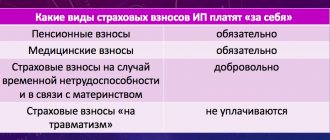

Dividends are taxed: personal income tax rate

From the dividends that the LLC pays to its individual participants (for example, founders) in 2021, income tax should be calculated, withheld and transferred to the budget.

Thus, dividends paid to tax residents of the Russian Federation in 2021 are subject to personal income tax at a rate of 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation). Let's give an example of dividend calculation.

Example

In March 2021, Lesnoy Cheburashka LLC paid its founding member B.V. Uspensky. dividends in the amount of 6,000,000 rubles. The company does not receive dividends from other organizations. When paying dividends to the founder, personal income tax is withheld in the amount of 780,000 rubles. (RUB 6,000,000 x 13%). As a result, 5,220,000 rubles were transferred to the participant. (RUB 6,000,000 – RUB 780,000).

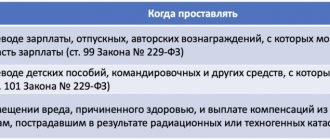

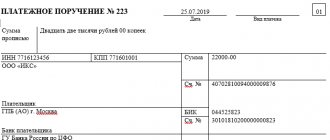

Correctly fill out field “107” in the payment order

When filling out a payment slip for transferring personal income tax on dividends received, special attention must be paid to filling out field “107”, which indicates the frequency of tax transfer or a specific date for the payment. The frequency of payment refers to the tax period for which the payment is transferred (it can be 3, 6, 9 or 12 months). It is important to correctly display this period in the payment document.

The "107" field consists of ten characters, which include two separating periods (the third and sixth characters).

The first two characters must consist of letters:

- “MS” – for monthly payments;

- “KV” – for quarterly payments;

- “PL” – for semi-annual payments;

- “GD” – for annual payments.

Next, indicate the number of the month (quarter or half-year) and year. If the payment is made for the year as a whole, zeros are indicated in the previous characters. The payment order is signed by the head of the organization, accountant or other authorized person, after which a stamp is affixed if the organization works with a seal. If an order is sent electronically, an electronic digital signature is sufficient.

Please note: personal income tax on dividends that were paid by an organization to several individuals can be paid in one payment.

Accordingly, for this you do not have to generate separate payment documents. The main thing is to indicate the correct amount and all other related details. The only caveat is that for such a generalized payment it is necessary to have supporting accounting documents that will allow, if necessary, to identify each recipient of income on which taxes were paid.

Please note that today you can easily fill out a payment order form using a special web service of the Federal Tax Service. To do this, you just need to go to the portal and, following the prompts, step by step enter the data to generate a payment.

Thus, the correctness of the payment identification and the timely payment of taxes depend on the correct completion of the payment document when transferring the amount of personal income tax from dividends received.

Features of transferring personal income tax from dividends in 2021

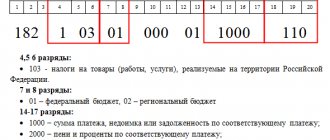

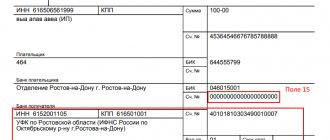

Pay personal income tax on dividends in 2021 to the usual KBK for personal income tax - 182 1 0100 110. There is simply no special “dividend” KBK.

As for the deadline for transferring personal income tax on dividends, the income tax withheld by the LLC from dividends paid to participants must be paid no later than the day following the day the dividends were transferred to them (clause 6 of Article 226 of the Tax Code of the Russian Federation). That is, let’s say: if you transferred dividends (transferred a payment slip to the bank) on March 13, 2021, then you need to pay personal income tax no later than March 14.

By the way, in the line about the purpose of payment, you can indicate the date when the income arose. This way, tax officials will immediately be able to verify that there was (or was) no violation of the deadlines for transferring personal income tax on dividends.

At the same time, we believe it is advisable to pay attention to the fact that in the payment order for the payment of personal income tax on the founder’s dividends, the month in which the “dividend” income arose must be indicated. This month will be the month when the dividend payment was transferred to the person (the accountant sent the payment to the bank).

We also note that in relation to personal income tax on dividends, a separate payment order must be generated. There is no need to pay “dividend” personal income tax along with salary taxes.

It is important to know that payment of personal income tax on dividends does not depend on where the recipient of part of the profit from the business lives or is registered. The company must necessarily transfer personal income tax on dividends received by the person to the place of the inspection where it is registered.

Now we will provide a sample payment order for personal income tax on dividends in 2021. You can download this sample in Word format and use it in your work.

Also see “Payment of personal income tax on dividends”.

An organization has the right to defer payment of personal income tax on dividends to the founder if it has a counterclaim against this person. For example, if the founder does not repay the debt or has not paid for the goods. That is, all counter debts must be offset. And if the founder’s debt is greater than or equal to the amount of dividends, then the company has the right not to transfer funds from dividends to him. Thus, it seems to take a deferment from paying personal income tax on such income.

Read also

11.01.2018

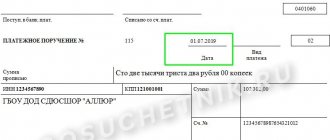

How to correctly draw up a payment order

Payment orders are drawn up according to the approved form, which is assigned the number 0401060. Each field of the payment order has its own number (in the sample payment order, which is available on our website, the field numbers are indicated). In order to correctly draw up a payment document for the transfer of personal income tax on dividends received, you must follow the recommendations approved by Order of the Ministry of Finance No. 107-n. All details in the payment order must be indicated correctly: only in this case the funds will be credited, and the tax authorities will not have any claims against the sender.

As when filling out any other payment order, in the case of paying personal income tax on dividends, the document must indicate the details of the sender and recipient of the funds (regional representative office of the Federal Tax Service). Please note: the recipient of the funds must be the tax authority at the place of registration of the tax-paying organization, and not at the location of the recipient of the dividends.

The payment order must indicate its number, date, and amount of funds transferred (in numbers and words). In the section “Taxpayer Status” (field “101”), the numbers “02” are indicated if the personal income tax is paid by an organization (tax agent) or the numbers “09” if the personal income tax is paid by an individual independently (a full list of statuses can be found in Order of the Ministry of Finance No. 107-n , which we mentioned above).

When drawing up a payment order, you must carefully fill out the budget classification code - KBK (field “104” in the payment document).

Each type of tax has its own specific BCC. The code consists of twenty digits separated by separate blocks. In 2018, in the KBK line for personal income tax on dividends, the code “182 1 0100 110” must be indicated. This code is the same both for payments for paying taxes on dividends received and for paying taxes on wages and benefits (if the recipient of funds in the form of dividends is a legal entity, this code will be different).

In field “105” the OK code must be indicated; the letters “TP” must be indicated - this means that the payment order displays payments for the current year. In line “108” the number of the document on the basis of which the payment is made is indicated, or “0” is entered if it is absent. Field “110”, which characterizes the type of payment, must be left blank when filling out the payment form.

Personal income tax on dividends in 2021: rate, kbk, sample payment form

In 2021, personal income tax on dividends is withheld and transferred to the budget by tax agents, that is, organizations that pay income to their participants and shareholders.

You will find the rate, BCC and a sample payment slip for the payment of personal income tax on dividends in 2021 in the article. How to reflect dividends in accounting and tax accounting >>>

Personal income tax rate on dividends in 2021

The tax agent usually calculates, withholds and transfers personal income tax to the budget. Only when income is received by a resident from sources abroad, the person himself must calculate and remit the tax. Experts from the Glavbukh System spoke about what taxes to withhold from dividends paid in 2021.

The calculation procedure depends on whether the recipient is a tax resident. If yes, then withhold personal income tax on accrued dividends at a rate of 13 percent. For dividends to non-residents - at a rate of 15 percent (clause 3 of Article 224 of the Tax Code of the Russian Federation).

Current personal income tax rates for different types of dividends, features and grounds for paying tax, see the table below.

| Subscribe to our channel in Yandex.Zen |

Table 1. Personal income tax rates on dividends in 2021

DividendsIncome recipientRateFeaturesBase

| From sources abroad (foreign organizations), regardless of the method of participation - by shares or by share in capital | Resident | 13% | The tax is determined and paid by the individual himself. It is not possible to reduce personal income tax on tax already paid abroad. An exception is provided only for amounts transferred to the budgets of countries with which Russia has concluded a treaty (agreement) on the avoidance of double taxation. The tax must be paid no later than July 15 of the year following the one in which the income was received | clause 2 art. 214, paragraph 1, art. 224 and paragraph 4 of Art. 228 NK | |

| From equity participation in the authorized capital of a Russian organization | Resident Member | The tax agent – the source of payment – calculates, withholds and pays personal income tax. The base for calculating personal income tax must be reduced by the amount of dividends that the tax agent received from equity participation in other organizations in the current and previous years | Tax must be paid no later than the next day after the day on which the income was paid. That is, no later than: – the day of transfer of dividends to the account of the participant (third parties on his behalf); – the next day after the actual deduction when paying dividends in cash | clause 3 art. 214, paragraph 1, art. 224, paragraph 6 of Art. 226 NK | |

| Non-resident participant | 15% | The tax agent – the source of payment – calculates, withholds and pays personal income tax. It is impossible to reduce the base for calculating personal income tax by the amount of dividends received by the tax agent | clause 3 art. 214, para. 2 p. 3 art. 224, paragraph 6 of Art. 226 NK | ||

| For shares of a Russian organization | Resident shareholder | 13% | The tax agent - issuer (depository, trustee) calculates, withholds and pays personal income tax from payments to shareholders, data on which are promptly provided to the registrar. If several payments are made during the year, then the tax is calculated on an accrual basis, offsetting previously paid amounts to the budget | The tax must be paid no later than one month from the earliest of the following dates: – the end of the tax period (year); – the expiration of the last one based on the start date of the agreement on the basis of which the tax agent pays income; – the date of payment of funds | clause 4 art. 214, paragraph 1, art. 224, paragraph 2, 9, 10 and 12 art. 226.1 NK |

| Non-resident shareholder | 15% | clause 3 art. 214, para. 2 p. 3 art. 224, paragraph 6 of Art. 226 NK | |||

| A person about whom information was not provided in a timely manner and whose rights to shares are recorded in securities accounts: – foreign nominee (authorized) holder; – depository programs | 15% | The tax agent – depository, trustee – calculates, withholds and pays personal income tax. If several payments are made during the year, the tax is calculated on an accrual basis, taking into account amounts previously paid to the budget. | clause 4 art. 214, para. 2 p. 3 art. 224, paragraph 2, 9, 10 and 12 art. 226.1 NK |

Deadlines for payment of personal income tax on dividends to the budget in 2021

Withhold personal income tax, regardless of the applied rate, directly when paying dividends (clause 4 of article 226 of the Tax Code). Experts from the Glavbukh System spoke about when to recognize dividends as income, as well as transfer personal income tax on them and reflect them in 6-NDFL.

Depending on the form of organization - LLC or JSC, transfer the personal income tax withheld from dividends to the budget within the following terms.

LLC transfers personal income tax no later than the day following the day:

- payment or transfer of dividends;

- payments of other income from which the amount of personal income tax must be withheld if dividends are paid in kind.

This is provided for in paragraphs 4, 6 of Article 226 of the Tax Code.

JSC transfers personal income tax on dividends on shares of Russian organizations no later than one month from the earliest of the following dates when:

- the relevant tax period has ended;

- the term of the last agreement based on the start date on the basis of which the tax agent - depositary pays income to the shareholder has expired;

- money is paid or securities are transferred.

This procedure follows from the provisions of paragraph 4 of Article 214 and paragraph 9 of Article 226.1 of the Tax Code.

Source: https://www.glavbukh.ru/art/92122-ndfl-s-dividendov-2020

Responsibility for non-payment of personal income tax on dividends

For untimely transfer of tax to the budget, for failure to pay penalties, for failure to submit reports, the tax agent is held accountable and penalties may be imposed on him. Depending on the violation, the following types of punishment are provided:

| Violation | Amount of fine |

| For one tax period | 10,000 rubles |

| More than one period | 20 000 |

| Understatement of tax | 20% of the underpaid amount, but not less than 40,000 |

For administrative violations, the employer and the person responsible may be subject to a fine up to and including removal from office.

And also, do not forget that you will need to report in form 2NDFL and 6NDFL to the tax office, where filling out the column for dividends is a mandatory requirement.

Deadline for payment of personal income tax on dividends

When paying income tax on dividends, there is a certain deadline that must be met or the company will be subject to penalties. The payment period also depends on the form of ownership of the enterprise:

- For a limited liability company - this period is the next day after the payment of dividends in accordance with clause 6 of Art. 226 NU RF;

- For a joint stock company , this period is one month from the date of payment of dividends.

Checking settlements with the budget for personal income tax on dividends

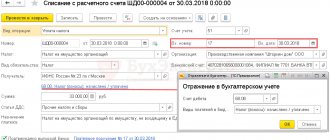

To check the calculations with the budget for personal income tax, you can create a report Account analysis for account 68.01 “Personal income tax when performing the duties of a tax agent” in the section Reports - Standard reports - Account analysis.

There is no debt to pay personal income tax on dividends from an individual.

see also

- Payment of income tax on dividends of RO NA

- Payment of dividends to founders

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- How not to make a mistake in indicating the Tax period in a payment order? It’s no secret that now a payment order for payment is quite simple...

- Payment of income tax on dividends Payment of income tax on dividends to the budget by a tax agent...

- Paying tax under the simplified tax system: object Income In this article we will talk about how to fill out a payment form…

- Payment of dividends to founders: individuals and legal entities Let's consider the features of reflecting the accrual and payment of dividends in 1C...

Who is considered the recipient of dividends?

Based on the results of the year, all taxes must be paid on the profit received by the enterprise. Only after this the remaining profit can be distributed among its participants. Participants of the company are those persons who have a share in the authorized capital of the enterprise. Private owners can be both legal entities and individuals.

Important! The profit of the enterprise is distributed in accordance with the charter of the enterprise. But most often this amount is calculated in proportion to the share in the authorized capital. Newly accepted participants may also qualify for payment of dividends according to their available share.

The company that pays dividends acts as a tax agent and withholds income tax on these payments. In order to receive dividends, the company convenes a meeting of the founders, draws up a protocol in which the percentage is recorded to whom and how much is due. Then the accountant goes to the bank and receives dividends by check, or transfers them to each participant on a card, but the bank has the right to request a protocol or a decision on the distribution of shares.