“Classic” trading

The simplest from the point of view of accounting and tax accounting is the “classic” trading option: goods are displayed on the sales floor, buyers choose the items they like, pay for them (in cash at the register or by bank card) and take them with them (or, possibly, the selected product delivered by the store to the address specified by the buyer).

Accounting records with this option will be typical for retail trade. Of course, in the accounting policy, in accordance with the requirements of PBU 5/01 “Accounting for inventories” <1>, the options for valuing goods chosen by the organization must be specified, in particular:

- are the costs of delivering goods from suppliers to the warehouses of a trading company included in the cost (purchase price) of goods (that is, are they debited to account 41 “Goods”) or are they taken into account as distribution costs in account 44 “Sales expenses”;

- whether a trade margin is applied (whether account 42 “Trade margin” is used), that is, whether goods are valued at their sales or purchase value.

Since this trading option does not have any accounting features, we will not consider it in detail. Let us only note that the “classical” trading scheme is quite possible in furniture showrooms, but most often it is used in stores where not too large items are presented, for example, chairs, tables, chests of drawers.

How to properly record furniture in accounting

The form is fixed by the Resolution of the State Statistics Committee dated January 21, 2003. No. 7. To finally understand what type of equipment office furniture belongs to, you need to familiarize yourself with clause 5 of PBU 6/01.

Info

According to the provisions of the regulatory document, if all the conditions set forth in clause 4 are met in relation to an object, but its cost does not exceed 40,000 rubles, then it can be taken into account as inventory. To preserve such property in production, it is necessary to organize proper control over its movement.

Based on the statement, it turns out that office furniture is part of the inventory. If a company purchases inexpensive items, they are all reported as inventory. In addition, the company maintains control over the movement and safety of purchased property.

Office furniture accounting

In this case, the service life of items is set within 5–7 years. Question No. 3. Can I independently develop a document form for furniture accounting? Yes, the law does not prohibit a specialist from independently developing a form for carrying out the procedure. Question No. 4.

Which category should the property be included in if its value is more than 100,000 rubles? In both tax and accounting, the item can be classified as fixed assets. Question No. 5. How to confirm the transfer of property into operation? To carry out the action, you can use the invoice.

The form of the document may be the same as for stationery. Rate the quality of the article.

Furniture accounting at the enterprise: postings

Attention to the Tax Code of the Russian Federation). The company has the right to write it off as costs under the “simplified procedure”. The basis for carrying out such manipulation is Article 346.16 of the Tax Code of the Russian Federation. However, the accountant must take into account Article 254 of the Tax Code of the Russian Federation.

If the company incurred expenses for the purchase of items belonging to this category, the accountant has the right to reflect them in the “Income and Expenses Accounting Book” immediately after payment. There is no need to wait until the property is put into operation (Article 346.17 of the Tax Code of the Russian Federation).

Attention! If a company makes contributions to the state under the simplified tax system, only reasonable costs can be taken into account.

Accounting for office furniture in a company

The chosen methodology for carrying out monitoring activities must be approved by a local act of the enterprise - the accounting policy. To document the movement of furniture, you can use the recommended forms of primary forms or your own templates. In the latter case, the documents will have legal force if a number of requirements are met:

- the form contains all the mandatory details inherent in the primary documents;

- the sample used is approved by the accounting policy;

- The document must be correctly formatted and no errors or omissions are allowed.

When any piece of furniture is disposed of, a write-off report is drawn up. This form is also required for disposal, resale or gratuitous transfer.

Source: https://advocatus54.ru/uchet-mebeli-v-ofise/

How to take furniture into account for tax purposes

Probably, any company has property that serves for quite a long time, obviously more than a year, but due to its low cost is not a main asset.

We are talking primarily about furniture, printers, photocopiers, and computers. Such objects are reflected in accounting on account 10 “Materials” as part of inventories.

And in tax accounting under the simplified tax system they are classified as material expenses (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Trade by samples and catalogs

Typically, a visitor to a furniture store purchases a specific model of furniture, and not a specific piece that he had the opportunity to examine, touch and “test” in the showroom. That is, exhibition copies of the product are most often presented on the sales floor, and all color options and modifications are not always available.

The buyer is additionally shown samples of upholstery fabric or other options for a particular model in catalogs. Ultimately, the buyer is delivered a similar product that is in the warehouse of the furniture store or, at the time of making the purchase, has not yet been received by the store from the supplier.

Thus, the store purchases from suppliers only the furniture that has already actually been sold to the buyer, which allows significant savings on costs associated with storing goods and maintaining large retail spaces. If a furniture store has chosen exactly this option – trading according to samples and catalogues, it is necessary to take into account a number of nuances.

Firstly, the legal side of the issue is fundamentally important - how exactly the relationship between furniture buyers, a furniture store and manufacturers (suppliers) is regulated. These can be either intermediary agreements, which we will talk about in more detail below, or standard retail purchase and sale agreements with buyers and supply or purchase agreements with suppliers (manufacturers, wholesalers).

Of course, contractual policy will have a direct impact on accounting records and tax treatment. In this case, one of the most significant terms of the retail purchase and sale agreement will be the moment established in it for the transfer of ownership to the buyer. If these conditions are not regulated, one must be guided by the norms of civil law.

So, according to paragraph 1 of Art. 223 of the Civil Code of the Russian Federation, as a general rule, the ownership right of the acquirer of a thing under a contract arises from the moment of its transfer. And in accordance with paragraph 3 of Art. 497 of the Civil Code of the Russian Federation, unless otherwise provided by law or contract, for the retail sale of goods according to samples or catalogs (remotely), the contract is considered fulfilled from the moment of delivery of the goods to the place of residence of the buyer - an individual (or at the location of the buyer who is a legal entity person) or to another place expressly specified in the contract.

This is important, because one of the five mandatory conditions for recognizing sales revenue, prescribed in paragraphs. “d” clause 12 of PBU 9/99 “Income of the organization” <2>, is the transfer of ownership of the goods to the buyer. And if at least one of these five conditions is not met in relation to cash and other assets received by the organization as payment, the organization’s accounting should recognize not revenue, but accounts payable.

As a rule, the buyer immediately pays for the selected furniture in the showroom (unless he takes out a loan or installment plan, which we will also talk about a little later), but it is not always delivered to him on the same day. Moreover, it is quite possible that such a specific model is not in stock and it will be necessary to order it from the supplier - and then the gap between the moment of receipt of money from the buyer and the date of delivery of the furniture purchased to him may be not just a few days, but several weeks or even months .

Therefore, it must be borne in mind that, according to Art. 487 of the Civil Code of the Russian Federation, in cases where the purchase and sale agreement provides for the buyer’s obligation to pay for the goods in full or in part before the seller transfers the goods, prepayment for the goods takes place. Thus, the amount received from the buyer who chose furniture according to the sample should be recognized as an advance payment and reflected in the credit of account 62 “Settlements with buyers and customers”, to which for these purposes a corresponding sub-account is opened (to account for the received advance payment) and analytical accounts (for accounting of settlements with each specific buyer).

If the activity of a furniture showroom in the retail trade of furniture has not been transferred to the payment of UTII, you should also keep in mind that upon receipt of an advance payment, VAT must be charged. However, later, after shipment of the goods, it will be possible to deduct the tax amount.

Secondly, it matters how trade is organized based on samples and catalogs - through a showroom (that is, an object of a stationary distribution network) or in another way, outside a stationary distribution network.

Trade in furniture by samples, as a rule, presupposes the presence of a stationary retail chain facility - a showroom (shop) where furniture samples are displayed. After all, according to paragraph 1 of Art. 497 of the Civil Code of the Russian Federation, the sale of goods by samples provides for the conclusion of a retail purchase and sale agreement based on the buyer’s familiarization with the sample of goods offered by the seller, which is displayed at the place of sale of goods.

And the Rules for the sale of goods by sample <3> directly state that organizations selling goods by sample must have premises allocated for displaying samples of the goods offered for sale. Moreover, it is necessary to provide samples of the offered goods of all articles, brands and varieties, components and devices, accessories and other related products for buyers’ review.

An example of the second option - when furniture is traded not through the objects of a stationary retail chain - could be, for example, a scheme in which a trading company has an office where not a single sample of furniture is presented, and visitors are only invited to look at catalogs and choose the models they like according to pictures, after which a retail purchase and sale agreement is concluded with the buyer, providing for the obligation to deliver the selected product to the place specified by the buyer.

We suggest you read: An employee is constantly on sick leave, how to fire him

The possibility of concluding an agreement on the basis of familiarization of the buyer only with the description of the goods - through catalogues, prospectuses, booklets, photographs, means of communication (television, postal, radio communications, etc.) or other means that exclude the possibility of direct familiarization of the consumer with the goods or a sample of the goods when concluding an agreement , – provided for in paragraph 2 of Art.

The presence of a stationary retail chain facility is fundamentally important for deciding whether the retail sale of furniture in this particular situation will be subject to the taxation system in the form of UTII. The fact is that, according to Art. 346.27 of the Tax Code of the Russian Federation, for the purposes of applying this special regime, retail trade does not include the sale of goods based on samples and catalogs outside a stationary retail network, including in the form of postal items (parcel trade), as well as through teleshopping, telephone communications and computer networks.

This means that the sale of furniture based on samples in a showroom store (through a stationary retail chain facility) is clearly subject to the payment of UTII (of course, subject to the remaining requirements of Chapter 26.3 of the Tax Code of the Russian Federation, including the area of the sales floor, the number of personnel, the structure of the authorized capital of the company ). The same applies to the sale of furniture through catalogues, if the conclusion of a retail purchase and sale agreement and the receipt of payment for the goods are carried out in the premises of a store recognized as an object of a stationary retail chain.

Such clarifications were given, in particular, in the recent Letter of the Ministry of Finance of Russia dated February 22, 2012 N 03-11-06/3/12. If the execution of transactions - the conclusion of an agreement for the sale of goods according to catalogues, price lists and demonstration samples (regardless of the form of payment) takes place in the office, and the goods are released (shipped) from the warehouse, such activity for the purposes of applying Ch. 26.3 of the Tax Code of the Russian Federation does not apply to retail trade and is not subject to transfer to a special regime in the form of UTII (Letter of the Ministry of Finance of Russia dated January 23, 2012 N 03-11-06/3/2).

Accounting for direct material costs in furniture production

The main equipment can be considered furniture that:

- used to implement the tasks of the company’s core activities;

- will be used for a long time (more than a year);

- not planned to be put up for sale in the short to medium term;

- is able to bring profit to the organization and increase revenue;

- the valuation reaches the lower threshold established by law for recognition as a fixed asset.

If the full list of criteria is not met, the acquired objects must be taken into account as inventory. ATTENTION! To recognize furniture as a fixed asset, according to accounting rules, its value must be at least 40 thousand rubles; in tax accounting, the lower valuation limit is approved at 100 thousand rubles.

Furniture intermediary trade

As already noted, furniture trade can be carried out using an intermediary scheme. In this regard, first of all, it should be emphasized that within the framework of intermediary relations, different options are also possible.

- A store may enter into an intermediary agreement with a manufacturer or wholesaler of furniture and not actually sell the furniture purchased as the store’s property, but provide intermediary services to the manufacturer (wholesaler).

- A furniture showroom (shop) may well enter into an intermediary agreement with the buyer. In other words, a salon (store) can act as an intermediary in selecting the best option, making a transaction with the manufacturer (seller) and delivering furniture in the interests of a person wishing to buy certain furniture. In such a situation, it turns out that first an intermediary (for example, agency) agreement must be concluded with the buyer of the furniture, and then on its own behalf or on behalf of the final buyer of the furniture, depending on the terms of the intermediary agreement, the furniture store will enter into a corresponding agreement with the manufacturer or a furniture wholesaler.

In any case, the revenue (income) of the intermediary, both in accounting and tax accounting, will be considered only his intermediary (commission, agent) remuneration, and not the entire amount received at the cash desk or into the intermediary’s accounts from buyers. Let us recall that values that actually enter the trading organization, but do not belong to it, must be taken into account off the balance sheet.

In particular, goods received on commission, that is, furniture that belongs to manufacturers or wholesalers, but is transferred by them for sale to a furniture showroom under an intermediary agreement, is reflected in account 004 “Goods accepted on commission.” And furniture purchased under an intermediary agreement with the buyer (and, accordingly, owned by this buyer, although in fact it may be in a warehouse or at the disposal of a furniture store for some time), should be reflected in account 002 “Inventory assets accepted at responsible storage."

Enter the site

RSS Print

Category : Accounting Replies : 9

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev.1 Next → Latest (1) »

| Lemon |

| Good afternoon The landlord provided me with a certificate of acceptance and transfer of furniture, how can I put this furniture on an off-balance sheet account? What wiring needs to be done? |

| I want to draw the moderator's attention to this message because: Notification is being sent... |

| PiliTomik [email hidden] Belarus, Grodno Wrote 1054 messages Write a private message Reputation: 221 | #2[497623] April 13, 2012, 16:27 |

Notification is being sent...

You don't have to be a dog to be a friend| angel_best [email protected] Republic of Belarus, Gomel Wrote 620 messages Write a private message Reputation: 137 | #3[497627] April 13, 2012, 16:31 |

Notification is being sent...

If you are white and fluffy, go to the solarium and get hair removal... A genius sleeps in each of us, but every day it gets stronger.....| Lemon [email hidden] RB, Minsk Wrote 166 messages Write a private message Reputation: | #4[497632] April 13, 2012, 16:42 |

Notification is being sent...

| PiliTomik [email hidden] Belarus, Grodno Wrote 1054 messages Write a private message Reputation: 221 | #5[497634] April 13, 2012, 4:44 pm |

Notification is being sent...

You don't have to be a dog to be a friend| angel_best [email protected] Republic of Belarus, Gomel Wrote 620 messages Write a private message Reputation: 137 | #6[497639] April 13, 2012, 16:55 |

kaminskaja2007 wrote:

I don’t have a quantity, but the available field is only the amount. This is fine? In my act, on the contrary, the amount is not indicated, only the quantity of furniture transferred.

I believe that the quantity should be mandatory, because it is written down in the act. You will then return it according to the quantity, but the amount is no longer necessary... if it is received through manual operations or by an accounting certificate, then the quantity will be entered.

I want to draw the moderator's attention to this message because:Notification is being sent...

If you are white and fluffy, go to the solarium and get hair removal... A genius sleeps in each of us, but every day it gets stronger.....| Yulia Vladimirovna [email protected] Belarus, Grodno-Minsk Wrote 5380 messages Write a private message Reputation: 583 | #7[497642] April 13, 2012, 16:59 |

kaminskaja2007 wrote:

I don’t have a quantity, but the available field is only the amount. This is fine? In my act, on the contrary, the amount is not indicated, only the quantity of furniture transferred.

In the act d.b. the amount and quantity are indicated.

I want to draw the moderator's attention to this message because:Notification is being sent...

Everything passes.| Lemon [email hidden] RB, Minsk Wrote 166 messages Write a private message Reputation: | #8[497644] April 13, 2012, 5:04 pm |

Notification is being sent...

| angel_best [email protected] Republic of Belarus, Gomel Wrote 620 messages Write a private message Reputation: 137 | #9[497646] April 13, 2012, 5:07 pm |

Notification is being sent...

If you are white and fluffy, go to the solarium and get hair removal... A genius sleeps in each of us, but every day it gets stronger.....| Yulia Vladimirovna [email protected] Belarus, Grodno-Minsk Wrote 5380 messages Write a private message Reputation: 583 | #10[497649] April 13, 2012, 5:28 pm |

Notification is being sent...

Everything passes.« First ← Prev.1 Next → Latest (1) »

In order to reply to this topic, you must log in or register.

Accounting and taxation of furniture components

Important

Let us note that the Tax Code does not make the effect of the limitation established by it in the application of benefits dependent on the peculiarities of the formation of the initial cost of movable property acquired from an interdependent person, which is included as an object of fixed assets (clause 25 of Article 381 of the Tax Code of the Russian Federation). At the same time, the Ministry of Finance of Russia has issued clarifications in which there is a conclusion that movable property items made from components purchased from a related party (not recognized as a related party), recorded as fixed assets from January 1, 2013, are not subject to taxation (letters of the Ministry of Finance of Russia dated 05/15/2015 No. 03-05-05-01/27973, dated 03/05/2015 No. 03-05-04-01/11797).

Selling furniture on credit

Furniture is often a very expensive product, and therefore it is often sold on credit. And there may be options here too.

- A loan for the purchase of furniture can be provided to the buyer by a bank or credit institution. The loan agreement is concluded between the buyer and the bank (credit institution), even if the paperwork is actually completed by a trained employee of the furniture showroom (or a representative of the bank, for whom a workplace is equipped right in the showroom for the convenience of buyers).

In this case, the furniture store will immediately receive the entire amount - from the buyer (if a first payment for the furniture is provided at the store’s cash desk) and from the bank (in the amount of the loan provided to the buyer, taking into account his down payment, if any). The buyer will make all further payments on the loan with the bank, and the furniture showroom will no longer have anything to do with them.

Therefore, the accounting entries in this option are not fundamentally different from ordinary retail sales: the accountant recognizes revenue in the amount of the full cost of the goods and reflects the receipt of funds directly from the buyer and from the bank (credit institution), as a result of which settlements with the buyer are “closed.”

- The store itself can provide a loan (installment plan). According to Art. 488 of the Civil Code of the Russian Federation, the sale of goods on credit includes cases where the purchase and sale agreement provides for payment for the goods within a certain time after its transfer to the buyer. In such a situation, the contract may well establish the buyer’s obligation to pay interest in an amount corresponding to the price of the goods, starting from the day the goods are transferred by the seller. And unless otherwise provided by the purchase and sale agreement, from the moment of transfer of the goods to the buyer and until payment, the goods sold on credit are recognized as being pledged by the seller to ensure the fulfillment by the buyer of his obligation to pay for the goods. In addition, an agreement on the sale of goods on credit may provide for payment for the goods in installments - in several payments over a certain time (Article 489 of the Civil Code of the Russian Federation).

In these cases, in accounting, revenue is recognized at the time of transfer (shipment) of the goods (or at another moment of transfer of ownership to the buyer depending on the terms of the contract), and at the same time, on account 62, the buyer’s receivables for furniture are formed, which he will repay in accordance with with a payment schedule or within the terms specified in the contract.

This debt will remain on the balance sheet until it is fully repaid. And since, as a general rule, until the goods are fully paid for, they are considered to be pledged to the seller, the accountant of the furniture showroom needs to reflect this goods on off-balance sheet account 008 “Securities for obligations and payments received.” In accordance with the Instructions for using the Chart of Accounts, the amounts of collateral recorded in account 008 are written off as the debt is repaid.

We invite you to read: How to fill out an income tax return

Some difficulty within this scheme is caused by the procedure for reflecting interest on a loan provided by a store. The easiest way is if interest is already included in the price of the product. That is, interest as such is not accrued and there is no mention of it in the contract, but the price of the product for customers purchasing it on credit (in installments) is initially set at a higher level than for those who pay the entire cost at a time.

For example, each product has a certain set of prices depending on the terms of payment. It is also possible that customers purchasing goods in cash are given a discount for immediate payment, that is, the sales price is essentially the price set taking into account the cost of a commercial loan.

Example 1. A furniture showroom provides its customers with the opportunity to purchase goods in installments without resorting to the services of credit institutions. All prices for furniture are set taking into account the provided installment plan (that is, interest on the loan is already included in the price), and those buyers who prefer to pay for the product at a time when purchasing it are given a discount for immediate payment in the amount of 15% of the cost of the product.

The terms of the installment plan are as follows: 20% of the cost of the goods must be paid by the buyer upon concluding the sales contract, the remaining amount is repaid in equal installments within 10 months. Ownership of the furniture is transferred to the buyer immediately at the time of its shipment (transfer), but until the buyer’s debt is fully repaid, the goods are pledged to the store.

In June 2012, the buyer purchased a soft corner worth 100,000 rubles on an installment plan. Let us assume that all payments will be made by him on time (from July 2012 to April 2013 inclusive) in cash at the salon cash desk. The purchase price of this product is 55,000 rubles. (goods are recorded at purchase prices, the organization applies a taxation system in the form of UTII).

| Contents of operation | Debit | Credit | Amount, rub. |

| In June 2012 | |||

| The down payment from the buyer was received at the cash register (RUB 100,000 x 20%) | 50 | 90-1 | 20 000 |

| The remaining portion of the revenue from the sale of goods is recognized | 62 | 90-1 | 80 000 |

| The purchase price of the goods sold is written off | 90-2 | 41 | 55 000 |

| The cost of unpaid goods pledged by the store is reflected | 008 | 80 000 | |

| The financial result is reflected 0) rub. | 90-9 | 99 | 45 000 |

| Monthly from July 2012 to April 2013 inclusive | |||

| Another payment received from the buyer (RUB 80,000 / 10 months) | 50 | 62 | 8 000 |

| Reduced amount of collateral received | 008 | 8 000 |

But what to do if interest under the agreement is calculated separately, that is, when a fixed price is set, the same for all buyers, but if an agreement is concluded that provides for the sale on credit (in installments), it specifies the interest rate and the procedure for calculating them , and, accordingly, the amounts received from the buyer actually represent two payments - to repay the principal cost of the goods and to pay interest on the loan (installment plan){q}

Based on the requirements of clause 6.2 of PBU 9/99, this situation, from an accounting point of view, is no different from the case when interest is included in the price of the goods. Indeed, this norm directly states that when selling goods on the terms of a commercial loan, provided in the form of deferment and installment payment, the proceeds should be taken into account in the full amount of receivables.

Similarly, in paragraph 2 of Art. 249 of the Tax Code of the Russian Federation stipulates that revenue from sales should be recognized in tax accounting - both under the general regime and under the simplified tax system - based on all receipts associated with payments for goods, works and services sold. Thus, at the time of transfer of goods, it is necessary to reflect both the revenue and the buyer’s receivables in the full amount of payments that he will have to make under the contract, including all interest provided for in the payment schedule. However, in practice it is necessary to pay attention to the specific terms of the agreement on the procedure for calculating interest.

This scheme will work normally only if the agreement strictly regulates both the amount and procedure for making payments (in particular, it prohibits early repayment of debt or, at least, does not provide for recalculation of the amount of interest), so that the total amount of interest that will be paid by this buyer, calculated and recorded in advance.

If, under the terms of the agreement, interest is calculated based on the balance of the principal debt (the outstanding sale price of the goods) and the buyer has the right to make subsequent payments in various amounts based on his financial capabilities and desires (but not lower than a certain minimum payment), at the time of sale (transfer) buyer) of the goods, the accountant is not able to determine the exact amount of interest that will be received under this particular agreement.

This problem can be solved in one of two ways, and the chosen option must be specified in the accounting policy. The first option is to recognize revenue “in parts”. That is, interest charged for the sale of goods on credit (in installments) is still recognized as revenue, but is charged to account 90 “Sales” only when their amount becomes determined based on the specific terms of the contract.

In this option, the initial revenue is recognized in the amount of the sale price of the goods, as well as that part of the interest that can be unambiguously calculated at the time of transfer of the goods (transfer of ownership of them to the buyer) based on the terms of the contract, for example, for the first months of installments, if the contract provides moratorium on early repayment of debt during these months and, therefore, the amount of interest for these months can be accurately calculated.

And in the future, the accountant also makes additional monthly entries on the credit of account 90 “Sales” for the amount of interest, that is, he adjusts the revenue taking into account the interest that is accrued for the next month according to the terms of the agreement (including based on the actual balance of the buyer’s debt).

How to take materials into account in furniture production

On July 28, the Glavbukh System published on the website nuances in the procedure for accounting for materials in furniture production

The procedure for accounting for materials in furniture production depends on what kind of materials we are talking about: our own or those received from the customer. This article will focus on our own materials. The procedure for organizing the accounting of your own furniture production materials depends on which group they can be classified into: main or auxiliary.

Accounting for basic materials

Basic materials are raw materials and materials that form the basis of furniture products or are its necessary components (for example, raw wood). Take them into account on account 10-1 “Raw materials and materials”.

Which materials are classified as basic depends on the structure of furniture production. Thus, the technological process at large enterprises may consist of such production stages as:

– timber harvesting (sawmill);

– primary wood processing - removal of bark, branches (woodworking shop);

– production of semi-finished products - lumber, building materials, plywood (semi-finished products production workshop);

– furniture production (workshop for the production of finished products, carpentry shop or assembly shop).

Therefore, large enterprises take into account wood raw materials (round timber, processed timber) in account 10-1. And materials created in-house and ready for furniture production (lumber, building materials, plywood, etc.) are included in semi-finished products of our own production.

Small and medium-sized furniture production organizations, as a rule, do not process wood. They produce finished furniture products, and purchase materials for their production externally. Therefore, such organizations take into account lumber, building materials, plywood, plastic and other similar materials in account 10-1.

Organize analytical accounting of basic materials into sections, groups, subgroups, depending on whether they have any common characteristics. So, for example, analytical accounting for the “Wood raw materials” group (account 10-1-01 “Wood raw materials”) may look like this:

– account 10-1-01-001 “Alder”;

– account 10-1-01-002 “Oak”;

– account 10-1-01-003 “Birch”;

– account 10-1-01-004 “Buk”.

The procedure for analytical accounting of basic materials is fixed in the accounting policy.

Accounting for auxiliary materials

Auxiliary materials are not the basis for furniture products. These are additional components, as well as spare parts, inventory, etc. To organize analytical accounting of auxiliary materials for furniture production, you can open the following subaccounts for account 10:

- 10-2 “Purchased semi-finished products and components, structures and parts” - take into account semi-finished products and components purchased from contractors. For example, dryers, sinks and taps for kitchen furniture, hoods, mirrors, mattresses, etc. The composition of semi-finished products can include seats and backs, bent-glued blanks, furniture panels, legs, cutting and upholstery for upholstered furniture, springs

- 10-5 “Spare parts” - here reflect spare parts for equipment. For example, spare parts for woodworking machines.

- 10-6 “Other Materials”—Consider other supporting materials here. For example, nails, bolts, screws, nuts, wood glue, varnishes, dyes, lubricants, cleaning agents, abrasives, antiseptics, film.

- 10-7 “Materials transferred for external processing” - use this subaccount when you transfer materials for external processing. For example, you transfer boards or plywood to your counterparty, and receive from him ready-made furniture sets made according to the provided drawings.

- 10-9 “Inventory and household supplies” - use this subaccount to account for inventory and other devices. For example, hammers, planes and other carpentry tools.

- 10-10 “Special equipment and special clothing in the warehouse.”

- 10-11 “Special equipment and special clothing in use” - use these subaccounts if you issue special clothing to employees. In particular, if, based on the results of a special assessment, the working conditions of furniture production employees are recognized as harmful or dangerous, then they are entitled to special clothing and other personal protective equipment.

Provide analytical accounting of auxiliary materials. This is done in sections, groups, subgroups, depending on whether the group (subgroup) has any common characteristics. For example, other materials (count 10-6) can be divided into groups: wood glue, nails, varnishes, etc. For convenience, they can be assigned a conventional numerical designation, that is, a code. Here is an example of such analytics for the “Carpenter’s glue” group (account 10-6-01 “Carpenter’s glue”):

– account 10-6-01-001 “Hyster glue”;

– score 10-6-01-002 “Fish glue”;

– score 10-6-01-003 “Bone glue”.

The procedure for analytical accounting of auxiliary and other materials should be established in the accounting policy.

glavbukh.ru

Documentation of work performance

Standard entries for furniture accounting When a company receives furniture from a counterparty, accounting records are created for the recording of new assets and their payment:

- D08 - K60 - at the time of registration of purchased expensive items;

- D19 – K60 - in the amount of VAT on purchased furniture;

- D60 - K50 or 51 - when making a payment to the supplier to repay the debt for the assets received.

The accountant is limited to this set of postings if the furniture was not put into operation immediately after purchase. To start using assets, they must be officially transferred in accounting to the fixed assets involved in daily activities (provided that the furniture set has already been assembled and installed). This is done by transferring the value of the object from credit 08 to debit 01 of account. Accrued depreciation is collected on account 02.

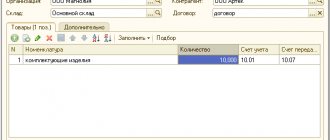

At the same time, officials noted that according to the Chart of Accounts, items of labor intended for processing, processing or use in production, or for economic needs, including components, are not taken into account as fixed assets. They are reflected as inventory in accounting account 10 “Materials”, including account 10-2 “Purchased semi-finished products and components, structures and parts.”

We believe that the method of accounting for components set out in the second question is, to a certain extent, consistent with the explanations contained in these letters. Therefore, in our opinion, such an approach to the application of this benefit is formally possible.

Reflection of objects in accounting occurs on the basis of the acceptance certificate, which was drawn up in advance. The paperwork is completed using form 0504101. According to the new rules, today it is not necessary to draw up a similar act to account for office equipment.

However, upon receipt of new property, the institution must draw up an order for the acceptance of material assets. The document is often used as the basis for recording office equipment in accounting.

We suggest you read: How to restore an adult’s birth certificate, what documents are needed and where to apply

Note! From the month that follows the period when office equipment is included in accounting, depreciation begins to accrue. The action is carried out until the full cost of the property is paid off or its disposal occurs.

Tax accounting for furniture purchases

The essence of the issue Choose a convenient method for you to control the safety of low-value property and write it down in the accounting policy for accounting purposes.

Fill out such a low-value property registration card for each object. And make entries in it on the basis of receipt and expenditure documents (receipt orders, invoices for the release of materials, etc.) on the day of the transaction. For example, when moving from one department of the organization to another or when leaving your company.

Thanks to such a low-value property accounting card, you will always know when and who received these objects, how long they were used in business and when they were written off.

In addition, if the tax authorities during the audit ask for documents confirming the movement of inexpensive property, you can provide them with this card.

Important

Account 08 also takes into account expenses associated with bringing pieces of furniture to a condition suitable for use (salaries of workers who carried out the assembly, insurance premiums from it, amounts paid to third parties for assembling furniture, and other similar expenses).

After completion of the formation of the initial value, as the fixed asset is put into operation, the amounts accumulated on account 08 are written off to the debit of account 01 “Fixed Assets”.

Taking into account the above, in the situation under consideration, pieces of furniture assembled (assembled) from individual component parts are taken into account as part of fixed assets and, in general, are recognized as subject to property tax.

Not all office equipment and inventory can be taken into account when writing off expenses. So, if there are no complaints about the purchased furniture, then the inclusion of some equipment in the documentation may raise questions among tax inspectors.

Property that was purchased Is it possible to write off expenses according to the simplified tax system and OSNO? Furniture items There will be no problems Equipment that makes office work easier It is possible to write off Air conditioners and heaters The company works according to the simplified tax system - there will be no problems The company works according to the simplified tax system - expenses will be canceled Kitchen appliances According to OSNO - accounting for expenses is allowed According to the simplified tax system - costs are not included in the list of permitted ones. Features of depreciation of office equipment and office furniture In a number of situations, depreciation may also be charged on office furniture and office equipment. If the object is part of the OS, the procedure is required.

How to properly record furniture in accounting

LOAN 012 - reflects the disposal of an object from the balance sheet (due to wear and tear, sale, etc.). This posting will mean that the property is no longer used in your business. And confirmation of this will be the write-off act. The form of such an act is approved by Resolution No. 71a.

However, it is too cumbersome and inconvenient for writing off low-value property. Therefore, it is better to develop your own sample act and approve it in the accounting policy for accounting purposes. An example of such a document is presented below.

Please note: Property should be assigned to an off-balance sheet account and written off from this account using single entries, without double entries.

The described procedure for accounting for “low value” on the balance sheet will allow you to establish control over objects from the moment they begin to be used until the time when they are written off due to wear and tear or disposal. Method two: get a “low value” accounting card.

We purchase office furniture (Chistyakova L.)

Accounting for inventories is carried out on off-balance sheet accounts. Property included in this category can be written off as expenses at once. The result of the write-off is the execution of the corresponding act.

If the cost of the purchased furniture exceeds the established amount and the items comply with the requirements of PBU 6/01, they can be classified as OS. Question No. 2.

Which depreciation group includes furniture purchased by the company for the office? According to the classification of fixed assets, furniture can be classified into group 4.

Accounting and taxation of furniture components

Standard entries for furniture accounting When a company receives furniture from a counterparty, accounting records are created for the recording of new assets and their payment:

- D08 - K60 - at the time of registration of purchased expensive items;

- D19 – K60 - in the amount of VAT on purchased furniture;

- D60 - K50 or 51 - when making a payment to the supplier to repay the debt for the assets received.

The accountant is limited to this set of postings if the furniture was not put into operation immediately after purchase.

To start using assets, they must be officially transferred in accounting to the fixed assets involved in daily activities (provided that the furniture set has already been assembled and installed).

This is done by transferring the value of the object from credit 08 to debit 01 of account. Accrued depreciation is collected on account 02.

Documents without which stationery and other office expenses cannot be written off

Registration of furniture movement in accounting transactions is regulated by the standards of PBU 6/01 and the Tax Code of the Russian Federation. Furniture sets should be classified as fixed assets, and cheaper elements of the interior furnishings of premises are allowed to be reflected as part of the inventory. The distribution of furniture among different types of assets is complicated by the discrepancy between approaches to assessing objects in tax and accounting.

Rules for organizing furniture accounting To understand how to capitalize furniture purchased or received free of charge, you need to know its exact cost. The need to create an inventory card for the asset and carry out monthly depreciation deductions depends on the value of this indicator.

Documentary evidence that an object is assigned to an off-balance sheet account will be a log of the presence of valuables on off-balance accounts - you will keep this log in relation to all objects recorded on account 012.

In it, indicate the name of the property, its inventory number, cost, date of commissioning, responsible person, date of removal from off-balance sheet accounting. Make the initial entry in the journal on the basis of a demand invoice or other document according to which the property is decommissioned.

Unified forms of the corresponding forms can be found in Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a (hereinafter referred to as Resolution No. 71a). Or you can develop your own “primary”. When the property becomes unusable or you decide to sell it, etc.

The main equipment can be considered furniture that:

- used to implement the tasks of the company’s core activities;

- will be used for a long time (more than a year);

- not planned to be put up for sale in the short to medium term;

- is able to bring profit to the organization and increase revenue;

- the valuation reaches the lower threshold established by law for recognition as a fixed asset.

If the full list of criteria is not met, the acquired objects must be taken into account as inventory. ATTENTION! To recognize furniture as a fixed asset, according to accounting rules, its value must be at least 40 thousand rubles; in tax accounting, the lower valuation limit is approved at 100 thousand rubles.

We believe that in a situation where a company acquires fixed assets not in a ready-to-use form, but in the form of separate parts (components) that require assembly, it is possible to initially reflect these assets as materials on account 10 (for example, subaccount 10-2 " Purchased semi-finished products and components, structures and parts” or another subaccount). When completing items of furniture from individual items (wardrobe, wardrobe, etc.), the cost of components is transferred from account 10 to account 08 in the context of individual fixed assets. It is advisable to consolidate this accounting procedure in the accounting policy of the organization.

The category includes expenses necessary to carry out business activities. Example 1. The Iskra company is on the simplified tax system and makes payments based on the income-expenses system. In January 2021, the organization decided to purchase a cabinet, the cost of which was 5,000 rubles.

Source: https://kodeks-alania.ru/nalogovyj-uchet-pokupka-mebeli/

We mark down exhibition samples

Perhaps one of the most common specific problems faced by furniture showroom accountants is determining the procedure for recording transactions related to registration, markdown and write-off of exhibition furniture samples.

As a rule, after demonstration interiors have fulfilled their function, when the assortment is updated, when previously demonstrated models go out of fashion, etc., they try to sell exhibition samples. But their price is usually reduced - after all, during the demonstration, they to a certain extent lose their presentation or become obsolete.

First of all, we note that the costs of discounting goods that have completely or partially lost their original qualities during exhibition are also mentioned in the list of non-standardized advertising costs in clause 4 of Art. 264 Tax Code of the Russian Federation. This means that both those who are on the general regime and those who use the “simplified” regime can take them into account.

If goods, according to the accounting policy, are accounted for at purchase price (that is, without using account 42), the very fact of markdown does not entail the need to make any additional entries. The goods continue to be accounted for in account 41 based on the amount of the actual costs that were incurred during its acquisition.

But if the balances of such goods exist as of December 31 of the reporting year (we are talking about a situation where, as a result of a markdown, the market value of goods turned out to be lower than its actual cost), you need to take into account the requirements of clause 25 of PBU 5/01 and create a reserve for reducing the cost of these material values.

But if goods are accounted for at sales prices, when deciding on a markdown, the accountant needs to adjust the amount of the markup applied to this product. To do this, a reversal entry is made on the debit of account 41 and the credit of account 42. However, it is made only within the limits of the previously accrued markup.

If the product was marked down more, that is, its sales value after the markdown became lower than its purchase price, the accountant should simply reverse the entire amount of the markup and leave in the debit of account 41 the amount of actual costs for the purchase of this product. And when preparing annual reports, you must be guided by the same rules on creating a reserve for reducing the value of material assets.

Example 4. Let's use the data from example 3. In July 2012, it was decided to update the display interiors, and therefore the pieces of furniture included in them were put up for sale at reduced prices. The amount of markdown was 30,000 rubles. (that is, this furniture is put up for sale for 250,000 rubles). To account for discounted furniture, the working chart of accounts provides for subaccount 41-6 “Discounted exhibition samples.”

| Contents of operation | Debit | Credit | Amount, rub. |

| Products previously used in the display interior have been transferred to goods intended for retail sale | 41-6 | 41-5 | 280 000 |

| Storno. Markdown of goods reflected | 41-6 | 42 | (30 000) |

Equipment decommissioning

Almost all office equipment objects are classified as means of mechanization. The service life of such items is more than 1 year. Typically, office equipment is taken into account as part of the operating system. During manipulations, the actual value of the property is taken into account.

Reflection of objects in accounting occurs on the basis of the acceptance certificate, which was drawn up in advance. The paperwork is completed using form 0504101. According to the new rules, today it is not necessary to draw up a similar act to account for office equipment. However, upon receipt of new property, the institution must draw up an order for the acceptance of material assets. The document is often used as the basis for recording office equipment in accounting.

The company must exercise control over the furniture that is on its balance sheet. All activities carried out for this purpose must be carried out in accordance with the company's accounting policies. In addition, the accountant must be familiar with the provisions of PBU 5/01 and PBU 6/01.

Features of furniture write-off depend on its value. If the price of an object is more than 40,000 rubles, and the period of use exceeds 1 year, the property is recorded on account 01. The original cost of the items is taken into account. When performing the write-off procedure, you will have to make the following entries:

- Dt 91 Kt 01 (residual value).

- Dt 02 Kt 01 (wear).

- Dt 10 Kt 99 (capitalization of material assets upon liquidation).

- Dt 91 Kt 99 (income from disposal).

- Dt 99 Kt 91 (loss on disposal).

Property included in this category can be written off as expenses at once. The result of the write-off is the execution of the corresponding act. It is compiled by a special commission, which includes officials working in the organization.

For various reasons, equipment may be written off. The reasons may be different and are indicated arbitrarily for printing the act. Completing the document does not require any special explanation.

Depreciation is charged at the end of the month through the month-closing transaction. Based on the parameters specified when accepting equipment for accounting, the program will automatically calculate the amount of depreciation. Depreciation begins to accrue from the next month after receipt.

After completing the operation, by clicking on the link marked in the figure, you can view the details.

Furniture manufacturing services is it necessary to capitalize the material in the accounting department?

The category includes expenses necessary to carry out business activities. Example 1. The Iskra company is on the simplified tax system and makes payments based on the income-expenses system. In January 2021, the organization decided to purchase a cabinet, the cost of which was 5,000 rubles. The company put the purchased property into operation and took it into account as a material value.

Attention

An example of an entry that will need to be made in the “Account Book...” is presented below. No. Date and number Contents Income Expenses 1 Cash receipt dated January 15, 2017 No. 01234567, commissioning certificate dated January 15, 2017 No. 1 The cost of the cabinet is reflected in the costs - 5,000 rubles. Nuances of accounting for purchased furniture Features of accounting for furniture and office equipment depend on the price of the property and the period of its commissioning.

Before proceeding to further manipulations, it is necessary to determine which category the purchase belongs to - OS or MPZ.