Every entrepreneur, director, and chief accountant is familiar with the feeling of slight anxiety when receiving requests from tax authorities to provide documents (information). The requirement may concern the taxpayer himself, his counterparties, familiar and unfamiliar third parties. Along with the requirements, notifications are often received about the need to provide explanations, including written ones, which differ little from the content requirements. Requirements may come as part of an ongoing inspection or at the stage of pre-inspection analysis, indicating the inspector’s interest.

Let's try to figure out how to save time, nerves and paper in the printer if a requirement has arrived, and how not to run into fines for failure to comply.

In recent years, the Tax Code of the Russian Federation has been giving inspectors more and more opportunities to request documents, judicial practice is turning away from taxpayers, and tax inspectors are getting the hang of it, sending more and more demands and asking for clarifications. As a result, the number of demands drawn up by tax authorities has reached its peak.

First, let’s figure out what the inspector can ask and from whom:

| According to Art. 88, 93 of the Tax Code of the Russian Federation as part of a desk audit | According to Art. 89, 93 of the Tax Code of the Russian Federation as part of an on-site inspection | According to Art. 93.1 of the Tax Code of the Russian Federation as part of a “counter” inspection | Summons to give explanations, including written ones, on the basis of (subclause 4, clause 1, article 31 of the Tax Code of the Russian Federation) | |

| In relation to the taxpayer himself | — Documents that are submitted along with the tax return; — Documents confirming the loss (reduction of the tax amount) declared in the updated declaration filed 2 years after the submission of the initial declaration; — Other documents provided for in Art. 88 of the Tax Code of the Russian Federation related to inspections of the application of benefits, payment of VAT, investment partnerships, returns of excisable goods, services of foreign organizations registered in the Russian Federation, transactions exempt from insurance contributions, deductions for the sale of goods under tax free, investment deductions. | Any documents and information related to the calculation and payment of audited taxes in the audited period. | Documents and information regarding a specific transaction, in the absence of a desk or on-site audit, if the tax authority has a reasonable need to obtain them. | Explanations about any aspects of the taxpayer’s activities, including the obligation to attach supporting documents. Response deadlines are set arbitrarily by the inspector. |

| Regarding your counterparty | Not requested. | Not requested. | Any documents and information related to the calculation and payment of taxes. | Explanations about the specifics of the relationship with the counterparty. |

| In relation to a third party - that is, organizations/individual entrepreneurs with which you, as a taxpayer, do not directly have contractual relations | Not requested. | Not requested. | Any available documents and information, if the person being inspected is connected with you “along the chain” of supply of goods (performance of work, provision of services). | Not requested. |

| Sanctions for non-compliance | Failure to provide documents - a fine of 200 rubles for each document not submitted (Article 126 of the Tax Code of the Russian Federation). Confiscation of documents is possible. Failure to provide information requested on the basis of clause 3 of Art. 88 of the Tax Code of the Russian Federation - a fine of 5,000 rubles. | Failure to provide documents - a fine of 200 rubles for each document not submitted (Article 126 of the Tax Code of the Russian Federation). Confiscation of documents is possible. | Failure to provide documents - a fine of 200 rubles for each document not submitted (Article 126 of the Tax Code of the Russian Federation). Failure to provide information - a fine of 5,000 rubles. | Disobedience to a lawful order or requirement of an official - a fine of 500 to 1,000 rubles for individuals, and from 2,000 to 4,000 rubles for officials (19.4 Code of Administrative Offenses of the Russian Federation) |

And now in more detail.

What may be asked during inspections?

The harsh reality: everything that is in any way connected with the calculation and payment of taxes audited by the inspection can be demanded from anyone.

One gets the strong impression that soon no one will be surprised by the demand, for example, for the birth certificate of the chief accountant, since it is the chief accountant who is responsible for calculating and paying taxes in the company. The other side of the coin is the possibility of tax officials abusing their powers.

And it is precisely because of such abuses, and not at all because of the taxpayer’s desire to hide compromising information, that there is often a reluctance to respond to requests from tax authorities. And sometimes there are outright stupidities.

Thus, quite recently, in the Sverdlovsk region and Chelyabinsk regions, taxpayers received requests asking them to submit “documents confirming the performance of work directly in outer space.”

Most likely, this wording was translated from Art. 164 of the Tax Code of the Russian Federation, which provides for the application of a 0% rate, and was thoughtlessly copied from the requirements set by any of the Roscosmos structures. However, for accountants of other companies such formulations, which gave reason to think about the vast expanses of the universe, caused bewilderment and a grin.

Document code 2626 tax invoice

By Order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/: Code Name of document 03 Birth certificate 07 Military ID 08 Temporary certificate issued instead of a military ID 10 Passport of a foreign citizen 11 Certificate of consideration of an application for recognition of a person as a refugee on the territory of the Russian Federation according to essence 12 Residence permit in the Russian Federation 13 Refugee certificate 14 Temporary identity card of a citizen of the Russian Federation 15 Temporary residence permit in the Russian Federation 19 Certificate of provision of temporary asylum on the territory of the Russian Federation 21 Passport of a citizen of the Russian Federation 24 Identity card of a military serviceman of the Russian Federation 91 Other documents The given Directory of codes for types of documents is not is the only one. To simplify automated data processing, a specific code is assigned to the type of identification document of an individual. Such codes are usually provided in the instructions for filling out the relevant forms.

For example, in a certificate of income of an individual 2-NDFL (approved by Order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/), it is necessary to indicate not only the series and number of the identification document, but also the two-digit code of such a document.

A directory of codes for types of documents identifying a taxpayer is given in Appendix No. 1 to the Filling Out Procedure, approved. By Order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/ So, for example, the passport of a citizen of the Russian Federation corresponds to code 21.

We present all the codes of document types given in Appendix No. 1 to the Filling Out Procedure, approved.

As part of the on-site inspection, any documents may be requested.

Clause 12 of Article 89 of the Tax Code of the Russian Federation contains only one limitation: they must be related to the calculation and payment of taxes. In the Letter of the Federal Tax Service of Russia dated July 25, 2013 No. AS-4-2/13622 “On recommendations for conducting on-site tax audits,” the tax service describes what documents and information may be of interest to inspectors, but in little more detail:

«During a tax audit, officials of the tax authority check, analyze, compare and evaluate documents and information that are important for drawing conclusions about the correctness of calculation, withholding and payment (transfer) of taxes and fees, as well as for making an informed decision based on the results of the audit

».

There is no exhaustive list of such documents; accordingly, the volume and composition of the requested documents and information is virtually unlimited.

The Federal Tax Service will be able to accept more documents electronically

Orders of the Federal Tax Service of Russia dated March 24, 2016 No. MMV-7-15/ [email protected] and dated April 13, 2016 No. MMV-7-15/ [email protected] approved new formats for invoices with expanded details and adjustment invoices with expanded details. details.

The format for submitting a document on the transfer of goods during trade operations in electronic form and the format for submitting a document on transfer of work results (a document on the provision of services) in electronic form have also been approved (Orders of the Federal Tax Service of Russia dated November 30, 2015 No. ММВ-7-10 / [email protected] and dated November 30, 2015 No. ММВ-7-10/ [email protected] ).

Despite the approval of these formats, organizations could not send them to the tax authority due to the lack of codes. This problem will be resolved soon.

In a letter dated July 29, 2016 No. AS-4-15/13968, the Federal Tax Service of Russia reports that work is currently underway to amend the Order of the Federal Tax Service of Russia dated June 29, 2012 No. ММВ-7-6/ [email protected] “On approval of the format of the inventory of documents sent to the tax authority electronically via telecommunication channels” and assigning codes to documents.

In particular, the documents will be assigned the following codes: 2937 - Document on the transfer of goods during trade operations; 2939 — Document on the transfer of work results (on the provision of services); 2441 - Invoice and document on the transfer of goods (work, services), property rights, including an invoice; 2943 — Adjustment invoice and document on changes in the cost of shipped goods (works, services), property rights, which includes an adjustment invoice. Assigning codes will allow organizations to send these documents to the tax authority electronically.

Let us remind you that currently organizations can send 10 electronic documents to the Federal Tax Service, which are assigned codes:

- 0924 - Invoice;

- 0925 - Purchase book;

- 0926 - Sales book;

- 1004 — Journal of received and issued invoices;

- 2181 — Certificate of acceptance and delivery of works (services);

- 2232 ——Additional sheet of the Purchase Book;

- 2233 — Additional sheet of the Sales Book;

- 2234 — Consignment note (TORG-12);

- 2772 — Adjustment invoice;

- 8888 - Response to Request for Explanation.

Now there will be 14 such electronic documents.

Requirements under “counter checks”.

The list of documents that can be requested directly from the taxpayer is limited within the framework of desk audits (Article 88 of the Tax Code of the Russian Federation). Basically, these are documents confirming the right to apply benefits or the legality of a refund or VAT refund.

However, these restrictions can be easily overcome by the inspector.

If documents related to the taxpayer’s activities cannot be requested during a desk audit from the taxpayer himself, then why not request the documents the inspector is interested in as part of a “counter” audit of each of the taxpayer’s counterparties. It turns out that the inspector is asking for documents not regarding the taxpayer himself, but the documents he has regarding all his counterparties. In fact, it is the taxpayer himself who is being audited. Formally, such demands are legal and in the vast majority of cases it is not possible to challenge them in court.

An important nuance of counter verifications is that the documents and information requested during them must be related to the taxpayer being audited, that is, to your counterparty, in respect of whom the audit is being carried out.

This connection does not have to be direct.

In a situation where you are asked for documents regarding your relationship with your counterparty, but are being checked by a third party (whom you may not know), such a requirement will be legal if your counterparty is a link in the chain of suppliers (buyers) leading to the third party being checked face.

Or, for example, you may be asked to provide information on how you recorded a transaction with a counterparty in your accounting records. The connection of this information with the taxpayer being audited (your counterparty) is not obvious, but the courts recognize the request for such information as lawful.

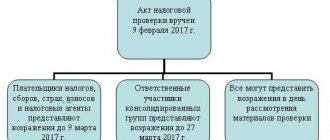

Requirements set as part of the pre-verification analysis.

If you receive a request that contains the phrase “Outside the scope of tax audits” and you are asked to submit documents relating to one or more tax periods, then “congratulations” - you are most likely a candidate for an on-site tax audit.

Let's give an example of a real claim received by a counterparty of one group of companies suspected by tax authorities of artificially splitting up their business:

Such requirements are used very widely by inspectors, and information about you with a similar requirement may be requested from all your counterparties.

The Tax Code of the Russian Federation does not provide for pre-audit analysis among tax control measures, but such requirements will have to be answered.

Legislative framework of the Russian Federation

valid Editorial from 29.06.2012

detailed information

| Name of document | ORDER of the Federal Tax Service of the Russian Federation dated June 29, 2012 N ММВ-7-6/ [email protected] “ON APPROVAL OF THE FORMAT OF THE DESCRIPTION OF DOCUMENTS SENT TO THE TAX AUTHORITY IN ELECTRONIC FORM VIA TELECOMMUNICATION CHANNELS” |

| Document type | order |

| Receiving authority | Federal Tax Service of the Russian Federation |

| Document Number | ММВ-7-6/ [email protected] |

| Acceptance date | 01.01.1970 |

| Revision date | 29.06.2012 |

| Date of registration with the Ministry of Justice | 01.01.1970 |

| Status | valid |

| Publication |

|

| Navigator | Notes |

ORDER of the Federal Tax Service of the Russian Federation dated June 29, 2012 N ММВ-7-6/ [email protected] “ON APPROVAL OF THE FORMAT OF THE DESCRIPTION OF DOCUMENTS SENT TO THE TAX AUTHORITY IN ELECTRONIC FORM VIA TELECOMMUNICATION CHANNELS”

FORMAT OF DESCRIPTION OF DOCUMENTS SENT TO THE TAX AUTHORITY ELECTRONICALLY VIA TELECOMMUNICATION CHANNELS

I. General provisions

1. This Format describes the requirements for an XML file for transmitting an inventory of documents sent to the tax authority electronically via telecommunication channels (hereinafter referred to as the exchange file).

2. Version number of this Format is 5.01.

II. EXCHANGE FILE DESCRIPTION

3. The name of the exchange file should be as follows:

R_T_A_K_O_GGGGMMDD_N, where:

R_T is a prefix that takes the value ON_OPDOCNO;

A_K — information recipient identifier, where:

A is the identifier of the recipient to whom the exchange file is sent, K is the identifier of the final recipient for whom the information from this exchange file is intended <*>; identifiers A and K look like a four-digit code for tax authorities (tax authority code in accordance with the Tax Authorities Designation System (SONO) classifier);

<*> The transfer of a file from the sender to the final recipient (K) can be carried out in several stages through other tax authorities that transfer the file at intermediate stages, which are indicated by the identifier A. In the case of a file transfer from the sender to the final recipient in the absence of tax authorities that carry out transmission at intermediate stages, the values of identifiers A and K are the same. For files submitted by taxpayers to the tax authority, the final recipient identifier in the file name K must match the value of the “Tax Authority Code” (CodeNO) attribute in the submitted exchange file.

O - identifier of the information sender, has the form:

for organizations - a nineteen-digit code (taxpayer identification number (hereinafter - TIN) and reason code for registration (hereinafter - KPP) of the organization (separate division);

for individuals - a twelve-digit code (TIN of an individual, if available. If there is no TIN - a sequence of twelve zeros).

GGGG — year of formation of the transferred file, MM — month, DD — day;

N - file identification number (length - from 1 to 36 characters. The file identification number must ensure the uniqueness of the file).

The file name extension is xml. The file name extension can be specified in either lowercase or uppercase letters.

Parameters of the first line of the exchange file

The first line of the XML file should look like this:

The name of the file containing the XSD schema of the exchange file should be as follows:

ON_OPDOCNO_1_912_01_05_01_xx, where xx is the schema version number.

The file name extension is xsd.

4. The logical model of the exchange file is presented in the form of a diagram of the structure of the exchange file in Figure 1 of this Format. The elements of the logical model of an exchange file are the elements and attributes of the XML file. The list of structural elements of the logical model of the exchange file and information about them are given in Tables 4.1 - 4.19 of this Format.

For each structural element of the logical model of the exchange file, the following information is provided:

Element name. The full name of the element <*> is given.

<*> Several elements can be described in a table row, the names of which are separated by the “|” symbol. This form of recording is used if there is a possible presence in the exchange file of only one element described in this line.

Abbreviated name of the element. The abbreviated name of the element is given. The syntax of the abbreviated name must conform to the XML specification.

Element type attribute. Can take the following values: “C” is a complex logical model element (contains nested elements), “P” is a simple logical model element implemented as an XML file element, “A” is a simple logical model element implemented as an XML element attribute file. A simple logical model element does not contain nested elements.

Element value format. The element value format is represented by the following conventions: T - character string; N—numeric value (integer or fraction).

The format of a character string is specified as T(nk) or T(=k), where n is the minimum number of characters, k is the maximum number of characters, the “-” symbol is a separator, and the “=” symbol means a fixed number of characters in the line. If the minimum number of characters is 0, the format is T(0-k). If the maximum number of characters is unlimited, the format is T(n-).

The format of a numeric value is specified as N(mk), where m is the maximum number of digits in the number, including the sign (for a negative number), the integer and fractional part of the number without a separating decimal point, k is the maximum number of digits of the fractional part of the number. If the number of digits of the fractional part of a number is 0 (i.e. the number is an integer), then the format of the numeric value is N(m).

For simple elements that are base in XML (defined in /content/base/), such as an element of type "date", the Element Value Format field is not populated. For such elements, the type of the base element is indicated in the “Additional Information” field.

The element's mandatory attribute determines whether the element (a combination of the element's name and its value) must be present in the exchange file. The element's mandatory attribute can take the following values: “O”—the presence of the element in the exchange file is mandatory; “N”—the presence of the element in the exchange file is optional, i.e. element may be missing. If an element accepts a limited list of values (according to a classifier, code dictionary, etc.), then the element’s mandatory attribute is supplemented with the symbol “K”. For example: "OK." If the number of implementations of an element can be more than one, then the element’s mandatory attribute is supplemented with the symbol “M”. For example: “NM, OKM.”

The value “U” can be added to the above-mentioned signs that an element is required if the XSD schema describes the conditions for the presence (absence) of an element in the exchange file or to the accepted values of the element. For example: “NU”, “OKU”.

Additional Information. For complex elements, a link to a table is provided that describes the composition of this element. For elements that accept a limited list of values from a classifier (code dictionary, etc.), the corresponding name of the classifier (code dictionary, etc.) is indicated or a list of possible values is provided. For a classifier (code dictionary, etc.), a link to its location may be indicated. For elements that use a custom data type, the name of the typical element is indicated.

The XSD scheme of the exchange file in electronic form is provided in a separate file and is posted on the website of the Federal Tax Service of Russia.

Figure 1. Exchange file structure diagram

Table 4.1

Exchange File (File)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| File ID | IDFile | A | T(1-150) | ABOUT | Contains (repeats) the file name (without extension and period) |

| Transmitting program version | VersProg | A | T(1-40) | N | |

| Format version | VersForm | A | T(1-5) | OK | Takes on the value: 5.01 |

| List of documents sent to the tax authority | Document | WITH | ABOUT | The composition of the element is presented in table. 4.2 |

Table 4.2

List of documents sent to the tax authority (Document)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| Document form code for KND | KND | A | T(=7) | OK | Typical element <KNDType>. Takes on the value: 1165034 |

| Document generation date | DateDoc | A | T(=10) | N | Type element <DateType>. Date in DD.MM.YYYY format |

| Document sender information | SvDep | WITH | ABOUT | The composition of the element is presented in table. 4.3 | |

| Information about the recipient of the document | SvPoluch | WITH | ABOUT | The composition of the element is presented in table. 4.4 | |

| Taxpayer information | SvNP | WITH | ABOUT | The composition of the element is presented in table. 4.5 | |

| Identifier of the document file for which the inventory is generated | IDFileMain | WITH | ABOUT | The composition of the element is presented in table. 4.6 | |

| Documents sent to the tax authority | DocForeign | WITH | ABOUT | The composition of the element is presented in table. 4.7 | |

| Information about the person who signed the document | Signatory | WITH | ABOUT | The composition of the element is presented in table. 4.11 |

Table 4.3

Information about the sender of the document (SvOtpr)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| Sign of the sender - authorized representative | PrizeOtprUP | A | T(=1) | OK | Takes on the value: 1 | 2, where: |

| 1 - no; | |||||

| 2 - yes | |||||

| Sender - organization | OtprYuL | WITH | ABOUT | Typical element <SVYULTip>. The composition of the element is presented in table. 4.15 | |

| Sender - an individual (including an individual entrepreneur) | OtprFL | WITH | ABOUT | Typical element <SvFLTip>. The composition of the element is presented in table. 4.14 |

Table 4.4

Information about the recipient of the document (SvPoluch)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| Tax authority code in accordance with SONO | CodeNO | A | T(=4) | OK | Type element <SONOTType> |

Table 4.5

Information about the taxpayer (SVNP)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| Taxpayer - organization | NPYL | WITH | ABOUT | Typical element <SVYULTip>. The composition of the element is presented in table. 4.15 | |

| Taxpayer - an individual (including an individual entrepreneur) | NPFL | WITH | ABOUT | Typical element <SvFLTip>. The composition of the element is presented in table. 4.14 |

Table 4.6

Identifier of the document file for which the inventory is generated (IdFileMain)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| File name of the request for the submission of documents, in response to which the inventory is generated | NameFileReq | P | T(1-150) | ABOUT | Contains (repeats) the file name (without extension and period) |

| Identifier of the tax return (calculation) file for which the inventory is generated | IDFileNalAccount | P | T(1-150) | ABOUT |

Table 4.7

Documents sent to the tax authority (DocNaprNO)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| Number of files sent | ColFile | A | N(2) | ABOUT | The total number of DocForm document files, ES files and DocScan document files is indicated. |

| Document presented as an xml file | DocForm | WITH | NM | The composition of the element is presented in table. 4.8. Mandatory if DocScan is not available | |

| Document presented as a scanned image | DocScan | WITH | NM | The composition of the element is presented in table. 4.9. Mandatory if DocForms are not available |

Table 4.8

Document presented as an xml file (DocForm)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| Document code | CodeDoc | A | T(=4) | OK | Takes on the value: 0924 | 0925 | 0926 | 1004 | 2181 | 2232 | 2233 | 2234, where: 0924 - Invoice, 0925 - Purchase Book, 0926 - Sales Book, 1004 - Journal of received and issued invoices, 2181 - Work (services) acceptance certificate, 2232 - Additional sheet of the Purchase Book, 2233 - Additional sheet of the Sales Book, 2234 - Consignment note (TORG-12) |

| Document form code for KND | KND_Doc | A | T(=7) | ABOUT | Typical element <KNDType> |

| Number of the basis document (main document) | NomDocMain | A | T(1-50) | N | Required for CodeDoc2181. For others, the CodeDoc is not filled in |

| Date of the basis document (main document) | DateDocMain | A | T(=10) | N | Typical element <DateSQLType> Date in the format DD.MM.YYYY. Required for CodeDoc = 2181. For others, CodeDoc is not filled in |

| Serial number of the requested document (requested information) | PornNomDoc | P | T(=4) | N | Mandatory when sending documents in response to a request for documents (information). The serial number of the requested document is indicated, in accordance with the requirement for the submission of documents (information). Has the form 1.XX (2.XX), where XX is the serial number |

| Document file name | NameFile | P | T(1-150) | ABOUT | File name of the document submitted to the tax authority in accordance with the approved format for this document without extension and period |

| File name of the ES of this document | NameFileEDS | P | T(1-150) | ABOUT | The name of the electronic signature file should have the following form: FilenameXXX.sgn, where: Filename is the file name of the document submitted to the tax authority in accordance with the approved format for this document, without extension and period; XXX - postfix of the ES file, taking the value “SGN”; .sgn - dot and ES file extension |

Table 4.9

Document presented as a scanned image (DocScan)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| Document code | CodeDoc | A | T(=4) | OK | Takes on the value: 0924 | 1665 | 2181 | 2215 | 2216 | 2230 | 2234 | 2745 | 2766, where: 0924 - Invoice, 1665 - Consignment note, 2181 - Work (services) acceptance certificate, 2215 - Cargo customs declaration / transit declaration, 2216 - Additional sheet to the cargo customs declaration / transit declaration, 2330 — Specification (calculation, calculation) of price (cost), 2234 — Consignment note (TORG-12), 2745 — Addendum to the contract, 2766 — Agreement (agreement, contract) |

| Title of the document | NaimDok | A | (1-1000) | ABOUT | |

| Document date | DateDoc | A | T(=10) | N | Generic element <DateSQLType>. Date in DD.MM.YYYY format. Required for CodeDoc = 0924 | 1665 | 2181 | 2330 | 2234 | 2745 | 2766. For others, the CodeDoc is not filled in |

| Document Number | NomDoc | A | T(1-50) | N | Required for CodeDoc = 0924 | 1665 | 2215 | 2216 | 2330 | 2745 | 2766. Can be filled in for CodeDoc = 2181 | 2234 |

| Total amount (including tax, if any) indicated in the document | SumTotal | A | N(17.2) | N | Required for CodeDoc = 0924 | 1665 | 2181 | 2330 | 2234. Can be filled in for CodeDoc = 2745 | 2766 |

| The tax amount indicated in the document | SumTax | A | N(17.2) | N | Mandatory for CodeDoc = 0924. Can be filled out for CodeDoc = 1665 | 2181 | 2330 | 2234 | 2745 | 2766 |

| Number of the basis document (main document) | NomDocMain | A | T(1-50) | N | Required for CodeDoc = 1665 | 2181 | 2216 | 2330 | 2745. Can be filled in for CodeDoc = 2234. Used for documents drawn up with a basis (main document) |

| Date of the basis document (main document) | DateDocMain | A | T(=10) | N | Generic element <DateSQLType>. Date in DD.MM.YYYY format. Required for CodeDoc = 1665 | 2181 | 2330 | 2745. Can be filled in for CodeDoc = 2234. Used for documents drawn up with a basis (main document) |

| Subject of the document | Pre-Doc | A | T(1-500) | N | Required for CodeDoc = 2745 | 2330 | 2766. For others, the CodeDoc is not filled in. Used to describe the subject of the document (subject of the agreement, etc.) |

| Serial number of the requested document (requested information) | PornNomDoc | P | T(=4) | N | Mandatory when sending documents in response to a request for documents (information). The serial number of the requested document is indicated, in accordance with the requirement for the submission of documents (information). Has the form: 1.XX (2.XX), where XX is the serial number |

| Document period | PerDoc | WITH | N | Typical element <PeriodType>. The composition of the element is presented in table. 4.13. Can be filled in for CodeDoc = 2181 | |

| Details of the person who drew up the document (details of the participant in the transaction, supplies specified in the document) | UchSdel | WITH | NM | The composition of the element is presented in table. 4.10. Required for CodeDoc = 0924 | 1665 | 2181 | 2330 | 2234 | 2745 | 2766 | |

| Document file name | NameFile | P | T(1-150) | OM | The file name of the scanned document is: KD_O_P_N1_GGGGMMDD_N2, where: KD is a prefix that takes the value of the document code in accordance with CodeDoc; O - the sender's identifier has the form: for organizations - a nineteen-digit code (TIN and KPP of the organization); for individuals - a twelve-digit code (TIN of an individual, in the absence of an INN - a sequence of twelve zeros); P - identifier of the final recipient - the tax authority, - four-digit code of the tax authority in accordance with SONO; GGGGMMDD — file creation date; N1, N2 - file identification numbers (GUID). If a document consists of several files, N1 is the same for all files of one document, N2 is unique for each file, regardless of its membership in the document. File name extension - tif | jpg. The following requirements apply to files containing scanned images: a black and white image with a scanned document resolution of no less than 150 and no more than 300 dpi using 256 shades of gray. File name of the document submitted to the tax authority in accordance with the approved format for this document without extension and period |

Table 4.10

Details of the person who drew up the document (details of the participant in the transaction, supplies specified in the document) (UchSdel)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| Role of the transaction participant | RoleParticipationDeal | A | T(=3) | OK | Takes on the value: 101 | 102 | 103 | 104 | 105 | 113 | 114 | 116 | 117 | 120 | 121 | 122 | 201 | 203 | 204 | 205 | 209 | 210 | 214 | 216 | 217 | 218 | 219 | 220 | 221 | 222 | 301 | 302 | 303 | 304 | 305 | 306 | 307 | 309 | 310 | 311 | 312 | 313 | 314, where: 101 - seller; 102 - supplier; 103 - customer; 104 - sender; 105 - shipper; 113 - founder; 114 - lessor; 116 - lender; 117 - drawer; 120 - policyholder; 121 - exporter; 122 - employer; 201 - buyer; 203 - performer; 204 - recipient; 205 - consignee; 209 - attorney; 210 - agent; 214 - tenant; 216 - borrower (borrower); 217 - recipient of the bill; 218 - user; 219 - keeper; 220 - insurer; 221 - importer; 222 - employee; 301 - participant; 302 - payer; 303 - declarant; 304 - carrier; 305 - forwarder; 306 - shareholder; 307 - issuer; 309 - investor; 310 - general contractor; 311 - subcontractor; 312 - contractor; 313 - intermediary; 314 - the person who drew up the document. For others, the CodeDoc is not filled in |

| Organization - party to the transaction | UchSdelOrg | WITH | ABOUT | Typical element <SvUchSdelYULTip>. The composition of the element is presented in table. 4.17 | |

| Individual entrepreneur - participant in the transaction | UchSdelFL | WITH | ABOUT | Typical element <SvUchSdelFLTip>. The composition of the element is presented in table. 4.16 |

Table 4.11

Information about the person who signed the document (Signatory)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| Sign of the person who signed the document | PrPodp | A | T(=1) | OK | Takes on the value: 3 | 4, where: 3 - head of the organization (individual entrepreneur); 4 - representative of the organization (individual entrepreneur) |

| Position of the person signing the document | MustSubp | A | T(0-128) | N | |

| Contact phone number | Phone | A | T(1-20) | N | |

| A | T(1-45) | N | |||

| TIN of an individual | INNFL | A | T(=12) | N | Type element <INNFLType> |

| Full Name | Full name | A | ABOUT | Typical element <FullType>. The composition of the element is presented in table. 4.18 | |

| Information about the authorized representative | Holy Pred | WITH | N | The composition of the element is presented in table. 4.12. Mandatory when PrSdp = 4 |

Table 4.12

Information about the authorized representative (SvPred)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| Name of the document confirming the authority of the taxpayer’s representative | NaimDok | A | T(1-120) | ABOUT |

Table 4.13

Document period (PeriodType)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| Beginning of period | NachPer | A | T(=10) | N | Generic element <DateSQLType>. Date in DD.MM.YYYY format |

| End of period | WindowsPer | A | T(=10) | N | Generic element <DateSQLType>. Date in DD.MM.YYYY format |

Table 4.14

Information about an individual (SvFLTip)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| TIN of an individual | INNFL | A | T(=12) | ABOUT | Type element <INNFLTType>. If there is no TIN - a sequence of twelve zeros |

| Last name, first name, patronymic of an individual | Full name | WITH | ABOUT | Typical element <FullType>. The composition of the element is presented in table. 4.18 |

Table 4.15

Information about the organization (SvYuLTip)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| Full name of the organization | NaimOrg | A | T(1-1000) | ABOUT | |

| TIN of the organization | INNUL | A | T(=10) | ABOUT | Typical element <INNULTYPE> |

| checkpoint | checkpoint | A | T(=9) | ABOUT | Typical element <KPPType> |

Table 4.16

Information about an individual (SvUchSdelFLTip)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| TIN of an individual | INNFL | A | T(=12) | N | Type element <INNFLTType>. If there is no TIN, a sequence of twelve zeros. Required for CodeDoc = 2181 | 2330 | 2745 | 2766. Can be filled in for CodeDoc = 0924 | 1665 | 2234 |

| Last name, first name, patronymic of an individual | Full name | WITH | ABOUT | Typical element <FullType>. The composition of the element is presented in table. 4.18 |

Table 4.17

Information about the organization (SvUchSdelYULTip)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| Full name of the organization | NaimOrg | A | T(1-1000) | ABOUT | |

| TIN of the organization | INNUL | A | T(=10) | N | Type element <INNULTYPE>. Required for CodeDoc = 2181 | 2330 | 2745 | 2766. Can be filled in for CodeDoc = 0924 | 1665 | 2234 |

| checkpoint | checkpoint | A | T(=9) | N | Type element <KPPType>. Can be filled in for CodeDoc = 0924 | 1665 | 2181 | 2330 | 2234 | 2745 | 2766 |

Table 4.18

Last name, first name, patronymic (full name)

| Item name | Abbreviated name (code) of the element | Element type attribute | Element Format | Mandatory element indicator | Additional Information |

| Surname | Surname | A | T(1-60) | ABOUT | |

| Name | Name | A | T(1-60) | ABOUT | |

| Surname | Surname | A | T(1-60) | N |

What to consider when preparing a response to a demand made outside the scope of tax audits?

The Tax Code of the Russian Federation contains a rule according to which, outside the framework of tax audits, an inspector may request documents and information about a specific transaction from the participants in this transaction or from other persons who have documents (information) about this transaction, if the tax authorities have a justified need to obtain them.

It follows from this rule that the tax authority must indicate information that makes it possible to determine the very specific transaction for which documents are requested, and the tax authority must justify the need to obtain them.

Information that allows you to specify a transaction (let us immediately note that this can be several transactions at once) can be details of a contract, invoices, and so on. And for such a specific transaction, you can request any volume of documents, any information.

That is, outside the framework of tax audits, the tax authority cannot request “all contracts for the last 3 years,” but can request “invoices from 01/01/2016 to 12/31/2018 related to the contract, for example, No. 1 dated 01/01/2015” .

In fact, the tax authority can request the same volume of documents as during an on-site tax audit, without going to it. The main purpose of such a pre-audit analysis is to determine whether it is worth going to an audit with a given taxpayer at all.

As for the justification for the need to request documents, the Tax Code of the Russian Federation does not explain what this “justified necessity” is, and whether the inspector is obliged to give the taxpayer any explanations about the reasons for requesting documents (information) from him outside the framework of tax audits.

Previously, courts more often agreed with taxpayers that the tax authority must clearly and clearly state what such a need is, otherwise “the requirement violates the rights and legitimate interests of a person in the field of entrepreneurial and other economic activities, imposing on him the obligation to submit documents not provided for in paragraph 2 of Art. 93.1 Tax Code of the Russian Federation.” Recently, there have been more decisions in which the court believes that “the justified need to obtain documents (information) only implies that they cannot be requested for non-official or other purposes not related to monitoring compliance with legislation on taxes and fees,” or the court agrees with the inspection that the need can be justified with the phrase “in connection with the emergence of a justified need,” or in other words, it is necessary because it is necessary...

Or it is even clarified that “the tax authority is not obliged to inform the counterparty of the relevant person whose documents (information) about transactions are requested, the reasons why he considered it necessary to send a request.” We believe that this judicial interpretation of Article 93.1 of the Tax Code of the Russian Federation is expansive, leading to the fact that the inspector is given the right to request documents arbitrarily from anyone, in any quantity, without carrying out any tax control measures, without any need, ignoring the norms of the Tax Code of the Russian Federation about the timing of the tax audit.

When inspection requirements are illegal

Situation one: The request does not indicate within the framework of which tax control measures the documents were requested.

At first glance, such a drawback may seem formal, but an analysis of the norms of the Tax Code of the Russian Federation and judicial practice suggests the opposite.

- Firstly, the obligation of the inspectorate to indicate in the request the tax control event during which the documents were requested is determined by the provisions of paragraph 3 of Art. 93.1 Tax Code of the Russian Federation.

- Secondly, the very form of such a requirement requires the presence of this information (Appendix No. 15 to the Order of the Federal Tax Service of Russia dated May 8, 2015 No. ММВ-7-2 / [email protected] ).

Accordingly, a requirement in which this information is missing does not comply with the provisions of the Tax Code of the Russian Federation, and is also drawn up in violation of the established form, that is, we are talking about an illegal request for documents as part of a tax audit.

If the documents were requested on the basis of clause 1 of Art. 93.1 of the Tax Code of the Russian Federation, then the chances that the court will recognize the demand as illegal are very high.

This is explained by the following: The Plenum of the Supreme Arbitration Court of the Russian Federation, in paragraph 27 of Resolution No. 57 of July 3, 2013, noted: it is possible to request documents from counterparties and other persons who have documents about the taxpayer being inspected only during the period of an audit or additional tax control measures.

If the request does not contain information about the tax control event, you are deprived of the opportunity to find out whether the tax authority currently has the legal right to request documents from you.

At the same time, the content of the request must clearly indicate that the obligation to submit documents is legally assigned to you. In the case under consideration, the content of the requirement does not allow us to verify the legality of assigning this responsibility to you.

However, tax authorities more often indicate clause 2 of Art. as a basis for requesting documents. 93.1 Tax Code of the Russian Federation.

In this case, the question of the legality of the claim is more controversial. However, as practice shows, in most cases the courts side with the taxpayer.

The tax authorities believe that, in accordance with paragraph 2 of Art. 93.1 of the Tax Code of the Russian Federation, the request for documents is an independent tax control measure. Therefore, there is no need to additionally indicate this information in the request.

However, the courts do not recognize the demand for documents on the basis of paragraph 2 of Art. 93.1 of the Tax Code of the Russian Federation is an independent measure of tax control.

As a rule, they agree that the inspection is obliged to indicate within the framework of which tax control measures the documents were requested. Otherwise, the inspection requirement is illegal (Resolution of the Arbitration Court of the West Siberian District dated June 13, 2021 No. F 04-1488/2017 in case No. A 27-12323/2016, Resolution of the Arbitration Court of the Volga District dated December 23, 2021 No. F 06 -16020/2016 in case No. A 65-12057/2016).

At the same time, some courts, unfortunately, take a more superficial approach.

For example, the Arbitration Court of the North-Western District, in its Resolution No. F 07-2225/2018 dated March 19, 2021, indicated that this deficiency in the formalization of the claim is of a formal nature. It does not suppress the powers of the inspection provided for in paragraph 2 of Art. 93.1 Tax Code of the Russian Federation.

However, despite the ambiguity of judicial practice, if the requirement to submit documents on the basis of clause 2 of Art. 93.1 of the Tax Code of the Russian Federation does not indicate a specific tax control measure, this can become a serious argument in your favor.

To do this, you need to provide the following arguments:

- the need to indicate tax control measures in the request follows from the provisions of paragraph 3 of Art. 93.1 of the Tax Code of the Russian Federation and Order of the Federal Tax Service of Russia dated May 8, 2015 No. ММВ-7-2/ [email protected] ;

- the taxpayer must know that the obligation to submit documents is legally assigned to him, namely, that documents are not requested arbitrarily, but as part of a specific tax control exercise. In particular, the Federal Tax Service of Russia warns about the inadmissibility of arbitrary demand for documents (Letter dated June 27, 2021 No. ED-4-2 / [email protected] ).

Situation two: The request does not contain information about a specific transaction.

As mentioned earlier, tax authorities have the right to request documents on a specific transaction outside of the audit (Clause 2 of Article 93.1 of the Tax Code of the Russian Federation).

At the same time, a situation often arises when, as part of such a requirement, documents are requested not about a specific transaction, but about the financial and economic activities of the organization in general, for example, accounting policies, staffing, accounting documents, etc.

The courts believe that such requirements violate the rights and legitimate interests of taxpayers and recognize them as illegal (see, for example, Resolution of the Arbitration Court of the Volga District dated December 23, 2021 No. F 06-16020/2016 in case No. A 65-12057/2016).

It happens that it is not clear from the requirement which transaction and which counterparty the requested documents relate to. If it is not possible to identify a specific transaction, then this also indicates the illegality of the demand.

Judicial practice in this matter is clear and completely on the side of the taxpayer (Resolution of the Arbitration Court of the Far Eastern District dated March 21, 2021 No. F 03-712/2017 in case No. A 51-14515/2016, Resolution of the Arbitration Court of the West Siberian District dated February 3, 2021 year No. F 04-7101/2017 in case No. A 75-6717/2016).

In addition, the inspection does not have the right to indicate a specific counterparty in its request and oblige you to provide documents on all transactions with it. In any case, the request must contain information allowing the identification of a specific transaction. The courts support this conclusion as well.

For example, in case No. A 14-14883/2015, the Arbitration Court of the Central District considered a situation where the inspectorate requested from an organization documents on all its transactions with the same counterparty over a three-year period. The court declared such a requirement illegal, pointing out that the inspection went beyond the powers granted to it by Art. 93.1 of the Tax Code of the Russian Federation (see Resolution of the Arbitration Court of the Central District dated April 24, 2021 No. F 10-980/2017 in case No. A 14-14883/2015).

When can the submission of documents (information) be refused?

The most common formal violations that lead to invalidity of a claim:

- There is no instruction attached to the request;

- The requirement was drawn up by an unauthorized person, for example, an official of an inspectorate with which you are not registered;

- The requirement (instruction) was not drawn up in the form prescribed by Order of the Federal Tax Service of Russia dated November 7, 2018 No. ММВ-7-2/ [email protected] “On approval of document forms provided for by tax authorities when exercising their powers...”. We are talking about a situation where, instead of a demand, the taxpayer is sent an “information letter” or another request not provided for by the Tax Code of the Russian Federation. Through such requests, tax authorities try to obtain information outside the audit deadlines or information that they cannot formally request. Whether to meet the inspector halfway or not in such a situation is purely the right of the taxpayer.

- The requirement was issued after the end of the tax audit. Important!

If a demand is made during an audit, but is received by the taxpayer after its completion, such a demand is recognized as legal.

- Documents and information were submitted to the inspection earlier.

- The requested documents and information do not relate to the period being audited or the subject of the audit.

This basis for refusal is fraught with several pitfalls.

Firstly, the connection between the requested documents and the verification period may exist, but may not be very obvious.

For example, an agreement may be dated to a previous period, but extend its validity to subsequent periods. Or the transaction may be completed in an earlier period, but affect the taxation of the next period for which the audit is carried out. In such cases, the demand will be legal.

Secondly, the connection between the requested documents (information) and the subject of the inspection may be indirect, but sufficient for the court to recognize such a request as lawful. In such cases, courts often comment in their decisions that the taxpayer is not given the opportunity to control and resolve the issue of the relevance of the evidence collected by the tax authority to the subject of the audit, since the decision on the need to require certain information for conducting a tax audit is the exclusive prerogative of the tax authorities.

Here you need to be careful and understand that the documents (information) must be clearly and definitely not related to the subject or the inspection period.

How to send a list of documents to the Federal Tax Service in response to a request

According to the order of the Federal Tax Service of Russia dated February 17, 2011 No. ММВ-7-2 / [email protected] (as amended on November 7, 2011), the taxpayer can transmit documents (information) via electronic communication channels in response to a received request.

To send a response to a request received from the tax authorities, you must:

1. On the main page of the Kontur.Extern system, go to the “New” section, select “Requirements” > “All requirements”. Next, click on the desired requirement in the list.

2. In the window that opens, click on the “Respond to request” button. The button becomes active after sending the acceptance receipt. Then select “Send requested documents”.

3. In the next window, you should select how documents will be added. You can add ready-made files by clicking on the “Upload from computer” link (you can also drag and drop the required files into the field that appears). If Diadoc is used to exchange documents between counterparties, then in the window that appears, you can click the “Select in Diadoc” link.

4.In the window that appears, select the files to download and click “Open”.

You can add documents in the form of scanned copies (files with the extension jpg, tif, pdf, etc.), as well as documents in the form of xml files (files with the xml extension), to the inventory.

You can add the missing files in the next step.

According to the inventory format approved by order dated January 18, 2017 N ММВ-7-6/ [email protected] , the following types of documents can be submitted in the inventory:

- Any document in the form of scanned images (the subscriber can indicate the name of the document independently in the appropriate field)

- In the form of an xml file, any document that has a tax return code (tax return code).

5. The downloading and recognition of the selected files will begin. At the end of the process, a list of downloaded documents will be displayed on the screen.

If necessary, you can add missing documents using the “+More documents” button.

To delete unnecessary files, hover your mouse over the line with the unnecessary document and click on the “Delete” button on the right side of the line.

6. After downloading, you need to start editing the added documents. To do this, click on the link with the name of the downloaded file.

Documents in the form of scanned images

In the editing window, you should select the type of loaded document. Depending on the selected type, fields will appear that must be filled out. Mandatory to fill out is the requirement item.

Clause of the requirement - this section indicates the number of the clause under which the document is indicated in the requirement in the form 1.XX or 2.XX. According to the format, the first digit of the serial number can take only one of two values - either 1 or 2. Next, XX is indicated through a dot - the two-digit serial number of the document being added.

1.XX is indicated for the documents sent in the inventory (specified in the requirement), and 2.XX is indicated for the information sent, requested in the requirement (they are not specific documents and are usually highlighted separately from the documents in the requirement).

If the downloaded document consists of several pages, you should combine them by clicking the “Connect” button

Conversely, extra pages should be separated into a new document by clicking the “Divide” button.

After all the items have been completed, click the “Next Document” button, after which the next loaded document will open. To go to the list of downloaded files, click on the button in the upper right corner or on the gray background.

Documents in the form of xml files

Unlike scanned copies, documents in the form of xml files require virtually no editing. After downloading them, you should fill out the requirement item - the item number under which the document is indicated in the requirement in the form 1.XX or 2.XX. According to the format, the first digit of the serial number can take only one of two values - either 1 or 2. Next, XX is indicated through a dot - the two-digit serial number of the document being added.

Together with the xml files of the invoice, adjustment invoice, work (services) acceptance certificate, as well as the delivery note (TORG-12), sgn signature files must also be transferred. Xml files and the corresponding sgn signature files should be downloaded from the program in which electronic document management with counterparties is carried out (for example, Diadoc).

The remaining documents that can be transferred to the inventory in the form of xml files (purchase book, sales book, journal of received and issued invoices, additional sheet of the Purchase Book, additional sheet of the Sales Book) are transferred without signature files.

For example, in order to transfer a delivery note in the form of xml in the inventory, you should add 4 files - two of them must have the xml extension (seller title and buyer title) and the corresponding two signature files with the sgn extension.

After the data has been entered, click the “Next Document” button, after which the next loaded document will open.

To go to the list of downloaded files, click on the button in the upper right corner or on the gray background.

If errors are found in the xml file (for example, “The buyer’s title is not loaded,” “The buyer’s title signature is not loaded,” then you should upload the missing documents. You can also delete such a document and re-upload it from the program in which it was generated. After this, repeat the download to Kontur.Extern.

7. Once all the necessary documents have been edited, you should go to the list and click the “Proceed to Submit” button.

The button will be inactive until the “Ready to send” status appears next to each uploaded document.

8. A window with the test results will open, in which you should click the “Proceed to Send” button.

If the inventory is signed by a certificate of an authorized representative, then together with it a message of representation (CoR) is sent to the tax office.

If the form is signed with a certificate from the legal representative (manager), then the message of representation is not transmitted.

The Proceed to Submit button does not appear if there are errors in the form or representation message. In this case, you should correct the errors found and resend.

9. In the next window, you must click on the “Sign and Send” button.

10. Inventory sent. A list of documents submitted for the inventory and the status of their processing by the Federal Tax Service will be contained under the request.

After sending the inventory, the processing statuses will change as follows:

- “Sent” - documents have been sent to the tax authority. Shipping date confirmed. The system will display the date and time the inventory was sent.

- “Delivered” - documents have been delivered to the tax authority, a “Notice of Receipt” has been received;

- “Accepted” - the documents have been accepted by the tax authority, an “Acceptance Receipt” has been received. The system will display the date and time of receipt of the receipt from the Federal Tax Service.

- “Rejected” - the documents were not accepted by the tax authority, a “Notice of Refusal” was received. The system will display the date and time of receipt of the notification from the Federal Tax Service.

What to do if asked for clarification?

Let us immediately pay attention to the basis on which norm they are asking for clarification.

If based on Article 93.1 of the Tax Code of the Russian Federation, then everything that is written above is relevant.

If, on the basis of clause 3 of Art. 88 of the Tax Code of the Russian Federation, then the tax authority must indicate in the request what errors in the tax return (calculation) and (or) contradictions between the information contained in the submitted documents were revealed by the check, or inconsistencies were identified between the information provided by the taxpayer and the information contained in the documents available from the tax authority, received during tax control.

If the tax authority does not indicate what errors or contradictions have been identified, then responding to it is your right, but not your obligation.

IMPORTANT!

Even then, the requirement should not be ignored. It is advisable to indicate in the answer that when the taxpayer independently checked the declaration submitted by him, no errors or contradictions were identified, and accordingly, the obligation to give any explanations does not arise.

Keep in mind that explanations will have to be given in any case if:

- the amount of loss is declared in the income tax return;

- the taxpayer declared in the declaration transactions (property) for which tax benefits were applied;

- in other cases specified in clauses 8.1, 8.2, 8.5, 8.6, 8.8, 12 art. 88 Tax Code of the Russian Federation.

If subsection is indicated as the basis for requesting documents or information. 3 p. 1 art. 31 of the Tax Code of the Russian Federation, then the taxpayer is not obliged to provide written explanations and documents, however, he will still have to appear at the tax authority and give explanations. Therefore, when receiving a request for information and/or documents based on a notice of summons to the taxpayer’s tax authority, the issue of providing documents and written explanations to the taxpayer should be decided based on how convenient it is for him. In most cases, written explanations drawn up in a calm environment will be more balanced, reasoned and controlled than explanations during a conversation with a tax inspector.

When can documents be requested?

In most cases, sending a corresponding request is lawful only in the case of a tax audit or additional tax control measures, which are themselves related to the audit (clause 1 of Article 93, clause 1 of Article 93.1, clause 6 of Article 101 of the Tax Code of the Russian Federation). Outside the framework of any inspection, inspectors have the right to request only documents or information about a specific transaction (Clause 2 of Article 93.1 of the Tax Code of the Russian Federation)

The format of the on-site audit allows tax officials to get acquainted with the original documents of the taxpayer, which they need to control the calculation and payment of taxes (clause 12 of Article 89 of the Tax Code of the Russian Federation). And, as a rule, inspectors use this right first. And if the information received is not enough, they will send a request to submit all or some documents in the form of certified copies. In this case, inspectors do not need any additional grounds other than the fact of conducting an on-site inspection, and the list of requested documents is limited only by the period and subject of the inspection.

During a desk audit, tax authorities, in addition to documents, have the right to demand explanations from the taxpayer, but for any demand, including documents, additional grounds are needed (clause 3, 7, article 88 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated October 13, 2015 No. 03- 02-07/1/58461). The forms of requirements for the provision of explanations and documents were approved by Order of the Federal Tax Service dated 05/08/2015 No. ММВ-7-2/ [email protected] – Appendices No. 1 and 15 (see Table 1).

Table 1

| Base | What the Federal Tax Service has the right to demand |

| Errors found in the declaration | Explanations or corrected (clarified) declaration (clause 3 of Article 88 of the Tax Code of the Russian Federation) |

| The information in the declaration contradicts the information from the documents submitted by the taxpayer | |

| The information in the declaration does not correspond to the information from the documents available to the Federal Tax Service | Explanations or corrected (clarified) declaration (clause 3 of Article 88 of the Tax Code of the Russian Federation). Documents confirming the accuracy of the information in the declaration (Clause 4 of Article 88 of the Tax Code of the Russian Federation, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 15, 2012 No. 14951/11) |

| The declaration reflects the loss | Explanations justifying the amount of loss (clause 3 of Article 88 of the Tax Code of the Russian Federation) |

| The tax amount in the “update” is less than in the original declaration | Explanations justifying the reduction of the tax amount (clause 3 of Article 88 of the Tax Code of the Russian Federation) |

| An “adjustment” that reduces the amount of tax payable or increases the loss is presented after two years from the last day of the deadline for filing the declaration. For example, a “clarification” on VAT for the first quarter of 2014 with the tax amount to be reduced was submitted on 04/22/2016 or later | Primary documents, tax accounting registers and other documents on the basis of which the amount of tax payable is reduced or the loss is increased (clause 8.3 of Article 88 of the Tax Code of the Russian Federation) |

| Mandatory supporting documents are not attached to the declaration | Documents that are attached to the declaration (clause 7 of article 88 of the Tax Code of the Russian Federation). For example, documents confirming the zero VAT rate specified in Article 165 of the Tax Code of the Russian Federation |

| The declaration states tax benefits | Explanations about transactions (property) for which benefits are applied. Documents confirming the right to benefits (clause 6 of Article 88 of the Tax Code of the Russian Federation) |

| A VAT return with the amount of tax to be refunded has been submitted. | Documents confirming the legality of VAT deductions (clause 8 of Article 88 of the Tax Code of the Russian Federation, letter of the Federal Tax Service dated September 16, 2015 No. SD-4-15/16337) |

| In the VAT return, information about transactions: – or contradicts other information in this return; – or do not correspond to the information about these transactions in the VAT return submitted to the Federal Tax Service by other persons; – or contradict information from the invoice journal. Moreover, such contradictions and inconsistencies indicate an understatement of VAT payable or an overstatement of tax refundable | Explanations and any documents (including invoices and primary documents) related to transactions in the information about which contradictions or inconsistencies were identified (clause 8.1 of Article 88 of the Tax Code of the Russian Federation, letters of the Federal Tax Service dated November 6, 2015 No. ED-4 -15/19395, dated 09/16/2015 No. SD-4-15/16337) |

| A declaration on mineral extraction tax, water or land taxes has been submitted | Documents that are the basis for the calculation and payment of these taxes (clause 9 of Article 88 of the Tax Code of the Russian Federation) |

The inspection that is conducting the inspection has the right to request from you the requirement to provide documents or information about the counterparty or a specific transaction only through the inspection with which you are registered. That is, she must send an order to your Federal Tax Service for the claim, and your inspectorate will issue you the demand itself, attaching a copy of the order (clause 3 of Article 93.1 of the Tax Code of the Russian Federation).