What are operating expenses?

Operating expenses according to the Tax Code of the Russian Federation

Operating expenses are costs of a business that are not related to the production of goods or provision of services. They are necessary for the functioning of the enterprise.

PBU 10/99 does not clearly define the term and does not delimit losses as a result of changes in classification in accordance with Order No. 116n. As is known, until 2006, other expenses were divided into non-operating, operating and emergency. According to today's standards, a simplified version of the gradation of expenses / income has been adopted for enterprises operating in any industry.

Similar to expenses, there are other operating incomes - these are financial receipts not related to the sale of the main product. If there is no evidence of indirect profitability, it is necessary to indicate the profit in subaccount 90 as income from core activities.

Company management styles

Effective management is a critical component of a thriving business. And the main role is given to the manager, who is entrusted with the responsibilities of focusing and controlling all areas of the company’s activities. The main characteristic of a leader is the management style he uses, which is his manner of communication, as well as a set of specific techniques for influencing employees. The most common management styles today are:

- authoritarian - it is characterized by such qualities as rigidity, unity of command, exactingness, prevalence of the power function, complete focus on achieving results;

- democratic – characterized by an orientation towards collegiality in decision-making, encouragement of initiative, responsibility on the part of lower-level employees, focus not only on the result, but also on the methods for achieving it;

- liberal - the distinctive features are a certain degree of passivity of the leader, giving subordinates complete freedom of action, and the maximum reduction of requirements.

Composition of operating expenses

Classification of expenses

If you imagine the complex of expenses existing in an enterprise, you can immediately understand which expenses are basic and ensure the production of the enterprise, and which of them are necessary to support its functioning, and these are the operating expenses of the enterprise.

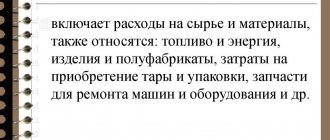

The list of indirect costs is regulated by PBU 10/99 clause 11, chapter 3. According to the document, operating expenses include:

- leased assets or received in other ways for temporary use on a reimbursable basis;

- leased rights to intellectual products;

- founders' investments into the process of other enterprises;

- any form of alienation of one’s own property – sale, lease, etc.;

- creation of funds to reserve money;

- payment of commissions and interest on bank accounts.

Important: expenses can be classified as operating expenses only if these expenses were not used to create a new product or provide services.

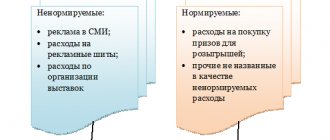

There is also a list of operating costs classified as other:

- repayment of penalties provided for by various contractual obligations;

- payment of losses caused by the company’s actions to third parties;

- losses on financial obligations that are impossible to recover;

- the size of the difference in currency fluctuations, due to which the company incurs losses when the cost of purchasing raw materials increases;

- losses from the write-off of assets that are out of order and, according to the conclusion of the commission, are unsuitable for restoration or partial sale;

- terminal expenses associated with the movement of cargo and business trips through the use of various land, air or road transport.

Operating income includes the same items that only benefit the enterprise, for example, rental of premises and other assets of the enterprise, income from representative activities, interest received on loans or the return of accounts payable that have expired.

The operating costs incurred by an enterprise can be much higher, it all depends on the type of its activity, for example, for a store such costs are the repair of the premises and cash register equipment, payment of salaries and contributions to extra-budgetary funds.

Operational classification of services.

Typically, service organizations are classified by the type of service they provide (financial, medical, transportation services, etc.). However, although division into such groups is convenient for presenting aggregate economic data, it is not suitable for operational management because it says little about the service process. In the industrial sector, in contrast to the service sector, there are very specific terms for classifying production operations. For example, batch production or continuous production. When used in a production environment, they immediately reveal the essence of the process. These terms are also used to describe the service process, but in order to reflect the fact that the service includes a service consumer (client) in the production system, additional information is needed. Such information, which, in our opinion, distinguishes the production function of one service system from another, is to establish the degree of contact with the client in the process of providing the service.

The term service contact reflects the customer's physical presence in the system, and service delivery refers to the workflow used to provide that service. The degree of contact in this case can be generally defined as the percentage of the time that the client must be in the service system to the total time that the entire process of servicing him takes. Typically, the longer the duration of contact between the service system and the service consumer, the higher the degree of interaction between them during the process of providing this service.

Based on this concept, we can conclude that service systems with a high degree of customer contact (High Degree Of Customer Contact) are much more difficult to manage and, in addition, they are much more difficult to rationalize than systems with a low degree of customer contact (Low Degree Of Customer Contact). Customer Contact). In systems of the first type, the client (since he takes part in the process of providing the service) will greatly influence the duration of service, the composition of the service and its actual or expected quality.

In table Figure 8.1 provides an example of differences in service requirements for two extreme degrees of customer contact.

As can be seen from this table, the presence of a client during the provision of a service affects absolutely all the characteristics that must be taken into account when designing the work of a service enterprise. It is also obvious that if the work is not performed in front of the client (in the example we are discussing, in the check processing center), its object is some kind of “substitute”: reports, databases, invoices, etc. Such works can be designed using the same principles as plant design, i.e. the goal in this case is to maximize the number of documents processed in one working day.

There are many different factors influencing the client on the terms of service provision, and therefore countless variations of services in systems with a high degree of contact with the client. For example, a bank branch can offer both simple banking operations, such as withdrawing cash from an account, which takes a few minutes, and quite complex ones, such as preparing an application for a loan, which requires at least an hour. In addition, these transactions can be carried out either on a self-service basis, for example, services are provided using ATMs, or on a collaborative basis, during which bank staff and the client work as one team, for example, when drawing up a loan application. The subsequent sections of this lecture introduce a number of other options for service operation configurations.

Table 8.1

The main differences between systems with a high and low degree of contact with the client in banking services

| Service characteristics | High contact system (bank branch) | Low Contact System (Receipt Processing Center) |

| Service point placement | Service must be carried out in close proximity to the service consumer | Service should preferably be located close to suppliers, transport hubs or labor sources |

| Planning service areas | The layout of the premises should take into account the psychological and physical needs and expectations of clients | The main criterion for space planning is to ensure maximum labor productivity |

| Contents of the service | The nature of the service is determined by the environment and the physical presence of the client | The client is not present in the service environment, so the service can be defined by fewer elements |

| Service Process Design | All stages of the service process have a direct and immediate impact on the customer | The client is not involved in most stages of document processing |

| Charting | The client is included in the work schedule and must be served | The client is primarily interested in the timing of completion of operations |

| Production planning | Orders cannot be stored, so smoothing the flow of service leads to business losses | It is possible to both defer order fulfillment and smooth out the service flow |

| Staff skills | Staff work directly with customers and are the main element of service, so they must be specially trained to work with people | Key personnel must have only professional skills |

| Quality control | The quality of the service is controlled by the client present and is therefore subject to change | Quality standards can be precisely defined; therefore quality is characterized by consistency |

| Temporary standards | The timing of services depends on the specific needs of the client; hence they are not strictly defined | The work is carried out with documents, so time standards can be very strict |

| Remuneration of employees | Due to varying work results, time-based wages are required | The ability to record the results of work allows you to apply a payment system based on results |

| Bandwidth Planning | To avoid loss of sales of services, capacity must be at the level of maximum demand | Since processed documents may be stored, throughput is determined by average demand level |

8.2. Design of service organizations

When designing service organizations, it is necessary to remember one distinctive feature of services: it is impossible to create an inventory of services. Unlike the manufacturing sector, in which it is possible during periods of decline in demand to accumulate stocks of products for sale during periods of maximum demand and thus maintain a relatively stable level of employment and capacity utilization, in the service sector, with rare exceptions, it is necessary to satisfy demand at the moment it arises . In this regard, the criterion of service throughput becomes a matter of paramount importance. Imagine yourself in many common situations where you become a customer of a service business, such as going to a movie or a restaurant. Typically, if a restaurant or movie theater is crowded, you go somewhere else. Thus, one of the most important questions when designing a service plant is: “What should our throughput (capacity) be?” Excessive capacity leads to unnecessary costs, and insufficient capacity leads to loss of customers. In such a situation, you should resort to marketing techniques. It is for this purpose that such tricks as discounted air ticket prices, special weekend menus in restaurants, etc. are used. The situation described above also serves as an excellent illustration of why in the service industry it is so difficult to separate the functions of operational management from the functions of marketing. A powerful mathematical tool for analyzing many of the most common service situations is queuing models. These models can more accurately answer questions such as how many clerks should work on a bank floor or how many telephone lines should a mail-order merchant have. Queue models are easily created using spreadsheets.

Selecting the target market and developing a package of services is the responsibility of senior managers. As a result, a platform is created for making direct operational decisions about the service strategy and designing a service delivery system.

There are many very important factors that differentiate the service design and development process from product development. First, in this case, the process and product must be developed simultaneously, since in the service industry the process is the product. (Note that it is a well-established fact that many product manufacturers also use a similar concept to integrate product and process design as closely as possible.)

Second, while the hardware and software created to support service design can be protected by patents and copyrights, the service process itself lacks the legal protection traditionally available in product manufacturing. Third, a package of services, unlike a package of goods that can be precisely defined, contains only the main result of the development process. Fourth, many elements of the service package are often determined by the level of training that employees receive before they actually become part of the service organization. This is especially true for so-called Professional Service Organizations (PSOs), such as law firms and hospitals, which require certification to be hired. Fifth, many service businesses are able to radically change their service offerings almost overnight. This degree of flexibility is available, for example, in so-called traditional service organizations: hairdressers, retail stores and restaurants.

Accounting and management of operating expenses

How expenses are accounted for

All operating expenses must be taken into account and, if necessary, reduced without losing the quality of the enterprise. In addition, they must be planned in advance for such cases as downtime of the enterprise, due to holidays or lack of activity, for the period of occurrence of circumstances independent of the enterprise, for example, fire, force majeure and others.

Among the popular methods for optimizing costs is reducing the wage fund by reducing the number of employees, but such a decision can negatively affect the quality and quantity of products produced.

As a result, there are delays in the delivery of products, and as a result, losses occur for the company.

Definition of capex and opex

Capex is an abbreviation for the English expressions capital expense or capital expenditure, meaning capital costs or expenses. These are expenses, usually one-time (irregular), directed by the company to the purchase of non-current assets, their modernization and reconstruction.

In fact, capital expenditures are intended to purchase capital goods that will become the foundation of the business and bring the main result.

Capital expenditures most often include the purchase of fixed assets and intangible assets, the main (but not the only) distinguishing feature of which is a long period of use in the activities of the enterprise.

Opex (English: operating expense, operating expenditure - operating costs ) - costs that a company incurs in the course of its current activities to ensure functioning. Such expenses are also called current period costs.

Almost all regular payments - rent, salaries of specialists, cost of consumables, etc. relate specifically to operating costs.

Thus, all costs in the process of business activity are either capital or operating (capex or opex). What does this division give? The main goal that is being pursued is to clarify for business leaders and investors how the company’s funds are spent. In addition, proper distribution of costs allows you to manage profits and tax amounts.

- The appearance of operating costs in the current period report reduces net profit before tax. At the same time, the amount of income tax is reduced.

- Capex in the company's reporting indicates the capitalization of costs, i.e. an increase in the value of assets and an increase in profit for the current period. In addition to the obvious advantages, this option also has a disadvantage - an increase in the amount of income tax. In addition, regular testing of assets to promptly detect impairment becomes mandatory.

Interesting: CAGR: what is this indicator and how to calculate it

Reflection of operating expenses in accounting

Account reflection 91

After finding out which company expenses are not core, you need to understand the peculiarities of their accounting. In accounting, they are accounted for in account 91, while income goes in subaccount 91.1, and expenses go in subaccount 91.2.

Important: entries are made to open accounts cumulatively, and at the end of the billing period, the difference between costs and other income is calculated and entered into subaccount 91.9, showing losses as a debit and profits as a credit.

Accounting is carried out in such a way that it is easy to conduct analytics for each previously performed operation.

Calculation of the efficiency of operating expenses

Efficiency calculation

The efficiency index for incurred operating expenses is established by the management body for each regulated company. One of the methods used is the efficiency of investment capital or indexation of established tariffs to optimize their level.

Investments raised to reduce costs are taken into account, and their impact on the level of costs at the stage of development and implementation of the application plan is studied.

Important: if, thanks to the implemented investment program, expenses can be reduced by 5%, then the efficiency index is applied at a 5% value.

At the same time, for enterprises:

- for thermal energy production, an index of 1%, maximum 5% is applied;

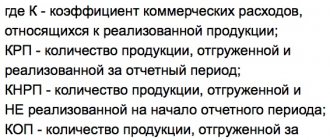

- for enterprises transmitting energy, the index obtained by applying the following formula IORj = max (IORj inv; IOR jcomp) , but not more than 5%.

After establishing the method, the management team monitors the activities of enterprises every 5 years and analyzes their activities through comparison. As a result, after comparative activities, an index of the efficiency of the companies' work process is determined.

Such a calculation of the efficiency index and comparative analysis are necessary to determine the level of costs and find ways to optimize them. So that the cost of production can be reduced if it turns out to be too high. The coefficient gives a clear idea of what percentage goes to maintaining the company's activities.

By drawing up graphical dynamics of activity using a coefficient, you can increase the company’s productivity by completely eliminating costs.

Company management tasks

The result of the application of operational consulting activities is the solution of the following list of tasks:

- increasing the company's manageability and flexibility;

- improving business performance;

- minimizing financial costs;

- implementation of an automated document flow system and optimization of information flow systems;

- automation of the documentation accounting process;

- optimization of marketing direction and increase in sales;

- improvement of the logistics system;

- building more effective relationships with partners and clients;

- increasing the efficiency of asset management;

- application of modern business planning systems;

- effective distribution of powers between individual structural units and personnel.

Factors Affecting Operating Expense Ratio

Main factors influencing the profitability of an enterprise

In order to operate efficiently, it is necessary to optimize non-operating expenses - this is the main goal of the management team. When they decrease, the rate of development of productivity and profitability of the enterprise is observed. There are several factors influencing the level of costs, and they are divided into internal and external.

External factors

External factors influencing the amount of operating expenses do not depend on the will and activity of the company and include:

- Inflation. The higher its level, the more companies incur additional expenses - this includes paying salaries and bonuses, interest on loans to banks, transportation or services of third-party companies;

- Increase in tax rates for extra-budgetary expenses. Deductions take up a significant percentage of the company's expenses and an increase in their rates significantly affects the growth of expenses.

Internal factors

Internal ones include:

- Volume of production and sales of finished goods. Despite the fact that increasing production capacity requires additional expenses, production costs can be significantly reduced due to the constant number of service personnel. For example, a mechanic was servicing one machine, when there were 3 of them, and the mechanic’s salary was the same, three machines were already being serviced, and there were more products, which meant their cost was lower.

- Duration of the production cycle. With its reduction, the level of investment costs, cash transactions, costs of storing products is reduced, the costs of accounts receivable, and the costs of paying employees and managers are reduced.

- Labor productivity indicator per one workplace. The higher this value, the lower the amount for operational settlements with employees.

- Technical condition of fixed assets at the enterprise. The more worn out the equipment is, the more money is required for depreciation. As a result, the question arises about the effectiveness of purchasing new machines.

- The amount of own working capital. The higher the percentage of equity capital used in the company's activities, the less the need for borrowed capital, which means there is a decrease in servicing loans and borrowings.

Principles of company management

The success and efficiency of the company as a whole depends on the quality of implementation of the management function at all stages. Based on this, it is of particular importance to consider the basic principles of company management, since it is a properly organized and structured management system at all levels that is the key to the development and prosperity of a business. The classic principles of effective management are the following:

- division of labor into separate units for each structural unit;

- a direct connection between authority and responsibility, which presupposes a full understanding of the person giving orders and making decisions about the level of responsibility for the actions taken;

- discipline and strict implementation of all rules and norms of behavior established by the company;

- commonality in achieving the main goals of the company, which presupposes the fruitful work of each employee for the benefit of common results;

- observance of subordination and unity of command in each department;

- taking proactive actions on the part of employees, which implies taking into account their opinions and suggestions to improve the efficiency of overall activities;

- the presence of a single control center, as well as a well-developed chain of lower-level structures;

- a fair and properly organized system of personnel motivation;

- definition of corporate spirit and its constant support at a high level.