Blog about taxes by Vladimir Turov

Good afternoon, colleagues.

A large-scale law has been adopted that has introduced many, many amendments to the Tax Code: this is Federal Law No. 424-FZ of November 27, 2021 . What changes does this Federal Law make to the Tax Code?

About penalties . Changes to Article 75 of the Tax Code of the Russian Federation : penalties must be transferred for the day of their repayment, inclusive. The total amount of penalties cannot now exceed the amount of the debt.

About value added tax. Article 49 of the Tax Code of the Russian Federation has been amended: services for managing sea-going vessels and river-sea vessels are exempt from VAT.

Services for the repair and maintenance of goods, including medical ones, including the cost of spare parts, parts, etc., are also exempt from VAT.

to Article 161 of the Tax Code of the Russian Federation : the rules for determining the tax base for VAT for the sale of raw hides, scrap, waste of ferrous and non-ferrous metals, and secondary aluminum have been clarified. By the way, now paragraph 8 of Article 161 of the Tax Code of the Russian Federation has been written more clearly. And there’s a lot in this article that I still don’t understand... It’s a very thick law...

to Article 170 of the Tax Code of the Russian Federation . The procedure for assigning amounts to expenses has been changed. We are talking about receiving subsidies or investments from the budget: you cannot deduct VAT on the amount of such a purchase.

About personal income tax. Amendments were made to Articles 208 of the Tax Code of the Russian Federation and 211 of the Tax Code of the Russian Federation . The news is bad. Now, if you, as the founder of a legal entity, leave the founders, or liquidate your company, you will have to pay personal income tax on all income received in kind from the liquidation, or if the founder leaves, you will have to pay personal income tax on all rubles. Those. Dividend tax will now have to be paid. I quote: “For the purposes of this chapter, income in the form of dividends is equivalent to income in the form of excess of the amount of funds, the value of other property (property rights) received by a shareholder (participant) of a Russian organization upon exit (disposal) from the organization or upon distribution of property of a liquidated organization between its shareholders (participants), over the expenses of the corresponding shareholder (participant) for the acquisition of shares (shares, units) of the liquidated organization.” It doesn’t matter what organization we leave, it doesn’t matter what we liquidate, if the authorized capital was 10,000 rubles, and you receive 1 million rubles, then you will have to pay personal income tax on 990,000. This didn’t happen before, but now the state has decided to “rip off” this money...

Article 220 of the Tax Code of the Russian Federation has a similar topic. You can reduce the amount of personal income tax, i.e. tax base for the amount of your expenses, if there are documented expenses for the formation of the authorized capital or for the contribution of property to the authorized capital. The situation is the same for foreign organizations.

About foreign companies . A huge number: in Article 7 of the Tax Code of the Russian Federation, in Article 25.13 of the Tax Code of the Russian Federation, in Articles 306, 309 and 312 of the Tax Code of the Russian Federation .

to Article 83 of the Tax Code of the Russian Federation : in cases not specified in the Tax Code, the specifics of registration will be determined depending on the volume of income, the average number of employees and the value of the company’s assets.

Of the entire law, I would like to draw your attention to two key changes, which, in my opinion, are the most important.

First . A new procedure for determining the tax base for value added tax when trading ferrous and non-ferrous scrap metals, raw animal skins, as well as waste paper.

Second . Payment of personal income tax in the amount of 13% upon leaving the founders or liquidation of the organization.

All other amendments are not so significant for most businessmen. So, this was a brief overview of Federal Law No. 424-FZ of November 27, 2021 .

If the information was useful to you, like it and subscribe to my blog: I give an honest analysis of the legislation of the Russian Federation.

In the next article you will learn about the new anti-terrorism bill.

Thank you, good luck with your business.

Links to the regulatory framework:

Federal Law No. 424-FZ of November 27, 2018

SIGN UP FOR A SEMINAR IN MOSCOW ON DECEMBER 25-26

(Visited 502 times, 1 visits today)

Vladimir Turov

Head of legal practice, practicing and leading specialist in tax planning, building individual tax schemes and holdings, optimizing financial flows.

How to calculate net assets and fair value of a share

The actual value of the share upon withdrawal of a participant must be calculated on the basis of the net assets (NA) of the company. Therefore, you first need to understand the financial statements.

A balance sheet is a form of reporting by which one can judge the state of affairs in a company. It contains information about the value of the company's property and its liabilities. The balance sheet looks like a table. It contains two parts: active and passive.

The asset shows the working and fixed capital of the company. This is the monetary expression of what the company has, including buildings, transport, equipment, etc.

This is what the balance sheet looks like. An asset consists of two sections: I. “Non-current assets” and II. "Current assets"

Liability is the company's capital and reserves, i.e. its own funds. And also its obligations: short-term and long-term. Long-term include loans, credits and other debts that need to be repaid for more than 1 year. Short-term - debt to employees, suppliers and creditors that can be repaid within a year.

The liability shows from what sources the company was able to obtain assets.

Liabilities occupy three sections in the accounting report: III. "Capital and Reserves", IV. “Long-term liabilities”, V. “Short-term liabilities”

The essence of balance is the equality of the company's resources, i.e. assets, and their sources - liabilities. Therefore, if the balance sheet is drawn up without errors, the totals of assets and liabilities will always be equal. If, when drawing up a balance sheet, equality does not work out, the accountant looks for an error until the asset and liability become the same.

Net assets are the difference between the assets and liabilities of the company according to the balance sheet (Order of the Ministry of Finance of the Russian Federation dated August 28, 2014 No. 84n).

Assets are the total of the balance sheet assets, and liabilities are the sum of Section IV. “Long-term liabilities” and V. “Short-term liabilities”.

Since assets and liabilities are equal, when sections IV and V are subtracted from liabilities, net assets remain. There are three sections in total: III, IV and V. Therefore, it turns out that net assets are the result of Section III of the balance sheet (“Capital and reserves”).

HA = A – r. IV – r. V = r. III

A - balance sheet asset (equal to liability).

R. IV is the result of the “Long-term liabilities” section.

R. V is the result of the “Short-term liabilities” section.

Let's calculate net assets using the example of the balance sheet for Start LLC.

Example of a balance sheet for Start LLC

For the example balance sheet, net assets as of December 31, 2019 will be equal to:

HA = A – r. IV – r. V = 2,180 – 0 – 940 = 1,240 thousand rubles

This amount corresponds to the total of Section III of the balance sheet as of December 31, 2019.

Order 84n allows you to exclude a number of assets and liabilities. This can be done when:

- the founders did not fully pay contributions to the authorized capital;

- the organization received the property free of charge;

- the organization uses government assistance.

But in most cases, we can assume that the company’s net assets are the result of section III of the balance sheet.

The actual value of the share is the part of the net assets that corresponds to the share of the participant leaving the company in the authorized capital (Clause 2 of Article 14 of Law No. 14-FZ).

Thus, upon exit, the former co-owner will not receive his initial contribution, but a share in the amount that the company earned during the time he participated in management.

When creating Start LLC, an authorized capital (AC) was formed in the amount of 10 thousand rubles. Ivanov A.A. contributed 7 thousand rubles (70% of the authorized capital), and Petrov V.S. - 3 thousand rubles (30% of the authorized capital). Two years later, Petrov decided to leave the society. The company's net assets by this time were equal to 200 thousand rubles. Therefore, upon exiting Petrov should receive:

DCI = 200 × 30% = 60 thousand rubles

The amount of net assets must be determined from the financial statements for the last reporting period on the eve of the date of the participant’s withdrawal from the company. For most legal entities, only annual reporting is mandatory (Article 13 of Law No. 402-FZ).

But for some types of organizations, such as insurance companies, quarterly financial reporting is required. Also, the company can generate accounting reports more often than once a year by decision of the owners.

Let's assume that a member submits his/her resignation from the society in May 2021. If a company submits financial statements once a year, then net assets and DCI will need to be calculated according to the balance sheet as of December 31, 2019. And if the law or the decision of the founders provides for quarterly reporting, then for the calculation it is necessary to take the balance sheet as of 03/31/2020.

Exiting participants are not always satisfied with the amount of DDI calculated on the basis of the balance sheet: the book value and market value of assets may differ significantly from each other. Such deviations are typical for real estate and various intangible assets: software products, trademarks, patents, etc.

If a participant does not agree with the amount of payment, he can appeal it in court and demand recalculation of the DDI at the market value of assets (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 17, 2012 No. 16191/11).

What are the restrictions on paying the actual value of a share?

DSD does not always have to be paid when a participant leaves. The law has several conditions under which payment can be made:

- The participant has fully paid for his share in the authorized capital.

- The company should not meet the signs of bankruptcy, and they should not appear after payment. The court may declare a company bankrupt under the following conditions:

- payments are overdue for more than three months;

- the total amount of debt exceeds 300 thousand rubles.

- The difference between net assets and authorized capital is sufficient to pay DSD.

Let's take a closer look at the last condition. A participant who leaves the company receives his share from the net assets. In fact, the funds are paid to him from the net profit accumulated by the company during its work.

In any case, the company's net assets must be greater than its authorized capital. Therefore, the exiting participant can receive an amount that does not exceed the difference between the current value of net assets and the authorized capital (Clause 8, Article 23 of Law No. 14-FZ). If this difference is not enough, then you must first reduce the authorized capital and then settle accounts with the retiring founder.

To reduce the authorized capital, the founders must hold a meeting, make a decision and send documents to the tax office. Tax officials will enter information about the reduction of authorized capital into the state register.

The authorized capital can only be reduced to the minimum established by law. Consequently, the maximum possible amount that an exiting participant can count on is equal to the difference between current assets and the minimum authorized capital. In general, for an LLC the minimum authorized capital is 10 thousand rubles (Article 14 of Law No. 14-FZ).

For certain types of activities, the authorized capital should be significantly higher. For example, for vodka producers - no less than 80 million rubles (Article 11 of Law No. 171-FZ), and for insurance companies - no less than 120 million rubles (Article 25 of Law No. 4015-1). Therefore, when opening a new business, check the authorized capital standards for your type of activity.

A participant leaves Alfa LLC, whose share in the management company is 40%. The company's net assets, according to the latest report, are 300 thousand rubles, the authorized capital is 200 thousand rubles. The amount that the exiting participant must receive is:

DCI = 300 × 40% = 120 thousand rubles

But if you subtract the payment amount from net assets, it turns out that they will become less than the authorized capital:

NA = 300 – 120 = 180 thousand rubles

Therefore, the company cannot immediately pay off the withdrawing participant. First you need to reduce the authorized capital to 180 thousand rubles, and only then can you make payments.

News

Question: A participant leaves the LLC in January 2018. The company pays the actual value of the share to the participant partially in property. The share was acquired by an individual before 2010 and belonged to him for more than 5 years. Is it correct that this income is not tax-free in accordance with clause 17.2 of Art. 217 (which in our case is subject to the condition of acquiring a share after 01/01/2011). Can a participant take advantage of a tax deduction under paragraphs. 2 p. 2 art. 220 in the absence of documented expenses for the acquisition of shares in the amount of 250 tr, if the size of the share in the management company was 10 tr?

Answer from the Consultation Line expert:

— Payment to an individual of the actual value of a share upon leaving an LLC (in cash or in the form of property of the same value) is not subject to personal income tax if the share in the authorized capital has continuously belonged to this participant by right of ownership (other property right) for more than five years (clause 17.2 Article 217 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated November 9, 2018 N03-04-06/80846).

Otherwise, the LLC calculates and withholds personal income tax from the specified payment (clause 1 of Article 210, clauses 1, 2 of Article 226 of the Tax Code of the Russian Federation).

If the holding period is shorter, the participant must show the income in the 3-NDFL declaration and calculate the tax himself. Income from the sale of a share can be reduced by the costs of its acquisition or by a fixed deduction of 250,000 rubles. (clause 17.2 of article 217, clause 2 of article 220 of the Tax Code of the Russian Federation).

It is necessary to submit a 3-NDFL declaration to the tax authority in connection with the sale of a share in the authorized capital of Russian organizations if the share was acquired earlier than 01/01/2011 and sold before November 27, 2018, or if the period of continuous ownership of it is less than five years (Article 216, p. 17.2 Article 217, paragraph 2 paragraph 1, paragraph 3 Article 228 of the Tax Code of the Russian Federation; Part 7 Article 5 of the Law of December 28, 2010 N 395-FZ; Article 3, Part 1, 11 Article 9 Law of November 27, 2018 N 424-FZ).

As a general rule, if you are a tax resident of the Russian Federation, from 01/01/2016, when selling a share in the authorized capital, you have the right to reduce the amount of taxable income by the amount of actually incurred and documented expenses associated with its acquisition (clause 3 of article 210, clause 1 clause 1, clause 2 clause 2 article 220 of the Tax Code of the Russian Federation; clause “b” clause 2 article 1, clause 2 article 2 of the Law of 06/08/2015 N 146-FZ).

Payment of personal income tax and submission of the 3-NDFL declaration when selling a share in an LLC

Income from the sale of a share that you owned for no more than five years, as well as a share acquired before 01/01/2011 and sold before November 27, 2018, is subject to personal income tax at a rate of 13% if you are a tax resident of the Russian Federation, or 30% if you are not you are such (clauses 1, 3, article 224 of the Tax Code of the Russian Federation; part 7, article 5 of the Law of December 28, 2010 N 395-FZ; article 3, part 1, 11 of article 9 of the Law of November 27, 2018 N 424-FZ).

When receiving such income, you need (clause 2 of article 226, clause 2 of clause 1, clauses 2, 4 of article 228, clause 1 of article 229 of the Tax Code of the Russian Federation):

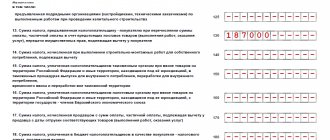

1. Fill out and submit the 3-NDFL declaration to the tax authority no later than April 30 of the year following the year of sale of the share.

If April 30 falls on a weekend or non-working holiday, then the declaration must be submitted no later than the next working day. The declaration must be submitted to the tax office at your place of residence. This can be done in person or through a representative, by post with a list of attachments or in electronic form.

If you submit the declaration in person, prepare it in two copies. One copy will remain with the inspection, and on the second the inspector will put a mark of acceptance indicating the date of receipt and return it to you. If the declaration is submitted by a representative, then he must have a notarized power of attorney from you. If you send a declaration by mail with a description of the attachment, the date of submission of the declaration will be the date it was sent by mail (clause 3 of article 29, clause 4 of article 80 of the Tax Code of the Russian Federation).

2. Pay personal income tax yourself no later than July 15 of the year following the year of receipt of income (clause 4 of article 228 of the Tax Code of the Russian Federation).

You can check your tax payment details with your tax office. You can also generate a payment document using the “Payment of Taxes for Individuals” service, or pay tax through the taxpayer’s personal account on the official website of the Federal Tax Service.

If you want to study this issue in more detail, we have prepared materials on this topic for you:

- Letter of the Ministry of Finance of Russia dated November 9, 2018 N 03-04-06/80846

- Ready-made solution: How income from participation in organizations is taxed with personal income tax (ConsultantPlus, 2019) {ConsultantPlus}

- {Typical situation: How to account for the sale of a share in the authorized capital of an LLC (Glavnaya Kniga Publishing House, 2019) {ConsultantPlus}}

- Situation: How to fill out the 3-NDFL declaration when selling a share in the authorized capital? (“Electronic magazine “ABC of Law”, 2019) {ConsultantPlus}

- Situation: How is the sale of a share in the authorized capital of an LLC taxed? (“Electronic magazine “ABC of Law”, 2019) {ConsultantPlus}

- Situation: What are the deadlines for filing a declaration in Form 3-NDFL and paying tax? (“Electronic magazine “ABC of Law”, 2019) {ConsultantPlus}

Withdrawal from the founders and transfer of shares: procedure for calculating personal income tax

An individual - the founder of an LLC, who is also its employee, plans to either leave the founders (transfer the share to the company) or sell the share to a third party (individual).

What is the procedure for calculating personal income tax in these cases? 07/15/2015 Author: Expert of the Legal Consulting Service GARANT Lazukova Ekaterina

Having considered the issue, we came to the following conclusion:

Both upon leaving the founders and in the event of selling a share to a third party, the taxpayer (former founder) will have income subject to personal income tax at a rate of 13%. However, in the first case, all responsibilities for calculating this tax, paying it to the budget and submitting reports (3-NDFL declaration) must be fulfilled by the former founder independently, and in the second case, these responsibilities are assigned to the company.

Rationale for the conclusion:

In accordance with Art. 209 of the Tax Code of the Russian Federation, income received from sources in the Russian Federation is subject to personal income tax. Income for the purpose of calculating personal income tax is recognized as an economic benefit in cash or in kind, taken into account if it is possible to evaluate it and to the extent that such benefit can be assessed, and determined in accordance with Chapter 23 of the Tax Code of the Russian Federation (Article 41 of the Tax Code of the Russian Federation).

When determining the tax base for personal income tax, all income of the taxpayer received by him, both in cash and in kind, or the right to dispose of which he has acquired, is taken into account, as well as income in the form of material benefits, determined in accordance with Art. 212 of the Tax Code of the Russian Federation (clause 1 of Article 210 of the Tax Code of the Russian Federation).

Sale of a share to a third party

Subclause 5 of clause 1 of Art. 208 of the Tax Code of the Russian Federation directly establishes that income from the sale of shares in the authorized capital is subject to personal income tax. Due to the fact that in this case the seller is a tax resident of the Russian Federation (clause 2 of Article 207 of the Tax Code of the Russian Federation), the income in question from the sale of the share is subject to personal income tax at a rate of 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation).

The taxpayer-seller of the share is obliged to calculate and pay personal income tax on the income received independently (clause 2, clause 1, article 228 of the Tax Code of the Russian Federation) no later than July 15 of the year following the year in which the income from the sale of the share was received (clause 6 Article 227 of the Tax Code of the Russian Federation). In addition to the obligation to pay tax, the founder who sells his share also has the obligation to submit to the tax authority (at the place of his registration) a declaration in form 3-NDFL (approved by order of the Federal Tax Service dated December 24, 2014 No. ММВ-7-11/ [email protected] ). The tax return is submitted no later than April 30 of the year following the year in which the sale transaction in question occurred (Clause 1, Article 229 of the Tax Code of the Russian Federation).

Please note that the company in which the share is being sold has nothing to do with the payment of personal income tax in this case, even despite the fact that the former founder is its employee. Therefore, the company does not need to reflect the income in question from the sale of the share in 2-NDFL certificates (Article 226 of the Tax Code of the Russian Federation). The same applies to the income tax return (the sale and purchase transaction in question does not apply to income tax at all).

We also want to note that in accordance with the second paragraph of paragraph. 2 p. 2 art. 220 of the Tax Code of the Russian Federation, the taxpayer (former founder) has the right to reduce the amount of income received from the sale of a share (part thereof) in the authorized capital of an organization by the amount of expenses actually incurred by him and documented expenses associated with obtaining these property rights. See also letters of the Ministry of Finance of Russia dated September 18, 2012 No. 03-04-08/3-306, dated December 6, 2012 No. 03-04-05/4-1370, dated June 28, 2011 No. 03-04-05/3-452, Federal Tax Service of Russia dated December 12, 2012 No. ED-4-3/ [email protected] To do this, simultaneously with the tax return in Form 3-NDFL, copies of documents confirming expenses incurred related to receiving income from the sale of the share (part of it) should be submitted to the tax authority ) in the authorized capital. Such documents may be:

— memorandum of association (initial agreement for the purchase and sale of a share);

— act of acceptance and transfer of property, if property was made as a contribution to the authorized capital;

— extract from the Unified State Register of Legal Entities;

— bank statement confirming the deposit of funds into the authorized capital into the current account;

— receipts for the cash receipt order for the contribution of money to the authorized capital;

— documents confirming payment for notary services, commission to the registrar for the transaction, etc.;

— documents confirming the reorganization of a limited liability company, etc.

See letters of the Ministry of Finance of Russia dated March 26, 2012 No. 03-04-05/3-372, dated April 8, 2011 No. 03-04-05/3-240, dated November 27, 2008 No. 03-04-06-01/355, dated 06/26/2008 No. 03-04-05-01/223, dated 03/02/2007 No. 03-04-06-01/54, Federal Tax Service of Russia for Moscow dated 05/04/2008 No. 28-10/ [email protected]

At the same time, the tax authority has the right to require other documents (not listed above), which, in its opinion, can confirm the expenses actually incurred by the taxpayer, since their specific list is not defined by law (letter of the Ministry of Finance of Russia dated May 31, 2010 No. 03-04-05/ 7-299).

Transfer of share to the company upon withdrawal of a participant

First of all, we draw your attention to the fact that when a participant leaves the company, his share is not sold. Let me explain.

By virtue of paragraph 1 of Art. 94 Civil Code of the Russian Federation, clause 1, art. 26 of the Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies” (hereinafter referred to as Law No. 14-FZ), a participant in a limited liability company has the right to leave the company by alienating a share to the company, regardless of the consent of its other participants or the company by filing applications for leaving the company, if such a possibility is provided for by the company's charter. In this case, the participant’s share passes to the company from the moment the company receives the relevant application. The company is obliged to pay to the company participant who submitted an application to leave the company the actual value of his share in the authorized capital of the company (clause 2 of article 94 of the Civil Code of the Russian Federation, clause 6.1 of article 23 of Law No. 14-FZ).

Currently, the official bodies have a strong position according to which the actual value of the share paid to a participant leaving the company is subject to personal income tax on a general basis on the full amount of income paid. For example, see letters from the Ministry of Finance of Russia dated June 15, 2012 No. 03-04-06/3-170, dated May 10, 2012 No. 03-04-05/3-615, dated April 25, 2012 No. 03-04-05/3-547 , dated 08/09/2010 No. 03-04-06/2-174, dated 06/21/2010 No. 03-04-06/2-126, dated 05/24/2010 No. 03-04-05/2-287, dated 03/02/2010 No. 03-04-06/2-19, dated December 29, 2009 No. 03-04-05-01/1032, dated October 9, 2006 No. 03-05-01-04/290, dated October 4, 2004 No. 03-05- 01-04/33, Federal Tax Service of Russia for Moscow dated 09/30/2010 No. 20-14/4/102611 *(3).

As in the first case, taxation is carried out at a rate of 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation).

According to paragraph 1 of Art. 226 of the Tax Code of the Russian Federation, Russian organizations from which or as a result of relations with which the taxpayer received income are required to calculate, withhold from the taxpayer and pay the amount of personal income tax.

The exception is income for which tax is calculated and paid in accordance with Articles 214.1, 227 and 228 of the Tax Code of the Russian Federation. Income in the form of the actual value of the share does not apply to the income provided for by the specified articles of the Tax Code of the Russian Federation.

Therefore, the organization, in relation to such income of the taxpayer, is a tax agent and is obliged to calculate, withhold from the taxpayer and pay the amount of personal income tax in the generally established manner, as well as submit the relevant information to the tax authority in form 2-NDFL. In addition, see letters of the Ministry of Finance of Russia dated June 21, 2010 No. 03-04-06/2-126, dated March 2, 2010 No. 03-04-06/2-19, resolutions of the Federal Antimonopoly Service of the Moscow District dated September 14, 2011 No. F05-8492/11 on case No. A40-123140/2010, Tenth Arbitration Court of Appeal dated May 14, 2012 No. 10AP-955/12.

Please note that the possibility of applying tax deductions specified in Art. 218-221 of the Tax Code of the Russian Federation, is not provided for the case under consideration. That is, personal income tax must be paid on the entire amount of income received (the actual value of the share). In addition, see letters of the Ministry of Finance of Russia dated June 17, 2014 No. 03-04-05/28920, dated October 28, 2013 No. 03-04-07/45465, decisions of the Tenth Arbitration Court of Appeal dated May 14, 2012 No. 10AP-955/12, dated June 6. 2011 No. 09AP-9552/11, as well as the resolution of the Federal Antimonopoly Service of the Moscow District dated September 14, 2011 No. F05-8492/11.

We also draw your attention to the fact that the date of receipt of the income in question is considered the day of actual payment of the actual value of the share (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Therefore, personal income tax is calculated and withheld only when the share is actually paid to the former participant. If, in violation of civil law, the cost of the share is not paid to the participant, personal income tax does not need to be calculated and withheld.

GUARANTEE

Post:

Comments

ADIM

July 18, 2015 at 9:11 pm

At the beginning of the article in the output, “first” and “second” should be swapped...

Valery

July 20, 2015 at 3:33 pm

That is, if upon creation, I contributed my share in monetary or property terms (with which all taxes were paid even before the creation of the company), then upon exit, if the share is returned to me in exactly the same quantity (amount), I must Should I pay 13% from it?

Or, nevertheless, from the difference - “the share received upon exit is the share contributed during creation.”