The most active flow of the company's financial resources passes through accounts that are associated with the movement of funds with suppliers and other counterparties. The speed of money turnover, existing debt indicators, and the presence of penalties are criteria for assessing the solvency of an enterprise. All these positions are assessed by potential partners before contracts are concluded. Accounting for transactions with suppliers and contractors is one of the central ones for the company’s entire accounting system. In this case, a count of 60 is used.

Scope of application of account 60 in accounting

Suppliers are firms that deliver raw materials, semi-finished products, components, goods, fixed assets and other inventories to other organizations for production and commercial activities.

Settlements with suppliers and contractors require strict accounting

Contractors are individuals and legal entities who perform work under a contract concluded in accordance with the current legislation.

Accounting account 60 aims to summarize information on transactions with specified persons in the following aspects:

- acquisition of inventory items;

- performing certain work;

- provision of service;

- delivery of valuables;

- unpaid deliveries;

- excess inventories and inventories;

- transport services;

- communication services.

Organizations involved in the execution of construction contracts, contracts for the performance of research, development and technological work and other contracts for the functions of a general contractor are also reflected in account 60.

All transactions are reflected in accounting account 60, regardless of the time of payment.

The tasks facing the accounting system for account 60 relate to issues of tracking financial flows operating between the company and suppliers. The account allows you to receive information that performs the following tasks:

- control over the status of amounts due to contractors and suppliers of goods and materials (information is relevant for owners, as well as for the formation of reliable reporting);

- formation of an information base. On its basis, the speed of funds turnover is controlled. The database is used to generate management reports;

- control over compliance with contractual obligations, terms, volumes of supplies and payment for them;

- drawing up a payment plan for suppliers when distributing financial resources;

- eliminating opportunities to violate the law regarding payment issues;

- monitoring of overdue payments.

60 account in accounting is a variant of an active-passive account, regardless of the chosen accounting system and the organizational and legal form of activity. It is designed to generate and collect data about each supplier and counterparty.

The basis for starting accounting are:

- concluding an agreement for the supply of inventory, fixed non-current assets, and intangible assets;

- provision of services of various nature (utilities, repair and maintenance of buildings, structures, machinery and equipment);

- transportation of goods;

- performance of work under the contract, etc.

Important! Accounting under account 60 is called “Settlements with suppliers and contractors.” A synthetic version of accounting is maintained for all organizations. For analytics, sub-accounts are generated for individual counterparties.

To account for transactions between counterparties when delivering goods, account 60 is used

What is account 60 in accounting?

According to the chart of accounts (approved by order of the Ministry of Finance dated October 31, 2000 No. 94n), account 60 is called “Settlements with suppliers and contractors.” It reflects all transactions related to the acquisition and payment of inventory, work, and services. Here are a few special cases:

- consumption of electricity, gas, water, etc.;

- identification of surplus inventory items upon their acceptance;

- purchasing delivery and communication services;

- uninvoiced deliveries (for which documents were not received from the sellers).

Count 60 is active-passive. The balance on it can be either debit or credit. Increases and decreases in funds can be shown either by debit or credit (for more details, see: “Chart of Accounts in 2021”).

Analytical accounting is usually organized by suppliers, contractors and invoices issued by counterparties. Sometimes, depending on the specifics of the company, analytics are carried out in the context of contracts, products, etc. The main thing is to have access to information about overdue debts to sellers, as well as about debts that have not yet matured.

Maintain accounting and tax records for free in the web service

Characteristics

Active - passive 60 account in accounting is used to combine data on transactions with counterparties.

The main characteristics that answer the question of whether the 60 account is active or passive:

- summarizes information about transactions with counterparties;

- summarizes information on transactions with subcontractors under construction contracts;

- the cost of acquired property is reflected according to Dt: 08.10, 20, 41 and Kt60;

- repayment of obligations is reflected according to Dt 60 and Kt 51,52,55;

- analytical accounting is formed in the context of each supplier, contractor and performer.

Count 60 belongs to the active-passive type:

- a debit balance indicates that the partner has not yet fulfilled his obligations to the company. The supplier company has a debt for the supply of goods, works or services;

- the presence of a credit balance indicates that the company has not yet paid the debt to the supplier or contractor.

Advances provided to suppliers for the upcoming supply of materials, raw materials, advances to contractors for upcoming work and services are taken into account.

Analytical accounting for account 60 is maintained for each accrued amount, for each supplier and contractor. The construction of analytical accounting provides the necessary data on:

- suppliers and accepted documents, the payment deadline for which has not yet arrived;

- suppliers who did not pay documents on time;

- to suppliers in case of unpaid deliveries;

- advances to suppliers;

- when issuing bills whose due date has not yet arrived;

- to suppliers for overdue payments;

- when receiving a commercial loan, etc.

Count 60 is active-passive, which characterizes its main feature

Organization of analytical accounting on account 60

Without more detailed accounting of what an organization must pay (or has already paid) to suppliers, accounting would become a real mess. It is recommended to maintain analytical accounting according to account 60 data for each of the suppliers and contractors. At the same time, the amounts must clearly indicate which bills are overdue, which have been repaid, for which an advance or bill of exchange was issued, whether the payment period has expired, etc.

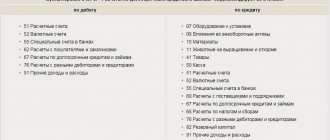

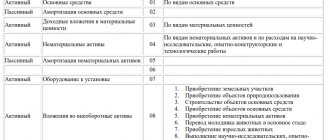

Subaccounts 60 accounts can be opened of the following type:

- 60/1 – to account for settlements with suppliers and contractors;

- 60/2 – to collect information on advances issued for planned supplies (rendering services);

- 60/3 – for accounting for issued bills.

In addition to the listed units of analytical accounting, similar subaccounts 60 can be created to account for settlements in foreign currency. At the end of each month, each of them has a final balance. The sum of the balances on all subaccounts of account 60 must coincide with the value of the final balance on the synthetic account.

A reversal sheet is used to verify information. Thanks to it, you can detect arithmetic errors in time and correct them. In addition, the data entered into this control table allows you to analyze indicators at any date, and not just at the end of the year or a certain period. The turnover sheet is also used for various types of analyzes of the economic situation at the enterprise: not all data can be obtained from financial statements. Sometimes interim control documents provide much more information than you might expect.

The register on the basis of which data is entered into account 60 and its subaccounts is journal order No. 6. The balance of account 60 is reflected in the balance sheet: in section V for the amount of accounts payable, in section II as accounts receivable.

Subaccounts

Analytics on account card 60 is carried out separately for each account.

It is necessary to organize the analysis of invoice 60 in such a way that you can track information on suppliers:

- according to separate documents;

- according to documentation that is not due;

- under unpaid contracts;

- on bills issued;

- by suppliers with issued credit amounts, etc.

To record transactions, sub-accounts are opened:

- 60.01: reflect mutual transactions with partners in purchase transactions and payment for goods;

- 60.02: reflect prepayment transactions;

- 60.03: reflects the company's securities.

Important! It is possible to open additional sub-accounts taking into account the specifics of the company.

Separate accounts are organized for mutual transactions with counterparties in foreign currency:

- 60.21: analogue to 60.01 for currency accounting;

- 60.22: analogue to 60.02 for currency accounting;

- 60.31 - analogue to 60.01 for transactions in monetary units;

- 60.32: analogue to 60.02 for transactions in monetary units.

During accounting, separate sub-accounts are created for counterparties

Balance sheet for account 60

This document is a summary of data on account 60 for all business transactions that were carried out using this account in the company for the period.

Important! The main feature of this document is that count 60 is active-passive.

Basic rules for forming a statement:

- Credit turnover. The loan reflects transactions that are associated with the purchase of materials, work, services, and equipment. Basic documents: invoices, acts, invoices.

- Debit 60 of account shows debit turnover. Transactions for payment of funds to suppliers are reflected. Among them: debt repayment, prepayment. Documents: payment slips, cash documents.

An example of a balance sheet for a conditional company for dummies is presented in the table below.

| Index | Balance at the beginning | Period transactions | balance at the end of period | ||

| Debit | Credit | Debit | Credit | Debit | Credit |

| 60 | 13691,00 | 155317,00 | 141626,00 | ||

| Supplier LLC "Phoenix" | 13681,00 | 154727,00 | 141046,00 | ||

| 321 from 11/01/2019 | 13681,00 | 154727,00 | 141046,00 | ||

| Document of transactions with the counterparty UK00-000001 dated 04/30/2019 | 10000,00 | 10000,00 | |||

| Receipt (act, invoice) from UK 00-000001 dated 05/20/2019 | 3481,00 | 3481,00 | |||

| Receipts (act, invoice) UK 00-000002 dated 06/02/2019 | 200,00 | 3304,00 | 3104,00 | ||

| Receipts (act, invoice) UK 00-000003 dated 06/19/2019 | 118000,00 | 118000,00 | |||

| Receipt of additional expenses UK 00-000002 dated June 19, 2019 | 11800,00 | 11800,00 | |||

| Receipts (act, invoice) UK 00-000004 dated July 17, 2019 | 1888,00 | 1888,00 | |||

| Receipts (act, invoice) UK 00-000005 dated 10/16/2019 | 5900,00 | 5900,00 | |||

| Receipts (act, invoice) UK 00-000006 dated 10/18/2019 | 354,00 | 354,00 | |||

| Afra LLC | 10,00 | 10,00 | |||

| 1 from 12.102.2019 | 10,00 | 10,00 | |||

| Write-off from account UK00-000004 dated 10/19/2019 | 10,00 | 10,00 | |||

| Transport company Altair LLC | 590,00 | 590,00 | |||

| 123 from 05/12/2019 | 590,00 | 590,00 | |||

| Receipts of additional expenses UK00-000001 dated May 29, 2019 | 590,00 | 590,00 | |||

| TOTAL | 13691,00 | 155317,00 | 141626,00 |

According to this statement, it is clear that in 2021 the conditional company paid the supplier Phoenix LLC 13,681.00 rubles, and goods were received at a cost of 154,727.00 rubles.

The total debt amounted to 141,046.00 rubles. Important! The debit balance of account 60 is reflected in the asset balance sheet (in the form of accounts receivable). The credit balance is reflected in the liabilities side of the balance sheet (in the form of accounts payable).

Count 60: what is it?

The purpose of the account was figured out, and everything seemed to be clear. What about its structure? What is it anyway - count 60, active or passive? Based on the fact that it reflects both receivables and payables, these accounts find their place in both the asset and liability of the balance sheet. Therefore, the account is active-passive. The balance at the end of the month can be formed either as a debit or as a credit. But more often, of course, the second option occurs.

In what cases is the account credited? Regardless of when the right to ownership of goods and materials or services (work) is transferred, the amount that must be paid to suppliers is reflected in account 60 immediately after receipt of goods and materials or services (work) with the relevant accompanying documents. The account is debited when repaying debts to suppliers, as well as for advance payments and deductions when exchanging inventory items.

How debits and credits are displayed

The account is credited for the cost of goods, inventory items, works and services accepted for accounting and corresponds with their accounts. Synthetic loan accounting is based on the supplier's documents, which does not depend on the assessment of values.

Account 60 is debited for the amounts of performance obligations. This also includes advances and prepayments. Corresponds with the accounts in which these funds are recorded.

The debit and credit of account 60 reflects different transactions

Postings

The main transactions for account 60 are reflected in the table below.

By debit.

| Debit | Credit | Explanation of the operation |

| 60 | 50.01 | The debt to the supplier is repaid from the cash register |

| 60 | 51 | The debt to the supplier has been repaid from the current account |

| 60 | 52 | The debt to the supplier was repaid in foreign currency |

| 60 | 55.01 | The amount of the used letter of credit is written off for settlements with the supplier |

| 60 | 76.02 | The amount of claims against the supplier is reflected |

| 60 | 91.01 | Accounts payable are included in other income after the statute of limitations expires |

| 60 | 91.01 | Positive exchange rate difference reflected |

Account document flow

Account 60 is used to form transactions with suppliers. Basic documents for the movement of funds:

- An invoice and invoice are the basis for creating a purchase book (VAT received).

- A payment order or bank statement serves to close accounts payable to contractors.

- The certificate of completion of work is the basis for payment of the amount specified in the contract.

When goods are delivered without a document, the actual receipts are also reflected in the registers. At the time of presentation of invoices 60, the invoice is adjusted taking into account the difference between the accounting prices and the cost of the goods according to the submitted documents.

Documentation for settlements with counterparties is strictly maintained

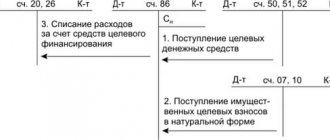

The procedure for writing off receivables and payables on account 60

According to accounting requirements, only true facts must be reflected in accounting data and reporting. If the documents show accounts payable with an expired collection period, then this rule is violated.

Thus, the company is obliged to write off accounts payable if the collection period established by law has passed.

In addition, a debt that can no longer be repaid is subject to removal if the counterparty has been deregistered and no longer exists as a legal entity.

The law establishes that the period during which the creditor has the right to demand its coverage is set at 3 years. In this case, it is necessary to correctly determine the beginning of this period.

When concluding a supply or service agreement, this document usually indicates the date for repayment of obligations. From the day following it, you need to start counting the statute of limitations.

However, the law provides for the deadline to be reset and counted from the beginning. This happens if the debtor acknowledges the existing debt in writing, makes partial payment, signs a reconciliation report, etc. In this situation, the limitation period must be counted first from this moment.

Attention! However, this cannot be done indefinitely. When a period of 10 years has been reached from the date of its formation, the debt must be written off unconditionally.

The debt write-off process is carried out in the following order:

- Carrying out an inventory of all payments. This procedure must be performed annually in order to compare the accounting data with the actual amounts of debt. During the inventory, it is also checked on what date the last movement on this debt occurred.

- Registration of an inventory report. There is a recommended form of the INV-17 form, but currently the company has the right to use its own forms. It is necessary to include in the act all the debts the company has, and not just the identified overdue ones. The document is drawn up in two copies, one is transferred to the accounting department, and the second remains with the commission.

- Preparation of accounting certificates. The accountant must analyze the executed act and draw up a certificate based on it. It reflects the counterparty for which there is a debt, the reason for the occurrence, the amount of the debt, as well as the day when the statute of limitations expired. Certificates of all expired debts, together with the act, are transferred to the manager for consideration and decision-making.

- Making an order. If the manager decides to write off, then he gives instructions to draw up an order to write off the debt. This document provides instructions to write off debt in accounting and tax accounting, and also appoints responsible persons. Based on the order, the accountant prepares accounting entries.