For what purpose were new forms introduced?

Until November 25, the forms approved eight years ago by Order of the Federal Tax Service of the Russian Federation dated January 25, 2012 No. ММВ-7-6 / [email protected] During this period, many changes occurred, in particular, in 2014, corporate legislation changed.

In practice, the existing forms did not allow the application of all legislative innovations, and therefore difficulties arose.

Thus, from June 24, 2021, LLCs have the right to act on the basis of one of 36 standard charters developed by the Ministry of Economic Development (Order of the Ministry of Economic Development of the Russian Federation dated August 1, 2020 No. 411). But in practice it was not possible to apply this: in the application form for state registration there was no corresponding column indicating the organization’s use of a standard charter. Thanks to the new form P11001, this problem has been solved.

Also from August 13, 2021 in Art. 178 of the Labor Code of the Russian Federation states that in order to complete the liquidation of a legal entity, it is necessary to make a full settlement with the dismissed employees. The new form P15016 provides a line to confirm that all payments have been made.

Application for registration of individual entrepreneurs in 2021

Home / Opening an individual entrepreneur

Download the individual entrepreneur registration form (Excel) or in PDF format.

View a sample of filling out form p21001

The application is submitted in 1 copy. There is no need to stitch or staple the sheets.

When submitting an application to the Federal Tax Service, you must attach the original receipt for payment of the state duty and a photocopy of your passport (with presentation of the original).

The preparation of the form should be approached responsibly, since all forms submitted to the Federal Tax Service are machine-readable, and any errors may result in inspectors refusing to register an individual entrepreneur.

In such a situation, the applicant will have to fill out the form again and also pay a state fee of 800 rubles again.

Instructions for filling out form p21001

Click (click) on the field to reveal detailed information.

General requirements

1) The form must be filled out manually or using software.

2) Data is entered in capital letters, when using software - in Courier New font 18 points high, starting from the first left cell.

3) When creating a form manually, only black ink is used; when printing on a printer, only black ink is used.

4) Only one character (letter, number, punctuation mark) is allowed to be entered into one familiar place.

5) When entering text information consisting of several words that are written separately, you must leave one empty space between the words.

6) If the data does not fit on one line, entering information is allowed in the following ways:

- up to and including the last cell of the line, as many characters as fit are written, the remaining characters are entered from the first left cell of the new line, without adding a hyphen;

- a word that does not fit (several words, a punctuation mark, a number) is written from the first cell of a new line, while empty spaces remaining in the previous line are considered a single space;

- if a word (number, punctuation mark) ends in the last character of a line, then the next word (sign, number), if written separately from the previous one, must be written from the second cell of the new line, the first empty cell will be a space.

In this case, it is allowed to fill in text data while simultaneously using all of the above methods.

7) Blank sheets of the form are not included in the document submitted to the registration authorities.

It is not permitted to make corrections (including using a proofreader) or additions to the completed document.

It is not permitted to make corrections (including using a proofreader) or additions to the completed document.

9) When printing on a printer, the absence of cell frames is allowed. Changing the location and size of fields is not allowed.

10) Double-sided printing of form sheets is prohibited.

Page 1

1. The page number is indicated: “001” (the following pages are numbered in order in the same format: “002”, “003”, etc.).

2. Full name to be filled in. in Russian. This point is mandatory for both Russian citizens and foreigners (Russians fill out the data in accordance with their passport, foreigners - according to their residence permit).

3. Item Full name Only foreigners should fill in Latin letters, and only if the information in Latin letters is indicated in the identity document. Citizens of the Russian Federation leave these fields empty.

4. The citizen's TIN is entered. If the code is missing, the field remains empty, the tax authorities will assign a TIN automatically.

Note: you can find out whether a citizen has been assigned an INN code on the Federal Tax Service website using the “Find out INN” service (https://service.nalog.ru/inn.do).

5. Next, fill in the following lines: gender, date of birth, place of birth.

Important! The place of birth should be recorded exactly as indicated in the passport (identity document), including abbreviations and punctuation marks.

6. Information about citizenship is entered below (nationals of foreign countries indicate the code of the country of citizenship, Russians do not fill in the country code).

Page 2

1. The address of the citizen's place of registration is indicated.

To fill it out correctly, you should use the codes and abbreviations from the Document Preparation Requirements (Appendix No. 20 to the Federal Tax Service order dated January 25, 2012 No. ММВ-7-6/ [email protected] ):

- Appendix No. 1. Codes of the constituent entities of the Russian Federation (but it’s easier to look up the code of your region on the Internet);

- Appendix No. 2. Names of address objects ().

For subjects of the Russian Federation: Moscow and St. Petersburg (77 and 78) – the “City” line is not filled in.

2. The details of the identity document are recorded.

Wherein:

- for a passport of a citizen of the Russian Federation, the document type code is 21. The remaining codes can be found in Appendix No. 3 to the above Requirements;

- Between the series and the number of the identity document, you must leave a blank space. If there is a space in the document series or number, it should be displayed as an empty cell.

Page 3

To be completed only by foreign citizens and persons without citizenship. Citizens of the Russian Federation do not fill out this page and do not submit it as part of the form.

Sheet A

It is necessary to indicate the OKVED codes of the types of activities that the future entrepreneur plans to engage in.

You can write down any number of codes, but only one of them will be the main one. It is filled out first on the sheet, and it is this code that the entrepreneur will subsequently indicate in tax returns.

Important! The OKVED code cannot contain less than 4 digital characters.

Sheet B

Lines Full name and the applicant’s signature must be filled in exclusively by hand in black ink in the presence of a tax inspector when submitting the application!

There is no need to notarize the signature when submitting the form in person.

Next, you need to indicate the procedure for issuing documents and contact information.

The telephone number must be filled in without spaces or dashes. The landline telephone number is recorded with the area code.

Examples of filling out a telephone number: +7(999)1234567 – for a mobile phone, 8(452)1234678 – for a landline phone.

If the document is sent to the Federal Tax Service electronically, you need to fill in the email address.

Did you like the article? Share on social media networks:

- Related Posts

- Open an individual entrepreneur in Saratov and the Saratov region in 2021

- Open an individual entrepreneur in Samara and the Samara region in 2021

- Open an individual entrepreneur in Perm and the Perm region in 2021

- Open an individual entrepreneur in Nizhny Novgorod and the Nizhny Novgorod region in 2021

- Open an individual entrepreneur in Tula and the Tula region in 2021

- Open an individual entrepreneur in Izhevsk and the Udmurt Republic in 2021

- Open an individual entrepreneur in Ufa and Bashkiria in 2021

- Open an individual entrepreneur in Irkutsk and the Irkutsk region in 2021

Discussion: there is 1 comment

- Zhanna:

04/29/2019 at 02:44Hello! Please tell me where I can get a certificate for opening an individual entrepreneur P21001?

Answer

Leave a comment Cancel reply

What forms will be introduced from November 25

All forms are divided into groups: for legal entities, individual entrepreneurs and peasant farms.

The order approved the following forms for legal entities:

- P11001 - application for state registration of a legal entity upon creation;

- P12003 - notification of the start of the reorganization procedure;

- R12016 - application for state registration in connection with the completion of the reorganization of a legal entity;

- R13014 - application for state registration of changes made to the constituent document of a legal entity, and (or) for changes to information about a legal entity contained in the Unified State Register of Legal Entities;

- R15016 - application (notification) about the liquidation of a legal entity;

- R16002 - application for making an entry in the Unified State Register of Legal Entities on the termination of a unitary enterprise, state or municipal institution.

Individual entrepreneurs can now use three forms:

- P21001 - application for state registration of an individual as an entrepreneur;

- P24001 - application for amendments to information about individual entrepreneurs contained in the Unified State Register of Individual Entrepreneurs;

- P26001 - application for state registration of termination by an individual of activities as an individual entrepreneur.

Two forms have been created for peasant (farm) households:

- P24002 - application for amendments to information about a peasant (farm) holding contained in the Unified State Register of Individual Entrepreneurs;

- P26002 - application for state registration of termination of a peasant (farm) enterprise.

A separate registration form for international companies and funds on the territory of the Russian Federation has been approved:

P18002 - application (notification) about state registration of an international company, international fund.

From November 25, the old forms will be canceled. Some of the new forms did not change their purpose and numbering; only their content was updated. The table shows the ratio of old forms to new ones.

| Old form | New form |

| P11001 | P11001 |

| P12003 | P12003 |

| P12001 and P16003 | P12016 |

| P13001 and P14001 | P13014 |

| P15001 and P16001 | P15016 |

| P16002 | P16002 |

| There were no analogues | P18002 |

| P21001 | P21001 |

| P24001 | P24001 |

| P24002 | P24002 |

| P26001 | P26001 |

| P26002 | P26002 |

Why are new registration forms needed?

Previous application forms for business registration were approved back in 2012, by order N ММВ-7-6 / [email protected] Since then, the regulations for receiving this public service have changed.

In particular, back in 2021, registration sheets from the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities began to be issued to applicants in electronic form, that is, there is no longer any need to come to the tax office or the MFC for them. If an entrepreneur or organization wanted to receive registration documents on paper, with the seal of the Federal Tax Service, then they had to additionally write a corresponding request.

Many problems arose with indicating addresses, especially for legal entities that planned to open in offices of business centers. Abbreviations for many address elements were not provided for in the order, so some applicants entered the address incorrectly.

And individual entrepreneurs sometimes encountered the fact that the registration in their passport was indicated differently from the address listed in a special register. As a result, the Federal Tax Service issued many refusals to register on a formal basis - the unreliability of the address.

In addition, since 2012, the legislation regulating the activities of LLCs has changed. For example, a company may have several directors, and it is not necessary to develop its own charter; you can simply choose from 36 standard options.

To take into account these and other changes in the creation and re-registration of a business, new forms were approved.

Changes to how you fill out forms

The order of the Federal Tax Service not only approved new forms and updated old ones, but also changed the rules for filling them out. Apply the following rules:

- For paper documents, use only black, blue and purple ink, and letters must be in capitals.

- On your computer, install the font Courier New, size 18, color black, capital letters.

- Corrections and additions are prohibited.

- Enter your email address; when the application is reviewed, all documents will be sent to this address. To receive a paper version, you need to make a note about this on the last page of the form.

- Write each character in one familiar place (cell).

Requirements for filling out forms

General requirements for the preparation of documents submitted to the registration authority

1.1. The application, notification or message form (hereinafter referred to as the application) is filled out using software or manually. When using software to complete the application form, characters must be printed in capital letters in 18-point Courier New font. Filling out the application form manually is done in black ink in capital block letters, numbers and symbols.

1.2. Each indicator in the application form corresponds to one field, consisting of a certain number of acquaintances. An exception is made for indicators whose values are date, numbers in the form of a simple or decimal fraction (including percentages), as well as indicators that indicate monetary units, codes according to the All-Russian Classifier of Economic Activities.

1.3. To indicate the date, three fields are used in order from left to right, separated by the sign “.” (“dot”): day (field of two characters), month (field of two characters) and year (field of four characters). In this case, the day and month from the first to the ninth are indicated in two numbers - 01, 02, 03 and so on.

1.4. A simple or decimal fraction corresponds to two fields, separated in the first case by the sign “/” (“slash”), in the second by the sign “.” ("dot"). The first field corresponds to the numerator of the proper fraction (the whole part of the decimal), the second - to the denominator of the proper fraction (the fractional part of the decimal). In this case, the first field is aligned to the right, the second - to the left.

1.5. For an indicator expressed in monetary units (size of authorized (share) capital, authorized (share) fund, nominal value of a share), two fields are used, separated by the sign “.” ("dot"). The first field indicates the value of the indicator, consisting of whole monetary units, the second - from a part of the monetary unit. In this case, the first field is aligned to the right, the second - to the left. If the indicator consists of whole monetary units, the second field (after the dot) is not filled in.

1.6. For an indicator whose value is a code according to the All-Russian Classifier of Economic Activities, three fields are used, separated by the sign “.” ("dot"). The indicator is filled in from left to right in accordance with the digital value of the code according to the All-Russian Classifier of Types of Economic Activities OK 029-2001 (NACE Rev. 1). In this case, at least four digital characters of the code are indicated.

1.7. Indicators containing a digital designation, with the exception of the indicators specified in paragraphs 1.3 - 1.6 of these Requirements, are filled out from left to right, starting from the leftmost sign.

1.8. When filling out the “series and document number” indicator, if there is a series and number in the document, first indicate the series, and then, through an empty space, the number. If there is a space in the series and/or document number, when filling out such details, the space is displayed as an empty sign.

1.8. When filling out the “contact telephone” indicator, the telephone number is indicated without spaces or dashes. The landline telephone number is indicated with the area code. Each bracket and “+” sign is indicated in a separate place.

1.9. The text fields of the application form are filled out from left to right, starting with the leftmost space. When writing a text value consisting of several words or words, numbers, symbols that must be written together, there should not be an empty space between such words (numbers, symbols). When writing a text value consisting of several words or words, numbers, symbols, there must be one empty space between the words (numbers, symbols) that must be written separately. If a text value does not fit on one line of a text field consisting of several lines, writing the text value is carried out taking into account the following: a) at the end of the line, as many characters (letters, numbers, signs) are indicated as will fit in the remaining familiar places, and the remaining characters are filled in from the leftmost familiarity of the next line. The hyphen is not placed in the word. b) a word or several words, a number, a sign are transferred to the next line. In this case, familiar spaces remaining empty on the previous line are defined as a single space. c) if a word (number, sign) ends on the last character space of a line, then the writing of the next word (number, character), which is written separately from the previous word (number, sign), begins from the second character space of the next line, and the first character space remains blank ( empty). It is allowed to fill out a text field using simultaneously several methods of writing a text value specified in this paragraph.

1.10. The presence of corrections or additions (additions) in the application is not allowed.

1.11. Blank sheets, as well as completely blank pages of multi-page sheets of the application form, are not included in the application submitted to the registration authority.

1.12. After filling out the necessary sheets of the application form and completing it, taking into account the provisions of paragraph 1.11 of these Requirements, continuous page numbering is entered in the “Page” field located at the top of the sheet of the application form. The page number indicator, which has three cells, is written as follows: for the first page - 001, for, for example, the sixteenth - 016.

1.13. When printing an application form to be completed manually or when printing an application form completed using software, the display of the form approval information (in the upper right corner of the first sheet of the application form) is not required.

1.14. The font color of the application prepared using the software must be black when printed on a printer.

1.15. When printing the application on a printer, it is allowed that there is no frame for completed and unfilled signs. In this case, changing the location of fields and sizes of familiar spaces is not allowed.

1.16. The application form can be filled out using software that provides a two-dimensional barcode on the application pages when printed.

1.17. Double-sided printing of an application and other documents submitted to the registration authority produced by a legal entity, an individual registered or registered as an individual entrepreneur, or a peasant (farm) enterprise is not allowed.

1.18. The application is certified by the signature of an authorized person (applicant). The application may be certified by the signatures of several applicants. In this case, the application sheet “Information about the applicant” is filled out for each applicant and signed by the specified person. The authenticity of the applicant's signature (applicants' signatures) on the application must be notarized, except for the case provided for in paragraph four of this paragraph. Certification of the signature of an individual registered or registered as an individual entrepreneur, as well as the head of a peasant (farm) enterprise on a notarial application is not required if the specified individual submits documents directly to the registration authority and simultaneously presents an identification document.

The “General Requirements” section applies to all P forms. In addition to general instructions, the Federal Tax Service Order offers a detailed description of the rules for filling out individual forms, which helps prevent possible errors and refusals during registration. all new forms in Word format.

IT IS IMPORTANT

Changes in document forms

Most of the forms have been modified to meet modern requirements. In this regard, new lines have been added in which certain information must be indicated.

In the forms, blocks with addresses of organizations and individual entrepreneurs have been made more complex. Now it is necessary to indicate the address in full accordance with the State Address Register, indicating, if available, the following data:

- The subject of the Russian Federation;

- type of municipality;

- locality;

- planning structure element;

- element of the road network;

- building/structure;

- premises - within a building, structure or apartment.

Also, in some forms (for example, P21001) a special line was added where it is necessary to note which body the applicant applied to - the MFC or the Federal Tax Service.

Amendments to the address columns of applications

When registering a business, changing the Charter (Unified State Register of Legal Entities), changing the address, current forms require indicating the address of the executive body of the legal entity. Address and location are considered synonymous. Now these concepts have been separated, the reference to a permanent executive body has been removed and some of the points have been renamed. When filling out the “location of legal entity” section, the applicant indicates the subject of the Russian Federation, the type and name of the settlement, city, village, village, and so on. After this, the address of the company is written within the location: subject, district, district, settlement (settlement, city, village, village, and so on) and, finally, elements of the planning structure and road network. According to the Civil Code of the Russian Federation and Order of the Ministry of Construction No. 738/pr, elements of the planning structure are considered districts, blocks, microdistricts, street and road networks, etc. Elements of the road network include streets, boulevards, squares, and so on. And here confusion can arise when a town, city, village or village is not divided into districts or blocks. In this case, the street is considered both an element of the planning structure and the road network.

Next, when filling out the “building” column, you will need to record the type: possession, house, structure, building, letter, and so on. And finally, if the company is registered in an apartment, then the applicant indicates the premises within its boundaries: “room, premises, etc.” This is "etc." looks strange. Typical Russian apartments are not divided into dining rooms, living rooms or offices. Therefore, it is not clear what other premises can be specified within a standard “Khrushchev” or three-room apartment.

Form P11001 - on registration of a legal entity

Several new lines have been added to the form for the following information:

1. The organization operates on the basis of a standard charter.

All standard charters are presented in Order of the Ministry of Economic Development of the Russian Federation dated August 1, 2020 No. 411.

2. Several persons are authorized to act on behalf of a legal entity.

3. The participants entered into a corporate agreement.

Additionally, the applicant has the opportunity to restrict access to information about the company in the Unified State Register of Legal Entities. To do this, you need to fill out sheet 3 of the form, indicating the grounds provided for by Federal Law No. 290-FZ dated 03.08.2018 or Decree of the Government of the Russian Federation dated 06.06.2019 No. 729.

You can limit access to information, for example, to the following companies:

- organizations subject to foreign sanctions;

- credit institutions providing banking support for state defense orders;

- legal entities located in the Republic of Crimea or Sevastopol.

Form P120016 - on state registration in connection with the completion of the reorganization of a legal entity

The list of reorganization methods has been supplemented with number 6, “Simultaneous combination of various forms of reorganization.” Lines have also been added to indicate the following information:

- the organization uses a standard charter;

- Several persons are authorized to act on behalf of a legal entity;

- A corporate agreement has been concluded between the participants.

You can restrict access to information about the succession and founders of the organization. The reasons for this should be specified in section 3.

Form R13014 - on state registration of changes in constituent documents or changes in information in the Unified State Register of Legal Entities

The form combined the old forms P13001 and P14001.

A new basis for filing form P13014 has been added. The form must be submitted to the Federal Tax Service if the organization has started or stopped using the standard charter. There are now columns for the following information:

- the company operates on the basis of a standard charter;

- several persons act on behalf of the LLC;

- A corporate agreement has been concluded between the participants.

Access to information can also be restricted. To do this, fill out sheet M. In addition, on page 5 of sheet E, a section has appeared on information about collateral management.

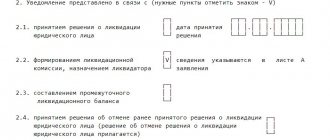

Form P15016 - on liquidation of a legal entity

The form combined two old forms - P15001 and P16001. There are two new grounds for filing an application:

- the liquidation period of the LLC has been extended;

- The organization has completed the liquidation process.

If there are grounds, access to information about the company can be limited by filling out sheet B. On page 2 of sheet B, you now need to confirm that the organization has made all payments due to its employees.

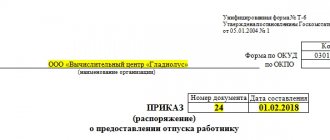

Form P21001 - on state registration of an individual as an individual entrepreneur

There are no major changes. On the title page, Russians indicate their full name only in Russian. Foreigners and stateless persons write their full name in Russian, then repeat it in Latin.

The data on the passport and place of residence were swapped. Now the first thing to fill in is your passport details. Foreigners and stateless persons indicate a document permitting stay on the territory of the Russian Federation. A separate line has been added in which it can be noted that the document is valid indefinitely.

Found documents on the topic “replenishment of the authorized capital of a private company 2018”

- Sample. Extract from the minutes of the general meeting of shareholders on changes in the authorized capital (appendix to the regulations on the procedure for increasing (decreasing) the authorized capital of an open joint-stock company) Documents of the enterprise's office work → Sample.

Extract from the minutes of the general meeting of shareholders on changes in the authorized capital (appendix to the regulations on the procedure for increasing (decreasing) the authorized capital of an open joint-stock company) to the regulations on the procedure for increasing (decreasing) the authorized capital of the joint-stock company (name of the joint-stock company) extract from the minutes of the general meeting of shares... - Example (sample) of a completed reduction decision statutory capital OOO

Founding agreements, charters → Example (sample) of a completed decision to reduce the authorized capital of an LLC...th participant of the company - limited liability company "", (address: , ogrn, inn) owner of a share in the authorized capital of the company in the amount of 100% (one hundred percent) of the authorized capital of the company, with a nominal value of 15,000.00 rubles. (fifteen...

- Sample. Map of the register of founders' contributions to statutory capital liquidated enterprise

Accounting statements, accounting → Sample. Map of the register of contributions of founders to the authorized capital of a liquidated enterprise+-+ +-+ +-+ +-+ form of ownership real estate registry number map of the register of founders’ contributions to the authorized capital of the liquidated enterprise full name of the enterprise: authorized capital , in thousand rubles: +-+ no.n…

- Example (sample) of a notice to creditors of a reduction statutory capital OOO

Founding agreements, charters → Example (sample) of notification to creditors of a reduction in the authorized capital of an LLC...EU:) notifies you that in 2020 the sole participant of the LLC made a decision to reduce the authorized capital of the company to (decision No. dated 201). claims of the company's creditors can be submitted to the address: . ...

- Example (sample) of a completed reduction protocol statutory capital OOO

Founding agreements, charters → Example (sample) of a completed protocol on reducing the authorized capital of an LLC... were present: 1. limited liability company "", (inn, ogrn; address: ) - owns a share in the authorized capital of the company in the amount of 25% of the authorized capital of the company, with a nominal value of 5,000.00 (five thousand rubles) rubles, in ...

- Sample. Payment transaction financing agreement statutory capital

Debt and loan agreement → Sample. Agreement on financing the operation to pay the authorized capitalcontract no. on financing the operation to pay for the authorized capital of the year “” 20, we refer to (name of the commercial bank) hereinafter as “bank”, represented by (position...

- Sample. Regulations on the order of increase (decrease) statutory capital joint stock company (standard form)

Founding agreements, charters → Sample. Regulations on the procedure for increasing (decreasing) the authorized capital of a joint stock company (standard form)... approved by the board of directors of the joint-stock company "" in 20, the regulation on the procedure for increasing (decreasing) the authorized capital of the joint-stock company 1. general provisions 1.1. The authorized capital is the company's own capital . ...

- The act of acceptance and transfer of non-monetary contribution to statutory capital Limited Liability Companies

Founding agreements, charters → Certificate of acceptance and transfer of non-monetary contribution to the authorized capital of the Limited Liability Companyact of acceptance and transfer of non-monetary contribution to the authorized capital of a limited liability company, 201, this act is drawn up in that the founder ...

- Sample. Agreement on depositing the share amount into statutory capital jar

Debt and loan agreement → Sample. Agreement on contribution of the share amount to the authorized capital of the bankcontract no. on the contribution of the amount of the share to the authorized capital of the bank of the city "" 20, hereinafter (name of the enterprise) referred to as enterprise-1, represented by , (should ...

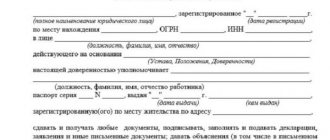

- Example (sample) of a power of attorney to receive documents on reduction statutory capital OOO

Founding agreements, charters → Example (sample) of a power of attorney to receive documents on reducing the authorized capital of an LLCPOWER OF ATTORNEY "" 201 Limited Liability Company "" (OGRN

- Sample. Map of the register of property contributions of the enterprise in statutory capital established enterprises

Accounting statements, accounting → Sample. Map of the register of property contributions of an enterprise to the authorized capital of established enterprises…+-+ +-+ +-+ +-+ form of ownership real estate registry number map of the register of property contributions of the enterprise to the authorized capital of established enterprises full name of the enterprise: +-+ no. name- type place right to the document, ID...

- Minutes of the general meeting of founders of a limited liability company (payment of authorized capital is made in cash)

Founding agreements, charters → Minutes of the general meeting of founders of a limited liability company (payment of authorized capital is made in cash) - Sample. Statement on replenishment (removal) of a permanent supply of tools (devices). Form No. MB-1

Accounting statements, accounting → Sample. Statement for replenishment (withdrawal) of a permanent stock of tools (devices). Form No. MB-1... by the resolution of the State Statistics Committee of the USSR dated December 28, 1989 no. 241 +-+ (enterprise, organization) code for payroll +-+ statement of replenishment for - permanent stock of tools withdrawal (devices) +-+ number date code corresponding account until...

- The decision to create an individual private enterprises

Founding agreements, charters → Decision to create an individual private enterpriseoption decision to create an individual private enterprise I,, resident (full name) (full address of permanent residence) passport series:n issued/m r…

- Agreement for the sale and purchase of shares in statutory capital

Founding agreements, charters → Agreement for the sale and purchase of a share in the authorized capitalagreement for the sale and purchase of a share in the authorized capital of the city of Moscow, September twenty-eighth two thousand and ten we, a citizen of the Russian Federation Ivanov and...

Form R24002 - on state registration of information about peasant farms in the Unified State Register of Individual Entrepreneurs

The number of sheets in the form has changed. Previously, there was a title page and seven sheets from A to G, now only the title page and sheets from A to C remain. Sheet A of the new form combines information from sheets A, B, C, D and D. Now it indicates:

- the reason for entering the information;

- information about the head of the peasant farm;

- information about citizenship;

- information about the identity document;

- address of residence in the Russian Federation;

- information about a document confirming the right of a foreigner to reside in the territory of the Russian Federation.

Sheet E with OKVED codes in the new version became sheet B, and sheet J became sheet C.

Reducing the number of applications and reducing the number of pages

The Federal Tax Service of the Russian Federation has reduced the number of applications submitted to the authorized Inspectorate of the Federal Tax Service when registering legal entities, individual entrepreneurs and amending the Charter (Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs). Instead of 19 forms, there will now be 12. The regulator has either excluded forms and pages (for example, reporting information about a legal entity registered before 2002, an application to terminate the activities of an affiliated legal entity, information about the formation of a liquidation commission and the appointment of a liquidator, etc.), or combined them (application for amendments to the constituent documents and application for amendments to the Unified State Register of Legal Entities, application and notification of liquidation of a legal entity, etc.). In addition, the document's developers have combined some pages in the statements. Thus, from November 25, 2021, a single page will appear for entering data on foreign and Russian founders (P11001 Sheet A).

Form P18002 - on state registration of an international company, international fund

This is a new form. It is served in the following cases:

- state registration of a legal entity in connection with a change in personal law through the procedure of redomiciliation (change of country of registration);

- termination of the status of an international company;

- the intention of an international company to change personal law in connection with registration in a foreign country through the procedure of redomiciliation;

- exclusion of an international company from the Unified State Register of Legal Entities due to registration in a foreign state through the procedure of redomiciliation;

- state registration of a legal entity in the order of incorporation.

The form indicates the reason for the submission, data of the legal entity, information about participants/founders, types of economic activity, branches and representative offices. Additionally, you can restrict access to information by indicating the reasons for this on sheet E.