Personalized accounting since 2017

From January 1, 2021, the calculation and payment of insurance premiums, except for contributions for injuries, are controlled by tax inspectorates (Chapter 34 of the Tax Code of the Russian Federation). But information about the insurance period is still controlled by the Pension Fund of the Russian Federation and its territorial bodies. In this regard, two reports must be submitted to the Pension Fund:

- monthly report SZV-M;

- annual report on insurance experience.

Until 2021, policyholders showed information about their length of service in section 6 of the quarterly calculation of RSV-1. However, from 2021, the RSV-1 calculation is no longer applied. His form has lost its power. Instead, information about your experience will need to be submitted as part of your annual reporting.

SZV-ISH

The form contains data on contributions, income and length of service of the employee.

Companies and individual entrepreneurs created in 2017 and later will definitely not have to submit this form. This is due to the fact that SZV-ISH, in fact, supplements the data in reports until 2021.

SZV-ISH must be sent if the policyholder has not submitted information (for 2021 and earlier). The deadline for submitting the SZV-ISH is not defined - the form is submitted after the failure to submit information on the insurance experience of employees for 2021 and earlier periods is discovered.

If the policyholder submitted forms RSV-1, SZV-3, SZV-1, SZV-6-1(2), SZV-6-4, SZV-4-1(2) and did not indicate information on one or more employees there, The error can be corrected by submitting SZV-KORR with the type OSP.

What new reporting forms have been approved?

Organizations and individual entrepreneurs became familiar with the SVZ-M form back in 2021. This form was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p. Using the SZV-M form, organizations and individual entrepreneurs are required to submit monthly information about their employees to the territorial offices of the Pension Fund:

- last name, first name and patronymic;

- SNILS;

- TIN.

Monthly SZV-M reports in 2021 must be submitted to the Pension Fund no later than the 15th day of the month following the reporting month. See “SZV-M in 2017: new deadlines for submitting initial, corrective and updated reports.”

At the same time, Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p approved completely new personalized accounting documents, which policyholders have not previously encountered. These regulatory documents are approved:

- form “Information on the insurance experience of insured persons (SZV-STAZH)”;

- form “Information on the policyholder transferred to the Pension Fund of the Russian Federation for maintaining individual (personalized) records (EDV-1)”;

- form “Data on the adjustment of information recorded on the individual personal account of the insured person (SZV-KORR)”;

- form “Information on earnings (remuneration), income, amount of payments and other remunerations, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH).”

Also, Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p approved the Procedure for filling out the above document forms and the format of information necessary for transmitting the forms to the divisions of the Pension Fund in electronic form.

Next, we will explain why these forms are required, to whom and when they will need to be submitted to the Pension Fund units. These forms are not submitted to the Federal Tax Service. You can also download the new forms and familiarize yourself with their samples. However, this article does not contain detailed instructions. Later we will publish a special article in which we will consider all the main aspects related to the formation of new personalized reporting.

From what date do they apply?

By Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p, it was registered by the Ministry of Justice of Russia on February 21, 2017 No. 45735. This document was officially published on February 22, 2017 on the official Internet platform. The document comes into force 10 calendar days after the date of publication. Therefore, it is necessary to apply new forms of individual (personalized) accounting documents from March 4, 2017.

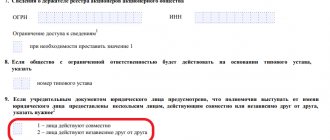

Example of filling out the EDV-1 form

Instructions for filling out the EFA-1 form

Type of information - an X indicates the type of form being submitted:

- Original

- Corrective

- Canceling

With the “Correcting/Cancelling” type, it is submitted if it is necessary to correct/cancel the data in section 5 of the previously submitted EFA-1 form with the “Original” type.

Reporting period (code) - the reporting period is indicated in accordance with the Parameter Classifier. For reporting from 2021 onwards, indicate 0 (reporting period - year), and indicate the year 2020 .

Section 3 “List of incoming documents” - in the column “Number of insured persons” the number of insured persons is indicated, the information on which is contained in the forms submitted simultaneously with EDV-1.

Section 4 “Data as a whole for the policyholder” - is filled out only if EDV-1 is submitted simultaneously with the SZV-ISH forms or with the SZV-KORR “Special” form and contains data as a whole for the policyholder for the reporting period.

Section 5 “Basis for reflecting data on periods of work of the insured person in conditions that give the right to early assignment of a pension in accordance with Article 30 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions” - is filled out if in the forms SZV- EXPERIENCE (with the type of information - ISH) and SZV-ISH, submitted simultaneously with the EDV-1 form, contain information about insured persons employed in the types of work specified in paragraphs 1-18 of part 1 of Article 30 of the Federal Law of December 28, 2013 N 400 -FZ:

- underground work, work with hazardous working conditions, in hot shops, with difficult working conditions, as working locomotive crews, in field geological exploration, prospecting, topographic and geodetic, geophysical, hydrographic, hydrological, forest management and survey work, logging work and timber rafting, work on loading and unloading operations in ports, as crew members on ships of the sea, river fleet and fishing industry fleet, drivers of buses, trolleybuses, trams, flight crews, dispatchers and ITS of civil aviation, in underground and open-pit mining, rescuers and etc.

and an example of filling out EDV-1

You can download:

- FORM form EDV-1 (.xls, 44 Kb)

- EXAMPLE of filling out the EDV-1 form (.xls, 50 Kb)

Examples of creating a package of documents with EFA-1

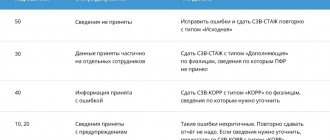

| № | Description of the situation | Package: Shape "type" |

| 1 | Standard situation: presentation of information for the entire organization for 20 employees | SZV-STAZH “initial” + ODV-1 “initial” |

| 2 | During the reporting period, the SZV-STAGE form was submitted for 20 employees, the submitted information was taken into account on the personal account, but later an error in the period of service of 1 employee | SZV-KORR “corrective” + EDV-1 “initial” |

| 3 | For the reporting period, the SZV-STAZH form was submitted for 20 employees, but 1 employee did not work during the reporting period, so the previously submitted information canceled | SZV-KORR “cancelling” + EDV-1 “initial” |

| 4 | During the reporting period, the SZV-STAZH form was submitted for 20 employees, but for 1 employee the information was not included in the personal account due to a discrepancy between the full name and SNILS | SZV-STAZH “supplementary” for 1 employee + EDV-1 “initial” |

| 5 | During the reporting period, the SZV-STAZH form was submitted for 20 employees; 1 employee forgot to provide information | SZV-STAZH “special” for 1 employee + EDV-1 “initial” |

| 6 | It is required to provide information for the entire organization for 20 employees for 2001 (previously, reporting for this period was not submitted) | SZV-ISH for 20 employees + EDV-1 “initial” with section. 1-4 |

| 7 | An error was identified in the previously submitted information for 2014: 1 employee was additionally charged insurance premiums, 1 employee had an error in the period of service - the CHILDREN code was not indicated in the additional information | SZV-KORR “corrective” + EDV-1 “initial” + DAM with completed line 120 and section 4 |

For instructions on filling out the SZV-STAZH , read the material “ SZV-STAZH: detailed information from PFR specialists ”

Form SZV-STAZH

The SZV-STAZH form was approved as Appendix No. 1 to Resolution of the Pension Fund Board of January 11, 2017 No. 3p. This form is a report on work experience, which must be submitted annually - no later than March 1 after the reporting year. For the first time, such a report will have to be submitted for 2021 (subclause 10, clause 2, article 11 of the Federal Law of 04/01/1996 No. 27-FZ).

The SZV-M length of service form must be generated by insurers for all insured persons who are in an employment relationship with the policyholder (including those with whom employment contracts have been concluded) or who have entered into civil law contracts with him (clause 1.5 of the Procedure for filling out the form “Information on insurance experience insured persons (SZV-STAZH)", approved by Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p). This form looks like this:

As you can see, section 3 of the new SZV-STAZH form is similar to section 6 of the RSV-1 calculation, which previously included information about the length of service of individuals. In section 3 of the SZV-STAZH report you will also need to show:

- Last name, first name and patronymic of each insured person (columns 2,3 and 4);

- work periods (columns 6 and 7);

- SNILS (column 5);

- codes for territorial and special working conditions (columns 8 and 9);

- calculation of insurance experience (columns 10 and 11);

- conditions for early assignment of an insurance pension (columns 12 and 13);

- information about the dismissal of the insured person (column 14).

Codes for experience

As before, when filling out section 6 of the RSV-1 calculation, the periods of work of insured persons in the SZV-STAZH form will need to be accompanied by various explanatory codes. Here are a few examples of acceptable “experience” encoding of section 11 of the new personalized report:

| Some codes for column 11 of section 3 of the SZV-STAZH form | |

| Code | Application |

| “AGREEMENT”, “NEOPLDOG”, “NEOPLAUT”. | These codes indicate the period of work of the insured person under a civil contract. If payment under the agreement was made during the reporting period, then the code “AGREEMENT” is indicated. If there is no payment in the reporting period, then the code “NEOLDOG” or “NEOLPAVT” is indicated. |

| "CHILDREN" | Holiday to care for the child. |

| "NEOPL" | Vacation without pay, downtime due to the fault of the employee, unpaid periods of suspension from work (preclusion from work) and other unpaid periods. |

| "QUALIF" | Advanced training with a break from production. |

| "UCHOTVUSK" | Additional holidays for those who combine work and study |

| "SDKROV" | Days for donating blood and providing leave in connection with this |

| "DLCHILDREN" | Otpksk for child care from 1.5 to 3 years |

| "DOPVIKH" | Additional days off for persons caring for disabled children. |

| "CHILDREN" | If parental leave until the age of 3 is granted to grandparents, other relatives or guardians |

Codes of territorial and special working conditions in columns 8 and 9 of section 3 of the SZV-V experience form will need to be filled out based on the Parameter Classifier used when filling out information for maintaining individual (personalized) records. Such a Classifier is drawn up as an appendix to the Procedure for filling out the form “Information on the insurance experience of insured persons (SZV-STAZH)”, approved. By Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p. Next you can:

- SZV-STAZH form in Excel format;

- Classifier of parameters used when filling out information for maintaining individual (personalized) accounting.

Deadline for submitting SZV-STAZH

For the first time, the SZV-STAZH report must be submitted for 2021: no later than March 1, 2021. Before this date, you must submit a report with the “Initial” information type to the Pension Fund. This type of information means that the report for 2017 is being submitted for the first time.

You can also submit the SZV-STAZH report with the “Corrective” information type. Such a report will need to be submitted in a situation where there were errors in the report with the “Initial” type that did not allow the data to be posted to individual personal accounts of insured persons (for example, if there were errors in SNILS).

We believe it is advisable to pay special attention to the type of information “Pension assignment”. The SZV-STAZH report with this type of information will need to be submitted to the Pension Fund of the Russian Federation for a person entering an insurance pension - within three calendar days from the date the insured person contacts the policyholder. This is provided for in paragraph 2 of Article 11 of the Federal Law of 04/01/1996 No. 27-FZ.

The SPV-2 form is no longer needed

Personalized accounting documents previously included form SPV-2 “Information on the insurance experience of the insured person for establishing a labor pension.” It had to be submitted to the territorial offices of the Pension Fund for those employees who are retiring. See Form SPV-2: sample filling."

The SPV-2 form has been canceled since 2021. In fact, the SPV-2 form was replaced with the SZV-STAZH form, which contains the type of information “Pension assignment”.

Who must report on the SZV-STAZH form

The employer’s obligation to annually report on the insured persons within the framework of personalized accounting is provided for in paragraph 2 of Art. 11 of the Law of 04/01/1996 No. 27-FZ (as amended on 12/28/2016), for this purpose a new reporting form SZV-STAZH was developed (adopted by Resolution of the Pension Fund Board of 01/11/2017 No. 3p, Appendix No. 1). The report contains information for each employee: about his period of work, accrual and payment of insurance “pension” contributions in the reporting year.

Filling out the SZV-STAZH for 2021 is mandatory for all organizations, individual entrepreneurs, private lawyers and notaries who have employees under employment and civil law contracts, for whose remuneration “pension” insurance contributions are accrued. It is necessary to submit the SZV-STAZH form even if in the reporting year no remuneration was paid to employees under existing contracts, or all employees were dismissed.

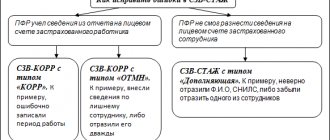

Form SZV-KORR

The SZV-KORR form will need to be filled out and submitted to the Pension Fund of Russia divisions to adjust the data recorded on the individual personal accounts of insured persons based on previously submitted reports. This is stated in paragraph 4.1 of the Procedure for filling out the SZV-KORR form, approved by Resolution of the Pension Fund Board of January 11, 2017 No. 3p. This form has a “telling” name – “Data on the adjustment of information recorded on the individual personal account of the insured person.” This form looks like this:

The SZV-KORR form is submitted by the policyholder to make changes to previously submitted data. This form may be submitted at the initiative of the policyholder at any time. There are no deadlines for submitting this form. The SZV-KORR form can be generated with different types of information:

- CORR - if you need to adjust the information on the individual personal account of the insured person as follows (for example, replace data on earnings (remuneration), income, amount of payments and other remunerations of the insured person or supplement data on accrued and paid insurance premiums).

- OTMN - based on the cancellation form, the data recorded on the ILS (individual personal account of the insured person) on the basis of reporting, the data of which is being adjusted, will be canceled;

- SPECIAL - a special type of information with which it will be possible to submit data on the insured person, whose information was completely absent in the previously submitted reports.

The SZV-KORR form can be submitted to the territorial division of the Pension Fund for adjustment of any period until 2021.

Next, you can create a new SZV-KORR form in Excel format.

SZV-KORR

This form is intended to correct data about the insured person on his personal account. For example, if the policyholder incorrectly indicated the start date of parental leave in SZV-STAZH for 2021, you need to submit SZV-KORR.

The policyholder has the right to send SZV-KORR to adjust the indicators of any previous period.

Filling out all forms is intuitive. The sections speak for themselves. It is important to submit your retirement forms on time when applicable events occur.

Submit reports to the Pension Fund via the Internet. Kontur.Extern gives you 3 months free!

Form SZV-ISH

The form “Information on earnings (remuneration), income, amount of payments and other remuneration, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH)” is filled out by the policyholder only for reporting periods until 2021 year (inclusive). And only in a situation where reporting deadlines were violated during these periods. This is stated in paragraph 5.1 of the Procedure for filling out the SZV-ISH form, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p. We are talking about situations where an individual did not submit reports at all, and now the policyholder has decided to report for past periods. This form looks like this:

In the SZV-ISH form for past periods you will need to indicate:

- information about the policyholder;

- information about the insured person;

- reporting period;

- information on the amount of payments and other remuneration accrued in favor of an individual;

- information on accrued insurance premiums for the reporting period.

There are no deadlines for submitting the temporary storage warehouse-iskh form. The policyholder may submit this form at any time he deems necessary.

Form SZV-1 in the Pension Fund of Russia

Introducing Form SZV-1

, which is submitted to the Pension Fund of the Russian Federation along with reporting on individual personalized accounting in the compulsory pension insurance system (OPS).

Form SZV-1 was approved back in 2006 by Resolution of the Board of the Pension Fund of the Russian Federation No. 192p dated July 31, 2006. It refers to the forms of individual accounting documents in the OPS system. The full name of the document is “Individual information about the length of service, earnings (remuneration), income and accrued insurance premiums of the insured person (SZV-1).”

You can download Form SZV-1 from the Pension Fund for free on this page.

Procedure for filling out Form SZV-1

In order to correctly prepare Form SZV-1, a special procedure for filling it out by the Pension Fund of the Russian Federation has been developed and approved. You can enter data into the form either on a computer (including in a special program) or manually. However, in any case, you must sign the bottom by hand. So, the filling rules:

- OKUD code - no need to fill out.

- Type of form - put an “X” next to the values: initial, corrective, canceling or pension assignment.

- Insurance number - indicated in accordance with the employee’s SNILS.

- Full name - first and last name must be indicated, and patronymic if any.

- Reporting period - indicate the quarter (1, 2, 3 or 0 if for a year) and year.

- Information about the employer - you need to indicate the registration number assigned to the company by the Pension Fund of Russia, and the short name of the company.

- Category of the payer of insurance premiums - the code and name are indicated in accordance with the Classifier of parameters accepted in personalized accounting.

- The amount of accrued insurance premiums - paid by the employer and from the earnings of the insured.

- Information about earnings (remuneration), income for the reporting period -€“ is indicated monthly and only in those cells where there are non-zero values. The total values must also be filled in.

- Contract number - to be filled in if the insured performs work under a civil law or copyright contract.

- The date of conclusion of the contract is indicated if item 10 is completed.

- Type of payment - indicated in accordance with the Parameter Classifier, if item 10 is completed.

- Work experience for the reporting period.

- Name of the manager's position; signature (by hand); full name.

- Date - filled in the format DD, month, YYYY).

- M.P. - a stamp is required.

Form SZV-1 can be submitted together with ADV-6-1, SPV-2 and other forms.

Form EDV-1

Form EDV-1 “Information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records” is an accompanying form. In paragraph 1.7 of the filling procedure approved by the Resolution of the Board of the Pension Fund of the Russian Federation from Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p it is said “Information in the form SZV-STAZH, SZV-ISKH, SZV-KORR is formed into packages of documents. One package contains one file and is submitted simultaneously with the EDV-1 form.” At the same time, it is clarified that document packages can include documents of only one name and one type.

In this case, EDV-1 is a document containing information on the policyholder as a whole. So, for example, in this form you need to summarize information about the total amount of accrued and paid insurance premiums for the reporting period. EFA-1 includes the following sections:

- Details of the policyholder submitting the documents;

- Reporting period;

- List of incoming documents;

- Data in general for the policyholder;

- The basis for reflecting data on periods of work of the insured person in conditions that give the right to early assignment of a pension in accordance with Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.

This form looks like this:

This form may contain the following types of information:

- original;

- corrective – submitted if you need to correct the data in section 5 of the EFA-1 form;

- canceling – submitted if it was necessary to cancel the data in section 5 of the EFA-1 form. You can find EFA-1 forms in Excel format in the “Documents” section on our website.

There is no need to talk about the deadlines for submitting the EFA-1 form, since it accompanies incoming documents. In other words, if, for example, the SZV-STAZH report is submitted, then it must be sent to the fund along with the EDV-1 form.

Deadline for submitting form EDV-1

Policyholders must report on the SZV-STAZH form for 2021 before March 1, 2021 , and each SZV-STAZH report (file) must be accompanied by the EDV-1 !

In addition, EDV-1 is submitted along with the forms SZV-KORR, SZV-ISKH.

In EFA-1, it is necessary to summarize data on the number of employees for whom information is provided in the form SZV-STAZH (as well as SZV-KORR, SZV-ISKH).

What other forms exist for accounting?

Let us recall that quite recently officials from the Pension Fund of the Russian Federation approved another set of personalized accounting forms, which are necessary, first of all, for registration as insured persons. See “New forms of personalized accounting documents have been approved.” These forms, in fact, are not reporting. These forms are simply necessary for the policyholder to fulfill his obligation to issue insurance certificates to employees, clarify information in the personalized accounting system, etc.

Among the approved forms:

- “Questionnaire of the insured person (ADV-1)”;

- “Insurance certificate of state pension insurance (ADI-1)”;

- “Insurance certificate of compulsory pension insurance (ADI-7)”;

- “Application for exchange of insurance certificate (ADV-2)”;

- “Application for issuance of a duplicate insurance certificate (ADV-3)”;

- “Request for clarification of information (ADI-2)”;

- “Inventory of documents submitted by the policyholder to the Pension Fund of the Russian Federation (ADV-6-1)”;

- “Accompanying statement (ADI-5)”;

- “Information on the work experience of the insured person for the period before registration in the compulsory pension insurance system (SZV-K).”

Read also

03.02.2017

SZV-STAZH 2021

SZV-STAGE - reporting to the Pension Fund of the Russian Federation, which contains information about the length of service of a person insured in the compulsory pension insurance system of the Russian Federation. The insurance period affects the size of the future pension.

The SZV-STAZH form is submitted in several cases in 2021.

Based on the results of 2021 - no later than 03/01/2021.

If during 2021 an employee submits an application for a pension to the company’s accounting department, there are only three days to send the SZV-STAZH.

You must also submit a report on your experience upon liquidation of the company.

Important! Issue SZV-STAZH to the employee (insured person) together with the work book upon dismissal.

SZV-STAZH and ODV-1 are two forms that are inextricably linked with each other. They always give up together.

The Pension Fund of Russia has changed the rules for filling out personalized reporting

The Pension Fund of the Russian Federation has made amendments to the procedure for filling out the forms SZV-STAZH, ODV-1, SZV-KORR and SZV-ISKH. The corresponding resolution dated September 2, 2020 No. 612p was published on the Official Internet Portal of Legal Information.

Let us remind you that the current procedure for filling out reporting forms for personalized accounting was approved by Resolution of the Pension Fund of the Russian Federation Board of December 6, 2018 No. 507p. It approves the following forms:

- Information about the insurance experience of the insured persons (SZV-STAZH);

- Information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records (EDV-1);

- Data on the adjustment of information recorded on the individual personal account of the insured person (SZV-KORR);

- Information on earnings (remuneration), income, amount of payments and other remuneration, accrued and paid insurance premiums, periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH).

The new amendments supplement the procedure for filling out the listed forms with new codes. In particular, a new code “VIRUS” is introduced. It is completed in relation to health workers involved in providing medical care to patients with COVID-19 and suspected cases of it.

New codes for the categories of the insured person are also being introduced:

- MS - for payers of insurance premiums who apply a reduced rate of insurance premiums in accordance with Federal Law No. 102-FZ dated 01.04.2020;

- VPMS - for foreign citizens or stateless persons temporarily staying in the territory of the Russian Federation, for whom insurance premiums are paid by payers of insurance premiums in accordance with Federal Law No. 102-FZ dated 04/01/2020;

- VZHMS - for foreign citizens or stateless persons temporarily residing on the territory of the Russian Federation, for whom insurance premiums are paid by payers of insurance premiums in accordance with Federal Law No. 102-FZ dated 04/01/2020;

- KV - for payers of insurance premiums who pay insurance premiums in accordance with Federal Law dated 06/08/2020 No. 172-FZ;

- VPKV - for foreign citizens or stateless persons temporarily staying in the territory of the Russian Federation, for whom insurance premiums are paid by payers of insurance premiums in accordance with Federal Law No. 172-FZ dated 06/08/2020;

- VZhKV - for foreign citizens or stateless persons temporarily residing in the territory of the Russian Federation, for whom insurance premiums are paid by payers of insurance premiums in accordance with Federal Law No. 172-FZ dated 06/08/2020.

The listed codes were introduced in connection with the establishment of reduced insurance premium rates for certain categories of payers by Federal Laws No. 102-FZ dated 04/01/2020 and No. 172-FZ dated 06/08/2020.

These laws established for small and medium-sized businesses reduced rates of insurance premiums for payments to employees, which at the end of the month exceed the minimum wage, as well as zero rates of insurance premiums for the second quarter of 2021 for small and medium-sized companies (organizations and individual entrepreneurs) operating in industries , most affected by the coronavirus.