Legal entities are required to pay income tax to the state in the form of a monetary amount. It is represented by a certain percentage of total profit, the amount of which is set by the state. The procedure for accrual and payment procedures is determined by law, in accordance with the Tax Code of the Russian Federation.

The profit, from which the country receives a certain percentage, is the income received by the legal entity, from which the cost of the costs incurred to conduct business has been subtracted. Not all expenses are regulated, and not all of them can be deducted from profit. Actually, the list of expenses taken into account is also specified in the Tax Code.

How to calculate income tax

Methods for determining profit

In total, there are two official methods that allow you to find out the amount of taxable profit.

- By accruing expenses as they occur and income as they come in, without relying on whether the money was actually spent or received.

- Accounting is carried out using the cash method, that is, immediately at the time of receipt or payment of money. Only some organizations can use the cash method. One of the conditions requires the presence of revenue for the past year in the amount of no more than 1,000,000 rubles for every three months.

There is an opinion that only an accountant, an employee of the company in question, can calculate income tax. This idea is fundamentally wrong. Any interested person, even a mathematical layman, can test himself and quite successfully determine the amount of taxation.

How tax law determines income, Ch. 25, art. 248 Tax Code of the Russian Federation

Tax calculation frequency

The settlement and profit process is constant. Every day, accounting is engaged in analyzing and systematizing accounting information and distributing it to registers. And all in order to correctly calculate the tax. This is called tax accounting.

This material talks about some of the nuances of this process.

By the way, the tax is calculated and declared at the end of the year, and during the year, advance payments are paid and interim declarations are submitted during reporting periods. Tax and reporting periods are coded in the declarations.

Look for a list of codes in the article “What is the tax and reporting period for income tax (codes)?” . It also contains information about the duration of these periods.

Who is obliged to pay

Legal entities, that is, organizations, are required to pay income tax. The amounts received from them go to the state budget. Exceptions may be made in cases where the enterprise has a special taxation regime, line of business, or is a foreign organization preparing in Russia for various significant global events.

Who is required to pay income tax?

USN is an abbreviation that stands for simplified taxation system. This regime provides tax exemption for:

- property;

- at a profit;

- on the income of an individual;

- on value added (excluding imports).

In addition, the presented regime implies the abolition of many of the payments listed above, and instead of them a single one is introduced, possible in the following options:

- a portion of the income received in the amount of 6% of the “body” is paid to the state;

- from the difference obtained by subtracting its expenses from the enterprise’s income, 5 to 15% are subtracted and paid to the country’s budget.

You can decide on the most suitable option by understanding the real amount of your expenses. If they do not reach half of the pay, therefore, choose the first option; in other cases, give preference to interest on the difference between profits and costs.

UTII - this abbreviation, when deciphered, sounds like a single tax on imputed income. This regime is intended for specific areas of enterprises, all of which are presented in the Tax Code of the Russian Federation. The authorities of the constituent entities of the Russian Federation can establish it as the main one for their regions in relation to these areas of activity.

These usually include:

- transportation of goods by transport;

- transportation of passengers;

- retail trade, etc.

With a single tax on imputed income, contributions to the state are withdrawn from income that is expected to be received in the future. It is found according to the following formula:

A*B*K1*K2

Where A is a physical indicator that is directly dependent on the market niche in which the organization operates, the number of employees, the size of the trading floor, the number of vehicles, etc.

B is the basic profitability specified in the Tax Code of the Russian Federation.

K1 is a specialized coefficient, currently equal to 1.868.

K2 is the second coefficient, which is determined in accordance with legal acts issued by the authorities of the subject in whose territory the individual business or legal entity is located.

Deflator coefficient rates are set by orders of the Ministry of Economic Development every year. The latest order can be downloaded from the link:

Note! Since the tax is taken from income that is assumed, imputed, the revenue received in reality does not in any way affect the final payments.

As in previous cases, the imputed income tax frees company representatives from the need to pay other contributions to the state budget. We are talking about taxes:

- for added value (not import);

- profit;

- property of tax residents of the country;

- income of an individual.

Another possible area that is not subject to income tax is the gambling business.

In addition, foreign companies that worked in Russia during the world Olympic competitions in Sochi in 2014, as well as those that are working now, in 2021, and are preparing for FIFA and next year’s World Cup are exempt from payment. football.

Exceptions

Taxable profit does not include:

- Income in the form of collateral or rights to it.

- Non-separable capital investment in leased property.

- Income in the form of property acquired as targeted financing.

- Contributions to the authorized capital.

- Income in the form of borrowed property.

- Other income provided for in Art. 251 NK.

Tax rates

The profit rate is calculated as a percentage and is currently legally equal to 20 units. In 2021, the amount paid was distributed as follows:

- 2% of the “body” went to the federal budget;

- the remaining interest went to the regional treasury.

However, shortly before the start of 2021, the inspectorate issued an order that outlined an updated redistribution between state budgets. Now the federal one receives 1% more, and accordingly the regional one decreases by the same amount.

It is also possible to individually change the size of the specified tax rate. This decision is made directly by the regional authorities, who have the right to reduce payments by reducing the percentage allocated to them. However, they also do not have the right to lower the rate to less than 13.5%.

This value is considered preferential. In the capital, companies engaged in the following work are subject to it:

- produce motor vehicles;

- carry out activities in a special economic territory;

- are representatives of parks of industrial and technological policies;

- use people with disabilities as employees.

The cultural capital also established a constant rate of 13.5% for certain categories of taxpayers, including companies operating in a special economic zone.

The example of the main cities of the country is followed by most of its other subjects. Lowering the rate is a common practice. However, in addition to the variety presented, there are also specialized bets. According to them, the tax received on profit is sent in full to the federal treasury.

Note! The remaining 3% due to the federal budget must be added to 13.5%. Local authorities cannot cancel or lower them.

The use of specialized rates is made due to their special characteristics of the company:

- status;

- activities.

Table 1. Specialized income tax rates

| Bid | Characteristics of the company and income |

| 20% | From the profits received, the following are given to the state:

|

| 10% | Foreign companies that do not have representative offices in the Russian Federation transfer to the authorities the income received from leasing vehicles and carrying out international transportation. |

| 13% | Russian companies receive money from other companies, no matter local or foreign, as well as dividends from existing deposited shares. |

| 15% | Payments are made to foreign organizations, from funds received from Russian companies, as well as to all owners of profits due on state and municipal securities. |

| 9% | A rate of 9% is imposed on income from Article No. 284 of the Tax Code. |

| Zero rate | And finally, organizations whose location and work is Russia are not taxed at all. Moreover, they are of a budget nature, that is:

|

In addition, the zero rate applies to residents of the economic zone, as well as members of local investment projects, the liberated economic zone in the Republic of Crimea and the federal city of Sevastopol.

Liabilities and assets for current tax

Question.

In what cases can liabilities and assets for current tax determined in accordance with IAS 12 Income Taxes be reflected in the statement of financial position as non-current liabilities and non-current assets, respectively?

Answer.

The need to separate liabilities and assets into short-term and long-term is determined by IAS 1 “Presentation of Financial Statements”, paragraphs 60-76. Current income tax liabilities and assets are no exception to this classification.

In Standard (IAS) 12 “Income Taxes”, paragraph 5, you can find the definition of current income tax: “Current tax is the amount of income taxes paid (refunded) in relation to taxable profit (tax loss) for the period. In turn, “taxable profit (tax loss) is profit (loss) for the period determined (determined) in accordance with the rules of the tax authorities, in respect of which (which) income taxes are paid (reimbursed”).

The obligation to pay income tax debt has the following terms:

Monthly advance payments - no later than the 28th day of each month of this reporting period.

Quarterly advance payments - no later than the 28th day from the end of the expired reporting period.

It follows that, in normal practice, income tax debt is a short-term liability.

Current income tax assets

are classified as long-term if they do not meet the criterion necessary to recognize an asset as short-term:

— an asset is cash or cash equivalents (as defined in IAS 7) unless it is restricted from being exchanged or used to settle a liability for at least 12 months after the end of the reporting period.

Liabilities for current income tax

are classified as long-term if they do not satisfy the criterion necessary to recognize the obligation as short-term:

— the obligation is repayable within 12 months after the end of the reporting period; or

- the company does not have an unconditional right to defer the payment of the liability for at least 12 months after the end of the reporting period.

In view of the above, it can be concluded that, as a matter of normal practice, current tax assets and liabilities should be classified as current.

Let's now look at an example where current tax assets and liabilities can be classified as non-current.

Current tax assets:

1) Situation:

The Company has overpaid income taxes. The company was registered in Moscow. Due to changes in the market, the Company decided to move to St. Petersburg. Due to a change in the tax office, the Company is reconciling taxes. Part of the overpayment of tax credited to the budget of a constituent entity of the Russian Federation? was never counted due to certain circumstances. The Company believes that the offset of this overpayment will not be made within 12 months after the reporting date.

Conclusion: This overpayment of current income tax must be included in long-term assets, indicating the circumstances of such reflection in the Notes to the financial statements.

Current tax liabilities:

2) Situation:

The Company has arrears of current income tax. The payment deadline is no later than the 28th day after the end of the expired reporting period. The company is experiencing financial difficulties and understands that it will not be able to fulfill its budget obligations on time. The company received the right to restructure its income tax debt.

Conclusion: The amount of income tax debt, the liability for which has been postponed for a period of more than 12 months after the reporting date, must be classified as long-term debt, indicating the circumstances of such reflection in the Notes to the financial statements.

Question. According to paragraph 63 of IFRS 39, published on the website of the Russian Ministry of Finance, if there is objective evidence of a loss from impairment of loans and receivables, the amount of the loss is assessed as the difference between the carrying amount of the asset and the present value of estimated future cash flows, discounted at the original effective interest rate on a financial asset.

Please clarify, should the difference between the book value of an asset and the present value of estimated future cash flows be discounted, as prescribed by the Russian Ministry of Finance, or should the estimated future cash flows be discounted, as follows from the discounting methodology?

Answer. Estimated future cash flows are subject to discounting. This judgment follows from the text of paragraph 63 of IFRS 39 in the original language.

Here's an example:

| Item no. | date | Contents of operation |

| 1 | September 30, 2011 | Received an interest-free loan for a period of 2 years, amount 250,000 |

| 2 | September 30, 2011 | Reflection of the initial cost of the loan in accordance with market conditions (reflection at amortized cost). |

| Let’s say the rate on similar loans on the market is 10% | ||

| PV=250,000/(1+10%/12)^48=167,858 | ||

| 3 | December 31, 2011 | Reporting date. Reflection of the loan at amortized cost, taking into account accrued interest. |

| PV= 167,858*(1+10%/12)^3= 172,090 | ||

| 4 | May 30, 2012 | Reporting date. Reflection of the loan at amortized cost, taking into account accrued interest. |

| PV= 167,858*(1+10%/12)^8= 179,380 | ||

| 5 | June 30, 2012 | The Company has objective evidence that the loan repayment amount will be 150,000 rubles, instead of 250,000 rubles. We calculate the present value of future cash flows at the reporting date. |

| PV=150,000/(1+10%/12)^48= 100,715 | ||

| 6 | June 30, 2012 | Reflection of the loan at amortized cost, taking into account accrued interest based on data on future cash flows. |

| PV= 100,715*(1+10%/12)^9= 161,632 | ||

| 7 | June 30, 2012 | Reporting an impairment loss as the difference between the asset's carrying amount and the present value of estimated future cash flows |

| 179 380 — 161 632 = 17 748 |

Formula for calculating income tax

As is clear from the information described earlier, the form of calculation of income tax will depend on the specific taxation system, as well as other circumstances that characterize the organization. Let's look at an example.

How to calculate income tax using the formula

You represent a company subject to the general taxation system. The general taxation system is a system in which a company is obliged to keep accounting records in full, while fulfilling its obligations to pay all general taxes to the budget:

- added value;

- at a profit;

- property;

- unified social or contributions to insurance funds.

Example. Over the past 12 months of work, your company received 4.5 million rubles, while costs amounted to 2.7 million. As you already understand, in this situation the tax will be calculated from the difference between the indicated amounts, that is, income and expenses - net profit. Let's count it.

4.5 – 2.7 = 1.8 or 1 million 800 thousand units of Russian currency. Let’s imagine that in the constituent entity of the Russian Federation, which is the place of business of your office, the main rate is regional and amounts to the standard 17%, then it turns out that you will pay the following amount to the local treasury:

1,800,000 * 17% = 306 thousand rubles

The federal treasury will receive the remaining three percent, that is, the amount:

1,800,000*3% = 54 thousand rubles

When the regional rate has dropped to the minimum 13.5%, you will pay the following amounts. For the region the payment will be:

1,800,000*13.5% = 243 thousand rubles

The same 54 thousand rubles will remain for the federal treasury.

As you can see, the amount deducted to the federal budget remains unchanged. It must be paid in any case, regardless of how the local tax rate changes. This tax is paid through advance payments monthly or every three months, and then at the end of the year. Firms that do not receive more than 15,000,000 in three months for the entire previous year have the right to transfer payments every quarter.

Other organizations are forced to pay every month. Three-month advances are calculated according to the profit actually received, and monthly advances - according to the expected receipt. The latter can be predicted by funds received for a similar time period in the past.

Expenses

Taxable income may be reduced by certain expenses. In particular, expenses related to the production and sale of the main product are accepted for deduction. They are divided into the following economic groups:

- Materials.

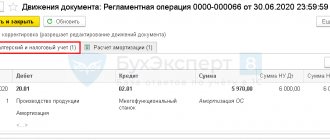

- Depreciation.

- Salary.

- Other expenses.

Also, taxable profit is reduced due to the costs of non-operating transactions. This category includes:

- Paid penalties and fines.

- Court expenses.

- Losses from previous periods.

- Payment for banking services.

- Other costs established by Art. 265 NK.

Art. 270 of the Code formulates a closed list of expenses for which taxable profit cannot be reduced. The Tax Code imposes strict requirements on the costs incurred by enterprises. They should be:

- Necessary and rational.

- Documented.

- Exclusively for the purposes of income-generating activities.

Income and expenses

Let's talk about how exactly the two main quantities needed to calculate income tax are determined. Income refers to incoming funds from the company’s main line of business, that is:

- trade;

- provision of services of various nature;

- carrying out work ordered by clients.

In addition, funds received from additional sources are also considered income, that is:

- interest received on deposits;

- money for rental property, etc.

When determining the amount of tax collection, incoming income is accounted for without applying value added tax or excise taxes. Confirmation of income received is made by providing any payment papers, that is:

- receipts;

- checks;

- statements of accounts;

- an entry in the account book;

- marks in the electronic database, etc.

Expenses mean the company's funds spent on the production of a product, service or work, which have a basis and are also official. These include the following costs:

- employees' wages;

- the price of the resource from which the product is made, as well as equipment, etc.

In addition, non-production costs are also considered:

- litigation costs;

- payment of interest on loans.

It is possible to reduce income and the tax on it due to expenses only if you provide evidence of the expenses incurred. At the same time, confirmations include not only payment documents, but also the expediency of the payments made. If it was not economically viable to give away any amount of money, the expense is considered unconfirmed. Documents used as evidence must also be correctly executed in order to have the necessary legal force.

There is a list of expenses that are not taken into account to reduce the tax base. Thus, the following must be deducted from the “body” of income:

- transport costs;

- costs incurred during production;

- credit interest;

- payment for an advertising campaign;

- insurance;

- cost of research work;

- payments for staff training;

- money for the purchase of software and electronic databases.

But expenses of a completely different nature that are indirectly related to production are not deductible:

- monetary motivation for employees on the board of directors;

- monetary contributions for exceeding the threshold of emissions into the environment;

- various penalties;

- property purchased on credit;

- cash investments in the authorized capital of the company;

- economic costs;

- payment for legal services is higher than the established tariffs;

- payment of real estate loans for company employees;

- prepayment for any product or service;

- contributions to social funds of a voluntary nature;

- the price of the property transferred free of charge, as well as the costs associated with the transfer procedure;

- travel of company employees from their place of residence to work and back;

- pension supplements;

- purchasing vouchers for employees for the purpose of treatment or recreation;

- payment for rest of employees, which was not provided for by law;

- covering the costs of holding sports and cultural events;

- purchase of personal items;

- the price of a subscription to literature that is not related to the direction of production;

- organizing meals for employees.

Video – Income tax: income and expenses

Types of income from which budget deductions are made

Taxable profit, the formula of which will be discussed below, is formed from sales income. During sales, the company transfers products of its own production or previously purchased, as well as its services to other persons on the basis of compensation - receiving benefits. The proceeds from the sale are thus represented as the proceeds received through the process. All other income is recognized as non-operating income. These include:

- Positive exchange rate differences.

- Dividends.

- Proceeds from the provision of property for rent.

- The cost of excess material assets determined during inventory.

- Interest on loans and credits provided.

- Penalties, fines, penalties received for violations of obligations by counterparties.

- Freely acquired property.

The list of non-operating income is considered open. This means that they may also include private, rare cases of receiving revenue not from the main type of activity.

Confession

Recognition of the units in question turning into profit occurs at certain points when a choice is made about the method of accrual. As we said at the beginning of the article, there are only two of them:

- cash method;

- accrual method.

Recognition of income and expenses occurs through the application of certain accrual methods

By the end of the current year, the company must make a choice which method is most preferable for it and inform the department of the tax service to which it belongs.

The nuances of each method are as follows. For cash accounting, accounting is carried out upon debiting or receipt of funds to the account, and not earlier than that moment. When tax payments are made, the marked dates are taken into account.

As for the accrual method, income is recorded directly when signing a contract or completing documents for work, and not when money “falls” into the account. The same goes for expenses. When a payment agreement is signed, then it is considered that the expenses have been incurred; no one will wait for the funds to be deducted.

Let's give an example. Your company rents premises, the next payment for which, according to documents, is made in the month of October, according to the invoice issued by the landlord. However, you intend to pay only in December. According to the accrual method, your company's accountant will record that the expense was made in October, since that is when the paper about the need to make it was received. With the cash method, the payment made on paper will correspond to the date of actual transfer of money, that is, December.

We remind you that every company that chooses it can use the accrual method. At the same time, for the cash method, there is a list of organizations that are prohibited from using it. These include:

- credit organizations;

- companies whose earnings over the last year did not exceed a million rubles.

Meaning

Profit performs three main functions:

- Reproduces the difference between income and expenses.

- Stimulates reproduction.

- Provides control over the effectiveness of the enterprise's performance.

The main sources of profit today are:

- Monopoly activity. It involves the production of unique goods or the provision of specific services necessary for society to maintain a normal standard of living.

- Commercial activity. Any enterprise on the market does this.

Profit at a loss

Calculating profit when receiving a loss is a question that worries many entrepreneurs, because how to pay tax when no net profit was received.

We hasten to reassure you! If there was no profit, it is effectively zero. Consequently, when multiplied by the tax rate, a zero value is also formed, which means there is no need to pay tax. It is important to remember one thing here: in order to achieve exemption from tax payments in the event that the company receives financial losses, it is necessary to officially confirm the loss. To do this, you need to file a tax return, just like in the case of making a profit. For information on how to do this, read the article on zero reporting.

Let's take another look at how to calculate income taxes. Your company produces interior compositions. It is necessary to calculate the tax amount for the first three months of 2021, provided that:

- you received a bank loan for half a million rubles;

- sold compositions worth 1 million 180 thousand (including value added tax);

- spent 350 thousand on the purchase of production resources;

- paid employees a fee for work in the amount of 250 thousand;

- contributed money to insurance funds for 40 thousand;

- depreciation was made by 30 thousand;

- paid interest payments for a loan in the amount of 25 thousand;

- At the same time, they took into account the loss for the past four quarters, amounting to 120 thousand.

It turns out that for the first three months of 2021, your company’s expenses amounted to 695 thousand rubles (350,000+250,000+40,000+30,000+25,000).

Since the income received is indicated without taking into account value added tax, it will total exactly one million rubles, since 180,000 is 18% VAT, which is due to the state.

The amount of the loan cannot be taxed by law, therefore, it is not considered a tax base. It turns out that your company’s net profit for the first three months of 2021 was 1,000,000-695,000-120,000 = 185,000.

The tax will be calculated according to the formula already known to us: 185,000*20% = 37,000, of which 3% (5550) will go to the federal budget and 17% (31450) to the local budget.

Let's sum it up

As you can see, not only a professional accountant, but also an ordinary person who does not have specific knowledge can cope with the procedure for calculating income tax. It must be remembered that the key to success is attentiveness. Use a calculator so as not to make mistakes in the calculations; if you do not understand any information, read this article carefully again, look at the Tax Code of the Russian Federation or ask a tax inspector for help. Remember, by knowing your rights and responsibilities as a taxpayer, you will avoid many problems with which the life of every citizen is inextricably linked. We wish you good luck in learning the intricacies of taxation and success in your work.