Tax agents

The obligation to pay income tax is assigned to legal entities and individual entrepreneurs who have hired personnel. In this case, they act as tax agents, so they must:

- charge tax monthly (with an accrual total);

- withhold the required amount when paying staff;

- make timely payment of personal income tax to the budget.

All of the above requirements are regulated by paragraphs. 3 and 4 tbsp. 226 Tax Code. In this case, funds received by the payer from other organizations are not taken into account in the calculation.

Salary

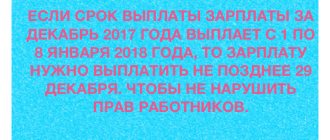

According to Art. 136 of the Labor Code of the Russian Federation, the tax agent is obliged to issue wages every 15 days. But deductions to the personal income tax budget are made only once during this time - after the final calculation of the amount of the employee’s remuneration. And then almost immediately the tax is withheld and paid (see table).

| Payment method | When to pay personal income tax on salary in 2018 | |

| Cashless | Funds are credited to a bank card | On the day of transfer |

| Spot | 1. The cashier of the enterprise hands out the money personally | No later than the date following the day of issue |

| 2. Funds are received from the bank | On the day of receipt | |

These deadlines are established in paragraph 6 of Art. 226 Tax Code of the Russian Federation. However, there are special rules. If you have any difficulties, ask our experts on the forum.

Until when do you pay personal income tax on your salary?

The deadlines for paying personal income tax on wages withheld by a tax agent are specified in paragraph 6 of Article 226 of the Tax Code of the Russian Federation.

In general, the transfer to the budget must be made the next day after the money is paid. If the personal income tax payment deadline falls on a weekend, it is postponed to the first next working day.

The organization must pay wages to employees at least twice a month (Part 6 of Article 136 of the Labor Code of the Russian Federation). When is personal income tax paid on wages for the first half of the month? When should you pay personal income tax on your salary if the wage system provides for weekly transfers of remuneration for work?

In order not to miss the transfer of personal income tax from your salary, we will provide the deadlines in one table:

| Type of payment | Personal income tax payment deadline |

| Advance (for the first half of the month) Transfer for the first, second, etc. weeks of the month, for part of the time worked | On the day following the day of payment of full monthly wages |

| Salary for the whole month | The next day after the date of income transfer |

| Calculation of severance | |

| Financial assistance, other one-time payments | |

| Payment of dividends, including “interim” ones |

An important rule should be added about material assistance: amounts provided to an employee as additional financial support are not always subject to personal income tax. In particular, you can do without withholding income tax if during the year the employee received financial assistance in an amount not exceeding 4,000 rubles. The grounds for such payments are provided in Art. 217 Tax Code of the Russian Federation. The same article states that the employer does not withhold personal income tax from an amount of up to 50,000 rubles paid in connection with the birth of an employee’s child. And according to the Explanations of the Ministry of Finance of Russia in Letter No. 03-04-07/62184 dated September 26, 2017, each parent has the right to a non-taxable limit, that is, in general, a young family can receive up to 100,000 rubles without paying personal income tax.

Payment for rest and illness

Since 2016, when accruing vacation pay and temporary disability benefits to an employee, the deadline for transferring personal income tax has become the last day of the month in which such funds were provided.

EXAMPLE accrued to K.V. Ivanov received vacation pay in the amount of 37,000 rubles, which were transferred to his account on February 8, 2018. The enterprise is obliged to pay income tax to the treasury no later than 02/28/2018.

Also see “Personal Income Tax Payment Deadline”.

Personal income tax on vacation and sick leave: deadlines, sample payment form, 6-NDFL

Vacation pay amounts must be reflected in Form 6-NDFL for the period in which they were paid to employees. Please note: accrued but not paid vacation pay is not included in the calculation according to Form 6-NDFL (letter of the Federal Tax Service of the Russian Federation dated August 1, 2016 No. BS-4-11 / [email protected] ).

In Form 6-NDFL, vacation pay is reflected as follows.

Section 1:

- line 020 – vacation payments transferred to employees in the reporting period, together with personal income tax;

- lines 040 and 070 - personal income tax on paid vacation pay.

Section 2:

- lines 100 and 110 - dates of payment of vacation pay paid in the last quarter of the reporting period;

- line 120 is the last day of the month in which vacation pay is paid. If this day falls on a weekend, you must indicate the next working day;

- line 130 - vacation pay along with personal income tax;

- line 140 – personal income tax withheld from vacation pay.

If an organization (tax agent) recalculates the amount of vacation pay and, accordingly, the amount of personal income tax, then section 1 of the calculation in Form 6-NDFL reflects the total amounts taking into account the recalculation (letter of the Federal Tax Service of the Russian Federation dated May 24, 2016 No. BS-4-11/9248) .

Sick leave benefits are reflected in Form 6-NDFL for the period in which they are paid. Accrued but unpaid benefits are not included in the calculation (letters of the Federal Tax Service of the Russian Federation dated January 25, 2017 No. BS-4-11 / [email protected] , dated August 1, 2016 No. BS-4-11 / [email protected] ).

Income in the form of temporary disability benefits is considered received on the day of its payment (transfer to the taxpayer’s account). Consequently, on line 020 of section 1 of the calculation in Form 6-NDFL, this income is reflected in the presentation period in which this income is considered received.

In section 2 of the calculation in Form 6-NDFL, this operation is reflected as follows:

- lines 100 and 110 - date of payment;

- line 120 - the last day of the month in which benefits were paid.

If it is a holiday, the first working day of the next month is indicated.

- line 130 - benefits along with personal income tax;

- line 140 - tax withheld from benefits.

If an employee’s vacation began in one quarter and ended in another, then there are no special features in filling out form 6-NDFL in this case. After all, vacation pay is reflected in the form for the period when it was actually issued to the employee. However, if the last day of the quarter falls on a weekend, then there are still nuances in filling out 6-NDFL. They are described in the letter of the Federal Tax Service of the Russian Federation dated 04/05/2017 No. BS-4-11/ [email protected]

In this case, amounts paid in the last month of the quarter must be reflected only in section 1. In section 2, vacation pay is included only in the report for the next quarter.