Salary in kind

In order for the payment of wages in kind to be legal, this must be stipulated in the collective or labor agreement with the employee. If there is no such condition in the contract, it can be introduced either by drawing up an additional agreement to the contract, or by approving the contract in a new edition. Another condition for issuing wages in this form is an application from the employee. The application must indicate that the employee requests that part of the salary be given to him in kind. Only if these two conditions are met will the issuance of wages not in cash equivalent be recognized as legal (

When is payment in kind allowed?

Let's talk about the main thing right away - the labor code does not allow wages in kind entirely. Its share cannot exceed 20% of the accrued amount. The rest must be paid in cash or transferred to a card.

Another important detail: this form of payment must be fixed in a collective or employment agreement. This is also beneficial for the company. Such foresight will relieve her of the need to transfer VAT on products used for salaries.

Payment in kind may be as follows:

- Products manufactured by the company.

- Other consumer goods purchased by the company for resale or other purposes.

- Groceries or free meals.

- Various raw materials, or any materials.

- Rent payment.

- Some types of insurance.

But there are also limitations. It is prohibited to use the following as payment in kind:

- All kinds of coupons, bonds and other similar documents.

- Alcohol, even if it is the company's own product.

- Narcotic and toxic substances.

- Ammunition and explosives.

- Poisonous products.

- A receipt is not a means of payment in kind.

You don't have to look for the answer to your question in this long article! via the form (below), and within an hour a specialized specialist will call you back to provide a free consultation.

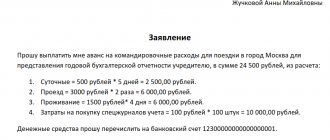

How can an employee write a statement?

An employee can draw up an application, for example, for only one payment, or for a certain period of time: a quarter, a year. At the same time, the employee retains the right to early refusal to pay wages in this form if the period specified in the application exceeds 1 month.

The wording in the application may be as follows: “Based on Article 131 of the Labor Code of the Russian Federation and clause 4.1 of the collective agreement, I ask you to pay me 20% of the accrued wages for January 2021 in kind - in goods of Continent LLC, namely, a microwave oven, the cost 5,500 rubles.”

If an employee pays alimony, then they must be withheld from this type of salary payments. The procedure for withholding alimony will be the same as for withholding from wages paid in cash (

Economic Sciences/7.Accounting and Auditing

Kamdin A.N., Shishkanova N.S.

Mordovian State University, Russia

Accounting for wages in kind

Due to the lack of available cash, organizations practice paying wages in finished products. The need for this option is also due to the fact that the amount of accrued wages in accordance with current legislation cannot be lower than the minimum wage. Moreover, if an employee fails to meet production standards through no fault of his own, the employer is obliged to pay him a monthly salary in the amount of not less than 2/3 of the tariff rate of the category (salary) established for him. These and similar restrictions objectively force the employer to expand the practice of paying wages with products of its own production, especially where such products are used for personal consumption (light industry, food industry and some others). However, payment of wages in kind must be provided for in a collective agreement or other regulatory document with notification to employees no later than 2 months in advance.

The share of wages paid in non-monetary form at Atyuryevskoye OJSC does not exceed 20% of the total wages, which corresponds to the law (Article 131 of the Labor Code of the Russian Federation) [1]. The legislation also defines a list of items in respect of which prohibitions or restrictions on their free circulation are established. Payment of wages in the form of alcoholic beverages, narcotic, toxic, poisonous and harmful substances, weapons, ammunition, etc. is not allowed.

In accounting, the repayment of payment obligations in non-monetary form simultaneously means that the administration repays its obligations to its staff regarding wages and the formation of the sales volume of finished products [2].

However, in accordance with the requirements of the Tax Code of the Russian Federation, the selling price of products should not deviate from the market price by more than 30%. Otherwise, the organization is obliged to make additional payments to the budget and extra-budgetary funds.

Example

In August 2007, a worker at Atyuryevskoe OJSC received a salary in the amount of 3,200 rubles, which was given to him with products of his own production - butter in the amount of 40 kg at the rate of 80 rubles. for 1 kg.

The average market price of oil in this reporting period was 100 rubles. for 1 kg. Consequently, the worker’s actual income was 3,200 rubles (80 rubles x 40 kg), while at market prices it was 4,000 rubles. (100 rub. x 40 kg). From the difference amount - 800 rubles. (4000 - 3200) an additional charge of the single social tax must be made - 284.8 rubles. (800 rub. x 35.6%): 100%.

The employee has one child aged 8 years. The non-taxable minimum is 600 rubles, and taking into account the standard deduction - 400 rubles, total - 1000 rubles. The amount of personal income tax will be 286 rubles. [(3200 –1000) x 13% : 100%].

Based on the market price, the amount of wages subject to personal income tax will be 3,000 rubles. (4000–1000), and the tax amount is 390 rubles. (3000 rub.x 13%): 100%). Thus, an additional 104 rubles must be withheld from the employee into the budget. (390 –286).

In accounting, the repayment of wage obligations with finished products is reflected as a sale transaction:

D 20 “Main production”

K 70 “Settlements with personnel for wages” – 3200 rubles.

D 70 “Settlements with personnel for wages”

To 90 “Sales” (subaccount 90 -1 “Revenue”) - 2810 rubles.

D 70 “Settlements with personnel for wages”

To 68 “Calculations for taxes and fees” (sub-account “Calculations for personal income tax”) - 390 rubles.

Consequently, the employee must receive 35.125 kg of butter (RUB 2,810: 80RUB) as part of accrued wages. At the market price, this amount of oil is 3512.5 rubles. (100 rubles x 35.125 kg), and the difference in the amount between the actual sale of oil and its sale at the market price is 702.5 rubles. (3512.55 –2810).

Since the accounting department calculated the value added tax on the sales amount - 2810 rubles, the amount of the tax itself based on the calculated rate (9.09%) is 255.43 rubles. [(RUB 2810 x 9.09%): 100%]. The following entry was made in the accounting for this amount:

D90 “Sales” (subaccount 90 –3 “Value added tax”)

K68 “Calculations for taxes and fees” (sub-account “Calculations for VAT”).

From the additional accrued difference of 702.5 rubles. the amount of value added tax is 63.86 rubles. [(RUB 702.5 * 9.09%): 100%), which will be reimbursed to the budget by the organization:

D 91 “Other expenses and income” (subaccount 91–2 “Other expenses”)

K68 “Calculations for taxes and fees” (sub-account “Calculations for VAT”).

If, as payment for labor, an object of fixed assets or other property of the enterprise is transferred to an employee of an enterprise, then in accounting, transactions on the transfer of such property are reflected using account 91 “Other income and expenses” [3].

Literature:

1 Russian Federation. Laws. Labor Code of the Russian Federation. - Moscow: Omega-L, 2006. - 184 p. — (Codes of the Russian Federation).

2 Astakhov V.P. Accounting (financial) accounting: Textbook. 7th ed., revised. and additional - M.: MCFR, 2006.-1072 p. — (Library of the journal “Directory of the Head of an Educational Institution”, 1-2006).

3 Kondrakov N.P. Accounting: Textbook. - M.: INFRA-M, 2005.-592 p. - (Higher education).

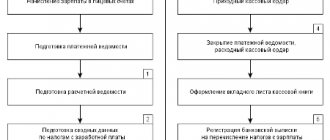

Registration of salary payment

To calculate salaries, one of the forms is used: statement T-51 or statement T-49. A statement such as T-53 will not be suitable for paying wages in this form, as it is not intended for this. An organization can develop a form independently, or use Form 415-APK, developed for agricultural complexes. In order for a company to use it, it must be provided for in the company's accounting policies. If the accounting policy does not provide for such a form, then appropriate changes will need to be made by order of the manager. If necessary, Form 415-APK can be adapted to the company's requirements.

How to process salary payment

In order to calculate salaries, the accountant uses the T-51 or T-49 statement. A separate statement is drawn up for issuance. The T-53 statement is not intended for issuing wages other than cash, so it will be difficult to use it for this type of payment. To simplify the work, you can use the statement form intended for agricultural complexes No. 415-APK, but in order to use it, this should be specified in the accounting policy of the organization (unless, of course, the company is engaged in non-agricultural activities).

What can be given to an employee?

Property that can be issued as salary must meet one of the following conditions: be useful or suitable for use for the employee’s personal purposes.

The following may be issued in this capacity:

- Goods or finished products;

- Materials or OS;

- Raw materials, etc.

An important condition for issuing wages in this form is the cost of the goods. If the employer inflates its price compared to the market price, such payment will be regarded as unreasonable. Market value is defined as the average market price established in the region of the employer.

There are also categories of valuables that are prohibited from being given as salary:

- Alcohol;

- Substances of a narcotic, toxic or poisonous nature;

- IOUs;

- Coupons;

- Ammunition or weapons.

How are income in kind calculated?

Income in kind is taken into account at the market value of goods, works, and services (Article 211, Article 105.3 of the Tax Code of the Russian Federation). The price must include VAT and excise taxes. The taxpayer can independently make adjustments and pay additional tax based on the results of the calendar year if he considers that the value does not correspond to the market value and was underestimated (clause 6 of Article 105.3 of the Tax Code of the Russian Federation). In the absence of an adjustment from the taxpayer, the price is considered market price until the Federal Tax Service proves otherwise (clause 3 of Article 105.3 of the Tax Code of the Russian Federation).

In cases where an individual independently paid part of the cost of goods received (services, property rights), only the remaining share, minus the amount contributed by the individual, is included in the accounting of income.

How much can a salary in kind be?

It is impossible to give the entire salary to an employee in goods or other valuables. Payment in kind should not exceed 20% of the accrued salary. If, nevertheless, there is a need to give the employee more than 20% of the salary in kind, then this must be formalized as a sale. Thus, the documents will reflect that the employee was paid his salary in full, after which he purchased some property from his employer for cash.

Important! It is impossible to exceed the limit of 20% for the payment of wages in kind, as this may be of interest to the inspection authorities.

Amount of payment in kind

Important! Only part of the salary can be paid in kind. This part should not exceed 20% of the total accrued salary.

There are also situations when an employee asks to give him more than 20% of his salary in kind. In this case, you need to formalize the sale of the property. That is, so that the documents show that the employee received the full amount of the salary, and then bought property in his organization for cash. If the payment amount exceeds the 20% limit, this will lead to claims from the inspection authorities (

Personal income tax and insurance premiums

Like wages paid in cash, wages in kind are subject to personal income tax and insurance contributions. In order to calculate the amount of personal income tax, you will need to determine the value of the value issued. The price is determined by agreement between the employee and the employer, based on the market price, including VAT. Personal income tax is calculated as 13% of this amount, and wages paid in kind are included in the employee’s total income, which is subject to reduction by standard deductions. Insurance premiums are charged on all wages, including that part that is paid in kind.

Important! Insurance premiums must be charged on the value of property issued to an employee as salary in kind. Personal income tax is also withheld from this amount.

Accounting for salaries in kind

Let's consider the main transactions depending on the property issued to the employee as salary:

| Business operation | Postings | |

| Debit | Credit | |

| The employee is given goods (finished products) | ||

| Goods were issued as payment for wages | 70 | 90 (sub-account “Revenue”) |

| The cost of the goods is written off | 90 (sub-account “Cost of sales”) | 43(41) |

| The employee is given materials (OS) | ||

| OS issued as salary | 70 | 91 (sub-account “Other income”) |

| The cost of the OS has been written off | 91 (subaccount “Other expenses”) | 01(08, 10, 21) |

| Depreciation written off on fixed assets | 02 | 01 |

Example of payment of salary in kind

Petrova O.P. I wrote a statement to the head of Kontinent LLC, in which I asked for a microwave oven worth 5,500 rubles, VAT – 838.98 rubles, as payment for my salary for January 2021. The conditions for such payment are fixed in the employment contract. For January 2021, Petrova received a salary of 40,000 rubles. The cost of the microwave oven at which the organization purchased it is 2,700 rubles, including VAT of 411.86 rubles. The cost of a microwave oven does not exceed the 20% limit for issuing wages in kind, so it can be issued to an employee.

Let's look at what the wiring will be like:

D44 K70 – salary accrued to Petrova O.P. – 40,000 rubles;

D70 K68 – personal income tax withheld from salary – 5,200 rubles;

D44 K69 – insurance premiums charged – 8,000 rubles;

D70 K90 (sub-account “Revenue”) - goods were issued as wages - 5,500 rubles;

D90 (sub-account “VAT”) K68 – VAT is charged on the goods – 838.98 rubles;

D90 subaccount (“Cost of sales”) K41 – microwave oven written off at cost – 2,288.14 rubles (2,700 – 411.86);

D70 K50 - the balance of the salary was paid 29,300 rubles (40,000 - 5,200 - 5,500).

When calculating income tax, Continent LLC must take into account the income received from the sale of a microwave oven - 4,661.02 rubles (5,500 - 838.98), and expenses will include the cost of the microwave - 2,288.14 (2,700 - 411.86).