Step-by-step instruction

On June 29, the Organization sold a Nissan Teana car to the buyer Simbirsoft LLC at a price of RUB 240,000. (including VAT 20%). On the same day, the Nissan Teana car was deregistered with the traffic police.

Depreciation in accounting and for profit tax purposes was calculated using the straight-line method. The depreciation bonus for sold fixed assets was applied in the amount of 30%.

The residual value of the fixed asset (BU = 440,000 rubles, NU = 308,000 rubles) exceeded sales revenue.

The parties to the transaction are not interdependent persons.

Sales are made before the expiration of 5 years from the date of commissioning of the vehicle.

Its remaining useful life is 11 months.

On July 2, payment was received from the buyer to the bank account in the amount of RUB 240,000.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| OS implementation | |||||||

| June 29 | 62.01 | 91.01 | 240 000 | 240 000 | 200 000 | Revenue from OS sales | OS transfer |

| 26 | 02.01 | 40 000 | 28 000 | 28 000 | Calculation of depreciation for the last month | ||

| 02.01 | 01.09 | 560 000 | 392 000 | 392 000 | Write-off of accumulated depreciation | ||

| 01.09 | 01.01 | 1 000 000 | 700 000 | 700 000 | Write-off of the initial cost of the OS | ||

| 91.02 | 01.09 | 440 000 | 308 000 | 308 000 | Write-off of residual value of fixed assets | ||

| 91.02 | 68.02 | 40 000 | VAT accrual on revenue | ||||

| Issuance of SF for shipment to the buyer | |||||||

| June 29 | — | — | 240 000 | Issuing SF for shipment | Invoice issued for sales | ||

| — | — | 40 000 | Reflection of VAT in the Sales Book | Sales book report | |||

| Deregistration of a car | |||||||

| June 29 | — | — | — | Removing a car from registration with the traffic police | Register of information Registration of vehicles - Deregistration | ||

| Reflection in the tax accounting amount of the loss from the sale of fixed assets | |||||||

| June 29 | 97.21 | 91.09 | — | 108 000 | 108 000 | Transfer of the amount of loss from the sale of fixed assets to the remaining private investment fund (NU) | Manual entry - Operation |

| Receipt of payment from the buyer | |||||||

| July 02 | 51 | 62.01 | 240 000 | 240 000 | Receipt of payment from the buyer | Receipt to the bank account - Payment from the buyer | |

| Accounting for the monthly amount of loss as part of indirect expenses for NU | |||||||

| July 31 | 91.02 | 97.21 | — | 9 818,18 | 9 818,18 | Accounting for the monthly amount of loss as part of indirect expenses (IO) | Closing the month - Write-off of deferred expenses |

For the beginning of the example, see the publications:

- Purchasing a car

- Acceptance for accounting of fixed assets with bonus depreciation

Tax accounting of losses from the sale of depreciable property

Depreciable property includes fixed assets and intangible assets.

Disposal of depreciable property may occur in connection with its: disposal (sale, exchange); gratuitous transfer; contribution to the authorized capital of another organization; write-off due to moral or physical wear and tear or liquidation due to an accident or other emergency; write-off due to shortage or theft; transfer during reorganization.

The provisions of Art. 323 of the Tax Code of the Russian Federation establishes that income and expenses on depreciable property are accounted for separately for each object. Also, on an object-by-object basis, based on analytical accounting data, profit (loss) from the sale of fixed assets and intangible assets is determined.

The loss from the sale of depreciable property is calculated in the manner established by clause 3 of Art. 268 Tax Code of the Russian Federation. Thus, if the residual value of depreciable property, taking into account the costs associated with its sale, exceeds the proceeds from the sale, the difference between these values is recognized as a loss to the taxpayer. The organization must determine the amount of this loss as of the date of the transaction (Article 323 of the Tax Code of the Russian Federation).

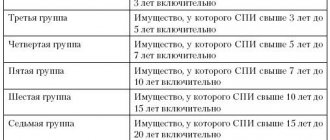

For profit tax purposes, losses on transactions with depreciable property are transferred to the future according to the rules of clause 3 of Art. 268 of the Tax Code of the Russian Federation: the loss is included by the organization in other expenses in equal shares during the period calculated as the difference (in months) between the useful life of the said property and the actual period of its operation until the moment of sale.

The write-off of losses begins from the month following the month in which the sale of the depreciable property occurred. This is due to the fact that in the month of sale, depreciation on such property will still be accrued (clause 5 of Article 259.1 of the Tax Code of the Russian Federation).

The organization must take into account the loss from the sale of depreciable property evenly in accordance with the rules of paragraph 3 of Art. 268 of the Tax Code of the Russian Federation and in the case when this property is sold not by the taxpayer organization itself, but by a bailiff during enforcement proceedings (Letter of the Federal Tax Service of Russia dated August 17, 2005 N 02-1-08 / [ email protected] , Resolution of the Federal Antimonopoly Service of the Volga District dated February 16, 2006 in case No. A49-5694/05-304A/08).

A loss received by an organization upon the sale of depreciable property used in the activities of service production facilities and farms (OPH) is a loss associated with the sale of property, and not a loss received as a result of the activities of service production facilities and farms. Therefore, when taking into account losses from the sale of depreciable property of a private enterprise, one should also be guided by clause 3 of Art. 268 of the Tax Code of the Russian Federation, and not the provisions of Art. 275.1 of the Tax Code of the Russian Federation, regulating activities related to the use of facilities of service industries and farms (Resolution of the Ninth Arbitration Court of Appeal dated 03.08.2010 N 09AP-16266/2010 in case N A40-13306/10-76-26/PO).

An organization may sell a fixed asset in respect of which a depreciation bonus was applied. If the sale occurs before the expiration of five years from the date of commissioning of the fixed asset in respect of which the depreciation bonus was applied, then the amount of the depreciation bonus in accordance with paragraph. 4 paragraph 9 art. 258 of the Tax Code of the Russian Federation is subject to restoration and inclusion in the tax base for income tax in the reporting (tax) period in which the fixed asset is sold. This rule applies to fixed assets put into operation starting from January 1, 2008.

The calculation of the period required to write off a loss from the sale of an under-depreciated fixed asset is influenced by increasing and decreasing depreciation coefficients (increasing coefficients are not higher than 2 - for objects operating in an aggressive environment or with an increased shift, and not higher than 3 - for leased items (clause. Clauses 1 and 2 of Article 259.3 of the Tax Code of the Russian Federation)). The application of increasing or decreasing coefficients to the depreciation rates of depreciable property objects entails a change in the useful life of such objects: when applying increasing coefficients - a decrease, and when applying decreasing coefficients - an increase (clause 13 of Article 258 of the Tax Code of the Russian Federation).

For example , when selling cars and passenger minibuses, for depreciation of which a reduction factor of 0.5 was applied, the resulting loss should be included in expenses evenly over the period, which is calculated as the difference between the useful life, adjusted by a factor of 0.5, and the actual period operation of the vehicle until the date of its sale (Letters of the Ministry of Finance of Russia dated 04/20/2009 N 03-03-06/1/262, dated 04/02/2008 N 03-03-06/2/34, etc.).

When determining the actual service life of an object of depreciable property, on the basis of which the period for writing off the loss is calculated, the period during which the object was mothballed for more than three months is not taken into account. According to paragraph 3 of Art. 256 of the Tax Code of the Russian Federation, such a fixed asset is excluded from depreciable property, and after re-mothballing, the useful life is extended for the period that the fixed asset object is mothballed.

The loss from the sale of depreciable property, which is actually used longer than the established useful life, is taken into account at a time (Letter of the Ministry of Finance of Russia dated December 27, 2005 N 03-03-04/1/454).

In order to correctly determine the period for writing off a loss for a specific item of depreciable property, the organization must reflect the following information in analytical accounting:

name of objects sold at a loss;

the number of months during which the loss can be included in other expenses;

the amount of expenses incurred each month.

Unlike tax accounting, in accounting, the amount of loss from the sale of depreciable property is related to the expenses of the current period and is included in other expenses at a time in the month when the sale occurred. Therefore, for the amount of the loss that will be taken into account for tax purposes in the following reporting periods, a deductible temporary difference is formed in the accounting records of the selling organization on the date of sale of the depreciable property. It results in the formation of a deferred tax asset.

Example 1 . Kommersant LLC sold its fixed asset in February. The loss from this operation amounted to 240,000 rubles. The remaining service life of the sold fixed asset is 12 months. In accounting, the amount of loss is attributed to February expenses as a lump sum. In tax accounting, 20,000 rubles will be included in expenses every month for 12 months. (RUB 240,000: 12 months). In February, the occurrence of a deferred tax asset in accounting is reflected in the accounting entry:

Dt 09 “Deferred tax assets”; Kt 68, subaccount “Calculations for income tax” - 48,000 rubles. (RUB 240,000 x 20%).

In tax accounting, starting in March, a portion of the loss in the amount of 20,000 rubles will be written off monthly until full repayment. At the same time, the deferred tax asset will be written off in accounting:

Dt 68, subaccount “Calculations for income tax”; Kit 09 - 4000 rub. (RUB 20,000 x 20%) - part of the deferred tax asset is repaid.

Data on the loss incurred upon the sale of depreciable property and the amount that is included in expenses for profit tax purposes in a specific reporting (tax) period are reflected in the corporate income tax return. The form of the declaration on which to report for 2010, and the procedure for filling it out, were approved by Order of the Federal Tax Service of Russia dated December 15, 2010 N ММВ-7-3 / [email protected] , registered with the Ministry of Justice of Russia on February 2, 2011. To reflect losses from sales depreciable property in the declaration, the organization must fill out sheet 02, as well as Appendices NN 1, 2 and 3 to sheet 02. Filling out the declaration must begin with Appendix No. 3 to sheet 02.

In Appendix No. 3 to sheet 02, lines 010 - 060 and 340 - 360 are filled in.

Line 010 of Appendix No. 3 to Sheet 02 indicates the total number of depreciable property items that the organization sold in the reporting (tax) period, and line 020 indicates the number of items sold at a loss. Line 030 reflects the total amount of proceeds from the sale of depreciable property, and line 040 reflects the residual value of such property and expenses associated with its sale.

Lines 010 - 030 of Appendix No. 3 to Sheet 02 are filled out in relation to all depreciable property items sold in the reporting (tax) period, including fixed assets sold at a profit.

Lines 050 and 060 of Appendix No. 3 to Sheet 02 show separately the amount of profit and the amount of loss received from the sale of depreciable property.

The indicators of lines 030, 040 and 060 are reflected respectively in lines 340, 350 and 360 of Appendix No. 3 to sheet 02. In turn, the indicators of these lines are used when filling out sheet 02, as well as Appendices NN 1 and 2 to sheet 02. The indicator of line 340 of the Appendix No. 3 to sheet 02 is indicated in line 030 of Appendix No. 1 to sheet 02, line indicator 350 is in line 080 of Appendix No. 2 to sheet 02, and line indicator 360 is in line 050 of sheet 02 “Losses”.

When calculating profit on line 060 “Total profit (loss)” of sheet 02, the data on line 050 are added to income, i.e. loss from the sale of depreciable property, shown on line 050, is recorded with a “plus” sign. As a result of this action, the loss received from the sale of depreciable property is not taken into account for profit tax purposes at a time. Part of the loss from the sale of depreciable property, which is recognized in tax accounting, is reflected in line 100 of Appendix No. 2 “Amount of loss from the sale of depreciable property attributable to expenses of the current reporting (tax) period” and as part of line 130 of Appendix No. 2 to sheet 02.

Example 2 . In November 2010, Kommersant LLC sold a CNC machine for RUB 354,000. (including VAT - 54,000 rubles). According to the tax accounting of the organization, the initial cost of the fixed asset is 1,550,000 rubles, the amount of accrued depreciation is 1,310,000 rubles. The residual value of the CNC machine at the time of sale is RUB 240,000. (RUB 1,550,000 - RUB 1,310,000). The costs associated with the sale of this fixed asset amounted to 5,000 rubles. (excluding VAT). The useful life of a CNC machine for tax accounting purposes is 48 months. Its actual service life up to and including November 2010 is 38 months. From the sale of a CNC machine, Kommersant LLC received a loss in the amount of 55,000 rubles. (354,000 rub. - 54,000 rub. - 240,000 rub. - 5,000 rub.).

For profit tax purposes, the loss from the sale of a CNC machine is taken into account evenly over 10 months. (48 months - 38 months). The amount of loss recognized in tax accounting monthly is 5,500 rubles. (RUB 55,000: 10 months). The amount of the loss is included in other expenses starting from December 2010.

In the income tax return for 2010, the organization must reflect these losses.

OS implementation

Regulatory regulation

Sales are recognized as the transfer of ownership of goods (including fixed assets) on a reimbursable basis (Article 39 of the Tax Code of the Russian Federation). At the same time, organizations must take into account the income and expenses associated with acquisitions and sales.

Income:

- In the accounting system, revenue from the sale of fixed assets is classified as other income and is reflected in the credit of account 91.01 “Other income” (clause 31 of PBU 6/01, clause 7 of PBU 9/99, chart of accounts 1C). Income is recognized at the moment of transfer of ownership of the fixed asset (clause 12 of PBU 9/99).

- In NU, income is the proceeds from the sale of fixed assets without VAT (clause 1 of Article 248 of the Tax Code of the Russian Federation). The date of receipt of income using the accrual method is the date of transfer of ownership of the asset (clause 1, article 39 of the Tax Code of the Russian Federation, clause 3 of article 271 of the Tax Code of the Russian Federation).

Expenses:

- In accounting, this is the residual value of the fixed asset and the costs associated with its implementation (dismantling, transportation, evaluation, etc.) (clause 5, clause 9 of PBU 10/99). Expenses in the accounting system are reflected in the debit of account 91.02 “Other expenses” (clause 31 of PBU 6/01, clause 11 of PBU 10/99, chart of accounts 1C).

- In NU, the amount of expenses that reduce sales income, just as in accounting accounting, includes the residual value of the fixed asset and expenses associated with its sale (Article 249 of the Tax Code of the Russian Federation, paragraph 1, clause 1, Article 268 of the Tax Code of the Russian Federation).

If the sale of fixed assets is carried out, in respect of which a depreciation bonus was previously applied, then the bonus must be restored if:

- the object is sold to a person who is interdependent with the taxpayer earlier than after 5 years from the date of commissioning.

VAT

Sales of fixed assets are subject to value added tax on the date of shipment (transfer) of fixed assets (clause 3 of article 38 of the Tax Code of the Russian Federation, clause 1 of article 39 of the Tax Code of the Russian Federation, subclause 1 of clause 1 of article 146 of the Tax Code of the Russian Federation, article 147 of the Tax Code RF).

The date of shipment of the OS is recognized (clause 1, clause 1, clause 16, article 167 of the Tax Code of the Russian Federation):

- date of drawing up the transfer and acceptance certificate (for example, OS-1) - for movable property;

- the date of transfer to the buyer according to the transfer and acceptance certificate, regardless of the date of state registration of the transfer of ownership - for real estate.

Features of calculating the tax base and the applied VAT rate depend on how input VAT was taken into account when purchasing fixed assets:

- VAT was not included in the cost of fixed assets (clause 1 of Article 154 of the Tax Code of the Russian Federation): tax base - the contractual cost of the sold fixed assets;

- VAT rate is 20%.

- tax base - profit from the sale of fixed assets, representing the difference between the contractual value of the sold fixed assets and its residual value;

When selling fixed assets, it is not necessary to restore the VAT accepted for deduction upon purchase, even if the fixed assets were sold at a loss (clause 3 of Article 170 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated January 15, 2015 N 03-07-11/422).

The amount of accrued VAT is reflected in Dt 91.02 “Other expenses” in correspondence with Kt 68.02 “Value added tax”.

Accounting in 1C

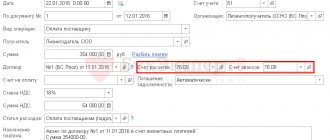

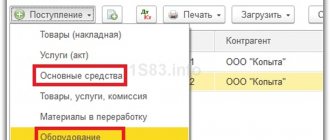

The sale of fixed assets is documented in the document Transfer of fixed assets in the section fixed assets and intangible assets - Disposal of fixed assets - Transfer of fixed assets.

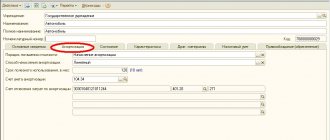

The header of the document states:

- OS event - description of the OS transfer event. In our example - Sale , which has an OS event type - Transfer ;

- Agreement - a document according to which settlements are made with the buyer, Type of agreement - With the buyer .

In our example, settlements under the agreement are carried out in rubles PDF. As a result of selecting such an agreement, the following subaccounts for settlements with the buyer are automatically established the Transfer of Assets

- Settlement account - 62.01 “Settlements with buyers and customers”;

- Advances account - 62.02 “Calculations for advances received.”

If necessary, accounts for settlements with the buyer can be corrected in the document manually or configured for the automatic insertion of other accounts for settlements with the counterparty.

On the Fixed Assets , the following is indicated:

- Fixed asset - implemented by the OS, selected from the Fixed Assets directory;

- Income account - 91.01 “Other income”;

- Subconto - an analytical item for accounting for other income and expenses, selected from the directory Other income and expenses, Type of article - Sales of fixed assets ;

- VAT account - 91.02 “Other expenses”;

- Expense account - 91.02 “Other expenses”. For analytical accounting, the same Subconto as for other income.

Postings according to the document

The document generates transactions:

- Dt 62.01 Kt 91.01 - revenue from the sale of fixed assets;

- Dt 91.02 Kt 01.09 - write-off of residual value;

- Dt 91.02 Kt 68.02 - accrual of VAT on the sale of fixed assets;

- Dt Kt 02.01 - depreciation calculation for the month of disposal of fixed assets;

- Dt 02.01 Kt 01.09 - write-off of accumulated depreciation to determine the residual value;

- Dt 01.09 Kt 01.01 - write-off of the original cost to determine the residual value;

Control

Calculation of monthly depreciation amount:

Calculation of financial results:

Documenting

The organization must approve the forms of primary documents, incl. OS implementation document and an inventory card form for OS accounting. In 1C, the OS Acceptance and Transfer Certificate (OS-1) and the OS Inventory Card (OS-6) are used.

The form can be printed by clicking the Print button - Certificate of acceptance of the transfer of OS (OS-1) of the document Transfer of OS . PDF

Based on this act, a record of disposal is made in the inventory card of the sold fixed assets, which is attached to the act of acceptance and transfer of fixed assets (clause 81 of the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n).

the OS Inventory Card (OS-6) button in Fixed Assets directory . PDF

Income tax return

Starting from the half-year declaration, the loss from the sale of fixed assets will be reflected in Appendix 3 to Sheet 02: PDF

- line 010 - number of retired fixed assets;

- line 020 - number of retired fixed assets with a loss;

- line 030 - revenue from the sale of fixed assets;

- line 040 - residual value of fixed assets;

- line 060 - loss from the sale of fixed assets.

Corporate income tax

Proceeds from the sale of an asset, determined on the basis of the contract price of the asset (excluding VAT), are recognized as income from the sale on the date of transfer of ownership of the asset to the buyer (clause 1, paragraph 5, clause 1, article 248, clause 1, 2, Article 249, paragraph 3, Article 271 of the Tax Code of the Russian Federation).

The organization has the right to reduce income from the sale of an asset by the residual value of this object, determined in accordance with clause 1 of Art. 257 of the Tax Code of the Russian Federation (clause 1, clause 1, article 268 of the Tax Code of the Russian Federation).

In this case, the residual value of the sold fixed asset exceeds the proceeds from its sale, therefore, the organization received a loss from the sale of the fixed asset in the amount of 80,000 rubles. (RUB 767,000 - RUB 117,000 - RUB 730,000).

[B=63]

The resulting loss is included in other expenses in equal shares over a period defined as the difference between the useful life of this property and the actual period of its operation until the moment of sale (Clause 3 of Article 268, Article 323 of the Tax Code of the Russian Federation). Therefore, in this case, the loss is recognized over 73 months (85 months - 12 months) in the amount of RUB 1,095.89. (RUB 80,000 / 73 months) monthly starting from the month following the month of transfer of the fixed asset object to the buyer.

Issuance of SF for shipment to the buyer

The organization is obliged to issue an invoice within 5 calendar days from the date of shipment and register it in the sales book (clause 3 of article 168 of the Tax Code of the Russian Federation).

You can issue an invoice to the buyer by clicking the Issue an invoice on the document Transfer of fixed assets . PDF

Invoice data is automatically filled in based on the document Transfer of Assets .

- Operation type code : “Sale of goods, works and services and operations equivalent to it.”

Documenting

You can print the completed invoice form by clicking the Print from the document Invoice issued or the document Transfer of Assets . PDF

Sales Book report can be generated from the Reports – VAT – Sales Book section. PDF

VAT declaration

The amount of accrued VAT is reflected in the VAT return:

In Section 3 p. 010 “Implementation (transfer on the territory of the Russian Federation...)”: PDF

- amount of sales revenue, excluding VAT;

- the amount of accrued VAT;

In Section 9 “Information from the sales book”:

- invoice issued. Operation type code "".

Deregistration of a car

When selling a vehicle, it is necessary to deregister the vehicle with the traffic police. From the moment of deregistration, the collection of transport tax stops.

If the vehicle is deregistered during the year, then the advance payment for transport tax is calculated taking into account the ownership coefficient (clause 3 of Article 362 of the Tax Code of the Russian Federation).

Deregistration of a vehicle with the State Traffic Safety Inspectorate is completed in the register of information Registration of vehicles, type of operation Deregistration in the section Directories - Taxes - Transport tax.

The register indicates:

- Fixed asset - a vehicle that is deregistered;

- Date - the date of its deregistration with the traffic police.

Sale of fixed assets at a loss

LLC on the general taxation system. We are going to sell fixed assets purchased in 2002. In accounting and tax accounting, depreciation is calculated equally. Sales will be at a loss.

How to record these transactions in accounting?

Accounting for the disposal of fixed assets is carried out in accordance with PBU 6/01 “Accounting for fixed assets”

, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n,

Methodological guidelines for accounting of fixed assets

, approved by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n.

Write-off of the cost of an item of fixed assets is reflected in accounting, as a rule, in the subaccount for accounting for the disposal of fixed assets

, opened to the fixed assets account.

, the original (replacement) cost is written off to the debit of the specified subaccount.

fixed asset object in correspondence with the corresponding subaccount of the fixed asset accounting account, and in credit of the specified subaccount -

the amount of accrued depreciation

for the useful life of the organization of this object in correspondence with the debit of the depreciation accounting account.

At the end of the disposal procedure, the residual value

an object of fixed assets

is written off from the credit of the subaccount for accounting for the disposal of

fixed assets to

the debit of the profit and loss account as operating expenses

.

Income and expenses from the disposal of fixed assets are subject to credit to the profit and loss account as operating income and expenses and are reflected in the accounting records in the reporting period to which they relate.

DEBIT 62 CREDIT 91-1

– proceeds from the sale of fixed assets;

DEBIT 01, subaccount “Disposal of fixed assets” CREDIT 01

– the initial cost of the disposed fixed asset item;

DEBIT 02 CREDIT 01, subaccount “Retirement of fixed assets”

– the amount of accrued depreciation;

DEBIT 91-2 CREDIT 01, subaccount “Retirement of fixed assets”

– the residual value of the disposed fixed asset is written off.

The loss from the sale of a fixed asset is reflected in the debit of account 99

in correspondence with the credit of

account 91

subaccount “Balance of other income and expenses” with the final turnover of the month.

According to Art. 268 Tax Code of the Russian Federation

For profit tax purposes, income from the sale of fixed assets is reduced by the residual value of the depreciable property.

In accordance with Art. 257 of the Tax Code of the Russian Federation, the residual value of fixed assets put into operation after 01/01/2002.

, is defined as the difference between the original cost and the amount of depreciation accrued over the period of operation.

If the residual value of depreciable property, taking into account the costs associated with its sale, exceeds the proceeds from its sale

, the difference between these values is recognized as a taxpayer’s loss taken into account for tax purposes.

The resulting loss is included in other expenses

the taxpayer in equal shares over a period defined as the difference between the useful life of this property and the actual period of its operation until the moment of sale.

The period is determined in months and is calculated as the difference between the number of months of the useful life of this property and the number of months of operation of the property until the moment of its sale, including the month in which the property was sold.

In Appendix No. 2 to Sheet 02 of the income tax return

organizations approved by order of the Ministry of Taxes of the Russian Federation dated November 11, 2003 No. BG-3-02/614 (as amended on June 3, 2004),

line 090

indicates the loss from the sale of depreciable property in the part related to other expenses of the current period.

Since when selling a fixed asset at a loss, the amount of the loss for tax purposes is not accepted in the month of sale of the fixed asset, a deductible temporary difference

, which leads to the formation

of deferred income taxes

.

According to PBU 18/02 “Accounting for income tax calculations”

, approved by order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n, that part of the deferred income tax, which should reduce the amount of income tax payable to the budget in the next reporting period or in subsequent reporting periods,

is recognized as a deferred tax asset

.

Deferred tax asset

is calculated as the product of the deductible temporary difference and the income tax rate.

The deferred tax asset is reflected in the debit of account 09 “Deferred tax assets”

and

account credit 68

.

When the loss (deductible temporary difference) is repaid in subsequent reporting periods, the deferred tax asset will also decrease.

Amounts by which deferred tax assets are reduced or fully repaid in the current reporting period are reflected in accounting as a credit to account 09

in correspondence with

the score 68

.

of current income tax will decrease

(tax payable to the budget).

Reflection in the tax accounting amount of the loss from the sale of fixed assets

If the residual value of an asset, taking into account the costs associated with its sale, exceeds the proceeds from its sale, then the difference between these values is recognized as a loss.

The loss from the sale of fixed assets under NU cannot be fully taken into account at the time of sale of the fixed assets. It is included in indirect (other) expenses in equal shares over the remaining useful life of the asset, defined as the difference between the established useful life of the asset and the actual life of its operation until the moment of sale (clause 3 of Article 268 of the Tax Code of the Russian Federation).

The loss under the accounting system is fully taken into account at the time of sale (clause 31 of PBU 6/01).

Determining the amount of loss

The amount of loss subject to equal write-off in tax accounting can be determined using the report Register of information on financial results from the sale of fixed assets and intangible assets in the section Reports - Income tax - Tax accounting registers - Register of reporting data generation - Financial results from the sale of fixed assets and intangible assets.

Reflection in the tax accounting amount of the loss from the sale of fixed assets

There is no standard document for reflecting in NU the operation of accounting for the amount of loss from the sale of fixed assets in 1C.

Therefore, we propose to reflect the loss from the sale of fixed assets according to NU by posting Dt 97.21 Kt 91.09:

- in the debit of account 97.21 - the transfer of losses to the future is reflected to automatically include the loss in other expenses in equal shares over the remaining useful life of the fixed assets;

- on the credit of account 91.09 - the loss is excluded from the expenses of the current period in NU.

This operation is reflected using the document Transaction entered manually, the operation type Operation in the section Operations – Accounting – Transactions entered manually.

The document states:

- Date - date of implementation of the OS;

- The amount is not indicated, because in accounting, the loss was recognized at a time when the document Transfer of Assets .

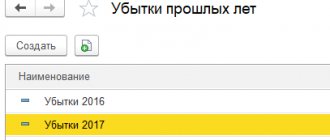

The reference book Deferred Expenses specifies the parameters for recognizing losses from the sale of fixed assets in the National Institution:

- Type for NU - Losses from the sale of depreciable property ;

- Amount - 108,000 , i.e. amount of loss according to NU;

The amount in the Deferred Expenses is indicated for reference only. To calculate the monthly loss amount, the amount indicated in account 97.21 is used, i.e. Amount NU Dt document Transaction entered manually .

- Recognition of expenses - By month ;

- The write-off period from to is the period during which the loss will be taken into account in other expenses for NL. Set starting from the month following the implementation, ending with the last month of the OS SPI.

Control

Expenses

In tax accounting, the reduction of income subject to income tax includes:

- the residual tax value of the object, which is reflected when posting the document “Transfer of fixed assets” in the debit of account 91.02.1 “Expenses associated with the sale of fixed assets”;

- the amount of expenses directly related to sales (according to paragraph 1 of Article 268 of the Tax Code of the Russian Federation: costs of storage, packaging, maintenance, transportation.

These amounts are reflected when posting documents in the program and manual operations in the debit of account 91.02.1 “Expenses associated with the sale of fixed assets.” In this case, you should select the item of other income and expenses with the type “Income (expenses) associated with the sale of fixed assets.”

According to paragraph 31 of PBU 6/01, the residual value of depreciable property and all expenses from its disposal are taken into account in reducing operating income.

As a result, the difference between the credit turnover of account 91.01.1 and the debit turnover of account 91.02.1 for each fixed asset and for items of other income and expenses with the form “Income (expenses) associated with the sale of fixed assets” will show the financial result of the sale of each depreciable object .

If a loss is received as a result of the sale of some fixed assets, then it is accepted for tax purposes in a special manner established by paragraph 3 of Article 268 of the Tax Code of the Russian Federation.

In order to write off the amount of the loss in tax accounting to the account of deferred expenses, we recommend using the document “Operation”, in which we will create entries on the credit of account 91.09 “Expenses associated with the sale of fixed assets” and the debit of account 97.03 “Negative result from the sale of depreciable property » for each fixed asset.

In the new element of the directory “Future expenses” the details are filled in as follows:

- “Type of RBP” - “Negative result from the sale of depreciable property”;

- “Method of recognizing expenses” - by month;

- “Amount”—the amount of loss;

- “Start of write-off” - the date of the beginning of the month following the month of transfer of the object;

- “End of write-off” - the end date of the end of the month of depreciation of this object in the event that the object had not been sold;

- “Account” - 91.02 “Other expenses”;

- “Account (NU)” - 91.02.P “Other expenses”;

- “Subconto BU (NU)” is an item of other income and expenses with the type “Income (expenses) associated with the sale of fixed assets.”

Temporary differences in the assessment of deferred expenses and non-operating expenses are also reflected in the transaction with a posting according to the type of accounting BP from the credit of account 91.02.P to the debit of account 97.03 for the amount of the loss with a minus.

When carrying out the regulatory operation “Write-off of RBP”, losses from the sale of fixed assets will be evenly included in other expenses of the current period. These expenses will be included in the report “Register of accounting for other expenses of the current period” with the type “Loss from the sale of depreciable property” and on page 100 of appendix. 02 sheet 02 “The amount of loss from the sale of depreciable property related to the expenses of the current (tax) period.”

Receipt of payment from the buyer

At the time of sale of the fixed assets, the buyer’s receivables were reflected in accordance with Dt 62.01 “Settlements with buyers and customers.” When payment is received from the buyer, the receivables are repaid and the posting Dt Kt 62.01 (chart of accounts 1C) is generated.

Receipt of payment from the buyer is documented with the document Receipt to the current account; transaction type Payment from the buyer based on the document Transfer of fixed assets by clicking the Create button based on - Receipt to the current account.

Document Receipt to current account transaction type Payment from buyer can be:

- enter through the section Bank and cash desk – Bank – Bank statements – Receipt button;

- download from the Client-Bank program or directly from the bank if the 1C:DirectBank service is connected.

The document states:

- from - date of payment by the buyer, according to the bank statement;

- According to document No. from - the number and date of the buyer’s payment order, according to the bank statement.

- Payer - the buyer who transferred the payment;

- Amount - payment amount in rubles, according to the bank statement;

- Agreement - a document according to which settlements are made with the buyer, Type of agreement - With the buyer .

- An income item is a cash flow item. In our example, fixed assets are sold, so the Income Item is indicated with the Type of Movement - Proceeds from the sale of non-current assets (except for financial investments) .

Selecting the Income Item in the payment document from the buyer is necessary to automatically fill out the Cash Flow Statement.

Postings according to the document

Document we generate transactions:

- Dt Kt 62.01 – receipt of payment from the buyer.

Accounting for the monthly amount of loss as part of indirect expenses for NU

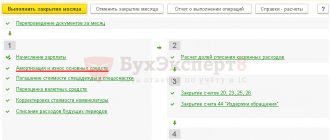

Every month until the loss is written off in full, in the procedure menu Closing the month is a routine operation Write-off of deferred expenses .

Postings according to the document

The document generates transactions:

- Dt 91.02 Kt 97.21 - recognition in the current month of the monthly amount of loss under NU.

Control

The calculation of the portion of the amount of loss in the taxable income included monthly in other expenses is determined by dividing the entire amount of the unaccounted loss in the taxable income by the remaining useful life.

Income tax return

Starting from the half-year declaration, the monthly amount of the loss written off is reflected as part of indirect (other) expenses: PDF

- Sheet 02 Appendix No. 2 page 100 “Amount of loss from the sale of depreciable property.”

Test yourself! Take a test on this topic using the link >>

Reflection in tax reporting

In the income tax return, the amount of current expenses from the loss on the sale of fixed assets is reflected on page 100 “The amount of loss from the sale of depreciable property related to the expenses of the current period of the reporting (tax period)”:

Also, these expenses can be analyzed using the report “Register of accounting for other expenses of the current period” with the view “Loss from the sale of depreciable property”:

Accounting and tax interface – Tax accounting – Registers for generating reporting data – Register for accounting for other and indirect expenses of the current period