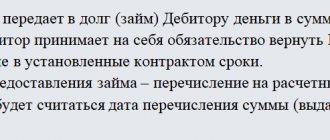

Lending money to a legal entity must be accompanied by a special agreement. This document indicates the loan amount and the timing of its repayment. However, the borrower does not always have the opportunity to return the money by the end of the contract.

In this case, he can pay the creditor in another way. However, for this it is necessary to conclude a debt novation agreement. You need to figure out what kind of document this is, how it is regulated at the legislative level and what it is needed for.

The meaning of the event

Debt may be generated by a company for a paid advance for the upcoming supply of goods, provision of services, or performance of work. A receivable is formed by the supplier at the time of shipment of materials in favor of the counterparty, transfer of property for rent and other relationships. It is not always possible for the debtor to fulfill the terms of the contract in full and within the established time frame.

In practice, there are often cases when the defaulter is unable to complete the work, pay for materials, etc. It is in such a situation that the optimal solution is to replace one type of obligation with another. Debt novation is a procedure that provides for the preservation of mutual settlements between counterparties, but in a different form. The debt itself continues to exist in value terms, but the terms of the transaction change.

The original agreement can be valid between individuals and legal entities, so the new contract is concluded between them. That is, there are no new participants in the innovation relationship. The essence of updating the contract is to replace the subject of the agreement.

For example, under a supply agreement, the supplier was unable to ship materials to the buyer for a certain amount due to the absence of the object of the transaction. Since the consumer is interested in returning the previously listed advance, he compromises and accepts the counterparty’s offer to convert the subject of the transaction into borrowing.

The borrower does not actually receive money on loan from the lender. The previous agreement had a cost dimension, which is translated into a lending agreement on new terms. It is likely that the debtor will have to pay interest on the loan amount in order to interest the customer in the feasibility and profitability of the transaction.

Novation of debt implies the preservation of debt relations, only in a slightly different form

Conditions for making an innovation

Novation of a debt into a loan obligation should be distinguished from changing the terms of a previous agreement. In the latter case, the original obligation is not replaced by another; the debtor will have to fulfill it in any case, taking into account the changes made by the parties in terms of payment terms and the amount of the debt.

To sign this agreement, the following conditions must be met:

- the original and new obligation must be relevant and not contradict the legislation of the Russian Federation for the transaction to have legal force;

- a new obligation is indicated in place of the original one, taking into account the terms of the previous agreement, while the method of repaying the debt or the subject of the transaction changes (the participants should not be bound by two different obligations);

- the appearance of additional or new parties to the agreement is unacceptable, as well as the withdrawal of one of the parties from the transaction;

- the agreement is drawn up taking into account the requirements of civil law for a loan agreement;

- the previous obligation terminates from the moment the relevant agreement is signed.

If at least one of the above conditions is not met, the transaction of the parties is considered invalid.

Useful material : Signs of fictitious bankruptcy.

Classification

Businesses and citizens need to understand what an outstanding debt novation agreement is used for and what it is. Novation is the process of approving a new subject of agreement, drawn up on paper. Innovation is a procedure for implementing an agreement reached by the parties. In economic and legal practice, a standard grouping of agreements for updating transactions is provided: offset, novation, compensation.

All types are characterized by paperwork certified by the signatures of the participants. Changes can be made at the discretion of the counterparties at any time during the validity of the main obligation. The main feature of such transactions is the use of payment methods that were not initially considered by the parties at all. It is important that offset and compensation completely or partially cover the existence of the debt, and novation transfers it to another form.

The innovation procedure can be used for two main directions:

- The existing arrears on bills of exchange, purchase of inventory items, and provision of services are replaced by a loan agreement.

- The reverse form, when a loan obligation turns into a supply contract, contract, lease, etc.

The main feature of innovation is a radical change in the terms of the contract. Moreover, the creditor actually does not incur any losses, and the debtor finds a method of pre-trial settlement of the dispute. If an addition is made, the agreement on installments or deferment is applied, but in fact the agreement does not change. When one counterparty assigns a debt to another person, we are not talking about novation, but about assignment.

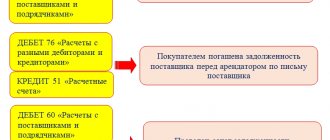

In the accounting of both parties to the novation, the previous obligation is recognized as extinguished and subject to liquidation. The financial service specialist must complete the appropriate postings. New debt is accounted for in accordance with the term of the loan as a short-term or long-term liability.

According to Art. 167, 171 of the Tax Code of the Russian Federation in the tax accounting of the supplier, the repayment amount is recognized as revenue and participates in the formation of the base for calculating income tax. The buyer does not have the right to submit a VAT deduction claim to the budget, since no actual payment for goods or services has been made. If the lender is an individual and dividends are expected to be paid, the borrowing company is the tax agent. Therefore, each time you transfer the loan body and interest, it is necessary to withhold personal income tax and transfer it to the budget.

Any agreement must be certified by the signatures of both parties

The obligation to repay the advance has been converted into a loan

In the tax accounting of the buyer (customer) and supplier (performer), reflect the novation of the obligation to return the advance into a loan obligation as two separate transactions:

- refund of advance;

- issuing (receiving) a loan.

Do this at the time the novation agreement comes into force (the moment the contract is signed or other moment provided for by the novation agreement).

This procedure follows from paragraph 1 of Article 414 and paragraphs 1 and 2 of Article 425 of the Civil Code of the Russian Federation.

In this case, the buyer (customer) becomes the lender, and the supplier (performer) becomes the borrower.

When calculating taxes, reflect the novation of debt from the buyer (customer) as follows.

If the organization applies the general taxation regime, do not take into account the amount of the advance payment, which is considered returned, in income (Articles 41, 249–251, paragraph 1 of Article 272, paragraph 2 of Article 273 of the Tax Code of the Russian Federation).

If the buyer (customer) previously reimbursed VAT on the advance payment issued to the partner, in the quarter in which the advance was novated, restore this amount of tax (subclause 3, clause 3, article 170 of the Tax Code of the Russian Federation). In turn, the seller cannot accept VAT as a deduction, since he did not return the advance payment to the buyer. For more information, see:

- How to recover input VAT;

- How to calculate VAT on advances received.

Organizations on a simplified basis when calculating the single tax do not take into account the advance amount returned by the counterparty (clause 1, 1.1 of Article 346.15, Articles 249 and 41 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated December 12, 2008 No. 03-11-04/2 /195). For more information about this, see: On what income do you need to pay a single tax when simplified.

When calculating UTII, the return of the advance payment does not affect the tax calculation. The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

If the buyer (customer) combines UTII and the general taxation system, take into account the amount of the advance payment that is considered returned according to the rules of the type of activity for which it was planned to purchase goods (work, services). This follows from paragraph 9 of Article 274 and paragraph 7 of Article 346.26 of the Tax Code of the Russian Federation.

The issuance of a loan for tax purposes should be reflected in the general order, depending on the tax regime that the organization applies. For more information, see:

- How to take into account the issuance of a loan for taxation (OSNO);

- How to take into account the issuance of a loan for taxation (Special regime);

- How to take into account interest on a loan issued for taxation;

- How to calculate interest on a loan.

When calculating taxes, reflect the novation of debt from the supplier (performer) as follows.

If an organization uses the accrual method, do not take into account the advance amount that is considered returned in the tax base (clause 49 of Article 270 of the Tax Code of the Russian Federation).

If an organization uses the cash method, the amount of the advance received increases income, and the amount returned reduces it (clause 2 of Article 273 of the Tax Code of the Russian Federation).

If the supplier (performer) applies a simplified procedure, reduce taxable income by the amount of the advance payment returned to the buyer (paragraph 3, paragraph 1, article 346.17 of the Tax Code of the Russian Federation).

When calculating UTII, the returned advance does not affect the calculation of the tax amount. The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

If the supplier (performer) combines UTII and the general taxation system, reflect the amount of the returned advance according to the rules of the type of activity to which the sale of this type of goods (work, services) relates. This follows from paragraph 9 of Article 274 and paragraph 7 of Article 346.26 of the Tax Code of the Russian Federation.

Receipt of a loan (interest on it) for tax purposes should be reflected in the general order, depending on the tax regime that the organization applies. For more information, see:

- How to take into account receiving a loan (credit) for tax purposes (OSNO);

- How to take into account receiving a loan (credit) for taxation (Special regime);

- How to take into account interest on a loan (credit) received for taxation;

- How to calculate interest on a loan received.

Situation: is it possible for the supplier (performer) to deduct VAT previously accrued on the advance received? The obligation to repay the advance has been converted into a loan obligation.

No you can not.

The amount of VAT previously accrued on an advance received can be deducted if the contract has been amended or terminated and the advance has been returned to the buyer (customer). This follows from paragraph 2 of paragraph 5 of Article 171 of the Tax Code of the Russian Federation and is confirmed by letter of the Federal Tax Service of Russia dated May 24, 2010 No. ШС-37-3/2447 (agreed with the Ministry of Finance of Russia).

Providing loans in cash is exempt from VAT (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation). Therefore, an organization does not have the right to deduct VAT on the basis of paragraph 5 of Article 171 of the Tax Code of the Russian Federation if the debt to repay the advance is converted into a loan.

Advice: there are arguments that allow you to deduct VAT on the advance received in the event of an obligation to repay the advance being added to the loan. They are as follows.

The legislation does not contain a mechanism for offset or refund of tax from the budget in the event of an obligation to pay tax and the termination of such obligation as a result of innovation. The procedure for filling out a VAT return, approved by Order No. 104n of the Ministry of Finance of Russia dated October 15, 2009, also does not provide for any other way of reflecting the amount of the new liability other than indicating the right to deduction. The organization does not have the right to submit an updated calculation for the quarter in which the advance was received, since at that moment there were no grounds for clarifying the data (Article 81 of the Tax Code of the Russian Federation). In such a situation, the organization has the right to interpret all doubts, contradictions and ambiguities in its favor and apply a deduction for VAT previously accrued on the advance received, in accordance with paragraph 5 of Article 171 of the Tax Code of the Russian Federation, without taking into account that the actual return of the advance upon innovation did not occur ( Clause 7, Article 3 of the Tax Code of the Russian Federation).

On this issue, arbitration courts side with taxpayers. The judges indicate that as a result of the innovation, an overpayment of VAT to the budget occurs. At the same time, it is proposed to return the resulting tax overpayment through deductions (resolutions of the Federal Antimonopoly Service of the North Caucasus District dated April 5, 2013 No. A32-2964/2012, Northwestern District dated February 12, 2013 No. A56-4264/2012, Moscow District dated April 21, 2010 No. KA-A40/3418-10). Consequently, the organization has the right to deduct VAT on the advance, converted into a loan, on the basis of paragraph 5 of Article 171 of the Tax Code of the Russian Federation.

It is possible that the tax inspectorate will interpret the provisions of paragraph 5 of Article 171 of the Tax Code of the Russian Federation differently. And it will consider it unlawful to use the right to deduct VAT from an advance in the event of an obligation to repay the advance being added to a loan. In this case, the organization will have to defend its position in court.

Situation: does the supplier (performer) need to charge VAT on the amount of the advance received, if in the same tax period (quarter) the obligation to supply goods (works, services) was converted into a loan obligation?

Yes need.

The moment of determining the tax base for VAT is the earliest of the following dates:

- day of shipment (transfer) of goods (works, services);

- day of payment, partial payment on account of upcoming deliveries of goods (performance of work, provision of services).

Such rules are established in paragraph 1 of Article 167 of the Tax Code of the Russian Federation.

The legislation does not provide for any exceptions for an advance payment (of goods, work, services) for which took place in the same tax period (quarter).

Thus, the organization is obliged to charge VAT to the budget on the amount of the prepayment received. In addition, the advance tax must be presented to the buyer (customer) of goods (work, services), property rights (paragraph 2, paragraph 1, article 168 of the Tax Code of the Russian Federation). To do this, within five calendar days from the receipt of the advance payment (unless the shipment did not occur within the specified period), the supplier must issue an invoice to the buyer for the received advance payment. This is stated in paragraph 3 of Article 168 of the Tax Code of the Russian Federation. This is also clarified by letters of the Ministry of Finance of Russia dated October 16, 2012 No. 03-07-11/426 and the Federal Tax Service of Russia dated May 24, 2010 No. ШС-37-3/2447.

Advice: there are arguments that allow the supplier (performer) not to charge VAT on the amount of the advance received if it was returned (including in connection with the conclusion of a novation agreement) in the same tax period. They are as follows.

The amount of VAT is calculated by the organization from all transactions that are recognized as an object of taxation in the current tax period (clause 4 of article 166 of the Tax Code of the Russian Federation). Including from the advance received for goods, work, services (Clause 1 of Article 167 of the Tax Code of the Russian Federation). In this case, it is necessary to take into account all changes that increase or decrease the tax base. This follows from paragraph 4 of Article 166 of the Tax Code of the Russian Federation.

Advances are considered payments that the organization received before the actual shipment of goods, performance of work, provision of services (see, for example, paragraph 1 of Article 487 of the Civil Code of the Russian Federation). That is, it cannot be recognized as an advance, for example, funds received by the taxpayer before the delivery of goods (work, services), in respect of which it became known that in fact there will be no shipment of goods (performance of work, provision of services) due to a change in the relationship under the transaction. For example, in the case when the obligation to supply goods is converted into a loan within one tax period, the advance received after the entry into force of the novation agreement can no longer be considered an advance payment (clause 1 of Article 414 of the Civil Code of the Russian Federation).

Thus, if the amount of the advance received is returned to the buyer in the same tax period in which it was received, no VAT taxable base arises. Therefore, there is no need to charge taxes to the budget.

However, following this position may lead to disagreements with inspectors. In arbitration practice there are examples of court decisions made in favor of organizations (see, for example, resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 10, 2009 No. 10022/08, FAS Central District dated March 21, 2013 No. A64-5557/2011, North -Caucasian District dated April 4, 2012 No. A20-246/2011, West Siberian District dated May 25, 2012 No. A03-13944/2011).

Regulatory resource

Any mutual settlements between individuals and organizations must be regulated by the norms of current legislation. Innovation transactions are no exception. Chapter 26 of the Civil Code of the Russian Federation regulates the procedure for terminating the existence of obligations, including changing the form of payments.

According to Art. 407 of the code, the parties, on a mutual initiative, decide on full or partial repayment of the debt, determine the potential consequences and risks. Article 414 confirms the right of a creditor and a debtor to formalize an agreement to completely replace one type of debt with another, if the original contract and the code of state laws do not contain direct prohibitions on such actions.

A loan obligation is formed between individuals subject to ten times the amount of arrears compared to the minimum wage. This threshold does not apply to legal entities. According to Art. 815 of the Civil Code of the Russian Federation, the borrower can issue a bill of exchange and transfer it in payment of the loan debt.

Art. 818 of the Civil Code allows innovations under sales and lease contracts. It is impossible to replace alimony debts and arrears that have a direct connection with the identity of the counterparties. For example, damage from an accident, injuries from physical impact, moral and material harm.

What is loan novation

Innovation is expressed by the parties to the relationship by mutual consent. New agreements specifically indicate which clauses are canceled or appear, marking the result of the innovation process. This applies to the cancellation of the requirements of the clauses of the original commitment.

Example of an agreement to replace obligations:

The innovation procedure implies stopping their action and the immediate emergence of new agreements between the same participants in the relationship. The emergence of certain new obligations provides for the mandatory conclusion of a contract by the participants in the borrowing relationship.

Accordingly, an alternative form of replacing a lease or sale transaction can be called a loan agreement.

According to the law, the direct object of the loan is money or objects that have certain generic characteristics. The group of such objects cannot include various works, rights or provision of services.

A loan is a real agreement officially concluded from the moment of transfer of funds or items.

Transaction regulations

The defaulter cannot, on his own initiative, unilaterally decide to borrow money from the creditor under the guise of changing the terms of the current agreement. Both parties schedule a meeting, discuss details, assess consequences and risks. You can entrust the preparation of the form to a qualified lawyer or download it via the Internet. There will be no significant difference in the samples, since borrowing does not imply special conditions or nuances.

The structure of the template is drawn up taking into account the requirements of civil law and aspects of the initial agreement. The form of the obligation must necessarily change; the participants in the relationship remain the same. To eliminate possible disputes and disagreements in the future, it is necessary to provide direct links to the base contract.

The contract must be concluded in accordance with existing legislation

The innovation can be applied at any stage of settlements between counterparties. It is not prohibited to reach a settlement agreement during the trial and decide to terminate the debt by novation into a loan.

For example, let’s imagine that the Master company did not pay the Tools company for the supply of components. The creditor files a lawsuit. The debtor, having assessed the potential costs, the risk of loss of property, bankruptcy, invites the creditor to compromise and replace the monetary obligation with a loan at interest. The addressee of the appeal will satisfy the request, since in addition to the principal debt he will receive additional profit.

Decor

When repaying a loan in goods, services, a bill of exchange, etc., an agreement on novation of the loan is concluded. It indicates that the parties have reached an agreement in this matter, and also determines the value of the products that are supplied against the loan.

This includes determining the fate of penalties and interest on the loan and the costs of packaging, loading and delivery of goods. Once the novation agreement is signed, the lender becomes the buyer and the borrower becomes the seller.

The lender's accountant performs the following actions:

- keeps records of products that have been received and are equal in value to the loan;

- enters this amount into the “expenses” section;

- indicates interest on the loan in the section “non-operating income”;

- transfers money that was issued as a loan into advance payments under supply contracts;

- records the delivered products, receives a shipping invoice and keeps records of incoming VAT.

With simplified taxation of the lender, the entire cost of goods goes into the “expenses” section, and the obligation becomes fully repaid.

But if only the main body of the loan is returned in goods, it will be necessary to reflect the interest received on it in a separate item.

The borrower, in turn, must perform the following actions:

- take into account the income received from the sale of goods;

- in the “expenses” column, indicate the purchase price of goods with which the loan is repaid, or the costs of their production;

- interest that must be paid to the lender is included in non-operating expenses;

- issue an invoice with VAT for advance payment within 5 days from the date of signing the contract;

- Having shipped the goods, issue a shipping invoice;

- charge VAT on the goods and record it in the journal.

Filling out the form

We list the main details and conditions, the reflection of which is an important point in the novation transaction:

- The name of the document, place and date of its preparation.

- Full name of the creditor, debtor for individuals, name for organizations.

- Power of attorney for an authorized person.

- Description of the subject of the agreement indicating the details of the obligation to be closed.

- Amount of debt.

- The transfer of one form of debt to another is approved, with details of the procedure for its repayment.

- The loan is issued at interest or free of charge.

- The parties confirm full fulfillment of the previous contract.

- It is recommended to describe confidential information and responsibility for its disclosure.

- The rules for resolving disputes are described.

- Details of the participants in the transaction and signatures of authorized persons.

When concluding a contract, it is important to follow all the rules for document execution.

To facilitate the process, you can use a sample agreement on novation of debt for the supply of goods as a loan obligation.

Novation agreement from a loan agreement

The novation agreement provides for the annulment of additional conditions or obligations provided for in the original document, unless in the terms of the novation the participants offer other options.

Thus, changing the contractual conditions for the supply of goods with a loan agreement does not provide for the collection of the financial penalty described in the delivery clauses. This is explained by the fact that in the process of the emergence of a new document, this nuance lost the connecting link between the parties to the supply agreement.

The principle of freedom of a new agreement in the loan version provides for the payment of a penalty if it is mentioned in the new loan documentation.

Borrowing situations can arise for various reasons. This is a purchase and sale option, installment payment terms, payment of rental debt and other options. The legislation provides for the replacement of preliminary clauses with conditions of purchase and sale or other agreements.

From the document there arises a proposal to replace debt obligations with other forms of raising funds. The agreement does not change the fixed obligations until the parties to the relationship fail to fulfill the specified contractual conditions.