Who are non-residents of the Russian Federation

Non-resident status is established based on the criteria given in Article 207 of the Tax Code of the Russian Federation. In particular, this is a stay in the country for less than 183 days within 12 months. In this case, the months must go one after another. If a person is outside the Russian Federation for a number of reasons, these periods will not be included in the calculated period. Consider these reasons:

- Study or treatment abroad for no more than six months.

- Travel to offshore hydrocarbon fields.

- Business trips (this paragraph applies to military personnel and government officials).

The list of reasons under consideration is specified in paragraphs 2.1 and 3 of Article 207 of the Tax Code of the Russian Federation. A person’s stay in Crimea from March 18 to December 31, 2014 will also be considered as being in the Russian Federation. Short-term departures (up to 6 months) from the state are also not taken into account in calculations.

Personal income tax on non-resident income received under a rental agreement

In accordance with paragraph 2 of Art. 223 of the Tax Code of the Russian Federation, remuneration for the performance of labor functions is considered received by the employee, including non-residents, on the last day of the reporting month, and upon termination of the employment contract - on the last working day. As of this date, the tax agent calculates the number of days the non-resident is in Russia (letter of the Ministry of Finance of Russia dated April 20, 2012 No. 03-04-05/6-534). Tax calculation in case of non-compliance with the 183-day rule is carried out separately for each payment without applying the standard tax deduction (clause 4 of Article 210 of the Tax Code of the Russian Federation) at a rate of 30%.

EXAMPLE of calculating the time of stay in Russia from ConsultantPlus: On March 20, 2021, the organization paid employee I.I. Ivanov income (anniversary bonus). For tax purposes, it determines the employee's tax status. The 12 months preceding this date are the period from 20 March 2021 to 19 March 2021 (inclusive). At this time I.I. Ivanov was on the territory of the Russian Federation in the following days... Read the continuation of the example in K+, having received free trial access.

Upon confirmation of a period of stay in the country of at least 183 calendar days, the employee is considered a resident. Personal income tax is calculated on an accrual basis from the beginning of the year (tax period) at a rate of 13%, taking into account the tax withheld in previous months at a rate of 30% (clause 3 of Article 226 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated February 10, 2012 No. 03-04-06/ 6-30).

For an example of personal income tax recalculation with a change of status, see here .

At the end of the tax period, the recalculation and return of personal income tax is carried out by the Federal Tax Service after submitting the 3-personal income tax declaration and documents confirming the status of a tax resident (clause 1.1 of article 231, article 78 of the Tax Code of the Russian Federation) to the tax office at the place of registration of the payer.

The materials in this section of our website will help you get an idea of the 3-NDFL declaration.

Tax rates for non-residents

The procedure for taxation of non-residents is established by Article 224 of the Tax Code of the Russian Federation. The rate is 30% of the income. For residents this rate is 13%. However, there are exceptions:

- Highly qualified employees. These are workers with a specific specialty. This category includes persons participating in the Skolkovo project. In this case, the salaries of specialists will be taxed at a rate of 13%. If an employee receives other forms of income from the company, they will be taxed at a rate of 30%.

- Foreign persons working on the basis of a patent. Since 2015, residents of countries with which Russia has a visa-free regime are not required to obtain a work permit. They need to apply for a patent. If applicable, income tax is paid in advance. If a person has a patent, he pays tax at a rate of 13%. The patent is valid for a limited time. The validity period is specified in the certificate from the Federal Tax Service.

- Foreign citizens with refugee status. In this case, the rate will also drop to 13%.

- Persons arriving from the EAEU countries. These citizens also receive benefits: simplified employment and preferential rates.

The list of exceptions also includes these employees:

- Participants in the resettlement program in the Russian Federation who were previously residents.

- People who have been given temporary asylum.

- Members of the crews of ships belonging to the ports of the Russian Federation.

In 2021, individuals do not have to pay personal income tax on funds received from foreign sources.

ATTENTION! The rate on income from shared ownership of a company for non-residents will be 15%.

Personal income tax rate for foreigners in Russia

Tax is imposed on the income of all foreign citizens, regardless of migration status (Clause 1, Article 270 of the Tax Code of the Russian Federation).

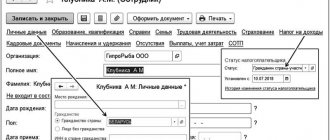

To determine personal income tax for a foreigner, it is necessary to determine whether he is a resident. Residence is confirmed by any documents allowing to establish the number of calendar days of a person’s stay on the territory of Russia (Letter of the Federal Tax Service of Russia dated 03/05/2013 No. ED-3-3/ [email protected] ). If the status is confirmed, then the rate is set to 13%.

Other rates are determined by clause 3 of Art. 224 Tax Code of the Russian Federation. For example, from winnings and interest income from bank deposits - 35%.

In most cases, the tax rate for non-residents on income from Russian sources is 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation). Personal income tax is reduced to 13% if a foreigner:

- He is a highly qualified specialist.

- He is a resident of a member country of the EAEU.

- He is a participant in the state program for the resettlement of compatriots.

- Works under a patent.

- Has refugee status or has received temporary asylum in the Russian Federation.

The preferential personal income tax rate for a foreigner with status 5 is valid provided that he undergoes re-registration at least once every year and a half (Federal Law of February 19, 1993 No. 4528-1 “On Refugees”).

All unearned income of non-residents from Russian sources, except dividends, is taxed at 30%, even if Russians themselves pay more (Letter of the Ministry of Finance dated 03/03/2017 No. 03-08-05/12133).

In addition, it is necessary to find out on what basis the foreigner is staying in the Russian Federation and his migration status.

with a residence permit

With a residence permit, a citizen works in the Russian Federation according to the rules in force for Russians, without additional permits in any region. All taxes and fees for foreigners with a residence permit are the same as for Russians, that is, the rate is 13%.

with RVP

A temporary residence permit is given on the condition that the citizen does not plan to leave the country for more than six months (clause 11, clause 1, article 7 of Federal Law No. 115-FZ of July 25, 2002). Consequently, after 183 days of residence in Russia, he becomes a tax resident, and the personal income tax rate for foreign citizens with a temporary residence permit becomes 13%.

VKS

Highly qualified specialists (hereinafter referred to as HQS) are a separate category of workers who have work experience, skills or achievements in a specific field of activity and claim high remuneration (p. 13.2 No. 115-FZ). They are charged personal income tax at the rate of 13%, regardless of the length of stay in Russia (clause 3 of Article 224 of the Tax Code of the Russian Federation), but only on income directly related to work activity.

The procedure for recognizing an employee as a highly qualified specialist is determined by Art. 13.2 of the Federal Law of July 25, 2002 No. 115-FZ.

Established tax rate for non-residents of the Russian Federation (table)

| Type of income | Personal income tax |

From work:

| 13% |

| From the labor activity of other categories of non-residents | 30% |

| Dividends from equity participation in the activities of Russian companies | 15% |

| Other types of income (winnings over 4,000 rubles, income from deposits, sales of property, etc.) | 30% |

Payment of personal income tax from non-residents

The employer pays personal income tax for its employees. This refers only to those companies with which the specialist has entered into an employment contract. If an employee works unofficially, the employer does not pay any taxes for him. However, there is an exception: specialists who work on the basis of a patent. When purchasing a patent, part of the taxes is paid in advance.

If the tax is calculated for non-residents working on the basis of a patent, the accountant should send a request to the fiscal authorities. This is necessary to determine the amount of advance payment already paid by the employee. The amount of tax deductions may be reduced by this amount. A response will be received within 10 days after sending the request.

If a specialist serves in several places at once, the advance can be credited to only one company.

As a rule, the company that first submitted the request can take advantage of the discount. The procedure for paying personal income tax for a non-resident is the same as for a resident. Tax calculation and remittance is carried out by the employer. That is, he plays the role of a fiscal agent.

The timing of tax payment is determined by the form of income received:

- Salary – on the date of non-cash payment or the date of cash withdrawal.

- Vacation pay and certificates of incapacity for work - no later than the end of the month of making payments.

- Income in kind – the next day after the transfer.

Information about the tax paid is transmitted to the Federal Tax Service. To transfer information, a 2-NDFL certificate is used.

Tax payment procedure for residents

The taxation procedure depends on the type of tax and the method of receiving income.

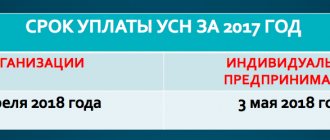

If a citizen (including a foreigner living in the country for more than 183 days a year) is employed in a Russian organization, then it becomes his tax agent and deducts personal income tax for him (Article 226 of the Tax Code of the Russian Federation). If a person worked for a foreign employer, he must independently pay personal income tax in the amount of 13% of income (Article 224 of the Tax Code of the Russian Federation) and submit a declaration in form 3-NDFL no later than April 30 of the following reporting year (Articles 228 and 229 of the Tax Code of the Russian Federation).

However, it should be remembered that in specific cases that provide for a special procedure for paying taxes, in order to avoid double charging, the norms of international agreements are applied (Article 7 of the Tax Code of the Russian Federation). For example, Article 15 of the Agreement of May 29, 1996 between the Russian Federation and Germany requires payment of tax in favor of Germany if the work was carried out on its territory. This means that, for example, a person working remotely from Russia for a German employer must pay personal income tax in Russia.

Can a non-resident count on a tax deduction?

If a person has non-resident status, tax deductions in relation to him are not accepted. This limitation is established by Article 210 of the Tax Code of the Russian Federation, paragraph 1 of Article 220 and paragraph 3 of Article 224 of the Tax Code of the Russian Federation. In addition, non-residents cannot use the method of reducing the income received from the sale of property by the purchase price of this property. These persons are not entitled to the benefits established by subparagraph 2 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation. That is, they cannot deduct expenses from income. This restriction was established in a number of letters from the Ministry of Finance. This is explained by the fact that a decrease in income for expenses is, in fact, a tax deduction, and it is not available to non-residents.

Are foreigners entitled to deductions?

To receive any tax deduction, both for an apartment and for education or treatment, citizenship does not matter. The main thing is that at the time of submitting documents for deduction to the tax office, you have the status of a tax resident of the Russian Federation and official income, subject to personal income tax at a rate of 13% (clause 3 of Article 210 of the Tax Code of the Russian Federation).

While a foreign citizen has not acquired tax resident status, he is not provided with tax deductions.

Clause 3 of Art. 218 of the Tax Code of the Russian Federation stipulates that the standard tax deductions established by this article are provided to the taxpayer by one of the tax agents who are the source of payment of income, at the taxpayer’s choice based on his written application and documents confirming the right to such tax deductions.

Is it possible to reduce income?

Is it possible to reduce income in order to reduce taxation? There is no clear judicial practice on this matter. However, some experts argue in favor of the possibility of reducing the volume. In particular, paragraph 4 of Article 210 states that the deductions established by Articles 218-221 of the Tax Code of the Russian Federation are not relevant for non-residents. At the same time, this does not indicate that the base cannot be reduced by the amount of spending. That is, there are no direct prohibitions in the Tax Code of the Russian Federation. The deduction of expenses from income is not called a tax deduction, and therefore there cannot be unambiguous restrictions here.

FOR YOUR INFORMATION! Even if a person is convinced that he can reduce the amount of income, he should not do this without prior approval from the tax office. Consent must be obtained before submitting the declaration.

What is tax residency

The first thing you need to know is that the basis for paying taxes is not a person’s citizenship, but his tax status. The status is determined by the term “tax residence”. A tax resident of the Russian Federation is a person who, over the past tax period (calendar year), stayed in the country for at least 183 days (Article 207 of the Tax Code of the Russian Federation).

Tax residents of the Russian Federation are required to pay personal income tax on income, regardless of the source of their receipt. This, for example, is wages from both Russian and foreign employers, sale or rental of property both on the territory of the Russian Federation and abroad (Article 208 of the Tax Code of the Russian Federation).

Income taxes from wages in 2021: personal income tax rates

13% personal income tax rate 2017

, it is subject to:

- income of employees who are tax residents of the Russian Federation, with the exception of those categories of employees presented below.

Income that is taxed at a rate of 13% includes wages, income from the sale of property, remuneration under civil contracts, and dividends received by tax residents.

Let us remind you that tax residents are considered to be employees who actually stay in the Russian Federation for at least 183 calendar days over the last year.

9% personal income tax rate 2017

, it is subject to:

- Income of foreign citizens who are non-residents: highly qualified specialists, people working under a patent, citizens of the EAEU.

- Interest on mortgage-backed bonds issued before January 1, 2007

15% personal income tax rate 2017

, it is subject to:

- Income received by the founders of trust management of mortgage coverage. Such income is required to be received on the basis of mortgage participation certificates that were issued to mortgage coverage managers before January 1, 2007.

- Dividends received from Russian companies by citizens who are not tax residents of Russia

15% personal income tax rate 2017

, it is subject to:

- All income of non-residents. The exceptions are dividends and income of foreigners: highly qualified specialists; foreign citizens working for individuals on the basis of a patent or from the EAEU.

30% personal income tax rate 2017

, it is subject to:

- Rewards and winnings in organized games, competitions and other promotional events. Tax is paid on the value of such rewards and winnings, which exceeds four thousand rubles per year.

35% personal income tax rate 2017

, it is subject to:

- Interest on bank deposits insofar as they exceed the amount of interest, which is calculated as follows:

For deposits in rubles - based on the refinancing rate of the Central Bank of the Russian Federation, increased by five percent. In this case, for such purposes, they take the refinancing rate that is relevant during the interval for which the presented interest is accrued. If the refinancing rate changed during this period, the new rate should be applied from the moment it was established.

For deposits in foreign currencies - based on nine percent per annum. Material benefits when saving on interest on credit (borrowed) funds.

At the same time, you must pay income tax from 2021 on the following amounts:

- For credits (loans) in rubles - from the amount of excess interest calculated taking into account 2/3 of the current refinancing rate (key rate), which is established by the Central Bank of the Russian Federation at the time of interest payment, over the interest amount calculated on the basis of the terms of the agreement.

- For credits (borrowings) in foreign currency - from the amount of excess interest, which is calculated on the basis of nine percent per annum, over the amount of interest calculated on the basis of the terms of the agreement.

- Income of shareholders from an agricultural credit consumer cooperative or a credit consumer cooperative:

- payment for the use of funds contributed by shareholders by a consumer credit cooperative;

- interest on the use of money by an agricultural credit consumer cooperative that is attracted from shareholders in the form of loans.

- The calculation of personal income tax is required to be carried out on the part of the excess of the indicated income over the amount of interest calculated on the basis of the refinancing rate of the Central Bank of the Russian Federation, increased by five percent.