The deadline for submitting the Calculation of Insurance Premiums for the 1st quarter is expiring soon - in 2021, you must submit the form before May 3 inclusive . In this material we will pay attention to how to reflect last year’s social insurance expenses, which were reimbursed in the 1st quarter of this year.

The problem is that, due to the expenses mentioned above, the indicator for line 090 of Appendix 2 to Section 1 does not reflect the actual state of calculations for social insurance contributions. Let's look at why this happens and what to do.

Procedure for payment of benefits

According to the rules in force today, sick leave and maternity benefits are paid in one of two ways:

- At the expense of the employer with subsequent reimbursement. This method is used in all regions, with the exception of participants in the FSS pilot project (point 2).

- Directly from the fund. We are talking about the “Direct Payments” project, which is carried out in some regions of Russia (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294).

Everything said below applies only to payers of insurance funds from point No. 1.

At the end of the month, the policyholder determines the amounts:

- accrued insurance premiums;

- benefits paid.

If more contributions are accrued than benefits paid, the difference is transferred to the Social Insurance Fund. If on the contrary, that is, the difference between contributions and benefits turns out to be a minus sign, then it is counted against future payments or returned from the Fund to the policyholder.

Exceptions to this procedure are provided only for benefits for the first 3 days of sick leave.

Help for calculation in the Social Insurance Fund 2021: sample filling

Payable to the budget - rub. In April, the Social Insurance Fund has not yet reimbursed the organization’s expenses, so in the calculation of r. We indicate contributions payable in the amount of rubles. In May we add the reimbursed rubles. Knowing how to reflect reimbursement of expenses in the DAM, do not be alarmed by discrepancies with accounting, but check yourself using control ratios. Most accounting software automatically checks these ratios and prevents you from filling out rows with incorrect numbers. If you fill out the calculation yourself, then the control ratios are given in the Letter of the Federal Tax Service of Russia from You can also order a reconciliation of calculations with the budget from the tax service, this will help make sure that the form is filled out correctly: if the accounting data coincides with the results of the reconciliation, then everything is correct.

Reimbursement of expenses to the Social Insurance Fund in 2021

For example, in fact, the Social Insurance Fund reimbursed the company’s expenses, but when filling out the calculation, it turns out that the company owes the Fund a larger amount than it actually did. In fact, there is no mistake in this. And you need to fill out the calculation exactly as indicated in the Procedure. Despite the fact that a large amount will be indicated in the final line of Section 1, as well as in the line of Appendix 2, only the amount of the contributions themselves will need to be paid to the Fund. After transferring all the information to the budget settlement card, tax authorities will see which amounts are arrears and which are overpaid.

How benefits are reflected in the RSV

When filling out the DAM form, benefits should be reflected in Appendix 2 to Section 1 :

- line 080 reflects the amount of compensation received by the policyholder from the Fund;

- on line 090 - the difference between the amount of benefits paid to insured persons and the amount of accrued contributions.

The Tax Service explained exactly how the amount of contributions is reflected in line 090 in a letter dated 08/23/17 No. BS-4-11 / [email protected] The calculation is made using the following formula (indicators are taken from the corresponding lines of Appendix 2 to Section 1):

Amount in line 090 = Line 060 - Line 070 + Line 080

The result is interpreted as follows:

- If it is positive , it means that the policyholder has a debt. In the column “Total from the beginning of the billing period” of line 090 the calculated value is indicated, and in the column “Characteristic” - 1.

- If the result is negative , then the Fund is in debt. In the column “Total since the beginning of the billing period” the value without the “-” sign , and in the column “Sign” - 2.

Table – rules for filling out line “080” in the “minor” classified parts of KND 1151111

| Line “080” in the “minor” parts of the SV calculation | Completion Instructions |

| Adj. 3 to Sec. 1, Page "080" | Procedure, part 12, clause 12.18 |

| Adj. 4 to Sec. 1, Page "080" | Procedure, part 13, clauses 13.2 and 13.3, as well as clause 13.6 |

| Adj. 6 to Sec. 1, Page "080" | Procedure, part 15, clause 15.4; indicator of page “080” = ratio of pages “070” and “060” * 100 |

| Adj. 9 to Sec. 1, Page "080" | Procedure, part 18, clauses 18.12 and 18.14 |

| Adj. 10 to Sec. 1, Page "080" | Procedure, part 19, clause 19.2 and 19.6 |

| Adj. 1 to Sec. 2, Page "080" | Procedure, part 21, clauses 21.1, 21.7 and 21.8 |

Discrepancies

As a result, it turns out that line 090 reflects a balance that does not correspond to the accounting data. Because of this, accountants have doubts about whether they filled out the above DAM lines correctly.

In fact, a discrepancy does not mean there is an error at all. It arises due to the specifics of the DAM form - it does not contain cells in which the incoming and outgoing balances should be reflected. Therefore, the amount by which benefits paid in 2021 exceed the amount of contributions is not reflected in the DAM for the 1st quarter of 2021. Accordingly, if in the 1st quarter a refund was received from the Social Insurance Fund, then from the calculation it will not be clear that it compensates for the difference between benefits and contributions for the previous year.

Let's explain with an example. In 2021, the positive difference between benefits paid and assessed contributions amounted to 25 thousand rubles. It is reflected like this:

- In the DAM for 2017, line 090 of Appendix 2 to Section 1 indicates the amount of 25 thousand rubles with attribute 2.

- In accounting, in the debit of account 69, the subaccount “Social Insurance Settlements” at the end of the year there remains a balance of 25 thousand rubles.

In the 1st quarter of 2021, the company did not charge contributions or pay benefits, but received compensation for last year’s expenses from the Social Insurance Fund in the amount of 25 thousand rubles. The reflection is like this:

- In the DAM for the 1st quarter of 2021: on line 080 of Appendix 2 to Section 1 - the amount is 25 thousand rubles;

- on line 090 of Appendix 2 to Section 1 - the amount is 25 thousand rubles with sign 1.

Conclusions: according to accounting data, there is a zero balance, and the DAM form indicates that the policyholder owes 25 thousand rubles. However, all data is correct.

Form and composition of the report for the 3rd quarter of 2021

The form and procedure for filling out the DAM (hereinafter referred to as the Procedure) were approved by order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. ММВ-7-11/ [email protected] Employers required to submit the DAM include not only legal entities or individual entrepreneurs, but also in general everyone who uses the services of hired workers. These could be, for example, farmers, lawyers, notaries, etc. The absence of a base in a particular period does not give the employer the right to refuse to submit a report.

The DAM form (with zero indicators) must be submitted even if no activity was carried out during the reporting period and no payments were made to individuals (letter of the Ministry of Finance dated March 24, 2017 No. 03-15-07/17273). Also see “Zero form 6-NDFL for Q3 2018“.

The DAM report form includes more than 20 sheets. This is not surprising given that this report combines information from multiple payments. However, a “regular” fee payer does not need to fill out all two dozen sheets. There are a number of required sections that contain basic information:

- Title page.

- Section 1, which provides general information about assessed contributions. Explanations of the various options for calculating contributions are given in the appendices to this section. The most “massive” options are contained in subsections 1.1 and 1.2 of Appendix 1 as well as in Appendix 2.

- Section 3, which includes personalized accounting data for individuals to whom income is paid.

It is the sections and appendices listed above that should be included in their reports by all economic entities that make payments to individuals (clause 2.4 of the Procedure).

All other calculation sheets are filled out if necessary, if the payer has a certain status or makes certain types of payments. For example, section 2 is filled out only by heads of peasant farms, and Appendix 9 to section 1 is filled out only by those employers who pay wages to foreign workers.

Next, we will consider in detail the order of filling out the sheets of the form - first the “general” sections, and then the “special” sections.

You can also fill out the calculation of insurance premiums for the 3rd quarter of 2021 in Excel format.

How to check

If you have doubts about the correctness of filling out the DAM, it is recommended to reconcile the calculations with the budget . This is the most reliable method that will give a 100% guarantee that there will be no errors.

You can also check the balance of social insurance settlements using a calculation certificate (Appendix 1 to the letter of the Federal Social Insurance Fund of Russia dated December 7, 2016 No. 02-09-11/04-03-27029). Such a certificate, along with other documents, is submitted to the Fund by those policyholders who want to receive compensation.

The document contains fields that reflect the debts owed by the policyholder and the Fund at the beginning and end of the reporting period. Thus, the mentioned calculation certificate reflects the real state of settlements with the Social Insurance Fund.

In conclusion, let us mention that when checking, inspectors are not guided by the contents of line 090 of Appendix 2 to Section 1. The document from which they receive data on mutual settlements is the Budget Payment Card . Reconciliation of the policyholder is carried out precisely on the basis of this card, and not at all according to data from the DAM.

How to reimburse social insurance expenses in 2021 for the past period

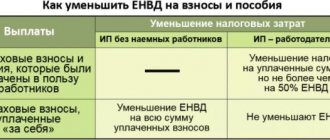

In 2021, companies, as before, are reducing insurance premiums for benefits. Let us remind you that the Federal Tax Service controls contributions from 2021. Because of this, the FSS carries out reimbursement of benefits in a new way. Read the article for details of the process.

Reimbursement of expenses from the Social Insurance Fund in 2021

Workers have brought in several sick days, and the company does not have enough money to pay benefits on time. In this case, you need to apply for money from the Social Insurance Fund. This rule was in effect before. In 2020, the list of documents has changed. It is also relevant for 2020.

If the overpayment occurred after the onset of 2021 and 2021, then the application to Social Insurance is submitted in the form recommended for use by the Social Insurance Fund letter dated December 7, 2016 No. 02-09-11/04-03-27029. This form must be accompanied by two more documents according to the forms recommended in the letter above.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Consultations on accounting and taxation » Insurance premiums » Should the return from the Social Insurance Fund for compensation for 2021, which came in 2021, be reflected in the new DAM report?

Question:

In 2021, a refund from the Social Insurance Fund for 2021 was received. Should it be reflected in the new DAM report?

Expert's answer

The amount of expenses for the payment of insurance coverage for 2021, reimbursed by the Social Insurance Fund at the beginning of 2021, is not reflected in the calculation of insurance premiums for the 1st quarter of 2021.

If, based on the results of the settlement (reporting) period, the amount of expenses incurred by the payer for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity (minus the funds allocated to the policyholder by the territorial body of the Social Insurance Fund of the Russian Federation in the settlement (reporting) period for payment of insurance coverage) exceeds the total amount of calculated insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity, the resulting difference is subject to offset by the tax authority against upcoming payments for compulsory social insurance in case of temporary disability and in connection with maternity based on the received from the territorial body of the Social Insurance Fund of the Russian Federation confirmation of the expenses declared by the payer for the payment of insurance coverage for the corresponding settlement (reporting) period or reimbursement by the territorial bodies of the Social Insurance Fund of the Russian Federation in accordance with the procedure established by Federal Law of December 29, 2006 N 255-FZ " On compulsory social insurance in case of temporary disability and in connection with maternity.”

Art. 431, “Tax Code of the Russian Federation (Part Two)” dated 08/05/2000 N 117-FZ (as amended on 04/03/2017) {ConsultantPlus}

11.12. On line 060 of Appendix No. 2, the corresponding columns reflect the amounts of calculated insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity from the beginning of the billing period, for the last three months of the billing (reporting) period, as well as for the first, second and third month of the last three months of the billing (reporting) period, respectively.

11.13. Line 070 of Appendix No. 2 in the corresponding columns reflects the amount of expenses incurred by the payer for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity from the beginning of the billing period, for the last three months of the billing (reporting) period, as well as for the first , the second and third month of the last three months of the billing (reporting) period, respectively.

11.14. Line 080 of Appendix No. 2 in the corresponding columns reflects the amounts reimbursed by the territorial bodies of the Social Insurance Fund of the payer's expenses for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity from the beginning of the billing period, for the last three months of the billing (reporting) period , as well as for the first, second and third month of the last three months of the billing (reporting) period, respectively.

11.15. Line 090 of Appendix No. 2 in the corresponding columns reflects the amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity, subject to payment to the budget or the amount of excess of expenses incurred by the payer for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity over the calculated insurance premiums for this type of insurance, indicating the corresponding attribute, from the beginning of the billing period, for the last three months of the billing (reporting) period, as well as for the first, second and third month of the last three months of the billing (reporting) period accordingly.

Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11/ [email protected] “On approval of the form for calculating insurance premiums, the procedure for filling it out, as well as the format for submitting calculations for insurance premiums in electronic form” {ConsultantPlus}

The indicator on line 090 of Appendix No. 2 to Section 1 of the Calculation - the amount of contributions payable or the amount of excess of expenses for payment of insurance coverage for sickness insurance over calculated insurance premiums - is calculated using the formula:

page 090 = page 060 - page 070 + page 080.

(“Newsletter “Express Accounting”, 2021, N 12) {ConsultantPlus}

In accordance with paragraph 1 of Article 21 of the Federal Law of July 3, 2016 N 250-FZ “On Amendments to Certain Legislative Acts of the Russian Federation and the Recognition of Invalidity of Certain Legislative Acts (Provisions of Legislative Acts) of the Russian Federation in Connection with the Adoption of the Federal Law “On the Introduction amendments to parts one and two of the Tax Code of the Russian Federation in connection with the transfer to the tax authorities of powers to administer insurance premiums for compulsory pension, social and medical insurance" decision on the return of amounts of overpaid (collected) insurance premiums, penalties and fines for reporting (calculated) periods that expired before January 1, 2021 are accepted by the relevant authorities of the Pension Fund of the Russian Federation and the Social Insurance Fund of the Russian Federation.

Thus, an application for the return of overpaid insurance contributions for compulsory pension insurance for billing periods that expired before January 1, 2021 should be addressed to the Pension Fund of the Russian Federation.

(Letter of the Ministry of Finance of Russia dated 03/06/2017 N 03-15-05/12706) {ConsultantPlus}}

For a refund of overpayments for periods up to 2021, please contact (Clause 1 of Article 21 of Law No. 250-FZ, Letter of the Ministry of Finance dated 03/06/2017 No. 03-15-05/12706):

- for contributions to VNiM - to the FSS with an application in form 23-FSS of the Russian Federation;

- for contributions to compulsory medical insurance and compulsory medical insurance - to the Pension Fund of the Russian Federation with an application in form 23-PFR.

Overpayments for periods starting from 2021 are returned by the Federal Tax Service. The refund procedure is the same as for tax refunds (clause 1.1 of Article 78 of the Tax Code of the Russian Federation).

{Typical situation: How to return overpayment of insurance premiums? (Glavnaya Kniga Publishing House, 2017) {ConsultantPlus}}

Thus, in accordance with tax legislation and the Procedure for filling out Appendix No. 2 to Section 1 of the calculation of insurance premiums (effective from 01/01/2017), line 080 will reflect the amounts of payer expenses reimbursed by the Social Insurance Fund that have taken place since the beginning of 2021 (from the beginning of the calculation period, for the last three months of the billing (reporting) period, as well as for the first, second and third months of the last three months of the billing (reporting) period, respectively). The legislation of the Russian Federation does not provide for the offset of overpayments on insurance premiums and expenses for the payment of insurance coverage for VNiM for 2021 against upcoming payments; they can only be returned.

The explanation was given by Maria Yurievna Krasnoperova, an accounting and taxation consultant at LLC NTVP Kedr-Consultant, in April 2021.

When preparing the answer, SPS ConsultantPlus was used.

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE ().