VAT (value added tax) is the most difficult tax to understand, calculate and pay, although if you do not delve deeply into its essence, it will not seem very burdensome for a businessman, because is an indirect tax. Indirect tax, unlike direct tax, is transferred to the final consumer.

Each of us can see the total amount of the purchase and the amount of VAT in the receipt from the store, and it is we, as consumers, who ultimately pay this tax. In addition to VAT, indirect taxes include excise taxes and customs duties. To understand the complexity of VAT administration for its payer, you will need to understand the main elements of this tax.

VAT elements

The objects of VAT taxation are:

- sale of goods, works, services on the territory of Russia, transfer of property rights (the right to claim debt, intellectual rights, rental rights, the right to permanent use of land, etc.), as well as gratuitous transfer of ownership of goods, results of work and provision of services. A number of transactions specified in paragraph 2 of Article 146 of the Tax Code of the Russian Federation are not recognized as objects of VAT taxation;

- carrying out construction and installation work for own consumption;

- transfer for one's own needs of goods, works, services, the costs of which are not taken into account when calculating income tax;

- importation of goods into the territory of the Russian Federation.

Free tax consultation

The goods and services listed in Article 149 of the Tax Code of the Russian Federation are not subject to VAT. Among them there are socially significant ones, such as: sales of certain medical goods and services; nursing and child care services; sale of religious items; passenger transportation services; educational services, etc. In addition, these are services in the securities market; Bank operations; insurer services; legal services; sale of residential buildings and premises; public utilities.

The VAT tax rate can be 0%, 10% and 20%. There is also the concept of “settlement rates”, equal to 10/110 or 20/120. They are used in operations specified in paragraph 4 of Article 164 of the Tax Code of the Russian Federation, for example, when receiving advance payment for goods, work, services. All situations in which certain tax rates are applied are given in Article 164 of the Tax Code of the Russian Federation.

Export transactions are subject to a zero tax rate; pipeline transport of oil and gas; electricity transmission; transportation by rail, air and water transport. At a 10% rate – some food products; most products for children; medicines and medical products that are not included in the list of essential and vital; breeding cattle. For all other goods, works and services, the VAT rate is 20%.

Calculate the VAT amount using a calculator

The VAT tax base is generally equal to the cost of goods, works, and services sold, taking into account excise taxes for excisable goods (Article 154 of the Tax Code of the Russian Federation). At the same time, articles 155 to 162.1 of the Tax Code of the Russian Federation provide details for determining the tax base separately for different cases:

- transfer of property rights (Article 155);

- income from mandate, commission or agency agreements (Article 156);

- when providing transportation services and international communication services (Article 157);

- sale of an enterprise as a property complex (Article 158);

- carrying out construction and installation work and transferring goods (performing work, providing services) for one’s own needs (Article 159);

- importation of goods into the territory of the Russian Federation (Article 160);

- when selling goods (work, services) on the territory of the Russian Federation by taxpayers - foreign persons (Article 161);

- taking into account the amounts associated with settlements for payment for goods, works, services (Article 162);

- during the reorganization of organizations (Article 162.1).

Tax period , that is, the period of time at the end of which the tax base is determined and the amount of tax payable under VAT is calculated, is a quarter.

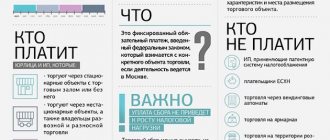

Russian organizations and individual entrepreneurs, as well as those who move goods across the customs border, that is, importers and exporters, are recognized as VAT payers Taxpayers working under special tax regimes: USN, Unified Agricultural Tax, PSN (except for cases when they import goods into the territory of the Russian Federation), and participants in the Skolkovo project do not pay VAT.

In addition, taxpayers who meet the requirements of Article 145 of the Tax Code of the Russian Federation can receive an exemption from VAT: the amount of revenue from the sale of goods, work, and services for the three previous months, excluding VAT, did not exceed two million rubles. The exemption does not apply to individual entrepreneurs and organizations selling excisable goods.

Intermediaries and VAT-exempt transactions

In accordance with paragraph 7 of Art. 149 of the Tax Code of the Russian Federation the right to take advantage of the VAT exemption when carrying out the activities listed in paragraphs. 1–3 of this article of operations do not apply to intermediaries. That is, if a person carries out such activities in someone else’s interests, then he is obliged to pay the full VAT rate on the amount of his remuneration (letter of the Ministry of Finance of Russia dated March 31, 2010 No. 03-07-05/15 and the Federal Tax Service of Moscow dated July 19, 2010 No. 16- 15/075620).

In this case, the exception is transactions for the sale of goods or the provision of services, which are exempt from VAT on the basis of clause 1, sub-clause. 1 and 8 clause 2, sub. 6 clause 3 art. 149 of the Tax Code of the Russian Federation (based on clause 2 of Article 156 of the Tax Code of the Russian Federation).

For more information on this, see the material “Which intermediary services are not subject to VAT” .

What is a VAT deduction?

At first glance, since VAT must be charged on the sale of goods, works, and services, it is no different from sales tax (turnover). But if we return to its full name - “value added tax”, then it becomes clear that not the entire sales amount should be subject to it, but only the added value . Added value is the difference between the cost of goods, works, services sold and the costs of purchasing materials, raw materials, goods, and other resources spent on them.

This makes clear the need to obtain a VAT tax deduction. The deduction reduces the amount of VAT accrued upon sale by the amount of VAT that was paid to the supplier when purchasing goods, works, and services. Let's look at an example.

Organization “A” purchased goods from organization “B” for resale at a cost of 7,000 rubles per unit. The VAT amount was 1,400 rubles (at a rate of 20%), the total purchase price was 8,400 rubles. Next, organization “A” sells the product to organization “C” for 10,000 rubles per unit. VAT on sales is equal to 2,000 rubles, which organization “A” must transfer to the budget. In the amount of 2,000 rubles, the VAT (1,400 rubles) that was paid during the purchase from organization “B” is already “hidden”.

In fact, the obligation of organization “A” to the budget for VAT is only 2,000 – 1,400 = 600 rubles, but this is provided that the tax authorities offset this input VAT, that is, provide the organization with a tax deduction. Receiving this deduction is accompanied by many conditions; below we will consider them in more detail.

In addition to deducting VAT amounts paid to suppliers when purchasing goods, works, services, VAT on sales can be reduced by the amounts specified in Article 171 of the Tax Code of the Russian Federation. This is VAT paid when importing goods into the territory of the Russian Federation; when returning goods or refusing to perform work or provide services; when the cost of shipped goods (work performed, services provided) decreases, etc.

VAT and single agricultural tax

In general, agricultural producers must pay value added tax. This obligation has appeared since 2021. However, businesses are entitled to VAT exemption. To do this, you need to submit a notification to your tax office no later than 20 days from the end of the month in which you begin to use the benefit. The conditions for VAT exemption are as follows:

- the person switches to the Unified Agricultural Tax and receives the right to be exempt from VAT in the same calendar year;

- if a company or individual entrepreneur is already working for the unified agricultural tax, then the proceeds from the sale of agricultural products in the previous tax period should not exceed the established limit: in 2021 - 100 million rubles; in 2019 - 90 million rubles; in 2021 - 80 million rubles; in 2021 - 70 million rubles; in 2022 and subsequent years - 60 million rubles.

Conditions for obtaining input VAT deduction

So, what conditions must a taxpayer fulfill in order to reduce the amount of VAT upon sale by the amount of VAT that was paid to suppliers or when importing goods into the territory of the Russian Federation?

- Purchased goods, works, and services must have a connection with objects of taxation (Article 171(2) of the Tax Code of the Russian Federation). Tax authorities often ask the question: will these purchased goods actually be used in transactions subject to VAT? Another similar question is whether there is an economic justification (orientation to making a profit) when purchasing these goods, works, services? That is, the tax authority is trying to refuse to receive a tax deduction for VAT, based on its assessment of the feasibility of the taxpayer’s activities, although this does not apply to the mandatory conditions for deducting input VAT. As a result, VAT payers file many lawsuits against unfounded refusals to receive deductions in this regard.

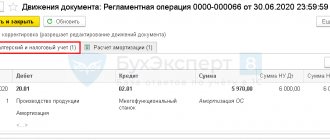

- Purchased goods, works, and services must be registered (Article 172(1) of the Tax Code of the Russian Federation).

- Availability of a correctly executed invoice . Article 169 of the Tax Code of the Russian Federation provides requirements for the information that must be indicated in this document. When importing, instead of an invoice, the fact of VAT payment is confirmed by documents issued by the customs service.

- Until 2006, in order to receive a deduction, the condition of actual payment of the VAT amount was in force. Now, Article 171 of the Tax Code of the Russian Federation provides only three situations in which the right to deduction arises in relation to the VAT paid: when importing goods; on business travel and entertainment expenses; paid by tax agent buyers. For other situations, the turnover of “tax amounts presented by sellers” applies.

- Prudence and caution when choosing a counterparty. About “Who is responsible for an unscrupulous counterparty?” we have already told you. Refusal to receive a VAT tax deduction may also be caused by your connection with a suspicious counterparty. If you want to reduce the VAT that you must pay to the budget, we recommend that you conduct a preliminary check of your transaction partner.

- Isolation of VAT as a separate line. Article 168 (4) of the Tax Code of the Russian Federation requires that the amount of VAT in settlement and primary accounting documents, as well as in invoices, be highlighted as a separate line. Although this condition is not mandatory to receive a tax deduction, it is necessary to monitor its presence in the documents so as not to cause tax disputes.

- Timely issuance of invoices by the supplier. According to Article 168 (3) of the Tax Code of the Russian Federation, an invoice must be issued to the buyer no later than five calendar days, counting from the day of shipment of goods, performance of work, provision of services. Surprisingly, even here the tax authorities see a reason for refusing the buyer a tax deduction, although this requirement applies only to the seller (supplier). The courts on this issue take the position of the taxpayer, reasonably noting that the five-day period for issuing an invoice is not a prerequisite for a deduction.

- The integrity of the taxpayer himself. Here it is already necessary to prove that the VAT payer himself, who wants to receive a deduction, is a bona fide taxpayer. The reason for this is the same resolution of the Plenum of the Supreme Arbitration Court of October 12, 2006 N 53, which defines the “defects” of the counterparty. Paragraphs 5 and 6 of this document contain a list of circumstances that may indicate the unjustification of a tax benefit (and the deduction of input VAT is also a tax benefit). Suspicious, in the opinion of YOU, are:

- the impossibility of the taxpayer actually carrying out business transactions;

- lack of conditions for achieving the results of relevant economic activities;

- carrying out transactions with goods that were not produced or could not be produced in the specified volume;

- accounting for tax purposes only those business transactions that are associated with obtaining tax benefits. These are conditions that are quite harmless at first glance, such as: the creation of an organization shortly before a business transaction; one-time nature of the operation; use of intermediaries in transactions; carrying out the transaction at a location other than the taxpayer's location. Based on this resolution, tax inspectors acted very simply - they refused to receive a VAT deduction, simply listing these conditions. The zeal of its employees had to be restrained by the Federal Tax Service itself, because... the number of those “unworthy” of receiving tax benefits simply went off scale. In a letter dated 05.24.11 No. SA-4-9/8250 Federal Tax Service about.

- Additional conditions for obtaining a VAT tax deduction may include a number of requirements from tax authorities for the preparation of documents (accusations of incompleteness, unreliability, and contradiction of the specified information are typical); to the profitability of the activities of the VAT payer; an attempt to re-qualify contracts, etc. If you are sure that you are right, in all these cases it is worth at least appealing the decisions of the tax authorities to refuse to receive a VAT tax deduction in a higher tax authority.

Banks' comments

VTB representatives believe that the consequence of the abolition of zero VAT will be a significant increase in the cost of software for banks, which is already a large expense item. “The cancellation of the benefit is premature, and it will really have a negative impact on the banking sector,” bank employees told Kommersant.

In the idea of the Ministry of Telecom and Mass Communications, representatives of Tinkoff Bank saw a potential cause of significant losses for the banking business. They emphasized that the abolition of preferential VAT will be carried out without taking into account modern market realities, and cited as an example the fact that banks have in many ways become IT companies, although they cannot claim benefits in the IT industry.

The Settlement Non-Bank Credit Organization (RNCO) “Payment Center” believes that the abolition of benefits will be followed by a decrease in the volume of software purchases made by banks. This opinion was expressed by member of the board of directors of RNKO Alexander Pogudin , adding that the consequence of this will be a reduction in the income of IT companies.

How to free up 2.5 hours a day for each employee

Business

Otkritie Bank board member Sergei Rusanov called it strange that “IT initiatives, which should be aimed at motivating technology development, underestimate this motivation for a large proportion of consumers, thereby narrowing the market.” Deputy General Director of the Qiwi group Maria Shevchenko called the initiative of the Ministry of Telecom and Mass Communications “critical for banks, if we consider it in conjunction with the initiative to switch banks to using Russian software in accordance with the Presidential Decree.”

VAT on export

As we have already said, when exporting goods, their sale is taxed at a rate of 0%. The company must justify the right to such a rate by documenting the fact of export. To do this, along with the VAT return, you must submit a package of documents to the tax office (copies of the export contract, customs declarations, transport and shipping documents with customs marks).

The VAT payer is given 180 days from the date the goods are placed under export customs procedures to submit these documents. If the necessary documents are not collected within this period, then VAT will have to be paid at a rate of 10% or 20%.

VAT on import

When importing goods into the territory of the Russian Federation, importers pay VAT at customs, which is calculated as part of customs payments (Article 318 of the Customs Code of the Russian Federation). An exception is the import of goods from the Republic of Belarus and the Republic of Kazakhstan; in these cases, payment of VAT is formalized at the tax office in Russia.

Please note that when importing goods into Russia, all importers pay VAT, including those working under special tax regimes (USN, UTII, Unified Agricultural Tax, PSN), and those who are exempt from paying VAT under Article 145 of the Tax Code of the Russian Federation.

The VAT rate for imports is 10% or 20%, depending on the type of goods. An exception is the goods specified in Article 150 of the Tax Code of the Russian Federation, for the import of which VAT is not charged. The tax base on which VAT will be charged when importing goods is calculated as the total sum of the customs value of goods, customs duties and excise taxes (for excisable goods).

Activities that are not subject to VAT

These types of activities include both the sale and execution, transfer, provision of works and services of the following categories:

- medical products approved by the list of the Government of the Russian Federation;

- medical services provided by specialized institutions and private practice doctors, except for cosmetology, veterinary medicine and sanitary-epidemiological services;

- care services for the disabled, elderly, and sick (the need for care must be confirmed by the conclusions of the relevant authorities);

- services for the maintenance of children in municipal preschool educational institutions, as well as for conducting classes in clubs, sections, studios with minor children;

- sale of food products produced by public catering canteens, if they are sold in the canteens themselves;

- services provided by archival institutions;

- services for the transportation of passengers by any urban and suburban public transport (except for taxis and minibuses), if transportation is carried out at uniform tariffs and with the provision of benefits;

- funeral services and sale of funeral supplies;

- sale of postage stamps (except for collectibles), postcards, envelopes;

- services for the provision of residential premises of any form of ownership for use;

- sale of coins made of precious metals that are a means of payment of the Russian Federation or other states;

- transfer and sale of shares in the authorized capital of organizations, shares of mutual funds, securities and financial instruments of futures transactions, except for the underlying asset of financial instruments subject to VAT;

- services related to depository services, which are provided by the depositary of funds of the IMF, the International Bank for Reconstruction and Development, the International Development Association within the framework of the articles of the Agreements of these organizations;

- repair and maintenance of goods and household appliances (including medical ones) during the warranty period;

- services of non-profit organizations licensed in the field of education and educational process;

- social services for minors, the elderly and people in difficult life situations; services to identify such citizens; services for the selection and training of guardians of such citizens;

- services to the population for physical education and recreation activities:

- vocational training and retraining services provided in the direction of the employment service;

- carrying out repair and restoration, conservation and restoration work on historical and architectural monuments;

- carrying out work as part of the implementation of targeted housing construction projects for military personnel;

- services provided by authorized bodies for which state duty is charged;

- sale of goods in stores that have passed the customs duty-free procedure;

- sale of goods, performance of work, provision of services produced as part of the provision of gratuitous assistance to the Russian Federation;

- services of non-profit cultural and art organizations, including cinematography organizations;

- servicing airports and aircraft on the territory and airspace of the Russian Federation;

- repair and maintenance of sea vessels during stay in ports, as well as pilotage;

- services of pharmacy organizations for the manufacture of medicines, production or repair of optics, hearing aids, prosthetic and orthopedic products, provision of prosthetic and orthopedic care;

- transfer of exclusive rights to inventions, know-how, results of intellectual activity;

- sale of religious items by religious organizations;

- banking operations, with the exception of collection;

- sale of folk arts and crafts of recognized artistic merit;

- insurance and pension services;

- sales of ore and other industrial products containing precious metals, scrap and waste of these metals, precious metals and stones, including unprocessed ones;

- intra-system sales of self-produced goods of FSIN institutions;

- free transfer of goods and services within the framework of charitable activities;

- sale of entrance tickets of the approved form by sports organizations for events held by them, rental services of sports facilities for the preparation and holding of such events;

- services of a bar association, bureau, or college to its members in connection with their professional activities;

- loan transactions in cash or in the form of securities;

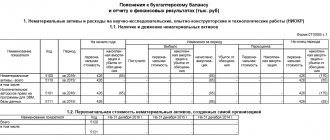

- carrying out research and development work at the expense of budget funds;

- services of sanatorium-resort and health-improving organizations;

- forest fire extinguishing services;

- sales of their products by agricultural enterprises;

- sale of residential premises and shares in them, including transfer of a share in the common right to common property in an apartment building;

- ] developer of shared construction[/anchor];

- transfer of samples of goods, the creation of a unit of which does not exceed 100 rubles;

- operations on the assignment of rights of claims of the creditor;

- carrying out work by residents in a special economic zone;

- services for the provision of air time or print space provided free of charge in accordance with the legislation of the Russian Federation on elections and referendums;

- services related to housing and communal services;

- services for the production and distribution of social advertising provided free of charge.

VAT under simplified tax system

Although simplifiers are not VAT payers, issues related to this tax nevertheless arise in their activities.

First of all, why do OSNO taxpayers not want to work with suppliers on the simplified tax system? The answer here is that the supplier on the simplified tax system cannot issue an invoice to the buyer with allocated VAT, which is why the buyer on the OSNO will not be able to apply a tax deduction for the amount of input VAT. The solution here is possible in reducing the selling price, because unlike suppliers on the general taxation system, simplifiers do not have to charge VAT on sales.

Sometimes simplifiers still issue the buyer an invoice with a allocated VAT, which obliges them to pay this VAT and submit a declaration. The fate of such an invoice may be controversial. Inspections often deny buyers a tax deduction, citing the fact that simplifiers are not VAT payers (even though they actually paid VAT). True, most courts in such disputes support the right of buyers to deduct VAT.

If, on the contrary, a simplifier buys goods from a supplier working on OSNO, then he pays VAT, for which he cannot receive a deduction. But, according to Article 346.16 of the Tax Code of the Russian Federation, a taxpayer using a simplified system can take into account input VAT in his expenses. This, however, only applies to payers of the simplified tax system Income minus expenses, because On the simplified tax system, income does not take into account any expenses.

VAT return and tax payment

The VAT return must be submitted at the end of each quarter, no later than the 25th of the next month, that is, no later than the 25th of April, July, October and January, respectively. Reporting is accepted only in electronic form; if it is presented on paper, it is not considered submitted. Starting from the report for the 1st quarter of 2021, the VAT return is submitted in an updated form (as amended by Order of the Federal Tax Service dated December 20, 2016 N ММВ-7-3/ [email protected] ).

The procedure for paying VAT differs from other taxes. The tax amount calculated for the reporting quarter must be divided into three equal parts, each of which must be paid no later than the 25th day of each of the three months of the next quarter. For example, according to the results of the first quarter, the amount of VAT payable amounted to 90 thousand rubles. We divide the tax amount into three equal parts of 30 thousand rubles each, and pay it within the following deadlines: no later than April 25, May, June, respectively.

We draw the attention of all LLC-organizations can pay taxes only by non-cash transfer. This is a requirement of Art. 45 of the Tax Code of the Russian Federation, according to which the organization’s obligation to pay tax is considered fulfilled only after presentation of a payment order to the bank. The Ministry of Finance prohibits paying LLC taxes in cash.

If you did not manage to pay taxes or contributions on time, then in addition to the tax itself, you will also have to pay a penalty in the form of a penalty, which can be calculated using our calculator:

In this article we tried to give basic concepts about VAT. Unfortunately, this tax, like no other, is endless in its complexity. We recommend that you contact specialists when calculating and paying VAT. For example, get a free one-hour consultation from our partners from 1SBO.

VAT refund on application basis with a guarantee

To claim VAT refund under a guarantee, you must submit to the inspectorate:

- surety agreement (form of surety agreement approved by Order of the Federal Tax Service of Russia dated March 6, 2019 No. ММВ-7-3/ [email protected] );

- application for application of the declarative procedure.

This must be done no later than five working days from the date of filing the VAT return for refund. The guarantor under the contract can be an organization of the Russian Federation that meets the requirements listed in clause 2.1 of Art. 176.1 Tax Code of the Russian Federation.

The validity period of the guarantee agreement must be at least 10 months from the date of filing the VAT return for reimbursement and no more than a year from the date of its conclusion. And the amount specified in the contract must fully cover the refundable amount of VAT (clause 4.1 of Article 176.1 of the Tax Code of the Russian Federation).