Transport tax: who should pay and for which cars

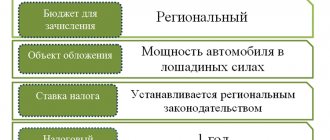

The state has developed special regulations that contain the specifics of paying car fees. The rules for depositing funds are recorded in the main tax document of the country. Thus, the study should begin with Article 357 of the Tax Code. This provision contains information about the obligation of all citizens to pay transport tax for cars that are subject to this penalty.

The next provision to study is Article 358 of the Tax Code. This article regulates which vehicles are subject to tax. That is, all owners of cars falling under this provision are required to promptly pay transport tax in the established amount.

TN is provided for the following types of vehicles:

- automobiles and motorcycles (including buses);

- Vehicles moving by air;

- transport moving on water.

The entire list of movable property subject to auto tax is provided in paragraph one of Article 358 of the Tax Code of the Russian Federation. The driver should take into account that this provision includes vehicles on pneumatic and caterpillar tracks, jet skis, snowmobiles, boats (both sailing and motor), as well as towed vessels.

Despite the fact that the list of taxable vehicles is quite extensive, there are also certain non-taxable vehicles:

- Motor vehicles specially designed for transporting people with disabilities. In this case, the car must be converted in accordance with the rules for the comfortable movement of disabled people.

- Vehicles that are listed as stolen.

- Specialized vehicles designed for agricultural and other work.

Information about which vehicles are not subject to transport taxation is contained in paragraph two of Article 358 of the Tax Code. Drivers whose cars fit into any of the listed categories should familiarize themselves with this legal provision in more detail. The information obtained will make it possible to verify the reality that the tax under discussion is not payable in a particular case.

Who must pay transport tax and what vehicles does it apply to?

According to Art. 357 of the Tax Code of the Russian Federation, transport tax is paid by individuals or organizations on which vehicles subject to taxation are registered.

Taxpayers are persons who, in accordance with the legislation of the Russian Federation, have registered vehicles that are recognized as an object of taxation in accordance with Article 358 of this Code, unless otherwise provided by this article.

Tax must be paid for registered in the Russian Federation:

- cars, buses, motorcycles and other self-propelled vehicles;

- airplanes and helicopters and other aircraft;

- sailing ships, yachts, motor boats and other watercraft;

The objects of taxation are cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis, non-self-propelled (towed vessels) and other water and air vehicles (hereinafter in this chapter - vehicles) registered in the prescribed manner in accordance with the legislation of the Russian Federation ( clause 1 of Article 358 of the Tax Code of the Russian Federation ).

Some cars are not subject to transport tax, for example:

- cars that have been specially converted for disabled people ;

- stolen cars;

- tractors and other equipment that is involved in agricultural work , etc.

A complete list of vehicles for which you do not need to pay tax can be found in paragraph 2 of Art. 358 Tax Code of the Russian Federation .

Until what date should individuals be paid in 2021?

Paragraph one of Article 360 of the Tax Code of the Russian Federation defines the tax period as a period equal to one calendar year. After the expiration of the specified time period, the person will receive a tax notice about the payment of the fee for owning the vehicle.

This paper is sent specifically by the tax authority. This feature of the procedure for collecting transport tax is recorded in the first paragraph of paragraph three of Article 363 of the Tax Code.

As of 2021, the period for making payments under TN begins to be calculated from the date of receipt of the payment notice. The received document will reflect key information on the discussed tax on this car.

The driver will be able to find out about:

- the amount required to pay transport tax;

- the amount of additional contributions (penalties for late payment of technical tax for the previous period).

It is important to know: if a motorist has not received a notice to pay the vehicle tax, he is NOT considered exempt from the obligation to pay the funds.

It is necessary to take care of receiving the paper in a timely manner. To do this, you need to contact the city tax office. The third paragraph of Article 363 of the Tax Code of the Russian Federation stipulates that the payment will be considered late if the motorist makes the payment later than December 1 of the year following the expiration of the previous reporting calendar year. This means that the maximum due date for paying the car contribution is December 1st.

In 2021, transport tax funds are paid for the previous repayment period (last year). Thus, in 2021, citizens must deposit funds for 2020 by December 1.

Is it possible to pay in advance?

According to the innovations adopted in January 2021, ordinary citizens, along with organizations (legal entities), have the opportunity to pay in advance. The meaning of advance payments is that vehicle owners can pay the amount of tax for it in the current year without waiting for the expiration of the tax period. To make an advance, just visit a bank branch or transfer funds using your mobile phone details.

It is worth noting that the innovation did not open up any fundamentally new opportunity for drivers, but only legitimized it properly. Until 2021, individuals could also deposit funds in advance. The transferred amount was regarded as an overpayment, but was still taken into account when recalculating the technical tax of the next tax period.

Tax for those who bought a car in 2021: calculation procedure

If a motorist purchased movable property in 2021, he will pay transport tax only from the next reporting period. At the same time, the country’s Tax Code (namely paragraph 3 of Article 362) suggests that the fee for the ownership of movable property is calculated depending on the period of legal ownership of the vehicle.

According to the standards for calculating tax deductions for owning a car, the size of the amount is affected by the date the car is registered or deregistered. So, if the registration or deregistration of a car occurred during the reporting stage, the contribution coefficient is calculated using the formula. It is enough to divide the number of full months of possession of movable property by the total number of months in a year. Advance payments are calculated according to a similar scheme.

To determine whether a given month will be taken into account when calculating the amount of transport tax, you need to follow the following rules:

- the car is registered before the 15th day of any month - the payment for the car is made taking into account the full month;

- The vehicle begins to be registered after the 15th day of any month - the coefficient for the full month of car ownership;

- the vehicle is deregistered or excluded from the state register before the 15th day of any month - the month is not taken into account in the calculations;

- a vehicle is deregistered or excluded from the state register after the 15th of any month - car tax is paid for the full month.

You can familiarize yourself with the provided rules in more detail by studying the second and third paragraphs of paragraph 3 of Article 362 of the Tax Code of the Russian Federation.

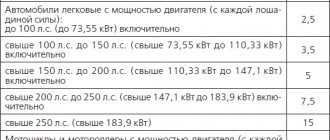

Example calculation

To understand the algorithm for calculating TN, it is enough to imagine a specific situation. For example, a motorist registered a BMW X5 on May 15, 2021. At the same time, the tax base for this vehicle is 231 rubles, and the tax rate is 75.

To calculate the transport tax for the full year of car ownership, you need to multiply the available numbers. So, for this car the owner will have to pay 17,325 rubles for a full year of owning the vehicle. However, it is important to consider that registration took place only four and a half months later.

Since registration took place on the 15th, the car tax will be paid for the full month. With this information in mind, you can finish calculating the amount. To do this, the resulting multiplication result must be multiplied by 9 and divided by 12. That is, the formula will look like this:

Thus, the owner of the specified car will be required to pay the amount for 8 full months for 7.5 months of actual ownership of the car. The transport tax in this case will be equal to 12993.75 rubles.

How do legal entities pay tax for transport?

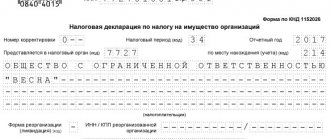

The procedure for paying car tax for legal entities differs from the procedure for paying TN for ordinary citizens. Individuals receive a payment notice from the tax office. Organizations are forced to carry out calculations independently in the tax return submitted for verification.

The first paragraph of paragraph 1 of Article 362 of the Tax Code of the Russian Federation regulates the obligation of legal entities to independently calculate both the amount of transport tax and the amount of advances. It is worth noting that legal entities will one way or another have to deal with the calculation of advance payments.

According to the rules of the specified provision of the Tax Code of the Russian Federation, the amount of tax contribution for owning a vehicle is calculated by multiplying the tax base and rate. This requirement is met in all cases, except for the exceptions indicated in the article.

You should also pay attention to the second paragraph of Article 362 of the Tax Code, which regulates the specifics of calculating the amount of tax based on advance payments already made. Everything is quite simple: you need to calculate the difference between the full amount required to be paid and the advances made previously.

Paragraph two of Article 363 of the Tax Code establishes the obligation of organizations to periodically make advance payments during the tax period—the year.

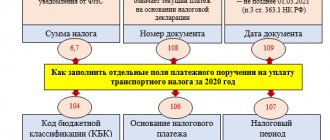

Tax returns are submitted by taxpayer organizations (legal entities) no later than February 1 of the year following the expired tax period.

Also, after the end of this period, the organization is obliged to make a tax contribution in full. It is important to note that the contribution amount is calculated taking into account the advance amounts already paid.

It is important to know: guided by paragraph six of Article 362 of the Tax Code of the Russian Federation, the constituent entities of the country have the right, at their own discretion, not to establish the amount of advances on tax payments. Thus, advance payments are not provided, for example, in the capital. Muscovites must pay transport tax once for the entire tax period.

By what date must a legal entity pay transport tax in 2021?

To answer the question about what is the deadline for depositing funds for transport tax, it is worth turning to paragraph one of Article 363 of the Tax Code of the Russian Federation. According to this provision, the constituent entities of the Russian Federation set the deadlines for depositing funds under the TN at their own decision. For this reason, it is impossible to specify a single deadline for paying transport tax for everyone.

The procedure for paying TN, as well as advances under this article for legal entities, is fixed in the code of laws of the subject of the Russian Federation. However, the deadline must meet some generally accepted requirements. Thus, the payment date should not occur earlier than the period fixed in the third paragraph of Article 363.1 of the Tax Code. You can read this information in the second paragraph of the specified provision of the original source.

If the legislation of the subject of the federation does not have information on the timing of making advance funds, they must be paid at the end of the tax periods - for the first, second and third quarters. Often, the final date for making an advance payment is considered to be the last day of the month following the reporting period. Tax authorities in St. Petersburg work according to this scheme. In other regions, taxpayers must clarify this information in the regional legislation.

Legal entities must know their rights, which will be violated if regional legislation obliges organizations to deposit funds on any specific date. This information is contained in the first paragraph of Article 363 of the Tax Code. Also, the payment deadline cannot be set earlier than the maximum deadline for submitting a tax return.

The maximum period for payment of contributions for a car cannot be determined by a date before February 1. The fact is that, according to paragraph three of Article 363.1 of the Tax Code of the Russian Federation, the date of February 1 is the deadline for legal entities to provide reporting documents.

When does the transport tax for 2021 arrive?

Phys. Individuals, unlike taxpayer-organizations, do not calculate the amount of tax on their own; the Federal Tax Service does this for them. The exact amount of tax (including debts and penalties), a receipt for payment, as well as the deadline by which the transport tax must be paid is contained in the tax notice that is sent to car owners by mail.

Taxpayers - individuals pay transport tax on the basis of a tax notice sent by the tax authority.

Clause 3 Art. 363 Tax Code of the Russian Federation

When is vehicle transport tax calculated in 2021?

The tax notice, which notifies the car owner of new tax charges, usually arrives in late summer or early autumn. One way or another, the Federal Tax Service is obliged to send a letter no later than a month before the deadline for payment of the TN, that is, no later than November 1.

If the responsibility for calculating the amount of tax is assigned to the tax authority, no later than 30 days before the payment deadline, the tax authority sends a tax notice to the taxpayer.

Clause 3 art. 52 Tax Code of the Russian Federation

Without the exact amount and payment details, you will not be able to pay the tax on time. Therefore, if you have not received a tax notice by November 1, contact your city tax office in person to receive it. Otherwise, you will be late in payment and you will be charged penalties.

Important!

If you use your taxpayer’s personal account on the official website of the Federal Tax Service, you will not receive a notification by mail. You should track new tax revenues using your personal account.

Deadline for payment of transport tax in Moscow, St. Petersburg and regions for organizations

In 2021, organizations can easily obtain information about the due date for car ownership payments. For these purposes, you can use Internet resources. In particular, the official website of the Federal Tax Service. After going to the site, you must click on the “Electronic Services” link, and then request information about rates and benefits for property ownership taxes.

It is more appropriate for residents of regions to search for information on the Internet.

Residents of the official and cultural capitals, as well as areas adjacent to these cities, can use the data given in the table:

| Subject | Prepaid expense | When do you need to pay transport tax? |

| Moscow | No advance payments are made | Until February 5 |

| MO | Maximum period - the last day of the month following the reporting period | Until March 28 |

| Saint Petersburg | Maximum period - the last day of the month following the reporting period | Until February 10 |

| Leningrad region | No advance payments are made | No advance payments are made |

It is important to know: in 2021, individuals are exempt from the need to track changes in the procedure for depositing funds under the Taxpayer Agreement. For ordinary citizens, the deadline for depositing transport tax funds is fixed - December 1.

Payment without receipt

Having looked at the full amount payable for the past year of using the car, any person reserves the right to repay the debt without waiting for a letter from the Federal Tax Service. And you can do this in several accessible ways:

- Using online banking (the recipient's details are not required, since when paying through Sberbank, the Tax Service KBK is indicated automatically);

- Via a stationary iBox or Qiwi terminal;

- Through the State Services website (to use this service, you must register on it in advance, which will take about 20-30 minutes).

Attention! Before you pay the mandatory fee, you need to find out exactly when the transport tax is due in 2021. After all, if you make a payment ahead of schedule, the system may not count it.

What is transport tax and when do you have to pay car tax in 2021 - conclusions

Thus, transport tax is a mandatory payment for owning a vehicle. All motorists whose ownership of movable property is officially recorded must make tax payments on time.

Subjects of the Russian Federation independently determine the payment deadline, as well as some payment fees. For this reason, residents of regions should clarify this information in regional legislation.

Payment rules for individuals and legal entities differ markedly, so they should not be considered together.

The procedure for transferring funds for car ownership for individuals will be as follows:

- Citizens contribute funds under the Taxpayer Tax Code using a notification indicating the amount of tax deduction. The amount is calculated by the tax service. Individuals are exempt from the obligation to make calculations themselves.

- The payment notice will contain additional information, including information about debts and overpayments. For the resulting debts, the motorist will be forced to additionally pay accrued penalties.

- For individuals, the maximum deadline for paying transport tax is fixed - the amount must be paid before December 1.

- The tax contribution for a new car will only be calculated at the end of the tax period. So, if the car was purchased in 2021, the tax must be paid in December 2022.

- The tax for transport will be lower if the motorist owned movable property for less than a full calendar year.

- The driver does not have to pay transport tax for a car that is officially listed as stolen.

The procedure for tax collection from legal entities is represented by the following rules and regulations fixed in legislation:

- Legal entities are responsible for independently carrying out transport tax calculations. In this case, all calculations must be reflected in the declaration.

- The tax return filing deadline is February 1 of the year following the tax period.

- Regions have the right to independently set the terms for making an advance payment. If local legislation provides for such contributions, funds are paid quarterly; if not, the tax is paid once at the end of the year.

- The deadlines for payment of transport tax are established in the legislative documents of the region. You can find information about when to make tax and advance payments on the website of the Federal Tax Service.

- Residents of the capital must make tax payments by February 5, and St. Petersburg residents by February 10.

- Regional legislation cannot set a maximum period for a date before February 1.

The most important rule for a taxpayer is to pay taxes on time. Otherwise, he may face negative consequences in the form of penalties.

How to pay transport tax - main methods

The rarity of the need to pay transport tax and the constantly changing deadlines that are established at the legislative level can lead to the fact that the need to pay is remembered literally on the last day, and late in the evening, when neither bank branches nor the post office are open. In this case, the only possible (and, frankly, the most convenient and fastest) is the method according to which payment of transport tax is made via the Internet. There are a number of sites you can use for this.

Question answer

Answers to the most common questions are provided in table form:

| Who must pay transport tax? | All individuals and legal entities who own vehicles |

| What vehicles are not subject to tax? | • Vehicles specially equipped for the transportation of people with disabilities • Cars that are officially listed as stolen • Specialized equipment that is used for seasonal and other work |

| Which vehicles are taxed? | • All vehicles moving under their own power • Air Transport • Water vehicles |

| Until what period should citizens deposit funds under TN | Until December 1 (as of 2021) |

| What to do if you haven’t received a transport tax notice? | Visit the tax office and request a notification |

| Is it necessary to pay transport tax if the car was purchased this year? | No: the person will be required to contribute amounts only from the next year. |

| If the car is purchased during the year, will the tax be paid for the full year? | If you have owned a car for less than a full year, only full months of ownership are taken into account when calculating the vehicle tax. |

| What rules are used to calculate TN for a full month? | Transport tax is taken into account for a full month if the car is registered before the 15th |

| Is notification sent to legal entities? | Legal entities are required to calculate the amount payable themselves, providing a report using a declaration |

| What is the maximum period for payment of transport tax for organizations | For regions, this indicator is calculated individually; however, the date cannot be set to a date before February 1 |

| Should organizations pay an advance? | This obligation is enshrined in the legislative documents of the constituent entity of the Russian Federation, therefore legal entities must clarify this issue |

| When legal entities must make an advance payment | After the expiration of tax periods (after the first, second and third quarters) |