Accrual of sick leave is an important issue for those who cannot perform their work duties for some time. According to labor legislation, persons who have temporarily lost their ability to work can count on compensation for their average earnings. With the help of Contour Accounting, the process of monitoring the accrual of sick leave is very easy if all the necessary data about the employee is entered.

What are the rules for accruing sick leave - 2020-2021

The calculation and accrual of temporary disability benefits in 2020-2021 are carried out according to the following algorithm:

Stage 1. The accountant calculates the average daily wage for the sick employee - for this he determines the billing period and the employee’s total earnings for the billing period.

The calculation period for sick leave is 2 calendar years preceding the year of the employee’s illness.

Example 1

Accountant Ignatieva came to work at Stigma LLC in April 2005. This is her first job. Ignatieva was on sick leave from 07/01/2020 to 07/10/2020, then the billing period was 2018–2019. (but if Ignatieva was on maternity leave in 2021 or 2021 or was caring for a baby and had no income, then for the billing period, upon application from the employee, the accountant can take the years preceding the billing period, that is, 2016–2017, but not earlier) .

No matter how many days there are in the years of the billing period, its duration is always 730 days. Excluded from this period are days of illness, pregnancy and childbirth, child care, as well as periods when a person did not work, but his earnings were retained, provided that contributions to the Social Insurance Fund were not accrued from this earnings.

Read more about excluded periods here.

Earnings for the billing period are wages, bonuses and other payments from the employer, for which social security contributions were calculated. State benefits and compensation from the employer are not included in this amount.

The accountant will find the average daily earnings (ADE) by dividing earnings for the billing period by 730 days.

Example 1 (continued)

Ignatieva earned 683,455 rubles in 2021, and 657,320 rubles in 2018.

SDZ Ignatieva: (657,320 + 683,455) / 730 = 1,836.68 rubles.

Stage 2. The accountant must compare the received SDZ amount with the maximum and minimum amounts. The maximum size of SDZ is calculated in accordance with the amounts of contribution limits to the Social Insurance Fund in the previous (calculated) 2 years; in 2021 it is equal to 2301.37 rubles. ((865,000 + 815,000) / 730 days). In 2021 - 2,434.25 rubles. ((912,000 rub. + 865,000 rub.) / 730 days)

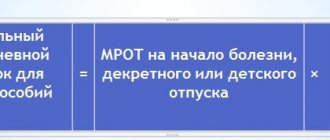

The minimum SDZ is equal to:

Minimum wage on the date of opening of sick leave × 24 months / 730 days.

In 2021, the minimum wage is 12,130 rubles, therefore, the minimum SDZ is 398.79 rubles. In 2021, the minimum wage, according to the current law “on the minimum wage,” is equal to the subsistence minimum, approved. for the 2nd quarter of 2021. The cost of living is 12,392 rubles.

But the government proposed calculating the minimum wage for 2021 in a new way. According to the project, it will increase to 12,792 rubles. Read more about the planned innovations in the Review from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Thus, the employer cannot take an SDZ amount of more than 2,301.37 rubles to calculate sick leave. and less than 398.79 rubles.

Important! If for days of incapacity for work falling on the period from April 1 to December 31, 2021 (inclusive), the amount of the benefit determined according to Law No. 255-FZ, calculated for a full calendar month, is less than the minimum wage, the benefit is calculated based on the minimum wage (Art. 1 of Law No. 104-FZ). How to calculate sick leave from April 1, read here.

If the employee’s earnings are above the maximum, then the benefit is paid based on the maximum SDZ.

Example 1 (continued)

Since Ignatieva’s SDZ is equal to 1,836.68 rubles. and this is less than the maximum SDZ for 2021 (2,301.37 rubles), then sick leave should be calculated based on the SDZ in the amount of 1,836.68 rubles, calculated based on Ignatieva’s actual income.

If the SDZ calculated by the accountant is less than the minimum, then the accountant takes the daily earnings in the amount of 398.79 rubles to calculate the benefit. - for a full-time worker.

NOTE! If the sick person works part-time, and his SDZ is less than or equal to the minimum, then the minimum SDZ is subject to reduction in proportion to the duration of working hours. That is, for an employee at 0.5 times the wage rate with average daily earnings less than 398.79 rubles. you will have to compare your actual earnings for the day with earnings calculated based on the amount of 398.79 / 2 = 199.40 rubles. This rule does not apply to employees whose SDZ is higher than the minimum: even if an employee works at a quarter rate, then his average daily earnings do not need to be divided by 4 (clause 16 of the Government of the Russian Federation of June 15, 2007 No. 375). Find out more about sick pay for part-time workers in this article.

Stage 3. The accountant must determine the total length of service of the employee for his entire career, since only an employee who has worked for more than 8 years has the right to receive 100% of the average daily wage. If the employee’s work experience is from 5 to 8 years, then they will pay him 80% of the average daily earnings, if less than 5 years (but more than six months) - 60%. For an employee with less than 6 months of work experience, sick leave is calculated based on the minimum wage (Article 7 of Law No. 255-FZ).

Read more about calculating length of service for calculating sick leave here.

From October 6, 2021, new rules for calculating sick leave are in effect. See here for details.

Example 1 (continued)

Since Ignatieva’s total work experience is 15 years 2 months (from April 2005 to June 2021 inclusive), she will receive 100% of the average daily earnings.

NOTE! For those who have received an injury or occupational disease at work, the earnings must be taken in full for calculation and a benefit paid in 100%, regardless of length of service (Article 9 of the Law “On Compulsory Social Insurance against Industrial Accidents and Occupational Diseases” dated July 24, 1998 No. 125-FZ).

Stage 4. The accountant multiplies the resulting SDZ amount by the number of sick days. The sick employee's certificate of incapacity for work is paid for by the Social Insurance Fund, but only from the fourth day of illness. The first 3 days must be paid by the employer.

But if a relative is sick and an employee is caring for him, then the rules for paying for such sick leave are different. Read about them in the material “Paying sick leave to care for a sick relative .

Go to the second screen - pivot table

For correct operation you need to perform the following steps.

- Select the billing year.

- Indicate your average earnings for each month of the last two years (excluding sick leave, benefits and other payments).

- Set the regional coefficient if necessary.

- If necessary, check the box if the employee works on a part-time basis.

Then the system will recalculate your daily earnings. If it is below the minimum wage, it is recalculated based on the established coefficients.

Where to get a certificate for accrual of sick leave

If an employee worked for you for several years before illness, then information about how much he earned is available in the accounting department. If the employee has worked for you for less than two years, you will take the earnings for calculating sick leave from a certificate of the amount of wages in the form of Order of the Ministry of Labor dated April 30, 2013 No. 182n, issued to the employee at the previous place of work. Every employer must issue such a document when dismissing an employee. The certificate contains information about the person himself, his earnings for the last two calendar years and the number of days of incapacity for work. A part-time worker may also request such a document from you in order to receive temporary disability benefits at their main place of work.

A sample certificate of earnings for accrual of sick leave can be viewed at the link .

Sick leave when working part-time

Who pays sick leave if a person works in several places? Article 13 of the law and the order of the Ministry of Health and Social Development dated June 29, 2011 No. 624n define the specifics of calculating benefits in this case. The period considered is the two previous calendar years. The following are the rules:

- If during this period the employee worked only for “current” employers , then each of them must pay their part of the disability benefit. In this case, sick leave is provided for each place of work.

- If during the period under review the employee worked in other places , then the benefit is paid by one of the last employers. The employee decides who exactly to turn to for payment. You need to obtain a salary certificate from the second employer and that he did not pay benefits.

- If during the period the employee was employed by these employers, as well as by others , then he can choose for himself how to receive benefits: each employer has a separate sick leave certificate or one of his last places of work.

If a part-time worker applies for benefits without a certificate of the amount of earnings that is needed for calculation, then the following procedure applies:

- the employer calculates the benefit based on the documents and information that he has;

- the employee provides certificates about the amount of earnings in other places;

- the employer recalculates for previous periods, but no more than 3 years before the date the certificate is provided.

How to make entries for accrual of sick leave

The accountant will reflect the accrual of sick leave in accounting as follows:

Dt 20 (and other cost accounting accounts - depending on how the patient works in which department) Kt 70 - sick leave accrued for the first 3 days of the employee’s illness;

Dt 69 (according to the subaccount of settlements with social insurance) Kt 70 - sick leave accrued at the expense of the Social Insurance Fund.

On the payment day, the accountant will make the following entries:

Dt 70 Kt 68 (subaccounts for income tax calculations) - income tax is withheld from sick leave;

Dt 70 Kt 50 (if from the cash register) or 51 (from the current account) - benefits were paid to the employee.

NOTE! For firms in the regions participating in the FSS pilot project, personal income tax must be withheld only from benefits for the first 3 days of incapacity for work (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294).

Example 1 (continued)

The amount of Ignatieva’s benefit for 10 days of illness: 1,836.68 × 10 = 18,366.80 rubles. Minus personal income tax, Ignatieva will receive 15,978.80 rubles.

The accountant will make the following entries:

Dt 20 Kt 70 in the amount of RUB 5,510.04. — sick leave accrued at the expense of the employer;

Dt 69 Kt 70 in the amount of RUB 12,856.76. — sick leave was accrued at the expense of the Social Insurance Fund;

On the day of payment of wages to employees:

Dt 70 Kt 68 in the amount of RUB 2,388.00. — personal income tax is withheld from benefit amounts;

Dt 70 Kt 50 in the amount of RUB 15,978.80. — Ignatieva’s temporary disability benefit was issued under RKO.

NOTE! In accordance with paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, income tax on temporary disability benefits in 2021 - 2021 must be transferred to the budget no later than the last day of the month in which the benefit was paid.

Minimum and maximum duration of sick leave

It is important to know how many days a person can be issued a sick leave certificate. The minimum period for this document is not established by law. The doctor makes the decision himself. Theoretically, he can issue a document even for one day, but usually this is impractical, and the therapist issues a bulletin for at least 3 calendar days.

But the law has a clear answer as to what is the maximum period for issuing sick leave at a clinic that can be used in a given case. It all depends on the conditions under which the treatment takes place. If we are talking about outpatient conditions (that is, the patient is treated at home), then the maximum duration is 15 days. Only the medical commission has the right to extend it. Dentists and paramedics can only issue a newsletter for 10 calendar days.

Is a sick leave certificate required for a patient if he is being treated in a hospital? This is another important question. In any case, the document is proof of treatment; no certificates for the employer can replace it. And the treatment period in this case is longer - the document is issued for the entire period of the patient’s stay in the hospital. If we are talking about a serious illness or surgical operation, it is impossible to predict them in advance. There are no maximum periods for inpatient treatment. In this case, for how long a sick leave certificate is issued to the patient depends on the specific disease. For example:

- concussion - up to 28 calendar days;

- removal of the appendix - up to 21 calendar days, depending on the presence of complications and the form of inflammation;

- removal of the gallbladder - up to 55 calendar days, and the doctor has the right to extend the notice for another 10 days for the patient’s rehabilitation;

- fracture of the limbs (depending on the severity and consequences) - from 30 to 60 calendar days;

- oncological diseases - up to 180 days.

Spinal injuries are considered the most serious. In this case, the answer to the question of how long sick leave is issued depends on the severity of the injury and the degree of displacement. Sometimes the total duration is up to 240 days, and after that the ballot can still be extended for a recovery period.

Since the legislation everywhere indicates the duration in calendar days, we can conclude whether weekends are included in the sick leave. This also applies to holidays. That is, benefits are accrued for this period.

Accrual of sick leave in 2021 - 2021: calculation examples

We will show you in more detail how to correctly calculate and accrue sick leave in 2021 - 2021.

Example 2

From 07/01/2020 to 07/05/2020, the cleaning lady Govorunova was on sick leave. She brought a certificate of incapacity for work to Barter LLC on July 6, 2020 - the accountant has 10 calendar days to accrue benefits.

Read about the timing of benefits payment in this article.

Govorunova works at 0.5 rate; she also worked for the previous 2 years and was not on maternity leave. Govorunova’s work experience is 12 years. Estimated period: 2018–2019.

Govorunova got a job at Barter LLC in January 2021; before that, she worked for individual entrepreneur I. F. Kuznetsov. Her earnings for 2021 are 68,505 rubles. The accountant will take the salary for 2021 from the certificate of salary amount given to Govorunova by IP Kuznetsov upon dismissal - 65,732 rubles. At the moment, Govorunova works only at Barter LLC. Average daily earnings of Govorunova:

(68,505 + 65,732) / 730 = 183.89 rubles.

This is less than the minimum SDZ size in 2021 (RUB 398.79). But, since Govorunova works part-time, her average daily earnings should be compared with 0.5 minimum wage = 199.40 rubles. Since the employee’s actual SDZ is greater than the minimum, we take the actual earnings to calculate:

199.40 × 5 days of illness = 997.00 rubles, of which the employer will pay 598.20 rubles. (for the first 3 days of illness), and 398.80 rubles. - social insurance.

EXAMPLE of calculating sick leave for caring for a sick family member from ConsultantPlus: Ivanova M.I. from July 2 to July 10, 2020 (9 calendar days) she was unable to work due to caring for her sick mother. Before this case of incapacity for work, Ivanov M.I. I took sick leave to care for my sick mother for 8 calendar days... Read the continuation of the example after receiving a trial demo access to the K+ system. It's free.

Example 3 (calculation of sickness benefit when changing years)

Engineer Mayseenko fell ill on July 1, 2020, and her sick leave was closed on July 10, 2020. Mayseenko’s work experience is 3 years and 7 months. She works part-time in 2 organizations: at Sopromat LLC she has been working at 0.5 rate since 2015, and she got a job with IP Stolyarov A.P. in December 2021, also at 0.5 rate.

Mayseenko decided to receive benefits from Sopromat LLC. Since in 2018–2019. She was first on maternity leave, and then cared for the child, then she wrote a statement asking her to change the years for the calculation. In this case, the calculation period is 2016–2017. At Sopromat LLC in 2021, Mayseenko earned 246,350 rubles, in 2021 - 275,034 rubles.

From IP Stolyarov A.P. Mayseenko will take a certificate stating that temporary disability benefits were not accrued or paid to her. SDZ Mayseenko's accountant will take only one place of work - Sopromat LLC, since the individual entrepreneur Stolyarov A.P. Mayseenko in 2016–2017. did not work:

(246,350 + 275,034) / 730 = 714.22 rub.

This amount fits within the boundaries between the upper (2301.37 rubles) and lower (398.79 × 0.5 = 199.10 rubles) size of the SDZ. Since Mayseenko’s experience is less than 5 years, she is entitled to only 60% of the SDZ:

714.22 × 60% = 428.53 rub.

Mayseenko's sick leave amount: 428.53 rubles. × 10 days of illness = 4285.35 rubles. For the first 3 days, expenses will be borne by the policyholder - 1,285.59 rubles, social insurance will pay 2,999.76 rubles. Minus income tax, Mayseenko will receive 3,728.35 rubles.

NOTE! If you are replacing an employee's years for calculating benefits, then there are mandatory conditions. First, the employee must write an application for a replacement. And second, the sick leave calculated with the replacement of years must be greater than that calculated in the usual manner, otherwise the employer pays benefits based on the standard calculation period.

Replacing the billing period

It is possible that during the billing period or in one of the years of the billing period the employee was on maternity leave or child care leave. In such a case, the employee may substitute those years from the pay period for other prior calendar years (or year) if doing so would result in an increase in the benefit amount. To do this, the employee must submit an application to the employer. This is stated in Part 1 of Article 14 of the Law of December 29, 2006 No. 255-FZ.

The billing period can only be replaced by those years (year) that immediately precede the occurrence of the insured event. For example, a woman was on maternity leave or child care leave in 2014–2015, and a new insured event occurred in 2021. Then 2014 and (or) 2015 can only be replaced by 2013 and (or) 2012. You cannot take any years that were before 2014-2015.

Such clarifications are given in the letter of the Ministry of Labor of Russia dated August 3, 2015 No. 17-1/OOG-1105.

What if the employee was first on maternity leave and then on parental leave for up to three years in the period from 2012 to 2015? Then, to calculate benefits, you can take 2011 and 2010. At the same time, there is no need to recalculate benefits that were assigned and paid before the release of the letter of the Ministry of Labor of Russia dated August 3, 2015 No. 17-1/OOG-1105.

Such clarifications are given in letters of the FSS of Russia dated November 11, 2015 No. 02-09-14/15-19989 and No. 02-09-14/15-19937, dated November 9, 2015 No. 02-09-14/15- 18677.

Situation: can an accountant independently change the calculation period for calculating sick leave benefits?

No, he can not.

The legislation does not provide for such a possibility. Sick leave benefits must be calculated based on the employee’s average daily earnings for the two years preceding the year of illness or other insured event (Part 1, Article 14 of Law No. 255-FZ of December 29, 2006). An accountant does not have the right to establish a special billing period on his own initiative.

It is possible to replace the standard billing period with other calendar years only at the request of the employee if during the years of the billing period he was on maternity leave or child care leave.

Results

The accrual of sick leave in 2021 has not undergone significant changes: the accountant needs, as before, to know the employee’s SDZ, length of service, and number of sick days. However, there are nuances in paying sick leave to an employee who was injured at work or to a woman who was recently on maternity leave.

For information on calculating sick leave after maternity leave, read the article “How to calculate sick leave after maternity leave?”

Find out how to pay sick leave for a domestic injury here. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Child benefits

Now let’s talk about whether 730 or 731 days can be taken to calculate sick leave for pregnancy and childbirth in 2021 to determine the amount of benefits. You need to take 731 days, since 2016 was a leap year (if you do not replace years).

When choosing 730 or 731 days for calculating maternity benefits in 2021, you can be guided by the letter of the Ministry of Labor of Russia dated July 3, 2017 No. 17-1/ОOG-314 “On calculating the maximum amount of monthly child care benefits.”

Read also

18.11.2017

How many times a year are you allowed to take sick leave?

There are no legal restrictions on the issuance of sick leave per patient per year. The employee takes as many times as he needs for treatment and recovery.

IMPORTANT!

The maximum duration of a certificate of incapacity for work in case of illness of the employee himself is 12 months. The duration of payment of benefits in case of illness or injury of the employee himself is not limited. All days of sick leave are paid for, regardless of how long it was issued and how many sick days the employee has during the year (Part 1, Article 6 of Law No. 255-FZ). An exception is benefits for disabled people and workers on fixed-term contracts.

If an employee constantly extends his sick leave, he must undergo a medical examination and, if necessary, register for disability. Then during the year the maximum period of sick leave is a total of 5 months, but not more than 4 months in a row.

If an employee is injured at work or has an occupational disease, the actual number of sick days is not taken into account, and the patient extends sick leave for as long as he needs until he fully recovers.

The exceptions are sick leave for pregnancy and childbirth, since they have fixed periods, and temporary disability, for which leaves are issued for 12 months. They are issued in the following cases:

- injuries with a long recovery period;

- tuberculosis;

- periods of rehabilitation after operations.

Special rules apply to certificates of incapacity for work issued for child care. For example, the duration of sick days for payment is limited by annual limits.

For details, see the article “How sick leave is paid for child care.”