When is the first report submitted after registering an individual entrepreneur?

The deadlines for submitting declarations directly depend on the chosen taxation regime and the availability of employees. The Federal Tax Service and funds are constantly changing forms and reporting forms - you need to constantly be aware of all updates, since a declaration in an outdated format will not be accepted.

If an individual entrepreneur plans to hire employees under an employment contract or a civil contract, it is necessary to register with the Social Insurance Fund as an employer. After registration, regardless of the tax regime, you are required to provide income reports for all your employees.

- The first reporting is SZV-M, a mandatory monthly report on employed workers, the deadline for submission is until the 15th of the next month + SZV-Experience - reporting reflecting the insurance experience of employees is submitted annually before March 1 to the Pension Fund of the Russian Federation.

- SZV-TD - information about the labor activity of employees, submitted every month to the Pension Fund of the Russian Federation, before the 15th day of the month following the reporting month.

- 4-FSS contains data on accruals for insurance premiums for “injuries”. The FSS accepts the report quarterly until the 20th in paper format and until the 25th in electronic format.

- DAM - the entrepreneur submits calculations for insurance premiums to the Federal Tax Service quarterly by the 30th day following the reporting period.

- 6-NDFL contains information about the accrued wages of employees in general. The report is submitted quarterly, before the last day of the month following the reporting quarter. 2-NDFL - an annual certificate indicating the employee’s earnings with a breakdown for each month. At the end of the year, reports are submitted by March 1, 2021 to the Federal Tax Service.

Reports for employees

For individual entrepreneurs, the number of reports increases only with the appearance of employees. And for an LLC, reports on employees are required immediately after creation, because the organization cannot work on its own and is considered an employer by default.

Every month, employees must make contributions to the tax office and the Social Insurance Fund. Total contributions range from 30.2% to 38% of wages, but benefits are available for some types of business. We talked about existing benefits in the article “Who can save on employee contributions.” All information about insurance premiums is included in reports for the tax and Social Insurance Fund.

Calculation of insurance premiums (DAM)

In this report you show all accrued contributions, except for “injury”. Submit the report once a quarter - by the 30th day of the month following the quarter:

- 1st quarter - until April 30;

- half-year - until July 30;

- 9 months - November 1;

- year - until January 31.

4-FSS

Once a quarter you need to report to the Social Insurance Fund about the contributions for employee injuries that you paid there. Submit the report on Form 4-FSS on paper by the 20th of the month following the quarter, and via the Internet by the 25th.

6-NDFL

As an employer, you are required to withhold 13% tax from your employee’s salary. This is personal income tax - personal income tax. It must be transferred to the tax office no later than the next day after salary payment. Then reflect all information about employee income and personal income tax withheld and paid in the reports.

Every quarter the tax office expects the 6-NDFL report. It contains the amount of income that all employees received, tax deductions and the total amount of personal income tax.

Deadlines are set:

- for the 1st quarter - until April 30;

- for half a year - until July 31;

- 9 months before October 31;

- a year - until March 1.

For periods up to 2021, employers also submitted a 2-NDFL report. It has been abolished since 2021, but in fact it was simply included in form 6-NDFL as a new section. This section must be filled out when preparing 6-NDFL at the end of the year.

Information on the average number of employees (ASCH)

Since 2021, employers have stopped submitting SSC as a separate report. But, as always, the information still needs to be provided to the tax office, only now as part of another report - the DAM. The average number should be reflected only in the DAM at the end of the year. To calculate the indicator, you need to understand how many people on average worked with you last year. If one employee worked all year, write down the number 1. But there are also complex cases, to which we have dedicated a separate article.

SZV-M, SZV-STAZH and SZV-TD

Every month, the SZV-M report is submitted to the Pension Fund of Russia, which contains a list of employees and their SNILS numbers. The report must be submitted by the 15th of each month.

SZV-STAZH is a more detailed report on the length of service of employees; it is submitted at the end of the year. You must report for 2021 by March 1, 2021. Submit the SZV-Stazh in advance if an employee retires or you liquidate the business.

SZV-TD is a report on the work activity of employees, on the basis of which their electronic work books will be filled out. They rent only to those employees for whom there have been personnel changes: hiring, transfers, dismissals, etc. Deadline - no later than the next working day after the hiring or dismissal of the employee; for other personnel events - until the 15th of the next month. If there have been no personnel changes, you do not need to submit a report. The zero form is not provided.

What reports to submit if the individual entrepreneur opened at the end of the year

If you opened an individual entrepreneur at the end of the year between December 1 and December 31, the reporting period begins from the date of registration with the tax office until December 31 of the following year. Under the simplified tax system, the tax period will end on December 31 of the next year.

For example, if registration as an individual entrepreneur took place on December 15, 2019, the annual report must be provided at the end of 2020.

For UTII, reports must be submitted by January 20 of the following year, unless the individual entrepreneur was registered more than 10 days before the end of December.

We recommend reading: What kind of reporting does an individual entrepreneur submit to the tax office and funds in 2021: types, rules, dates and deadlines.

IP on OSNO

An individual entrepreneur who has not submitted a notification to the tax office about the transition to a certain regime automatically switches to the OSNO regime. Individual entrepreneurs in the general taxation system are required to report on income received in VAT and 3-NDFL declarations.

VAT declaration

The VAT report is submitted to the Federal Tax Service every quarter. If the registration of an individual entrepreneur occurred less than 10 days before the end of the quarter, the first report should be submitted only at the end of the next quarter.

That is, if an individual entrepreneur opened on December 24, 2021, the report is submitted at the end of the first quarter - until April 25, 2021 inclusive, indicating transactions for December.

If an individual entrepreneur is registered more than 10 days before the end of the quarter, the first report is submitted before January 25.

Declaration 3-NDFL

3-NDFL is due every year until April 30. An entrepreneur who registered an individual entrepreneur at the end of the year transfers personal income tax only at the end of the next year.

Deadlines for paying taxes for individual entrepreneurs in 2021

Alina Margutova

December 17, 2021 5519

0

IP

In 2021, individual entrepreneurs can work for OSNO, become self-employed, or choose one of the special regimes: simplified tax system, PSN, unified agricultural tax. The single tax on imputed income - UTII will cease to exist from January 1, 2021. We will tell you when individual entrepreneurs in general and special regimes must pay taxes and contributions.

simplified tax system

Simplified entrepreneurs are required to pay to the budget:

- simplified tax system;

- personal income tax for your employees;

- insurance premiums for your employees and for yourself;

- property tax for individuals;

- transport tax;

- land tax.

According to the law, advance payments of the simplified tax system must be transferred to the budget quarterly, no later than the 25th day of the month following the reporting period. Therefore, in 2021, you need to pay off the budget within the following deadlines:

- for 2021 - until April 30;

- for the first quarter of 2021 - until April 26, 2021;

- for the first half of 2021 - until July 26, 2021;

- for 9 months of 2021 - until October 25, 2021;

- for 2021 - until May 2, 2022.

BASIC

An entrepreneur under the general taxation system pays VAT, personal income tax, property tax and all other taxes, except those provided only for special regimes.

Personal income tax

Individual entrepreneurs pay advance payments for personal income tax for 2021 no later than the 25th day of the first month following the reporting period. Therefore, advances must be transferred to the budget within the following deadlines: April 26, July 26 and October 25, 2021.

Tax for 2021 must be paid by July 15, 2021, and tax for 2021 must be paid no later than July 15, 2022.

VAT

VAT is transferred to the budget in equal shares no later than the 25th day of each of the three months following the expired quarter. In 2021, individual entrepreneurs must transfer VAT to the budget within the following terms:

- for the fourth quarter of 2021 - until January 25, 2021;

- for the first quarter of 2021 - until April 26, 2021;

- for the second quarter of 2021 - until July 26, 2021;

- for the third quarter of 2021 - until October 25, 2021;

- for the fourth quarter of 2021 - until January 25, 2022.

Insurance premiums

The employer pays insurance premiums for employees and for himself. Contributions for employees are transferred monthly until the 15th. If the 15th falls on a weekend, the deadline for payment of contributions is postponed to the next working day after the weekend.

Therefore, contributions for employees must be paid before: January 15, February 15, March 15, April 15, May 17, June 15, July 15, August 16, September 15, October 15, November 15, December 15, 2021 and January 17, 2022 .

The deadline for paying individual contributions for oneself depends on the amount of income. If income does not exceed 300,000 rubles, then contributions must be paid by December 31, 2021. If income exceeds 300,000 rubles, then the budget must be paid before July 1, 2022.

PSN

Individual entrepreneurs on PSN do not pay VAT, personal income tax on income from commercial activities, as well as property tax on activities that have been transferred to this regime. Other taxes must be paid as for OSNO.

The tax under PSN is the cost of the patent. It can be purchased for any number of months within a calendar year.

Individual entrepreneurs on PSN pay insurance premiums for themselves and for their employees. The deadlines for their payment are the same as for individual entrepreneurs on OSNO.

NAP

An individual entrepreneur can be a payer of tax on professional income if he has no employees, but does not have the right to combine this tax regime with any others. NAP exempts you from paying personal income tax and insurance premiums.

The tax amount is calculated by the Federal Tax Service and sends notifications with the accrued tax and payment details by the 12th day of each month.

The tax must be transferred no later than the 25th at the place of business.

The deadlines for paying NAP in 2021 are as follows:

- for December 2021 - until January 25, 2021;

- for January 2021 - until February 25, 2021;

- for February 2021 - until March 25, 2021;

- for March 2021 - until April 26, 2021;

- for April 2021 - until May 25, 2021;

- for May 2021 - until June 25, 2021;

- for June 2021 - until July 26, 2021;

- for July 2021 - until August 25, 2021;

- for August 2021 - until September 27, 2021;

- for September 2021 - until October 25, 2021;

- for October 2021 - until November 25, 2021;

- for November 2021 - until December 27, 2021;

- for December 2021 - until January 25, 2022.

Alina Margutova

December 17, 2021 5519

0

Was the article helpful?

83% of readers find the article useful

Thanks for your feedback!

Comments for the site

Cackl e

Products by direction

1C-Reporting

—> Service for transmitting reports to regulatory authorities from 1C:Enterprise programs

Astral Report 5.0

—> Online service for submitting reports to regulatory authorities

Declaration for individual entrepreneurs on the simplified tax system

Reporting under the simplified system consists only of a declaration according to the simplified tax system. It is submitted annually, the report for 2021 must be sent by April 30, 2021 inclusive. The declaration is submitted every year, and advance payments are paid quarterly.

We recommend reading: Taxes and reporting of individual entrepreneurs on the simplified tax system 6% + what is considered income and how to work with primary documents.

When to pay taxes using the simplified 6%

Entrepreneurs on a simplified basis transfer 6 percent monthly to the tax office in advance payments - income tax. The amount is equal to 6% of all income that the individual entrepreneur receives. The tax must be submitted by the 25th day of the month following the reporting period:

- first quarter - until April 25;

- second quarter - until July 25;

- third quarter - until October 25;

- The fourth quarter coincides with the annual report and must be submitted by April 30.

In addition to quarterly payments to the tax office, individual entrepreneurs pay contributions for themselves and for employees, if any:

- to the Pension Fund;

- to the Federal Health Insurance Fund;

- to the Social Insurance Fund.

Entrepreneurs do not pay transport tax and property tax if the transport and property are not the property of the company.

VAT declaration

Reporting under the value added tax regime is submitted no later than the 25th day of the month after the quarter. If the individual entrepreneur was registered more than 10 days before the end of the year, the declaration is submitted before January 25, if less than 10 days - before April 25.

An individual entrepreneur may be exempt from filing a VAT return. To do this, a notification is submitted to the Federal Tax Service that the activity is not related to the sale of excisable goods and the amount of proceeds from the sale of goods and provision of services for 3 consecutive months amounted to no more than 2 million rubles.

What taxes and fees do you need to pay?

Registration of an entrepreneur at the end of the year gives rise to the obligation to submit reports and pay fees. If a businessman has managed to receive income, he will have to transfer taxes to the budget. Obligations will depend on the taxation regime:

- PSN. No reporting provided. The payer will only need to purchase a new patent.

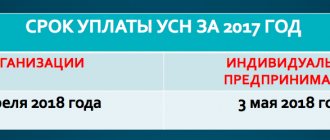

- USN. Taxes for 2021 will have to be paid in December, and the declaration must be submitted before the end of April 2021.

- UTII. The report for the last quarter is required to be sent by January 25. If the activity was not carried out for all three months, the tax is calculated according to the time worked.

- BASIC. The procedure for submitting reports on the general system will not differ. The entrepreneur is obliged to make calculations for personal income tax, VAT, etc.

If there are no employees, there is no need to send documents to extra-budgetary funds. Since 2012, entrepreneurs are no longer required to fill out multi-page forms. They only need to remit fixed fees in a timely manner before the end of December of the current year. In 2018, their cost will be 26,545 (PFR) and 5,840 (MHIF) rubles.

Accrual algorithm! The base rate should be divided by the number of days in a year, and then multiplied by the number of days the entrepreneur status is valid. Contributions are required to be transferred by December 31st. Additional calculations will be made until July 2021. It is necessary to transfer 1% of income exceeding the annual limit of 300,000 rubles to the Pension Fund. The amount of contributions should not exceed the maximum limit of 218,200.

Let us remind you that the administration of fixed fees is carried out by the tax service.