Application of the new minimum wage in St. Petersburg in 2018

The regional agreement of September 20, 2017 on the minimum wage in St. Petersburg for 2021 establishes the following minimum wage from January 1, 2021:

- for the minimum salary – 17,000 rubles;

- the tariff rate (salary) of a 1st category employee is 13,500 rubles.

13,500 rubles is less than the minimum wage due to the fact that this amount does not include social and incentive payments (Labor Code of the Russian Federation, Article 129).

In 2021, the minimum wage was at least 16,000 rubles. Accordingly, the minimum wage in 2021 in St. Petersburg will increase by one thousand rubles. At the same time, the tariff rate (salary) of a 1st category employee did not change and remained at the same level – 13,500 rubles.

Minimum wage in St. Petersburg in 2021 from May 1

From May 1, 2021, the federal minimum wage will increase.

What is the minimum wage established from May 1 in St. Petersburg? Can the salary be less than the minimum wage? What should employers do in connection with the increase in the minimum wage? Is it possible to refuse to apply the regional minimum wage? The answers are in our article. In 2021, the minimum wage was increased twice: from January 1 and May 1. The federal minimum wage has been 11,163 rubles since May. This is the amount that the employer must accrue in favor of the employee if the latter has worked for a full month. For what reasons can an employee receive less than the minimum wage?

Firstly, employers withhold personal income tax from all employees’ accrued salaries. Therefore, the employee will receive less in hand, not 11,163 rubles, but 9,712 rubles.

Secondly, the employee will receive an amount less than the minimum wage if he has worked less than a full month, the labor standard has not been met, or the established amount of work has not been completed.

Thirdly, if an employee works part-time, he receives a salary in proportion to the time worked. Consequently, the amount “on hand” will be less than the minimum wage.

For what reasons can an employee receive more than the minimum wage?

Firstly, the minimum wage increases by a regional coefficient if the employee works in a region where such a coefficient is established (determination of the RF Armed Forces dated December 21, 2012 No. 72-KG12-6).

Secondly, many regions have established their own minimum wage, which is increased compared to the all-Russian one. This is due to socio-economic and climatic features.

The main rule : the regional minimum wage cannot be less than the federal one.

If a constituent entity of the Russian Federation has not revised the regional minimum wage for a long time and it turns out to be less than the federal one, then the minimum wage should be no less than 11,163 rubles.

In the city of St. Petersburg, the minimum wage is established by the Regional Agreement dated September 20, 2021. From the document it follows that:

- The minimum wage for a fully worked month cannot be less than 17,000 rubles,

- The tariff rate of a 1st category employee cannot be less than 13,500 rubles.

Let us recall that the tariff rate is the amount of cash payment (salary) excluding compensation, incentives and social payments. The employer can calculate wages based on the tariff rates established by the company. But in the end, the accrual for a full month should reach 17,000 rubles. Additional payment can be made, for example, through incentive payments. If, in addition to salary, the employee has no other accruals, then the employer will have to make an additional payment up to the regional minimum wage.

In St. Petersburg, the minimum wage is 17,000 rubles. valid from January 1, 2021. Therefore, the May increase in the federal minimum wage will not affect employers in St. Petersburg. There will be no need to review wages or make changes to local regulations, as this should have been done at the beginning of the year.

Minimum wage in 2021 in St. Petersburg and employers

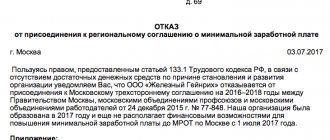

Note that the minimum wage established at the federal level is mandatory for all employers, but this standard does not apply to the regional minimum wage. This is stated in the Labor Code of the Russian Federation (Article 133.1).

That is, the employer has the right, within thirty days after the publication of the proposal to join the regional agreement on the minimum wage, to send a refusal to the authorized body. For the northern capital, such an authorized body is the Committee on Labor and Employment.

If a refusal is not provided, employers are required to apply the regional minimum wage. Based on Part 6 of Article 5.27 of the Administrative Code, if the wages of employees are less than the established minimum wage, this threatens the employer with a fine of up to 50 thousand rubles.

Minimum wage for 2021 in St. Petersburg

Starting from 2021, it is planned to carry out a phased comparison of the minimum wage and the subsistence level. For this purpose, in 2021, the Ministry of Labor, on behalf of the President of the Russian Federation, submitted the idea of a bill for consideration.

The project involves increasing the federal minimum wage (in St. Petersburg, from January 1, 2018, the value will be presented below) across the country in 2021 to the level of 85% of the current subsistence level. Accordingly, the minimum wage will be 9,489.00 rubles.

In 2021, the minimum wage and the cost of living will be completely equal.

Today, the minimum wage in St. Petersburg (an increase is expected in 2021) is 16,000.00 rubles. An important point is to determine the cost of living for employees of state-owned enterprises. Public sector employees, regardless of region, are guided by the federal minimum wage. Accordingly, for residents of St. Petersburg working in the government sector, the minimum wage will be 7,800.00 in 2021.

What changes are expected in the minimum wage from 01/01/2021 in St. Petersburg? Just like the increase in the federal minimum wage, it is planned to increase the regional values of this indicator.

For the federal city of St. Petersburg and the Leningrad region as a whole, the regional minimum wage is differentiated.

Thus, the minimum wage for 2021 in St. Petersburg will be 18,000.00 rubles, while in the region the minimum wage is expected to increase to 12,500.00 rubles.

Despite the fact that an increase in the minimum wage is predicted, the exact date of entry into force of the changes is still unknown, since the draft law under consideration has not been approved.

After the document adopts the status of law, the signing of a regional agreement on the minimum wage in St. Petersburg 2021 will also be relevant.

Thus, the prospects for increasing the “minimum wage” should be taken into account by all employers without exception in order to prevent the application of penalties.

Similar articles

- Minimum wage from July 1, 2018

- Minimum wage from 01/01/2021

- Increasing unemployment benefits and reducing the period of their payments

- Minimum wage for 2021 by region table

- Minimum wage from 01/01/2021

Living wage and minimum wage in St. Petersburg

The concepts of “minimum wage” and “living wage” should not be confused. St. Petersburg is one of the Russian regions where the minimum wage is higher than the subsistence level. The cost of living is published on the official website of the city administration.

The cost of living in the city of St. Petersburg for various categories of the population as of the 3rd quarter of 2021 is as follows:

- per capita – 10,791.60 rubles;

- children – 10,403.20 rubles;

- pensioners – 8612.20 rubles;

- working-age population – 11,868.20 rubles.

This indicator was approved by Decree of the Government of St. Petersburg No. 963 dated November 27, 2021.

Minimum wage from January 1, 2021: new size

The minimum wage has been increased to 9,489 rubles from January 1, 2021. The calculation of many payments depends on the new minimum wage, including temporary disability benefits, maternity benefits, child care benefits for up to 1.5 years, as well as numerous social benefits, the amount of which is tied to the minimum wage.

You can track the latest increase in the minimum wage from our table, which takes into account changes from 2021.

| The period from which the minimum wage is established | Amount of the minimum wage (rub., per month) | Regulatory act establishing the minimum wage |

| From January 1, 2021 | 9489 | |

| from July 1, 2021 | 7 800 | Art. 1 of the Federal Law of December 19, 2016 No. 460-FZ |

| from July 1, 2021 | 7 500 | Art. 1 of Federal Law dated June 2, 2016 No. 164-FZ |

| from January 1, 2021 | 6 204 | Art. 1 of the Federal Law of December 14, 2015 No. 376-FZ |

As you can see, from January 1, 2021, there was a fairly significant increase in the minimum wage. For 1689 rub. (9489 rub. – 7800 rub.). Why did this happen?

This might also be useful:

- The minimum wage and the cost of living are planned to be equal in 2021

- How to bypass 54-FZ

- Increasing K1 for UTII in 2021

- Tax calendar for 2021 for individual entrepreneurs

- Production calendar for 2021

- Increasing the minimum wage in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Minimum wage from January 1, 2021 and wages

The minimum wage is the minimum wage that an organization or individual entrepreneur (employer) must accrue to employees for the month they have fully worked (Article 133 of the Labor Code of the Russian Federation). However, keep in mind that an employee may receive less than the minimum wage in person - minus personal income tax and other deductions, for example, alimony. Accordingly, from January 1, 2018, it is impossible to pay less than 9,489 rubles.

It is worth noting that the salary of employees from January 1, 2018 may be less than 9,489 rubles. After all, the total salary, which includes (Article 129 of the Labor Code of the Russian Federation) cannot be less than the minimum wage:

- remuneration for work;

- compensation payments, including additional payments and allowances;

- incentive payments (bonuses).

The total amount of all such payments from January 1, 2021 must be at least 9,489 rubles.

If, from January 1, 2021, the employee’s salary is less than the minimum wage (9,489 rubles), then the employer may be held accountable in the form of fines. The fine for an organization can range from 30,000 to 50,000 rubles, and if detected again - from 50,000 to 70,000 rubles. For a director or chief accountant, the liability may be as follows: for a primary violation, they may issue a warning or a fine of 1,000 to 5,000 rubles, for a repeated violation, a fine of 10,000 to 20,000 rubles. Moreover, they can be disqualified for a period of one to three years (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Minimum wage in the regions from January 1, 2018

From January 1, 2021, regional authorities can establish in a special agreement their own minimum wage, which exceeds the federal minimum wage (Article 133.1 of the Labor Code of the Russian Federation). However, the regional minimum wage can be abandoned. For these purposes, you will need to issue a reasoned refusal and send it to the local branch of the Committee on Labor and Employment.

In accordance with Part 1 of Art. 133.1 of the Labor Code of the Russian Federation in a constituent entity of the Russian Federation, a regional agreement may establish a different minimum wage. It should not be lower than the minimum wage approved by federal law (Part 4 of Article 133.1 of the Labor Code of the Russian Federation). Employers are considered to have acceded to the regional agreement on the minimum wage if, within 30 calendar days from the date of its publication, they have not sent a written reasoned refusal to join it to the Ministry of Labor of Russia. In this case, the organization is obliged to comply with all provisions of the regional agreement (Part 8 of Article 133.1 of the Labor Code of the Russian Federation). This means that the minimum wage established by the regional agreement is mandatory for the employer.

Note that Moscow, as the capital, is traditionally famous for its more expensive life than other subjects of the Russian Federation. Therefore, the minimum wage in the capital is higher than the federal one. Now in Moscow for the 2nd quarter of 2021, the minimum wage is 18,742 rubles. Currently, there is no information on the minimum wage for 2018 in Moscow. However, most likely, in the next month the Moscow Government will set a living wage for the 3rd quarter of 2021. This indicator will be used as the Moscow minimum wage from January 1, 2021.

As for the minimum wage from January 1, 2021 in the Moscow region, its size has not changed since December 1, 2016 and is 13,750 rubles. (clause 1 of the Agreement on the minimum wage in the Moscow region between the Government of the Moscow region, the Union “Moscow Regional Association of Trade Union Organizations” and associations of employers of the Moscow region, concluded on November 30, 2016 No. 118).

It is this indicator that will continue to be applied in 2021, provided, of course, that a new regional Agreement is not adopted.

You can see the size of the minimum wage from January 1, 2021 in Russia in the table by region 2021. However, at present there is practically no new data on the minimum regional wage.

Compared to other constituent entities of the Russian Federation, the federal city of St. Petersburg and the Leningrad Region stand apart. These regions have already decided on the minimum wage for 2021. From January 1 it is:

- 17,000 rub. – in St. Petersburg (Regional agreement on the minimum wage in St. Petersburg for 2021 dated September 20, 2017 No. 323/17-C;

- 11,400 rub. – in the Leningrad region (Regional agreement on the minimum wage in the Leningrad region for 2021 dated September 21, 2017 No. 10/C-17).