The concept of targeted financing

Targeted financing is the allocation of funds for the implementation of strictly defined goals with the ability to control expenses. It could be:

- conducting scientific research;

- capital construction;

- organization of events;

- development of a new line of activity, etc.

According to the sources of funds received, financing is distinguished:

at the expense of the budget (state):

- subsidies - for example, to compensate for housing and communal services costs;

- transfers – for the construction of capital construction projects;

- grants – for carrying out research work.

at the expense of non-governmental organizations:

- scholarships;

- grants;

- investments.

If the financing conditions are met, the funds received become their own, otherwise they will have to be returned, “getting into” accounts payable.

Account 86 in accounting

An important aspect of accounting for these funds is the competent determination of their purpose and purpose in accordance with the agreement.

Sources of financing activities (funds for special purposes) are reflected in credit 86 of the accounting account, and their use itself is reflected in debit:

Subventions are funds from the budget that are provided on the condition of shared financing of targeted expenses to a legal entity (in order to reduce production costs) or to an individual, or to the budget of another level of the RF BS.

Analytical accounting of target funds is carried out according to their purpose and sources of income.

Attention! It is prohibited to use designated funds for other purposes.

Postings to reflect target financing on account 86

In general, accounting entries for account 86 in commercial organizations look like this:

- Dt76 – Kt86 – reflects the receipt of targeted funds;

- Dt86 – Kt98 – target money is reflected as prospective income;

- Dt60 – Kt51 – payment has been made to the supplier for materials or goods;

- Dt10 – Kt60 – materials or goods delivered to the receipt;

- Dt20 – Kt10 – materials are written off;

- Dt91 – Kt20 – expense account is closed;

- Dt98 – Kt91 – targeted funds are reflected in the line of other income.

Records of the movement of received amounts depend on the nature of the activity of the economic entity. Thus, non-profit organizations can directly reflect the receipt of materials by posting Dt86 - Kt20 .

What it is

This type of material support refers to the gratuitous receipt of financial resources and other instruments that must be used in accordance with the purpose pursued by the person who provided it.

That is, it turns out that the expenditure of this type of funds is limited by certain conditions. If they are carried out correctly, the received instruments will go to the section of your own; if this is not done, you will have to return them and “get into” accounts payable. The list of these material resources includes the following elements and areas:

- assistance from the state;

- subsidies from legal entities and individuals;

- non-repayable loans;

- sponsoring events.

These are direct economic actions aimed at increasing the benefits of the organization. They are presented in the form of subsidies, subventions, assistance and support in all directions. There are several goals that targeted funding can be used to achieve:

- expense or coverage of unprofitable areas;

- maintaining an optimal financial position;

- replenishment of balance funds;

- acquisition of assets.

Funding for the following plan cannot be reflected:

- receiving assistance in the form of benefits, including tax breaks, exemptions and holidays;

- credit funds or other repayable obligations;

- state capital and participation.

There are two key conditions under which detailed reflection of target financing occurs:

- the need for a sufficient level of confidence and probability in achieving the target distribution of funds;

- confidence that help will be 100% received.

What does the balance show and how is account 86 closed?

The credit part of account 86 displays the amount of funds allocated to the company under the terms of targeted financing. Its debit part reflects the unused balance, which will be spent in the future or returned to the investor.

In a standard situation, when the funds received under the contract were spent on the implementation of contractual goals in full, no additional entries are required to close the account. If the funds remain, then the accountant will have to reflect their further movement:

- if the balance can be used by the company at its own discretion, then posting Dt86 - Kt90 (sales) or Dt86 - Kt91 (other income) will be required;

- if the balance must be returned to the “sponsor”, then the posting looks different - Dt86 - Kt51 (non-cash payment), Dt86 - Kt50 (cash payment), Dt86 - Kt52 (payments in foreign currency).

Typical postings for account 86

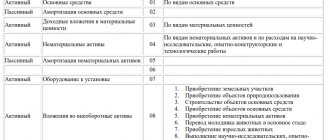

By debit of the account

| Business transactions | Debit | Credit |

| Targeted financing funds were used to implement targeted activities (non-profit organizations) | 86 | 20 |

| Targeted financing funds were used to implement targeted activities | 86 | 26 |

| Used investments are included in additional capital (non-profit organization) | 86 | 83 |

| Targeted financing funds are included in deferred income | 86 | 98 |

By account credit

| Business transactions | Debit | Credit |

| Equipment requiring installation, received for special-purpose events, was capitalized | 07 | 86 |

| Received investments in non-current assets as investments | 08 | 86 |

| Materials received for their intended purpose | 10 | 86 |

| Animals received as targeted funding have been registered | 11 | 86 |

| Inventory received for its intended purpose was capitalized | 15 | 86 |

| A work in progress object was received as targeted financing | 20 | 86 |

| Goods received as targeted financing were capitalized | 41 | 86 |

| Targeted funding received | 50 | 86 |

| Targeted funding received | 51 | 86 |

| Targeted funding has been transferred to the foreign currency account | 52 | 86 |

| Targeted financing funds were transferred to a special account | 55 | 86 |

| Targeted funding accrued | 76 | 86 |

Repaying a loan using a donation received

In 2011, a donation was received to repay the loan, pay for banking services and statutory activities. The loan was returned, banking services were paid for 2011.

We reflected this with the following entries:

Debit 51 Credit 86 - 20,000 rub. — donation received;

Debit 66 Credit 51 - 7000 rub. - the loan is repaid;

Debit 86 Credit 51 - 13,000 rub. — paid for banking services for 2011;

Debit 86 Credit 60 - 5000 rub. — rental of a PO box for the first quarter of 2011;

Debit 86 Credit 76 - 2000 rub. — banking services for 2010

That is, our income of target funds is 20,000 rubles, and their expenditure will be 20,000 rubles. or 18,000 rubles?

Will loan repayment be subject to income tax?

If there are not enough funds in account 86 to pay salaries, can the unpaid part of it be attributed to account 76, and when contributions arrive, attributed to account 86?

The non-profit organization maintains accounting records in accordance with the Chart of Accounts for accounting financial and economic activities, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n. Financing of the activities of a non-profit organization that does not conduct business activities is carried out through targeted funds (membership fees, donations, etc.).

Account 86 is intended for accounting for targeted financing funds. The instructions for using the Chart of Accounts say that the receipt of targeted financing funds is reflected in the loan, and their use is reflected in the debit of account 86. Thus, the turnover in the debit of account 86 cannot in any way exceed the turnover in the loan account 86 and in principle there can be no overspending of target financing. Targeted funding can only be spent in full or under-spent. Accordingly, there can be no receivables on account 86.

It follows from the text of the question that in 2010, due to the lack of targeted funds, the financing of your organization’s expenses for paying for banking services and renting a P.O. box was carried out using funds raised under an interest-free loan agreement concluded with an individual. To repay the loan, your organization needs the receipt of appropriate targeted funds. Thus, your organization has a receivable to deposit funds to repay the loan received.

But who should contribute these funds? The sources of formation of the property of a non-profit organization that does not carry out entrepreneurial activities are both regular and one-time receipts from the founders (participants, members), and voluntary property contributions and donations (Clause 1, Article 26 of the Federal Law of January 12, 1996 No. 7FZ “On Non-Commercial organizations"). Consequently, debtors are both the founders and the persons making donations.

The instructions for using the Chart of Accounts say that designated funds received as sources of financing for certain activities are reflected in the credit of account 86 “Targeted financing” in correspondence with account 76 “Settlements with various debtors and creditors.” Consequently, the debt to deposit funds to repay the loan received must be reflected in the debit of account 76 in the subaccount “Financing debt”.

The accounting entries for 2010 will be as follows:

Debit 51 Credit 66

— 7000 rub. — received an interest-free loan from an individual;

Debit 76 Credit 51

— 2000 rub. — paid for banking services;

Debit 20 Credit 76

— 2000 rub. — banking services are included in the organization’s expenses;

Debit 60 Credit 51

— 5000 rub. — paid for the rental of the PO box;

Debit 20 Credit 60

— 5000 rub. — payment for the rental of a PO box is included in the organization’s expenses;

Debit 76 Credit 20

— 7000 rub. — debt has been generated for the funds necessary to repay the loan.

Since there is no movement of targeted funds for these operations (they were carried out using borrowed funds), in the form of a report on the targeted use of funds received for 2010, there will be no receipt and use of targeted funds.

In 2011, your organization received a donation in the amount of 20,000 rubles to repay the loan, pay for banking services and conduct statutory activities.

The accounting entries in 2011 will be as follows:

Debit 51 Credit 76

— 20,000 rub. — receipt of funds to the current account as a donation from a specific donor;

Debit 76 Credit 86

— 20,000 rub. — the funds received (donation) are taken into account as targeted funding;

Debit 66 Credit 51

— 7000 rub. - the loan is returned;

Debit 86 Credit 76

— 7000 rub. — funds from targeted financing were used to repay the loan;

Debit 76 Credit 51

— 13,000 rub. — paid for banking services;

Debit 20 Credit 76

— 13,000 rub. — banking services are included in the organization’s expenses;

Debit 86 Credit 20

— 13,000 rub. — funds from targeted financing were used to pay for banking services.

Thus, both the income and expenditure of targeted financing for 2011 will be 20,000 rubles each.

Your organization is not subject to corporate income tax either when receiving a loan or when repaying it with a donation. Borrowed funds received are not included in the tax base for income tax on the basis of subclause. 10 p. 1 art. 251 Tax Code of the Russian Federation.

Donation funds used to repay the loan are not included in the tax base on the basis of clause 2 of Art. 251 Tax Code of the Russian Federation. After all, the donation (targeted funding) in this case is used by your organization strictly for its intended purpose.

Payment of wages in a non-profit organization that does not conduct entrepreneurial activities is reflected in the accounting records by the following entries:

Debit 20 Credit 70

— salaries of the organization’s employees are accrued;

Debit 70 Credit 50 (51)

— accrued wages paid to employees;

Debit 86 Credit 20

— targeted financing funds were used for employee salaries.

The unpaid portion of the salary will be listed on credit 70 of account as accounts payable to employees.

Let us note that the Labor Code provides for the employer’s liability for failure to pay wages on time (Article 142 of the Labor Code of the Russian Federation). Thus, if the employer violates the established deadline for paying wages, he is obliged to pay it with interest (monetary compensation) in the amount of not less than one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time from amounts not paid on time for each day of delay starting from the next day after the established payment period until the day of actual settlement inclusive (Article 236 of the Labor Code of the Russian Federation).

Normative base

The rules for the formation in accounting of information on the receipt and use of state aid provided to commercial organizations, including subsidies, are established by PBU 13/2000 “Accounting for state aid.”

Read in the berator “Practical Encyclopedia of an Accountant”

How to reflect targeted financing funds on the balance sheet

The recipient accepts budget funds for accounting if two conditions are met (clause 5 of PBU 13/2000):

- there is confidence that the conditions for the provision of these funds by the organization will be met;

- there is confidence that the specified funds will be received.

Budget subsidy funds are accounted for as the occurrence of targeted financing and debt for these funds. As soon as the money is actually received, the debt decreases and the accounts for accounting for cash, capital investments, etc. increase accordingly (clause 7 of PBU 13/2000).

In general, the occurrence of targeted financing is reflected on the date of the decision to provide a subsidy.

The wiring is like this:

- Debit 76 Credit 86

a decision was made to pay a subsidy;

- subsidy received.

In the case of a subsidy for wages and emergency needs, according to Resolution No. 576, you can reduce the number of entries by excluding the reflection of the subsidy debt on account 76, and limit yourself to posting:

- Debit 51 Credit 86

subsidy received on the current account.

Let's explain with an example.

Example 1. How to reflect receipt of a subsidy under Resolution No. 576 The company is a small enterprise. Works in the affected industry. The number of employees in March is 10 people. The firm applied for the subsidy on May 14, 2021 for April. The Federal Tax Service examined the application and considered that all conditions were met. Since the application was received in the first half of the month, the payment was made after May 18. On May 21, the inspection informed the company about the payment of a subsidy in the amount of 121,300 rubles. (RUB 12,130 x 10 people). The accountant made the following entry:

- Debit 51 Credit

86,121,300 rub. – funds for targeted financing have been received.

Federal Law No. 121-FZ of April 22, 2021 exempts subsidies to those affected by coronavirus from taxation from January 1, 2020. These funds are not subject to income tax, tax under the simplified tax system and unified agricultural tax.

Targeted financing in accounting

The term “targeted financing” refers to the transfer of funds to a company for a strictly defined purpose, the details of which are previously discussed with the source of financing. Such a source can be government agencies, various funds, or simply individuals and investors.

The main purposes of financing are usually:

- Scientific research;

- Research in various industries;

- Capital construction;

- Sets of activities with different target orientations (for example, an advertising campaign, the task of which is to promote a certain product in the market environment);

- Repurposing production to produce another product, etc.

The main criterion for spending targeted funds is the strict definition of the framework for the implementation of the projects to which they are directed and strict control of use. Appropriations from the state budget include:

- transfers for capital construction of facilities;

- tranches for R&D;

- subsidies to compensate for lost income and other payments.

An important feature of state targeted financing is the non-refundability of allocated funds, i.e. the company will not have to return the allocations received from the state budget.

Targeted funds from non-state funds are listed as:

- Scholarships/grants (for example, for various scientific developments, cultural development, etc.);

- Investments paid based on the results of competitions;

- Investments of foreign companies and individuals.

Receipt of targeted funds must be formalized by a concluded agreement with additional documentary justification attached to it. The agreement sets out the requirements and conditions, the fulfillment of which becomes mandatory to receive funds, and also reflects the target orientation of the investment.