The taxpayer determines profit (loss) from the sale or disposal of depreciable property on the basis of analytical accounting for each item as of the date of recognition of income (expense).

Accounting for income and expenses on depreciable property is carried out object by object, with the exception of accrued depreciation on objects of depreciable property when using the non-linear depreciation method.

Analytical accounting should contain information:

on the initial cost of depreciable property sold (disposed of) in the reporting (tax) period;

on changes in the initial cost of such fixed assets during completion, additional equipment, reconstruction, partial liquidation;

on the useful life of fixed assets and intangible assets adopted by the organization;

on the amount of accrued depreciation on depreciable fixed assets and intangible assets for the period from the start date of depreciation accrual to the end of the month in which such property was sold (disposed of) - for objects for which depreciation is accrued using the straight-line method;

on the amount of accrued depreciation and the total balance of each depreciation group and each depreciation subgroup (when using the non-linear depreciation method);

on the residual value of depreciable property items included in depreciation groups (subgroups), determined in accordance with paragraph 1 of Article 257 of this Code - upon disposal of depreciable property items;

on the sales price of depreciable property based on the terms of the purchase and sale agreement;

on the date of acquisition and date of sale (disposal) of property;

on the date of transfer of property into operation, on the date of exclusion from depreciable property on the grounds provided for in paragraph 3 of Article 256 of this Code, on the date of re-conservation of property, on the expiration date of the contract for gratuitous use, on the date of completion of reconstruction work, on the date of modernization;

about the expenses incurred by the taxpayer related to the sale (disposal) of depreciable property, in particular the expenses provided for in subparagraph 8 of paragraph 1 of Article 265 of this Code, as well as the costs of storage, maintenance and transportation of the sold (disposed) property.

On the date of the transaction, the taxpayer determines, in accordance with paragraph 3 of Article 268 of this Code, profit (loss) from the sale of depreciable property.

In analytical accounting, on the date of sale of depreciable property, the amount of profit (loss) for the specified operation is recorded, which is taken into account in the following order for the purpose of determining the tax base.

The profit received by the taxpayer is subject to inclusion in the tax base in the reporting period in which the property was sold.

The loss received by the taxpayer is reflected in analytical accounting as other expenses of the taxpayer in accordance with the procedure established by Article 268 of this Code.

Analytical accounting must contain information on the name of the objects for which there are amounts of such expenses, the number of months during which such expenses can be included in other expenses associated with production and sales, and the amount of expenses attributable to each month. The period is determined in months and is calculated as the difference between the number of months of the useful life of this property and the number of months of operation of the property until the moment of its sale, including the month in which the property was sold.

Commentary to Art. 323 Tax Code of the Russian Federation

Article 323 of the Tax Code of the Russian Federation is devoted to the peculiarities of maintaining tax accounting for transactions with depreciable property.

Article 323 of the Tax Code of the Russian Federation establishes an exhaustive list of information that an organization must reflect in analytical accounting. First of all, this is information about the initial cost of the object being sold, about changes in this initial cost, about its useful life, about the method of calculation and the amount of accrued depreciation. In addition, analytical accounting must contain information about the selling price of the object, the dates of its acquisition and sale, as well as the costs incurred by the organization during the sale.

To determine the income from the sale of a depreciable property, it is necessary to subtract from the sales price the price of its acquisition, reduced by the amount of accrued depreciation, and the amount of expenses associated with its sale.

Quite often, depreciable property is sold at a loss when the proceeds from the sale are less than the expenses. Taxable profit can be reduced by the amount of this loss, but not immediately after the sale of the object, but over a period of time. This period is calculated in months and is equal to the difference between the useful life of the object and the number of months of its operation until the moment of sale, including the month in which it was sold. Therefore, at the time of realization, such a loss is included in deferred expenses and transferred to non-operating expenses in equal shares until it is completely written off.

An organization that has received a loss from the sale of a depreciable property must reflect the following information in analytical accounting:

— name of the object, the implementation of which costs exceeded income;

- the number of months during which this amount of excess of expenses over income should be included in non-operating expenses; - the amount of expenses incurred each month.

How to calculate property tax based on cadastral value

If your company pays tax on the cadastral value, the calculation algorithm is as follows:

- Request the cadastral value of the building at the beginning of the tax period from the regional office of Rosreestr.

If the cadastral value of the premises is not determined, but the cadastral value of the building in which it is located is known, then the tax base is determined as the share of the cadastral value of the building corresponding to the share of the area of the premises in the building.

- The tax amount for the year is equal to the cadastral value of the building multiplied by the tax rate.

K = number of months of the reporting period during which the company owned the property (including months of receipt and disposal) / number of months in the reporting period.

In the number of full months, take into account the months in which the right to the object arose from the 1st to the 15th, inclusive, or ceased after the 15th. If the right arose after the 15th or before the 15th inclusive, do not include such months in the tax calculation.

If the building has several owners, multiply the cadastral value by your share, and then by the tax rate and coefficient K.

- If the law of a constituent entity of the Russian Federation provides for quarterly advance payments within the tax period, then the advance payment is equal to ¼ of the tax amount calculated above.

Depreciable property in tax accounting

Depreciable property includes fixed assets that are the property of the enterprise . rented or leased, etc.

In addition, property accounted for as fixed assets must meet the following requirements :

- are used directly for the production of products, provision of services, for the needs of enterprise management,

- has a shelf life of more than 1 year,

- not intended for subsequent resale,

- has an initial cost of 40 thousand rubles.

Not subject to depreciation . land, water, subsoil, unfinished construction objects, securities, street improvement objects, works of art, etc.

A complete list of depreciable property that is not subject to depreciation is enshrined in the Tax Code of the Russian Federation. In tax accounting , different property included in the list of fixed assets is not taken into account equally .

Property tax

Depreciable property in tax accounting for the purpose of calculating property tax is recognized as items of fixed assets owned, rented or leased if they are accounted for on the balance sheet under account 01 .

Funds transferred by legal entities to pay property taxes go to the budget of a certain region of Russia .

The property tax rate for legal entities is determined by regional executive authorities within the framework of the rates prescribed in the Tax Code of the Russian Federation and is no more than 2.2% .

Items of fixed assets, accounted for as movable property, put into operation since 2013 in the base for calculating legal property tax. persons are not included.

The base for calculating the tax includes real estate and movable property transferred into operation as fixed assets before the beginning of 2013. Movable property, which is fixed assets, will be taken into account in the tax base for the calculation and payment of corporate property tax until disposal or full depreciation.

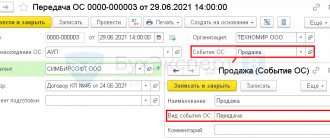

Examples of taxation of transactions with fixed assets

Income tax, transactions with fixed assets can be carried out in the following cases.

- Sale of fixed assets. Thus, the sale of fixed assets represents taxable income, on the basis of which the tax base for income tax is formed.

- Depreciation of fixed assets. This element of accounting for fixed assets directly affects the tax base of the enterprise with income tax (reduces it).

- Disposal of fixed assets. Thus, the disposal of fixed assets can generate both other income and other expenses, which also affects the payment of income tax.

When selling fixed assets by a VAT payer enterprise, a VAT tax base arises. For the buyer, this amount of VAT is a tax deduction.

Tax under the simplified taxation system in a regime where the tax base is only income is levied on transactions involving the sale or disposal of fixed assets.

Depreciation and other expenses incurred upon disposal of fixed assets do not affect tax.

If an enterprise payer of the simplified taxation system is in the “Income minus Expense” mode, then depreciation and other expenses upon disposal of fixed assets reduce the tax base.

In some cases, an object of fixed assets is subject to taxation by the regional property tax of organizations, according to Chapter 30 of the Tax Code of the Russian Federation. It is worth noting that certain fixed assets are not subject to this tax (nuclear installations, icebreakers, etc.).

The presence of vehicles at the enterprise obliges these objects to be subject to regional transport tax, in accordance with Chapter 28 of the Tax Code of the Russian Federation. There are also exceptions for certain types of vehicles (for example, fishing sea and river vessels).

Chapter 31 of the Tax Code of the Russian Federation obliges the imposition of land tax on land plots, with the exception of certain types (for example, land plots from the forest fund). This tax falls under the category of local taxes and fees.

In cases where a fixed asset is transferred free of charge to an individual, such person is obliged to pay personal income tax. For example, the management of an organization decided to reward an employee with a car, which is on the balance sheet of the enterprise. In this case, personal income tax is determined from the residual value of the car and paid by the enterprise as the tax agent of the enterprise employee.

Depreciable property in tax accounting.

Legal consultations by phone

+7 (free for St. Petersburg)

Depreciable property occupies a very important place in tax reporting. It represents funds that are the property of the enterprise, but leased or rented.

What constitutes depreciable property according to the Tax Code. Article 256 of the Tax Code of the Russian Federation provides a clear definition of depreciable property. These are material assets or the results of mental labor, as well as other objects that are owned by the taxpayer (taxes) and are used to generate income. It is indicated that the cost of all these objects is repaid through depreciation.

Any property that is used (and from which income is received) for more than one year, and also if it has an original cost of more than 40 thousand rubles, is depreciable. All property received by an enterprise from its owner for management is subject to the same procedure. This depreciation procedure is regulated by tax legislation (Article 256 of the Tax Code) relating to tax agreements.

This type of depreciable property includes such means as mobilization capacities, capital investments that are leased as inseparable improvements, as well as those investments that are provided under an agreement of gratuitous donation and use.

What property is not subject to depreciation? According to Article 256 of the Tax Code, the following types of property are not subject to depreciation:

· Land, as well as natural reserves, subsoil with proven mineral reserves;

· All unfinished construction projects;

· Inventories for material and production purposes;

· Securities, including shares, futures, forwards, options;

· Property of budgetary and non-budgetary organizations that is not used to generate income. This also includes all property purchased with budget money and for its intended purpose;

· All objects intended for improvement;

· Books and other works of art.

How is the cost of depreciable property calculated? Article 257 of the Tax Code regulates the value of property subject to depreciation. This determines the amount spent on its purchase. When this property was received free of charge, the value is determined by assessment. It is carried out in accordance with the same article of the Tax Code, taking into account the market prices in force at the time of the operation.

The initial cost of the property also includes taxes and fees that are paid upon the purchase of the property, as well as interest on the use of loan funds. But VAT is deducted from it. other refundable taxes, cost of equity, enterprise, interest on debt obligations. This law does not regulate the value of property received from a contribution to the authorized capital.

The cost of a company's fixed assets is determined by adding up the costs of its purchase, delivery, construction and bringing it to a condition in which it can be considered fit for use. In this case, the amount of excise taxes and value added tax is deducted from the entire amount.

Corporate income tax. Art. 270 of the Tax Code determines the calculation scheme for this tax. Property that is subject to depreciation is taken into account in the income tax calculation process. This tax is paid by a legal entity. The same article provides for a single profit tax rate in the amount of twenty percent of the profit received. According to the rules established by this code, only two percent of it goes to the federal budget, and the remaining amount goes to the local budget of the federal subject in whose territory the payment was made.

The basis for calculating income tax is the difference between the income of an enterprise or institution and its expenses. The amount of expenses also includes depreciation charges.

The accounting policy of an enterprise or other business entity specifies the moment at which its income and expenses are recorded. The calculation of the taxable base for determining the tax will depend on it.

There are special taxation regimes approved in the Tax Code. Special regimes are spelled out in more detail in Chapter 26 of the Tax Code. Provided that the company uses such a tax regime. it does not pay income and property taxes. Therefore, it is exempt from depreciation charges and from reporting on them. All this is also stated in the reporting policy of a particular enterprise.

If you have any questions regarding the inclusion of depreciable property in tax accounting, you should contact tax specialists who specialize in these nuances.

Tax accounting of depreciable property

The costs associated with production and sales include the amount of depreciation accrued:

- for fixed assets for production purposes;

- for intangible assets that are used in the production activities of the company.

Fixed assets are property that is used as means of labor for the production and sale of goods or for the management of an organization. Intangible assets (IMA) are the results of intellectual activity, objects of intellectual property (exclusive rights to them), which are also used in production or for management needs (for example, a trademark). According to the Tax Code, these assets are called depreciable property.

Depreciation is the gradual transfer of the cost of fixed assets and intangible assets to expenses that reduce the tax profit of the company. It is charged only on depreciable property. It includes fixed assets and intangible assets, which:

- belong to the company by right of ownership (with the exception of fixed assets that require state registration);

- used to generate income;

— have been in use for more than 12 months;

- cost more than 20,000 rubles.

An intangible asset does not have a tangible structure, but the company must have a document confirming the exclusive right to it.

The amount of depreciation that should be charged for fixed assets and intangible assets depends both on the service life of the depreciable property and on its original cost. In order for a fixed asset to be classified as depreciable, its original cost must exceed 20,000 rubles. (Clause 1 of Article 256 of the Tax Code of the Russian Federation). If the object costs less than 20,000 rubles. then depreciation is not charged on it - its cost is written off in tax accounting as a lump sum as part of material expenses (clause 3, clause 1, article 254 of the Tax Code of the Russian Federation). The same rule exists in accounting.

Both in tax and accounting, the initial cost of a fixed asset is formed depending on how it was acquired. In accounting and tax accounting, the initial cost of purchased fixed assets is formed in different ways. Namely, according to accounting rules, some expenses are included in their initial cost, but according to tax accounting rules, they are not. Thus, the tax value of fixed assets does not include:

What property is not taxed?

In a number of cases, property objects are not subject to tax, namely when such property is excluded from the list of objects of taxation, as well as when the owner of the property is granted the right to a tax benefit. Let's consider each of the above cases in more detail.

Property is excluded from the list of taxable objects

Based on the provisions of the Tax Code (Article 374, paragraph 4), the following are excluded from the list of property objects subject to property tax:

- plots of land, water and natural resource facilities;

- property (both movable and immovable) that is on the balance sheet of the structures of the Ministry of Internal Affairs, the criminal correctional system, the prosecutor's office and other law enforcement agencies;

- property included in the state list of cultural heritage;

- all fixed assets of І and ІІ depreciation groups;

- nuclear service water vessels (icebreakers, nuclear-powered ships), as well as vessels registered in the RMRS (Russian International Register of Ships);

- space objects and nuclear installations.

Preferential property

The provisions of the Tax Code and other current legislative acts provide for the procedure for providing benefits for paying property tax. According to the documents, the benefits are of an industry and social nature, and therefore 100% discounts on tax payments are provided to organizations in the medical, scientific, religious spheres, as well as organizations of the disabled.

| No. | Who gets the benefit? | Description |

| 1 | Prosthetic and orthopedic enterprises | Property owned by enterprises that manufacture orthopedic and prosthetic products is not subject to taxation, namely: · means used to compensate for persistent disabilities (prostheses of the upper and lower extremities); · rehabilitation devices (bandages, corsets, splints, reclinators); · orthopedic shoes and insoles. |

| 2 | Scientific centers | If a scientific center has state status (based on the Decree of the Government of the Russian Federation), its property is not subject to tax. A similar rule applies to universities, provided that the educational institution has experienced equipment, and the institution’s research results are recognized internationally. |

| 3 | Law firms and legal organizations | All organizations with the status of legal entities can use a 100% exemption on property tax. An exception is chambers of lawyers belonging to the category of non-profit organizations. |

| 4 | Institutions of the criminal correctional system | The benefit applies to the property of criminal correctional authorities only if the property is used to carry out the main functions of such an institution. |

| 5 | Organizations of disabled people | The property of organizations of disabled people is not subject to taxation if: · the organization was created by disabled people: · at least 80% of the organization’s members are disabled (members of their families); · The main goal of the organization is to represent and protect the interests of people with disabilities. Also, the property of legal entities whose 100% of the authorized capital consists of contributions from public organizations of disabled people is not taxed. However, the benefit does not apply to property: · used for the manufacture and/or sale of excisable goods; · brokerage companies and intermediary organizations. |

| 6 | Religious organizations | The property of organizations registered as a legal entity and in the form of a religious association of citizens on a voluntary basis is not taxed. |

| 7 | Pharmaceutical companies | If the main activity of an organization is the manufacture and sale of pharmaceutical products, the property of such a company is not subject to tax. It is important to fulfill the following conditions: · the company has a license to operate; · in case of other activities (except pharmaceutical), the company maintains separate accounting. |

How to keep tax records of depreciable property

The rules for tax accounting of depreciable property are established by Chapter 25 of the Tax Code of the Russian Federation. In some cases, the provisions of this chapter provide organizations with the right to choose from several possible accounting options. Thus, an organization can establish in its accounting policies for tax purposes:

- method of depreciation of fixed assets and intangible assets (except for buildings, structures, transmission devices included in the eighth to tenth depreciation groups) (clause 1 of article 259 of the Tax Code of the Russian Federation);

- the procedure for applying the “depreciation bonus” is the write-off of no more than 10 percent (30% in relation to fixed assets included in the third to seventh depreciation groups) of the initial cost of the fixed asset, as well as the costs of its completion, additional equipment, reconstruction, modernization, technical re-equipment ( clause 9 of article 258 of the Tax Code of the Russian Federation);

- the procedure for applying increasing coefficients to depreciation rates for fixed assets (clauses 1 and 2 of Article 259.3 of the Tax Code of the Russian Federation);

- application of reduced depreciation rates (voluntary) (clause 4 of Article 259.3 of the Tax Code of the Russian Federation);

- the procedure for determining the depreciation rate for fixed assets that were in operation (clause 7 of article 258 of the Tax Code of the Russian Federation).

When drawing up an accounting policy for tax purposes, keep in mind that some of the rules can only be established in relation to all objects at the same time, and some - to a specific list of objects at the organization’s choice. For example, reduced depreciation rates may apply to items selected by the manager.

Dear readers! Our articles talk about typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please contact the online consultant form on the left or call ext. 479 (Moscow) ext. 122. It's fast and free!

Apply the selected methods of tax accounting for depreciable property throughout the entire tax period (year). It is possible to change the tax accounting of depreciable property in the middle of the year only if the legislation on taxes and fees has changed. This procedure is provided for in paragraph 6 of Article 313 of the Tax Code of the Russian Federation.

Organization of tax accounting

The basic requirements for tax accounting of depreciable property are given in Article 323 of the Tax Code of the Russian Federation. Accounting for income and expenses on depreciable property is carried out object by object. The exception is depreciation when using the non-linear method.

The tax accounting system developed in the organization must contain information:

- about the initial cost of the property;

- about the useful life;

- on the date of acquisition and commissioning;

- on depreciation of fixed assets (intangible assets) accrued for the entire period of operation of the facilities - using the straight-line method of calculating depreciation;

- about depreciation and the total balance of each depreciation group (subgroup) - with a non-linear method of calculating depreciation;

- on the residual value of depreciable property upon its disposal from the depreciation group;

- about sales (date, sales price and sales costs), etc.

A complete list of information that analytical accounting of depreciable property should provide is given in Article 323 of the Tax Code of the Russian Federation.

The Tax Code of the Russian Federation provides for two options for maintaining tax accounting:

- use of accounting registers;

- use of tax accounting registers specially developed by the organization.

This is stated in Article 313 of the Tax Code of the Russian Federation.

How to calculate property tax based on average annual value

To calculate the base, add the values of the residual value of the objects on the 1st day of each month and on the last day of the tax period, and then divide the resulting amount by the number of months in the year.

| date | Residual value of property, rub. | Calculation of advance payments and tax for the year |

| 1st of January | 250 000 | Calculation of advance payment for 1st quarter: tax base = (250,000 + 240,000 + 230,00 + 220,000) / 4= 235,000 rub. advance payment = 235,000 × 2.2% / 4 = 1292.50 rubles |

| 1st of February | 240 000 | |

| March 1 | 230 000 | |

| April 1 | 220 000 | Calculation of advance payment for half a year: tax base = (250,000 + … + 190,000) / 7 = 225,000 rub. advance payment = 220,000 × 2.2% / 4 = 1210.00 rub. |

| 1st of May | 210 000 | |

| June 1st | 200 000 | |

| July 1 | 190 000 | Calculation of advance payment for 9 months: tax base = (250,000 + … + 160,000) /10 = 205,000 rub. advance payment = 205,000 × 2.2% / 4 = 1127.50 rubles. |

| August 1 | 180 000 | |

| September 1 | 170 000 | |

| October 1 | 160 000 | Tax calculation for the year: tax base = (250,000 + … + 130,000) /13 = 190,000 rub. Tax amount for the year = 190,000 × 2.2% = 4180.00 rubles. Additional payment including advance payments = = 4180.00 – 1292.50 – 1210.00 – 1127.50 = 550.00 rub. |

| Nov. 1 | 150 000 | |

| December 1 | 140 000 | |

| 31th of December | 130 000 |

The tax base of depreciated objects is zero, but they are included in the report.

Tax registers

If the selected rules for accounting for depreciable property in accounting and tax accounting coincide, then the organization can generate tax accounting data based on accounting registers (paragraph 3 of Article 313 of the Tax Code of the Russian Federation). It is not necessary to maintain separate tax registers. This situation is explained by a number of reasons. Firstly, information for tax accounting is taken from the same primary documents that are used to reflect transactions in accounting. Secondly, due to the overlap of many methods and methods of assessment in tax and accounting, it is impractical to compile separate tax registers. To calculate the tax base, you can use accounting data.

Filling registers

Fill out tax accounting registers in chronological order. Tax registers can be maintained in the form of special forms: development tables, statements, journals. Do this on paper (machine) or electronically.

Situation: how to reflect in tax accounting a fixed asset that is fully depreciated (residual value is zero), but which continues to be used?

A fully depreciated fixed asset item is not reflected in tax accounting.

If a fixed asset is fully depreciated, then its cost is fully included in expenses. After the residual value in tax accounting becomes equal to zero, this fixed asset does not participate in the formation of expenses for income tax. Therefore, do not reflect it in tax accounting, since the object of tax accounting is the expenses accepted when calculating income tax (paragraph 4 of Article 313 of the Tax Code of the Russian Federation).

Reflect such an object of fixed assets only in accounting, since control of the availability of assets, including property, is ensured with the help of accounting (Articles 2 and 11 of the Law of December 6, 2011 No. 402-FZ).

An example of compiling a tax register for accounting for expenses for depreciation of fixed assets

On June 2, the organization purchased a computer for 60,000 rubles. On June 15, the main facility was put into operation. The useful life of a computer for accounting and tax accounting is 36 months. Depreciation is calculated using the straight-line method.

According to the accounting policy for tax purposes, when purchasing a fixed asset, the organization writes off 10 percent of its cost as part of depreciation charges. Therefore, depreciation in tax accounting is calculated from the original cost reduced by the amount of the depreciation bonus. It is 54,000 rubles. (60,000 rub. – 60,000 rub. × 10%). The organization's accountant took into account the depreciation premium in the month in which depreciation on the computer began to be calculated, that is, in July.

Due to differences in the initial cost of the fixed asset and the use of bonus depreciation, the monthly amount of depreciation in tax and accounting will be different:

- in accounting – 1667 rubles/month. (RUB 60,000 36 months);

- in tax accounting – 1500 rubles/month. (RUB 54,000 36 months).

The organization's accountant reflected the depreciation charge on the purchased computer for tax accounting purposes in the depreciation calculation register

Position of the Supreme Court

Regarding the property tax on equipment, the RF Armed Forces indicated when equipment is considered movable property for tax purposes (or rather, its absence).

The Supreme Court noted that in the All-Russian Classification of Fixed Assets OK 013-2014 (SNS 2008) (adopted and put into effect by order of Rosstandart dated December 12, 2014 No. 2018-st), equipment does not relate to buildings and structures.

It forms an independent group of OS, with the exception of directly provided cases (for example, equipment of built-in boiler installations).

As a general rule, production equipment, including those installed on a foundation, cannot be considered a structure. At the same time, the Supreme Court of the Russian Federation pointed to a similar position of the Ministry of Industry and Trade of Russia, which was sent by the Federal Tax Service (letter dated March 23, 2018 No. OV-17590/12 “On the issue of qualification of fixed assets for industrial production”, brought to the attention of the tax inspectorates by letter dated March 28, 2018 No. BS- 4-21/5834).

Also see “Is a structure real estate or not?”

machinery and equipment that are named in the corresponding section of the Classifier are not considered taxable real estate are not components of buildings. Such objects located inside and outside the building:

- are not intended for its maintenance;

- aimed at producing finished products or servicing the production process.

The mere fact of installing equipment in a building specially erected for its operation does not mean that this equipment is intended to serve the building. The purpose of the equipment does not change because its subsequent dismantling and relocation will require:

- additional costs;

- partial liquidation of the building.

The court noted that the expert opinion presented by the inspection essentially boils down to assessing the feasibility of dismantling in the event of relocating production, if such a decision is made. And this puts taxpayers investing in equipment upgrades a disadvantage

Error correction

If an error is found in the tax accounting register, only the employee responsible for maintaining the register has the right to make a correction. Moreover, the correction must not only be certified by the signature of the latter (indicating the date), but also justified in writing.

This procedure is provided for in Article 314 of the Tax Code of the Russian Federation.

The Tax Code of the Russian Federation does not specify how to make corrections to the tax register. Therefore, this can be done, for example, by including a correction entry (if the register is generated electronically) or by crossing out the incorrect amount (if the register is compiled on paper).