Payer status: what to indicate in 2021 on payments for contributions and taxes

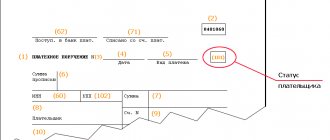

When filling out a payment order for paying taxes and insurance premiums, the payer indicates his status (code) in field 101.

Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n approved the list of payer status codes.

Code 08 is no longer indicated

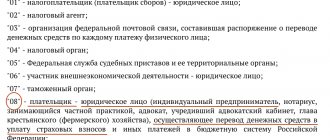

Previously, when transferring any type of insurance premiums, the code “08” was indicated in field 101, which means: “payer-legal entity (notary engaged in private practice; lawyer; individual entrepreneur; head of a peasant/farm enterprise) transferring funds to pay insurance premiums and other payments to the budget system of the Russian Federation.”

Now these are the rules. In payment slips for contributions, enter code 01 when paying contributions to the Federal Tax Service for pension, medical and social insurance. When paying contributions for themselves, individual entrepreneurs set the status to 09.

Enter code 08 only when paying contributions for injuries.

What to indicate

The required status of the compiler when paying the state duty in 2021 and in the future is indicated in accordance with Appendix No. 5 to Order of the Ministry of Finance No. 107n of 2013.

Please note that from the end of April 2021, this regulatory document has been in effect in a new edition. The changes were made by Order of the Ministry of Finance No. 58n dated 04/05/2017. It is valid from April 25, 2017 and partially from October 2, 2021.

The reason for the changes is amendments to the tax legislation, where, from January 1, 2017, most of the rules on insurance contributions to extra-budgetary funds (except for the Social Insurance Fund for injuries) were transferred. Therefore, the status of the compiler when paying the state duty must be indicated taking into account these changes.

The problem is that in the mentioned Appendix No. 5 to Order No. 107n of the Ministry of Finance, not a word is said about the corresponding code (value) of field 101 in relation to the state duty. To resolve this issue, you need to turn to tax legislation.

According to paragraph 1 of Article 333.16 of the Tax Code of the Russian Federation, the state duty is legally equivalent to fees when applying for legally significant actions:

- to government agencies;

- to local authorities;

- to other authorities and/or to individual authorized specialists.

Further in the table, based on the letter of the law, we have described what status of the originator should be indicated in the payment order for state duty.

Please note that in practice, the interpretation of compiler status codes in relation to state duty may be different among tax authorities, banks, etc. Keep this in mind.

| State duty: payment originator status | |

| Code | Situation |

| 01 | The organization pays state duty, which is supervised by tax authorities |

| 08 | A state duty that tax authorities do not administer. It is contributed by: · organization; · merchant; · private notary; · advocate; · head of peasant farm. |

| 09 | The individual entrepreneur pays the state duty, which is supervised by the tax authorities. |

| 10 | A private notary pays a state fee, which is supervised by tax authorities |

| 11 | The lawyer (advocacy office) pays the state duty, which is supervised by the tax authorities |

| 12 | The head of the peasant farm pays the state duty, which is supervised by tax authorities |

| 13 | An ordinary individual pays a state duty, which is supervised by tax authorities |

| 24 | An ordinary individual pays a state duty, which the tax authorities do not administer |

Here are some examples of state duties administered by the Federal Tax Service of Russia:

- for registration/liquidation of a company or individual entrepreneur;

- changes to the charter;

- re-issuance of tax registration certificate, etc.

Also see “Personal income tax: status of the preparer in the payment”.

Read also

13.07.2017

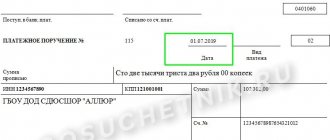

Sample payment slip indicating the status indicator (field 101)

Next, see a sample of filling out the status indicator in field 101 of the payment:

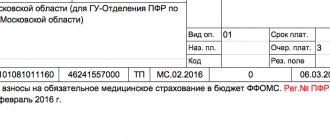

Due to the fact that from 2021 the payment of insurance premiums is administered by the tax office, the payer must indicate code “01” in the payment order.

Thus, now issuing a payment order for the transfer of insurance premiums is identical to a payment order for the payment of taxes. The difference is in the BCC and the purpose of payment.

There is an opportunity to repay your debt to the budget at the expense of third parties. This is directly indicated by paragraph 1 of Art. 45 of the Tax Code of the Russian Federation. In this regard, the list of codes for field 101 has been supplemented.

Here is an updated list of payer status codes for 2020.

What is the taxpayer status when paying state duty?

Tax officials themselves must ensure that the information in the payment order is correct and, if an error is discovered, they must notify the taxpayer about it. This is due to the order dated July 25, 2021 No. ММВ-7-22/ on new rules for working with unclear payments.

Payment order for payment of state duty - sample 2021-2021

For example, in relation to the state duty for consideration of cases in courts, the administrator is the tax service (the value of the first three indicators of the BCC is 182). Therefore, when filling out the recipient’s details in the payment document, it is necessary to indicate the details of the tax office with which the court hearing the case is registered.

The window is filled in with a number when making payments with any budget system. If a transaction type does not have its own code, there is no need to indicate it - the column simply remains blank, and you cannot mark a zero in it. This happens, for example, in cases where it is necessary to transfer funds as an advance to an employee of your company or money for sick leave.

Payer status codes for 2021

| Decoding | Code |

| Taxpayer (payer of fees, insurance premiums) – legal entity | 01 |

| Tax agent (when paying personal income tax for employees) | 02 |

| Participant in foreign economic activity – legal entity | 06 |

| An organization (individual entrepreneur) that transfers other obligatory payments to the budget | 08 |

| Taxpayer (payer of fees) – individual entrepreneur | 09 |

| Taxpayer (payer of fees) – notary engaged in private practice | 10 |

| Taxpayer (payer of fees) – a lawyer who has established a law office | 11 |

| Taxpayer (payer of fees) – head of a peasant (farm) enterprise | 12 |

| Taxpayer (payer of fees) - another individual - bank client (account holder) | 13 |

| Participant in foreign economic activity – individual | 16 |

| Participant in foreign economic activity - individual entrepreneur | 17 |

| A payer of customs duties who is not a declarant, who is obligated by Russian legislation to pay customs duties | 18 |

| Organizations and their branches that withheld funds from the salary (income) of a debtor - an individual to repay debts on payments to the budget on the basis of a writ of execution | 19 |

| Responsible participant of a consolidated group of taxpayers | 21 |

| Member of a consolidated group of taxpayers | 22 |

| Payer – an individual who transfers other obligatory payments to the budget | 24 |

| Founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise or third parties who have drawn up an order for the transfer of funds to repay claims against the debtor for the payment of mandatory payments included in the register of creditors' claims during the procedures applied in a bankruptcy case | 26 |

| Credit organizations (branches of credit organizations) that have drawn up an order for the transfer of funds transferred from the budget system, not credited to the recipient and subject to return to the budget system | 27 |

| Legal or authorized representative of the taxpayer | 28 |

| Other organizations | 29 |

| Other individuals | 30 |

Payer status when paying state duty

An increase in time is allowed only under force majeure circumstances. To register, you need to submit the following documents: application for car registration; passport with Russian citizenship; vehicle passport; certificate of design safety (if there are design changes); purchase and sale agreement or other document confirming the legality of ownership; MTPL insurance policy; “Transit” license plate, if one was issued previously; receipt for payment of state duty.

Taxpayer status when paying state duty

When filing a lawsuit, payment of the state fee is sent to the details of the court hearing the case. General information about field 101 The general rules for drawing up payment orders are established by Regulations of the Central Bank of the Russian Federation No. 383-P, and Order of the Ministry of Finance of the Russian Federation No. 107n. These regulations regulate the rules for filling out line 101, which contains the payment order; the state duty is paid strictly indicating the status of the payer.

- 02 – if income tax is paid by an organization or individual entrepreneur who is the employer in relation to the individual for whom the personal income tax is transferred, that is, in this case the payer acts as a tax agent;

- 09 – if the tax is paid by the individual entrepreneur for himself;

- 10 – if the tax is paid by a notary engaged in private practice for himself;

- 11 – if the tax is paid by a private lawyer for himself;

- 12 – when transferring the tax amount by the head of the peasant farm for himself;

- 13 – if a payment order for the payment of personal income tax is filled out by an individual independently to transfer tax on his income;

- 26 – this status of the compiler is indicated in bankruptcy, when the personal income tax debt is repaid from the register of claims.

We recommend reading: Advantages of a Young Military Family

Common options for filling out field 101 in a payment order

In practice, accountants of individual entrepreneurs and large companies most often use status codes when processing a number of budget payments.

Taxes, contributions to the Pension Fund and the Compulsory Medical Insurance Fund on behalf of an individual entrepreneur. If an accountant prepares insurance premiums on behalf of an individual entrepreneur for the entrepreneur himself or his employees, field 101 has the value 09.

All tax collections of the organization, including insurance premiums. If an accountant pays income tax and transfers contributions to the Pension Fund, code 01 is used.

Transfer of personal income tax to an organization or individual entrepreneur. If an accountant pays 13% of employee income to the budget, the organization acts as a tax agent, so the payer status will be 02.

Field 101 remains blank if funds are transferred in favor of ordinary counterparties (legal entities and individuals). In general, payer status is relevant for budget payments and allows state tax authorities to correctly account for the amounts of funds received from individuals and organizations. Indicating an incorrect payer status will result in the payment being classified as an unspecified receipt, so the Federal Tax Service will continue to charge penalties or late fees.

State Duty Status 01 Or 08

- OKTMO - at the location of the court;

- will indicate the payer status - 01;

- basis of payment (field 106) - TP;

- recipient - the Federal Tax Service for Moscow

, indicating the Federal Tax Service Inspectorate at the location of the court (in this case, Federal Tax Service Inspectorate No. 26); - in fields 107 “Tax period”, 108 “Document number” and 109 “Document date” will enter 0;

- KBK - 182 1 0800 110;

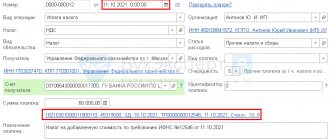

And when filling out the fields, fill out the main positions as follows: Payer status, field 101 – “01”; Taxpayer INN and KPP, fields 60 and 102 – TIN and KPP of the organization; Payer, field 8 – name of the organization; Payment order, field 21 – “5 ";Code, field 22 – “0”; KBK, field 104 – KBK state duties; Basis of payment, field 106: – “0”; Tax period, field 107 – “0”; Document number, field 108 – “0”; Document date, field 109 – “0” Purpose of payment, field 24 – text explanation. For example,

Tax period 0 Number (field 108) 0 Date (field 109) 0 Read also the article ⇒ “How to fill out a payment order for fines in 2020” Sample of filling out a payment order for state duty Notification Bank marks Index doc.

18209965171147669381 (101) 13 Form No. PD (tax) Full name MUKHINA MARIA MIKHAILOVNA Address 119019, ST. ARBAT, 1, KV. 1, MOSCOW INN Amount 4000.00 Recipient Bank GU Bank of Russia for the Central Federal District BIC 044525000 Account.

No. 00000000000000000000 Recipient of the UFC for the city.

The amount of the fee depends on the type of application, the price of the claim and who the plaintiff (applicant) is - an organization or an individual 182 1 08 01000 01 1000 110 182 1 0800 110 182 1 0800 110 182 1 0800 110 About how the state duty will be reflected in accounting, read the article “Basic entries in accounting for state duties.” Sample payment order for state duty to the arbitration court in 2017–2020 Let's look at the procedure for filling out a payment order for state duty using a conditional example.

In other words, all mandatory contributions, taxes and state duties are transferred using one code “01”. The differences will relate to the BCC and the purpose of the payment. Benefits for paying state duty Status “01” or “08”? Starting from 2021, the document for payment of mandatory contributions, including state fees, is drawn up taking into account the changes.

When generating a payment order, in field 101 you must indicate the status of the originator. This article will provide an explanation of status codes, the advisability of specifying codes, and the consequences in case of an incorrectly filled out field in 2021.

When is it necessary to indicate originator status on a payment order? When generating a payment order, namely filling out the “101” field, you must be guided by the Order of the Ministry of Finance of Russia dated November 12, 2013.

No. 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation.”

: 13 Percent of the Tuition Fee for Full-time Tuition

Duty originator status 01 or 08

But why go to court when you can fill out the payment form correctly? Read more about tax agents in the articles: A separate status has been allocated for companies (or their branches) for cases when the organization receives a writ of execution against an employee, according to which it is necessary to withhold from the salary arrears of payments to the budget. The amount withheld is transferred using code 19.

On amendments to the Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n.”