Repayment of a loan to an individual from a legal entity

To correctly carry out the operation of returning borrowed funds, you must first familiarize yourself with the legislative framework.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

There are a number of regulatory documents according to which it is possible to correctly carry out the operation of repaying a loan to an individual from a legal entity.

The main defining document of the relationship between the lender and the borrower is the agreement. According to paragraph 1, Article 808 of the Civil Code of the Russian Federation, it is subject to mandatory registration of a loan between individuals if the amount exceeds 1000 rubles, and with the participation of a legal entity - regardless of the amount.

Therefore, the loan repayment procedure must be described in detail in the relevant clauses of the agreement.

To perform this procedure, the use of cash registers is not required, and checks are not issued to reflect transactions in the cash book.

This provision is regulated by letter of the Ministry of Finance of Russia No. 03-11-05/40 dated February 21, 2008. This means that the use of trading proceeds to repay a loan is not recommended.

You can carry out the operation in the following way:

- deposit the required amount into the current account of a legal entity as revenue from the organization’s activities;

- use a checkbook to withdraw money and transfer it to an individual – the lender. The procedure is certified by a receipt, which can be notarized.

Regarding the maximum one-time amount of repayment of a loan obligation, there is an unambiguous instruction of the Central Bank No. 1843-U, the first paragraph of which limits cash payments when carrying out operations to repay credit (borrowed) obligations in the amount of 100,000 rubles. The same applies to both the principal body of the debt and the accrued interest.

If the total amount exceeds the established limit, then non-cash transactions must be performed. The procedure for performing them is fully consistent with that described above, with the exception of the last point.

If there are not sufficient funds in the current account for settlement, they are replenished by depositing proceeds. In the future, when drawing up a payment order to the bank, the number and date of signing the loan agreement are indicated in the “destination” column.

Funds must be transferred only to the account specified in the agreement. To do this, the bank must provide a copy of it.

A sample loan agreement between an individual and an individual entrepreneur can be downloaded in the article: loan agreement between an individual and an individual entrepreneur. How an individual can get a microloan for urgent needs is described here.

New rules for receiving and spending cash from the cash register

It will soon be necessary to pay in cash with other organizations and entrepreneurs according to new rules. The Bank of Russia established new rules for cash payments in Directive No. 3073-U dated October 7, 2013 “On cash payments.” The new rules come into force on June 1, that is, 10 days after the date of publication of Directive No. 3073-U in the Bulletin of the Bank of Russia (published on May 21).

Note! The old Instruction No. 1843-U, dedicated to cash payments, has been canceled (Instruction of the Bank of Russia dated October 16, 2013 No. 3076-U).

Below you will find a table that will help you quickly determine what amounts are allowed to be paid without complying with the limit and from the proceeds.

What and how can you spend cash?

| Pay | Is it possible to issue (pay) from cash proceeds? | Is it possible to issue (pay) more than 100,000 rubles. |

| Settlements with employees | ||

| Salaries and employee benefits | Yes | Yes |

| Issuance of cash on account | Yes | Yes |

| Settlements with counterparties | ||

| Payment for goods (except for securities), works, services | Yes | No |

| Payment of money for returned goods (uncompleted work, unrendered service), previously paid in cash | Yes | No |

| Payment of money for returned goods previously paid by bank transfer | No | No |

| Loans, repayment of loans and interest on them | No | No |

| Dividends | No | No |

| Payments under a real estate lease agreement | No | No |

| Cash entrepreneur | ||

| Money for personal purposes not related to running a business | Yes | Yes |

From an individual

If the agreement was concluded between individuals, then their relationship is not limited to the maximum one-time repayment amount of 100,000 rubles. Therefore, they most often use receipts - documentary evidence of receipt of money.

This is a legal document that has full legal force. However, it is not always compiled correctly.

Below are the main points that should be displayed on the receipt:

- Full name and passport details of the lender;

- Full name and passport details of the borrower;

- reference to the agreement or receipt for the provision of a cash loan;

- the amount of current debt repayment;

- date and signatures of the parties and witnesses.

It is important that the document be written by hand that the money was received from the individual in the full amount indicated in the receipt.

This procedure must be witnessed by at least two third parties. In the future, it is attached to the agreement, and the original remains with the borrower, and a certified copy with signatures remains with the lender.

Does it need to be notarized? Even without this procedure, it has the same legal force as one certified by a notary. However, if litigation arises, it will be much more difficult for the latter to prove that it is a fake.

It is possible to repay the debt through the bank accounts of the parties. But in this case, it is necessary to indicate in the purpose of payment the contract number (drawn up without fail) and the date of its conclusion. Otherwise, the credited amount cannot be considered as repayment under the terms of the loan agreement.

How to return a debt to an LLC participant?

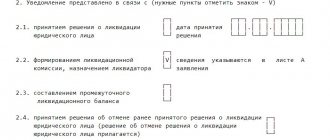

If a company borrowed certain funds from its founder for a specific period, repayment of such debt is carried out according to the following rules:

- The debt must be repaid in full within the established time frame (according to the loan agreement). If the deadline for repayment of the monetary debt is not clearly indicated in the relevant agreement, the loan provided (received) will be considered perpetual. While a loan with an indefinite repayment period is in force, the founder has the right at any time to demand that the borrowing company repay it in full within one month.

- If the founder, the lender, provided the borrower with funds in foreign currency, the corresponding debt is repaid in domestic rubles. The actual refund amount is determined on the maturity date in accordance with the current exchange rate.

- The receipt and repayment of a loan issued by a shareholder is properly recorded in the accounting records of the borrower company. If funds are raised by a business company for a period not exceeding 12 (twelve) months, it is considered short-term and is reflected in accounting under account 66. If funds are raised by the borrowing company for a period exceeding 12 (twelve) months, then it is long-term and is recorded in accounting under account 67.

- If a monetary loan agreement concluded between the founder, the lender, and the borrower company, provides for the payment of interest for the use of funds received, the amount of the corresponding overpayment - the amount of accrued interest - is recorded in accounting on account 66 (67) as the difference on the borrowed loan.

- Relations are formalized by an appropriate agreement drawn up in accordance with the norms of current legislation that protects the rights and regulates the obligations of the parties. The key legal act in this case is the Civil Code of the Russian Federation (CC).

Repayment of a loan to an individual through a cash desk

According to current legislation, repaying loan debt using cash from the cash register is prohibited. They fall under the category of revenue received through the sale of goods, services or other means. This is directly stated in the Code of Administrative Offenses (CAO), in Article 15.1.

It describes penalties for improper handling of cash and revenue. Since the cash book does not have a section for limited expenses for a loan (credit), in the case of issuing funds directly from the cash register, the official may be fined from 4 to 5 thousand rubles.

Therefore, you first need to deposit the proceeds to the bank, and then receive the required amount from the checkbook. This procedure was described above in the methods of repaying debt between an individual and a legal entity.

In practice, such offenses occur frequently. For large loan amounts, a one-time payment of a fine may be financially more expedient than constant payments in the form of a bank commission when depositing funds into a current account and withdrawing them using a checkbook.

However, we do not recommend using this method, since it contradicts the current legislative norms of the Russian Federation.

Limit of 100,000 rubles. obligatory for all parties to the contract

The limit for cash payments remains the same - 100,000 rubles. under one contract. That is, the maximum amount should, as before, include the total amount of cash payment for one transaction. Even if one party to the contract transfers money to the other in parts. For example, a buyer pays for a product in installments.

The very rule about the need to conduct cash payments within the limit has been formulated in a new way. There was such a thing as participants in cash payments. They are considered to be any legal entities and entrepreneurs. All of them have the right to pay in cash within the framework of one agreement only within the limit (clause 6 of Directive No. 3073-U).

For exceeding this limit, a fine of up to 50,000 rubles is provided. (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). Moreover, for a long time the question of who the tax authorities have the right to bring to administrative responsibility for this violation remained controversial: both parties to the contract, only the seller who receives cash, or only the buyer who pays with it. Inspectors fined both of them. And the judges recognized this as lawful (resolutions of the FAS Volga-Vyatka District dated November 30, 2010, section No. A28-2959/2010 and the FAS Volga District dated October 12, 2010, section No. A65-6852/2010).

Now there will be no disputes. Administrative liability is established for over-limit payments. Participants in cash payments are both parties to the agreement. So the tax authorities have the right to fine both the one who received more than 100,000 rubles and the one who paid the excess amount for exceeding the limit.

Companies and entrepreneurs can, as before, pay with individuals in cash without any restrictions on amounts. For example, any cash amount can be paid to a private contractor for work or service, or received as a loan from an employee or founder. There was no ban before, but now it is directly permitted by paragraph 5 of Directive No. 3073-U. Thus, officials decided to delay setting a limit on cash payments to ordinary citizens. There was an idea to introduce a limit in the amount of 600,000 rubles in 2014, and from 2016–2017 to reduce it to 300,000 rubles.

Cash

In many cases, it is much more convenient for the lender to receive all or part of the debt (with phased repayment) in cash. This situation can have an unpleasant effect on the correctness of cash accounting of a legal entity.

In this case, it is recommended to follow the scheme of depositing money into a current account and then withdrawing it using a checkbook.

These restrictions came into force on June 1, 2014 and are associated with the new instruction of the Central Bank of Russia No. 3073-U on the procedure for conducting cash payments.

According to this resolution, withdrawal of money from the cash register is possible only in the following cases:

- payment of wages and social benefits;

- consumer needs of a legal entity not related to its activities. The loan agreement does not fall under this clause, since it was concluded as part of the business activities of the individual entrepreneur;

- for issuance to employees of the organization for reporting.

In addition to the correct withdrawal of funds, it is necessary to correctly display their movement in the financial statements. This also applies to loan repayment to an individual.

The wiring in this case should be made according to the following scheme:

- partial or full repayment of the loan, according to a previously signed agreement - Debit 50 (51), Credit 76;

- return of borrowed funds – Debit 50 (51), Credit 78 (sub-account for loans provided).

Currently, there are no regulatory documents describing the procedure for repaying loan obligations between individuals. Therefore, the main document confirming the receipt of cash in this case may be a receipt or a separate appendix to the agreement (if it was drawn up).

Is the lender obliged to use cash register when providing a loan or when it is repaid: what does the law say?

In accordance with Article 1.1 of Law 54-FZ (LINK), calculations for the purposes of using cash registers include the issuance (return) of borrowed funds to pay for goods, work, and services. An online cash register is required for entrepreneurs and legal entities (hereinafter referred to as enterprises) to conduct payments throughout Russia, except for the exceptions expressly stated in the law (Clause 1, Article 1.2 of Law 54-FZ).

The cash register is used only by users. Those. persons carrying out settlements. CCP users draw up a cash register receipt (or BSO) and provide it to the consumer (client) on paper or electronically (clause 2 of Article 1.2 of Law No. 54-FZ). But users - those who are obliged to work with cash register systems - can only be legal entities and entrepreneurs (Article 1.1 of Law No. 54-FZ). This obligation does not apply to citizens without registration as individual entrepreneurs, even if they sell something.

[adsp-pro-1]

From all of the above we can draw a simple conclusion:

- The online cash register is used only by those who receive money from the buyer (client) or pay it to the buyer (client) (clause 1 of article 4.3., clause 2 of article 1.2 of law No. 54-FZ). At the same time, the receipt (payment) of money occurs within the framework of operations classified by Law No. 54-FZ as “settlements”;

- someone who is a buyer (client) does not use the online cash register for payments at all (letters from the Federal Tax Service of Russia No. AS-4-20 / [email protected] dated 08/10/2018 - LINK, from the Ministry of Finance of the Russian Federation No. 03-01-15 /52265 from 07/25/2018 - LINK). This statement applies even to enterprises that find themselves in the role of consumers. The basis is paragraph 2 of Article 1.2 of Law No. 54-FZ, which states that the seller, and not the consumer, punches and transfers cash documents. Additionally, the Russian Ministry of Finance speaks about the “realization” nature of calculations in its letter dated October 05, 2021 No. 03-01-15/71861 - LINK. In which the Ministry of Finance indicates that “CCT is used by a person who sells goods, performs work, or provides services.”

But still, should the lender issue a cashier's check (CSR) when issuing (repaying) a loan? Yes. Based on all of the above, the lender is a user within the meaning of the law on cash register systems. But only on the condition that his loan is used to purchase goods (work, services) that the lender himself sells. This means that at the time of granting such a loan and its full or partial closure, the lender is obliged to use the cash register system.

[adsp-pro-2]

On the map

The procedure for repaying debt under a loan agreement to a debit agreement can somewhat reduce the costs of a legal entity.

To carry out this operation, you must provide certified copies of the following documents to the servicing bank:

- loan agreement;

- payment schedule for it (if the payment is made in parts).

You can then freely manage the funds available in your current account. The payment order must indicate the agreement number, its date and, if necessary, the number of the annex to it (payment schedule).

This is one of the most convenient ways - repaying a loan to an individual through a current account helps optimize settlements between the parties.

This form of calculation will not only reduce the cost of servicing the loan, but will also allow you to display all the necessary transactions in the accounting documentation.

The procedure for returning money between individuals to a bank card was described above.

conclusions

The repayment of the loan to the founder must be carried out in accordance with the rules provided for by the concluded agreement and the generally binding requirements established by the current legislation of the Russian Federation (for example, the norms of the Civil Code).

If the loan relationship provides for a fee for the use of funds, the agreement must indicate the rate of interest charged and the procedure for making interest payments.

The borrowing company can repay the debt to the equity holder-lender in various available ways.

The most popular option is to transfer money to a debit bank card. Correct accounting of debt repayments is also of particular importance.

Return of property

If for some reason the borrower cannot repay the loan debt, then an alternative option is possible.

According to Article 409 of the Civil Code of the Russian Federation, with the mutual consent of the parties, the borrower can provide any type of property - movable or immovable - as compensation for funds.

In this case, an additional agreement is drawn up, in which “compensation” will appear instead of the term “loan”.

However, in this case certain tax risks arise. They are associated with the problem of determining the current value of property.

To agree on an exact figure, it is recommended to invite independent experts who, by examining the condition of the property and comparing the current market value with a similar one, will determine the final price.

In practice, it is very difficult to come to a clear opinion when resolving this issue. Especially in cases where property is retained by force, after receiving a corresponding court decision.

The only exceptions are those cases when the contract was initially written as collateral, its primary value and possible depreciation during the term of the agreement were determined.

As can be seen from the above, repayment of a loan to an individual can be carried out in several ways. The main thing is to decide on what is optimally convenient for both parties before signing the agreement and entering into force. In this case, you can avoid many ambiguities and possible problems in the future.

Is it possible for an 18-year-old unemployed person to get a cash loan? Find out from the article: loans from 18 years of age. How to correctly draw up a loan receipt between individuals, see the example.

The procedure for obtaining an interest-free loan between individuals is described on the page.

You cannot issue loans and pay rent from the cash register.

Paragraph 4 of Directive No. 3073-U provides a new list of transactions for which the company and entrepreneur can pay exclusively with cash withdrawn from the current account. You cannot use cash proceeds directly from the cash register. This list includes settlements for securities, lease agreements, loans, as well as for the organization and conduct of gambling.

This restriction applies not only to settlements between companies, entrepreneurs, or a company and an entrepreneur. This also applies to their settlements with individuals.

In this case, the limit is 100,000 rubles. must be observed only under agreements concluded either between two companies, or between a company and an entrepreneur, or between two entrepreneurs. If one of the parties to the agreement is an individual, then the limit does not apply (clause 5 of Directive No. 3073-U). Let's take a closer look at the rules on rent and loans.

Rent . To pay cash for renting real estate, you need to withdraw it from your account. The company has no right to use proceeds from the cash register. Moreover, regardless of who the contract was concluded with - with another organization, with an entrepreneur or with a private individual.

Note! Cash proceeds from the cash register can be used to pay for renting a car or other movable property. When renting real estate, you need to withdraw money from your account or pay by bank transfer.

Companies and businessmen must comply with this rule regardless of whether they pay rent in cash or, for example, pay off fines and penalties or make a deposit. In addition, the restriction applies to both tenants and landlords. In most cases, the tenant pays in cash when he makes a payment to the landlord for the use of the property. But another option is also possible. For example, the landlord may return the overpayment under the contract to the tenant. To do this, you also need to use cash withdrawn from the account. After all, Directive No. 3073-U deals with all operations under a lease agreement.

At the same time, this restriction does not apply to the rental of movable property. A company that rents, for example, a car, has the right to repay the next payment from cash proceeds. It is not necessary to first deposit it into your account and then withdraw it in order to pay.

In the previous Directive No. 1843-U there was no direct clause stating that rent must be paid only from money withdrawn from the account. At the same time, rent was not on the list of purposes for which cash proceeds could be spent.

That is, formally the restriction existed before. But if until recently tax authorities did not focus their attention on this, now cash payments for rent will certainly begin to arouse close interest among inspectors.

Loan . The ban on the use of cash proceeds from the cash register applies to both the issuance of loans and their repayment and interest payments. That is, it concerns both parties to the contract - both the lender and the borrower. In addition, the ban on spending proceeds applies not only to contracts concluded between two companies or a company and an entrepreneur, but also to contracts signed with an individual. This could be, for example, a founder who gave a loan to his company. Or a director who, on the contrary, received a loan from the organization. It also does not matter what kind of loan was received or issued - interest-bearing or interest-free.

In the previous Directive No. 1843-U, payments under loan agreements were not included in the list of purposes for which cash proceeds can be spent. Referring to this, Bank of Russia specialists explained that such cash cannot be used to issue loans (letter dated December 4, 2007 No. 190-T). The tax authorities fined the violators, and the judges supported them (resolution of the Federal Antimonopoly Service of the West Siberian District dated May 27, 2010, section No. A03-14966/2009). Inspectors also fined those who repaid loans or paid interest on them in cash from the proceeds. It was not possible to cancel these fines (decision of the Moscow City Court dated December 14, 2012, case No. 7-2207/2012).