Are you switching from UTII? Connect Kontur.Accounting

45% discount in November: RUR 7,590 instead of 13,800 rub. per year of work

Easy bookkeeping

The system itself will calculate taxes and remind you of the deadlines for payments and submission of reports.

Automatic calculation of salaries, vacation pay and sick leave

Technical support 24/7, tips inside the service, reference and legal database

Sending reports via the Internet

Reports and KUDiR are generated automatically based on accounting data

Electronic document management and quick verification of counterparties

Documents, transactions, analytical reports, VAT reconciliation

An example of calculating tax payments for an existing hairdressing salon

The following is a calculation of tax payments and social contributions using the example of a real-life hairdressing salon.

Input data

- Location: Kostroma

- Type of activity: Hair salon

- Number of employees: 10 people

- Payroll fund: 170,000 rubles per month.

- Basic income for a hairdressing salon: 7,500 rubles

- Deflator coefficient (K1) 2012: 1.4942

- Correction factor for this type of activity in the city of Kostroma: 0.6 (1.6).

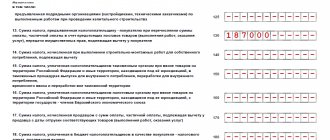

Calculation of social contributions to extra-budgetary funds

170,000 rubles * 30% = 51,000 rubles.

Calculation of tax on imputed income

10 people * 7,500 rubles * 1.4942 * 1.6 * 15% = 26,895.6 rubles

Adjustment of tax on imputed income to the amount of social contributions

The amount of social contributions made is more than 50% of the calculated value of the tax on imputed income, then the amount of adjustment is a maximum value of 50%

26,896 rubles * 50% = 13,448 rubles.

In total, the hairdresser pays taxes and social contributions of about 65,000 rubles per month.

Victor Stepanov, 2012-10-01

Restrictions on the use of UTII

A businessman who wishes to apply UTII must make sure that he meets all the requirements for applying the regime:

- no more than 100 personnel;

- participation of organizations in the management company is no more than 25%;

- compliance of the type of activity with the list of household services;

- provision of services to individuals for a fee;

- regional legislation includes this type of activity.

A salon can use UTII only if the territory of the municipality where it is located allows the use of this special regime. For example, Moscow salons cannot switch to imputation.

Beauty salons cannot operate on UTII from January 1, 2021. Choose the most favorable tax system for your salon using our online calculator. Kontur experts held a webinar and talked about the transition from UTII, we collected the most interesting explanations in the article. If you don’t find the answer to your question, ask it in the comments, we will definitely answer.

For this special regime, the final consumer of cosmetic services can only be an individual. If a salon provides cosmetic services to a legal entity under a corporate agreement, imputation cannot be applied. Such services are subject to taxes according to OSNO or simplified tax system.

Composite formula for calculating UTII

Basic yield

The main component of the formula for calculating UTII is the basic profitability indicator . This is a value established by law that shows how much profit an entrepreneur can receive using a certain unit of physical indicator.

The basic profitability is established by art. 346 of the Tax Code for each individual physical indicator within the scope of the type of activity that is suitable for UTII taxation according to the law.

To determine your basic profitability, an entrepreneur needs to find his type of activity in a given list of works, services or occupations and use a constant profitability indicator.

Physical indicators

The next necessary value for calculating the UTII tax is a physical indicator, which is also separate for different types of activities.

To understand what this is, it is worth giving an example: for a business entity that is engaged in retail trade falling under UTII, it will be 1 square meter, for providing automotive services - 1 car, for providing other types of services - 1 employee.

Coefficient K1

To know how to calculate UTII, you need to become familiar with the term deflator coefficient, called K1. This indicator is established by law separately for each year.

For example, K1 deflator coefficients for recent years:

- 2013 — 1,569;

- 2014 – 1,672;

- 2015 — 1,798;

- 2016 — 1,798;

- 2017 — 1,798.

K2 coefficient

The calculation of the UTII tax is also carried out using a second constant indicator - K2, which is a coefficient established legally, but not in the federal, but in the local regime.

That is, local authorities determine its size independently for different types of activities in order to regulate the market. Using a “reducing” value (up to 0.005), this tax can be significantly reduced. Regulation occurs depending on the territorial location.

UTII rate

To objectively show how UTII is calculated, it is necessary to talk about another constant indicator, without which no tax calculation is possible - the tax rate. For objects that are engaged in activities suitable specifically for UTII, this figure is 15%. It is used, as in all cases of taxation, by multiplying a certain tax base by it.

When calculating UTII for individual entrepreneurs, to reduce tax, you can use social payments made for employees who work precisely in the area of activity that is subject to UTII. This category of payments includes:

- Regular payments made to the pension fund.

- Payments to provide employees with health insurance.

- Social insurance, if available.

- Payments made by the employer when there is a temporary disability.

Before calculating UTII for individual entrepreneurs, it is worth saying that the amount of those payments by which the tax will be reduced should not exceed half of the tax amount that was initially calculated. Entrepreneurs should also take into account that they do not have the right to take into account the amount for insuring themselves when making deductions. This rule works when an individual entrepreneur has employees.

Calculation of UTII online and features of regional UTII

For each region, it is important to know the nuances of calculating UTII. We strongly recommend that you familiarize yourself with the accounting features in your region using the links in the table:

| The subject of the Russian Federation |

| 01 Republic of Adygea |

| 02 Republic of Bashkortostan |

| 03 Republic of Buryatia |

| 04 Altai Republic |

| 05 Republic of Dagestan |

| 06 Republic of Ingushetia |

| 07 Kabardino-Balkarian Republic |

| 08 Republic of Kalmykia |

| 09 Karachay-Cherkess Republic |

| 10 Republic of Karelia |

| 11 Komi Republic |

| 12 Republic of Mari El |

| 13 Republic of Mordovia |

| 14 Republic of Sakha (Yakutia) |

| 15 Republic of North Ossetia-Alania |

| 16 Republic of Tatarstan |

| 17 Republic of Tyva |

| 18 Udmurt Republic |

| 19 Republic of Khakassia |

| 20 Chechen Republic |

| 21 Chuvash Republic |

| 22 Altai region |

| 23 Krasnodar region |

| 24 Krasnoyarsk region |

| 25 Primorsky Krai |

| 26 Stavropol region |

| 27 Khabarovsk region |

| 28 Amur region |

| 29 Arkhangelsk region and Nenets Autonomous Okrug |

| 30 Astrakhan region |

| 31 Belgorod region |

| 32 Bryansk region |

| 33 Vladimir region |

| 34 Volgograd region |

| 35 Vologda region |

| 36 Voronezh region |

| 37 Ivanovo region |

| 38 Irkutsk region |

| 39 Kaliningrad region |

| 40 Kaluga region |

| 41 Kamchatka region |

| 42 Kemerovo region |

| 43 Kirov region |

| 44 Kostroma region |

| 45 Kurgan region |

| 46 Kursk region |

| 47 Leningrad region |

| 48 Lipetsk region |

| 49 Magadan region |

| 50 Moscow region |

| 51 Murmansk region |

| 52 Nizhny Novgorod region |

| 53 Novgorod region |

| 54 Novosibirsk region |

| 55 Omsk region |

| 56 Orenburg region |

| 57 Oryol region |

| 58 Penza region |

| 59 Perm region |

| 60 Pskov region |

| 61 Rostov region |

| 62 Ryazan region |

| 63 Samara region |

| 64 Saratov region |

| 65 Sakhalin region |

| 66 Sverdlovsk region |

| 67 Smolensk region |

| 68 Tambov region |

| 69 Tver region |

| 70 Tomsk region |

| 71 Tula region |

| 72 Tyumen region |

| 73 Ulyanovsk region |

| 74 Chelyabinsk region |

| 75 Transbaikal region |

| 76 Yaroslavl region |

| 77 Moscow city |

| 78 St. Petersburg |

| 79 Jewish Autonomous Region |

| 86 Khanty-Mansiysk Autonomous Okrug-Ugra |

| 87 Chukotka Autonomous Okrug |

| 89 Yamalo-Nenets Autonomous Okrug |

| 91 Republic of Crimea |

| 92 city of Sevastopol |

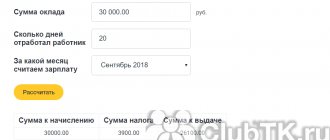

In some regions, a convenient online calculator for calculating UTII has been created (an example of a service from the Republic of Bashkortostan).

How to register a beauty salon with UTII

The owner who opened a beauty salon is registered at the place where services are provided. Having opened several salons within the same district, it is enough to register with one of the inspectorates. And businessmen who open salons in several municipalities at once are registered in each of them. This means that you need to file a return and pay tax separately in each entity.

To register, submit a tax application in the form of UTII-1 for organizations and UTII-2 for individual entrepreneurs. From the day you started applying the imputation, you have 5 working days to submit your application. The day of transition to UTII is considered to be the date you indicated in the application.

New declaration on UTII

On September 24, 2021, the Ministry of Justice registered the order of the Federal Tax Service dated June 26, 2018 No. ММВ-7-3/ [email protected] , which approved the new form of declaration for UTII.

The new form makes it possible to reduce the single tax on the amount of individual entrepreneurs’ expenses on online cash registers.

This right of individual entrepreneurs to UTII was granted by Federal Law No. 349-FZ dated November 27, 2017.

According to the law, the tax deduction is 18,000 rubles for each purchased online cash register. At the same time, the costs of purchasing a cash register include the costs of purchasing a cash register, fiscal drive and software. In addition, the costs can take into account the cost of all services for setting up, connecting and modifying the cash register.

In this regard, Section 4 has appeared in the new declaration form, where you can reflect the costs of the purchased cash register, as well as information about the cash register model itself.

The deduction can only be claimed for tax periods that begin in 2021 and end after registration of the cash register.

Types of services that a salon can provide on UTII

Calculate UTII in Kontur.Accounting - a convenient online service for calculating salaries and sending reports to the Federal Tax Service, Pension Fund and Social Insurance Fund. Get free access for 14 days

The taxpayer himself chooses and indicates the code of the type of activity that he intends to carry out. Personal services to the population, as a rule, fall into the category of household services, since they are received by individuals on a reimbursable basis. But not all services provided by beauty salons fall under the list of household services approved by Decree of the Government of the Russian Federation dated November 24, 2016 N 2496-r. UTII includes:

- hairdressing services for men, women and children;

- make-up and make-up;

- eyebrow correction and tinting, eyelash extensions;

- face and neck skin care;

- hygienic massage of the face and neck;

- hygienic facial cleansing;

- piercing and tattooing;

- manicure and pedicure;

- SPA care;

- body care, hair removal.

To provide cosmetology or medical services, you must obtain a license. To do this, specialists must have diplomas and certificates, the equipment must be registered, and the premises must be checked by the SES and approved by the fire department.

Hairdressing services

All-Russian classifier of services to the population, approved by Resolution of the State Standard of Russia dated June 28, 1993 N 163, in section. 01000 “Household services” code 019300 includes hairdressing and beauty services provided by public utility organizations.

Thus, activities in the provision of hairdressing services relate to entrepreneurial activities in the provision of household services and can be transferred to “imputation”.

What hair salon doesn't offer manicures and pedicures?

Calculation of UTII for a beauty salon

Calculate UTII in Kontur.Accounting - a convenient online service for calculating salaries and sending reports to the Federal Tax Service, Pension Fund and Social Insurance Fund. Get free access for 14 days

The reporting and tax period for UTII is quarterly, so you need to pay tax at the end of each quarter by the 25th of the next month. The single tax is calculated based on several indicators using the formula: UTII = (FP × BD × K1 × K2) × 3 × 15%.

Physical indicator (PI) depends on the type of activity. Beauty industry services are classified as household services. According to Art. 346.29 of the Tax Code FP for personal services - number of employees. If you're an individual entrepreneur, don't forget to count yourself.

Basic profitability (BR) is also determined taking into account the type of activity. For household services, it is 7,500 rubles per FP unit, that is, per employee. For calculating UTII, actual income does not matter.

K1 – calculated every year by the Ministry of Economic Development and depends on inflation. In 2021, the coefficient is 2.005.

K2 – reduction factor established by the constituent entities of the Russian Federation. To find out, study regional legislation in the “Features of regional legislation” section on the official website of the Federal Tax Service.

The tax rate in general is 15%, but regional authorities can set differentiated reduced rates from 7.5 to 15%. An important advantage of imputation is the ability to reduce tax on insurance premiums. Individual entrepreneurs who work as one person and pay contributions only for themselves can reduce the tax by 100% and not pay it at all. Organizations and individual entrepreneurs with employees are limited in this; they reduce the tax by no more than ½.

UTII for hairdressing services. Basic return - 2021

For the activities of salons that provide hair cutting and coloring services to the population, it is not difficult to answer the question of where to get the basic profitability for calculating UTII. Hairdressing salon services are classified as household services, therefore, as the base value it will be necessary to take the total rate for the provision of household services to the population, namely 7,500 rubles per month, multiplied by the number of employees employed in the business, not excluding the entrepreneur himself.

Next, a deflator coefficient set at 1.868 until the end of the current decade will need to be applied to the base rate. Next, the resulting figure will need to be recalculated again taking into account the K2 coefficient. Employees of the Federal Tax Service will calculate it using the following three indicators:

- coefficient, which takes into account a specific type of service to the population; for it, for the majority of beauty salon services in most regions, the indicator is 0.7. You must understand that for UTII, code 07 for basic profitability cannot be applied to all types of services that salons can provide; they must be provided for in OKUN. Treating salon guests with herbal teas or oxygen cocktails, retail sales of cosmetic products cannot be taken into account in this category;

- coefficient, which is determined by the location, zone of the city or district in which the salon is located. Depending on the location (in the city center, in a village, near the central highway) it will range from 0.05 for small villages where less than 150 people live, to 1);

- coefficient calculated based on the average salary of employees, it usually turns out to be equal to 1.

The final amount will become the base rate of return on the basis of which the amount of tax contributions for the owner of a hairdressing salon will be calculated.

For comparison and understanding of how to determine the basic profitability for UTII for household services, you can look at the profitability in ruble terms for other types of activities in the table:

| Kind of activity | Physical indicator | Numerical profitability indicator for one month |

| General household services, basic income according to UTII | Number of people employed in providing services | 7 500 |

| UTII for taxi, basic income | Number of seats for passengers in all vehicles of the entrepreneur | 1 500 |

| UTII for hotels, basic profitability | Square meter of room retail space | 1 000 |

| UTII for car washes, basic profitability | Number of people employed in providing services | 12 000 |

| UTII for retail trade, basic profitability | Square meter of retail space | 1 800 |

| UTII for hairdressing salons, basic income | Number of people employed in providing services | 7 500 |

It is obvious that fairly favorable UTII rates are applied to the activities of hairdressing salons, aimed at increasing the attractiveness of this business for entrepreneurs. It can be calculated based on the rates for the adjustment coefficient approved by local authorities, and when choosing the location of the salon, you can achieve a significant reduction in the overall level of payments.

For an entrepreneur choosing a form of taxation for the next tax period, the ability to independently calculate the basic profitability for UTII will help plan their financial flows in an optimal way.

Similar articles

- Basic yield

- Deflator coefficient for UTII for 2016-2017

- Value K1 for UTII from 2021

- Coefficients K1 and K2 for UTII for 2021

- How to find out K2 for UTII 2018

An example of calculating UTII for a beauty salon

The staff of the Aelita salon includes 4 people, including individual entrepreneurs. The salary of each employee is 20,000 rubles, the annual wage fund is 720,000 rubles. Insurance premiums for employees per year are 216,000 rubles. The individual entrepreneur will make contributions for himself in the amount of 40,874 rubles per year, since the basic profitability does not exceed 300,000 rubles. Let's calculate the tax amount:

- UTII (month) = 4 × 7,500 × 2.005 × 0.65 × 15% = 5,864.6 rubles;

- UTII (year) = 5,864.6 × 12 = 70,375.2 rubles;

- Half of this amount can be deducted from insurance premiums paid, then UTII will be 35,187.6 rubles per year.

Mandatory social contributions from the hairdresser's payroll.

In addition to the tax on imputed income, an entrepreneur is required to make deductions from the employee wage fund to extra-budgetary funds:

- Pension Fund (PFR)

- Social Insurance Fund (SIF)

- Compulsory Health Insurance Fund (MHIF)

The amount of social contributions in 2012 is 30% of which the Pension Fund is 22%, the Social Insurance Fund is 2.9%, the Compulsory Medical Insurance Fund is 5.1%.

Social contributions of a hairdressing salon are calculated using the formula:

Payroll fund * 30%

Important point: If the amount of remuneration per employee in the reporting year reaches 512,000 rubles, then insurance contributions from the amount exceeding 512,000 rubles to the Pension Fund are charged at the rate of 10%

Reporting to extra-budgetary funds is submitted quarterly, and social contributions are paid monthly, by the 15th of each month.