Home / Real estate

Back

Published: 01/25/2020

Reading time: 7 min

0

485

This morning the doorbell rang: a neighbor came for consultation with a letter received the day before. She was accused of being behind on payments for a house she bought a year and a half ago. Everything would be fine if she received a receipt for paying the tax. But there was no letter with a receipt and now you have to not only pay the property tax, but also penalties for being late. She came to me to find out more about everything. It’s not a difficult matter, he explained. I’ll explain it to you too.

- When do you need to pay annual property taxes?

- What to do if you haven’t received a receipt from the tax office? Do they charge penalties for late tax payments?

- How to pay property taxes if there is no receipt?

Why might I not receive a tax notice?

“Paper” tax notices are not sent to Russians who use the “Personal Taxpayer Account”. In this case, the document will appear in your account and will not be duplicated by mail. The exception is when the user has requested in advance to receive paper documents.

The notice is also not sent to those who have tax benefits, deductions or other legal grounds that completely exempt them from paying tax. These are certain categories of pensioners and disabled people, military personnel, etc.

Also, you should not wait for the document if the total amount of taxes is less than 100 rubles. Then the notification will be sent only in the calendar year, after which the possibility of sending the notification is lost.

In addition, Russians who have not notified the Federal Tax Service that they are the owners of real estate or vehicles will not be able to receive a notification. Finally, a document sent by mail may, for some reason, simply not reach the addressee.

Tax Features

Property owners are required to pay property taxes by October 1 annually in accordance with the established procedure. The financial procedure is carried out using a receipt, which is regularly sent to the taxpayer by mail.

If the tax has not arrived, does this mean that there is no need to pay at all? This issue requires attention, since for non-compliance with the provisions of the Tax Code of the Russian Federation, property owners will face the consequences indicated by the norms of adopted laws.

The law obliges property owners and residents of residential premises to pay tax on a regular basis.

If the receipt does not arrive, the state does not have the right to charge a fine or penalty, since it is responsible for the fact that the document is late or was completely lost. But this does not mean that the taxpayer will not have to carry out a financial transaction.

Any payment documents that property owners receive in accordance with the established procedure must arrive no later than the first of August.

Taking into account the innovations that came into force on January 1, 2020, the tax system uses the cadastral value of real estate to deduct the final amount. It is known that 28 regions of the country already use a similar formula.

By 2021, a full transition to the new system will be carried out in Russia. Against this background, requests for repeated examinations have become more frequent, establishing the real assessment and, accordingly, the value of real estate that is the object of taxation.

Why isn't the tax coming?

In such a situation, the taxpayer must know exactly the reason, since, starting from it, it is necessary to follow a specific sequence of actions.

The following situations can be identified, which often become the reason for the lack of a receipt:

- The taxpayer's actual residence address has changed. The place of residence of the property owner has changed, but government authorities have not yet received information on this issue.

- Congestion of postal routes and system failures. Even though taxes are sent via registered mail, it often happens that they arrive late.

- Registration on the specialized portal “State Services”. Upon registration, the taxpayer stops receiving paper notifications, since all such information is located in his personal account. Thus, payments can be made online using the functionality of the site. If the property owner wishes to receive receipts in paper form again, he must contact the tax department with a corresponding request.

- Minimum amount condition. If the total tax amount is less than one hundred rubles, the receipt is not sent by mail. The taxpayer receives a notification only at the end of the allowable period for payment of the state property tax.

- Internal error in the tax system. In this case, the taxpayer is mistakenly not included in the group with a financial liability. This situation does not lead to the accrual of fines and penalties, since the authorized body is responsible for what was done.

- If the property owner is a new taxpayer, the notification may not arrive due to the fact that it is not in the database. In this case, you must personally contact the responsible authority with a corresponding application.

Provided that you live at the place of actual registration, but notifications do not arrive in any form (and you are not registered on the State Services website), you must follow the following algorithm of actions:

- visiting the post office at your place of residence in order to clarify whether any letters have arrived in your name;

- visiting the official website of the Federal Tax Service and “Personal Account” to find out if there are notifications there;

- make a personal visit to the tax office to receive a notification in this format.

Preferential categories

Preferential categories were formed by the current Tax Code in order to establish order and a certain system in the payment of debts on property issues.

It should be noted that beneficiaries often have the right not to pay property tax for only one unit of real estate. This means that, having several apartments, garages, etc., an individual can, at his own discretion, choose that property for which tax will not be charged.

Preferential categories:

- pensioners;

- war veterans;

- disabled people of the first and second groups;

- heroes of the USSR;

- persons who participated in the liquidation of the Chernobyl accident.

Where to go if you haven't received a tax notice?

If the tax notice has not been received, you must contact the tax office in person, by mail, through the MFC or “Personal Account” on the website of the Federal Tax Service of the Russian Federation. You can also contact the inspection through the service’s online service in the section “Contact the Federal Tax Service of Russia”

In his appeal, the taxpayer must inform that he owns a piece of real estate or a vehicle, but has not received a tax payment notice. Those who have never previously received notifications or have not claimed tax benefits in relation to taxable property will also need to contact the tax office and report ownership of property or a vehicle.

Question answer

What to do if you transferred “extra” taxes?

Why doesn't my apartment tax arrive?

As the Federal Tax Service explains, the owner of real estate may not receive a tax notice for one of the following reasons:

- The tax amount is too small . In accordance with tax legislation, when the amount due is less than 100 rubles, neither a paper nor an electronic notice is sent to the taxpayer. In this case, the tax will be included in the receipt for payment next year, while fines and penalties for non-payment will not be charged (clause 4 of Article 52 of the Tax Code of the Russian Federation).

- The notification came in electronic form . For citizens who have gained access to their personal account on the Federal Tax Service website, paper receipts will no longer be sent to the post office - their sending is canceled automatically (Clause 2 of Article 11.2 of the Tax Code of the Russian Federation). If you wish, you can continue to receive receipts in paper form; to do this, you need to select the appropriate item in your profile settings in the “Contact Information” section.

- The tax service did not receive information about the emergence of ownership of the apartment . If the property was purchased recently, it is possible that information about this has not yet reached the tax authorities. If November 1 has already arrived and the notification has not arrived, you need to contact the Federal Tax Service (via the website, in person or by phone) before the end of the year and report your right to the property.

- The tax was no longer charged . This can happen if a citizen has received a benefit - for example, if he retired or became disabled. More information about tax rates and preferential categories can be found on the official website of the Federal Tax Service.

In addition, the tax notice is compiled by the tax service, but this does not mean that it cannot contain errors. All data specified in the document must be carefully checked. If the amount payable is more than required, the ownership period is incorrectly indicated, the benefit is not taken into account, or tax was received for an apartment that was sold or transferred to another owner through inheritance or gift, then you need to report this to the Federal Tax Service through the taxpayer’s personal account or using a special service.

What property is subject to tax?

Owners of houses, apartments, rooms, cottages, garages, parking spaces and other capital construction projects must pay the tax. Land plots are also taxed, including those used as gardens, vegetable gardens, summer cottages, household plots and for individual housing construction.

Transport tax will need to be paid by owners of cars, motorcycles, yachts, boats and other vehicles.

Certain categories of Russians can count on federal benefits for property, land and transport taxes. These are Heroes of the Soviet Union and the Russian Federation, disabled people from childhood, groups I and II, disabled children, certain categories of pensioners, military personnel, etc. Regions can also introduce their own additional benefits. You can find out about the possibility of receiving benefits on the Federal Tax Service website.

How is property tax calculated in 2021?

Property tax is calculated by the Federal Tax Service, after which it sends a notification to the individual’s place of residence, which contains information about the amount of tax required to be paid.

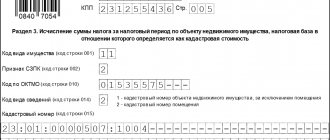

On January 1, 2015, Chapter 32 of the Tax Code of the Russian Federation came into force, which provides for a new procedure for calculating property tax. According to the new rules, the tax is calculated not on the inventory value of the object, but on the basis of its cadastral value

(i.e. as close as possible to the market).

Note!

All subjects of Russia had to completely switch to calculating property taxes based on cadastral value by January 1, 2020.

The new calculation procedure is introduced separately by each subject of the Russian Federation. In 2021, the tax based on the cadastral value of real estate for individuals will be calculated in 74 regions (this is what will need to be paid in 2021). The tax for the period 2021 will be calculated based on cadastral value in all regions of the Russian Federation, except Sevastopol.

How is tax calculated from cadastral value?

Property tax for individuals based on the cadastral value of the property is calculated using the following formula:

Nk = (Cadastral value – Tax deduction) x Share size x Tax rate

Cadastral value

When calculating the tax, data on the cadastral value of an object is taken from the state real estate cadastre as of January 1 of each year (for new objects - at the time of their registration with the state). You can find out the cadastral value of an object at the territorial office of Rosreestr.

Tax deduction

When calculating tax, the cadastral value for the main types of objects can be reduced by a tax deduction:

| Object type | Tax deduction |

| Apartment | Reduced by the cost of 20 square meters of this apartment |

| Room | Reduced by the cost of 10 square meters of this room |

| House | Reduced by the cost of 50 square meters of this house |

| A single real estate complex that includes at least one residential premises (residential building) | Decreased by one million rubles |

The authorities of municipalities and cities of Moscow, St. Petersburg, and Sevastopol have the right to increase the amount of tax deductions described above. If the cadastral value turns out to be negative, then it is assumed to be zero.

Calculation example

Petrov I.A. owns an apartment with a total area of 50 sq. meters. Its cadastral value is 3,000,000 rubles. Cost of one sq. meter is equal to 60,000 rubles.

The tax deduction in this case will be: RUB 1,200,000.

(RUB 60,000 x 20 sq. meters).

When calculating the tax, it is necessary to take the reduced cadastral value: 1,800,000 rubles.

(RUB 3,000,000 – RUB 1,200,000).

Share size

If the object is in common shared ownership

, the tax is calculated for each participant in proportion to his share in the ownership of this object.

If the property is in common joint ownership

, the tax is calculated for each of the participants in joint ownership in equal shares.

Tax rate

Tax rates in each subject of Russia are different; you can find out their exact amount in force in 2021 on this page. Please note that tax rates should not exceed the following limits:

| Tax rate | Object type |

| 0,1% | Residential buildings (including unfinished ones) and residential premises (apartments, rooms) |

| Objects of unfinished construction if the designed purpose of such objects is a residential building | |

| Unified real estate complexes, which include at least one residential premises (residential building) | |

| Garages and parking spaces | |

| Commercial buildings or structures whose area does not exceed 50 square meters. meters and which are located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, horticulture or individual housing construction | |

| 2% | Administrative, business and shopping centers |

| Non-residential premises that are used to accommodate offices, retail facilities, catering facilities and consumer services | |

| Objects whose cadastral value exceeds 300 million rubles | |

| 0,5% | Other objects |

The authorities of municipalities and cities of Moscow, St. Petersburg, Sevastopol have the right to reduce the tax rate 0,1%

to zero or increase it, but not more than three times. Also, depending on the cadastral value, type and location of the object, local authorities have the right to establish differentiated tax rates.

Calculation example

Object of taxation

Petrov I.A. belongs ½

apartments with a total area of 50 sq. meters. The cadastral value of the apartment is 3,000,000 rubles. The tax deduction will be equal to 1,200,000 rubles.

Tax calculation

To calculate the tax, we take the maximum possible tax rate 0,1%

.

Substituting all the available data we get the formula:

900 rub.

((RUB 3,000,000 - RUB 1,200,000) x ½ x 0.1%).

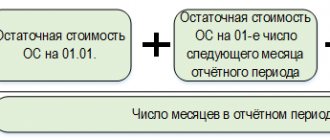

How is tax calculated on inventory value?

Property tax for individuals based on the inventory value of the property is calculated using the following formula:

Ni = Inventory value x Share size x Tax rate

Inventory value

When calculating the tax, data on the inventory value submitted to the tax authorities before March 1, 2013 is taken. You can find out this information at the BTI branch at the location of the property.

Share size

If the object is in common shared ownership

, the tax is calculated for each participant in proportion to his share in the ownership of this object.

If the property is in common joint ownership

, the tax is calculated for each of the participants in joint ownership in equal shares.

Tax rate

Tax rates in each subject of the Russian Federation are different; you can find out their exact amount on this page. Please note that tax rates should not exceed the following limits:

| Inventory value | Tax rate |

| Up to 300,000 rub. (inclusive) | Up to 0.1 percent (inclusive) |

| Over 300,000 rub. up to 500,000 rub. (inclusive) | Over 0.1 to 0.3 percent (inclusive) |

| Over 500,000 rub. | Over 0.3 to 2.0 percent (inclusive) |

Note

: depending on the amount of inventory value, type and location of the object, local authorities have the right to establish differentiated tax rates.

Calculation example

Object of taxation

Petrov I.A. belongs ½

apartments in Moscow.

The inventory cost of the apartment is 200,000 rubles.

.

Tax calculation

The tax rate for this apartment is provided in the amount

0,1%

.

Property tax in this case will be equal to: 100 rubles.

(RUB 200,000 x ½ x 0.1 / 100).

How is tax calculated under the new rules in the first 4 years?

When calculating the tax from the cadastral value, its amount is significantly larger than when calculating from the inventory value. In order to prevent a sharp increase in the tax burden, it was decided: in the first four years (after the introduction of new rules in the region), the tax should be calculated using the following formula:

H = (Hk – Ni) x K + Ni

Nk

– tax calculated from the cadastral value of the object (see above).

Neither

– tax calculated from the inventory value of the object (see above).

TO

– a reduction factor, thanks to which the tax burden will gradually increase by 20% each year.

Coefficient K is equal to:

- 0.2 – in the first year;

- 0.4 – in the second year;

- 0.6 – in the third year;

- 0.8 – in the fourth year.

Starting from the 5th year, property tax must be calculated based on the cadastral value of the property.

Note

: tax calculation according to the above formula is carried out only in cases where the tax from the cadastral value is obtained more than from the inventory value.

Pensioners and other beneficiaries

The legislation establishes a fairly wide list of property tax beneficiaries (it also includes pensioners). You can find out whether a citizen has benefits that exempt him from paying taxes in his Federal Tax Service or on the tax service website. If the taxpayer retired or became a benefit recipient for another reason, and property tax payments continue to arrive, you should submit an application to the Federal Tax Service regarding your right to a benefit.

Read also: Tax benefits for pre-retirees

Property tax payment deadline

In 2021, a single deadline for payment of property taxes has been established for all regions of Russia - no later than December 1

next year. That is, before December 1, 2021, you need to pay tax for 2021.

note

that in case of violation of the deadlines for payment of property taxes, a penalty will be charged for the amount of arrears for each calendar day of delay in the amount of one three hundredth of the current refinancing rate of the Central Bank of the Russian Federation. In addition, the tax authority may send a notice to the debtor’s employer to collect the debt at the expense of wages, and also impose a restriction on leaving the Russian Federation. There is no fine imposed on individuals for non-payment of taxes.

You must report your property to the tax office by January 1, 2021.

Individuals pay land tax, as well as property tax for individuals, on the basis of notifications sent to them by the tax authority. The tax notice must contain the following information:

– the amount of tax to be paid,

- object of taxation,

- the tax base,

– tax payment deadline.

Starting from 2015, the transferred taxes must be paid before December 1 of the year following the expired tax period (year). Thus, taxes for 2015 must be paid before December 1, 2016.

In case of failure to receive a tax notice, the taxpayer is obliged to report the availability of real estate assets by December 31 of the year following the expired tax period (year). Copies of title documents for real estate objects must be attached to this message (clause 2.1 of Article 23 of the Tax Code of the Russian Federation). In this case, the tax amount is calculated starting from the year in which you submitted the message (paragraph 4, paragraph 2, article 52 of the Tax Code of the Russian Federation).

The message is not submitted to the tax authority if you previously received a tax notice about paying tax in relation to this object or you have the right to tax benefits, and therefore a tax notice was not sent to you (clause 2.1 of Article 23 of the Tax Code of the Russian Federation).

The application and copies of title documents can be submitted to the tax authority in person or sent by registered mail.

From January 1, 2021, liability is provided for failure to report the presence of real estate (clause 2.1 of article 23 of the Tax Code of the Russian Federation) in the form of a fine in the amount of 20% of the unpaid tax amount (clause 12 of article 1 of Law dated 04/02/2014 No. 52 -FZ). At the same time, in 2021 you may be held liable under paragraph 1 of Art. 126 of the Tax Code of the Russian Federation.

Please note that if you have access to the taxpayer’s personal account, you will receive a tax notice of tax payment only in electronic form and you should not wait for this document by mail.

If you have not received a notice of payment of property tax for individuals, you need to act as follows:

- Notify the tax office about the presence of property in your property, and attach copies of title documents to this message. This rule applies to property for which tax has not previously been assessed.

- If you have previously received tax notices, but this year you still haven’t received one, contact the tax office so that this notice will be issued to you. Perhaps it got lost in the mail or was not sent by mistake.

- If you are an Internet user, then register a personal taxpayer account, in which case all taxes can be paid without leaving your home.

If a notice of payment of property tax for individuals has nevertheless arrived, but the figures to be paid have shocked you, then you need to act as follows:

- Find out the cadastral value of your apartment

It is worth recalling that from January 1, 2015, a new procedure for calculating property tax for individuals has been in effect - apartment owners pay tax based on the cadastral value of residential premises. Therefore, the amount of tax directly depends on the cadastral value of the apartment.

The cadastral value of an apartment can be found on the official website of Rosreestr (in electronic form), as well as through multifunctional centers (MFC) or in the division of the cadastral chamber (on paper).

- Calculate tax

Property tax is calculated based on the cadastral value of the apartment, reduced by the cadastral value of 20 square meters of the total area of this apartment. That is, if your apartment is 45 square meters. m., then to calculate the tax you need to subtract 20 sq. m. from this area. m. (45 sq. m. - 20 sq. m. = 25 sq. m.)

The tax rate in Moscow is 0.1% of the cadastral value of housing, if the cadastral value of the property is no more than 10 million rubles.

-from 10 to 20 million rubles – 0.15%.

– from 20 to 50 million rubles – 0.2%.

-from 50 to 300 million rubles. -0.3%.

– over 300 million rubles – 2% (Moscow Law of November 19, 2014 No. 51 “On the property tax of individuals”).

- Contact the tax office

If the tax amount or cadastral value of the apartment indicated in the notice, in your opinion, does not correspond to reality, then you need to contact the tax office for clarification. This may have happened due to a technical error.

- If a taxpayer believes that the cadastral value of his property differs significantly from the market value, he has the right to appeal the results of the cadastral valuation. You can contact the court or the commission for resolving disputes about the results of determining the cadastral value at the territorial administration of Rosreestr. Individuals do not have to contact the commission, but directly submit an application to the court.

Lawyer Svetlana Zhmurko

Make an appointment for a consultation with a lawyer by phone: 8(985)998-58-08

Civil law

- How to register a bathhouse and a garage and whether you have to pay tax for them later

Permalink

- Gas can be supplied to the house using maternity capital

Permalink

- What documents are needed so that a young family can get an apartment or build an individual housing construction house?

Permalink

- If the apartment is not delivered on time

Permalink

- How to rent out a room or apartment correctly

Permalink

Latest publications in the press (All publications)

Can an apartment be taken away from the owner?

TVNZ

Why do they want to extend the dacha amnesty for another five years?

TVNZ

“New settlers have become insolent”: deputies demand to protect developers from consumer extremism

TVNZ

“They looked at me like I was crazy”: a pensioner is trying to protest taxes for expensive land registered in her name

rt in Russian

How to save on utility bills in the summer

TVNZ