Accounting for cash on account 50 – “Cash desk”

Accounting account 50 is intended for accounting for cash flows, that is, for accounting for cash transactions. Debit 50 is intended to reflect cash inflows, credit 50 is intended to reflect cash outflows.

Documentation of cash transactions

All cash receipts and payments must be reflected in the statutory cash book; its maintenance is mandatory for every organization. All entries in the cash book are made on the basis of primary documents: incoming and outgoing cash orders. The entry of cash into the cash register is formalized by a cash receipt order, unified form KO-1, and the write-off of cash from the cash register is formalized by an expenditure cash order, form KO-2.

Analysis of account 50 shows that account 50 is active, intended to reflect assets (cash), its balance is always debit. An increase in an asset is reflected in a debit, a decrease in a credit.

Transactions with cash necessarily involve the use of cash registers, with the exception of some types of activities for which strict reporting forms can be used; read more about this in this article.

For each organization, a cash balance limit is established, that is, the amount of cash that can remain in the cash register at the end of the day; the amount in excess of the limit must be handed over to the bank at the end of each working day. When transferring cash to the bank, a forwarding slip is issued for the bag. The excess amount of cash can be left only to pay wages and benefits, but no more than five working days, including the day the bank issues the money.

The cash desk can store not only cash, but also monetary documents (paid tickets, vouchers).

Conducting cash transactions is regulated by certain regulatory documents that must be studied for proper cash accounting and proper cash management.

Regulatory documents for cash transactions: (click to expand)

- The Regulation “On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation”, approved by the Bank of Russia on October 12, 2011 No. 373P, is the main document regulating cash transactions.

- Regulations on the use of KKM No. 745 1993 (ed. 08.08.2003)

- Directive of the Bank of Russia dated June 20, 2007 No. 1843-U “On the maximum amount of cash settlements between legal entities.” At the moment, the maximum amount of cash payments between legal entities is limited to 100 thousand rubles.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

Count 50: basic information

Account 50 is the active accounting account. An increase in the resource account on it is reflected as a debit, and a decrease as a credit. For example, if funds from an accountable person are deposited at the cash register, then debit entries will be generated on the account, and if a certain amount of funds is withdrawn from the cash register for transfer somewhere, then account 50 will be involved in credit entries.

Account balance 50 is debit. It is calculated by adding debit turnover to the opening balance and subtracting credit turnover from it. The ending balance shows the balance of funds in the cash register on a specific date.

Cash resources on hand are assets. The cash balance at the reporting date is reflected in the enterprise's balance sheet in the asset category (line 1250). When preparing annual financial statements, most business accountants try to bring account balance 50 to zero.

Accounting is carried out in both national and foreign currencies.

Postings to account 50

| Debit | Credit | Operation name |

| 50 | 51 | Withdrawing money from a current account |

| 50 | 62 | Receiving payment from the buyer in cash to the cash register |

| 50 | 75 | Contribution to the authorized capital by the founder in cash |

| 60 | 50 | Payment to the supplier in cash |

| 70 | 50 | Payment of wages to employees |

The indicated accounting entries for accounting for cash transactions are the most common standard options; you will find a complete list of entries in the Chart of Accounts ().

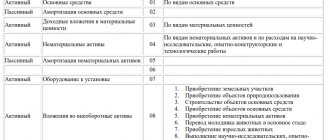

This page is an appendix to the Chart of Accounts for accounting of financial and economic activities of organizations.

Account 50 “Cashier” is intended to summarize information about the availability and flow of funds in the organization’s cash desks.

Sub-accounts can be opened for account 50 “Cashier”:

- 50-1 “Organization cash desk”,

- 50-2 “Operating cash desk”,

- 50-3 “Cash documents”, etc.

Subaccount 50-1 “Cash of the organization” records the funds in the cash desk of the organization. When an organization carries out cash transactions with foreign currency, then corresponding sub-accounts must be opened to account 50 “Cash” for separate accounting of the movement of each cash foreign currency.

Subaccount 50-2 “Operating cash desk” takes into account the availability and movement of funds in the cash desks of commodity offices (piers) and operating areas, stopping points, river crossings, ships, ticket and baggage offices of ports (piers), train stations, ticket storage offices, ticket offices post offices, etc. It is opened by organizations (in particular, transport and communications organizations) if necessary.

Subaccount 50-3 “Cash documents” takes into account postage stamps, state duty stamps, bill stamps, paid air tickets and other monetary documents in the organization’s cash desk. Cash documents are accounted for on account 50 “Cash” in the amount of actual acquisition costs. Analytical accounting of monetary documents is carried out by their types.

The debit of account 50 “Cash” reflects the receipt of funds and monetary documents at the organization’s cash desk.

The credit of account 50 “Cash” reflects the payment of funds and the issuance of monetary documents from the organization’s cash desk. Account 50 “Cashier” corresponds with the accounts:

| by debit | on loan |

| 50 Cash 51 Current accounts 52 Currency accounts 55 Special accounts in banks 57 Transfers in transit 60 Settlements with suppliers and contractors 62 Settlements with buyers and customers 66 Settlements for short-term loans and borrowings 67 Settlements for long-term loans and borrowings 71 Settlements with accountable persons 73 Settlements with personnel for other operations 76 Settlements with various debtors and creditors 79 Internal settlements 80 Authorized capital 86 Targeted financing 90 Sales 91 Other income and expenses 98 Deferred income 99 Profit and loss | 50 Cash 51 Current accounts 52 Currency accounts 55 Special accounts in banks 57 Transfers in transit 58 Financial investments 60 Settlements with suppliers and contractors 62 Settlements with buyers and customers 66 Settlements for short-term loans and borrowings 68 Settlements for taxes and duties 69 Settlements for social insurance and security 70 Settlements with personnel for wages 71 Settlements with accountable persons 73 Settlements with personnel for other transactions 75 Settlements with founders 76 Settlements with various debtors and creditors 79 On-company settlements 80 Authorized capital 81 Own shares (shares 94 Shortages and losses from damage to valuables 99 Profit and loss |

Accounting for non-cash funds to account 51 – “Current account”

All non-cash payments can be made if you have a current account. It opens in a credit institution, otherwise called a bank. How to open a current account and what documents you need to provide, read this article.

To record the movement of non-cash funds of the organization, 51 accounting accounts are intended.

Is he active or passive?

Analysis of account 51 proves that it is active, it keeps records of the company's assets (non-cash money), and it always has a debit balance. The debit of account 51 is intended to reflect the receipt of non-cash funds (an increase in an asset), and the credit of account 51 is intended to reflect the write-off of non-cash funds (a decrease in an asset).

Currently, an organization is allowed to have several current accounts. Accounting account 51 () can be divided into several analytical ones, each of which will keep records for each individual current account of the enterprise.

The primary document confirming the fact of debiting and receiving non-cash funds is a bank statement, which contains information about all amounts received and debited from the organization’s current account.

Funds are written off on the basis of a payment order, which is drawn up in 2 copies and sent to the bank; one copy is marked by the bank stating that the order has been accepted and returned. When you deposit money from the cash register to your current account, an announcement is issued for a cash contribution.

HIGHLIGHTS OF THE WEEK

01/27/202109:00 Taxes

Tax deductions can be obtained without 3-NDFL

28.01.202118:01

Accounting and reporting

Five changes in the work of an accountant and one requirement from February 1, 2021.

27.01.202115:25

Special modes

Individual entrepreneur on PSN: recommended form of notification of tax reduction on insurance premiums

30.01.202116:18

Special modes

Answers to questions from the Federal Tax Service for individual entrepreneurs on a patent

01.02.202110:01

Special modes

Reduce the patent for contributions: a notification form has appeared

PODCAST 4.12.2020

What has changed in taxes and reporting since 2021?

All episodes

Comments on documents for an accountant

Is it possible to apply NAP when assembling and selling computer systems?

02.02.2021 Federal legislation establishes a list of types of activities for which approximation is permitted...

The employer pays for the trip: is personal income tax charged?

02.02.2021 Personal income tax is not paid if the employer fully or partially finances the voucher, which allows...

Subsidy for coronavirus prevention: what other questions remain?

02/01/2021 The Federal Tax Service reminded under what conditions SMEs can receive a subsidy from the state.

‹Previous›Next All comments

Typical transactions for account 51

| Debit | Credit | Operation name |

| 51 | 62 | Receipt of payment or advance from the buyer |

| 51 | 50 | Cash deposit to the bank from the company's cash desk |

| <51 | 75 | Contribution to the Authorized Capital by non-cash means |

| 51 | 66 (67) | Obtaining a short-term (long-term) loan |

| 60 | 51 | Payment to the supplier by bank transfer |

| 50 | 51 | Withdrawing money from an account |

| 75 | 51 | Payment of dividends by bank transfer |

| 66 (67) | 51 | Repayment of credit (loan) |

Summarize:

An organization can use both cash and non-cash money for mutual settlements. To account for the former, a cash register is used, and for the latter, a current account is used. Each cash accounting operation must be documented in primary documents, and the corresponding entry is reflected in the accounting records.

Account 50 "Cashier"

Account 50 “Cashier” is intended to summarize information about the availability and flow of funds in the organization’s cash desks.

Sub-accounts can be opened for account 50 “Cashier”:

50-1 “Organization cash desk”,

50-2 “Operating cash desk”,

50-3 “Cash documents”, etc.

Subaccount 50-1 “Cash of the organization” records the funds in the cash desk of the organization. When an organization carries out cash transactions with foreign currency, then corresponding sub-accounts must be opened to account 50 “Cash” for separate accounting of the movement of each cash foreign currency.

Subaccount 50-2 “Operating cash desk” takes into account the availability and movement of funds in the cash desks of commodity offices (piers) and operating areas, stopping points, river crossings, ships, ticket and baggage offices of ports (piers), train stations, ticket storage offices, ticket offices post offices, etc. It is opened by organizations (in particular, transport and communications organizations) if necessary.

Subaccount 50-3 “Cash documents” takes into account postage stamps, state duty stamps, bill stamps, paid air tickets and other monetary documents in the organization’s cash desk. Cash documents are accounted for on account 50 “Cash” in the amount of actual acquisition costs. Analytical accounting of monetary documents is carried out by their types.

The debit of account 50 “Cash” reflects the receipt of funds and monetary documents at the organization’s cash desk. The credit of account 50 “Cash” reflects the payment of funds and the issuance of monetary documents from the organization’s cash desk.

Account 50 “Cashier” corresponds with the accounts:

| by debit | on loan |

| 50 Cash 51 Current accounts 52 Currency accounts 55 Special accounts in banks 57 Transfers in transit 60 Settlements with suppliers and contractors 62 Settlements with buyers and customers 66 Settlements for short-term loans and borrowings 67 Settlements for long-term loans and borrowings 71 Settlements with accountable persons 73 Settlements with personnel for other operations 76 Settlements with various debtors and creditors 79 Internal settlements 80 Authorized capital 86 Targeted financing 90 Sales 91 Other income and expenses 98 Deferred income 99 Profit and loss | 50 Cash 51 Current accounts 52 Currency accounts 55 Special accounts in banks 57 Transfers in transit 58 Financial investments 60 Settlements with suppliers and contractors 62 Settlements with buyers and customers 66 Settlements for short-term loans and borrowings 68 Settlements for taxes and duties 69 Settlements for social insurance and security 70 Settlements with personnel for wages 71 Settlements with accountable persons 73 Settlements with personnel for other transactions 75 Settlements with founders 76 Settlements with various debtors and creditors 79 On-company settlements 80 Authorized capital 81 Own shares (shares 94 Shortages and losses from damage to valuables 99 Profit and loss |