The simplified tax system (STS) is the most popular taxation system for medium and small businesses. When working under the simplified tax system, the tax burden is minimal, and accounting is simple enough for individual entrepreneurs to maintain it themselves. “Simplified” suggests two options for calculating taxes:

- USN Income

- USN Income minus expenses

In most cases, this system is convenient and beneficial, but using this tool is not always advisable. You can choose a tax system after comparing a number of criteria.

Amount of payments to the state

Tax payments to the budget and transfers to pension, social insurance and compulsory medical insurance funds. On average, insurance premiums are paid in the amount of 30% of employee salaries, and individual entrepreneurs must also transfer contributions for themselves. Under the simplified system, tax rates are lower than under the general system. Under the “Revenue” option of 6%, from 2021 regions have the right to reduce the tax rate to 1%. According to the “Income minus expenses” option, the rate is 15%, which can be reduced to 5%.

At the “Income” rate, advance payments for unified social security can be reduced by transferring insurance premiums up to 50%. Individual entrepreneurs without hired workers and with low income may not pay a single tax at all. At the “Income minus expenses” rate, insurance premiums are taken into account as expenses, but this procedure also applies in other tax systems.

We can conclude that the simplified tax system is beneficial when calculating taxes from income.

How to calculate the tax for individual entrepreneurs using a simplified method based on the results of 2021 without employees

The simplified taxation system (STS) is a tax regime adopted in 2002. “Simplified” is often chosen by representatives of small businesses, both individual entrepreneurs and legal entities, because of the simple procedure for paying taxes and uncomplicated reporting. This mode has some limitations:

- the organization must have less than 100 employees;

- annual income must be less than 150 million rubles;

- residual value is less than 150 million rubles;

- the share of participation of other organizations in it is less than 25%;

- A simplified organization should not have branches.

The “Income” regime of the simplified tax system is especially beneficial for individual entrepreneurs without employees, since with a low level of cash receipts, the tax can be fully paid off by insurance premiums.

For example, in 2021, with insurance contributions to the Pension Fund and the Compulsory Medical Insurance Fund - 32,385 rubles. if an individual entrepreneur has an income of less than 539,750 rubles, then there will be no tax. This is if the entrepreneur paid contributions quarterly.

Basic provisions of the simplified taxation system

When choosing the “simplified” taxation system, you can choose “income minus expenses” as the object of taxation, in which 15% tax is levied on the difference between the organization’s income and expenses, and “income”, in which 6% tax is paid on the amount of income.

The first mode is chosen by those who have a large level of expenses, the second mode – by those whose expenses make up a small part of their turnover. In addition, individual entrepreneurs who do not have employees often choose the “income” mode due to the fact that there is no need to document their expenses.

Features of paying tax on the simplified tax system

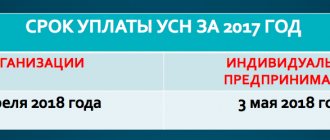

The tax required to be paid under the simplified taxation system is called single. Profit tax and personal income tax are not charged to the simplified tax system. There is no VAT charged, except for that which is paid when importing goods into Russia. The tax is calculated based on the results of the calendar year, and it is paid no later than April 30 of the following year by entrepreneurs. For example, the simplified tax system tax for 2021 must be paid no later than April 30, 2021. Legal entities have stricter limits; they must pay before March 31, 2021

But advance payments are made throughout the year. The deadlines for their payment are as follows:

- for the first quarter (3 months) – until April 25;

- for half a year (6 months) - until July 25;

- nine months (9 months) - until October 25.

Advance payments must be made if the individual entrepreneur received income in a given quarter. If there was no income, then there is no need to make advance payments.

Advance payments calculated and paid during the reporting year are taken into account when calculating tax for the year. In addition, every individual entrepreneur without employees, regardless of the tax regime, must pay insurance premiums for himself. These payments reduce the tax amount down to zero for low income levels.

Calculation of tax for the object “income” using a specific example

Let’s take as an example an individual entrepreneur without hired workers on a “simplified” market who rents premises and is engaged in sewing and repairing clothes. He has a cash register for payments by individuals and a current account for settlements with legal entities and the purchase of fabrics and accessories.

Using the calculator in the left column of the site, we calculate its annual and advance tax for 2021 based on the following initial data:

- for the 1st quarter he received an income of 121,920 rubles. (non-cash and cash receipts);

- for the 2nd quarter the income was 156,126 rubles.

- 3rd quarter – 98,451 rub.

- 4th quarter – 182,340 rubles.

Contributions for compulsory pension and health insurance were paid:

- 1st quarter – 6636 rub. 25kop. to the Pension Fund and 1460 rubles. to the Compulsory Medical Insurance Fund (total 8096 rubles 25 kopecks);

- 2nd quarter – 6636 rub. 25kop. to the Pension Fund and 1460 rubles. to the Compulsory Medical Insurance Fund (total 8096 rubles 25 kopecks);

- 3rd quarter – 6636 rub. 25kop. to the Pension Fund and 1460 rubles. to the Compulsory Medical Insurance Fund (total 8096 rubles 25 kopecks);

- 4th quarter – 6636 rub. 25kop. to the Pension Fund and 1460 rubles. to the Compulsory Medical Insurance Fund (total 8096 rubles 25 kopecks);

As you can see, the payments were distributed across quarters and amounted to the required 26,545 rubles. per year for pension insurance and 5840 rubles. for medical

Fill the calculator with this data. We indicate the object of taxation (income), leaving 6% in the tax rate line.

Next, fill in the income fields by quarter, rounding kopecks to rubles with the original data.

The next block is “Contributions paid to the Pension Fund and the Federal Compulsory Medical Insurance Fund”, here the amounts for quarters are identical, we enter in 3 quarters - 6636, rounding up kopecks. And in the latter - 6637, taking into account the discarded kopecks, otherwise the annual amount will not add up.

PS The calculator now allows you to enter numbers with kopecks, so the calculation is simplified for users of the service. We drive to each field - 8096.25.

Be sure to put o, otherwise the tax will be calculated incorrectly (in this particular case).

The individual entrepreneur from this example is not a payer of the trade tax, so we do not fill out the block of the same name (and do not put zeros).

Then click the “Calculate” button. As a result, we obtain the calculated values of advance and annual tax.

Below are the values for filling out section 1.1. declarations:

And section 2.1.1 of the declaration:

If you put this data in, it will already be included in the declaration.

What to do if the individual entrepreneur did not pay advance tax payments or paid them, but the amounts differ from those calculated?

If there were no advance payments, we pay the entire tax amount in one payment. We find out the amount by adding lines 020, 040, 070, 100 or using the calculator in the left column of our website.

In the event that there have been tax payments, but they differ from the values in lines 020, 040, 070 and 100, then we look at the total amount of tax and pay exactly as much as is necessary for this. If a large amount was transferred, then there are two options:

- return the overpayment to your current account;

- offset the overpayment against the payment of another tax transferred to the budget of the same level.

In both cases, you must contact your tax office.

Author of the article Burenin Viktor

Author of a series of articles devoted to optimization of taxation and submission of tax reports under the simplified tax system, administrator and consultant of the website deklaraciya-usn.ru on these issues. Entrepreneur since 2004 […]

Disputes with tax authorities

In the “Income” mode, the taxpayer does not have to justify the correctness of documenting his expenses. Income is recorded in the Book, and a declaration is submitted within the specified period; expenses are not taken into account. Taxpayers working under the “Income minus expenses” option confirm expenses, but there are almost no disputes with the tax authorities on this matter. Disputes regarding the payment of VAT are also excluded, except for the import of goods into the Russian Federation.

A significant disadvantage of the simplified tax system is the limitation of the circle of counterparties to those who do not take into account input VAT.

Calculator from the Nalog-Nalog.ru service

Top 3 for Google searches. The service offers two calculators: one for the simplified tax system of 15% and the other for the simplified tax system of 6%. The calculation can be done for a quarter, or for a year. It is enough to indicate the tax rate, income and expenses by quarter.

Pros: the calculation can be immediately printed, and the text below describes the amounts of quarterly advance payments.

Disadvantages: when entering income and expenses, character digits are not separated by spaces. This is not critical, but the figure “15,000,000” is perceived and read much easier than “15,000,000.”

Important! Please note that to calculate the simplified tax system of 15%, the same initial data were used as in the example for Kontur.Accounting and Kontur.Extern. We checked the calculations in other calculators and found that Nalog-Nalog.ru made an error in the calculations. The service shows the presence of an overpayment under the simplified tax system in the amount of 272,500 rubles, which cannot exist.

It is difficult to reliably determine the cause. This is probably due to the fact that income in the 3rd quarter is greater than income in the 4th. If you enter income in ascending order, there is no problem.

Who can apply the simplified tax system

Legal entities and individuals who are not subject to the following restrictions can work under the simplified system:

- Banks, pawnshops, investment funds, insurers, non-state pension funds, professional participants in the securities market, microfinance organizations;

- Organizations with branches;

- State and budgetary institutions;

- Organizers of gambling;

- Foreign organizations;

- Participants in production sharing agreements;

- With a share of participation of other organizations over 25%, except for non-profit, budget-funded scientific and educational institutions and those in which the authorized capital consists entirely of contributions from public organizations of people with disabilities;

- If the residual value of fixed assets is more than 100 million rubles.

- Individual entrepreneurs producing excisable goods, extracting minerals, except sand, clay, peat, crushed stone, building stone;

- Individual entrepreneurs with more than 100 employees.

Also, the simplified tax system does not apply to private notaries and lawyers.

Calculator Clerk

Top 4 in Google search. The Clerk's calculator is only suitable for calculating the tax burden under the simplified tax system of 6%. You can select “Individual entrepreneur without an employee” so that the system reduces the tax payable by the entire amount of insurance premiums, and not by 50%, as if there are employees.

The calculator can take into account trade fees, benefits and down payments paid.

Pros: the main advantage is that based on the values entered into the calculator, you can download an already completed declaration. All you have to do is enter your details into it.

Disadvantages: the calculator cells are too narrow. As you can see in the screenshot, the number “15000000” is not completely visible. In addition, the digits are not separated by spaces.

Tax base for the simplified tax system

In the “Income” mode, the tax base is income in monetary terms. For the “Income minus expenses” option, expenses are subtracted from this amount. For taxation under the simplified system, income is:

- Proceeds from the sale of own or previously purchased goods, works, services and property rights;

- Non-operating income: property received free of charge, interest on loans, bank accounts, securities, etc.

Expenses recognized for taxation under the simplified system are given in Art. 346.16 Tax Code of the Russian Federation.

Calculator 1C-Start

Top 5 in Google search. The service does not allow you to take into account paid trading fees. The tax base can only be determined quarterly. To calculate the tax amount, indicate income, expenses and insurance premiums paid.

Pros: clear interface.

Disadvantages: the calculation algorithm is not shown, the digits are not separated by spaces, the calculation can only be done quarterly.

Important! For the calculation, we took our example from the calculator for Kontur.Accounting. They simply indicated the annual amount of income and expenses as quarterly.

Of all the calculators, it is worth noting the services from SKB Kontur. They have a clear interface, a wide range of settings, and the opportunity to study the calculation algorithm. Suitable for all users.

The calculator from Clerk is only suitable for simplifiers with a rate of 6%. And the 1C calculator should only be used to calculate quarterly advance payments. If you want to calculate your tax for the year, this is not your option.

You should treat the Tax-Naulog.Ru service with caution. Sometimes the calculator calculates correctly, and sometimes it doesn’t. The exact reason has not been established.

How to switch to simplified tax system

When registering individual entrepreneurs and LLCs to switch to a simplified taxation system, they submit a notification within 30 days from the date of state registration. You can also notify the tax office about working under the simplified tax system when registering an enterprise or individual entrepreneur.

If in the reporting period income exceeded 60 million rubles, the taxpayer loses the right to the simplified tax system from the quarter in which the excess occurred. A deflator coefficient is set each year, for example, in 2021, 60 million rubles. multiplied by 1.329, i.e. the limit is 79.74 million rubles.

To switch to the simplified tax system, existing legal entities and individual entrepreneurs must wait for the new calendar year and submit a notification before December 31. UTII payers, after ceasing a certain type of activity, submit an application within a year.

Advance payments on simplified tax system income 6%

Using this taxation system, you will need to make advance payments at the end of each quarter. If, after calculating the tax, the resulting tax amount is greater than the deductions amounting to the payment of contributions to pension and medical funds for an individual entrepreneur, as well as more than 50% of the amount of contributions paid for employees, if any, then it is necessary to make an advance payment of the simplified tax system.

The deadlines for paying advance payments in 2021 are slightly different from 2021, due to the postponement of weekends and holidays:

- Until April 30, 2021 for the 4th quarter of 2021;

- Until April 26 for the 1st quarter of 2021;

- Until July 26 for the 2nd quarter of 2021;

- Until October 25 for the 3rd quarter of 2021;

- Until April 30, 2022 for the 4th quarter of 2021.