All articles

14299

2020-03-13

Starting in January, the rules for how tax is calculated based on cadastral value for legal entities and individuals have partially changed. Companies no longer have to pay it for movable property. Read about all the nuances and in what cases payment is required in the article.

Taxation takes place in a lump sum or with advance payments. Payment is made at the location of the object. When certain dates approach, the phrase “property tax at cadastral value” is heard more and more often. What it will be like in 2020 was determined by the inventory and cadastral price, now only the latter.

What is cadastral value tax and what is its essence?

This is one of the types of mandatory payments to the state, which is based on an established tariff. A tax is generated and must be paid in a number of transactions with a house, apartment, etc. or at the end of the period.

The fixed tax on the cadastral value includes the determination of the latter - the price that is formed as a result of an independent assessment of the property. When calculating the total amount of the duty, the price is taken into account, which is formed according to methods approved by local authorities.

Important! To pay the correct fee, you need to obtain a certificate from the Unified State Register of Real Estate about the cadastral value (to order, follow the link).

When paying taxes based on the cadastral value, data from the unified register is taken into account. If they are not available, an independent initial assessment must be ordered.

How to calculate residential house tax in 2021

In the same way as the land tax (example above), we can figure out how to pay the tax on a residential building. This is also a local tax, the so-called property tax. Payment of tax on a residential building is regulated by Chapter 32 of the Tax Code.

At the moment, the tax on a residential building is determined based on the cadastral value of the residential building. At the same time, tax payers are exempt from paying for 50 square meters of the total area of this residential building. (Clause 5 of Article 403 of the Tax Code).

For more details on how the tax is calculated based on the cadastral value of a residential private house, read a separate article: “Calculation and determination of the tax on a private residential building based on the cadastral value”

Example of calculating property tax

Calculations are also carried out for land plots. The norm is prescribed in Article 389. NK of Russia. For the basic price, in order to calculate the tax, information is taken from the unified register. If changes have been made to the land plot, then the cadastral value of the plot is taken into account - the land tax on the date of the changes.

Note: increasing the size of the collection is not a popular measure, but is sometimes used to fill the treasury. In the Russian Federation, a rule has been established that it is not the tax itself that is actually revised, but the cadastral valuation once every 5 years.

Important! Don't fall for scammers. If you need an objective assessment of real estate, contact us through the official website.

Look at the example of tax calculation, understanding what exactly is included in the formula.

According to the rules, when making a preliminary calculation, allocate 0.1% of the indicator for further payment to the treasury. This applies to residential premises, outbuildings, no more than 50 sq.m., and subsidiary plots.

Increased cadastral value, interest - tax will be higher and, according to analysts, can reach up to 20%.

Property of individuals: how the tax base is determined

Individuals pay tax if they are owners of real estate:

- residential building, apartment, room;

- garage or parking space;

- unfinished construction project;

- other building, structure, premises.

The tax base for personal property tax is determined based on the cadastral value of real estate owned by the payer. The cadastral valuation for calculation is taken as of January 1 of the tax period. The tax base and tax payable are calculated by the Federal Tax Service. Tax authorities receive these data from the Unified State Register of Real Estate.

Property tax for legal entities. persons

When researching in advance what the tax is based on the cadastral value, check out the local collection rates.

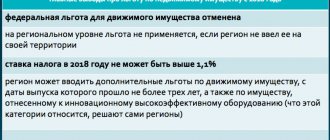

The current size for companies changed at the beginning of 2021. According to Art. 2 and 4 of Law No. 302-FZ dated August 3, 2018, when calculating this payment on the property of organizations, it is no longer necessary to take into account movable property. The exceptions are:

- spaceships;

- monuments as architectural objects;

- natural and water resources.

Property tax is regional and its amount varies between regions. Benefits are determined by local authorities and the Code.

Why do you need a List of Property?

The list of property contains a list of those objects subject to property tax, for which this tax is calculated based on their cadastral valuation. In this regard, the authorized authorities of the constituent entities of the federation have an additional function - providing a detailed list of real estate objects belonging to the categories of objects subject to tax on the cadastral value. The types of these objects are listed in subsection. 1, 2 p. 1 art. 378.2 Tax Code of the Russian Federation.

For more information about which real estate objects are included in the List of Property, read the material “For which real estate objects the tax base is calculated based on the cadastral value .

According to paragraph 7 of Art. 378.2 of the Tax Code of the Russian Federation, the authorized government body of the subject of the federation, before the beginning of the coming year, draws up a List of property, submits it to the Federal Tax Service and places it in the public domain on its own website or on the website of the subject of the federation.

The list of property is compiled in the form of a list of real estate objects with information on their cadastral numbers and exact addresses. Based on this list, taxpayers determine whether the real estate listed on their balance sheet as a fixed asset belongs to property objects subject to property tax at cadastral value.

How to pay tax if the property is in the cadastral list, but its value is not determined, find out here.

Read about the stages of calculating tax from cadastral value in the article “Step-by-step instructions for calculating property tax from cadastral value” .

Calculation of tax based on the cadastral value of real estate

You need to make a preliminary calculation, then you should follow these step-by-step instructions:

- select a subject of the Russian Federation on the map;

- select a suitable municipal entity;

- indicate the type of duty and period;

- Click on the “find” button.

An online service to find out the real estate tax by cadastral value and what the fee will be saves time. As a result, you get a table indicating interest rates, because the tax in each region is different. You can also find out in advance the tax on the cadastral value of an apartment or any other real estate, for example, a house, outbuildings on a plot, and calculate it for a land plot.

When property tax is calculated based on cadastral value

The region may decide to calculate the property tax levy based on the cadastral value of individual real estate properties. This decision is enshrined in regional legislation. Information about real estate taxed in this way must be posted on the website of the region or the authorized regional authority. For example, in Moscow, the mayor’s website contains an electronic service that allows you to determine whether a taxpayer’s property is included in the list.

To determine the taxable base, the cadastral valuation must be taken as of January 1 of the tax period. You can find it out on the Rosreestr website by the cadastral number of the property.

How to calculate land tax based on cadastral value

Organizations carry out tax calculations independently. In order to find out in advance what the tax will be for individuals, use online services or trusted agencies.

We do the calculations ourselves. To do this, we multiply the cadastral valuation by the product of the area of the object minus the deduction, and multiply by the appropriate rate. We recommend paying the fee on time and in full to avoid problems with the law.

The calculation rules are simple, the main thing is to know the formula. Multiply the data and find out how much you need to pay for the whole year. For example, in one region of the Russian Federation, when calculating for a residential building, a coefficient of 0.3% is used, in the capital region it reaches 0.4%. As an example: the tax on the cadastral value of an apartment is 0.1%; for “luxury options” it can be increased up to 1%. To find out the price per 1 sq. m, before making the calculation, divide the indicator by the entire area.

A fundamental nuance: the duty is not paid on the entire area, but only on that which is subject to taxation. Now you understand how simple, accurate and competent it is to calculate property taxes on your own.

Tax calculation

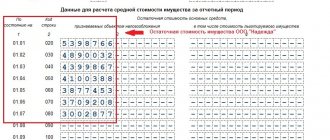

For real estate objects, the tax base for which is determined as the cadastral value, the new subclause 1.1 of Article 380 of the Tax Code of the Russian Federation establishes separate tax rates. Their maximum value cannot exceed: in 2014 – 1.0 percent; in 2015 – 1.5 percent; in 2021 and subsequent years - 2 percent. Moreover, increased rates are provided for Moscow during the transition period: in 2014 – 1.5 percent; in 2015 – 1.7 percent.

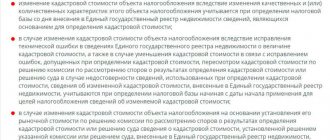

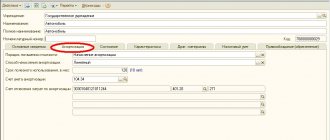

The calculation of the amount of tax and the amount of advance tax payments in relation to property for which the tax base is determined as its cadastral value is carried out in the general manner, but taking into account three features.

Firstly, the amount of the advance payment is calculated at the end of the reporting period as one-fourth of the cadastral value of the property as of January 1 of the year that is the tax period, multiplied by the corresponding tax rate.

Secondly, if the cadastral value of real estate was determined during the tax (reporting) period and (or) the specified object is not included in the list as of January 1 of the year of the tax period, determining the tax base and calculating the amount of tax (advance payment) for the current tax period is carried out in accordance with the general procedure provided for in Chapter 30 of the Tax Code of the Russian Federation.

Thirdly, an object of real estate is subject to taxation by the owner of such property.

The tax base for property tax is:

- if the cadastral value of the real estate itself is determined, then this value is as of January 1 (clause 2 of Article 375 of the Tax Code of the Russian Federation);

- if the cadastral value of the premises owned by the organization has not been determined, but the cadastral value of the building in which it is located has been determined, the cost of this premises, determined by the formula (clause 6 of Article 378.2 of the Tax Code of the Russian Federation):

Tax base for premises, the cadastral value of which has not been determined = Cadastral value of the building (as of January 1 of the current year) in which the premises are located / Total area of the building X Area of the premises

The tax amount for the year is calculated according to the formula (clause 12 of article 378.2, clause 1 of article 382 of the Tax Code of the Russian Federation):

Annual amount of property tax based on cadastral value = Tax base X Tax rate

Deductions and their sizes

Before calculating the tax, keep in mind: the deduction applies to all residential properties owned. When determining the cost of the duty, the deduction is not tied to the number of owners. The tax is calculated based on the cadastral value, taking into account the type and area of the property. There is a rule for how to calculate taking into account the area of the object (in m2):

- room: up to 10;

- apartment is 2 times larger;

- for home, agricultural buildings no more than 50.

The criterion directly determines what the tax will be, and the indicator determines how many “squares” are ready to be “forgiven.”

You can order an electronic extract of the cadastral value from Rosreestr, signed with an electronic digital signature, on this page of our website.

What determines the amount of apartment tax in 2021?

Before calculating the tax on an apartment, you need to find out its cadastral value. If the figure received from the cadastral chamber is not satisfactory, you can go to court for a recalculation.

In large cities - Moscow, St. Petersburg and Sevastopol - the cadastral value is revised every two years, citing the dynamics of the real estate market (in other cities - every three years). It depends on the infrastructure of the area, the degree of wear and tear of the house, and the number of similar offers on the market.

Rate for calculating tax based on cadastral value:

0.1% - for most objects, including residential buildings and parts thereof, apartments, rooms, complexes, garages and parking spaces, utility buildings with an area of up to 50 m2;

2% – for objects with a cadastral value of more than 300 million rubles;

0.5% – in relation to other objects.

Tax rates can be reduced to zero or increased by a maximum of three times by regulations in major cities. If local authorities do not set their own rates, the calculation is based on the maximum limit.

Over the past few years, it has also been practiced to calculate tax based on inventory value if the cadastral value has not been determined. The total inventory value was multiplied by a deflator coefficient (it changed during 2015–2019 from 1.147 to 1.518). For objects with a value of up to 300,000 rubles. the tax was 0.1%, from 300,000 to 500,000 rubles. – 0.1–0.3%, over 500,000 rubles. – 0.3–2%. From 2021, these calculations will no longer be relevant.

Who gets benefits?

Citizens defined in Art. 399 and 407 of the relevant Code. The document determines that the fee may not be paid by certain persons at the federal and regional level. Such a tax at the federal level is not interesting for such categories as:

- WWII veterans;

- Heroes of the Soviet Union and the Russian Federation;

- disabled children, 1st, 2nd groups;

- liquidators of a number of emergency situations;

- military personnel and their families.

Pensioners do not have to worry about additional expenses - they are exempt from payment. You need to pay and pre-calculate the amount of the fee in the case where, for example, there are 2 apartments or a large plot of land. Benefit for only 1 property in the category

It is not necessary to calculate the tax in advance based on the cadastral value for persons whose building is less than 50 square meters. You may not find out what the amount of payment is for a number of other persons who have benefits from local governments. Large families do not pay the fee.

The tax does not provide a benefit if the object is above 300 million rubles.

If he is not paid according to the benefit, the person independently informs the service about this, providing documents for proof.

Last changes

On August 3, 2018, Federal Law No. 302-FZ was adopted. He makes changes to the Tax Code of the Russian Federation. This includes the abolition of property tax on movable property. The changes will take effect from 01/01/2019. Consequently, organizations will calculate and pay fees only from real estate. If the company does not own real estate, then it will not be recognized as a taxpayer: it will not have the obligation to calculate tax and will be exempt from preparing and submitting appropriate tax reports.

Legal documents

- chapter 30

- chapter 32

- Art. 375 Tax Code of the Russian Federation

- 08/03/2018 Federal Law No. 302-FZ was adopted