General concepts

The K2 coefficient is a coefficient that adjusts profitability for tax purposes.

The K2 coefficient is the product of values that take into account various factors that influence activity. Hidden text

- Seasonality;

- Product range;

- Operating mode;

- Features of the place of activity;

- Amount of income;

- Area of the electronic information board field;

- Outdoor advertising field area;

- Number of vehicles on which advertising is placed, etc.

How do coefficients affect the amount of UTII?

UTII is calculated from the amount of imputed income, taking into account two coefficients:

- Deflator coefficient K1;

- Correction factor K2.

These coefficients allow you to adjust the basic profitability taking into account the influence of various external conditions (factors) on the amount of income received (clause 4 of Article 346.29 of the Tax Code of the Russian Federation).

Coefficient K1

K1 is a deflator coefficient. It is used to bring imputed income to the level of consumer prices for goods (work, services) of the past year. That is, to take into account inflation indicators for the past year (paragraph 5 of Article 346.27 of the Tax Code of the Russian Federation).

The value of K1 for the next calendar year is usually established by the Ministry of Economic Development of Russia and publishes its value in the Rossiyskaya Gazeta no later than November 20 of the previous year (clause 2 of the order of the Government of the Russian Federation dated December 25, 2002 No. 1834-r). That is, the K1 value for 2021, logically, should be published no later than November 20, 2021.

However, this approach is planned to be abandoned. As you can see, for 2017-2019 K1 is proposed to be approved by federal law. Accordingly, the Ministry of Economic Development, apparently, will not approve the deflator coefficient for 2021.

Let us recall that for 2021 the coefficient K1 was set at 1.798 (Order of the Ministry of Economic Development of Russia dated October 20, 2015 No. 772). If the commented project is accepted, the coefficient for 2017 will increase by 0.093 (1.891 - 1.798).

K2 coefficient

K2 – correction factor. With its help, factors affecting the basic profitability of various types of business activities are adjusted. For example, the range of goods, seasonality, operating hours, amount of income, features of the place of business (paragraph 6 of Article 346.27 of the Tax Code of the Russian Federation).

K2 is established and adjusted by representative bodies of municipal districts, city districts, legislative (representative) government bodies of federal cities of Moscow and St. Petersburg (clause 3, clause 3, article 346.26, clause 6, article 346.29 of the Tax Code of the Russian Federation).

The period during which the established K2 must be applied may not be limited in time. At the same time, local authorities may approve an adjustment factor for a particular year. That is, it is possible that local authorities may also change K2 for 2021.

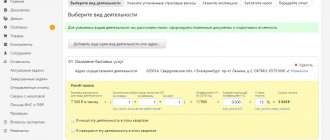

How to find your K2

In order to determine your coefficient, you need to go to the Tax Inspectorate website to the section describing the features and rules for applying the single tax on imputed income. In the upper left corner of the site you can select the region in which you need to look at the legislation on this issue. When selecting a region, you can see the “Regional Legislation” section, which presents all the regulatory documents on the application of UTII in each municipality of a given region.

Example.

If we open the regional legislation for the Orenburg region regarding the application of UTII, then in the section you can download the regulations for each municipal entity. Download the Regulations for the city of Orenburg regarding the application of UTII. It can be viewed here:

Decision dated September 18, 2012 No. 502

The document indicates all types of activities that are subject to tax on imputed income, as well as the procedure for calculating the K2 coefficient.

FAQ

^Back to top of page

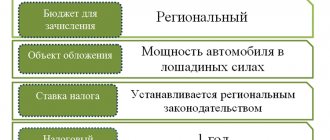

Tax calculation procedure

In what order are subsidies allocated from budgets of different levels to taxpayers of the single tax on imputed income taxed?

Budgetary allocations received from the budget in the form of subsidies to compensate for lost income in connection with the sale of goods, performance of work or provision of services at prices regulated by state or municipal authorities, carried out within the framework of business activities subject to a single tax on imputed income, are taxed within the limits There should be no other taxation regimes, including within the framework of the simplified taxation system.

At the same time, subsidies allocated from budgets of different levels to taxpayers of a single tax on imputed income for purposes not related to compensation for lost income in connection with the sale of goods, performance of work or provision of services at prices regulated by state or municipal authorities are subject to inclusion as part of non-operating income taken into account when determining the tax base in accordance with the provisions of Chapters 25 or 26.2 of the Code.

How is the value of the physical indicator of multi-level parking determined?

The total area of paid parking is taken into account, determined on the basis of title and inventory documents.

Procedure for filling out declarations

How to correctly round the value of a physical indicator?

When rounding the size of a physical indicator, values of less than 0.5 units are discarded, and 0.5 units or more are rounded to the whole unit. (clause 2.1 of the Procedure for filling out a tax return for UTII, approved by order of the Federal Tax Service of Russia dated January 23, 2012 No. ММВ-7-3 / [email protected]

How to take into account changes in the value of a physical indicator during the tax period?

This change must be taken into account when calculating UTII from the beginning of the month in which it occurred (clause 9 of Article 346.29 of the Tax Code of the Russian Federation).

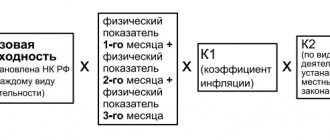

How to calculate the amount of the tax base when the value of the physical indicator for the type of activity changes during the quarter?

When determining the tax base, the values of the physical indicator in each month of the tax period should be taken into account. The tax base for UTII is calculated according to the formula (clause 9, clause 5.2 of the Procedure for filling out the UTII declaration for certain types of activities (approved by Order of the Federal Tax Service of Russia dated January 23, 2012 N ММВ-7-3/ [email protected] ):

NB=BD* K1*K2*(FP1+FP2+FP3)

Where

- NB - tax base;

- BD - basic profitability;

- K1—deflator coefficient;

- K2 - correction factor;

- FP1, FP2, FP3 are the values of the physical indicator in the first, second and third months of the quarter, respectively.

What value of the deflator coefficient K1 is used in 2019-2020?

The value of the deflator coefficient in 2021 is 1.915, in 2021 - 2.005.

How is the declaration filled out when carrying out one type of activity, subject to UTII, in different places?

When a taxpayer carries out the same type of business activity in several separately located places, when filling out a UTII declaration, Section 2 is filled out separately for each place where this type of business activity is carried out (each OKATO code). (clause 5.1 of the Procedure for filling out a tax return for UTII, approved by order of the Federal Tax Service of Russia dated June 26, 2018 N ММВ-7-3/ [email protected] )

How to calculate K2

The calculation is carried out on the basis of legal documents for each region. In the previously presented document for the Orenburg region, K2 is calculated using the formula:

K2 = AxBxCxDxV, in which the variables have the following values:

A is a variable that takes into account the characteristics of types of economic activity;

B is a variable that takes into account the specifics of conducting activities depending on the type of settlement;

C is a variable that takes into account the size of retail space in retail trade;

D is a variable that takes into account the characteristics of the work of disabled people of groups I and II; parents who support a disabled person living together and requiring constant care since childhood, who do not have employees;

V is a variable that takes into account the range of goods sold in retail trade.

Example.

IP Vilkin A.A. Engaged in retail trade of fruits and vegetables in the city of Orenburg. The store area is 70 square meters. The labor of hired workers is used in the amount of 2 sellers; there are no disabled people or parents of disabled people among the workers. It is necessary to calculate the size of K2 for this case.

K2 = AxBxCxDxV, in which the variables have the following values:

A is a variable that takes into account the characteristics of types of economic activity =1;

B is a variable that takes into account the peculiarities of conducting activities depending on the type of settlement =1;

C is a variable taking into account the size of retail space in retail trade = 0.9;

D is a variable that takes into account the characteristics of the work of disabled people of groups I and II; parents who support a disabled person from childhood who lives together and requires constant care, and who do not have employees = 1;

V is a variable that takes into account the range of goods sold in retail trade = 0.9.

Thus K2=1*1*0.9*1*0.9=0.81

The K2 size for this case is 0.81.

Now let’s calculate the tax amount for the first quarter of 2021: (click to expand)

Tax = 70 (hall area) * 1800 (basic profitability amount) * 1.868 (K1 coefficient) * 0.81 (K2 coefficient) * 3 (number of months) * 0.15 (tax rate) = 85,791 rubles.

Increasing UTII from 2021: calculation example

There is a high probability that the bill of the Russian Ministry of Finance will be adopted. Let's try using examples to calculate UTII from 2021 taking into account the new coefficient and compare the indicators with 2021. So, the general formula for calculating UTII in 2021 remains the same:

Let us give examples of calculations adjusted for K1.

An example of calculating UTII in 2021

Tsvetochek LLC is engaged in retail trade through its own store with a sales area of 80 sq. m. m. In the city where trade is carried out, the use of UTII is allowed. The tax rate for retail is 15%. Alpha LLC conducted imputed activities in January, February and March. The calculation will be based on the following indicators:

- in 2021, the new value of the deflator coefficient K1 is 1.891;

- The regional authorities set the value of the correction coefficient K2 at 0.7.

- the basic profitability for retail trade in the presence of trading floors is 1800 rubles/sq.m. m.

Imputed income for February–March 2021 (that is, for the 1st quarter) will be:

571,838 rubles. = 1800 rub./sq. m × (80 sq. m + 80 sq. m + 80 sq. m) × 0.7 × 1,891.

UTII for the first quarter of 2021 with the new value of the K1 coefficient will be:

RUB 85,776 = RUB 571,838 × 15%

Comparison of calculation with 2021

Let’s assume that the bill to increase the coefficients for “imputation” is not adopted and in 2021 the K1 coefficient remains at the same level – 1.798. In this case, under the same conditions, the amount of UTII payable for the 1st quarter of 2021 will be less. In this case, the basic profitability indicator will be equal to 543,715 rubles. = 1800 rub./sq. m × (80 sq. m + 80 sq. m + 80 sq. m) × 0.7 × 1,798.

The amount of tax payable will be 81,557 rubles = 543,715 rubles. × 15%

Thus, if the new coefficient for UTII is approved, then with similar indicators, the amount of tax for the 1st quarter of 2021 will increase by 4219 rubles. (RUB 85,776 – RUB 81,557). In percentage terms, the increase in 2021 will be 5.2 percent.

How to round K2

When calculating K2, a situation may arise when the figure is very long. In such cases, the coefficient is rounded to 3 decimal places. Rounding occurs according to the rules of mathematics, that is, if the fourth digit is greater than 5, then the third is increased by one digit, and if the fourth digit is less than 5, then it is simply removed.

Example.

Coefficient K2 according to the calculation results is equal to 1.2588963. In such a situation it will be rounded to 1.259.

Basic Concepts

It is impossible to fully reveal the essence of the K2 coefficient by separating it from other components of UTII. All basic terms that relate to this tax are disclosed in Article 346.27 of the Tax Code of the Russian Federation.

The calculation is made based on the following indicators:

- Basic return. Conditional income assigned by the state to each type of activity;

- Physical indicator. The previous indicator is taken for one unit. Depending on the type of activity, this may be a square meter of area, a unit of transport, 1 employee, etc.;

- Coefficient K1. Changes the tax amount (increasingly) in accordance with inflation processes. Established annually at the federal level;

- K2. Approved by local authorities in order to ease the tax burden depending on the characteristics of the business (seasonality, level of profitability, etc.);

- Tax rate. Set at 15%.

The income on which this taxation system is based is calculated by multiplying the basic amount of income by the physical indicator. And to obtain the final tax amount, it is necessary to multiply the imputed income by the tax rate and deflator coefficients.

The K2 coefficient is of the greatest interest for entrepreneurs, as it allows you to save on taxation.

On what basis

The use of K2 in calculating the amount of tax is carried out on the basis of regulations approved by the authorities of districts and cities.

When doing business in a number of regions simultaneously, K2 should be determined on the basis of the legislation of the municipality in which the company is registered as a UTII taxpayer. This rule is regulated by Art. 346.28 Tax Code of the Russian Federation.

There are situations when there is no approved K2 in the area. In this case, the tax is calculated only on the basis of basic profitability.

If the value of the indicator for the current year exists, but this normative act has not yet gained legal force, the taxpayer should use the coefficient of the previous period.

Procedure for calculating UTII

The calculation of the single tax is simple and is carried out on the basis of the standard indicators established by the Tax Code of the Russian Federation.

The tax base for calculating the single tax is imputed, i.e. potential income of the taxpayer UTII. Thus, the tax is calculated on the basis of imputed and not actually received income.

The tax base is calculated as the product of the basic profitability for a certain type of business activity, calculated for the tax period, and the value of the physical indicator characterizing this type of activity (clause 2 of Article 346.29 of the Tax Code of the Russian Federation).

In this case, the basic profitability is adjusted (decreased or increased) by coefficients K1 and K2 (clause 4 of Article 346.29 of the Tax Code of the Russian Federation).

The formula for calculating the tax base is as follows:

NB = DB x K1 x K2 x (FP1 + FP2 + FP3),

where NB is the tax base;

BD – basic profitability established for a specific type of business activity;

K1 – deflator coefficient;

K2 – correction factor;

FP1, FP2, FP3 – values of the physical indicator established for each type of activity in the first, second and third months of the quarter, respectively.

Calculation formula and payment of UTII

The single tax is calculated based on the results of the tax period using the following formula:

UTII = (Tax base * Tax rate) – Insurance Contributions.

The UTII rate is the same for all types of activities and all territories – 15%.

UTII taxpayers have the right to reduce the amount of tax calculated for the tax period by the amounts of payments (contributions) and benefits that were paid in favor of employees employed in those areas of the taxpayer’s activity for which a single tax is paid (Article 346.32 of the Tax Code of the Russian Federation).

If there are employees, it is possible to reduce the UTII tax on insurance premiums paid, but not more than 50 percent of the calculated tax amount.

Individual entrepreneurs working without employees (do not make payments or other remuneration to individuals) can reduce the amount of the single tax by the entire amount of fixed insurance contributions paid to the Pension Fund and Compulsory Medical Insurance in the reporting period (without applying the 50% limit). The resulting tax amount payable in this case cannot be less than 0.

The tax period for UTII is a quarter (Article 346.30 of the Tax Code of the Russian Federation).

This means that it is necessary to calculate and pay tax to the budget at the place of registration with the tax authority as a UTII taxpayer at the end of each quarter no later than the 25th day of the first month of the next tax period.

In the payment order for the transfer of tax, you must indicate the budget classification code (BCC).