General provisions

So what is an agency agreement concluded with an individual, and what are its features?

This is an accepted written agreement between two parties that does not require registration with government agencies. This document involves the performance of certain actions by an agent - an individual on the instructions of the principal - the employer . All important features, conditions and principles of interaction between these parties follow from civil legislation, Chapter 52 of Part Two of the Civil Code of the Russian Federation:

- Initially, it defines the concepts of an agent - the executor of the order and a principal - the customer, and establishes the principles of their relationship. According to Art. 1005 of the Civil Code, an agent can assume responsibility and work with a third party on his own behalf, but at the expense of the customer. Another option is on behalf of the latter and at his expense. In this option, the rights and obligations under the transaction will be borne by the principal, and the agent, in principle, will provide intermediary services. Therefore, a clause on the responsibility of the parties must be included in the document.

- In Art. 1006 of the Civil Code describes the principles of payment of agency fees. It must be borne in mind that if the document does not reflect the terms of payment, then the principal will be forced to pay the money a week from the date of the executor’s report. For the employer, of course, it will be beneficial to include a separate clause in the duration of the agreement in order to avoid unexpected consequences.

- In Art. 1007 of the Civil Code defines possible restrictions in relationships. So, for example, a restriction may be the employer’s obligation not to enter into other agreements (in this activity). The restriction for the agent is the impossibility of carrying out actions fixed by the contract with other principals. In addition, in the case of, for example, concluding an agency agreement with an individual. person to search for clients, you can establish a restriction on the employer’s right to search for clients independently.

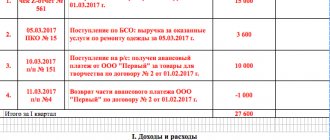

- Given that in these relationships all the person’s expenses are borne by the customer, this person needs to periodically report on his work and expenses incurred. In Art. 1008 of the Civil Code stipulates that it is mandatory to attach the necessary primary expenditure documents to the report; the important point is the date of submission and the period for checking the documents - by default, within 30 days, the customer is obliged to check the documents and report any disagreements.

- In the course of work, the agent himself may enter into subagency contracts, the terms of which are established by Art. 1009 Civil Code. The parties must also agree on the subagency and reflect the outcome in writing.

- Termination of such a contract with an individual. person is possible on the basis of Art. 1010 GK:

- refusal of its execution by any of the parties, but only if the terms are not specified in it;

- death of the performer;

- declaring him incompetent or missing.

- Depending on whose name the agent acts, his relationship with the employer can be built on the principles of contractual terms of the assignment or commission (Article 1011 of the Civil Code).

When drawing up agency agreements with an individual, you should rely on the above information. If the agreement is drawn up correctly, taking into account all the nuances that arise, such a relationship is beneficial and convenient for both parties.

For a person, the main convenience will be the opportunity to earn money on their own, at a time convenient for themselves, and also with reimbursement of expenses.

For an employer, this is a convenient way to find a good specialist to perform non-core activities for the company (this could be the services of an auditor, marketer, accountant, lawyer, services aimed at selling goods, etc.) for a certain time and save on a permanent salary for a staff member and , of course, the cost of an additional workplace. Also, the employer will be able to terminate the contract or refuse payment (or possibly both) if it is not completed efficiently and on time. However, most likely this will not happen, because the performer in such a relationship is interested in showing his best side.

You can familiarize yourself with the proposed sample form of an agency agreement below.

Sample agency agreement with an individual.

It is imperative to take into account that in addition to all of the above, the document must have:

- full details of the Principal;

- Agent's passport details;

- a detailed list of those assigned;

- liability in case of possible non-compliance with obligations;

- the start and end period of the document (if desired, the possibility of extension);

- date of signing the document, signatures of the parties.

How the work is organized

The agent’s tasks include searching for clients using a database provided by the company or on an independent basis.

Having found a client, the agent formalizes the purchase of a service or product by signing an agreement or drawing up other documents confirming the fact of the transaction. The list of supporting documents is agreed upon in advance.

Determining its structure and form is the prerogative of the company. The report is the basis for payment of remuneration. Claims must be made no later than 30 days (or other period prescribed by law or contract) after receipt of the documents, otherwise the report is considered accepted.

Actual employment relationships are sometimes hidden behind the performance of work under an agency agreement. This happens in shopping centers. The employee is subject to labor regulations and has a place of work. However, payments are calculated and made as an agent.

Taxation under an agency agreement with an individual

Having decided on the question of what an agency agreement with an individual is, you need to understand what taxes and contributions the principal will now have to pay on the remuneration to his agent.

In Russia, according to the law, when concluding GPC agreements with an individual, the role of the tax agent will be with the principal (clause 1 of Article 226 of the Tax Code of the Russian Federation). This means that personal income tax. he counts the persons himself and pays them to the budget. When applying for a job as an agent, a person should know this in order to avoid problems with taxes and conflicts with the customer - after all, he will receive an amount reduced by personal income tax.

The employer will determine the personal income tax rate based on whether his contractor is a resident or not. In the first case, the rate is 13%, but if you are not a resident of the Russian Federation (stayed in the Russian Federation for less than 183 days) - 30%.

However, personal income tax is not the only payment in this case.

In addition to payments to the resident agent, the principal is also required to pay insurance premiums to the Pension Fund of the Russian Federation and contributions to compulsory medical insurance (clause 1 of Article 420 of the Tax Code of the Russian Federation). For 2020, the Tax Code contains the following tariffs:

- for pension insurance 22%;

- for compulsory medical care - 5.1%.

It is important that disability contributions are not paid from these amounts (Article 422 of the Tax Code).

In turn, contributions for injuries are paid only when this condition is stated in the contract.

Regulatory regulation

To find out the pros and cons of working under an agency agreement, let’s consider what acts it is regulated by.

The Civil Code defines what agency relations are and describes the rights and obligations of the parties. The Code is not the only document regulating this area of public relations. When proposing to sign such an agreement, one should not lose sight of tax legislation.

In addition, relations with agents are subject to laws regulating certain areas (for example, tourism). They may establish additional rules.

The application of these norms is discussed in judicial practice, often in arbitration. Also, general explanations on this matter are given in some Resolutions of the Plenum of the RF Armed Forces.

Example of calculating personal income tax and insurance premiums

For example, a tax resident employee fulfilled the conditions on time, reported for expenses and, as a result, received the 30 thousand rubles required under the contract. As a result, taxes under an agency agreement with an individual are 12,030 rubles, including:

- Personal income tax – 30 t. 13% = 3.9 t. rub.;

- contributions to compulsory pension insurance – 30 t. 22% = 6.6 t. rub.

- contributions for compulsory medical insurance – 30 t. 5.1% = 1.53 t. rub.

After calculating the amounts received, you must remember to indicate in your tax reporting and pay.

Agency agreements with an individual are a good solution especially for small businesses - simplified cooperation in accordance with the law. In these relations, the main thing for everyone is the correct execution of documents and further compliance with the agreed conditions. Only then will they be mutually beneficial and fruitful, without unnecessary legal and other unnecessary expenses.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - fill out the form below or call right now: +7 (ext. 692) (Moscow) +7 (ext. 610) (St. Petersburg) +8 (ext. 926) (Russia) It's fast and free!

Agency agreement when hiring

The hiring of new employees is increasingly carried out on the terms of their performance of work under an agency agreement, i.e., without entering into an employment relationship. In this case, we cannot talk specifically about hiring, since we will be talking specifically about civil law relations, and not about labor relations. Although this type of contract cannot replace an employment contract and is used so widely, some companies are already replacing the hiring of employees with agency deals as much as possible. When looking for a job in sales, for example, it is almost impossible not to encounter this.

An agency agreement for the sale of goods or services produced by a particular organization assumes that an individual will sell products on behalf of the manufacturer, receiving a certain percentage of this or a fixed payment. This form of legal relationship can be beneficial to both one and the other party.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

VAT from the principal on the sale of goods, works, services under an agency agreement

The procedure for calculating VAT, issuing and registering invoices with the principal depends on on whose behalf the goods (work, services) are sold: on your behalf or on behalf of the agent.

VAT on the principal when selling goods, works, services on his own behalf

Calculate VAT, issue and register invoices as usual - just as if you were selling goods directly, without intermediaries.

Charge VAT on the day of shipment by the agent to the buyer of goods (works, services) (clause 1, clause 1, article 167 of the Tax Code of the Russian Federation, clause 16 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 N 33).

If there was an advance payment for goods (work, services), then charge VAT twice (clause 2, clause 1, clause 14, article 167 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated February 28, 2006 N MM-6-03/ [email protected] ):

- on the day your agent received the advance payment;

- on the day when the agent shipped goods (work, services) to the buyer.

You can deduct the accrued VAT on the advance payment in the quarter when the goods (work, services) are shipped to the buyer (clause 8 of Article 171, clause 6 of Article 172 of the Tax Code of the Russian Federation).

Issue an invoice to the buyer no later than five calendar days from the date of shipment by the agent of goods (work, services) or from the date the agent receives the prepayment (clause 3 of Article 168 of the Tax Code of the Russian Federation).

It is important that you receive timely information from the agent about goods (works, services) shipped and advances received. Otherwise, you may be late in calculating the tax and issuing the invoice.

It is better to stipulate in the agency agreement a condition regarding the period within which the agent informed you about the shipment and receipt of the advance payment.

Register invoices in the sales book in chronological order in the quarter when the shipment occurred or when the advance was received (clause 1, clause 3, article 169 of the Tax Code of the Russian Federation, clauses 1 - 3, 20 of the Rules for maintaining the sales ledger).

Include the accrued VAT in the total amount of tax based on the results of the quarter in which the shipment was made or the advance was received (clause 4 of Article 166, clause 1 of Article 173 of the Tax Code of the Russian Federation).

VAT from the principal when selling goods, works, services on behalf of the agent

The agent issues invoices to buyers, and he gives you copies of them. Based on these copies, you charge VAT and issue invoices to the agent. You do not issue an invoice to the buyer.

Receive from the agent a copy of the invoice that he issued to the buyer for the shipment of goods (work, services) or for an advance payment.

You can agree with the agent that instead of copies, he will transfer you data from issued invoices in any form convenient for you.

It is important that you receive timely information from the agent about the goods (works, services) shipped by him and about the advances received. Otherwise, you may be late in calculating the tax and issuing the invoice.

It is better to stipulate in the agency agreement a condition regarding the period within which the agent informed you about the shipment and receipt of the advance payment.

Accrue VAT on the day of shipment by the agent to the buyer of goods (works, services) (clause 1, clause 1, article 167 of the Tax Code of the Russian Federation, clause 16 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 N 33).

If there was an advance payment for goods (work, services), then charge VAT twice (clause 2, clause 1, clause 14, article 167 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated February 28, 2006 N MM-6-03/ [email protected] ):

- on the day your agent received the advance payment;

- on the day when the agent shipped goods (work, services) to the buyer.

You can deduct the accrued VAT on the advance payment in the quarter when the goods (work, services) are shipped to the buyer (clause 8 of Article 171, clause 6 of Article 172 of the Tax Code of the Russian Federation).