At the end of the tax period, individual entrepreneurs, as a rule, submit declarations to the tax office. In particular, individual entrepreneurs using the simplified tax system fill out a declaration regardless of whether income was received or not. This service can significantly simplify the maintenance of the simplified tax system. We recommend trying it to minimize risks and save your time.

If there is no income, entrepreneurs using the simplified tax regime submit a so-called zero declaration.

In our publication today, we will look at who can submit a zero declaration under the simplified tax system in 2021 for 2021, the rules and procedure for filling it out.

The essence of a zero declaration under the simplified tax system

In the legislation of the Russian Federation there is no such term as “zero declaration”. This concept is used among individual entrepreneurs.

A zero declaration under the simplified tax system for individual entrepreneurs is a document that reflects data for the tax period during which there was no movement of funds through the individual entrepreneur’s accounts. As a result, the formation of a tax base for calculating payments to the state is excluded.

Refusal to submit a declaration to the Federal Tax Service faces penalties, even if the individual entrepreneur did not operate.

A zero declaration under the simplified tax system is not an empty document. Calculation of tax according to the simplified tax system taking into account “net” income (when all expenses are taken away) leads to the formation of losses (for the past year). Despite the presence of losses, the individual entrepreneur will still have to pay a tax of 1% (of income).

The only exception can be an individual entrepreneur who uses income as an object of taxation. Lack of income in this case does not imply payment of individual entrepreneur tax.

Despite the lack of income, the individual entrepreneur is obliged to make certain payments to the budget in any case. Such payments include mandatory fixed contributions of individual entrepreneurs for themselves for pension and health insurance.

The amount of these payments increases annually with the following dynamics:

- In 2021, the amount of fixed contributions for these purposes was 32,385 rubles. Including 26,545 rubles for pension insurance and 5,840 rubles for medical insurance.

- In 2021, the amount of fixed contributions increased and was already 36,238 rubles (29,354 for pension insurance; 6,884 for medical insurance).

- In 2021, there will be another increase in the size of fixed contributions. The total amount of contributions payable in 2021 will be 40,874 rubles, including 32,448 rubles for pension insurance and 8,426 rubles for medical insurance.

How to submit “zero” reporting for individual entrepreneurs if there are workers

We now know how to submit “zero” reporting in the absence of employees, let’s consider another case - an individual entrepreneur with employees.

Individual entrepreneur on the simplified tax system with employees

A non-working individual entrepreneur with employees is not common in practice; As a rule, such an individual entrepreneur is created only to ensure that the work experience of one or more employees is not interrupted. In this situation, an individual entrepreneur who has chosen the simplified system is required to submit the following documents to the Federal Tax Service four times a year (every quarter):

- Form 4-FSS (until the 15th of the next month);

- RSV (until the 15th in one month);

- Personalized accounting (according to the DAM schedule).

Once, the manager submits to the fiscal authority a declaration according to the simplified tax system (according to general standards), as well as a report to Rosstat on the number of employees.

Individual entrepreneur on OSNO with employees

Submitting “zero” reporting under OSNO with employees is a little more difficult - you need to submit more documents. Moreover, all of them must be handed over once a quarter. List of documents:

- VAT declaration;

- 4-FSS;

- RSV;

- Personalized accounting.

In addition to these papers, you must submit a report to Rosstat once.

The deadlines for submitting documentation are the same:

- To the Pension Fund by the 15th month after the end of the quarter;

- To the Social Insurance Fund - before the 15th day of the month following the end of the billing period;

- VAT – no later than the 20th day of the first month of the next quarter;

- Documentation on the number of employees – strictly until January 20.

Instructions for filling out a zero declaration of the simplified tax system

Please note that when filling out a declaration under the simplified tax system in the event of no income, calculation of the total amounts is not provided. Paid insurance fixed contributions for medical and pension insurance are not reflected in the zero declaration of the simplified tax system.

General rules for filling out declarations, including a zero declaration of the simplified tax system:

- all words are written in capital block letters; when generating a report on a computer, Courier New font (16-18 height) is used;

- monetary amounts are indicated exclusively in full rubles without kopecks (rounding according to the arithmetic rule);

- use black paste;

- blots and corrections are unacceptable;

- each letter is written in a separate box;

- put dashes in unfilled cells;

- if the amount is zero, a dash “-” is also added;

- The report cannot be flashed.

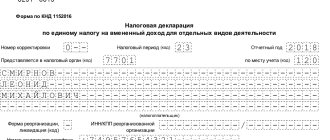

Filling out page 1:

1. First, fill out the “TIN and KPP” columns (individual entrepreneurs fill out only the TIN column).

2. In the “Adjustment number” column, enter “0” if the declaration for the tax period is submitted for the first time; "1", "2", etc. — put if the previously submitted declaration is updated;

3. In the “Tax period” column the following is entered:

- "34" (meaning year);

- “50” – if the individual entrepreneur ceases business;

- “95” – if the individual entrepreneur switches to another taxation system;

- “96” - if the individual entrepreneur ceases the activity in relation to which the simplified tax system was applied, but will not cease its activity at all.

4. In the column “Reporting year” the year of filing the declaration is indicated.

5. Next, indicate the tax authority code.

6. The full name of the individual entrepreneur is indicated (if an organization, indicate its name).

7. Rosstat data is entered in the “OKVED” column.

8. In the “Reliability...” section, information about the director of the enterprise is entered.

9. The “Date” column is filled in and signed by the responsible person.

10. A stamp is placed (on the title page).

COMPLETING SECTION 1.1

SECTION 1.1 - “the amount of tax (advance tax payment) paid in connection with the application of the simplified taxation system (object of taxation - income), subject to payment (reduction), according to the taxpayer,” is filled out by individual entrepreneurs who pay % of total income. The maximum tax rate is 6%.

1. "TIN". Enter the individual entrepreneur's TIN from the taxpayer's registration certificate. 2. Page number 002. 3. Code according to OKTMO - line code 010. The code of the locality in which the entrepreneur lives is indicated, according to the all-Russian classifier of municipal territories. There are eleven cells in this field. but, if the code is eight-digit, then dashes are placed in the remaining three cells. 4. Lines 020 – 110 - dashes are added in each cell. 5. At the bottom of the page, the individual entrepreneur or his representative puts a signature and date.

COMPLETING SECTION 1.2

Section 1.2 - “the amount of tax (advance tax payment) paid in connection with the application of the simplified taxation system (the object of taxation is income reduced by the amount of expenses), and the minimum tax subject to payment (reduction), according to the taxpayer.” Fill out individual entrepreneurs who work on the simplified tax system for income minus expenses. Maximum rate 15%.

1. “TIN” is entered into the individual entrepreneur’s TIN from the taxpayer’s registration certificate. 2. Page number 002. 3. OKTMO code - line code 010. indicates the code of the locality in which the entrepreneur lives, according to the all-Russian classifier of municipal territories. There are eleven cells in this field. but, if the code is eight-digit, then dashes are placed in the remaining three cells. 4. Lines 020 – 110 - dashes are added in each cell. 5. At the bottom of the page, the individual entrepreneur or his representative puts a signature and date.

COMPLETING SECTION 2.1.1

SECTION 2.1.1 - “calculation of tax paid in connection with the application of the simplified taxation system (object of taxation - income).” This is the third sheet of the declaration. It must be filled out by individual entrepreneurs using the simplified tax system for income.

1. We also put down the TIN at the top, with dashes on the checkpoint line; 2. Page number “3”; 3. Line 102 – taxpayer attribute:

- “1”—the individual entrepreneur hired workers in the reporting year;

- “2” - the individual entrepreneur did not use hired labor.

4. Lines 110 – 113, 130 – 133, 140-143 - add dashes;

5. Lines 120 - 123 - you must enter the tax rate (maximum 6).

COMPLETING SECTION 2.1.2

Section 2.1.2 - “calculation of the amount of trade tax that reduces the amount of tax (advance tax payment) paid in connection with the application of the simplified taxation system (object of taxation - income), calculated based on the results of the tax (reporting) period for the object of taxation depending on the type of business activities in respect of which a trade tax has been established in accordance with Chapter 33 of the Tax Code of the Russian Federation.” Fill out individual entrepreneurs on the simplified tax system for income.

This section contains 2 sheets. Similarly with the previous sheets, indicate the TIN and dashes in the checkpoint line. The page numbers are “4” and “5” respectively. Next, put dashes in all lines.

COMPLETING SECTION 2.2

Section 2.2 - “calculation of the tax paid in connection with the application of the simplified taxation system and the minimum tax (the object of taxation is income reduced by the amount of expenses).” Filled out by individual entrepreneurs who use the simplified tax system for income minus expenses.

Similarly with the previous sheets, indicate the TIN and dashes in the checkpoint line.

- in lines 210-253, 270 – 280 - put dashes;

- in lines 260 – 263 - indicate the tax rate (maximum 15%).

This might also be useful:

- The procedure for filling out a zero declaration according to the simplified tax system for individual entrepreneurs

- Unified simplified tax return 2021

- Rules for filling out the UTII declaration for individual entrepreneurs in 2021

- What taxes does the individual entrepreneur pay?

- simplified tax system for individual entrepreneurs in 2021

- Tax system: what to choose?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

How to submit “zero” income tax reporting

So, the next point is to submit “zero” income tax returns. It is worth recalling the deadlines - the tax return declaration must be submitted to the fiscal authority by the 28th of the month following the quarter, and the general annual declaration must be submitted by March 28.

Order of the Federal Tax Service of the Russian Federation dated November 26, 2014 No. ММВ-7-3/ [email protected] , and the completed declaration should be submitted either in person or sent by mail. A GMP declaration is made in paper or electronic form. If the enterprise conducted economic activities, then the declaration is filled out as usual. The only difference between a “zero” declaration and a regular one is that income, and therefore tax, is zero.

Read material on the topic: Accounting for gifts to employees, their children, clients and business partners

Comments

View all Next »

Alina 04/29/2015 at 05:46 pm # Reply

020 - indicate: object of taxation “income” - 182 1 05 01011 01 1000 110; object of taxation “income minus expenses” - 182 1 0500 110. And in the declaration: 020 this is “The amount of the advance payment due no later than the twenty-fifth of April of the reporting year p. 130 - p. 140 section. 2.1"

Olga 12/07/2015 at 02:08 # Reply

Good afternoon When filling out a zero declaration, the Russian language changes to symbols. How to fill it out correctly? Thank you

Natalia 12/07/2015 at 10:09 am # Reply

Olga, download in Excel format, I just checked, it is filled out in Russian.

Makism 03/07/2016 at 10:42 am # Reply

Hello! Can you help me if the declaration has not been filed for 4 years due to circumstances that the tax office does not understand (personal). How can I submit a zero declaration for all these years (the individual entrepreneur collapsed long ago, so there were no income or expenses, debts only accumulated in the pension). The tax filing date for all years will be fresh, that is, this year, but for all 4 or you need to register exactly the 13th year, 14th, 15th, 16th (that is, it turns out retroactively). And can you submit, for example, 1 declaration per year or will there be several of them per year (do you need to write down all the details quarterly)?

Natalia 03/08/2016 at 09:53 # Reply

Maxim, good afternoon. It is necessary to submit a separate declaration for each year, indicating in each of them the year for which it is submitted: 2013, 2014, etc., for 2021 it is still too early to submit. The simplified tax system declaration is submitted once a year until April 30 of the year following the reporting year. The filing date in each declaration is set to the date on which you will file. For each failed declaration, you will need to pay a fine of 1,000 rubles. If the declaration is zero, then there will be no penalty.

ALINA 03/12/2016 at 05:39 pm # Reply

Good afternoon. When filling out the simplified tax system declaration for 2015, the following picture is obtained: line 130=2310; str131=6210; str132=15990; p133=21210. Line 140=5568 (contributions to the Pension Fund); str141=11136; str142=16704; line 143=32272 (contributions to the Pension Fund + advance payment according to the simplified tax system). Accordingly, when calculating str020=-3258. What should I reflect on line 20 and how should I fill in all the other lines?

Regita 03/19/2016 at 12:47 # Reply

Hello. I have the following question for you: is it necessary to file a declaration if you were registered as an individual entrepreneur on 08/03/2015 and immediately after receiving the individual entrepreneur certificate, you filed an application for a patent, which was received only on 09/01/2015? There was no activity in August. Thank you.

Natalia 03/19/2016 at 01:57 pm # Reply

Regita, good afternoon. If you have not submitted an application for the application of the simplified tax system, if you have submitted an application for the PSN no later than 30 days after the date of registration of the individual entrepreneur, then you do not need to submit a declaration. If before submitting an application for the simplified tax system you submitted an application for the use of the simplified tax system, then you must submit a declaration of the simplified tax system by 04/30/2016. If the application for PSN was submitted by you after 30 days from the date of registration of the individual entrepreneur, this means that before receiving the patent you were registered on OSNO, therefore, you must submit 3-NDFL and a VAT return.

Elena 03/23/2016 at 10:04 # Reply

Natalia, good afternoon. And I have an almost similar situation. patent since February 2, individual entrepreneur registered since January 10. As I understand it, I need to submit a declaration - there were no activities in January, an application was written for the simplified tax system. So the question is: submit a zero declaration? or write for the whole of 2015 (there was a patent since February)?

Natalia 03.23.2016 at 14:15 # Reply

Elena, you need to submit a zero declaration for the entire 2015.

Albert 03/23/2016 at 08:44 pm # Reply

Which TIN should I put?

Hello! Tell me, please, is the tax authority’s TIN and KPP entered on all sheets or your own?

Natalia 03.23.2016 at 21:58 # Reply

Albert, good evening. You put your TIN on all sheets of the declaration, but the individual entrepreneur does not have a checkpoint.

Svetlana 03/24/2016 at 14:09 # Reply

Hello!

The individual entrepreneur had no activities, no income, the system produced income. Contributions to the Pension Fund were paid, do they need to be reflected in the declaration?

Natalia 03.24.2016 at 18:52 # Reply

Hello Svetlana! No, you do not need to report contributions on your return.

Tatyana 04/06/2016 at 09:52 # Reply

Hello. An LLC was opened in January 2021. simplified tax system 6%. No activity yet. You need to submit quarterly zero reporting. Please tell me which form to fill out.

Natalia 06/27/2016 at 16:59 # Reply

Tatyana, the simplified tax system declaration is submitted once a year, and not quarterly.

Elena 04/18/2016 at 12:34 pm # Reply

Hello. Please tell me if the individual entrepreneur did not conduct business, but paid expenses on the current account into the current account. How to fill out the declaration correctly. Income - expenses system. Thank you

Natalia 06/27/2016 at 16:56 # Reply

Elena, how to fill out the declaration correctly is written in the article to which you wrote a comment. If there is no income, put “0”. But you had to pay your contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund on time.

Svetlana 05/22/2016 at 01:30 pm # Reply

Where in your form 020 - indicate: the object of taxation “income” - 182 1 0500 110; object of taxation “income minus expenses” - 182 1 0500 110? You don’t have a line for KBK in your declaration!!! Neither in Excel nor in PDF

Natalia 06/27/2016 at 16:52 # Reply

Svetlana, good afternoon. The object of taxation is indicated in section 1.1, line code 001. BCC is not indicated in the declaration.

View all Next »