What is KBK (budget classification code)

The concept of the BCC was first mentioned in the summer of 1998 in the edition of the Budget Code of the Russian Federation dated July 31, 1998 No. 145 Federal Law. The meaning of a long sequence of characters was explained here - this is a means of grouping the budget.

Our country’s budget receives a huge amount of cash flows every day. To systematize them and control the sources of funds, a system of codes was needed that would detail the purpose of financial resources.

For this purpose, the first KBK directory was created, which, of course, has been frequently amended since 1998. The introduction of the CBC allowed:

- reduce the number of errors made when making payments to the budget;

- systematize financial information;

- if necessary, view the history of a specific financial transaction;

- simplify the process of monitoring debts to the budget;

- make the budget planning procedure more clear.

Important!

Changes to the KBK directory are made almost every year. Therefore, it is necessary to check the latest information every time. Read below about where to find the latest CBC.

“When specifying the KBK code, be sure to focus on the latest version of the classifier. Since, due to frequent changes in the economic life of the country and the emergence of new sectors of the economy, changes are made to the code system. An incorrect indication by the KBK is a tax offense and, accordingly, entails penalties.”

Consultant of the Federal Tax Service Yakimova A.A.

About the KBK for 2015 and responsibility for errors

Since 2015, it is necessary to apply new budget classification codes for taxes and fees administered by the Federal Tax Service of Russia. :

Land tax

The changes affected, in particular, the BCC for land tax. In addition, individuals and legal entities now do not have to fill in the details “110” - payment type” when issuing a payment order. Instead, the following codes of subtypes of income will be reflected in 14-17 digits of the BCC, allowing you to identify the type of payment:

- 2100 - penalties on the corresponding payment;

- 2200 - interest on the corresponding payment.

In addition, the BCC for insurance premiums paid to the Pension Fund has been updated. New codes are presented in the information of the Pension Fund of the Russian Federation “On budget classification codes for payment of insurance premiums since 2015” and on the website of the Federal Tax Service of the Russian Federation.

In accordance, from January 1, 2015, the budgets of urban and rural settlements are formed not according to general principles, but separately for urban and rural settlements (Article 61 of the Budget Code of the Russian Federation).

The change in budget legislation entailed the publication of Order of the Ministry of Finance of the Russian Federation dated December 16, 2014 No. 150n “On amendments to the Instructions on the procedure for applying the budget classification of the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n”, providing for changes in budget classification codes .

For the property tax of individuals, instead of the previously existing code “Property tax of individuals, levied at the rates applied to taxable objects located within the boundaries of settlements,” two new codes have been introduced: “Property tax of individuals, levied at the rates applied to taxable objects located within the boundaries of rural settlements" and "Property tax for individuals, levied at the rates applicable to taxable objects located within the boundaries of urban settlements."

State duty

Changes in budget classification codes from January 1, 2015 also affected the state duty. If the application and package of documents required for state registration of legal entities and individual entrepreneurs are submitted to the Multifunctional Center, the document for payment of the fee indicates the budget classification code “182 1 0800 110” “State fee for state registration of a legal entity, individuals persons as individual entrepreneurs, changes made to the constituent documents of a legal entity, for state registration of liquidation of a legal entity and other legally significant actions (when applying through multifunctional centers).”

Penalties and interest

From January 1, 2015, the budget classification codes for the payment of penalties and interest have changed. For the purposes of separate accounting by tax authorities of revenues from penalties and interest, the following codes for the subtype of budget revenues have been introduced:

- “2100” - penalties for the corresponding payment;

- “2200”—interest on the corresponding payment.

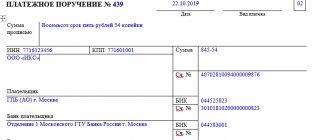

Since 2015, payment orders have not included detail 110 – “payment type”. All necessary information about payment types is now contained in the KBK. Taxpayers should carefully fill out tax payment documents, since if the budget classification code is incorrectly indicated, the payment will be classified as unclear and will require clarification from the tax authority.

What are the consequences of mistakes with KBK?

Experts from the reference and legal service “Normative” note that the obligation to pay insurance premiums will not be considered fulfilled if the payment document contains an incorrect BCC. Thus, by virtue of this, the obligation to pay insurance premiums is considered fulfilled by the payer of insurance premiums, including:

- from the date of presentation to the bank of an order to transfer to the budget of the corresponding state extra-budgetary fund to the corresponding account of the Federal Treasury (indicating the appropriate budget classification code) funds from the account of the insurance premium payer in the bank if there is a sufficient cash balance on it on the day of payment;

- from the day an individual deposits cash into a bank, cash desk of a local administration or into a federal postal service organization for their transfer to the budget of the corresponding state extra-budgetary fund to the appropriate account of the Federal Treasury (indicating the appropriate budget classification code).

In this case, the obligation to pay insurance premiums is not recognized as fulfilled if the payer of insurance premiums incorrectly indicated in the order to transfer the amount of insurance premiums the account number of the Federal Treasury, the budget classification code and (or) the name of the recipient's bank, which resulted in the non-transfer of this amount to the budget of the corresponding state extra-budgetary fund to the appropriate Federal Treasury account.

If an error is made even in one BCC sign, this is interpreted as non-payment of the fee. Therefore, if such an error occurs, it is necessary to make a new payment slip and transfer contributions. And since indicating an incorrect BCC does not entail the non-crediting of a sum of money to the state budget, the next step should be to try to return or offset the amount transferred in the wrong direction (Article 26 of Federal Law No. 212-FZ).

What is an INN (individual tax number)

TIN is a required detail for many documents. There are TINs for individuals (consists of 12 digits) and TINs for legal entities (10 characters long). This code is required by the Federal Tax Service. With the help of the TIN, tax payers are monitored as part of a single database. This simplifies tax accounting and contributes to the correct conduct of business.

The TIN of a legal entity is as follows: XX YY ZZZZZ R, where

- XX is the code of the subject of our country in which the taxpayer is registered;

- YY – number of the tax office with which the taxpayer is registered;

- ZZZZZ – number under which the legal entity is registered in the unified journal of the tax authority;

- R is a control character that checks the provided information.

What is OKTMO

This abbreviation stands for All-Russian Classifier of Municipal Territories. OKTMO shows which subject of our country the legal entity belongs to. This detail, indicated in the declarations, is important for Rosstat. This is how the organization determines, for example, the volume of financial revenues for municipalities. This data is then used in budget planning. OKTMO approved by order of Rostandart dated June 14, 2013 No. 159-st.

The code may consist of 8 or 11 digits, which indicate the following:

- 1 and 2 digits are a subject of the Russian Federation;

- 3,4,5 symbols - district, district or intracity formations of some constituent entities of the country (Sevastopol, St. Petersburg, Moscow);

- 6,7,8 signs – rural or urban settlement, intra-city areas;

- 9,10,11 numbers are intended for objects that are part of municipal entities (for example, an 11-digit code is provided for the village of Zhukovka, which is considered an integral part of Moscow).

In tax returns, 11 cells are always allocated for OKTMO. If your code consists of 8 digits, you need to fill in 8 cells from left to right, and put a dash in the remaining three. Writing zeros in empty cells is a gross violation

(letter of the Federal Treasury for the Moscow Region and the Ministry of Finance of the Moscow Region dated 02/03/14 No. 48-12-13/02-728 and No. 22ish-693/22-07-02).

Example code structure

KBK is a twenty-character code, and for each component part of the symbols there is a different grouping of digits.

For income, the codes look like this:

| Administrator code | Income code of the type of receipt | Subspecies code | KOSGU | ||||||||||||||||

| group | subgroup | article | sub-article | element | |||||||||||||||

| 1 | 2 | 3 | 1 | 1 | 2 | 1 | 2 | 1 | 2 | 3 | 1 | 2 | 1 | 2 | 3 | 4 | 1 | 2 | 3 |

The first three characters are responsible for codifying the revenue administrator, that is, they determine which department is responsible for a particular revenue receipt.

The next category in the KBK divides budget revenues into certain types. There are only two of them. One of them combines tax and non-tax revenues, the other – gratuitous revenues. Each group is in turn divided into subgroups. Thus, the first group (tax and non-tax income) has eighteen such subgroups, while the second has only seven. A detailed list of all subgroups was approved as part of Order No. 65n.

To designate budget expenses, a twenty-character code is also used, which is somewhat different from the revenue code in its structure. Their only similarity is that in both codes (as, indeed, in the KBK of sources of deficit coverage), the first three digits classify the main manager (administrator) of budget funds, and the last three digits correspond to certain KOSGU.

The expenditure classification of budget indicators also consists of section codes (two characters - fourth and fifth), subsection (also two characters, sixth and seventh), target item of expenditure (consists of seven characters - from the eighth to the fourteenth category of the KBK) and type of expenditure (three numbers).

At the same time, the exclusive right to establish the list and names of expense sections (there are fourteen in total), subsections (each section has its own) and types of expenses (common to all expenses) belongs to the Ministry of Finance in our country.

But with target articles, not everything is so simple. Starting from the 2014 budget, a program method is used in its formation. And due to the fact that the Federation, regions and municipalities have their own programs, it is not possible to classify them equally for all budgets. Therefore, appropriate clarifications were made to the Budget Code, assigning the authority to determine the codes of target items and the rules for their application to the financial authorities of budgets at all levels.

Order of the Ministry of Finance No. 65n and the latest KBK directory

At the same time, the structural component of the target articles has also changed. Firstly, starting in 2014, letter designations were allowed to be used in the classification for the first time. The list of them is strictly defined by order No. 65n. Secondly, with a program budget, the first two digits in the code of the target item began to indicate the corresponding state or municipal program, the third digit - to detail the subprogram, and the last four - to codify a specific area of expenses.

KBK structure

So, KBK consists of 20 characters. It is more convenient to see the structure of the indicator in the table.

| Characters in order | Explanation | Example |

| 1,2,3 | Indicate the body that manages budget funds | 182 – tax service, 392 – Pension Fund of the Russian Federation, 393 – Social Insurance Fund |

| 4,5,6 | Type of contribution paid | 101 – income tax, 102 – insurance fees for pension insurance. |

| 7,8 | Budget level for which funds are intended | 01 – federal level. 02 – local |

| 9,10,11 | Sub-item of income | Determined by the classifier; for personal income tax, for example, 010. |

| 12,13 | Income element | Also determined by the classifier. For personal income tax – 01 |

| 14,15,16,17 | Payment type | 1000 – contribution or arrears of tax, 3000 – fine, 2100 – pennies, etc. |

| 18,19,20 | Type of income | 110 – tax revenue, 160 – social insurance contributions. |

Example. The BCC for paying property tax (which is not part of the Unified Gas Supply System) looks like this: 182 1 0600 110.

The digital digits in this long number indicate the following:

- 182 – this block indicates that the manager of the funds is the Federal Tax Service.

- 106 – numbers indicate a specific tax – property tax.

- 02 – address for receiving funds – local budget.

- 010 – property tax subsection number.

- 02 – code of the income element for this tax.

- 1000 - the symbols indicate the type of payment - this is a tax, and not a fine or penalty, for example.

- 110 – the numbers indicate the type of budget income: this is tax revenue, not a social insurance contribution.

What parts does the code consist of?

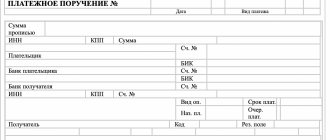

The budget classification code consists of 20 digits, conditionally divided into 4 groups: 3, 10, 4 and 3 digits.

Each group encrypts specific information:

- The first 3 digits are of an administrative nature, identifying the recipient of the funds. This is the account in which funds for this type of payments and contributions are collected.

- The second 10 digits indicate the income group and determine the type of payment.

- The third 4 digits additionally characterize the purpose of the payment (program group). For example, taxes have the combination "1000".

- The last 3 digits are classifying and determine the type of economic activity. For example, social contributions and transfers belong to group “160”.

IMPORTANT!

Since codes may change, it is necessary to constantly check with reputable sources for relevance. Thus, in 2021, their number has decreased, combining several areas into one code. The change also affected the designation of fines and penalties for late payment of insurance premiums and additional tariffs.

How to find out an organization’s BCC online

In order to find out the BCC for the payment you are interested in, follow these steps:

- Go to the official website of the Federal Tax Service https://www.nalog.ru.

- Hover your cursor over the “Activities” tab and select “Taxation in the Russian Federation.”

1

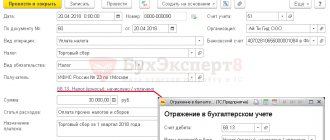

3. In the window that opens “Russian Federation Budget Revenue Classification Codes....” select the type of payer - legal entity, individual, individual entrepreneur. Let's take a legal entity as an example.

2

4. A list of contributions and payments opens. We choose the one we need. Let's say personal income tax.

3

5. The screen displays a list of BCCs for various cases related to the payment of personal income tax. If this is a contribution or tax arrears (and not a penny, for example), select the code shown in the figure.

4

KBK: insurance premiums IP-2020

BCCs for insurance premiums represent the largest group of codes that are necessary for entrepreneurs of absolutely all taxation regimes. Individual entrepreneurs, when filling out payments for insurance premiums in 2021, must indicate the following BCC:

| Type of contribution | KBK |

| Insurance premiums for OPS | 182 1 0210 160 |

| Insurance premiums for compulsory medical insurance | 182 1 0213 160 |

| Insurance premiums for VNiM | 182 1 0210 160 |

| Insurance premiums for injuries | 393 1 0200 160 |

| Additional insurance contributions to compulsory pension insurance for employees who work in conditions that give the right to early retirement, including: | |

| 182 1 0210 160 |

| 182 1 0220 160 |

| 182 1 0210 160 |

| 182 1 0220 160 |

Errors on the topic “How to find out the BCC of an organization by TIN or OKTMO”

Error.

The accountant, filling out the payment slip for the transfer of income tax, indicated the same BCC for both of its parts - intended for the federal and local budgets: 182 1 0100 110.

It is not right. As a result, there is an overpayment of taxes for the federal budget (which in itself is not scary, because the payment can be reduced by this amount in the next period). But arrears are recorded in the local budget. This is already a tax offense punishable by financial measures.

To avoid problems with tax authorities, the accountant should indicate a different BCC for income tax going to the local budget: 182 1 0100 110.

Why do we need KBK in 2021?

Let's probably start with the very definition of CBC to understand what it is. Budget classification codes (BCC) are a combination of symbols that is used by accounting departments and employees of banks, as well as other government budgetary institutions. For example, for income tax, the BCC for income tax, etc. will be used.

This combination symbolizes a specific monetary transaction or transfer, therefore it is a convenient way to group items of income and expenses that an organization or individual entrepreneur sends to the budget. KBK codes for the simplified tax system are especially useful, as they further simplify the already easy annual calculation system for individual entrepreneurs.

It is through the use of BCC or budget classification codes that various departments have the opportunity to correctly interpret payment data in the Russian Federation. In Russia, also, competent budget classification codes can help with:

- making correct payment transactions (such as tax, insurance or fines);

- restore the history of the movement of all funds in payments;

- greatly simplify the work of government workers. services;

- establish a fixed payment arrears.

Also, if we talk about 2021, KBC is a real guarantee that all the money will go to the right accounts, and companies or entrepreneurs will not receive fines for violations due to errors.