VAT compensation when simplified in the estimate

Reimbursement of VAT under the simplified tax system in estimates in 2021, as well as in 2020, is a pressing issue when drawing up estimate documentation.

And although VAT compensation in the estimate under the simplified system is most often part of accounting reports and other sets of documents submitted to regulatory authorities, VAT in the estimate under the simplified tax system must also be reflected by specialists from the estimate department. It should be noted that the simplified taxation system implies the absence of payment of value added tax in most cases.

However, there are also cases when a construction company using the simplified tax system still has to deal with this tax. Therefore, logical questions arise: how to recalculate the estimate from VAT to “simplified” and how to refund VAT in the estimate under the simplified tax system.

VAT refund scheme

To return VAT, it is recommended to strictly follow the generally accepted algorithm of actions. By following the tax refund scheme, the payer will protect himself from making stupid mistakes and will help defend his rights if questions arise from the tax inspectorate.

Submitting a declaration indicating the amount of VAT to be refunded

To receive a tax refund, first of all, the company will need to prepare papers that confirm the right to a refund. The next step is to fill out your tax return.

The declaration is submitted to the territorial division of the Federal Tax Service at the place of registration in electronic form. The rule has been in effect since the beginning of 2015.

Important!

If an enterprise, for any reason, cannot send an electronic document, but transmits it in paper form, then this fact is equivalent to failure to provide reporting.

After receiving the declaration, the Federal Tax Service Inspectorate conducts a desk audit within 60 days. In some cases, described in Articles 176 and 88 of the Tax Code of the Russian Federation, the time it takes is increased to three calendar months.

During the audit process, the tax inspector requests documents that confirm the validity of the VAT deduction.

Upon completion of the procedure, tax authorities issue a ruling on a tax refund or draw up a report on the identification of violations.

Registration of a tax audit report by employees of the Federal Tax Service

If during a tax analysis an employee of the Federal Tax Service identifies violations, a report is drawn up within 10 calendar days from the end of the analysis. It is signed by the employees who analyzed the enterprise and the official responsible for maintaining tax records.

The act contains the following information:

- Time to conduct enterprise analysis. The document indicates the date of signing the act.

- Location, name of the company where the inspection was carried out, as well as the full name of the person being inspected.

- Full name, position of the persons who participated in the desk audit.

- Details of the document that is the basis for the analysis. Most often this is the decision of the head of the tax office.

- Time of submission of the declaration by the enterprise.

- A complete list of documents that were examined during the analysis of the company. The period for which the tax officer inspected the enterprise is also indicated.

- Full analysis time. The start and end dates are displayed.

- List of violations identified during the inspection. The act reflects only those deficiencies that are documented.

- Conclusion and conclusion. Compiled by an inspector with references to regulatory legislation.

The act is handed over to the enterprise within five days from the date of its preparation.

Submission of written objections by the taxpayer (if any)

If a company does not agree with the violations found at the enterprise, as well as with the conclusions reflected in the desk inspection report, it has the right to file an objection. The protest is submitted exclusively in writing within one calendar month from the moment of familiarization with the act.

To confirm the legitimacy of the objections, the enterprise has the right to submit documents substantiating the fact of non-compliance.

Making a decision to hold the taxpayer liable or to waive claims

Within ten days from the receipt of objections, the tax officer is obliged to make a decision:

- refund VAT;

- hold the company accountable;

- do not hold the company liable.

The employee of the Federal Tax Service notifies the enterprise of his decision no later than five days after its adoption. This rule is enshrined in the Tax Code of the Russian Federation, or more precisely in Article 176.

Offset of VAT towards repayment of debts, if any (arrears for VAT, federal taxes, penalties, fines)

An employee of the Federal Tax Service checks the company for tax debt. If it is detected, the tax refund is applied to offset debts.

If the amount of debt does not exceed the amount of tax to be refunded, as well as in the case of debt formation from the moment of filing the declaration to the end of the analysis, then interest is not charged.

If the amount of VAT to be refunded is greater than the amount of arrears, the remaining amount must be credited to the company's account. In the opposite situation, the company pays off the remaining debt using its own funds.

Making a decision on VAT refund (in the absence of violations that could have been identified during a desk audit)

If, during the tax analysis, the Federal Tax Service employees did not identify any violations, a tax refund determination must be made no later than seven days later.

VAT refund to the taxpayer (in the absence of arrears for VAT, federal taxes, penalties, fines)

If the enterprise regularly fulfills its tax obligations and has no debt to the tax service, the Federal Tax Service makes a determination on the payment of previously paid VAT.

Important!

To receive previously paid tax due to legal circumstances, a company or its representative is required to submit an appropriate application. It is provided along with the declaration, or separately from it after analysis.

Transfer of VAT amounts to the taxpayer’s bank account (5 working days from the date of receipt of the OFC order)

After receiving an order from the Federal Tax Service, OFK is obliged to transfer the entire amount indicated in the document within five days. The territorial division of the Federal Tax Service Inspectorate that sent the order notifies the OFK about the completion of the operation.

If funds are credited within the time limits required by law, the refund procedure is considered completed.

If within twelve days from the end of the tax analysis the required funds have not been received into the company’s current account, interest is charged on the entire amount.

Payment of interest to the taxpayer in case of violation of VAT refund deadlines

In case of violation of the VAT refund deadlines, penalties will be charged on the tax amount. The company has the right to request their payment.

If the debt to the company is fully repaid, then the procedure is considered completed. If only the VAT refund amount is received, the company has the right to request payment of interest.

The decision to grant the accrued penalty is made by the Federal Tax Service within three days from the moment of familiarization with the notification from the OFK about sending funds to the recipient.

Cases of VAT compensation in estimates

It should be noted that when working on a simplified taxation system, an entrepreneur or construction company is exempt from paying a number of taxes and contributions. Value added tax, or VAT, is one of them. However, this fact also deprives taxpayers in this taxation system of receiving a VAT refund under the simplified tax system in the estimate.

It should also be noted that since 2021, the amount of VAT tax has increased significantly, and today it is 20%. In this regard, when the question arises of how the simplified tax system is taken into account in the estimate, it is also important to understand how to reimburse VAT costs using the simplified tax system in the estimate.

After all, a construction organization operating in a simplified mode often encounters estimates in Form No. 4, local resource estimates, object estimates, summary estimates and other forms of estimate documentation, which indicate the cost item for VAT payment.

In addition, when purchasing materials and repairing machinery and equipment, the organization also pays the specified tax. Therefore, the issue of registering the simplified tax system in the estimate sometimes arises very acutely. After all, what is interesting in this case is the method of how to return the paid VAT and how the application of the simplified tax system refund can be taken into account in the estimate.

In various regulatory documents on VAT reimbursement under the simplified tax system, the estimate pays attention to various cases where such a need arises. In addition, many training courses and lectures, as well as various forums and seminars, are devoted to this topic. In addition, it should be borne in mind that the preparation of estimates under the simplified taxation system of the simplified tax system has been updated for 2021 and must be carried out taking into account all current regulations and acts.

State order and VAT compensation simplified

Compensation for the execution of government orders is calculated and processed according to a similar principle. Performers of work working on a simplified basis pay VAT to their counterparties on OSNO. For example, paying for the work of subcontractors or when purchasing materials and components “including VAT”.

The Union of Estimating Engineers, in its recent letter No. RS-PG-200/2020 dated June 8, 2021, suggests that simplifiers use an algorithm for determining VAT cost compensation. The simplified tax calculated using the formula, working under government orders, is also reflected in the estimate calculation in a separate line “VAT compensation”. Otherwise, the executor of a government order for the simplified tax system does not have the right to present them for payment to the customer and will lose 20% of his expenses paid to contractors “including VAT”. As you can see, there is nothing complicated in the procedure for calculating VAT compensation using simplified methods.

Formula for VAT compensation under the simplified tax system in the estimate

The formula for VAT compensation under the simplified tax system in the estimate in the letter of the State Construction Committee No. NZ-6292/10 dated October 6, 2003 is the main formula today. Although it should be noted that there is some uncertainty in resolving this issue.

This uncertainty is due to the fact that the simplified tax system formula in the estimate and, in addition, the theses concerning the determination of the cost of overhead costs and estimated profit in estimates in “simplified” terms were recommended by different regulatory documents, sometimes somewhat contradictory to each other. Therefore, what formula for calculating 20% VAT compensation in the estimate will be applied should be clarified not only by the text of the contract for the construction project, but also by the current regional regulatory documents.

So, returning to the text of letter No. NZ-6292/10 dated October 6, 2003, several directions can be highlighted. The first of these is the simplified tax system formula for the estimate. It should also be clarified that there is no formula as such in the letter, however, the appendix to the letter provides an example of a calculation that will allow you to understand how the simplified tax system is taken into account in the estimate.

When do you have to pay VAT under the simplified taxation system?

Let's name the most common cases when you have to transfer VAT under the simplified system.

1. When issuing invoices with allocated VAT . Often clients using the general taxation system refuse to make transactions with suppliers using the simplified tax system. The fact is that “simplified” companies are not VAT payers and are not required to issue invoices. As a result, buyers are unable to deduct input tax.

To get out of this situation, sellers voluntarily issue invoices with an allocated VAT amount. This allows customers to apply the deduction. The supplier using the simplified tax system, in turn, must transfer to the budget the VAT indicated in the invoice (subclause 1, clause 5, article 173 of the Tax Code of the Russian Federation).

ATTENTION . Many sellers approach the issue differently. They register two legal entities: one is transferred to the simplified system, and the second is left on the general one. If the client uses a special regime and does not need an invoice, then the contract with him is signed by the first organization. If the buyer is on OSNO, then the second company becomes its supplier.

2. When importing goods. One of the operations in which the simplifier must pay VAT is the import of goods. This is directly stated in paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation.

If the supplier is located in a member country of the Eurasian Economic Union (EAEU), then the tax must be transferred after the importer accepts the goods for accounting. The taxable base will be the sum of two values: the cost of the goods and the excise tax (for excisable products).

If the foreign supplier is not located in the EAEU, then value added tax must be paid at customs. In this case, the taxable base is the sum of the cost of the goods, customs duties and excise taxes (for excisable products).

The VAT rate in general is 20%, and for certain goods - 10%. There is also a list of goods that are exempt from VAT upon import. These are cultural values, books for libraries, etc. (Article 150 of the Tax Code of the Russian Federation).

Fill out and submit a new VAT declaration online for free when importing from EAEU countries

3. In case of trust management of property. Another operation that obliges a company to remit VAT to the simplified tax system is the sale of property received by it in trust. According to Article 174.1 of the Tax Code of the Russian Federation, the trustee must issue an invoice. In this case, in the line “Seller” you should make a note “D.U.” - this is the requirement of paragraph 3 of Article 1012 of the Civil Code of the Russian Federation.

IMPORTANT. The remuneration for services that the trustee under the simplified tax system receives from the founder of the management (that is, from the owner of the property) is not subject to VAT.

Formula for VAT compensation under the simplified tax system in the estimate. Counting example

If you look at Figure 1, you can see an example of calculating VAT under the simplified tax system in estimates in 2021, as well as in the year 2021. This calculation is based on the example from the attachment of the above letter.

Figure 1. Example of calculating VAT compensation in estimates for the simplified tax system

As you can see, the calculation has three columns, each of which indicates the necessary data for calculating a sample estimate without VAT under the simplified tax system. The first column indicates cost items. According to the methodological document in construction MDS81-35.2004, the items of estimated costs include the following categories: the cost of materials, operation of machines and mechanisms, as well as the cost of the wage fund (WF), which constitute direct costs in the estimate. The wage fund is the summation of workers' wages and drivers' wages.

Plus, as part of the estimate forms, there are enlarged standards for overhead costs (OS) and estimated profit (SP), which are also components of the estimated cost items. By the way, letters from the State Construction Committee and the Ministry of Justice also recommend reducing coefficients for the norms of NR and SP under the simplified tax system, which will be discussed further in the text.

In addition to those listed above, the cost of paying taxes is included in the estimate form, and various limited costs, costs for unforeseen expenses, etc. can also be listed.

However, the purpose of the simplified tax system in the estimate is that, as noted above, many taxes cannot and should not be reflected in the estimate form due to the tax regime. Therefore, for taxes such as VAT on materials under the simplified tax system in the estimate, a calculation is provided similar to that illustrated in Figure 1. Thus, it becomes clear how each of the cost items in the first column of the calculation is deciphered in the estimates of the simplified tax system.

The second column in the example of calculating the simplified tax system in the estimate contains the spontaneous cost of work, which is measured in thousands of rubles. And in the third column, calculations are made for reimbursement of VAT costs under the simplified tax system in the estimate. For convenience, all simplified taxation formulas in the estimate in Figure 1 are described in detail, however, in a real estimate they can be indicated immediately in the totals.

So, in order to calculate the amount of VAT compensation under the simplified tax system in the estimate, you should first find out the amount of value added tax for each cost item. So, if you turn to the line “Materials”, the amount of which, indicated in the second column, is equal to 5000 thousand rubles, you can calculate the amount of VAT in the amount of 20% in the following way: 5000 multiplied by 20%. The result is 1000 thousand rubles.

Workers' wages remain unchanged, since VAT is not paid on them. But regarding the costs of operating machines, the same principle applies as when calculating VAT in estimates under the simplified tax system for materials.

However, it should be taken into account that the operation of machines must be taken into account in this calculation in its pure form, that is, without the cost of machine operators’ salaries. Therefore, the simplified tax system formula in the estimate in this line is given as follows: the driver’s salary “350” is deducted from the amount of operation of machines “1800”. Next, an identical calculation is made, that is, the amount of VAT is calculated. In this case it is 290 thousand rubles.

The “Total” line shows the amount of VAT on materials and mechanisms, which is taken into account in the simplified tax system estimate: 1000+290 =1290.

The next step in calculating VAT compensation in the estimate is calculating the tax as part of overhead costs and estimated profit. Since HP and joint venture in the estimate are calculated on the basis of payroll, calculations will be made from the sum of the salaries of workers and drivers, that is, from 1900 + 350 = 2250 thousand rubles.

As you can see, coefficients of 1.18 and 0.7 are also applied to the overhead cost indicators in the estimate. The coefficient of 1.18 is included in the calculation based on Appendix 2 of MDS 81-4.99 and is an aggregated standard in housing and civil construction for this type of standard. Also, the simplified tax system formula in the estimate in the HP part contains a reduction factor of 0.7, which will be discussed further in the text in the corresponding paragraph.

Thus, it turns out that the amount of overhead costs for calculating the VAT refund under the simplified tax system in the estimate in Figure 1 is 1858.5 thousand rubles. To this amount, an indicator of the specific weight of materials costs in the amount of 0.183 is applied, and the amount of VAT of 20% is also calculated.

In relation to the estimated profit indicator, similar calculations are made for reimbursement of VAT costs under the simplified tax system in the estimate. However, the aggregated standard indicator is excluded from the formula. Instead, the calculations must include the industry-wide SP standard, applied on the basis of MDS81-25.2001. In addition, the specific gravity of materials for the estimated profit is 0.15 and must also be taken into account in the final calculation.

After making all the calculations, you need to display the total amount for all lines. In the example in Figure 1, this is 1397.57 thousand rubles. Thus, VAT compensation under the simplified tax system in the estimate in this case will be 11.43%.

Why can’t VAT be excluded from the estimate?

The fact is that, despite its prevalence, the simplified tax system is a special case of taxation practice. The largest enterprises, budgetary organizations and suppliers of basic resources, operate under the general taxation system ( OSNO ), many trade and service enterprises do the same. It is reasonable to assume that if there is a legal entity or entrepreneur using the simplified tax system, then the services that he himself receives from other organizations are, one way or another, subject to VAT. And you will still have to pay the bills, classifying them as expenses. It turns out that the amount of VAT for such an entrepreneur is included in the total cost of the goods or services.

Let's give a rough example: the cost of one brick in a trading company is 10 rubles. The VAT rate is 20%, the amount of VAT is 2 rubles.

- For a buyer working under OSNO, a brick will cost 10 rubles, VAT 2 rubles, total including VAT 12 rubles.

- For a buyer working under the simplified tax system, a brick will cost 12 rubles. . VAT is not allocated and cannot be refunded

But in estimates, VAT is accrued as a result (in limited costs), and in estimate items, the cost of materials (MAT) and operation of machines (EM) is indicated without VAT. This means the contractor will buy a brick for 12 rubles, and add a brick to the estimate for 10 rubles. By not charging VAT in the end, he loses 2 rubles. But he cannot charge VAT as a result of the estimate, because he is not the payer.

In this case, the contractor must be reimbursed for the VAT he paid. In limited costs, as a result of the estimate, “VAT” is replaced by . ”

From January 1, 2021, the value added tax is 20%. This change will be applied to all participants in economic activity, regardless of the terms of previously concluded contracts. Amendments have been made to the article and the formula for calculating VAT compensation. For details on accounting for the new VAT amount in invoices, see thematic collections of reference and legal systems and on the official website of the Federal Tax Service

Alternative formula for VAT compensation under the simplified tax system in the estimate

Many sources devoted to the subject of estimates also indicate another simplified tax system formula in the estimate. Figure 2 shows this calculation method. However, it should be noted that the choice of the formula for calculating 20% VAT compensation in the estimate should be carried out strictly with the agreement of each type of calculation by all legally interested parties in the construction work.

Figure 2. VAT compensation formula

Thus, the calculation algorithm in Figure 2 has similar features to the calculation example from the letter of the State Construction Committee No. NZ-6292/10 dated October 6, 2003, shown in Figure 1. That is, the calculations are made using the same parameters from the estimate form: cost of materials , mechanisms, as well as remuneration.

However, you can note that in the given formula for VAT compensation under the simplified tax system in the estimate, slightly different indicators are applied to the NR and SP standards. The coefficient of the specific weight of costs for materials from MDS81-33.2004 is applied to overhead costs, the same indicator is taken into account for the estimated profit.

Many experts prefer this formula for VAT reimbursement under the simplified tax system in the estimate, and not from the letter from the State Committee for Construction. However, as noted above, this method must be approved and agreed upon by the competent authorities.

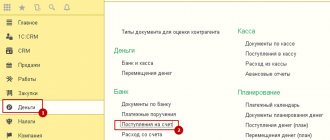

In addition, economic calculations of this type can be carried out in various estimation programs. For example, you can compensate for VAT under the simplified tax system in the “Grand Estimate”. The simplified tax system formula in the “Grand Estimate” is entered using the same algorithms as other formulas in the specified software package, so this action should not cause difficulties.

Who needs it

Most companies that have switched to a simplified tax regime are exempt from calculating and paying VAT. Of course, some operations are exceptions, but still the general rule applies to everyone.

Consequently, when calculating the price of work, goods and services, a subject using the simplified tax system should not take into account value added tax. After all, he doesn’t have to pay it. However, this is not always the case.

Let’s say that a construction organization, using a simplified regime, decided not to include VAT in costs when drawing up estimates. In theory, everything is correct. After all, the subject has no obligation to pay tax to the budget. But the materials that will be purchased for construction work, in most cases, already include VAT.

As a result of excluding VAT from estimates, the company will suffer losses. Of course, with a small transaction value, unaccounted expenses will be minimal, and the organization may practically not feel them. It is also possible to miss the costs of VAT compensation under the simplified tax system (formula below) if the main suppliers and contractors also work under the simplified tax system. However, with suppliers on OSNO and with a large transaction amount, the losses will be significant.

Let's look at the situation using a specific example:

For example, one piece of wooden board with the same price tag will have a different cost:

- for a company on OSNO - 120 rubles, including 100 rubles - the net cost of the board, and 20 rubles - the amount of VAT, which the company will subsequently issue for deduction. As a result, the company will buy one board from OSNO for 100 rubles;

- for an organization or individual entrepreneur using the simplified tax system, the same wooden board will cost 120 rubles without any right to a tax refund from the budget.

But the simplifier will include only 100 rubles in the estimate for the cost of the board, without VAT. It is these 20 rubles of unaccounted tax that should be included in the estimate in the special section “Compensation for VAT expenses.” Otherwise, the company may suffer losses.

Ratios to estimated profit and overhead costs

Estimators quite often wonder what deductions they should apply to estimated profits and overhead costs.

Estimators, as a rule, work on a permanent basis in the same company, which is engaged in a specific activity. If the estimator needs to make an estimate for another type of activity, he can draw it up according to the usual template. This template may deviate from the pricing norms and requirements in the required activity.

Organizations that are on a simplified basis must use special lowering indices for expenses and estimated profits when preparing budget documents.

The choice of coefficients for estimated profit (SP) and overhead costs (OC) is directly dependent on the method of indexing the cost to current prices.

There are two indexing methods:

- To construction and installation work;

Indexation to construction and installation works is mainly used when it is necessary to perform investment calculations. Less commonly, this method is used for settlements between the customer and the contractor. This method of calculation is the use of the same index to the price of construction and installation work (to direct costs in the estimate).

- By item of expense.

Indexation by expense items is used if it is necessary to make payments for work between the customer and the contractor. This method involves the use of various indices for driver salaries, machine operation, and materials. In almost all cases, the indices for the operation of equipment for drivers' salaries are the same. This means that the index for the wage fund is general.

If an organization is on a simplified basis, it must use all the same coefficients as general-regime organizations, however, in addition to general indices, it must also use special ones:

- In relation to overhead costs – 0.94;

- In relation to the estimated profit - 0.9.

Similar articles

- How to calculate VAT at a rate of 18% of the amount?

- How to correctly take into account input VAT under the simplified tax system?

- When do you have to pay VAT under the simplified tax system?

- Including VAT

- VAT under simplified tax system