Structure and purpose of props

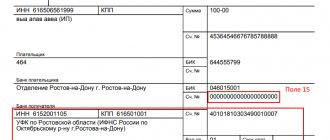

When transferring payments for taxes, fees, contributions and other types of fiscal payments, take into account the special procedure for filling out a payment order. So, for example, to pay money to the Federal Tax Service, you will have to fill out special fields in the payment slip: tax line (fields 104 to 110 inclusive).

Field 107 is the tax period in the payment slip, 2021 - the format of this detail is presented as follows: “ХХ.ХХ.ХХХХ”, where the alphabetic and numeric values of the code are separated by dots.

The key purpose of the code is to determine for what period the settlement with the Federal Inspectorate is carried out. For example, when funds are received into a current account, tax authorities must know exactly in favor of which reporting period to credit the funds.

Payment of property tax to the budget

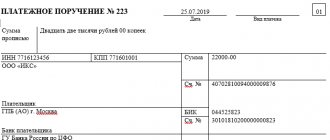

After paying property tax to the budget, based on a bank statement, you need to create a document Write-off from current account transaction type Tax payment. A document can be created based on a Payment Order using the link Enter document debited from current account. PDF

The basic data will be transferred from the Payment order document.

Or it can be downloaded from the Client-Bank program or directly from the bank if the 1C: DirectBank service is connected.

It is necessary to pay attention to filling out the fields in the document:

The document generates the posting:

- Dt 68.08 Kt 51 – debt to the budget for property tax has been repaid.

Exceptional situations

In some cases, the tax period in the 2021 payment bill may have a different meaning. Let's determine the most popular:

- Contributions for injuries. When listing insurance coverage against accidents and occupational diseases, indicate “0” in clause 107.

- State duty. If the institution pays the state fee to the budget, then in paragraph 107 indicate the specific date of payment.

- Additional payments based on the inspection report. If the company pays arrears according to a tax audit report or according to writs of execution, then enter the value “0”. If payment is made upon request, which specifies a specific date for settlement, then in clause 107 indicate the exact date of payment.

- Customs duties in the payment invoice (tax period) - what to indicate? If the organization pays fees and duties to the customs authority, then in field 107 you will have to indicate the territorial number of the customs office.

If there is an error in the payment order in clause 107, then it is necessary to prepare a letter to clarify the payment. This document is compiled in any form indicating incorrect and correct values. Also, be sure to indicate in the letter the number of the payment document and its date, the name and credentials of the institution, and contact information.

How to generate a payment order to the tax office

For the tax office, you can generate a payment order online, quickly and without errors, on the official website of the Federal Tax Service of Russia. The service is free (thank you). Here you can prepare a new document (print it or send it by mail, but it may end up in spam), check the accuracy of the already drawn up payment document, or make your own online payment through one of the partner banks that have entered into a cooperation agreement with the Federal Tax Service.

To access the service you need to register, the process will not take much time. But to make a payment in real time you will have to use an electronic signature.

Tax period codes in 2021

Tax returns must indicate the tax period code. Digital designations of periods depend on the type of declaration. We’ll figure out what codes to use when reporting taxes in this article.

The tax period code includes two digits. In addition to declarations, such a code is placed on tax bills. Thanks to these codes, Federal Tax Service inspectors determine the reporting period for the submitted declaration. Also, such a code will make it clear to the Federal Tax Service that the company is being liquidated (during liquidation, its own code is inserted).

Results

A payment order for the payment of penalties is issued similarly to a payment order for the payment of taxes (the same status of the payer, the same details of the recipient and the same income administrator are indicated).

A payment order (or payment order) contains the payer's order to transfer funds from his current or personal account to the recipient's account for a banking organization or federal executive body that performs cash service functions (Treasury). Key regulatory documents for filling out instructions by state employees:

- the form form was approved by Bank of Russia Regulation No. 383-P dated June 19, 2012 (as amended on October 11, 2018);

- rules for filling out details, as well as basic information about calculations, are specified in Order of the Ministry of Finance dated November 12, 2013 No. 107n (as amended on April 5, 2017);

- the list of budget classification codes that are used for payments to the budget system is fixed by Order of the Ministry of Finance dated 06/08/2018 No. 132n.

The Bank or the Treasury executes the payment within the period established by law or earlier, in accordance with the terms of the agreement for servicing the payer’s current or personal account.

Types of tax periods:

- month;

- quarter;

- half year;

- 9 months;

- year.

The tax period code is recorded on the title page of the declaration or other reporting form. Usually, payers can find all the codes for a particular declaration in the order they fill out the declaration (in the appendix). For example, for the income tax return, the period codes are described in the Order of the Federal Tax Service of the Russian Federation dated October 19, 2016 No. ММВ-7-3 / [email protected]

If the tax is considered cumulative, returns are submitted in the periods listed below with codes:

- quarter - 21;

- first half of the year - 31;

- 9 months - 33;

- calendar year - 34.

Fill out and send reports to the Federal Tax Service via the Internet and the first time. 3 months of Kontur.Externa for you for free!

Try it

If the declaration is submitted monthly, the codes will be as follows:

For consolidated groups of taxpayers, their own codes have been approved: from 13 to 16 (where code 14 corresponds to a half-year, and 16 to a year).

The coding of monthly reporting of consolidated groups begins with code 57 and ends with code 68.

When liquidating a company, you need to enter code 50.

For property tax, other codes are used:

51 - I quarter during reorganization;

47 - half a year during reorganization;

48 - 9 months during reorganization.

Procedure for paying property tax

Property tax taxpayers pay (Article 383 of the Tax Code of the Russian Federation):

- tax for the year;

- advance payments (for 1 quarter, half a year, 9 months), unless otherwise provided by the law of the subject of the Russian Federation (clause 2 of Article 283 of the Tax Code of the Russian Federation).

The deadline for paying property tax and advance payments is established by the constituent entity of the Russian Federation (clause 1 of Article 383 of the Tax Code of the Russian Federation).

Payment is made to the Federal Tax Service:

- for organizations and separate divisions that have a separate balance sheet - according to the location of the organization and each of the separate divisions (Article 384 of the Tax Code of the Russian Federation);

- for organizations on whose balance sheet real estate assets are located outside the organization’s location - according to the location of these real estate assets (Article 385 of the Tax Code of the Russian Federation).

- in relation to property for which the tax is calculated based on the cadastral value - according to the location of these real estate objects (clause 6 of Article 383 of the Tax Code of the Russian Federation).

Let's take a closer look at the procedure for generating and paying property taxes to the budget in the program.

Payment order field 107: tax period

The value of field 107 of the tax payment can take the following form:

- “MS.XX.YYYY”, where XX is the month number (from 01 to 12), and YYYY is the year for which the payment is made. For example, when transferring an advance payment for income tax for March 2021, in field 107 of the payment slip, you need to enter “MS.03.2019”;

- “Q.XX.YYYY”, where XX is the quarter number (from 01 to 04), YYYY is the year for which the tax is paid. So, when transferring the next VAT payment, for example, for the second quarter of 2021, field 107 should indicate “KV.02.2019”;

- “PL.XX.YYYY”, where XX is the number of the half-year (01 or 02), YYYY is the year for which the tax is transferred. For example, when transferring a payment under the Unified Agricultural Tax for the 1st half of 2021, put “PL.01.2019” in the payment slip;

- “GD.00.YYYY”, where YYYY is the year for which the tax is paid. For example, when making the final calculation of income tax for 2021, in field 107 of the payment slip you will need to enter “GD.00.2019”.

Filling out a payment order for income tax

Payer status (field 101)

. In field 101 “Payer status” of the income tax payment order, you must enter code “01” if the company is a taxpayer. If you are remitting tax as a tax agent, you must enter the code “02”.

Payment order (field 21)

. Thirdly, banks write off taxes on behalf of the tax office (Article 855 of the Civil Code of the Russian Federation). That is, by collection. If the company pays taxes itself, then this is the 5th priority. So, you need to put “5”.

Code (field 22)

. For current payments, “0” must be entered in the “Code” detail (field 22), for payments at the request of the inspection - a 20-digit number, if it is in the request. If there is no number in the request, the value is “0”.

Payment type (field 110)

. From March 28, 2021, in payment orders for income tax, it is no longer necessary to fill out field 110 “Type of payment” (Instruction of the Bank of Russia dated November 6, 2015 No. 3844-U).

Document date (field 109)

. When paying tax before filing a return, you must enter “0” in field 109. For current payments, after submitting reports - the date of signing the declaration. When repaying arrears: without an inspection requirement - value “0”, upon request - the date of the requirement.

Document number (field 108)

. In field 108, the company fills in the document number that is the basis for the payment. For current payments and debt repayment, you must enter “0”. And for payments at the request of the inspection - the requirement number.

Tax period (field 107)

. There are 10 characters in the props, they must be divided by dots.

The first two are the frequency of payment: month, quarter, year (MS, CV, GD).

The second two are the number of the month (01 - 12), quarter (01 - 04), year - (00).

The last four are the year for which the company pays tax.

Reason for payment (field 106)

. In field 106, the company writes the value “TP” - for current payments. If he repays the debt, he puts “ZD”, and when making payments at the request of the inspectorate - “TR”.

OKTMO code (field 105)

. In field 105 you must fill in the code OKTMO.

If the tax is credited to the federal budget, the code is 8-digit.

If the tax is credited to the budget of a subject or municipality, the code is 8-digit. If the tax is distributed among the settlements that are part of the municipality, 11 characters must be entered.

KBK (field 104)

. In field 104 you need to put the budget classification code, which will consist of 20 characters.

- Income tax to the territorial budget - 182 1 01 01012 02 1000 110

. - Income tax to the federal budget - 182 1 01 01011 01 1000 110

.

IMPORTANT! The BCC for 2021 for income tax has changed. A separate code has been introduced for income tax of controlled foreign companies. See all KBK for income tax 2021 in the table.

The payment order for income tax in 2021 is submitted to the bank within the same time frame as last year. We will discuss in this article what rules such documents must be drawn up.

Field 107 in a payment order in 2021: when is a specific date set?

If the Tax Code of the Russian Federation for the annual payment provides for more than one payment period and specific dates for payment of this tax are established, then these dates are indicated in field 107 of the payment slip (clause 8 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n).

A striking example of such a tax is personal income tax paid by an individual entrepreneur to the OSN for himself (not as a tax agent). After all, he must transfer the tax at the end of the year no later than July 15 of the year following the reporting year, and during the year advances are transferred (clause 9 of Article 227 of the Tax Code of the Russian Federation): no later than July 15, October 15 of the reporting year and January 15 of the year following for reporting.

As we can see, the Code does not contain wording regarding this tax, as for other taxes (for example, “the tax is paid no later than the 28th day of the month following the reporting period”), but specific dates are indicated. Accordingly, in field 107 of the personal income tax payment for an individual entrepreneur, you need to put exactly the date for yourself, for example, “07/15/2019” when paying an advance for January - June 2021.

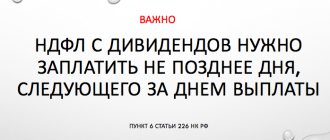

Field 107 in the personal income tax payment slip

If an organization/individual entrepreneur pays personal income tax to the budget as a tax agent, then in the personal income tax payment order, field 107 is filled out in the usual manner (i.e. in the “MS.XX.YYYY” format). After all, the Tax Code does not stipulate specific dates for payment of agency personal income tax.

Consequently, no new rules for filling out personal income tax payments have appeared. And the explanation of the Tax Service (Letter of the Federal Tax Service dated July 12, 2016 N ZN-4-1 / [email protected] ), given back in 2021 and regarded by some experts as an innovation in filling out field 107 of personal income tax payments, is only a general commentary on the procedure filling out payment orders for tax payments.

Taking into account this fact, when transferring personal income tax, for example, from a salary for March 2021, tax agents must put “MS.03.2019” in field 107 of the payment slip.

Filling out a payment order for income tax

To pay tax by payment order, it is enough to have money and fill out the form correctly. There is an approved form for this. It consists of a large amount of encoded information about the purpose of payment, period and other data.

The following information is required:

- Payer and recipient details

- , OKTMO, order of payment

- Indication of the payment period (month, quarter).

In 2021, minor changes were made, but they did not greatly affect the payment form and the procedure for filling it out. A significant change is the increase in the portion of the tax transferred to the federal budget. Now the remaining 17% goes to the regional budget.

Important! It is necessary to clarify in a timely manner what is being paid to the regional budget. Depending on the type of activity, tax breaks are possible, giving the right to pay not 17%, but less, up to 12.5%.

To correctly fill out a payment order for corporate income tax, it is enough to correctly enter the necessary details in the appropriate fields of the form. It is also important to correctly note the status of the payment, indicating that this is income tax.

Example of a payment slip with explanations

Tax status

When filling out the PP, you must correctly enter the payment status in accordance with other codes. It is worthwhile to clarify the concepts of payer status and payment purpose.

- The payer

and its legal form are indicated in field 101. - To indicate the purpose of the payment,

you must fill in field 24. However, you need to remember that for different KBK it is necessary to prepare several payments according to the number of codes.

Sample samples

For half a year or for a year

The most relevant is the payment for the transfer of tax for half a year or for a year. The difference between the PP for a year and half a year lies only in filling out field 24. When making a planned transfer of funds, the period is indicated there in combination with the phrase about paying income tax. The remaining data is filled in according to the names of the fields, excluding Nos. 104-110:

- Field 104 - BCC value.

- Field 105 - OKTMO.

- Field 106 is a two-digit value of the payment basis.

- Field 107 is an indicator of the tax period.

- Field 108 - document number for the basis of payment.

- Field 109 - date of the payment basis document.

Now there is no need to indicate codes in field 110, it remains empty. The field is not removed from the payment order for future indication of the UIN. There is a relationship between fields 108 and 106. If the latter indicates the current payment (TP), then “0” is entered in 108, which does not require specifying a date. Payment orders do not have the same filling principle, the only difference is in the tax period indicator.

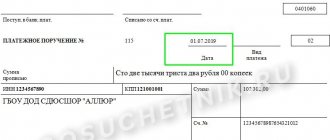

A sample PP for income tax for the half-year is available below, and the form can be downloaded.

Sample PP for income tax for half a year

Below you will find an example of filling out an advance payment form, the form of which can be downloaded.

Sample PP for monthly advance payment

You will find a sample tax order based on actual profit after the declaration is submitted below, and you can download it.

Example of PP for tax based on actual profit

Penalties and fines

At first glance, the payment for penalties and fines is almost no different from the payment for income taxes. There are only 3 differences in it:

- Another KBK code

- Changing the basis of payment

- Differences in the tax period field.

In clause 104, you must indicate the BCC corresponding to the payment of penalties. Now there is no need to put PE in clause 110 - everything is indicated in the KBK. Independent calculation of penalties requires the indication in clause 106 of the ZD code instead of TP, and at the request of the tax office - TR. If the penalty is accrued based on the inspection report, then you need to use the AP code. The completion of clause 107 depends on these codes - ZD and AP require setting a zero. If the code is TR, then the date from the tax demand document is indicated.

The PP for payment of fines can be downloaded.

PP for payment of penalties

Fine payment is also available for .

Payment of fine

Companies pay income tax to the federal and territorial budgets. We have compiled a cheat sheet for tax transfers and samples of payment orders for income tax in 2016.

In 2021, changes were made to the requirements for filling out payment orders. To make it easier to understand, see ready-made samples of payment orders for income tax

for payment of taxes to the federal and territorial budgets.

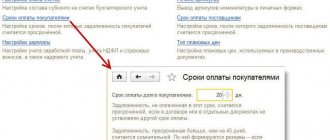

How to fill

To fill out a payment document through Sberbank Online, the client must undergo authorization. During initial registration, select the “New Document” tab and fill in the payment details. When making a repeated payment, select the necessary details from the filters that are suitable for your transaction. The “Tax period” field is filled in automatically when repeating a payment to Sberbank Online.

Important. Be sure to check that all data is entered correctly, especially in field 106.

Next, click “Create” and determine the order of payments. Confirmation is carried out via SMS notification to the number of the head of the organization or accountant.

The code looks like this: NN.NN.NNNN. It contains 8 characters of letters and numbers and two dots to separate items.

The letters (first and second) are the period code for timely payment of tax (MS - month, CV - quarter, PL - half-year, GD - payment for the year).

The third sign is a dot. The fourth and fifth indicate a specific payment period:

- monthly payment - enter the numbers 01 - 12 (01 - January, 02 - February, 03 - March, etc.);

- quarterly payment – numbers indicating the current quarter (01 – first, 02 – second, 03 – third, 04 – fourth);

- payment for half a year (01 – first half of the year, 02 – second half of the year);

- 00 is entered when making payments for the year.

The sixth character is a comma for separation. The seventh, eighth, ninth and tenth indicate the year (for example, 2021).

Note. The payment for June 2021 to the Social Insurance Fund will look like this: “MS.06.2018”.

The “00” icon is entered when paying an advance payment, fee or tax for the current period when an inaccuracy is detected in the declaration, when the taxpayer independently decided to pay the difference in tax.

Important. When transferring an advance payment, fill in the appropriate signs for the future period, not the current one.

If an individual entrepreneur is subject to simplified taxation and has received a patent, he can pay for it through Sberbank Online.

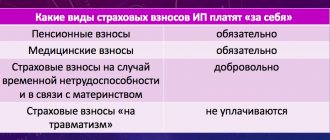

Insurance premiums

The data in column 107 depends on the recipient:

- to transfer insurance contributions to the Social Insurance Fund, indicate “0”;

- for any other contributions indicate data in the format “NN.NN.NNNN”.

Insurance premiums are transferred to the tax service from 01/01/2017. Contributions to the Social Insurance Fund for compensation for injuries caused while performing work duties are called “injury contributions.”

Payment order functions and fields 107

A payment order is a document with the help of which a legal entity or individual entrepreneur transfers funds for various purposes.

The order is accepted on paper with a blue seal or in electronic form. Funds are debited from the counterparty's current account.

Column 107, indicating the payment period, must be filled out in accordance with the rules.

Specifying the exact date

Options for indicating the exact date in field 107 “Tax period” are determined by the Legislation of the Russian Federation:

- if in cell 106 “Basic payment” the codes of the basis for paying tax to the budget are entered: TP, ZD, BF, TR, RS, OT, RT, PB, PR, AP, AR, TL, ZT, O, then in column 107 in In this case, write the exact date and current deadline.

Important. When filling out the exact date in column 107 based on the requirements of the Federal Tax Service or Enforcement Proceedings, enter the value “00”.

- if in cell 106 “Main payment” for payment of customs duties and fees the following values are entered: DE, PO, CT, TD, IP, TU, BD, KP, DK, PC, KK, TK, 0, then in this case indicate the customs code organ in field 107 of 8 digits.

Important! In column 107, it is permissible to manually enter the date in the value “Tax. period" or code in the meaning "Customs code. authority" in the case when the ID value is indicated in field 106.

Procedure for filling out field 107 when paying personal income tax

Personal income tax is not only levied on wages. Vacation and sick pay are also subject to personal income tax. The frequency of payment is specified in the Tax Code of the Russian Federation. It is different for each payment:

- for salaries, the transfer period is the day following the issuance in cash or transfer to a card;

- when transferring vacation pay, sick leave payments - on the last day of the month of settlement with the counterparty.

Paying personal income tax through Sberbank Online requires creating different payment orders; cell 107 is filled out the same way for each transfer.

Errors when filling out field 107

Article 4 of the Tax Code of the Russian Federation explains that if cell 107 is filled in incorrectly, the funds will be credited to the budget.

Important. An error in field 107 does not constitute evasion of tax contributions; accordingly, no fine or penalty will be charged.

Submit an application for correction to the tax authority and attach a copy of the payment order or payment receipt in which the error was made.

When field 106 is filled in

“Regulations on the rules for transferring funds” No. 383-P explains the procedure for filling out bank payment documents. Compliance with the rules helps to avoid disputes with regulatory authorities.

Cell 106 must be completed regardless of the type of document carrier. It indicates the basis for the current payment, for example, IN - repayment of an investment loan agreement, AR - repayment of debt under an executive document. The symbols and their interpretation can be found on the website of the Federal Tax Service or Sberbank.

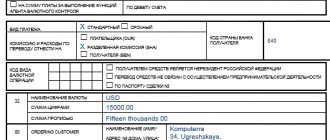

Filling example

The screenshot below shows an example of filling out a payment order.

Useful tips for filling out a payment form

Our recommendations will help you prepare a payment order quickly and without errors:

| Stages of preparation and execution of payment orders for the transfer of income tax for 2021 | Completion tips and additional information | |

| 1. Preparatory stage | ||

| Calculate income tax based on the results of 2021 (NP2018) | The materials in our section will help you understand the nuances of forming the tax base (TB). | |

Divide NP2018 into two parts:

| Find out what legal acts set the percentage of tax distribution from the message | |

Make 2 payments for each part of the payment:

| When you still need to issue a separate payment when paying income tax, we’ll tell you | |

| 2. Executing a payment order | ||

| Fill in the basic payment details for payment orders | Download the payment form and find out what to enter in its fields | |

Indicate KBK on your payments for:

| Find out which KBK you need to indicate in the payment order for the transfer of fines from the publication | |

In field 24, decipher the purpose of the payment - “Income tax for 2018, credited:

| How to clarify the erroneous wording in field 24 in non-tax payments, we tell you | |

| In field 106 (basis of payment) indicate “TP” - payment for the current year | Find out how fields 106 and 108 of a payment order are interconnected from the publication | |

| In the (tax period) field, enter GD.00.2018 | Find out the definition of the term “tax period” from the material | |

| Indicate the date on the payment no later than 03/28/2019 and pay NP2018 no later than this day | When tax payment deadlines may be delayed, we will tell you | |

| In field 101 (payer status), enter “01” if you are transferring NP2018 for yourself | Find out about all the codes for field 101 of the payment order at | |

| 3. Control stage | ||

| Please check that the payment details entered into the payment fields are correct before sending it to the bank. | Find out what errors in the payment order will not allow the tax to go to the budget from the material | |

Our experts have prepared a sample of filling out an income tax payment for 2021.

Download a sample income tax payment form for the year from the link: