” .

Purpose of new Rules

The new Rules are intended for state authorities, local governments, organizations creating archives for storing, compiling, recording and using archival documents generated in the process of their activities.

They do not apply to the organization of storage, acquisition, recording and use of documents from the Archival Fund of the Russian Federation and other archival documents containing information constituting state secrets.

The New Rules are a normative document. Their regulatory status determines more stringent requirements for their content. Previously published rules (see above) included not only norms (rules, requirements), but also recommendations and methods on how these norms should be applied. All provisions of a recommendatory, methodological and descriptive nature are excluded from the new Rules. It was in this part that the draft of these Rules during the discussion was criticized by archivists, who constantly said that the Rules should be detailed and contain not only the rules themselves, but also the mechanism for their implementation.

Structure and content of the new Rules

The new Rules consist of seven sections:

- General provisions.

- Organization of storage of documents of the Archive Fund of the Russian Federation and other archival documents in the organization.

- Accounting for documents from the Archive Fund of the Russian Federation and other archival documents in the organization.

- Completing the archive with documents from the Archive Fund of the Russian Federation and other archival documents.

- Organization of the use of documents from the Archive Fund of the Russian Federation and other archival documents of the organization.

- Transfer of organization documents for storage to the state (municipal) archive.

- Transfer of documents during reorganization or liquidation of an organization, change of the head of the organization's archive.

The appendices to the new Rules provide accounting and other forms of documents used in the archives of organizations.

The sequence of the main sections of these Rules corresponds to Federal Law No. 125-FZ and the 2007 Rules, although, as many experts noted at the discussion stage, it would be more logical to start with acquisition and end with use.

Sections of the new Rules reflect the main functions of the organization’s archive:

- organizing the storage of documents from the Archive Fund of the Russian Federation and other archival documents;

- document accounting;

- completing the organization’s archive with documents;

- organizing the use of archival documents;

- transfer of documents for storage to the state (municipal) archive.

In addition, the new Rules include a section “Transfer of documents during reorganization or liquidation of an organization, change of the head of the organization’s archive.”

note

Unlike the Basic Rules of 2002, Rules No. 526 do not contain provisions related to the organizational aspects of the activities of the archive itself (the goals and objectives of the archive, its functions, rights, etc. are not defined). Their main purpose is to establish requirements for organizing processes for archival storage of documents, from completing the organization’s archive with documents to organizing the use of documents.

Let's look at the sections in more detail.

Drawing up an order for storing documents, mandatory elements

An entrepreneur must draw up such a document immediately from the moment of opening his business. Using it, you can create a unified system for storing documents of various types, be it the charter of an enterprise or a regular official memo.

It is worth noting that there is no single form for preparing such a document, and therefore the entrepreneur is allowed to develop his own form. Registration should begin with the “header”, which must contain information about the legal entity, its place of registration, TIN, and so on.

Section I. General provisions

Defines the legal basis for the development and scope of the document, and also contains provisions defining some organizational foundations for the activities of the organization’s archive.

The new Rules apply to state authorities, local governments and organizations that are sources of acquisition of state and municipal archives, in the process of whose activities documents of the Archival Fund of the Russian Federation (hereinafter referred to as organizations) are formed. The provisions of these Rules can also be used by other state and non-state organizations whose activities do not generate documents of the Archive Fund of the Russian Federation.

Based on the provisions of Federal Law No. 125-FZ, the new Rules state that state bodies, local government bodies of a municipal district, urban district and intra-city district are required to create archives for storing, compiling, recording and using archival documents generated in the process of their activities. The tasks and functions of the archive (central archive) of a state body, local government body, organization - the source of acquisition of the state, municipal archive are determined by the regulations approved by the head of the organization.

note

The New Rules do not apply to the organization of storage, acquisition, recording and use of documents from the Archival Fund of the Russian Federation and other archival documents containing information constituting state secrets.

An important feature of the new Rules is that they establish the basic requirements for organizing the storage of electronic documents in the archives of organizations.

Section IV. Transfer of organization documents for storage to the state (municipal) archive

Determines the procedure for transferring organization documents for storage to the state (municipal) archive. This section establishes that:

- organizations - sources of acquisition of state (municipal) archives, after the expiration of the temporary storage period for documents of the Archive Fund of the Russian Federation in the archive of the organization, transfer them for permanent storage to the corresponding state (municipal) archive in accordance with Rules No. 19;

- state and non-state organizations that are not sources of acquisition of state (municipal) archives may transfer documents of the Archival Fund of the Russian Federation, generated in their activities, to state (municipal) archives on the basis of agreements.

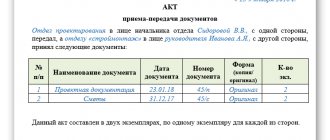

The new Rules establish the procedure for transferring documents. They emphasize that documents are transferred for permanent storage in an orderly state with the appropriate scientific reference apparatus, and the transfer of documents to the state (municipal) archive is formalized by an act of acceptance and transfer of documents for storage (Appendix No. 30).

Accounting for costs of storing documents and registers

Expenses for storing documents in the company’s own archive are usually collected on account 26 “General business expenses (OCR)”. Such costs may include:

- payment of utilities;

- renovation of premises;

- rental payments if the building is rented by an organization;

- wages with contributions to employees, etc.

Postings:

- Dt 26 Kt 60, 76 – utility payments, rent payments;

- Dt 26 Kt 23, 10, 70, etc. cost accounts (or 60, 76) - depending on whether the repairs are carried out in-house or by a third-party organization;

- Dt 26 K 70, 69, 68 – wages with deductions, if an individual employee is registered in the archive;

- Dt 19 Kt 60, 76 – VAT is recorded on services of third-party organizations;

- Dt 68 Kt 19 – VAT deductible on services of third-party organizations;

- Dt 60 Kt 51, 50 – payment for services of third-party organizations.

Note that the organization can carry out repairs on its own and at the expense of the established repair fund. Then the wiring will be like this:

- Dt 26 Kt 96 – monthly contributions to the fund;

- Dt 96 Kt 23, 10, 70, etc. – actual expenses for repairing the archive.

To account for third-party archive services, use account 97 “Deferred expenses”:

- Dt 97 Kt 60, 76 – the cost of archive services is recorded in accounting;

- Dt 60, 76 Kt 51 – the cost of archive services has been paid;

- Dt 26 Kt 97 - part of the storage costs is included in the costs.

The portion of expenses included in the monthly costs is calculated based on the manager’s order indicating the period for writing off the costs of archive services (for example, 12 months).

In tax accounting, “archival” costs are classified as other expenses directly related to the production and sale of products, as management expenses (Article 264-1 of the Tax Code of the Russian Federation, paragraph 18). Amounts are included in calculations for NU purposes.

It should be borne in mind that according to Art. 149-2 Tax Code of the Russian Federation, paragraphs. 6, archive services are not subject to VAT, therefore, the tax amount will not have to be excluded from costs.