Account 52 Currency accounts is intended to reflect settlements in foreign currency. Russian companies do not have the right to carry out currency transactions among themselves, with the exception of certain situations. But they can take out foreign currency loans from a bank, buy and sell foreign currency, and open foreign currency accounts in Russia and abroad.

Russian companies can pay foreign companies in foreign currency or rubles.

Cash foreign currency received from a foreign currency account can only be used for employee business trips abroad.

Instructions 52 count

Instructions for using the chart of accounts for accounting the financial and economic activities of organizations in accordance with Order No. 94n dated October 31, 2000

Account 52 “Currency accounts” is intended to summarize information on the availability and movement of funds in foreign currencies in the organization’s foreign currency accounts opened with credit institutions in the Russian Federation and abroad.

The debit of account 52 “Currency accounts” reflects the receipt of funds to the organization’s foreign currency accounts. The credit of account 52 “Currency accounts” reflects the write-off of funds from the organization’s foreign currency accounts. Amounts erroneously credited or debited to the organization’s foreign currency accounts and discovered when checking statements of a credit institution are reflected in account 76 “Settlements with various debtors and creditors” (sub-account “Settlements for claims”).

Transactions on foreign currency accounts are reflected in accounting on the basis of statements from the credit institution and monetary settlement documents attached to them.

Sub-accounts can be opened for account 52 “Currency accounts”:

- 52-1 “Currency accounts within the country”,

- 52-2 “Currency accounts abroad.”

Analytical accounting for account 52 “Currency accounts” is maintained for each account opened for storing funds in foreign currency.

Legislative standards for accounting for currency transactions

If a company needs to conduct any transactions in foreign currency, it needs to open a foreign currency account with a bank.

Bank statements and the settlement documents attached to them (applications for transfers, applications for the sale/purchase of currency, etc.) show the movement of currency and are the basis for accounting for foreign exchange outgoings and incoming transactions. In accounting, account 52 is a reflection of foreign currency transactions. It has its own characteristics, and they must be fulfilled.

For proper accounting of account 52 - Currency accounts, several legislative standards have been adopted: Chart of Accounts and Instructions for its application (Order of the Ministry of Finance dated October 31, 2000 No. 94n), Law “On Accounting” dated December 6, 2011 No. 402-FZ, PBU 3/2006 “Accounting for assets and liabilities in foreign currency”, Law “On Currency Regulation and Currency Control” dated December 10, 2003 No. 173-FZ, Regulations of the Central Bank of the Russian Federation “On the procedure for purchasing and issuing foreign currency to pay travel expenses” dated June 25, 1997 No. 62, etc.

Typical transactions for account 52

By debit of the account

| Business transaction | Debit | Credit |

| Cash foreign currency deposited into a foreign currency account | 52 | 50 |

| The purchased foreign currency is credited to the foreign currency account | 52 | 51 |

| Funds were transferred from one currency account to another | 52 | 52 |

| Funds are transferred to a foreign currency account from a special bank account | 52 | 55 |

| The purchased foreign currency is credited to the foreign currency account | 52 | 57 |

| Cash in foreign currency received to repay a previously issued loan | 52 | 58-3 |

| Amounts overpaid to the supplier were returned to the foreign exchange account | 52 | 60 |

| Advance payment in foreign currency from the supplier was returned | 52 | 60 |

| Foreign currency received from the buyer | 52 | 62 |

| The buyer made an advance payment in foreign currency | 52 | 62 |

| Received a short-term loan in foreign currency | 52 | 66 |

| Received a long-term loan in foreign currency | 52 | 67 |

| Unused foreign currency issued for reporting was returned to the foreign exchange account | 52 | 71 |

| A loan in foreign currency was returned to the foreign currency account | 52 | 73-1 |

| The amount of compensation for material damage caused by the employee is credited to the foreign currency account | 52 | 73-2 |

| Funds were transferred to the foreign currency account as a contribution to the authorized capital | 52 | 75-1 |

| Received insurance compensation in foreign currency from an insurance company | 52 | 76-1 |

| Funds in foreign currency are credited to a foreign currency account for a recognized (awarded) claim | 52 | 76-2 |

| Funds in foreign currency are credited to a foreign currency account on account of dividends (income) due to the organization from participation in other organizations | 52 | 76-3 |

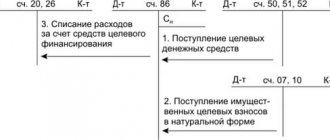

| Targeted funding has been transferred to the foreign currency account | 52 | 86 |

| Received payment for products sold (goods, works, services) | 52 | 90-1 |

| Funds from the sale of other property, as well as additional income received in foreign currency, are reflected in other income | 52 | 91-1 |

| The positive exchange rate difference on the foreign currency account is included in other expenses | 52 | 91-1 |

| Foreign currency received into a foreign currency account as a result of extraordinary events is included in other income | 52 | 91-1 |

| Foreign currency received free of charge | 52 | 91-1 |

| Cash received into a foreign currency account to be included in deferred income | 52 | 98-1 |

By account credit

| Business transaction | Debit | Credit |

| The cash desk received foreign currency from a foreign currency account | 50 | 52 |

| Foreign currency transferred to a special bank account | 55 | 52 |

| Foreign currency listed for sale (conversion into rubles) | 57 | 52 |

| Shares paid from foreign currency account | 58-1 | 52 |

| Loan transferred from foreign currency account | 58-3 | 52 |

| Funds were transferred from a foreign currency account under a joint activity agreement | 58-4 | 52 |

| Debt in foreign currency to the supplier was repaid | 60 | 52 |

| An advance in foreign currency was transferred to the supplier | 60 | 52 |

| The amount overpaid by the buyer is returned | 62 | 52 |

| The advance payment was returned to the buyer from a foreign currency account | 62 | 52 |

| A short-term loan or interest on it in foreign currency has been repaid | 66 | 52 |

| A long-term loan or interest on it in foreign currency has been repaid | 67 | 52 |

| Salaries (dividends) to employees were transferred from a foreign currency account | 70 | 52 |

| Cash issued in foreign currency on account | 71 | 52 |

| A loan was provided to an employee in foreign currency | 73-1 | 52 |

| Dividends were paid from the foreign currency account to the founders (participants) | 75-2 | 52 |

| Deposited wages paid | 76-4 | 52 |

| Own shares purchased from shareholders were paid from a foreign currency account | 81 | 52 |

| Expenses were paid from the current account using retained earnings (by decision of the founders (participants) of the organization) | 84 | 52 |

| Negative exchange rate difference on the foreign currency account is included in other expenses | 91-2 | 52 |

| Foreign currency lost as a result of emergency circumstances is included in other expenses | 91-2 | 52 |

| Expenses related to eliminating the consequences of emergency situations were paid from a foreign currency account | 91-2 | 52 |

| Various expenses were paid from a foreign currency account using a previously created reserve. | 96 | 52 |

Sale and purchase of currency: accounting entries of the organization

There are companies that, due to the specifics of their business activities, have a need to convert their own currency into any other or vice versa.

To be able to carry out such an operation, you must first approve an agreement with the bank, especially if the transfers will be in large quantities.

Next, a separate account is opened in the name of the organization, from which it will be possible to see all financial transactions made by the enterprise. Such control is necessary to confirm legal income and avoid questions from the Federal Tax Service.

Account 52 in accounting: postings, examples of transactions on a foreign currency account, in what currency accounting is carried out, how a statement of account 52 is maintained in accounting

Account 52 of accounting is the active account “Currency accounts”. Serves to reflect information on the movement of foreign currency funds in accounting. Using standard transactions, invoice 52 is sent, as well as features of reflecting transactions on a foreign currency account.

Features of currency transactions

An organization that sells goods (materials, services) to foreign buyers or purchases goods (materials, services) from foreign suppliers carries out the following operations: purchase, sale, registration of a transaction in foreign currency.

For settlement transactions, the organization opens a foreign currency account in a bank. In most cases, the bank opens two foreign currency accounts for companies - current and transit:

- The current currency account is used to reflect credited foreign currency funds for the export sale of goods (materials, services);

- A transit currency account is used to execute the sale of foreign currency proceeds transferred to counterparties who are not residents of the Russian Federation in payment for goods (materials, services). After transfer, the bank transfers the balance of the currency from the transit account to the current currency account.

Changes that came into effect in 2015 regarding the accounting of exchange rate differences in foreign exchange transactions allow the recalculation of assets and liabilities to be performed on the last date of the current month. Law of April 24, 2015 No. 81-FZ allows you to equate exchange rate differences in accounting to exchange rate differences in tax accounting.

List of standard entries for accounting for transactions on account 52 “Currency accounts”

| frenni2007 | What documents to carry out the transfer operation from a foreign currency to a ruble current account. The postings should look like this: In general, I have a question about the UPP, what documents should be used to implement such operations: 57.11 - 5251 - 57.1191 - 57.11 (exchange difference). |

| frenni2007 | |

| frenni2007 | A payment order for debiting funds with the type of transaction - transfer to another account - does not allow you to select current accounts with different currencies. A payment order for debiting funds with the type of transaction - other debiting funds - swears for accounts with different currencies. Maybe first you need to somehow transfer from 52 to 57 some other documents, tell me what to do? What algorithm? |

| Pippi | Bogacheva has an example of how to arrange the transfer of funds from the foreign exchange office to the ruble office... similarly with accounts.Transferring money from a foreign currency account to a ruble account in 1C Bukh 77I can’t copy-paste. |

| Another | 1. Outgoing payment order - type of transaction - other write-off of DS - this is from a foreign currency account. 2. Incoming payment order - type of transaction - receipts from the sale of foreign currency. (Well, indicate rates and amounts there) Correspondent accounts should be “Money in transit” That’s all. |

| frenni2007 | I struggled for a long time, but I found everything myself. In the end, I got it this way: 1) Outgoing payment order - operation - other write-off of DS - 57.22 - 52: 2) Incoming order for receipt of DS - operation - proceeds from the sale of foreign currency - 51 - 57.11 through accounts 91. |

| Another | I don’t know your chart of accounts, but in the first document, IMHO, there should be a correspondent account - “57.11” + an amount difference will be formed that will close this account. |

| frenni2007 | (6) Standard chart of accounts. In the first document there can be no amount difference, there is a credit to the account of 57.22 (or maybe 57.11, I chose 22, because it goes from foreign currency to ruble). Exchange rate differences can only arise at the time of leaving the account 57.22 with a document for write-off. This does not happen here, since these operations take place in one day. There is an exchange rate difference only on account 52, the days of receipt and debit on 57.22 are different. It is calculated by Currency Revaluation. Like so. |

| Dt | CT | Wiring Description | Document |

| 57 | 51 | Transfer of the amount in rubles for the purchase of foreign currency. currencies | Bank statement |

| 52 | 57 | The amount of purchased foreign currency is reflected | |

| 57 | 52 | Foreign currency for sale listed | Bank statement |

| 51 | 57 | The proceeds from the sale of foreign currency were transferred to the ruble current account | |

| 91.02 | 57 | Negative exchange rate difference when buying (selling) is reflected | Accounting information |

| 57 | 91.02 | Positive exchange rate difference when buying (selling) is reflected | |

| 60 | 52 | Write-off of currency funds to the supplier to pay for the delivery | Bank statement |

| 66 (67) | 52 | Repayment of borrowed funds and payment of interest in foreign currency is reflected | |

| 75 (76, 79) | 52 | Transfers of foreign currency funds to other counterparties are reflected | |

| 52 | 62 | Receipt of foreign currency from buyers for goods (services) sold | |

| 52 | 66 (67) | Reflection of receipts of borrowed funds in foreign currency | |

| 52 | 75 (76,79) | Receipt of foreign currency from other counterparties | |

| 50 | 52 | Receiving currency from the bank to the cash desk | Receipt cash order |

| 71 | 50 | The issue of foreign currency to an accountable person is reflected | Account cash warrant |

| 50 | 71 | The return of unused currency funds by the accountable person to the cash desk is reflected | Receipt cash order |

| 52 | 50 | Transferring currency from the cash register to the bank | Account cash warrant |

Accounting for currency transactions on account 52 using an example with postings

Let's consider an example of selling foreign currency.

The dollar exchange rate set by the Central Bank of the Russian Federation was:

- as of December 27, 2016 – 60.9084 rubles per US dollar;

Source: https://buhvopros.com/provodki-prodazha-valyuty/