For entrepreneurs who want to “put down roots” in Crimea or Sevastopol (a new subject of the federation), the next 25 years promise to be a real tax haven. The favorable tax situation will affect many areas of business, so today entrepreneurs are preparing the necessary documents to obtain the status of a participant in the state support program for Crimea.

The entire Crimean peninsula is officially recognized as a Special Economic Zone (SEZ) until 2040, and this step can safely be considered a favorable factor for the development of business in Crimea and attracting new investments into the economy of the republic.

- Conditions for participation in the SEZ of Crimea and Sevastopol

- Reduced tax rates and other benefits for business in Crimea

- Features of taxation in Crimea and Sevastopol

- Freedom of customs space and port zones of Crimea

- Land use and construction on the territory of the Crimean SEZ

- Economic interaction with mainland Russia

- Termination of the contract of a FEZ participant voluntarily and forcibly

- Legislative framework for the Special Economic Zone in Crimea

- SEZ management bodies

The current conditions of the FEZ in Crimea are the most attractive for investors, due to a number of reasons. For example, the preferences and benefits associated with various areas of business are quite serious, including:

- 2% maximum tax rate on profits in the first 3 years of activity;

- Providing the opportunity to pay insurance premiums from salary in the amount of 7.6% during the first 10 years;

- The opportunity to have a “0” corporate property tax rate for 10 years;

- The tax rate under the National Tax Service was zero until 2021, and during the next five-year period it was 4%.

These, like many other pleasant tax surprises, are designed to stimulate and develop the economic activities of entrepreneurs on the Crimean peninsula. As stated by the current Deputy Minister for Crimean Affairs A. Sokolov, the Russian government is striving to create new incentives and opportunities for local businesses, to help them adapt to Russian laws and modern conditions.

In addition, loyalty is also due to the fact that the political and economic risks that have arisen and sanctions sentiments, which are directly related to activities on the peninsula, require certain compensation. And these types of benefits can push the development of business in Crimea and make the conditions as profitable and attractive as possible for both local entrepreneurs and foreign sponsors.

So far, in practice, the conditions for working in a free economic zone on the new Russian territory have not yet been fully worked out, so it is quite difficult to talk about the pros and cons. It is clear that in the course of setting up the new system, it will be necessary to adopt additional laws, amendments, or make some changes to existing laws - depending on the first experience gained and related nuances. But today we can call the conditions for entering the zone of economic freedom quite simple.

Conditions for participation in the SEZ of Crimea and Sevastopol

The operation of the SEZ on the peninsula is regulated by Federal Law dated November 29, 2014 under N 377-FZ. The current legislation does not yet provide for restrictions on the organizational and legal form of individual entrepreneurs or legal entities wishing to become participants in the SEZ.

Entrepreneurial activity in the SEZ is limited; it cannot concern the use of subsoil for the purposes of exploration and extraction of minerals, development of deposits on the continental shelf of the Russian Federation.

This means that any legal entity. persons and individual entrepreneurs registered and registered in Crimea with tax authorities have the right to receive the status of a SEZ participant. It is mandatory to have a corresponding investment declaration on the implementation of an investment project in the territory of the Republic of Crimea. As Andrey Sokolov, Deputy Minister for Crimean Affairs, said in an interview with CrimeaBusinessConsulting, in order to fully enter the profitable economic zone, it is necessary to have a registration of an individual entrepreneur/legal entity in Sevastopol or Crimea, as well as an investment project with a capital investment of at least 3 million rubles for the first 3 years of activity. Without the status of an independent legal entity, various representative offices and branches of companies will not be able to enter the zone.

For smooth entry into the free economic zone, a number of conditions and formalities must be observed. Mandatory are:

- Registration of an individual entrepreneur or organization in Sevastopol or the rest of Crimea.

- Registration with local tax authorities.

- Submitting a corresponding application with a request to conclude an agreement with the possibility of operating in a FEZ. This application is submitted in writing to the Council of Ministers of Crimea or the Legislative Assembly of the city of Sevastopol.

- Attachment of the specified documentation package when submitting an application. Such documents are: - for legal entities. persons - photocopies of constituent documents, - copies of documents on tax registration, - photocopies of state registration certificates. registration of individual entrepreneur or legal entity. person - an investment declaration set out in the appropriate form.

- Filling out the established sample investment declaration. The content of the declaration is determined by the standards of Federal Law Federal Law No. 377, reflecting the following information: - type of activity, - purposefulness of the investment project, - economic and technical definition of the investment project (the size of the average salary and the number of planned job vacancies must be indicated), - the amount of total capital financial investments, planned within the framework of the project (in particular, information is required on planned investments in the first 3 years, counting from the date of conclusion of the contract), - a reflection of the implementation of the investment project in Crimea or Sevastopol, - a reflection of the schedule of annual investments in the first 3 years of activity.

- The next point is waiting for the relevant authorities to make a decision and the final conclusion. The procedure and timing of consideration depend on the size of capital investments. If the investment amount is more than 100 million rubles, the application with the draft agreement and attached documentation is sent for consideration to the expert council on SEZ issues no later than 7 days. The council reviews the application within 15 days, and the body may require the applicant to make any changes to the submitted declaration. If the declared amount is less than 100 million rubles, the application is required to be considered by the highest executive authorities of Sevastopol or the Republic of Crimea, depending on the place of registration of the applicant. Review takes place within a 7-day period.

- Conclusion of an agreement on work in a free economic zone. The concluded agreement is then included in the register of participants in the free economic zone.

- The last organizational issue is obtaining a certificate of inclusion of the participant in the unified register of SEZs. It is from this time that the applicant becomes a full participant and receives the right to carry out business and other types of activities in the territory of the free economic zone under special tax regimes. Opportunities and conditions are governed by the framework of the concluded agreement.

Refusal to conclude an agreement is practically impossible if the participant has fulfilled all the specified requirements and provided all the necessary information and documents. This point is also regulated by current legislation.

Reduced tax rates and other benefits for business in Crimea

According to Russian legislation, in this situation there are 2 types of tax benefits. The former include benefits determined for zone participants, and the latter are general benefits that apply to all individual entrepreneurs and organizations operating in the zone.

Benefits for residents of FEZ in Crimea and Sevastopol include:

- Reduced corporate income tax rates and the possibility of using increased depreciation rates for fixed assets;

- When working on VAT - tax benefits when placing products under the customs procedure of a free zone of customs control;

- Possibility of zero taxation on the property of organizations for 10 years;

- Total insurance premiums for the 10-year period have been reduced to 7.6%;

- Land tax is not paid in the first 3-year period of operation.

The SEZ Law may establish a certain list of requirements regarding the reimbursement and payment of VAT, as well as the application of tax deductions for excise duties. In addition, there are certain issues when registering FEZ participants as payers of special taxes.

Recommendations for choosing a tax regime for small businesses in Crimea

To make 2021 a productive year for small businesses, the following activities must be completed:

- Conducting an analysis of the financial benefits of a particular taxation system using the results of nine months of 2019.

- If you are just starting your business, or high profitability is not planned, or there is instability, then the most profitable option would be to choose a flexible simplified tax system.

- Remember that UTII will never give you guarantees that the tax burden will be minimal.

- If your business activity is properly organized and shows high profitability, then choose UTII. You get the following: all increases in excess of the income imputed by the Tax Code of the Russian Federation will not be taxed.

- If you carry out activities on UTII, then you should register the simplified tax system as the use of this taxation system for use in other types of activities.

- It is recommended to control the dynamics of the deflator coefficient according to the Unified Tax Code and the simplified tax system, and it is mandatory to take it into account in the calculation process.

- It is necessary to monitor innovations in the tax system, as they may affect the amount of the tax burden. These include: - replacing property tax with real estate tax; — the possibility of obtaining additional preferential conditions for Crimean taxpayers; — introduction of a sales tax; — loss of property tax benefits for small businesses.

Previous post Putin opens the railway bridge to Crimea - trains across the Crimean bridge will transport 3 million people a year

Next entry Villa Elena 5* reviews and photos of hotel rooms in 2021

Features of taxation in Crimea and Sevastopol

Income tax in the Crimean economic zone is the most pleasant and profitable, because FEZ participants pay corporate income taxes at reduced rates. This is the case when it comes to taxes to the regional budget. And residents are completely exempt from paying taxes to the federal budget - for 10 years from the date of receipt of the first profit. Tax rates are determined by the highest executive bodies of Crimea and Sevastopol, but their amounts will not exceed the established maximum. For example, for the first 3 years a participant pays 2% income tax to the local budget, from 4 to 8 years of activity - 6%, starting from the 9th year of operation - 13.5%.

No less comfortable is the fact that participants in the free economic zone are also exempt from taxation in relation to property on the balance sheet of organizations. The important point is that tax-free property must be acquired or created for the purpose of carrying out certain activities in the territory of the FEZ. The property must also be located within the zone. Participants are exempt for 10 years, the countdown of which begins from the next month after the property is registered.

This type of property includes not only the property of organizations, but also property transferred by local governments to the balance sheet of the enterprise. It is believed that the most relevant benefits in this area will be for the housing and communal services sector and those organizations that manage a large number of property holdings.

A similar option is a discount on land taxes. The criteria for providing benefits are practically the same - the location of the land plot on the territory of the SEZ, as well as its operation in order to implement the terms of the agreement in the territory of the zone. The validity period of these benefits is 3 years from the month the FEZ participant entered into ownership of a specific plot if all necessary conditions are met.

Premiums are paid at 7.6% over a 10-year period. This benefit applies to residents who received the status of a FEZ participant no later than a 3-year period from the date of formation of the free economic zone on the Crimean peninsula.

Compliance with all rules, conditions, benefits will be fully monitored. But although all tax audits will be carried out by the Federal Tax Service, any unscheduled audits must be strictly coordinated with the Ministry of Crimea and individual economic bodies of the constituent entities.

Law of Crimea on corporate income tax

Direct income tax is regulated by federal legislation in Chapter 25 of the Tax Code of the Russian Federation. The law provides for nuances in calculating tax for certain types of companies, since in Russia tax tariffs depend on the activities of the enterprise, as well as membership in one or another category of payers.

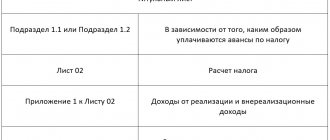

In the decree you can find a declaration form, which is submitted within the deadlines established by law, a list of tax payers, as well as the object of taxation.

Law of the Republic of Crimea No. 61-ZRK/2014 dated December 29, 2014 regulates the indicator - the income tax rate. Crimea 2021 determined tax tariffs according to this decree in 2014, the levy did not change, but preferences at the federal level changed. Thus, the subjects of the republic belong to the free economic zone, the organizations of which are subject to three preferential tariffs.

Joining a free economic zone and applying corresponding preferences is established at the legislative level in other decrees. Thus, laws regulate corporate income tax; Crimea operates in accordance with the following regulations:

- No. 61-ZRK/2014 dated December 29, 2014 on the establishment of tax tariffs for the collection of income for enterprises operating in the territory of Crimea;

- Letter No. S-D-4-3/483 dated January 19, 2016 on the application of preferential rates to organizations participating in the free economic zone;

- Letter of the Tax Policy Department No. 03-03-06/13851 dated 03/13/17 on the calculation of the tax base for income collection;

- Law of the city of Sevastopol No. 110-ZS dated 02/03/2015 on preferential rates for FEZ participants operating in the territory of the city of Sevastopol;

- Federal Law No. 377 of December 25, 2018, which specifies the requirements by observing which organizations become participants in the SEZ.

The rules for carrying out investment activities are similar to other regions of Russia.

Freedom of customs space and port zones of Crimea

Along with the development and creation of a free economic zone, its analogue in customs terms is being created - a Free Customs Zone. Within the jurisdiction of the Free Economic Zone, any goods will be able to be used and placed on the territory of the Free Economic Zone without paying taxes and customs duties. Also, measures of non-tariff or unlimited regulation of certain types of products, as is customary in the countries of the Customs Union, will not be applied. To import goods with zero taxation, FEZ participants will need to provide a certificate confirming the resident’s participation in the FEZ register.

With the export of products from the free economic trade zone, everything is a little different. For example, if a company purchased goods within the framework of a free economic zone or specific products were manufactured with the participation of such goods, then when exporting these goods from the territory of the free economic zone, the company will be required to pay additional customs duties and fees, from which in other cases it was exempt, including import VAT .

However, there is an exception to the rule. If the goods were purchased to carry out activities in the zone, then after the expiration of the 5-year period, the products will be available for export to any other regions of Russia without customs payments and procedures.

In this case, the resident of the zone has the right to choose whether he pays VAT and customs duties for individual components of the product, or for goods produced using these components. If two or more business entities take part in the import and export of goods, then the benefits for customs duties are retained in full.

The next point is Federal Law 377, a law that provides for subsidies that reimburse the costs of FEZ participants. Such costs include fees, taxes, customs duties for goods imported for construction, equipment, and technical equipment of facilities necessary for residents of the zone to implement declared plans and projects. At this time, regulations governing the payment of subsidies of this type are at the development stage.

The same provisions in the legislation of the Russian Federation determine the status of seaports in Crimea and Sevastopol - according to the adopted amendments to the laws, they are considered free ports. On the territory of free ports they use the rules and procedures in accordance with the legislation of the Customs Union.

Also, by decision of the Government of the Russian Federation, a separate procedure for customs procedures is established in free ports. These procedures may concern the transport of passengers, vehicles, cargo, animals and various types of goods. At the moment, the Government’s decision has not yet been made, although a draft document has already been developed.

New VAT rate on a cash receipt: in what cases can penalties be avoided?

Before the new year, taxpayers using cash register equipment must install the appropriate update in the software to generate a cash receipt with a VAT rate of 20%. Let us remind you that in accordance with Federal Law No. 303-FZ, from January 1, 2021, the VAT tax rate was increased from 18% to 20%. Accordingly, starting from this day, all cash receipts must contain a VAT rate of 20%.

The Federal Tax Service of Russia, in its letter dated December 13, 2018 No. ED-4–20/ [email protected], provides an explanation in which case taxpayers can be held administratively liable.

Let us remind you that the norms of the law of May 22, 2003 No. 54-FZ “On the use of cash register equipment when making payments in the Russian Federation” approved the mandatory details of a cash receipt and a strict reporting form, which also includes the tax rate for value added tax.

Part 4 of the Code of the Russian Federation on Administrative Offenses establishes administrative liability, including for the use of cash register equipment in violation of the conditions for the use of cash register equipment established by the legislation of the Russian Federation.

Indicating an incorrect rate and amount of VAT on a cash receipt while reflecting the full amount of the calculation constitutes an administrative offense. Let us clarify that a person is subject to administrative liability only for those administrative offenses for which his guilt has been established. Irremovable doubts about the guilt of a person brought to administrative responsibility are interpreted in favor of this person.

Thus, the absence of guilt can be considered the use by users after 01/01/2019 of a cash register with non-updated software in terms of indicating the VAT rate of 20% (20/120) and (or) calculating the amount at the VAT rate of 20% (20/120) until the corresponding update provided that such an update will be made within a reasonable time and the subsequent generation of tax reporting for the tax period will be carried out with the calculation of the current VAT rate and in accordance with the procedure specified in the letter of the Federal Tax Service of Russia dated October 23, 2018 No. SD-4-3/ [email protected]

In addition, if information on calculations is generated from the user’s accounting system at a VAT rate of 20% (20/120) while retaining the reflection on the cash receipt of tag 1199 “VAT rate” with the values “VAT 18%” or “VAT 18/118%” ", tag 1200 "VAT amount for the item of calculation", tag 1102 "VAT amount of the check at the rate of 18%" and (or) tag 1106 "VAT amount of the check at the calculated rate 18/118", until the corresponding update of the user's cash register software within a reasonable time deadlines, such actions will not constitute a violation of the legislation of the Russian Federation on the use of cash register equipment.

Considering that the maximum period for updating the software of the cash register fleet within a reasonable time, subject to actions taken by the user himself, does not extend beyond the first tax period for VAT in 2021, that is, during the first quarter of the coming year, non-updating of the cash register software in terms of instructions and (or) calculation of the VAT rate of 20% (20/120) after the specified period may indicate the user’s inaction or the user’s taking insufficient measures to comply with the requirements of the legislation of the Russian Federation on the use of cash register equipment.

In case of updating the software regarding the indication and calculation of the VAT rate of 20% in relation to calculations made before 01/01/2019 at the VAT rate of 18%, it is also necessary to make similar adjustments when returning from 01/01/2019 goods, works, services sold before 01/01. 2019, offset from 01/01/2019 of advances received before 01/01/2019, application of correction cash receipts (strict reporting correction forms) from 01/01/2019, which will also indicate the absence of the user’s fault.

*All images and videos used are the property of their respective owners.

Tell your friends!

Urgent messages - at . Subscribe! Would you like to leave a comment? Go a little lower✎.. Comments for the site Cackl e

Land use and construction on the territory of the Crimean SEZ

Article 17 of Federal Law 377 defines certain procedures relating to land use and construction on the territory of the SEZ. The law will come into force in January 2021, and its application in practice will concern the placement of those facilities that are considered necessary for the implementation of investment projects planned by participants.

At the same time, it is also quite important that the land plots necessary for the participant to implement the plans will be provided by the municipality or the state for rent for a period agreed in advance - without any bidding options.

The planning of the territory of the FEZ and the development of relevant documentation, as well as decision-making in this direction will be dealt with by the Council of Ministers of Crimea or the Government of Sevastopol. Documentation on the planning of the territory and the placement of objects on it must be prepared by the participants at their own expense. Objects will be located by prior approval of the location, or in accordance with the layout of the territory. There will be no public hearings when approving the location of facilities by the Federal executive authorities. Moreover, urban planning regulations do not apply to areas intended for the placement of objects.

Preparatory work can begin even before the actual issuance of a construction permit - from the date of submission of design documents. Local authorized bodies are able to determine lists of types of preparatory work. And the permits for the construction of facilities, as well as for the commissioning of facilities, are issued by the Council of Ministers of the Republic of Crimea and the authorities of Sevastopol.

Economic interaction with mainland Russia

It is worth considering the fact that any activity of companies implies compliance with the general provisions of the Tax Code of the Russian Federation, and benefits for FEZ participants are provided only in certain cases. Such preferential provisions may be applied in favor of activities carried out by the company within the framework of the Free Economic Zone.

In other cases, benefits may only be applicable if separate accounting is maintained, the rules and regulations of which are also at the development and planning stage. It turns out that separate accounting can be difficult due to certain specifics of the company’s activities, when it is necessary to determine the scope of the agreement and those items for which business is conducted on a general basis.

Example: an entity is engaged in consulting, providing consultations both in the Crimea and in another region of Russia. Moreover, the organization is registered in a free economic zone, the central office is located here, and branches are located throughout the mainland. But the law does not provide for any restrictions or prohibitions for SEZ participants when expanding business activities to other regions of Russia.

Another option in which the working conditions in the SEZ will be of interest to mainland businessmen is the absence of prohibitions on the use of various types of transport outside the zone. That is, after a SEZ participant purchases vehicles, they can subsequently be used in operation on the mainland and in international transport.

These are primarily specialized types of transport intended for the transport of passengers and goods: buses, tractors, tractors, air, rail and water transport. However, there are some nuances here too.

Firstly, it will be impossible to use transport for personal purposes. And secondly, subsequently such vehicles will be limited in terms of their stay on the territory of mainland Russia.

The growth of tax revenues to the budget of the Republic of Crimea at the end of 2018 amounted to 117%. The head of the Republic of Kazakhstan, Sergei Aksenov, spoke about this on his Facebook page.

“In general, the consolidated budget of Crimea, the federal budget, and unified social taxes are ahead of the pace of socio-economic development, thanks to which about 100 billion rubles were collected over the year,” Aksenov wrote.

According to him, the Republic is actively working with non-residents who avoid paying taxes.

“The position of the government of the Republic on this matter is fundamental: if Crimeans and other citizens of Russia regularly pay taxes, then the same applies to citizens of other countries working in the territory of Crimea,” noted Sergei Aksenov.

He also added that by February 1, it is planned to develop a set of proposals to declare a moratorium on concluding agreements with non-residents, primarily with resource supply organizations, in case of failure to fulfill tax obligations.

RIA Crimea, January 10, 2021

How the Crimean budget 2018 was replenished and spent

At the end of 2018, the Republic of Crimea exceeded its annual budget revenue targets – a total of 40.6 billion rubles were received. This was announced by the Deputy Chairman of the Council of Ministers of the Republic of Kazakhstan - Minister of Finance Irina Kiviko.

“According to preliminary data, the annual budget revenue targets of the Republic for the past year were exceeded and amounted to 100.3%, or 40.6 billion rubles. In comparable conditions, this is 6 billion, or 17.2% higher than in 2021,” the press service of the Crimean Ministry of Finance quotes her.

According to Kiviko, the largest revenues to the budget came from personal income tax - 18 billion rubles. At the same time, the treasury received 6.4 billion rubles in corporate income tax, 5.4 billion rubles in excise tax payments, 3.3 billion rubles in taxes levied in connection with the use of a simplified taxation system, 2.2 billion rubles in corporate property tax, 438.3 million rubles - transport tax.

The Deputy Prime Minister added that non-tax revenues for the year amounted to 4.4 billion rubles.

Kiviko noted that the increase in budget revenues was ensured, first of all, by the growth of the Crimean economy and investments in it, a large number of registered legal entities and individual entrepreneurs, measures to legalize wages and attract separate divisions whose head enterprises are located in other regions to pay personal income tax Russia.

Crimeans received 10 billion rubles in social payments

In 2021, 9.9 billion rubles were allocated for social payments to Crimean residents, said Minister of Finance of the Republic of Kazakhstan Irina Kiviko.

“Based on the results of the past year, all applications for the provision of social support measures to Crimeans - residents of the Republic, received both from the Ministry of Labor and Social Protection and from the Ministry of Education, Science and Youth of the Republic of Crimea, were fulfilled by the financial department in full,” she quotes press service of the Ministry of Finance of the Republic of Kazakhstan.

Thus, according to Kiviko, 580.6 million rubles were allocated for the monthly payment assigned in the event of the birth of a third child (or subsequent children) before he reaches the age of three, and 293.2 million for the payment in connection with the birth (adoption) of the first child million rubles, for payment of housing and communal services to certain categories of citizens - 486.4 million rubles, for social payments to the unemployed - 181.5 million rubles.

In addition, the Deputy Prime Minister added, a subvention was allocated to municipal budgets within the framework of the state program of Crimea “Social support for citizens for 2015-2020” in the amount of 2.4 billion rubles, and 69.5 million were allocated for activities under the state program of labor and employment. rubles

RIA Crimea, January 12, 2021

******

Read on topic:

Crimea begins to increase its income

Only for three months of 2021. 21 billion rubles in taxes were collected in Crimea

For six months of 2018, Crimeans paid 47 billion rubles in taxes

Revenues to the Crimean budget are growing steadily

Tax revenues from Crimeans increased by 120% over the year

Crimea ends 2021 without a budget deficit

Termination of the contract of a FEZ participant voluntarily and forcibly

Losing the status of a FEZ participant is possible for a number of reasons – not only when the contractual terms expire. In addition, the contract may be terminated by agreement of the parties or due to the termination of the company's activities.

Also, if certain violations were revealed during inspections, the participant may be forcibly deprived of his rights - through the courts and on the basis of provided evidence of violation of the terms of the contract. The executive authorities of Crimea and Sevastopol may demand termination of the contract through the court in cases where:

- Indication of incorrect information - underestimation of the size of capital investments with a clear difference from the figures specified in the contract, or unreasonable changes in the schedule of annual investments in the first 3 years;

- Changes in the focus of the investment project;

- Carrying out business activities on the territory of the zone that were not provided for by this agreement;

- Other violations of contractual terms for the implementation of the established investment declaration.

If this agreement is terminated due to a court decision, the FEZ participant is excluded from the unified register. Disputed issues are considered by the Arbitration Court of Sevastopol or the Arbitration Court of Crimea.

Taking into account Article 41 of Part One of the Arbitration Procedural Code, a participant in a free economic zone has the right to present its arguments in the process of considering controversial issues. He can present any evidence, try to defend his position, appeal court decisions and acts.

Legislative framework for the Special Economic Zone in Crimea

- Federal Law of the Russian Federation dated November 29, 2014 No. 377-FZ “On the development of the Crimean Federal District and the free economic zone in the territories of the Republic of Crimea and the federal city of Sevastopol.”

- Federal Law of the Russian Federation dated November 29, 2014 No. 379-FZ “On amendments to parts one and two of the Tax Code of the Russian Federation in connection with the adoption of the Federal Law “On the development of the Crimean Federal District and the free economic zone in the territories of the Republic of Crimea and the federal city of Sevastopol” "

- Federal Law of the Russian Federation dated November 29, 2014 No. 378-FZ “On amendments to certain legislative acts of the Russian Federation in connection with the adoption of the Federal Law “On the development of the Crimean Federal District and the free economic zone in the territories of the Republic of Crimea and the federal city of Sevastopol.”

- Order of the Ministry of the Russian Federation for Crimean Affairs dated 02/09/2015 No. 25 “On approval of the approximate form of an agreement on the conditions of activity in a free economic zone.”

- Order of the Ministry of the Russian Federation for Crimean Affairs dated 02/09/2015 No. 26 “On approval of the investment declaration form.”

- Order of the Ministry of the Russian Federation for Crimean Affairs dated 02/09/2015 No. 27 “On approval of the form of the certificate of inclusion of a legal entity, individual entrepreneur in the unified register of participants in the free economic zone.”

- Order of the Ministry of the Russian Federation for Crimean Affairs dated 02/09/2015 No. 28 “On approval of the Procedure for the work of expert councils on free economic zone issues.”

- Order of the Ministry of the Russian Federation for Crimean Affairs dated March 11, 2015 No. 53 “On approval of the personal composition of the expert council on issues of a free economic zone in the territory of the Republic of Crimea.”

- Law of the Republic of Crimea dated December 29, 2014 No. 61-ZRK/2014 “On establishing the corporate income tax rate on the territory of the Republic of Crimea.”

- Law of the Republic of Crimea dated November 19, 2014 No. 7-ZRK/2014 “On the property tax of organizations.”

- Law of the Republic of Crimea dated December 29, 2014 No. 60-ZRK/2014 “On establishing the rate of the unified agricultural tax on the territory of the Republic of Crimea.”

- Law of the Republic of Crimea dated December 29, 2014 No. 59-ZRK/2014 “On establishing the tax rate paid when applying the simplified taxation system in the territory of the Republic of Crimea.”

- Order of the Council of Ministers of the Republic of Crimea “On issues of organizing the functioning of a free economic zone on the territory of the Republic of Crimea” dated December 31, 2014 No. 1639-r.

What legislation applies

Russian tax legislation will be applied in the territories of the Republic of Crimea and the city of Sevastopol from January 1, 2015. Until this point, tax legal relations are regulated by the regulatory legal acts of Crimea and Sevastopol (Part 2 of Article 15 of the Federal Constitutional Law of March 21, 2014 No. 6-FKZ). These are the following documents:

- Regulations on the specifics of applying legislation on taxes and fees on the territory of the Republic of Crimea during the transition period (approved by Resolution of the State Council of the Republic of Crimea dated April 11, 2014 No. 2010-6/14);

- Law of the city of Sevastopol dated April 18, 2014 No. 2-ZS “On the specifics of applying legislation on taxes and fees in the territory of the federal city of Sevastopol during the transition period.”

Such clarifications were provided by the Federal Tax Service of Russia in a letter dated April 4, 2014 No. GD-4-3/6133.