Certificate form

In order for the certificate to be accepted by the CZN employees for further calculations, it must contain the following information:

- the full name of the organization in which the citizen who is registering with the CZN worked. Its legal address, INN/KPP;

- the period that the current unemployed person worked at the enterprise. The certificate must indicate not only the date of admission and dismissal, but also the number of weeks that he worked. If he worked for less than 26 weeks, then he can only qualify for minimum unemployment benefits. Its size today is 850 rubles. Information must be indicated exactly as it is presented in the work book;

- information about working conditions - full or part-time;

- the average earnings of this employee for the last 3 months of his work at this enterprise;

- periods that are not taken into account in the calculation. The certificate must also reflect the periods for the 12 months preceding the dismissal, when the employee was actually absent from the workplace, but his earnings were retained for this period;

- grounds for issuing a certificate;

- signatures of the head of the enterprise and the chief accountant, as well as transcripts and seal impressions.

Full name of the employee;

The billing period has been fully worked out

If the billing period has been fully worked out, calculate your average daily earnings using the formula:

| Average daily earnings | = | Employee earnings for the billing period | : | 12 | : | Average monthly number of calendar days (29.3) |

This calculation procedure is established by part 4 of article 139 of the Labor Code of the Russian Federation.

An example of determining average daily earnings to calculate compensation for unused vacation upon dismissal. The employee worked the entire pay period. The employee is entitled to vacation in calendar days

Economist A.S. Kondratyev wrote a letter of resignation on May 12, 2015. He is entitled to compensation for unused vacation. Kondratyev worked for the organization for three years.

The calculation period for payment of compensation included the months from May 2014 to April 2015. The employee worked the entire pay period.

Employee accruals for the billing period are reflected in the table:

| Month of billing period | Number of working days in the billing period according to the calendar | Number of days actually worked in the billing period | Average monthly number of calendar days | Salary, rub. |

| year 2014 | ||||

| May | 19 | 19 | 29,3 | 30 000 |

| June | 19 | 19 | 29,3 | 30 000 |

| July | 23 | 23 | 29,3 | 30 000 |

| August | 21 | 21 | 29,3 | 30 000 |

| September | 22 | 22 | 29,3 | 30 000 |

| October | 23 | 23 | 29,3 | 30 000 |

| November | 18 | 18 | 29,3 | 30 000 |

| December | 23 | 23 | 29,3 | 30 000 |

| 2015 | ||||

| January | 15 | 15 | 29,3 | 30 000 |

| February | 19 | 19 | 29,3 | 30 000 |

| March | 21 | 21 | 29,3 | 30 000 |

| April | 22 | 22 | 29,3 | 30 000 |

| Total | 245 | 245 | – | 360 000 |

The accountant calculated Kondratiev’s average daily earnings as follows: 360,000 rubles. : 12 months : 29.3 days/month = 1023.89 rub./day.

Situation: how to calculate the average monthly number of calendar days when calculating the average daily earnings to pay compensation for unused vacation upon dismissal? One of the months of the billing period was worked beyond the usual norm.

When calculating compensation for unused vacation upon dismissal, determine the average daily earnings in the usual manner.

In this case, the month that the employee worked in excess of the monthly working hours is considered fully worked. It does not contain calendar days that are excluded from the calculation period (for example, those associated with illness, vacation, downtime, etc.). Therefore, the number of days in this month for the purposes of calculating compensation for unused vacation upon dismissal will be 29.3 days. This conclusion can be made by part 4 of article 139 of the Labor Code of the Russian Federation, paragraph 10 of the regulation approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

Amounts taken into account

Clause 2 of the Resolution of the Ministry of Labor No. 62 specifies the amounts that must be reflected in the certificate of average earnings and which are taken into account when calculating it. These are amounts such as:

- earnings, which are calculated in favor of the hired employee based on the established tariff rate and the actual time worked;

- payments at piece rates and in the form of a percentage of revenue;

- employee income in non-monetary terms;

- various bonuses and additional payments accrued over the last 3 months of work that could be assigned to a dismissed employee for class, skill, length of service, qualifications, possession of an academic degree, access to secret documents, for combining two professions;

- regional coefficients and allowances;

- the amount of increased payment for involving an employee in performing heavy work, for performing a labor function in workplaces with dangerous or harmful conditions;

- payment for night hours, overtime, for working shifts on weekends and holidays;

- bonus payments, which are provided for by the system of remuneration and bonuses at the enterprise.

Vacation: calculation features

When calculating vacation, the base and period are determined in a similar manner. The structure of payments included in the calculation is the same: we include remuneration for work provided for by the remuneration system, but exclude social payments and certain types of compensation.

The time period for calculation is determined according to special rules. For each fully worked month falling within the billing period, we take into account the average number of days - 29.3. This is a similar average of days for calculating vacation pay ((365 days a year - 14 holidays) / 12 months).

If the month is not fully worked out, then use the formula:

1. 29.3 / 30 days. in April × (30 days - 10 days business trip) = 19.5 days for a month not fully worked.

2. Then the number of days for each month out of 12 calendar months are summed up.

3. 19.5 days. (for a month not fully worked) + 29.3 × 11 months. (for the rest of the time) = 341.8 days.

Expert opinion

Kostenko Tamara Pavlovna

Lawyer with 10 years of experience. Author of numerous articles, teacher of Law

To determine the amount of vacation pay, you must multiply the resulting average daily earnings by the number of vacation days, excluding holidays.

Please note that the calculation of average earnings to compensate for unused vacation is calculated in a similar manner.

This is important to know: Federal Law “On Compulsory Social Insurance”, 2021 edition

What amounts are excluded?

Payments made for the following periods are not taken into account when calculating average earnings for the purpose of granting benefits at the employment center:

- The actual absence of an employee from the workplace, but with the preservation of his place and income. These are periods such as:

- vacation, both main and additional;

- illness confirmed by a sick leave certificate. Periods of illness “for oneself” or “for care” are not taken into account;

- study leave;

- periods of maternity leave and child care up to 1.5 years;

- periods when the employee provided actual care for his disabled child;

- was on leave granted to him for performing overtime work, instead of payment for it according to the Labor Code of the Russian Federation.

- Downtime of workers caused not by the fault of management, but by strikes and other factors. Even if the employee did not take part in the strike, these days are excluded from the pay period, since the strike did not give him the right to work fully and perform his labor functions.

- Days on which the employee was released from performing his job duties and no payment was made for these days. For example, vacation at your own expense.

Calculation period

A situation may arise that in the last months before dismissal, the employee did not receive the income that can be taken into account for the central tax payable. For example, he went on study leave for 4 months to write his thesis and pass the final certification. What period should be taken into account?

In this case, you need to take for calculation those 3 months that preceded the period not taken into account. If the resigned employee worked for this employer for less than three months, then the certificate must indicate the period from the moment of hiring until the actual dismissal. This information will be taken into account when assigning benefits.

If an employee worked on a part-time basis, his average earnings will be calculated by dividing the amount of wages accrued to him for the time he actually worked by the number of days he worked, calculated based on the data of the production report card or other documents that take into account the attendance of employees at work. It often happens that a woman quits her job immediately after taking maternity leave before the child reaches 1.5 years of age.

What periods need to be taken into account in her case?

This period is not included in the calculation of average earnings for the labor center, so you need to take previous periods before going on maternity leave. For example, a woman quit her job on March 1, 2018, immediately after her maternity leave ended.

You need to take April, March and February 2021 for calculation. It was during these months that the woman received accountable income.

What standards govern the calculation of average daily earnings?

Here are the legal norms on the basis of which the average daily earnings are calculated upon dismissal:

- Art. 139 Labor Code of the Russian Federation;

- Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the specifics of the procedure for calculating average wages.”

According to them, average daily earnings must be calculated for a period of 12 consecutive calendar months, up to the month in which the basis for the corresponding accrual arose.

In general, the procedure for calculating it includes:

1. Determination of the calculation period and the quantity related to it:

- calendar days - to calculate payments for vacation not taken;

- working days - to calculate severance pay.

2. Summarizing the salary that needs to be taken into account.

3. Dividing the salary amount by the duration of the pay period in days.

Examples of calculations

The formula for calculating average earnings is as follows: The average earnings of a specific employee for 1 working day * the number of days that he actually worked for a given period.

To correctly calculate the income of a given employee for 1 working day, you must:

- sum up all earnings for the current period, taking into account clause 2 of Government Decree No. 62;

- sum up the days that, according to the working time sheet, were working days for this employee in the pay period;

- divide the first value obtained by the second.

But you need to take into account some nuances regarding the inclusion of bonuses in your total earnings:

- For monthly bonuses, the rule of one payment applies - only one value of the same type of payments can be taken into account in one month;

- for annual bonuses, 1/12 of the accrued amount for each month in the base interval is taken into account.

To understand how to correctly calculate average earnings, you need to give several illustrative examples.

Example 1. An employee quit on February 28, 2018.

To calculate, you need to take the period - January 2021, December 2021 and November 2021. According to the Determination of the Armed Forces of the Russian Federation dated 06/08/2006 No. KAS06-151, if an employee quits on the last working day of the month, then this month can be used for calculations if this affects the change in average earnings upward.

In this example this is true.

- in total there were 61 working days in this period, and the employee actually worked 48 days. On average, there are 20.3 working days in each month;

- in total there were 59 working days in this period, the employee worked 52 days of them. Average number of days 59 / 3 = 19.6;

By decision of the employer and the employee himself, February can be ignored, since the average earnings have become less.

Example 2. An employee got a job on December 25, 2017, and quit on February 28, 2018. Required information:

- in total in this period there were 17 + 20 + 22 = 59 working days, of which 42 days were worked. The average number of days for this period is 59 /3 = 19.6;

Example 3. An employee quit on the last day of her maternity leave.

For what period should she be given a certificate if neither maternity leave nor child care leave is included in the period for calculation? She needs to be issued a certificate with data for the last 3 months before maternity leave. Based on the data received, the unemployment benefit will be calculated at the Employment Center.

The data is as follows: A woman quits her job in March 2021 after maternity leave. You need to take April, March and February 2021 for calculation. Income for these months is as follows:

Accounting for bonuses

When calculating average earnings, bonuses and other types of additional remuneration are taken into account according to a special algorithm.

Thus, one bonus is taken into account for any one indicator for each month that is calculated. That is, if we assume that the employee received two additional remunerations in one month, but according to different indicators, for example, one for exceeding the plan, the other for an improvement proposal, then only one of them will be taken into account.

- bonuses and any other remuneration issued based on the results of two or more (up to 12) months;

- bonuses and other types of remuneration issued based on annual results within a calculated period of 12 months. The time of accrual of annual bonuses will not matter, the main thing is that the period for which the bonus was issued was included in the last 12 months;

- one-time payments for long service.

This is important to know: Complaint to the Constitutional Court of the Russian Federation: completed sample 2021

Calculation mechanism

The average salary for the employment center is taken 3 months before dismissal from the first to the last day.

In accordance with the regulated procedure, the calculation of average earnings includes:

- the basic salary calculated on the basis of the official salary, approved interest rates on the tariff and piece rates established by the organization; additional payments for combining professions, bonuses for skill and professionalism, rewards for achieved financial indicators provided for by internal local documentation; bonuses for production performance for a quarter, half-year or other time interval in the proportions assigned to the corresponding period; the quarterly premium refers to the month for which it is accrued as 1/3, the annual premium - as 1/12, regardless of the time of accrual.

- if there was a vacation or monetary compensation for earned and unused time for rest; if the employee did not work fully for a month due to the enterprise being in a state of forced downtime or spending part of the time on business trips; if you had sick leave for your own illness or caring for a sick relative.

The formula for calculating average earnings for an employment center is:

Working hours included in the formula are calculated according to the work schedule, and not according to statistics. Ignoring the norm leads to a distortion of the result during a shift schedule and irregular work hours.

What period is taken?

To calculate the average daily earnings necessary to further determine the amount of compensation due for unused vacation, it is necessary to proceed from the period worked by the employee for a given employer, equivalent to 12 months (clause 4 of Government Resolution No. 922).

If the employee’s period of work at the enterprise is less than a year, it is necessary to take into account the wages that were accrued to him for the time actually worked (more information about how to calculate compensation for leave upon dismissal if the employee worked for 11 months or less is discussed here).

If the termination of the employment contract occurs on the last day of the month, this month must also be taken into account when performing the calculation (letter of Rostrud No. 2184-6-1 dated July 22, 2010), that is, for example, upon dismissal on August 25, 2019, information about income received will be calculated for the period from 08/01/2018 to 07/31/2019. If the employee quits on August 31, the calculation period will include the days from 09/01/2018 to 08/31/2019.

Read about what to do if you are not paid compensation for unused vacation, and are also refused to pay your wages, and how to draw up and file a claim with the court for non-payment. Find out what compensation you are entitled to for late payments upon dismissal.

Documenting

- What do you need and how to get unemployment benefits?

The standard form of the document is not provided for by law, but the Ministry of Labor, by letter No. 16-5/B-421 dated August 15, 2016, proposed its own version, emphasizing its advisory nature for execution. It is up to the organization whether or not to adhere to the recommendations of the labor department, approved by the employment center that provides the document form to the unemployed.

A legal entity or individual can independently develop a form, but it is necessary to fill out a certificate for the labor exchange indicating mandatory information, including:

- period of employment relationship with the employer; average earnings 3 months before termination of the employment contract, regardless of the initiator; working hours established by the organization’s schedule for a specific employee; data on periods excluded from the calculation, with a statement of reasons.

Conditional Numerical Example

The algorithm for calculating average monthly earnings, including and excluding a number of income received, and the amount in monetary terms is demonstrated in detail by an example with the following conditions:

The calculation is performed step by step:

- It is necessary to calculate the total amount of time worked from November 2021 to January 2021, excluding working days due to vacation and temporary disability:

- November: 21 – 7 = 14; December: 21 – 5 = 16; January: 17 – 3 = 14.

Total for the period: 14 + 16 + 14 = 44 days worked according to the schedule.

- The total working time according to the statistics department: 21 + 21 + 17 = 59 days.

- It is necessary to calculate the included income with reference to the corresponding time intervals:

- November: 20000 / 21 * 14 + 1000 = 14333.33 rubles; December: 20000 / 21 * 16 + 1000 = 16238.10 rubles; January: 20,000 / 17 * 14 = 16,470.59 rubles.

Taxable income included in the aggregate indicator: 14333.33 + 16238.10 + 16470.59 = 47042.02 rubles.

- The obtained data is substituted into the final formula: average monthly income = 47042.02 / 44 * 59 / 3 = 21026.36 rubles.

If there is no income in the actual time interval, then the previous period, consisting of three consecutive months, is taken for calculation. The key point is the attribution to the time for which payments are assigned in accordance with administrative documents and the inclusion of payments in proportion to the time worked.

The document provided to the Employment Promotion Fund is a certificate from the last employer with all required details filled in. An enterprise or individual entrepreneur can develop a certificate form independently reflecting the data required by the labor exchange to calculate an increased amount of unemployment benefits.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

Need some advice? directly on the site. All consultations are free / The quality and completeness of the lawyer’s response depends on how completely and clearly you describe your problem:

Unemployed citizens who have the status of unemployed and are registered with the territorial employment center are entitled to receive a monthly benefit, the amount of which is calculated on the basis of average earnings for the reporting period. In the article, we will use examples to analyze how to calculate unemployment benefits, what is the period for payment of state assistance, how to register with the employment center and obtain unemployed status.

Who is paid unemployment benefits?

How to register with the employment center

How to calculate unemployment benefits

Registration of unemployed persons is carried out on the basis of an application from citizens to the territorial employment center with the following documents:

- identity card (for citizens of the Russian Federation - passport, for foreigners and stateless persons - residence permit);

- employment history;

- certificate of secondary education;

- diploma of secondary technical/special, higher education;

- other documents confirming work experience and professional qualifications (certificates and diplomas of completion of courses, trainings, seminars);

- a certificate of average earnings for the last 3 months, issued by the last employer (the form can be downloaded here ⇒ Certificate of average earnings for the labor center);

- application for registration as unemployed (the form can be obtained at the employment center directly at the time of application).

Graduate students and persons without work experience apply to the employment center for registration if they have a passport and education document (certificate, diploma).

Upon contacting the employment center with the necessary documents, the citizen is assigned the status of unemployed.

For what period are unemployment benefits granted?

Unemployment benefits are assigned from the moment of registration as unemployed for a period of up to 12 months. The basis for termination of benefit payment is the loss of the citizen's unemployed status due to employment or expiration of the period of registration with the employment center.

Loss of unemployed status is also possible in cases where a citizen:

- twice refused the offered vacancy without good reason;

- did not appear at the employment center to select vacancies within 10 days after registration;

- twice refused the proposed training (for persons without work experience);

- provided fictitious documents about length of service and average earnings to the employment center.

Calculation of average earnings for unemployment benefits

The calculation period for determining the amount of average earnings for unemployment benefits is 3 calendar months preceding the month of registration with the employment center. For example, the reporting period for an employee who quit on 08/31/2020 and contacted the employment center on 09/03/2020 will be from 06/01/2020 to 08/31/2020.

When calculating average earnings, all income received by the employee during the billing period is taken into account, including:

- salary;

- bonuses;

- allowances;

- bonuses;

- material aid;

- additional payment for overtime;

- vacation pay;

- other payments that are elements of remuneration.

At the same time, the time and accrued amounts during which the employee:

- was on leave at his own expense or on sick leave;

- received maternity benefits;

- did not work due to downtime or due to a strike at the enterprise.

Let's look at an example. 09/28/2020 Bobrov S.D. resigned from Chance LLC. On the day of his dismissal, Borov requested a certificate from the accounting department to submit to the employment center.

The calculation period for Bobrov's average earnings is from 07/01/2020 to 09/30/2020, during which the employee:

- worked all days in July and August (22 and 23 days, respectively);

- Out of 20 working days in September, he worked 15 days and was on sick leave for 5 days.

During the reporting period, Bobrov was paid a salary and a bonus. When determining the amount of average earnings for September, the calculation includes that part of the bonus that falls on the days actually worked (15 out of 20)

The calculation of Bobrov's average monthly earnings is presented below:

| Reporting period | Number of working days in the reporting period | Number of days actually worked | Employee income for the reporting period | Average monthly earnings for the reporting period | |

| Salary | Prize | ||||

| July 2021 | 22 | 22 | 19,500 rub. | 2,200 rub. | 19,500 rub. + 2,200 rub. = 21,700 rub. |

| August 2021 | 23 | 23 | 19,500 rub. | 2,200 rub. | 19,500 rub. + 2,200 rub. = 21,700 rub. |

| September 2021 | 20 | 15 | 19,500 rub. | 2,200 rub. | (19,500 rub. + 2,200 rub.) / 20 * 15 = 16,275 rub. |

Let's calculate Bobrov's average daily earnings for the reporting period:

(21,700 rub. + 21,700 rub. + 16,275 rub.) / (22 + 23 + 15) = 994.58 rub.

The certificate for the employment center indicates the following amount of average earnings for calculating benefits:

RUB 994.58 * ((22 + 23 + 15) / 3) = 19,891.60 rubles.

Example of calculating unemployment benefits

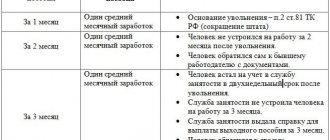

Based on the formula presented above, the amount of unemployment benefits is adjusted in accordance with the value of the coefficient, which, in turn, depends on the period during which the citizen is registered with the employment center.

In 2021, the benefit amount is determined based on the following values of the adjustment factor (Coeff):

No.

The amount of benefits accrued due to unemployment in 2021 cannot exceed 4,900 rubles/month.

Let's look at an example. 09/03/2020 Shukshin applied to the employment center to register as unemployed. Based on the certificate provided, Shukshin’s average monthly salary is 12,050 rubles.

Let's calculate the amount of unemployment benefits assigned to Shukshin:

RUB 12,050 *0.75 = 9.037.50 rub.

RUB 12,050 *0.6 = 7.230 rub.

RUB 12,050 *0.45 = 5,422.50 rub.

Since the calculated amount of the benefit for each month that Shukshin is registered exceeds the maximum allowable amount (4,900 rubles), Shukshin is paid a monthly amount based on the established limit (4,900 rubles/month).

Allowance for persons without work experience

The amount of benefits for citizens without work experience, including for graduate students and persons with unofficial experience (performing work without formalizing an employment agreement or a civil law contract) in 2021 is set at 850 rubles/month. The specified amount is paid in a fixed amount and does not depend on the period during which the citizen is registered with the employment center.

The minimum allowance is 850 rubles/month. it is also paid to persons whose insurance period over the last 12 months is less than 26 weeks.

Let's look at an example. On September 3, 2020, graduate students Khorkov and Surkov registered with the employment center, and therefore they were assigned a minimum allowance of 850 rubles/month.

On 02/04/2020, Khorkov and Surkov got jobs at Flagman LLC, but after 4 months Khorkov quit and on 06/03/2020 he was registered as unemployed again. Since Khorkov’s total period of work over the last 12 months was less than 26 weeks, the graduate student was assigned a minimum allowance of 850 rubles/month.

Surkov terminated his employment contract with Flagman LLC on October 31, 2020 and registered with the employment center on November 4, 2020. Since Surkov’s work experience over the last 12 months was more than 26 weeks, the amount of benefits for a graduate student is calculated based on average earnings (RUB 11,040).

For the first 3 months of being registered as unemployed (November 2021 – January 2021), the amount of Surkov’s benefit is calculated in the amount of 8,280 rubles. (RUB 11,040 * 0.75), but actually paid in the maximum allowable amount of RUB 4,900.

Average earnings for a business trip

To calculate the average salary for the duration of your stay on a business trip, you will also have to calculate the base for calculation and determine the billing period.

Include similar categories of payments in the database, but exclude material assistance, benefits, compensation for travel, accommodation, recreation, and food. Take into account the amounts that were accrued over the previous 12 months.

Include only the time actually worked in the pay period. Exclude days of illness, other business trips, vacations, downtime and other unworked time from the calculation.

Having determined these indicators, divide the base by the number of days worked. The resulting average daily earnings must be multiplied by the number of days spent on a business trip.

Please note that the duration of a business trip includes days spent on the road (to the place of business and back), days of downtime or delays. For weekends and holidays on which the employee did not work while on a business trip, average earnings are not accrued.

Days not included in the calculation

To determine the amount of unemployment benefits, it is necessary to take into account the 3 months preceding the termination of the employment relationship. It is established by law how to calculate the average salary for an employment center. However, some of the days paid by the employer are not taken into account. These periods include:

- the time period during which the employee received a salary without performing labor functions;

- days spent on sick leave;

- maternity leave and parental leave for children under 3 years of age.

Responsibilities for calculations fall on the shoulders of accountants.

As a result, it may turn out that all 3 months consist of days that are not taken into account in the calculations. In such situations, the accountant should substitute into the formula the payment for the three-month interval closest to the date of dismissal, when the person worked and received income.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

Important! An employee who is dismissed within the first 30 days after signing a contract can only hope to have actual days worked included in the calculation.

In case of failure to perform their labor functions

In real life, employees can receive payment in the amount of the established salary if the management of the enterprise sent them on forced rest. Cases like this precede the liquidation of an enterprise or the reduction of its workforce. For shift workers, the calculation does not include days when the employee was given time off for overtime.

Another option is that the organization was on strike, and although the employee did not participate in it, he was deprived of the opportunity to work. In fact, the staff is not at work and does not perform their official duties.

The employer is obliged to pay for forced suspension of work

Note! Vacation period is also not taken into account

Due to illness

Paid sick leave prior to dismissal is also not included in the formula for calculating average earnings for listing on the stock exchange. This is quite beneficial for the person being fired, since sickness leave is paid in accordance with one of the established percentage rates.

Typically, the accrued amount is less than the average monthly income expressed in days.

Pregnancy and childcare period up to 3 years of age

Such cases are also not uncommon. Circumstances when a woman breaks the contract after being on maternity leave or one of the maternity leaves also refers to a special settlement procedure.

Here, you should also calculate the average salary for the employment center based on the nearest three-month interval when the employee was actually at the workplace.

Days included in the calculation of average income for the employment service

Resolution of the Ministry of Labor No. 62 dictates the need to use in calculation calculations all days during the established three-month period when labor activity took place. Remuneration is calculated based on the set tariffs and the actual time worked.

It does not matter whether the payments were given in cash or in kind.

Note! In addition to the days worked, the accountant is obliged to include in the certificate for the employment center the amounts issued for the time period in question from the bonus fund. However, in this case there is a special calculation procedure that you should also know.