Minimum wage and minimum wage

In order to protect the interests of every employed person, the law establishes a minimum wage. Each employer is obliged to guarantee its employees the receipt of the established amount, but only if they work a full month. If work is performed in smaller volumes, the amount of official profit is reduced proportionally.

In 2021, the following indicators are taken as a basis:

- working out working hours for the month in full (minimum 40 hours per week, but a different duration may be established by the staffing table);

- compliance with standards (for example, manufacturing 5,000 parts per month at a factory).

The minimum wage is a state value, that is, a set amount of wages valid throughout the Russian Federation. The requirement applies equally to all sectors of employment, to public and private companies. But regional authorities are vested with the right to establish the minimum wage in force in the territory of a particular subject of the Federation.

The minimum wage in the region cannot be lower than the minimum wage.

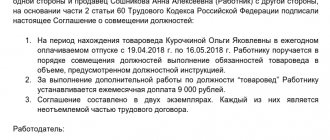

Another feature of regional regulation of the salary of an employed person is that employers sign an agreement with the municipality on the use of the minimum wage amount. Signing an agreement is voluntary, so not all companies act on the basis of the minimum wage. Moreover, a party to the agreement can be not only a legal entity or individual entrepreneur, but also company trade unions that protect the interests of workers.

In 2021, the minimum wage in Russia is 11,280 rubles.

For violation of legislation in the field of remuneration of officially employed citizens, legal entities are held accountable within the framework of administrative and civil legislation.

How to correctly calculate wages after the decision of the Constitutional Court of April 11, 2021

Allowances, additional payments and other charges that are due to workers for working in non-standard conditions and are not of a regular nature cannot be taken into account when comparing wages with the minimum wage. We are talking about the payments that we have given in the table.

Changes in salary from 04/11/2021

In addition, it does not matter whether night and/or holiday work is carried out within or outside working hours. Part of the shift that occurred at night, on a weekend or on a holiday must be paid at an increased rate. This very additional payment should not be included when comparing earnings with the minimum wage.

In these cases, since the employee is underemployed, the remuneration he receives at the end of the month may be lower than the established minimum wage. In this case, the minimum amount to be paid is calculated in the appropriate proportion of the minimum wage.

- The employee works full time, there are no regional coefficients or bonuses, the salary is 5,000 rubles, the monthly bonus is 2,000 rubles, a budgetary organization. So, the employee receives 7,000 rubles, which is 4,163 rubles. less than the established minimum wage. Accordingly, he needs to pay an additional 4,280 rubles.

- The employee works for a Moscow company that is a party to the regional agreement on the minimum wage in Moscow. Salary – 15,000 rubles, monthly bonus – 2,000 rubles. Since at the moment the regional minimum wage in Moscow is 18,580 rubles. (see “Moscow tripartite agreement for 2021 - 2021 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations”), then the employee must pay an additional 1,580 rubles.

- The employee works in an area equated to the regions of the Far North. Salary - 5,000 rubles, regional coefficient - 1.2, bonus for length of service - 10%, no regional minimum wage. As we wrote above, for this category of workers, the salary part of the salary is brought up to the minimum wage level, without taking into account the coefficient and bonus for length of service. In this case, since there are no other additional payments, we evaluate only the salary. Accordingly, the employee must pay an additional 6,280 rubles. And then the coefficient and bonus will be calculated on the salary amount increased to the minimum wage - 11,280 rubles.

We recommend reading: Benefits for children of war in the Altai region in 2021

Additional payment up to the minimum wage for an incomplete month worked

3) workers carrying out labor activities in public and temporary jobs (including internships), organized by the employer for temporary employment of workers as part of the implementation of programs of additional measures to reduce tension in the labor market of the region and promote employment of the population

The minimum wage established by federal law is ensured by: organizations financed from the federal budget - from the federal budget, extra-budgetary funds, as well as funds received from entrepreneurial and other income-generating activities; organizations financed from the budgets of the constituent entities of the Russian Federation - at the expense of the budgets of the constituent entities of the Russian Federation, extra-budgetary funds, as well as funds received from entrepreneurial and other

Components of the minimum wage

Article 129 of the Labor Code determines what types of payments will be included in a person’s salary.

Table “Types of deductions”

| Salary | Incentive payments | Compensation |

| The salary depends on the type of work activity. The amount is fixed in the staffing table and will be the same for all employees of a particular position. | Material incentives provided for certain types of achievements. For example, exceeding production plans. The following types of cash payments fall into this category:

The law does not provide for a unified list of such incentives, therefore, depending on the specifics of production, the employer can independently regulate the list and procedure for providing material incentives to employees. The main condition is fairness, that is, receiving incentives should be available to all officially employed persons. | This category includes regular compensation provided to a person for performing work under special conditions. Example:

Compensation is provided individually, depending on the person’s functional responsibilities. |

The law establishes that the minimum wage includes salary, regular compensation and material incentives. This amount will not include one-time compensation related, for example, to payment for business trips, compensation for the cost of office supplies or fuel/taxi required to travel to the place of work.

Additional pay for working at night and on weekends should not be within the minimum wage. This is what the CC decided

The composition of wages “within the minimum wage” was considered by the Constitutional Court. A watchman of a commercial company from the Irkutsk region appealed to the Constitutional Court.

The man is sure that his salary was calculated incorrectly. His salary was 4268 rubles. Also, a regional coefficient and a percentage bonus were calculated for work in areas equivalent to the regions of the Far North, as well as other allowances and additional payments provided for by the employer’s local regulations.

Payment for overtime work, work at night, on weekends and non-working holidays was made in an increased amount based on the established salary. Since the salary was set at an amount lower than the minimum wage in the Irkutsk region, the calculation of wages was carried out on the basis that the amount of wages, taking into account the salary and all payments, including payment for overtime work, work at night, on weekends and non-working holidays, should be no less than the minimum wage (the regional coefficient and percentage bonus were calculated for the entire amount of wages).

Believing that the employer’s actions in calculating wages violated his rights, the man went to court. The court of first instance partially satisfied the employee's claims.

We recommend reading: Is it possible to discharge a person from an apartment if he is registered temporarily?

The court considered that the minimum wage established by the Regional Agreement in the Irkutsk Region (12,652 rubles) should be taken as the basis for remuneration in 2021, and in January 2021, in connection with the termination of the said agreement, the minimum wage (9,489 rubles), based on which it is necessary to calculate the payment for the actually worked time according to the duty schedule, after which the amount of payment in the increased amount of overtime work, night work, weekends and non-working holidays (in those months when it was made) should be added to the received amount and the regional coefficient and percentage should be calculated allowance. On appeal, the decision of the first instance court was changed, the amount to be recovered in favor of the employee was reduced.

In this case, the court proceeded from the fact that the employee’s salary, including all compensation

Features of calculating the minimum wage

Despite the strict definition of what elements the minimum wage consists of, in practice a number of features related to the calculation of official profit for a working person must be taken into account.

Bonuses

The Labor Code leaves employers the opportunity to independently regulate the procedure for providing wages, taking into account the mandatory requirements:

- monthly income cannot be lower than the minimum wage;

- Money is paid at least twice a month.

As for bonuses, these are additional allowances that can be one-time or periodic (monthly, quarterly, annual, holidays). Regardless of what type of bonus is awarded to the employee, it is included in the amount of the minimum wage.

Example:

The workers received a one-time bonus on New Year's Eve. The goal is to thank employees for an effective working year. The bonus amount was 7,000 rubles and was taken into account in the amount of the minimum wage.

Nights, weekends, holidays

According to the requirements of labor legislation, if an employee is involved in official work on weekends and holidays, as well as when working night shifts, the person’s activities must be paid additionally. This is a regular compensation payment associated with the lack of normal rest.

The resolution of the Plenum of the Supreme Court of the Russian Federation established that such compensation payments should be included in the amount of the minimum wage, but their provision should be universal and fair for all participants in the labor relations of a particular enterprise.

Harmfulness

When applying for a job, a person must be warned that work activity will be associated with harmful conditions. Also, the parties to the contract must stipulate the amount of wages accrued for such work. In addition to the salary, the amount of the bonus is negotiated, which is also included in the minimum wage (fixed 11,280 rubles).

Overtime work

Judicial practice shows that courts in different regions make different decisions on such issues. Thus, there is a practice when overtime hours were included in the minimum wage, since this time relates to the officially worked period. A person is at work, performing his labor functions.

On the other hand, there are precedents when overtime work was not included in the minimum wage. The court reasons its decision by saying that a person’s working day has long been completed and he deserves a good rest, but is forced to work, so such an additional payment should be an incentive that exceeds the minimum wage.

Regional coefficient

The introduction of the regional coefficient is due to the special climatic conditions that workers in a particular region have to face. Also, an increasing coefficient may be introduced due to a particularly high pricing policy in the territory of a subject of the Federation.

In order to eliminate contradictions and disputes, the Constitutional Court of Russia provided clarifications regarding the regional coefficient and the minimum wage. Thus, it was decided not to include increasing factors in the minimum wage. That is, the minimum wage is calculated first, and then a fixed bonus is added. This is due to the fact that work in special climatic conditions is associated with constant harmful or dangerous working conditions. Therefore, such employees should receive more income than workers in similar areas in other regions.

This rule was approved by Resolution of the Constitutional Court of Russia No. 38 of December 7, 2021. The law does not have retroactive force, therefore employees for whom the regional coefficient was previously included in the minimum wage amount cannot claim an increase in payments. But from December 7, 2017, violation of the established requirements will be the basis for the employer’s legal liability.

Constitutional Court of the Russian Federation dated April 11, 2019 No. 17-P: Minimum wages, overtime, holidays and night

The employee was paid a salary (taking into account salary and payments for overtime work, work at night, on weekends and holidays) in an amount not less than the minimum wage in the region.

The courts have recognized that wages must be no less than the minimum wage (or the minimum wage in a constituent entity of the Russian Federation), after which a regional coefficient and a percentage increase are applied to it.

The Constitutional Court of the Russian Federation did not agree with this.

If we calculate wages in this way, the monthly wages of workers involved in work in conditions deviating from normal (night time, overtime, weekends and non-working holidays) would not differ from the wages of persons working under normal conditions.

The establishment of increased pay for such types of work is due to the employee’s increased labor costs caused by a reduction in rest time or work at a time that is not biologically intended for active work.

Thus, the interrelated provisions of Article 129, parts one and three of Article 133 and parts one - four and eleven of Article 133.1 of the Labor Code of the Russian Federation, in their constitutional and legal meaning in the system of current legal regulation, do not imply inclusion in wages (parts of wages) employee not exceeding the minimum wage, increased pay for overtime work, night work, weekends and non-working holidays. In principle, the same as the regional coefficient and the percentage premium (Resolution of the Constitutional Court of the Russian Federation of December 7, 2017 No. 38-P).

Resolution of the Constitutional Court of the Russian Federation of April 11, 2019 N 17-P

“In the case of verifying the constitutionality of the provisions of Article 129, parts one and three of Article 133, as well as parts one, four and eleven of Article 133.1 of the Labor Code of the Russian Federation in connection with the complaint of citizen S.F. Zharova"

The Constitutional Court of the Russian Federation, composed of Chairman V.D. Zorkin, judges K.V. Aranovsky, A.I. Boytsova, N.S. Bondar, G.A. Gadzhieva, Yu.M. Danilova, L.M. Zharkova, S.M. Kazantseva, S.D. Knyazeva, A.N. Kokotova, L.O. Krasavchikova, S.P. Mavrina, N.V. Melnikova, Yu.D. Rudkina, O.S. Khokhryakova, V.G. Yaroslavtseva,

guided by Article 125 (part 4) of the Constitution of the Russian Federation, paragraph 3 of part one, parts three and four of Article 3, part one of Article 21, articles 36, 47.1, 74, 86, 96, 97 and 99 of the Federal Constitutional Law “On the Constitutional Court of the Russian Federation” Federation",

considered at a meeting without a hearing the case on checking the constitutionality of the provisions of Article 129, parts one and three of Article 133, as well as parts one, four and eleven of Article 133.1 of the Labor Code of the Russian Federation.

The reason for considering the case was a complaint from a citizen, full name. The basis for considering the case was the revealed uncertainty regarding the question of whether the legal provisions challenged by the applicant comply with the Constitution of the Russian Federation.

Having heard the report of the judge-rapporteur V.G. Yaroslavtsev, having examined the presented documents and other materials, the Constitutional Court of the Russian Federation

installed:

According to Article 129 of the Labor Code of the Russian Federation, which reveals the content of the basic concepts used in regulating wages, wages (employee remuneration) are recognized as remuneration for labor depending on the qualifications of the employee, the complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in areas exposed to radioactive contamination, and other payments of a compensatory nature) and incentive payments (additional payments and allowances of an incentive nature, bonuses and other incentive payments) (part one); tariff rate - a fixed amount of remuneration for an employee for fulfilling a standard of work of a certain complexity (qualification) per unit of time, without taking into account compensation, incentives and social payments (part three); salary (official salary) - a fixed amount of remuneration for an employee for the performance of labor (official) duties of a certain complexity for a calendar month without taking into account compensation, incentives and social payments (part four); basic salary (basic official salary), basic wage rate - minimum salary (official salary), wage rate of an employee of a state or municipal institution carrying out professional activities in the profession of a worker or position of an employee, included in the corresponding professional qualification group, excluding compensation, incentives and social payments (part five).

Part one of Article 133 of this Code provides that the minimum wage is established simultaneously throughout the entire territory of the Russian Federation by federal law and cannot be lower than the subsistence level of the working population, and part three of the same article establishes the rule according to which the monthly salary of an employee , who has fully worked the standard working hours during this period and fulfilled the labor standards (job duties), cannot be lower than the minimum wage.

By virtue of Article 133.1 of the said Code, in a constituent entity of the Russian Federation, a regional agreement on the minimum wage may establish the amount of the minimum wage in a constituent entity of the Russian Federation (part one) for employees working on its territory, with the exception of employees of organizations financed from the federal budget (part two ); the amount of the minimum wage in a constituent entity of the Russian Federation is established taking into account socio-economic conditions and the cost of living of the working population in it (part three) and cannot be lower than the minimum wage established by federal law (part four); the monthly salary of an employee working in the territory of the relevant constituent entity of the Russian Federation and who is in an employment relationship with an employer in respect of whom the regional agreement on the minimum wage is valid in accordance with parts three and four of Article 48 of this Code or to whom the said agreement is extended in the manner established by parts six to eight of Article 133.1 of this Code, cannot be lower than the minimum wage in this constituent entity of the Russian Federation, provided that such employee has fully worked the standard working hours during this period and fulfilled labor standards (job duties) (part eleven).

The applicant in this case, citizen Full Name, working as a watchman in a joint stock company, was given a salary of 4,268 rubles, a regional coefficient and a percentage increase in wages for work in areas equivalent to the regions of the Far North, as well as other allowances and additional payments provided for by local regulations employer. Payment for overtime work, work at night, on weekends and non-working holidays was made in an increased amount based on the established salary. Since the applicant’s official salary was set at an amount below the minimum wage in the Irkutsk region, the calculation of wages was carried out on the basis that the amount of wages took into account the salary and all payments, including payment for overtime work, work at night, on weekends and non-working days holidays, must be no less than the minimum wage (the regional coefficient and percentage bonus were calculated for the entire amount of wages). Believing that the employer's payroll practices violated his rights to receive fair wages, the applicant filed a lawsuit.

By the decision of the Bodaibo City Court of the Irkutsk Region dated April 18, 2021, the requirements of the full name were partially satisfied. The court considered that the minimum wage established by the Regional Agreement on the Minimum Wage in the Irkutsk Region dated January 26, 2021 (12,652 rubles) should be taken as the basis for wages in 2021, and in January 2021 in connection with the termination of the said agreement — the minimum wage established at the federal level (9,489 rubles), on the basis of which it is necessary to calculate payment for actually worked time according to the duty schedule, after which the amount of payment in the increased amount for overtime work, night work, and weekends should be added to the amount received and non-working holidays (in those months when it was carried out) and calculate the regional coefficient and percentage increase in wages.

By the appeal ruling of the judicial panel for civil cases of the Irkutsk Regional Court dated August 2, 2021, the decision of the first instance court was changed, the amount to be recovered in favor of the full name was reduced. In this case, the court proceeded from the fact that the employee’s wages , including all compensation and incentive payments provided for by the wage system, as well as increased wages in conditions deviating from normal ones, must be no less than the minimum wage (or the minimum wage in a subject of the Russian Federation), after which a regional coefficient and a percentage premium are added to it .

According to the applicant, the provisions of Article 129, parts one and three of Article 133, as well as parts one, four and eleven of Article 133.1 of the Labor Code of the Russian Federation do not correspond to Articles 7, 17, 19, 37 and 55 of the Constitution of the Russian Federation, since according to the meaning given them by law enforcement practice, they allow the employer to set the employee a salary, the amount of which, taking into account the inclusion of compensation for work in hazardous working conditions, payment for overtime work, work at night, on weekends and non-working holidays, does not exceed the minimum wage in the Russian Federation, which violates his right to increased wages in conditions deviating from normal ones.

In accordance with Articles 74, 96 and 97 of the Federal Constitutional Law “On the Constitutional Court of the Russian Federation”, the Constitutional Court of the Russian Federation, upon a citizen’s complaint about a violation of his constitutional rights and freedoms, verifies the constitutionality of the law or its individual provisions to the extent that they were applied in the applicant’s case, the consideration of which has been completed in court, and makes a decision only on the subject specified in the complaint, assessing both the literal meaning of the legal provisions being tested and the meaning given to them by official interpretation or established law enforcement practice, as well as based on their place in the system of legal norms , without being bound when making a decision by the grounds and arguments set out in the complaint.

As follows from the court decisions adopted in the applicant’s case, he did not work in hazardous working conditions, and corresponding payments are not provided for him.

Thus, the subject of consideration of the Constitutional Court of the Russian Federation in the present case is the interrelated provisions of Article 129, parts one and three of Article 133 and parts one - four and eleven of Article 133.1 of the Labor Code of the Russian Federation to the extent that on the basis of these norms the issue of inclusion in the salary (part of the salary) of an employee that does not exceed the minimum wage, increased payment for overtime work, work at night, weekends and non-working holidays .

The Constitution of the Russian Federation, declaring Russia a legal social state, the policy of which is aimed at creating conditions ensuring a decent life and free development of people, stipulates that in the Russian Federation the labor and health of people are protected, everyone has the right to remuneration for work without any discrimination and not lower than the minimum wage established by federal law (Article 1, Part 1; Article 7; Article 37, Part 3).

The right to fair wages and equal remuneration for work of equal value without distinction of any kind is recognized as one of the most important rights in the world of work by the Universal Declaration of Human Rights (Article 23), the International Covenant on Economic, Social and Cultural Rights (Article 7), as well as the European Social Charter (revised), adopted in the city of Strasbourg on May 3, 1996 (Article 4 of Part II).

By virtue of the above provisions of the Constitution of the Russian Federation and international legal acts, the legal regulation of remuneration for persons working under an employment contract must guarantee the establishment of wages in an amount determined by objective criteria reflecting the qualifications of the employee, the nature and content of his work activity and taking into account the conditions of its work implementation, which together determine the amount of money paid to the employee necessary for the normal reproduction of the labor force. At the same time, determining the specific amount of wages should not only be based on the quantity and quality of labor, but also take into account the need for a real increase in wages when working conditions deviate from normal (resolutions of the Constitutional Court of the Russian Federation dated December 7, 2021 N 38-P and dated 28 June 2018 N 26-P; Determination of the Constitutional Court of the Russian Federation of December 8, 2011 N 1622-О-О).

According to part one of Article 129 of the Labor Code of the Russian Federation, wages (employee remuneration) are remuneration for labor depending on the qualifications of the employee, the complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal conditions, work in special climatic conditions and in areas exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments). Accordingly, an employee’s salary, in addition to the tariff part (tariff rate, salary, including official salary), may include incentives and (or) compensation payments. Compensation payments (additional payments and allowances) are intended to compensate for the impact of unfavorable factors on the employee. The inclusion of these payments in wages is due to the presence of factors (production, climatic, etc.) that characterize the employee’s work activity.

Along with this, in the case when labor activity is carried out in conditions deviating from normal (when performing work of various qualifications, combining professions (positions), overtime work, working at night, weekends and non-working holidays and when performing work in other conditions deviating from normal), the employee is made appropriate payments provided for by labor legislation (Article 149 of the Labor Code of the Russian Federation).

Accordingly, an employee’s remuneration may consist of wages established for him taking into account working conditions and the characteristics of work activity, and payments for work under conditions deviating from normal, including when performing overtime work, working at night, on weekends and non-working holidays - work performed during the time that is intended for rest.

As follows from the literal meaning of Articles 149, 152, 153 and 154 of the Labor Code of the Russian Federation, overtime work, work at night, on weekends and non-working holidays are paid at an increased rate. Thus, in accordance with the said Code, overtime work is paid for the first two hours of work at least one and a half times the rate, for subsequent hours - at least double the rate (Article 152), work on a day off or a non-working holiday is paid at least double amount (Article 153), each hour of work at night is paid at an increased rate compared to work under normal conditions (Article 154).

The establishment of increased pay for overtime work, work on weekends and non-working holidays, and night work is due to the employee’s increased labor costs caused by a reduction in rest time or work at a time that is not biologically intended for active work , as well as the deprivation of the employee’s ability to manage rest time, use it for its intended purpose, which leads to additional physiological and psycho-emotional stress and creates a threat of harm to health by working at night or reducing the time to restore strength and performance.

The above legislative regulation is intended not only to compensate the employee for the negative consequences of deviations of his working conditions from normal, but also to guarantee the effective exercise of his right to fair wages, which meets the goals of labor legislation and is consistent with the main directions of state policy in the field of labor protection, one of which is the priority of preserving the life and health of workers (Articles 1 and 2, part one of Article 210 of the Labor Code of the Russian Federation).

Involvement of an employee in the manner prescribed by law to overtime work, work on weekends and non-working holidays, as follows from the Labor Code of the Russian Federation, is carried out on the basis of an order of the employer in compliance with the rules provided for by law (on limiting the involvement of certain categories of workers, on the need, as a rule, obtain the written consent of the employee) (Articles 99 and 113). In addition, a quantitative limit has been established for overtime work - no more than 4 hours for two days in a row and 120 hours per year (part six of Article 99). Night work is carried out on the basis of the established working hours, including shift schedules (Article 103).

Consequently, work under these abnormal conditions cannot be performed on a regular basis (except in cases of employment exclusively for night work); When working in shifts, the number of night shifts in different periods may vary.

Thus, payments related to overtime work, work at night, on weekends and non-working holidays, in contrast to compensation payments of a different nature (for work with harmful and (or) dangerous working conditions, in areas with special climatic conditions), cannot be included in the regularly received monthly salary , which is calculated taking into account permanent factors of labor organization, production environment or unfavorable climatic conditions, etc.

The Labor Code of the Russian Federation, in accordance with the requirements of Articles 7 (Part 2) and 37 (Part 3) of the Constitution of the Russian Federation, provides that the minimum wage is one of the main state guarantees for remuneration of workers (Article 130). At the same time, the minimum wage is established simultaneously throughout the entire territory of the Russian Federation by federal law and cannot be lower than the subsistence level of the working-age population (part one of Article 133), and the monthly wage of an employee who has fully worked during this period the standard working time and fulfilled the labor standards (labor duties), cannot be lower than the minimum wage (part three of Article 133).

According to Article 133.1 of the Labor Code of the Russian Federation, in a constituent entity of the Russian Federation, a regional agreement on the minimum wage may establish the amount of the minimum wage, which is determined taking into account socio-economic conditions and the cost of living of the working population in the corresponding constituent entity of the Russian Federation and cannot be lower than the minimum amount wages established by federal law (parts one, three and four).

The Constitutional Court of the Russian Federation, in a number of its decisions, formulated the following legal positions regarding the institution of the minimum wage and the minimum wage in the constituent entity of the Russian Federation:

the institution of the minimum wage, by its constitutional and legal nature, is intended to establish the minimum amount of money that should be guaranteed to the employee as remuneration for the performance of labor duties, taking into account the subsistence level (Resolution of November 27, 2008 N 11-P);

remuneration for work not lower than the minimum wage established by federal law is guaranteed to everyone, and therefore, the determination of its value should be based on the characteristics of labor inherent in any work activity, without taking into account the special conditions for its implementation; this is consistent with the socio-economic nature of the minimum wage, which involves ensuring the normal reproduction of the labor force when performing simple unskilled work in normal working conditions with normal intensity and subject to working hours (Resolution of December 7, 2017 N 38-P);

the provisions of Articles 129 and 133 of the Labor Code of the Russian Federation do not affect the rules for determining an employee’s wages and the remuneration system, when establishing which each employer must be equally observed as a norm guaranteeing an employee who has fully worked the standard working time for the month and has fulfilled labor standards (labor duties), wages not lower than the minimum wage, and demands for increased wages when working in conditions deviating from normal (definitions dated October 1, 2009 N 1160-О-О and December 17, 2009 N 1557- O-O);

in the mechanism of legal regulation of wages, an additional guarantee in the form of the minimum wage in a constituent entity of the Russian Federation should, in appropriate cases, be applied instead of the minimum wage established by federal law, without replacing or canceling other guarantees provided for by the Labor Code of the Russian Federation (Resolution No. 7 December 2021 N 38-P).

From the above legal positions it follows that the contested provisions of Articles 129, 133 and 133.1 of the Labor Code of the Russian Federation in systematic connection with its Articles 149, 152-154 imply, along with compliance with the guarantee of establishing wages not lower than the minimum wage, the determination of fair wages for each employee, depending on his qualifications, the complexity of the work performed, the quantity and quality of labor expended, as well as increased wages in conditions deviating from normal, including when working at night, overtime, working on weekends and non-working holidays.

Accordingly, each employee must be equally provided with both a salary in an amount not lower than the minimum wage (minimum wage) established by federal law, and increased payment in case of work performed in conditions deviating from normal, including overtime work, work at night, on weekends and non-working holidays. Otherwise, the monthly wages of workers involved in work under conditions deviating from normal conditions would not differ from the wages of persons working under normal conditions , i.e. workers who performed overtime, night work, weekend work or a non-working holiday (i.e. under conditions deviating from normal) would be in the same position as those who performed similar work within the established working hours day (shift), during the day, on a weekday.

This would lead to a disproportionate restriction of the labor rights of workers involved in performing work in conditions deviating from normal, and would conflict with the general legal principles of legal equality and fairness arising from Article 19 (Part 2) of the Constitution of the Russian Federation, which stipulate, among other things, the need to provide for reasonable differentiation in relation to subjects in different situations, and implying the obligation of the state to establish legal regulation in the field of remuneration, which ensures fair wages based on objective criteria for all workers and does not allow the application of the same rules to workers in different situations position In addition, this would contradict Article 37 (Part 3) of the Constitution of the Russian Federation, which establishes a guarantee of remuneration for work without any discrimination.

Thus, the interrelated provisions of Article 129, parts one and three of Article 133 and parts one - four and eleven of Article 133.1 of the Labor Code of the Russian Federation, in their constitutional and legal meaning in the system of current legal regulation, do not imply inclusion in wages (parts of wages) employee not exceeding the minimum wage, increased pay for overtime work, night work, weekends and non-working holidays .

Based on the above and guided by Articles 47.1, 71, 72, 74, 75, 78, 79 and 100 of the Federal Constitutional Law “On the Constitutional Court of the Russian Federation”, the Constitutional Court of the Russian Federation

decided:

Recognize the interrelated provisions of Article 129, parts one and three of Article 133 and parts one - four and eleven of Article 133.1 of the Labor Code of the Russian Federation as not contradicting the Constitution of the Russian Federation, since, according to their constitutional and legal meaning in the system of current legal regulation, they do not imply inclusion in the composition of wages remuneration (part of the salary) of the employee, not exceeding the minimum wage, increased payment for overtime work, night work, weekends and non-working holidays.

The constitutional and legal meaning of the interrelated provisions of Article 129, parts one and three of Article 133 and parts one, four and eleven of Article 133.1 of the Labor Code of the Russian Federation, as revealed in this Resolution, is generally binding, which excludes any other interpretation in law enforcement practice.

Law enforcement decisions in the case of a citizen, full name, are subject to review taking into account the constitutional and legal meaning of the interrelated provisions of Article 129, parts one and three of Article 133, and parts one, four and eleven of Article 133.1 of the Labor Code of the Russian Federation, identified in this Resolution.

This Resolution is final, not subject to appeal, comes into force on the date of official publication, is effective directly and does not require confirmation by other bodies and officials.

This Resolution is subject to immediate publication in the Rossiyskaya Gazeta, Collection of Legislation of the Russian Federation and on the Official Internet Portal of Legal Information. The resolution must also be published in the “Bulletin of the Constitutional Court of the Russian Federation”.

Constitutional Court of the Russian Federation

Related Posts

- Constitutional Court of the Russian Federation of November 29, 2012: severance pay upon dismissal Thus, this legal provision does not imply the provision of an employment service to the body when it resolves the issue...

- Medical examination of employees and paid leave (Article 185.1 of the Labor Code of the Russian Federation) All employees, when undergoing medical examination in the manner prescribed by legislation in the field of health protection, have the right...

- Professional Standard for Teachers and the Resolution of the Constitutional Court of the Russian Federation Let's talk about professional standards. I raised this topic several years ago, the last article was...

Responsibility of enterprises

Each participant in labor relations is obliged to fully comply with the established requirements of the law. Violation of working conditions and remuneration entails legal liability. You can hold a company accountable in the following ways:

- filing a complaint with the labor dispute commission;

- filing a complaint through the organization's trade union;

- sending a statement of claim to the court.

To protect interests, it is necessary to collect a complete package of documents confirming the violation on the part of the company.

In addition, companies are regularly inspected to identify violations of labor laws. If it is discovered that some employees receive profits below the minimum wage, the legal entity is held accountable. In 2021, the following types of sanctions apply:

- 30 – 50 thousand rubles fine for a single violation;

- 50 - 70 thousand rubles fine for repeated bringing to administrative responsibility.

In order to avoid liability, the employer must also take into account the fact that if, after calculating all salaries, allowances and compensations, the amount of wages does not reach 11,280 rubles, an amount is added to the current figure until the amount of payments reaches 11,280 rubles. If an agreement is signed with regional authorities, the minimum wage (MW) will have to be followed.

Additional payment of wages up to the minimum wage

An employee’s salary for a month, provided that working hours are fully worked out and labor standards are met, cannot be lower than the minimum wage (Article 133 of the Labor Code of the Russian Federation).

For failure to comply with this norm for more than two months, the employer may be punished:

- fine - from 200,000 to 500,000 rubles;

- a fine in the amount of the convicted person’s wages for a period of 1 to 3 years;

- imprisonment for a term of 2 to 5 years, with or without deprivation of the right to hold a position or conduct certain activities.

The federal minimum wage from January 1, 2021 is 11,280 rubles.

What to do if an employee’s salary is below the minimum wage?

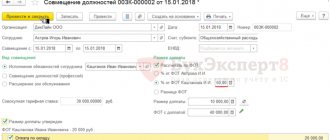

One option is to increase your salary. Another option is to make an additional payment. After all, wages include not only the salary itself, but also compensation payments (for example, bonuses for working conditions), as well as incentive payments (for example, bonuses).

note

If an employee is assigned a part-time working day, or if the actual time worked is less than the established norm, then his work is paid in proportion to the time worked. Therefore, a salary can be paid below the minimum wage, and this will not be a violation.

Summary

- Does the minimum wage include the overtime of watchmen's watches?

- In May, the watchman has 180 hours of work. How many overtime hours?

- Recycling for contract military personnel

Questions

1. Does the minimum wage include overtime for watchmen?

1.1. Hello, Elena! Hours worked in excess of the established standard working hours are more consistent with the concept of overtime work; accordingly, additional payment for them is made beyond the minimum wage.

1.2. Hello, Elena. Any overtime (overtime) is paid additionally and cannot be included in the minimum wage.

2. In May, the watchman has 180 hours of work. How many overtime hours?

2.1. When calculating wages each month, you need to take into account the number of hours actually worked by employees for that month. Each hour of work is paid at a single rate, and work in a shift beyond the established duration is paid as overtime. With the summarized accounting of working hours, the issue of payment for overtime work will be decided after summing up the accounting period and identifying the number of hours of overtime work (the difference between the actual and established number of working hours), that is, the duration of working time is taken into account not for one day or one week, but for a longer accounting period (month, quarter, year). (Article 104 of the Labor Code of the Russian Federation).

3. In our organization in January, a watchman (according to the duty schedule) worked 159 hours. He was accrued a salary in the amount of the minimum wage of 11,280 rubles. Including: salary, night 35%, payment for holidays in the 2nd rate, overtime for 23 hours in the 2nd rate and additional payment up to the minimum wage. Was the processing fee calculated correctly?

3.1. They simply no longer have the right to pay less.

4. The base is guarded by 4 guards, the 2nd are absent at the moment, how can I legally formalize shifts for the remaining 2 guards, because in fact they will have a lot of overtime, and 120 hours of overtime per year are allowed. Thank you.

4.1. The question is not legal, but accounting. From the legal side, we can only say that part of the working time, the territory and property of the organization will be without guard protection, which is not prohibited by law in itself.

5. I work as a guard at a school. Work from 20.00-08.00 every other day (we are 2 people) Salary 5940+ nights, weekends - everything is included in the minimum wage, but we have monthly overtime of 16 hours or more per month, in the slider the overtime is indicated as holidays and everything is included in the minimum wage. What should I do?

5.1. Good afternoon. You need to contact the court, the prosecutor's office, or the city with such a statement and complaint. In this case, you must provide evidence of processing. Sincerely, labor lawyer Gogatishvili rd.

6. I work as a custodian at a school every other day or two, we have a lot of overtime during the holidays, but they say it’s all included in the minimum wage.

6.1. You can contact the prosecutor's office and the labor inspectorate to conduct an investigation into these facts.

6.2. And you read your employment contract what is written there.

7. I work as a watchman for January 2021, I worked 216 hours with a standard of 136 hours, we have summed up payment, should my employer pay me for overtime.

7.1. Dear guest! Summarized accounting of working hours assumes that the duration of the working day during the accounting period should not exceed the standard hours (see Article 104 of the Labor Code of the Russian Federation). The accounting period cannot exceed one year. In your case, it all depends on the length of the accounting period. It can be 3, 6 or 12 months. Those arising in January 2021 may be offset by shorter working hours in February and March (for example). Payment for overtime hours is made if the duration of working hours exceeds its normal duration for the accounting period. Contact your manager to clarify the duration of the accounting period, after which you can draw a conclusion about the legality of the employer’s actions.

8. Is the monthly standard of hours taken into account when calculating the salaries of 3 female guards? How is overtime paid if the norm is 152 hours, and they have 240 hours?

8.1. Payment for overtime is described in Article 152 of the Labor Code of the Russian Federation, which states that the employer needs to provide time and a half wages for the first two hours of work, and double wages for subsequent hours. Higher coefficients are also possible if this is reflected in the local regulatory framework of the enterprise, collective or labor agreements. Also, the time worked can be replaced by rest equal to or exceeding the hours of overtime. The choice of one or another method of compensation is the prerogative of the employee, not the employer.

9. We have 4 guards registered in our organization with a schedule of every three days. When one of them goes on vacation, the other three move on two days later. We don’t reflect this on the timesheet and pay them as usual. Tell me what would be more correct, to hire a 5th guard or to pay overtime? After all, we have the right to pay only 100-120 hours per year of overtime, but more hours come out. THANKS IN ADVANCE.

9.1. Good afternoon You need to hire another guard, otherwise you will be held accountable during any inspection. In addition, overtime work must be paid additionally.

9.2. Good afternoon, Liana Alexandrovna! On what basis do you not pay employees extra for actual work time? This is a direct violation of labor laws. You risk being brought to administrative liability - a manager and a legal entity. Hire an additional employee and pay as expected. Every problem has a solution, the main thing is to be able to find it. Thank you for using the site's services!

How, according to the law, remuneration for work at night occurs in the Russian Federation

The concept of “night work hours” is precisely defined in Article 96 of the Labor Code of the Russian Federation, which states that the hours from 22:00 to 06:00 are considered night hours. If an employee has a regular work schedule within the specified time frame in accordance with the employment contract, he is considered a night shift worker, otherwise the employee has the right to receive additional payment for the time he worked at night.

Night shift from a legal point of view

Additionally

The duration of working hours on the night shift for workers in creative professions (theater performers, members of circus troupes and film crews, media workers) is regulated by the terms of the labor or collective agreement, as well as local regulations.

Article 96 of the Labor Code of the Russian Federation provides an explanation according to which the definition of a night work shift includes labor activities carried out in the time period from 22-00 in the evening to 06-00 in the morning. Thus, if the majority of an employee's working time falls within the specified hours range, the work is considered to be night work.

According to this article, the duration of a work shift at night should be one hour less than during the daytime. If daytime work hours are 8 hours, it is acceptable to set a seven-hour work schedule for night work without having to work the missing hour.

In some cases, the reduction of working hours at night may not occur when:

- The worker was originally hired to work at night.

- The employee is involved taking into account reduced working hours.

- Employees work in shifts with one day off per week.

Who may be required to work at odd hours

Legal acts define categories of persons who are prohibited from engaging in labor activities at night. The following are not allowed for such work:

- Employees are pregnant.

- Minor employees, except for citizens under 18 years of age participating in the creation or performance of works of an artistic nature, as well as persons indicated in the List approved by Decree of the Government of the Russian Federation No. 252 of April 28, 2007.

Article 96 of the Labor Code of the Russian Federation also identifies categories of employees who can be involved in work at night, but only taking into account their voluntary consent. These include:

- working women with children under 3 years of age;

- women and men raising children under 5 years of age alone (without a spouse);

- employees with disabilities;

- employees with children with disabilities;

- workers caring for a sick family member (subject to an official medical report).

Citizens belonging to the listed categories of employees may be required to work at night if there are no medical contraindications, and there is also the voluntary consent of the employees themselves in writing. This means that these persons’ refusal to work at night cannot be charged as absenteeism.

How is transfer to night work carried out?

Night time according to the Labor Code of the Russian Federation is the time from 22-00 in the evening of one day to 06-00 in the morning of the next day.

If a person is hired for a position initially to work on the night shift, such a clause must be spelled out in the employment contract concluded between the employer and the employee.

In a situation where an employee was employed to work during the daytime, and in the process of work it became necessary to transfer the employee to night hours, the employer is obliged to notify the employee of changes in the schedule no later than a month before the actual transfer to non-working hours.

Working shifts at night have a certain advantage in the form of payment, taking into account the premium. Not all employees are aware of what hour of night work the bonus is calculated from.

So, for example, when a shift starts at 20-00 pm, the increased rate of remuneration is applied to hours worked after 22-00, while the previous two hours are calculated at the established rate for daytime working hours.

Considering that work at night is paid at an increased rate, citizens working at night should be aware of how and from what time night hours are counted, in order to avoid a situation where the employer tries to save money by taking advantage of the fact that employees do not know their right

Please note: in the event of force majeure circumstances, the employer has the right to attract personnel to work at night, regardless of the presence or absence of consent from the employees.

How are night work hours calculated?

The bonus payable to employees working night shifts must be at least 20%. A more precise value is established in an individual organization. According to statistics, on average this figure is around 40%. For example, increased values apply to the following categories of workers:

- organizations carrying out security, watchdog and related activities – 35%;

- employees of the penitentiary system - 35%;

- healthcare workers – 50%.

In other cases, the right to establish a bonus for employees working at night remains with the management of the organization, but the head of the institution must take into account that such a bonus must be at least 20%.

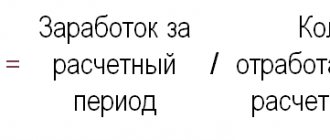

In order to understand how to calculate night work hours, you need to divide the amount of the monthly salary by the number of working calendar days. The resulting value is divided by the number of hours in one working day.

This value shows how much the employee is entitled to per hour worked during the day. The hourly wage is multiplied by the premium percentage established in a particular organization.

This will be the total amount that must be paid to the employee for each hour worked at night. Payroll is calculated in a similar way for employees to whom time-based wages are applied.

In order for the additional payment for night work to be calculated correctly, the employer must very accurately keep records of employees' working hours. Hours worked during the day should be marked with one code (for example, “I”) on the accounting sheet, and hours worked at night with another (for example, “N”). Find out how to mark a business trip on your timesheet here.

Separately, situations should be considered when the night shift falls on weekends and holidays.

In such cases, the amount of bonuses is summed up, since, according to the norms of Labor legislation, holidays and weekends are paid in double amount (read more about payment for work on a day off according to the Labor Code here).

The exception is employees working on a shift schedule, for whom weekends are normal work shifts, but this rule does not apply to holidays - night shifts that coincide with holidays are paid at double the rate, taking into account the established premium for night work.

The Decree of the Government of the Russian Federation determines that the amount of additional payment for work at night cannot be less than 20% of the employee’s regular salary.

Additionally, remuneration for work at night in the Russian Federation can also be regulated by internal regulatory documents of the enterprise (Article 154 of the Labor Code of the Russian Federation).

Each employer has the right to offer employees any additional payment for working at night, but not less than 20% of the hourly rate.

Payment for night hours according to the Labor Code of the Russian Federation in 2021 is carried out in accordance with the amount of additional payment established by the regulatory documents of the enterprise and the time worked at night.

For example, consider a case in which the employer has not exceeded the minimum allowable amount of additional payment for night hours - 20% and an employee who receives a fixed hourly wage of 500 rubles has worked a total of 10 night hours in one month.

We calculate wages at night:

(Amount of hourly pay)/(Rate of additional payment for work at night (in percent))*Number of hours worked=(500 rubles)/(20%)*10 days=1000 rubles

In this case, a thousand rubles will only be an additional payment for night hours, in accordance with the Labor Code of 2021, and the labor hours themselves are paid separately in accordance with the amount of wages.

If an employee receives a fixed monthly salary, it is necessary to calculate the rate per hour of labor. To do this, you need to divide the monthly rate by the number of hours that a person should normally work in the current month.

Employees who are employed specifically to work night shifts are also entitled to receive additional payment, and this should be taken into account when determining the monthly salary when an employment contract is drawn up with the employee.

Watch the following video for information on pay for night work.

Working extra hours at night

When applying for a job, an employment contract is concluded between the employer and the employee, which indicates the number of hours that the employee must work per month in order to receive a full salary.

If an employee worked overtime at night, he is entitled to additional payment for work, but in an amount no greater than the payment of overtime hours for work during the daytime. Read more about payment for overtime hours in the article https://otdelkadrov.

online/8686-pravila-primer-rascheta-oplaty-sverhurochnoi-raboty-po-tk-rf-v-year-godu.

Please note: you should distinguish between the concepts of overtime work and night work, which many people confuse.

Overtime is work that is performed at times not specified by the work schedule, and not at night. And night work is work activity from 22.00 to 6.00, planned by the employer in advance.

Sometimes these concepts can overlap each other, in the case where the work is both night and overtime.

Each hour of overtime at night is paid additionally in an amount equal to the average wage of an hour of labor for an employee.

Daytime overtime hours are paid additionally in the amount of 50% of the hourly rate for the first 2 hours and 100% for all subsequent ones.

However, the employer can independently indicate in the regulatory documents of the enterprise the possibility of higher payment for overtime work at night, since this is not prohibited by the Labor Code of the Russian Federation and other legislative acts.

The calculation of payment for overtime at night is carried out in the same way as the calculation of payment for work at night.

In this case, the employee’s hourly rate is multiplied by 200% and the time worked overtime at night.

For example, if an employee’s pay is 500 rubles per hour, and he worked an additional 10 hours at night, the employer must pay 10 thousand rubles for this time (at the rate of 500*200%*10).

Taxation of additional payments for night work and overtime

Additional payments for night work and overtime are considered part of the employee’s salary, therefore all payments are deducted from them on a general basis.

That is, insurance premiums, as well as pension and social contributions, as well as personal income tax, should be deducted from the amount of additional payments. All deductions are made by the organization’s accounting staff, and the employee is paid the amount taking into account all the changes.

Thus, the employee will not have to independently take care of paying taxes and insurance premiums for the overtime worked.

Source: https://otdelkadrov.online/8633-osushhestvlenie-oplaty-nochnyh-chasov-po-tk-rf-v-year-godu-primer-rascheta