Increase in the minimum wage from January 1, 2021: was it or not?

The minimum wage is the minimum wage that an organization or individual entrepreneur (employer) must accrue to employees for the month they have fully worked (Article 133 of the Labor Code of the Russian Federation).

The Moscow authorities increased the minimum wage in Moscow from January 1, 2021. What is the size of the new minimum wage in Moscow in 2021? From January 1, 2018, the minimum wage in Moscow is 18,742 rubles (Decree of the Moscow Government dated September 12, 2017 No. 663-PP).

At the end of 2021, Moscow authorities recorded the cost of living for the third quarter of 2021. (Decree of the Moscow Government dated December 5, 2017 No. 952-PP). But the amount turned out to be 289 rubles less than the subsistence level for the second quarter. Therefore, the minimum wage in Moscow from January 1, 2021 remained at 18,742 rubles. After all, it is impossible to reduce the minimum wage due to a decrease in the cost of living (clause 3.1.1 of the agreement dated December 15, 2015). By the way, this amount has not changed since October 1, 2021. You can trace how the minimum wage increased in Moscow (see table by year):

| Validity | Amount (rubles per month) |

| 01.10.2017 – | 18742 |

| 01.07.2017 – 30.09.2017 | 17642 |

| 01.10.2016 – 30.06.2017 | 17561 |

| 01.01.2016 – 30.09.2016 | 17300 |

| 01.11.2015 – 31.12.2015 | 17300 |

| 01.06.2015 – 31.10.2015 | 16500 |

| 01.04.2015 – 31.05.2015 | 15000 |

| 01.01.2015 – 31.03.2015 | 14500 |

| 01.06.2014 – 31.12.2014 | 14000 |

| 01.01.2014 – 31.05.2014 | 12600 |

| 01.07.2013 – 31.12.2013 | 12200 |

| 01.01.2013 – 30.06.2013 | 11700 |

| 01.07.2012 – 31.12.2012 | 11700 |

| 01.01.2012 – 30.06.2012 | 11300 |

| 01.07.2011 – 31.12.2011 | 11100 |

| 01.01.2011 – 30.06.2011 | 10400 |

| 01.05.2010 – 31.12.2010 | 10100 |

| 01.01.2010 – 30.04.2010 | 9500 |

| 01.09.2009 – 31.12.2009 | 8700 |

| 01.05.2009 – 31.08.2009 | 8500 |

| 01.01.2009 – 30.04.2009 | 8300 |

| 01.09.2008 – 31.12.2008 | 7650 |

| 01.05.2008 – 31.08.2008 | 6800 |

| 01.09.2007 – 30.04.2008 | 6100 |

| 01.05.2007 – 31.08.2007 | 5400 |

| 01.09.2006 – 30.04.2007 | 4900 |

| 01.05.2006 – 31.08.2006 | 4100 |

| 01.10.2005 – 30.04.200 | 3600 |

| 01.05.2005 – 30.09.2005 | 3000 |

| 01.10.2004 – 30.04.2005 | 2500 |

| 01.05.2004 – 30.09.2004 | 2000 |

| 2nd half of 2003 | 1800 |

| 01.01.2003 – 30.06.2003 | 1500 |

| 01.09.2002 – 31.12.2002 | 1270 |

| 01.01.2002 – 30.08.2002 | 1100 |

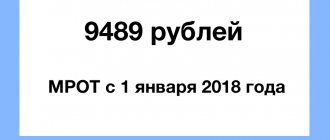

From January 1, 2021, the federal minimum wage is 9,489 rubles. See “Minimum wage from January 1, 2021.” However, the Moscow “minimum wage” is higher than the federal one. After all, regions have the right to set their own minimum wage, but not less than the federal one (Part 4 of Article 133.1 of the Labor Code of the Russian Federation).

The minimum wage in the capital Moscow directly depends on the cost of living for the working population living in this region. This follows from clause 3.1.2 of the tripartite agreement between the Moscow Government, Moscow associations of trade unions and employers, concluded on December 15, 2015. Therefore, this amount continues to apply from January 1, 2018:

| Region | Region code | Minimum wage (RUB) |

| Moscow | 77 | 18 742* |

* The minimum wage includes additional payments, allowances, bonuses and other payments, except for payments in accordance with Articles 147, 151–154 of the Labor Code.

Main conclusions

Next, let’s summarize all of the above and tabulate the amounts of insurance premiums for individual entrepreneurs “for themselves” from 2021 and focus on the main changes:

| RUR 26,545 – mandatory amount of fixed pension contributions from 2021. From 2021 it will be indexed. |

| 5840 rub. – mandatory amount of fixed medical contributions from 2021. From 2021 it will be indexed. |

| From 2021, the maximum amount of contributions to the Pension Fund budget is 212,360 rubles. |

| From 2021, pension and medical contributions are no longer “tied” to the minimum wage. |

Read also

24.01.2018

Minimum wage and Moscow salary: dependence

Moscow employers (organizations and individual entrepreneurs) must set a salary no less than the Moscow minimum wage (RUB 18,742) only if they have joined the Moscow regional agreement. Those employers who, within 30 calendar days after the publication of the agreement, have not sent a written reasoned refusal to join to the labor authority of a constituent entity of the Russian Federation, will automatically join it. If your such refusal has been sent, then the salary in Moscow from January 1, 2021 can be compared with the federal minimum wage (9489 rubles). For many employers, the difference is noticeable: 9253 rubles. = (RUR 18,742 – RUR 9,489).

The Moscow minimum wage, applied from January 1, 2021, already includes a tariff rate (salary) or wages under a non-tariff system, as well as additional payments, allowances, bonuses and other payments, with the exception of payments:

- for working in harmful and dangerous conditions;

- combining professions (positions), expanding service areas, increasing the volume of work;

- night and overtime work, work on weekends and holidays.

In other words, for overtime work, you need to pay above the Moscow minimum wage. This procedure follows from clause 3.1.3 of the Tripartite Agreement.

Compare the total payment amount for the month with the minimum wage before you withhold personal income tax. That is, a person can receive less than the minimum wage.

Include in the minimum wage all bonuses and rewards included in the remuneration system. The exception is regional coefficients and bonuses; they are calculated above the minimum wage.

What has been talked about for so long has come true

For many years, a paradoxical situation has persisted in the country when the cost of living, that is, the amount necessary to ensure livelihoods, exceeds the minimum wage. In fact, this means that in the Russian Federation there is a whole category of working citizens whose earnings are not enough to satisfy minimal human needs.

The subsistence minimum is the cost of a conditional consumer basket, which includes a minimum set of food products, non-food products and services that are necessary to ensure human life. The cost of living also includes mandatory payments and fees.

The cost of living is approved at the end of each quarter, using numerous statistical data, including the inflation rate, to determine it. The federal subsistence minimum is set by the Government of Russia, and regional minimums are set by regional governments.

You can read more about the subsistence level and its difference from the minimum wage in the article “We use the subsistence level to calculate alimony.”

Finally, things have reached the final stage of raising the minimum wage to the subsistence level established in Russia. Initially, the Ministry of Labor prepared a bill on a two-stage increase in the minimum wage (https://regulation.gov.ru/projects/List/AdvancedSearch#npa=73033):

- from January 1, 2021 – up to 85% of the subsistence level of the working-age population;

- from January 1, 2021 – up to 100%.

Responsibility

For wages below the minimum wage, fines are imposed without proper justification. The company, if the violation is the first, faces a fine from 30,000 to 50,000 rubles. If the violation is repeated – from 50,000 to 70,000 rubles. For an official, the sanctions are accordingly: a fine from 1000 to 5000 rubles. and from 10,000 to 20,000 rubles. or disqualification from one to three years. The same rules apply to an entrepreneur as to an official, only disqualification cannot be applied to an individual entrepreneur (clauses 1 and 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Application of the new minimum wage in St. Petersburg in 2018

The regional agreement of September 20, 2017 on the minimum wage in St. Petersburg for 2021 establishes the following minimum wage from January 1, 2021:

- for the minimum salary – 17,000 rubles;

- the tariff rate (salary) of a 1st category employee is 13,500 rubles.

13,500 rubles is less than the minimum wage due to the fact that this amount does not include social and incentive payments (Labor Code of the Russian Federation, Article 129).

In 2021, the minimum wage was at least 16,000 rubles. Accordingly, the minimum wage in 2021 in St. Petersburg will increase by one thousand rubles. At the same time, the tariff rate (salary) of a 1st category employee did not change and remained at the same level – 13,500 rubles.

When in Moscow to rely on the federal minimum wage

Let us highlight several situations when in Moscow in 2021, instead of the regional minimum wage, it is necessary to use the federal one (even if there was no refusal to join the agreement).

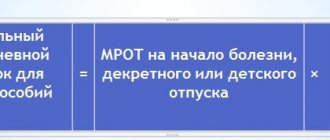

Calculation of benefits

To calculate social benefits, use the federal minimum wage, not the regional one. Let us remind you that “minimum” social benefits are received by employees with earnings below the minimum wage or with short work experience (up to 6 months) (clause 1.1 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ).

Accrual of vacation pay

The federal, and not the regional, minimum wage should also be taken into account when calculating vacation pay. The average monthly earnings calculated for calculating vacation pay cannot be lower than the minimum wage (clause 18 of the Regulations, approved by Government Resolution No. 922 of December 24, 2007). Therefore, you need to compare the calculation result with this indicator. And if the comparison is not in favor of the employer, you will have to make an additional payment up to the federal minimum wage.

Calculation of individual entrepreneur contributions “for oneself” for 2021

Insurance premiums for individual entrepreneurs “for themselves” for 2021 are also determined based on the federal minimum wage. In this case, you need to take the value set at the beginning of the year (RUB 7,500). However: from 2021, individual entrepreneurs’ contributions “for themselves” are no longer tied to the minimum wage. The Tax Code - in paragraph 1 of Article 430 - now spells out fixed amounts that all businessmen will have to pay throughout the year. And these fixed payments do not depend on the amount of income. And it doesn’t matter whether the businessman worked at a profit or at a loss. As a general rule, all individual entrepreneurs will have to pay such contributions to the Federal Tax Service budget. See “Insurance premiums for individual entrepreneurs from 2021“.

Source: “HR Blog”.

Read also

21.11.2017

What contributions do individual entrepreneurs pay: introductory information

Individual entrepreneurs are required to pay insurance premiums on payments and remunerations accrued in favor of individuals within the framework of labor relations and civil contracts for the performance of work and provision of services (Clause 1 of Article 419 of the Tax Code of the Russian Federation). But individual entrepreneurs must also transfer mandatory insurance premiums “for themselves” (Article 430 of the Tax Code of the Russian Federation):

- for pension insurance;

- for health insurance.

Individual entrepreneurs are required to transfer insurance premiums “for themselves” in any case. That is, regardless of whether they are actually conducting business activities or are simply registered as individual entrepreneurs and are not engaged in business. This follows Article 430 of the Tax Code of the Russian Federation. This approach will continue in 2021.

There are also insurance premiums in case of temporary disability and in connection with maternity. Individual entrepreneurs, as a general rule, do not pay this type of insurance premiums (clause 6 of Article 430 of the Tax Code of the Russian Federation). However, payment of these contributions can be made on a voluntary basis. This is provided for in Article 4.5 of the Federal Law of December 29, 2006 No. 255-FZ. Why pay these contributions voluntarily? This is done so that in the event of, for example, illness, the individual entrepreneur can receive an appropriate sickness benefit at the expense of the Social Insurance Fund.

The deadlines for payment of individual entrepreneur contributions have changed

Starting from 2021, the deadlines for paying insurance premiums for individual entrepreneurs have changed. Already charges from payments for 2021, the amount of insurance premiums in the amount of 1 percent for excess of 300,000 rubles can be paid no later than July 1. Previously, the cutoff date was April 1. Also see “Deadlines for payment of individual entrepreneur insurance premiums for 2021“.

Individual entrepreneurs do not pay insurance premiums for injuries at all. Payment of this type of insurance premiums by individual entrepreneurs is not provided even on a voluntary basis.

Minimum wage in 2021 in St. Petersburg and employers

Note that the minimum wage established at the federal level is mandatory for all employers, but this standard does not apply to the regional minimum wage. This is stated in the Labor Code of the Russian Federation (Article 133.1).

That is, the employer has the right, within thirty days after the publication of the proposal to join the regional agreement on the minimum wage, to send a refusal to the authorized body. For the northern capital, such an authorized body is the Committee on Labor and Employment.

If a refusal is not provided, employers are required to apply the regional minimum wage. Based on Part 6 of Article 5.27 of the Administrative Code, if the wages of employees are less than the established minimum wage, this threatens the employer with a fine of up to 50 thousand rubles.

Living wage and minimum wage in St. Petersburg

The concepts of “minimum wage” and “living wage” should not be confused. St. Petersburg is one of the Russian regions where the minimum wage is higher than the subsistence level. The cost of living is published on the official website of the city administration.

The cost of living in the city of St. Petersburg for various categories of the population as of the 3rd quarter of 2021 is as follows:

- per capita – 10,791.60 rubles;

- children – 10,403.20 rubles;

- pensioners – 8612.20 rubles;

- working-age population – 11,868.20 rubles.

This indicator was approved by Decree of the Government of St. Petersburg No. 963 dated November 27, 2021.

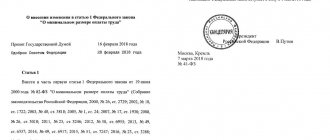

Minimum wage 2021: new indicators from November 1

Labor legislation obliges employers to pay workers wages (with all allowances) not lower than the established minimum in the country.

According to Federal Law No. 41-FZ dated 03/07/2018, from 05/01/2018 the minimum wage in the country is 11,163 rubles. This is the minimum that all employers are required to comply with, regardless of their form of ownership. However, in some regions, the May increase in the minimum wage in 2021 is not the last. From November 1, there should be an increase in the minimum wage in 2021 in Moscow. The latest news from the capital's government confirms that starting from November, employers will have to pay no less than 18,871 rubles, since this is the minimum cost of living established for the second quarter of 2020 (Moscow Government Decree No. 1114-PP dated September 19, 2018). The increase in indicators is insignificant - only 39 rubles, however, this should be recorded in the regulations of employers, and they should pay their employees a little more.

A similar situation is in the Krasnodar region. The regional authorities approved the cost of living for the 2nd quarter for the working population in the amount of 11,185 rubles (Order of the Ministry of Labor and Social Development of the Krasnodar Territory dated July 31, 2018 No. 1084). Moreover, from May 1, companies paid employees 11,163 rubles. Thus, the increase in the minimum wage in the Krasnodar Territory will be 22 rubles.

Let us recall that the increase in regional wage levels is associated with the existence of agreements between trade unions, employers and authorities on equating the regional minimum wage to the subsistence level established in the subject. Such regions, in addition to Moscow and the Krasnodar Territory, also include the Voronezh and Sverdlovsk regions, the Republics of Karelia and Crimea, etc. In the Novosibirsk and Leningrad regions, St. Petersburg and some other Russian regions, the minimum wage at the local level is revised once a year - by January 1 . For them, from 01.11.2018, most likely, nothing will change. But in any case, the editors of the TK Club recommend that you follow the news in your region or region.