From 2021, a new procedure for transferring losses from previous years is in effect. How to apply the new order in practice? What needs to be taken into account when reducing the tax base for income tax on losses of previous years? Is it necessary to document losses for tax periods that were verified during an on-site tax audit?

According to the Federal Law of November 30, 2016 No. 401-FZ “On amendments to parts one and two of the Tax Code of the Russian Federation and certain legislative acts of the Russian Federation,” starting from the first reporting period of 2017, the procedure for accounting for losses of past tax periods is changing.

Tax innovations (part 1)

Tax innovations (part 2)

Tax innovations (part 3)

New rules for carry forward losses

During reporting (tax) periods from January 1, 2021 to December 31, 2021, the tax base for the tax for the current reporting (tax) period (determined according to the rules of Article 274 of the Tax Code of the Russian Federation) cannot be reduced by the amount of losses received in previous tax periods. periods, by more than 50 percent (clause 2.1 of Article 283 of the Tax Code of the Russian Federation).

But there are exceptions to this rule. The specified 50 percent limitation does not apply to tax bases to which reduced tax rates for income tax apply.

Starting a business – is it allowed to take into account losses?

The Tax Code in Chapter 25 allows losses received to be taken into account when calculating the tax base. However, this action is allowed only in subsequent tax periods, and only if the tax base is positive. In this way, according to paragraph 1 of Art. 283 of the Tax Code of the Russian Federation, and losses are transferred to the future.

In business practice, there are circumstances in which a taxpayer incurs expenses in a certain reporting period, but does not receive income. Most often this happens when starting a business, when the company is at a preliminary stage preparing for production or construction. During this time period, it is forced to pay wages to staff, purchase materials and equipment, etc.

IMPORTANT! Starting from 01/01/2017 and until 31/12/2021, the company can take into account losses for previous periods in such a way that the positive annual result obtained is not reduced by the carry forward loss by more than 50%. When losses can be recognized without restrictions, find out here.

The Ministry of Finance of Russia, in letter dated August 26, 2013 No. 03-03-06/1/34810, and the Federal Tax Service of Russia, in letter dated April 21, 2011 No. KE-4-3/6494, express the opinion that the taxpayer has every right in such situations to make carry forward losses.

It should be noted that the Ministry of Finance has recently sharply changed its position in favor of taxpayers. Previously, ministry experts insisted that the taxpayer does not have the right to transfer losses until he carries out activities aimed at generating income. Moreover, the Ministry of Finance generally considered it unnecessary to record expenses during such periods.

This position has been the cause of many lawsuits. And, despite the obvious discrepancy between the position of the Ministry of Finance and the norms contained in paragraph. 4 paragraphs 1 art. 252 of the Tax Code of the Russian Federation, arbitration courts sometimes supported the regulatory authorities.

Accounting for losses from previous years when tax authorities identify arrears

When making a decision after completing a tax audit and calculating the arrears of income tax payable to the budget, tax authorities must also take into account the amount of losses from previous years.

Thus, in one of the arbitration disputes, the judges came to the conclusion that the tax authority unreasonably, when making a decision, did not take into account the losses of previous years when determining the company’s tax liabilities for income tax.

In order to take into account losses of previous years when determining the taxable base for income tax, a company has the right to file an appropriate tax return, as well as declare such accounting during an on-site tax audit, in particular, by submitting appropriate objections to the audit report.

The courts found that the subject of the on-site tax audit of the company was, among other things, the issue of the correct calculation and payment of income tax for the period from 01/01/2011 to 12/31/2013. In the income tax return for 2011, the company declared a loss in the amount of 43 million rubles, according to the audit, the loss amounted to 34 million rubles, for 2012 - 26 million rubles, for 2013 - 21 million rubles.

RESTORATION OF ACCOUNTING AND TAX ACCOUNTING

In addition, the tax authority indicated that the company has the right to carry forward losses calculated in 2007, 2008, 2009, 2010. During the audit, the company filed an application to carry forward losses from previous years in objections to the tax audit report.

In this regard, the tax inspectorate is obliged to take into account the amount of loss from previous years and make additional tax assessments, penalties and fines taking into account the amount of loss that reduces the tax base for the tax (Resolution of the AS of the West Siberian District dated December 21, 2016 No. A27-1017/ 2016).

A similar decision on the need for the tax inspectorate to adjust tax liabilities for the amount of losses from previous years (however, regardless of the company’s submission of an updated tax return) was made in the Resolutions of the Seventh Arbitration Court of Appeal dated October 25, 2016 No. A27-4936/2016 and the AS of the West Siberian District dated June 14, 2016 No. A27-15349/2015.

And in the decision of the AS of the Kemerovo region dated 09/05/2016 No. A27-4936/2016 it is noted that the reduction by the taxpayer of the tax base of the current tax period by the amount of the loss received in the previous tax period is his right, which is exercised by reflecting the amounts of the loss that reduces the tax income tax base in the relevant declaration (Article 80 and Article 283 of the Tax Code of the Russian Federation). In this case, it is the taxpayer who independently determines in what period and in what amount to count his existing loss. The tax authority is not empowered to forcefully determine the amount of loss to be taken into account when calculating income tax, which is consistent with the position set forth in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 24, 2012 No. 3546/12, according to which the ability to take into account the amount of loss is of a declarative nature and the taxpayer is obliged to prove their legality and validity.

AUDIT REPORT

In this case, the company filed objections to the on-site inspection report with the question of making such records in order to determine the tax obligations of the taxpayer, thereby declaring the transfer of losses from previous years to the audited tax period in which the arrears were identified. The tax inspectorate should have adjusted the company's tax obligations. A different legal approach entails a distortion of the real amount of tax liabilities.

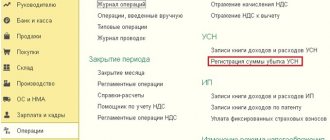

How to transfer losses from previous years in the accounting database

Currently there is no automatic transfer of losses in the programs. Therefore, we will transfer the loss using manual entries. Please note that the manual loss carry forward operation is carried out on December 31, after the close of the tax period, but before the balance sheet reformation.

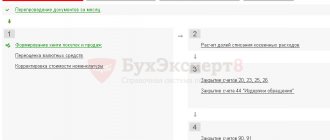

Closing the tax period in which the loss was incurred

- We will forward the documents for December;

- We close the month, but skip the “balance sheet reform” operation. D 99.01 – K 90.09 The program must generate the posting independently.

- We create a manual loss transfer operation: D 97.21 – K 99.01 – the amount of loss carried forward to future periods. 97.21 “Other deferred expenses” 99.01 “Profits and losses from activities with the main tax system”

- For account D 97.21, we create the subaccount “Loss ... year” and configure this subaccount correctly. Type for NU - Losses of previous years Type of asset in the balance sheet - Other current assets Amount - Amount of loss Recognition of expenses - In a special order Write-off period - from XX.XX.XXXX

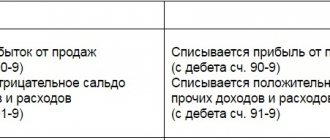

We are carrying out the “balance sheet reform” document

D 84.02 – K 99.01 D 90.01 – K 90.09

The program must generate the postings independently. The transfer of losses is carried out after the regulatory operation “Calculation of income tax”.

Write-off of losses from previous years

Now, in the new tax period, starting from the date specified in Subconto, if an organization makes a profit in tax accounting, it will automatically be reduced by part of the loss of the previous period or the entire amount. The write-off will take place monthly until the entire loss is written off. The operation can be seen in Menu – Closing the month – Write-off of losses from previous years. D 99.01 – K 97.21 – the amount of the written off part of the loss.

We reflect the transferred loss in the income tax return

On Sheet 02 of Appendix 4, you must indicate the year from which we are transferring the loss and the amount of the loss Total; the amount of the tax base; the amount of loss, but not more than 50% of the profit; the balance of the unwritten loss. We go to Sheet 02; the amount of the transferred loss should be automatically transferred to page 110.

—

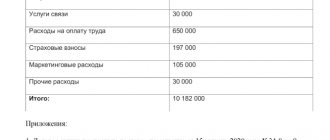

Carrying forward a loss using an example

When calculating income tax for 2021, Mega LLC received a loss of 350,000 rubles. This loss can be carried forward to the future, forming from December 31, 2017. manual wiring operation D 97.21 – K 99.01 = 350,000 rub. In the 1st quarter of 2021, when calculating income tax for Mega LLC:

Income 1,200,000 rubles, Expenses 1,000,000 rubles.

The tax base was 200,000 rubles. (1,200,000 – 1,000,000), we can reduce it by the amount of loss, but not more than 50% of the profit. In our case, we reduce by 100,000 rubles. In the income tax return on Sheet 02, Appendix 4, we indicate: - the year from which we transfer the loss = 2021; — amount of loss Total = RUB 350,000; — tax base amount = 200,000 rubles; - amount of loss, but not more than 50% of profit = 100,000 rubles; — balance of unwritten loss = 250,000 rubles (350,000 – 100,000)

—

Deferred loss carryforward

There are situations when organizations do not want to reduce the tax base for losses from previous years in the current tax period, because carrying forward losses to the future is a right. But then a situation may arise when management needs to reduce the tax base, thereby reducing the tax.

Important! — If you do not apply PBU 18/02 and are sure that you will never carry forward the resulting loss, then you do not have to create a manual “Loss Transfer” operation at the end of the year. — If you apply PBU 18/02, then this operation will have to be created, otherwise the program will not allow you to close the first month of the next year.

In this case, we still recommend creating an operation to transfer the loss, but then without indicating the start date for writing off this loss.

How to do this: In a manual operation to transfer a loss, for account 97.21, we create a subaccount “Loss ... year” Type for NU - Losses of previous years Type of asset in the balance sheet - Other current assets Amount - Amount of loss Recognition of expenses - In a special order Write-off period - LEAVE LINE IS EMPTY Later, when you decide to reduce your tax base by the amount of the loss, you will need to indicate in the “write-off period” field the first date of the tax period from which you want to start writing off.

We suspend the write-off of losses for a while

It happens that an organization has written off a loss over a certain period of time, but this year does not want to reduce the tax profit for the loss of previous years and needs to stop writing off the loss for a while.

In this case, it is necessary to create a transaction entered manually with the posting: D 97.21 (sub-account “Balance of loss 2017”) - K 97.21 (sub-account “Loss 2017”) - the amount of the balance of the loss not transferred. We set up the subconto “Remaining loss 2017” as described above, i.e. We leave the dates of the write-off period blank.

Then, when write-off is required again, it will be necessary to post back:

D 97.21 (sub-account “Loss 2017”) - K 97.21 (sub-account “Balance of loss 2017”) - the amount of the balance of the loss not transferred.

Documentary proof of losses

The right to take into account a loss corresponds to the obligation of taxpayers to keep documents confirming the amount of loss incurred during the entire period when it reduces the tax base of the current tax period by the amounts of previously received losses (clause 4 of Article 283 of the Tax Code of the Russian Federation).

Such documents include all primary accounting documentation that confirms the financial result obtained (Resolutions of the Volga Region Autonomous District of July 14, 2016 No. A12-47947/2015, Moscow District of May 23, 2016 No. A40-100692/2015).

The absence of documents confirming the amount of loss incurred implies the loss of the taxpayer's right to transfer losses from previous years, as not supported by documents, into the calculation of the tax base for income tax for the current tax period. Since the ability to take into account the amounts of loss is of a declarative nature, the taxpayer has the obligation to prove their legality and validity. Therefore, in order to decide on the possibility of accepting expenses for the purpose of calculating income tax, it is necessary to check the reality of such expenses and their documentary evidence.

The Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 24, 2012 No. 3546/12 clarifies that since the ability to take into account the amounts of loss is of a declarative nature and the taxpayer is obliged to prove their legality and validity, in the absence of documentary evidence of the loss with relevant documents, including primary accounting documents, During the entire period when he reduces the tax base by the amounts of the previously received loss, the taxpayer bears the risk of adverse tax consequences.

With a different approach, the tax authority must accept the declared amount of losses from previous years without justification, without checking their size, which makes it impossible to determine the real amount of the tax liability in the audited period.

LEGAL SUPPORT FOR BUSINESS

A similar position is reflected in the definitions of the Supreme Arbitration Court of the Russian Federation dated December 3, 2013 No. VAS-17101/13, dated August 9, 2013 No. VAS-10478/13, dated November 13, 2012 No. VAS-14298/12.

Inventory acts, certificates for them, as well as tax returns for previous tax periods are not evidence of the incurrence of costs that entail the formation of a loss by the company (Resolution of the Central District Administration of January 18, 2016 No. A35-8716/2014).

Important!

But what to do in situations where the taxpayer has had an on-site tax audit conducted, confirming the correctness of accounting for income and expenses for tax purposes, and the procedure for generating losses from previous years? During the audit periods, does the company need to re-submit documents confirming the amount of losses incurred? According to the regulatory authorities, it is impossible to do without supporting primary documents even in cases where the amount of losses is confirmed by the results of a previously conducted on-site tax audit (Letter of the Ministry of Finance of the Russian Federation dated May 25, 2012 No. 03-03-06/1/278, dated April 23. 2009 No. 03-03-06/1/276).

However, in judicial practice there are decisions that confirm the taxpayer’s right to carry forward losses from previous years if its amount is established based on the results of an on-site tax audit.

How to reflect the presence of a carry-forward loss in an income tax return

Information about losses from previous years is recorded in Appendix 4 (PR4) to sheet 02 of the declaration for non-residential income. If there is a carryover loss, PR4 is included in the tax reporting, reflecting the balances of the loss at the beginning and end of the current year. PR4 is required to be included in the declaration for the 1st quarter and year (even in the absence of carryover losses).

In PR 4 they reflect line by line:

- 010 – loss of previous years at the beginning of the year for which the declaration is prepared;

- 040 – 130 — amount of losses by time of formation;

- 140 – base for NNP;

- 150, 151 – the amount of loss by which the company has the right to reduce the base of the income tax of the current year;

- 160, 161 – the balance of the unwritten off “last year” loss, which is carried over to the next year (filled out in the annual declaration).

The transfer of income tax losses from the example presented will be reflected in the following way in the PR4 declaration for 2021:

EXAMPLE No. 2

On-site tax audits were carried out against the company for 2004-2006, 2007-2009.

The tax authority, when conducting on-site audits for the specified periods, verified and confirmed the correctness of accounting for income and expenses for tax purposes, and the procedure for generating losses from previous years.

In this part, no violations were identified in the procedure for generating losses and recording expenses.

According to tax authorities, the amount of losses cannot be confirmed only by declarations, since declarations are not primary accounting documents and do not document the existence of a loss for the company.

In addition, tax legislation does not provide for the termination of the obligation to store documents after the end of the tax audit.

However, the court sided with the company based on the following arguments.

The subject of an on-site tax audit is the correctness of calculation and timely payment of taxes (clause 4 of Article 89 of the Tax Code of the Russian Federation).

MANDATORY AUDIT

Thus, the correctness of the formation of losses for previous years is subject to verification by the tax authority in order to verify the correctness of calculation and payment of income tax within the period covered by the on-site audit.

Clause 5 of Article 89 of the Tax Code of the Russian Federation establishes a ban on conducting two or more on-site tax audits on the same taxes for the same period. Repeated inspections are allowed on the grounds specified in clause 10 of Article 89 of the Tax Code of the Russian Federation.

Resolution of the Supreme Arbitration Court of the Russian Federation dated March 16, 2010 No. 8163/09 clarifies that during a repeat audit, data that has not been changed by the taxpayer or is not related to the specified adjustment cannot be re-verified.

As the judges noted, the tax authority did not provide evidence that in the newly audited tax authority the payer’s tax obligations were adjusted in comparison with the data previously audited. That is, the company has not submitted any updated declarations since the on-site tax audit.

Therefore, the decision of the tax inspectorate is unlawful (Decision of the Tax Administration of the Sverdlovsk Region dated July 21, 2016 No. A60-19076/2016).

But in this case one more point should be taken into account. If the company submitted documents to the tax authorities in the form of originals (which were subsequently returned to the company), then the restriction on re-submission of documents at the request of the tax authorities does not apply (clause 5 of Article 93 of the Tax Code of the Russian Federation). Therefore, the company is obliged to submit documents confirming the losses incurred once again (Decision of the AS of St. Petersburg and the Leningrad Region dated June 27, 2016 No. A56-8850/2016).

Features of carrying forward losses

Some losses are carried forward in a special manner. The following features are established for losses:

- From activities carried out by service industries and farms (Article 275.1 of the Tax Code of the Russian Federation).

- For operations carried out with securities and financial instruments of futures transactions, if these securities and transactions are non-negotiable (clause 22 of Article 280 of the Tax Code of the Russian Federation).

- For operations that are carried out with depreciable property (clause 3 of Article 268 and Article 323 of the Tax Code of the Russian Federation).

- For transactions related to the assignment or assignment of the right of claim (Article 279 of the Tax Code of the Russian Federation).

During what period can the tax base be reduced for losses?

In accordance with paragraph. 2 clause 7 art. 346.18 of the Tax Code of the Russian Federation, a loss under the simplified tax system “income minus expenses” can be declared within 10 years after the year of its formation. If expenses exceeded income for more than one period, but several, the resulting losses are written off sequentially (paragraph 5, paragraph 7, article 346.18 of the Tax Code). That is, a loss arising in 2021 cannot be written off earlier than the loss of 2021.

The amount of minimum tax paid during the period of writing off losses of previous years can also be written off over the next 10 years.

The taxpayer decides what amount of loss to declare in the declaration - full or partial. The legislation does not limit it in this part, as long as the deadlines are met and the total amount presented is not greater than the losses received for all previous years.

Tax accounting of losses from previous years is kept in section III of KUDiR.

Regulatory regulation of loss write-off

| Tax Code of the Russian Federation part 2 | Procedure for calculating income tax |

| Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n | Approves PBU |

| Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n | Approves PBU 18/02 |

| Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n | Approves the chart of accounts and its application |

| Order of the Federal Tax Service of Russia dated October 19, 2016 N ММВ-7-3/ [email protected] | Income tax return form |