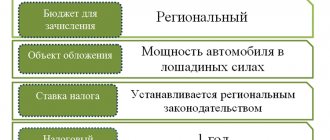

A little about transport tax

It should be understood that transport tax refers to regional taxes, and therefore the income from its payment is received by the subject of the Russian Federation in which it is paid. As already mentioned, transport tax is paid by both individuals and legal entities. However, there are some situations when this tax does not need to be paid. This applies, for example, to cars used by disabled people, rowing boats, and tractors. A more complete list can be found in the Tax Code of the Russian Federation.

Regional legislation may contain various benefits for the payment of transport tax. For example, pensioners and large families may sometimes be exempt from paying it. Instead of a waiver, a larger discount may also be provided.

KBK transport tax for organizations

The table shows the cbk for transport tax for 2021 for legal entities; they are relevant in 2021. When paying penalties, contributions, standard or other payments, the corresponding numbers apply.

| Payment name | KBK |

| Payment amount (recalculations, arrears and debt for the corresponding payment, including canceled ones) | 182 1 0600 110 |

| Penalties on the corresponding payment | 182 1 0600 110 |

| Interest on the relevant payment | 182 1 0600 110 |

| Amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation | 182 1 0600 110 |

| Other supply | 182 1 0600 110 |

| Payment of interest accrued on amounts of excessively collected (paid) payments, as well as in case of violation of the deadlines for their return | 182 1 0600 110 |

BCCs for organizations and individuals differ, but the differences are minimal. The main difference is the income sub-item, since funds come from various sources. Payments from individuals are numbered subsection 12, and from enterprises - 11. Also, before paying the fee for a vehicle, it is important to see whether the car is on the list of expensive ones or not. And organizations should regularly monitor collection rates, which can be found in Art. 361 ch. 28 Tax Code of the Russian Federation

The deadlines for payment of the transport fee, as well as last year’s BCC, are valid at the current time, but the latter are updated very quickly. Therefore, it is recommended to track codes on the official website of the Federal Tax Service: from individuals and from legal entities.

Penalties for transport tax of legal entities and citizens

So, in case of late payment, you will need to pay a penalty. It is important that if there is a delay, it is necessary to pay the tax as quickly as possible, because penalties will be charged for each day of delay in the amount of 1/300 of the current refinancing rate of the Bank of Russia. This means that, for example, if you are one day late with your payment, you will not suffer any major negative consequences. But if the delay is much more days, this may result in the need to pay a large sum of money.

Transport tax 2021 changes

BCC of transport tax in 2021 for organizations

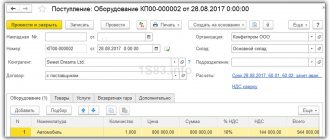

Any organization, regardless of the tax system, is obliged to pay transport tax on all registered vehicles that are used in business activities.

Calculation of the amount of tax payments, in accordance with the Tax Code of the Russian Federation, Art. 362 clause 1, organizations make on their own if such payments are established at the regional level. Payment (Tax Code of the Russian Federation, Art. 363.1, clause 3) is transferred quarterly (if advances are available) or immediately for the whole year after its end. Reports are submitted to the fiscal authorities before the beginning of February of the year following the reporting year.

For legal entities, the BCC for transport tax this year is as follows: 182 1 0600 110. Since 2021, the BCC has not suffered changes, and there is no recalculation for the next year.

What is KBC?

Having dealt with the transport tax and the responsibility for its late payment, you should study the topic of the BCC, which must be indicated when paying penalties. KBK, or budget classification code, is intended for the preparation and execution of budgets, as well as reporting. With the help of the KBK, the purpose of those financial resources that are paid by tax entities is indicated.

A budget classification code is required when one of the parties to legal relations is the state or its authorized bodies. Thus, the payment of taxes and penalties is precisely such a case due to the public nature of such legal relations.

Procedure for filling out a transport tax return

List of KBK for transport tax and decoding of codes

The abbreviation KBK stands for budget classification code. It is represented by a certain set of figures that help in grouping the funds entering the country's treasury.

Budget classification codes for transport tax

This concept was introduced according to the Budget Code (Budget Code) of Russia at the end of July 1998. The use of these codes greatly facilitates the work of the relevant structures in grouping the income received by the budget and the costs incurred from it. In addition, reporting becomes easier, as well as control activities related to this area of government activity. Among other things, the presence of codes makes it possible to conduct data comparisons.

These codes are used only in cases where financial transactions are involved, in which the state will be one of the participating parties.

Taxpayers enter budget classification codes in payment orders when making payments, as well as to cover various penalties associated with late provision of the main payment or other circumstances.

Each code is represented by twenty digits. It is divided into four main blocks.

- The first block is administrative; it determines the government structure in whose favor the future payment will be received. In the case that we are considering in this material, the administrator will be the Federal Tax Service of the Russian Federation. Its code is 182.

- The second group of values determines the type of deductions, implying the definition of: the group of incoming income, that is, their nature;

- subgroups - that is, it is a tax, duty or monetary sanctions;

- articles - this figure is determined by the income classifier;

- element - the level of the budget to which the contribution will ultimately go, for example, to the local or federal, etc.

- tax deduction;

- tax income;

After combining all the above elements, you receive one digital sequence, which is subsequently entered into the line of the payment order, which determines the purpose of the funds sent to the treasury.

The good news is that you don't have to figure out and create the code sequences yourself. All of them have long been presented by the relevant services in the form of lists inside official documents. In the table below we provide a list of BCCs for transport tax .

Table 3. BCC for transport tax for legal entities

| Type of tax payment | Budget classification code |

| Code for recalculations, arrears and debts for the corresponding and canceled payment | 182 1 0600 110 |

| Penalty code | 182 1 0600 110 |

| Code for interest on payment | 182 1 0600 110 |

| Code for monetary penalties or fines | 182 1 0600 110 |

| Code for other income | 182 1 0600 110 |

| Code used when paying interest that was accrued on amounts of overpaid funds, as well as in case of violation of the deadlines for their return | 182 1 0600 110 |

Table 4. BCC for transport tax for individuals

| Type of tax payment | Budget classification code |

| Code for recalculations, arrears and debts for the corresponding and canceled payment | 182 1 0600 110 |

| Penalty code | 182 1 0600 110 |

| Code for interest on payment | 182 1 0600 110 |

| Code for monetary penalties or fines | 182 1 0600 110 |

| Code for other income | 182 1 0600 110 |

| Code used when paying interest that was accrued on amounts of overpaid funds, as well as in case of violation of the deadlines for their return | 182 1 0600 110 |

When paying penalties for transport tax, certain types of KBK are used . We wrote about this in a separate publication dedicated to penalties for late transport tax.

Penalties for transport tax: KBK 2018

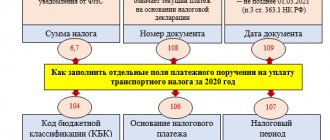

So, we have come to the most important topic of this article: how to properly pay penalties if there was a delay in paying transport tax?

To pay penalties, you must fill out the payment order correctly. It is very important, in particular, to correctly fill out the KBK penalties for transport tax. Any mistake in even one figure can turn out badly for an organization or individual. This will be discussed in more detail below.

So, what budget classification codes are provided for transport tax?

KBK penalties for transport tax

If you fail to pay your transport tax on time, you will have to pay a late fee. What penalties are assigned to individuals and legal entities?

- For individuals, KBC penalties: 182 1 0600 110.

- For legal entities of KBK penalties: 182 1 0600 110.

A special calculator will help you calculate the penalty.

The payment form, which is intended for paying tax on a vehicle, contains special details. According to the law, a taxpayer can avoid penalties only in 2 cases:

- If there is a court decision to temporarily suspend transactions on accounts;

- If the inspection seized the property.

You can calculate late fees using a certain formula:

- amount of tax debt * number of overdue days * 1/300 of the Central Bank of Russia refinancing rate.

The latest figure in 2021 was 9%. It is easier to calculate using a calculator created for this purpose.

The payer can pay penalties for transport tax himself. But if this does not happen, then the tax authorities carry out forced collection from the payer.

From 10/01/2017, from 31 days of delay, organizations began to be charged 1/150 of the refinancing rate.

Penalties for non-payment of transport tax are not the only punishment. Also, an irresponsible taxpayer will be assessed a fine for failure to comply with the law. The amount of the fine will depend on the type of violation by the taxpayer. If the established amount was not paid out of malicious intent, then the taxpayer will have to pay 40% of the existing debt. If the payment was not made due to negligence, you will have to pay only 20%.

What are the consequences of filling out the CBC incorrectly?

As mentioned above, it is necessary to carefully check each figure when filling out the KBK. However, it happens that a mistake is still made, which is noticed only later. What to do in such a situation?

An error in filling out a payment order is not critical in a situation where it did not result in non-transfer of tax to the treasury. In this case, all you need to do is write a statement in which you need to point out this very mistake. At the same time, it must be accompanied by evidence of the error - a copy of the payment order with an incorrect indication of the KBK.

But how can you understand whether such an error was the reason for not transferring penalties on transport tax for individuals and organizations? Here it should be said that judicial practice proceeds from the following position: if an error is made in indicating the BCC, this in itself does not lead to non-payment of tax. Thus, there is no need to worry about this.

Similar articles

- What is the BCC for transferring penalties for personal income tax?

- BCC for penalties on transport tax in 2016-2017

- Calculation of transport tax in 2021

- Property tax - current BCC for organizations

- KBK for organizations and individuals on transport tax

KBK for legal entities

Commercial companies must pay tax on all vehicles they own. They must do the calculations themselves. Payment is transferred once a quarter or for the whole year at once. The report must be submitted to the fiscal authorities before 01.02. of the year following the reporting year

KBK transport tax in 2021 for legal entities and organizations is as follows:

| Tax for legal entities | KBK |

| KBK | 182 1 0600 110 |