#4 14.11.2013 11:32:08

they total amounts must match

who told you this? The bases for personal income tax and insurance contributions are completely different. Don’t be like the tax authorities who once charged organizations additional personal income tax from the insurance premium base.

Pregnant employees of organizations can take maternity leave.

It is paid based on the average salary.

Many expectant mothers are concerned about the question: is the benefit income or not?

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Entering maternity benefits into 2 personal income taxes

Maternity benefits are not defined by the Tax Code as payments subject to income tax and are not included in the 2nd personal income tax.

The employee loses the right to receive them if she does not stop performing her official duties after the sick leave is issued to her.

The legislation provides for one type of profit for a pregnant working woman. She decides for herself what she needs more: a salary or an allowance.

If an enterprise pays only maternity benefits to an employee in the reporting year, the accounting department does not include this information in the tax department.

When applying for a maternity leave, it is advisable not to delay sending a certificate from a gynecologist and other necessary documents to the accounting department.

Reflection of benefits in 6 personal income tax

A woman provides a sick leave certificate to the accounting department upon reaching 30 weeks of gestation.

If after this he goes on maternity leave and does not work even part-time, then the benefit received is not included in the declaration.

Calculation 6 personal income tax will be filled out in accordance with order MMV 7-11-450. There are, however, no specifics about birth payments.

Profit in the form of maternity benefits is completely reduced by the benefit amount. It is impossible to show in the calculation that this income is exempt from taxation.

The head of the enterprise is fined for deliberately concealing information about the exemption of maternity payments from tax.

A woman who continues to work before giving birth, when filling out personal income tax declaration 6, is required to indicate the amount of salary received during this period.

According to the letter of the Ministry of Finance 03-04-06-02-47, in the second part of the 6 personal income tax report, all bonuses and other additional payments paid to the employee in excess of maternity leave are also indicated.

In accordance with BS 4-11-13984, additional payments are reflected as follows:

- 100 - date of receipt of additional remuneration;

- 110 - the same information is written here as in the previous field;

- 120 is the next number after the specified number in the 100 field.

So, in accordance with the norms of the Tax Code of the Russian Federation, maternity benefits are considered preferential income - exempt from income tax. A pregnant woman's sick leave is not included in personal income tax certificates 2 and 6. Only rewards are entered there.

Share a link to the article or save it

Have you found the answer to your question? Find out how to solve exactly your problem - call right now:

Procedure for payment of amounts

The following categories of women have the right to maternity benefits:

- Working;

- registered with the central control center;

- full-time students;

- military.

The amount of payments depends on the amount of accrued income. It should be separately noted that the state also took care of those women who took in children from the orphanage.

If an employee on maternity leave refuses subsidies and continues to work, she is not entitled to transfer benefits, since she receives her basic income, which is subject to personal income tax. At any time she can go on maternity leave, in which case the payment of remuneration will be stopped and the benefit will replace it.

The subsidy is transferred to the woman at her place of employment. If the company was liquidated during maternity leave, payments continue to be made to the social insurance at the place of residence.

The subsidy is calculated based on the amount of earnings, for students - from a scholarship, for military personnel - from salary allowance. For dismissed employees due to the liquidation of the organization, 300 rubles are paid.

The amount of maternity leave is calculated based on average earnings for the last 2 years. If a woman was on maternity leave during a given period of time, it can be replaced by previous months. It is important to exclude periods of sick leave from the calculation.

What is personal income tax certificate 2?

In principle, this is a specialized declaration that reflects the income received by an individual. It should be noted right away that in our country there is a law that indicates the need to deduct tax contributions from almost all types of income of individuals. It is for this reason that the tax agent, played by the employer, must provide detailed data on all types of employee income precisely through certificate 2 of the personal income tax.

The certificate is drawn up on the basis of clearly established rules. In principle, there is a form in which the following data is indicated:

- Information about the employee and employer;

- Data on income received and deductions;

- Data on deductions;

- Total income;

- The total amount of calculated, withheld and remitted taxes.

There are certain features of document design with different characteristics. You can read about this in specialized instructions that are created for accountants as an ideal assistant in the preparation of certificate 2 of personal income tax. You also need to draw your attention to the existence of software, the use of which allows you to get the benefits of quickly calculating the necessary tax deductions.

Maternity leave and taxes

By law, any monetary income is taxed. Is the income of individuals (abbreviated as personal income tax) paid as maternity leave taxed? Employees and their employers are certainly interested in the question: will certain tax levies be made on maternity benefits?

Of course, no one wants this money to be deducted by the authorities. Women want to receive all payments without any deductions that reduce the total amount of vacation pay. In this regard, the question arises: “If tax levies cannot be circumvented, how can they be reduced?”

Such questions are best answered by a qualified lawyer, but in this case you can delve into some of the subtleties on your own, especially since the legislative norms quite clearly state what happens to vacation pay, whether they are taxed or not. In any case, the answer to the question of whether they are taxed is clear - withholding personal income tax from maternity leave is unacceptable. Maternity benefits are not taxed because it is against the law.

Despite the fact that it is illegal to collect personal income tax from maternity leave, there are cases when taxation of cash payments received on maternity leave still occurs. If, despite all this, the accountant at the enterprise withheld a certain amount as tax, it must subsequently be returned to the employee. To return the money, an employee or employee of the organization must write a written statement addressed to the head of the company or accountant, after which the woman will be returned the money due.

The issue of tax withholding from the benefits in question is directly linked to the issue of calculating these payments accrued to a pregnant woman taking maternity leave. According to the existing law, all benefits provided by the state itself are actually exempt from personal income tax.

The only exception is taxes aimed at subsidies for temporary inability to carry out labor activities. That is, the exception is when you are on forced sick leave with a sick child. Unlike other payments, maternity benefits are not subject to any taxes also because these benefits are fully provided by the state.

How to find out the maternity income code in personal income tax certificate 2?

Maternity and pregnancy benefits are not subject to taxation - clause 1 of Art. 217 Tax Code of the Russian Federation. It also needs to be said that there are specialized codes that allow you to determine the type of income. All codes are in specialized reference books. There is no corresponding code for this type of income, such as pregnancy benefit or childbirth benefit. According to the letter of the Ministry of Finance dated 04.04.2007 N 03-04-06-01/109, if the income includes types of income that are exempt from personal income tax, they must be displayed in the certificate with sign 2.

Many accountants, when filling out certificates, put code 2300 in cases of child benefit, which is displayed in the certificate with attribute 2. Thus, income is indicated and at the same time it is indicated that taxes are not deducted from this income.

Sick leave income code in personal income tax certificate 2 The sick leave income code in personal income tax certificate 2 is 2300. Thus, when filling out personal income tax certificate 2, the accountant must reflect this amount under a certain code. The certificate is being issued. Salary income code in personal income tax certificate 2 Salary income code in personal income tax certificate 2 – 2000. Personal income tax certificate format 2 is a very important element in the formation of reporting documentation on income and deducted taxes. Quite. Income code 2300 in personal income tax certificate 2 Income code 2300 in personal income tax certificate 2 reflects benefit data. This refers to temporary disability benefits. Almost all types of income in our country are taxed123 Income code for 2nd personal income tax salary Income code for 2nd personal income tax on salary - 2000. As you know, certificate 2nd personal income tax is based on indicating all the income of an individual, which is displayed in a code format. Reference.

How are maternity benefits calculated?

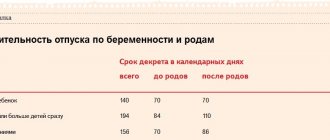

In this article, “maternity leave” is maternity leave . We will describe the specifics of calculating benefits: to whom, how much and how maternity benefits are calculated, and give an example.

The main thing in the article:

• changes and link to the law (new edition) • formula for calculating maternity leave • example • instructions on how to calculate - 5 simple steps • minimum and maximum maternity leave in 2020-2021 • online calculator

Maternity benefits are paid based on 100% of average earnings. The length of service does not matter, unless it is less than 6 months.

Maternity leave in 2020-2021: changes and new law

Changes in 2021 affected mainly the amount of minimum and maximum benefits (due to indexation and an increase in the minimum wage), the maximum values are discussed below.

In Law No. 255-FZ itself, as of 2021, changes have appeared in two articles:

- Article 16 on the procedure for calculating the insurance period has been supplemented - the periods of service in “... the compulsory enforcement authorities of the Russian Federation” are included in the insurance period;

- Article 2.3 has been clarified. on registration and deregistration of policyholders (more details).

There were no changes to the calculation rules.

Formula for calculating maternity benefits

For working women, maternity benefits are paid in the amount of 100% of average earnings for the previous two years.

The formula is simple, but you need to take into account the features and limitations. We will analyze them at each step of calculating benefits.

How to calculate maternity benefits - 5 simple steps

To calculate the amount of maternity payments you need:

| 1. Calculate the average daily earnings, for this we determine: | |

| • billing period – 2 years, for which we calculate earnings | Step 1 |

| • the amount of earnings in this period | Step 2 |

| • number of days of the billing period | Step 3 |

| Calculation summary: average daily earnings | Step 4 |

| 2. Multiply the average daily earnings by the number of days of maternity leave | Step 5 |

We put all stages of the calculation into 5 steps.

Step 1. Determine the billing period

The billing period is the period for which we calculate earnings to then calculate the amount of maternity payments.

In general, the calculation period is 2 calendar years preceding the year of maternity leave. For maternity leave in 2021, these are 2018 and 2021; in 2021, 2021 and 2021 are taken into account.

Exceptions to the general case: during the previous 2 years (or in one of them) there are periods when the employee was already on maternity or child care leave.

In this case, one or both years can be replaced to calculate maternity leave. The year is replaced by an earlier one, but not any year, but immediately preceding the onset of the previous maternity and/or child care leave.

| Example . The employee is going on maternity leave in 2021. The years 2021 and 2021 should be used for calculations. But from September 2015 to July 2017 she was also on maternity leave and maternity leave. In this case, 2021 can be replaced by 2015. Calculation period: 2021 and 2015. The woman submits an application to the employer to change the calculation periods. Such a replacement must necessarily increase maternity payments - this is stated in the law (otherwise the calculation year will not be replaced). And this needs to be checked when making calculations. |

Step 2. Determine the amount of earnings for the billing period

What amounts do we take into account and what amounts do we not take into account?

+ We take into account payments from which deductions were made to the social insurance fund: wages, bonuses, bonuses.

– We do not take into account: sick leave, benefits, income under civil contracts, if there were no contributions to the Social Insurance Fund, and other amounts from which they were not paid to the Social Insurance Fund (unofficial salary, financial assistance up to 4,000 rubles).

We compare the amount of earnings for each year with the legal limit: in 2021 it is 815,000 rubles, in 2021 it is 865,000 rubles, in 2021 it is 912,000 rubles. If annual earnings are greater than the specified limit value, then we take the limit value to calculate benefits.

see: how to calculate 2-NDFL certificate

In the 2-NDFL certificate we are interested in clause 3 “Income taxed at the rate”: codes and amounts.

+ We take into account income with code

- 2000 – income under an employment contract

- 2012 – vacation pay

- 2400 – “compensation” for using the car

— We do not take into account income with a code

Other codes

- 2010, 2201-2209 - payments under civil contracts and royalties - we take into account only if they were deductions to the Social Insurance Fund (must be indicated in the contract)

- 2760 – financial assistance – we take into account the amount exceeding 4000 rubles per year.

To simplify the calculation, you can subtract excess amounts from the total amount of income in clause 5 of the certificate.

read more about where the limit values come from

The law establishes maximum amounts of income per year from which contributions to the Social Insurance Fund are made. Contributions are not paid for incomes above these amounts.

In the law, this maximum amount (or limit value) is called “the maximum base for calculating insurance premiums.” It is set every year, the values are given in the table:

| Year | Maximum base for calculating contributions to the Social Insurance Fund, rub. |

| 2020 | 912 000 |

| 2019 | 865 000 |

| 2018 | 815 000 |

| 2017 | 755 000 |

| 2016 | 718 000 |

| 2015 | 670 000 |

| 2014 | 624 000 |

| 2013 | 568 000 |

| 2012 | 512 000 |

| 2011 | 463 000 |

| 2010 | 415 000 |

Since income exceeding the “limit base” does not make contributions to the Social Insurance Fund, these incomes are not taken into account when calculating maternity benefits.

We add up the amounts for 2 years - we received earnings for the billing period, which we will take into account to calculate the benefit.

Step 3. Calculate the number of days in the billing period.

From the number of calendar days in each year (365 or 366) of the billing period, subtract:

– days when the employee was on sick leave, on maternity leave, or on maternity leave.

Periods of unpaid leave are not excluded.

We add up the result obtained over 2 years - we get the number of days in the billing period.

Step 4. Calculate average daily earnings

We divide the earnings for the billing period (see step 2) by the number of days in the billing period (see step 3). The resulting value must be compared with the minimum and maximum values.

Minimum by law

The average daily earnings received cannot be less than the daily earnings based on the minimum wage (minimum wage).

The minimum wage value is taken as of the date of maternity leave. From 01.01.2020 minimum wage = 12,130 rubles, we get:

RUB 12,130 x 24 months / 730 = 398.79 rub.

If the value of the average daily earnings obtained in the calculations is less than based on the minimum wage, then to calculate the benefit we take the value based on the minimum wage.

For a part-time employee, it is important to take into account the following feature:

If the insured person, at the time of the occurrence of the insured event, works part-time (part-time, part-time), the average earnings, on the basis of which benefits are calculated in these cases, are determined in proportion to the duration of the insured person’s working hours.

- clause 1.1 art. 14 of Law No. 255-FZ (garant.ru)

That is, when working half-time, the minimum is calculated from 50% of the minimum wage.

Maximum by law

The average daily earnings received cannot be more than the daily earnings based on the size of the “limit base for calculating insurance premiums.” What kind of limiting base this is is described above.

Please note: even if there was a replacement of years in the calculation period, the limit value is considered for the two years preceding the date of leaving on the current maternity leave.

For maternity leave in 2021, the maximum value of average daily earnings is:

(RUB 815,000 + RUB 865,000) / 730 days = RUB 2,301.37

For maternity leave in 2021, the maximum value of average daily earnings is:

(RUB 865,000 + RUB 912,000) / 730 days = RUB 2,434.25

If during the calculations we received a value of average daily earnings higher than the limit, then to calculate the benefit we take the limit value.

For an employee whose total length of service (all, i.e., throughout her life) is less than 6 months, it is important to take into account the following feature:

An insured woman with an insurance period of less than six months is paid maternity benefits in an amount not exceeding the minimum wage for a full calendar month... taking into account... coefficients [note: we are talking about regional coefficients, if they are established].

- clause 3 of Art. 11 of Law No. 255-FZ (garant.ru)

After checking for the minimum and maximum, we get the average daily earnings, which we will use in calculating the amount of maternity benefits.

Step 5. Calculate maternity benefits

In the general case, everything is simple: we multiply the resulting average daily earnings (see step 4) by the number of days of maternity leave on sick leave.

Exception: the employee did not present a sick leave certificate to the employer and continued to work and receive a salary for some time. After presenting sick leave, maternity leave is issued, and benefits are calculated from the day you go on maternity leave.

In this case, the maternity leave period is reduced by the number of days for which the employee was paid. Accordingly, the benefit will also be reduced. That is, an employee cannot work a little more before the birth of the child in order to receive benefits a little longer after the birth.

Minimum maternity payments in 2020-2021

The minimum amount of maternity benefits is limited to the minimum wage: the benefit will not be less than the minimum wage if the employee goes on maternity leave from full time.

From January 1, 2021, the minimum wage = 12,130 rubles. (the indicator is taken as of the date of maternity leave).

If maternity leave lasts 140 days, the minimum is RUB 55,830.60. = 12,130 rub. x 24 months / 730 days x 140 days (if maternity leave starts after 01/01/2020)

In the draft federal budget, the minimum wage from January 1, 2021 is 12,445 rubles. Based on this value, for 140 days of maternity leave starting in 2021, they will pay at least 57,281 rubles. = 12,445 rub. x 24 months / 730 days x 140 days

For part-time work (partial week, etc.), the minimum benefit must be proportionally reduced.

The maximum benefit amount is limited by the earnings limit, above which social security contributions are not accrued (see above for limit values).

The maximum amount of maternity benefits in 2020 for 140 days will be 322,191.80 rubles. = (RUB 815,000 + RUB 865,000) / 730 days x 140 days

The maximum amount of maternity benefits in 2021 for 140 days will be 340,795 rubles. = (RUB 865,000 + RUB 912,000) / 730 days x 140 days

If the total insurance period is less than 6 months, the maximum amount of maternity benefits for each calendar month is not higher than the minimum wage.

The employee is going on maternity leave in January 2021. Vacation is 140 days. In 2018, she was on sick leave for 150 days; in 2021, the duration of sick leave was 50 calendar days.

Actual earnings (minus disability benefits) for 2021 amounted to 850,000 rubles, for 2021 – 494,000 rubles.

The minimum wage from January 1, 2021 is 12,130 rubles.

The maximum base for insurance premiums in 2021 is 815,000 rubles, in 2021 – 865,000 rubles.

| Step 1. | During the two years preceding the maternity leave (i.e. in 2021 and 2018), the employee did not have maternity or child care leave - we do not replace the period. Calculation period: 2021 and 2019 |

| Step 2. | Earnings already minus sick leave: for 2021 - 850,000 rubles, for 2021 - 494,000 rubles. Compare with limit values. For 2018, we take the maximum size of the base - 815,000 rubles. (since actual earnings for 2021 turned out to be higher than the limit), for 2021 - actual earnings. Total we get 815,000 + 494,000 = 1,309,000 rubles. |

| Step 3. | Number of days in the billing period: 730 – 150 – 50 = 530 days |

| Step 4. | Average daily earnings: RUB 1,309,000. / 530 days = 2,469.81 rubles. This is higher than the minimum (12,130 rubles (minimum wage) x 24 months / 730 = 398.79 rubles), but also exceeds the maximum. For maternity leave in 2021, the maximum average daily earnings is:( 815,000 + 865,000) / 730 = 2,301.37 rubles. – we take it into account. |

| Step 5. | Benefit amount: RUB 2,301.37. x 140 days = RUB 322,191.80 |

The amount received is paid to the employee in full at a time; no tax is paid on this amount.

Online calculator for calculating maternity benefits in 2019-2020

To calculate maternity benefits, you can use an online calculator. It's convenient and free.

Legislative foundation

- Law of May 19, 1995 N 81-FZ “On state benefits for citizens with children”

Source: https://xn—-7sbbglfctdartkggiohcjidi8b5gqk.xn--p1ai/kak-rasschityvayutsya-dekretnye