Who distributes the costs

It is not always necessary to distribute expenses into direct and indirect. The diagram will help you understand in which case this needs to be done:

As you can see, non-trading organizations in which income and expenses are determined on a cash basis do not need to divide expenses into direct and indirect. The same applies to those who use simplified or imputation instead of the general regime, as well as entrepreneurs. The latter, even if they are in the general regime, do not pay income tax.

All this follows from the provisions of Articles 272, 318 and 320 of the Tax Code of the Russian Federation.

12) expenses for operations with containers;

Chapter 14.4. CONTROLLED TRANSACTIONS. PREPARATION AND PRESENTATION OF DOCUMENTATION FOR TAX CONTROL PURPOSES.

To prevent inspectors from having questions, establish this procedure in your accounting policies. Please note that this cannot be done for work or production of goods.

Such expenses are reflected on the date of early redemption of the share certificate (its share) by the trustee of the banking management fund.

The Tax Code does not clearly define the terms “direct” expenses and “indirect” expenses. However, from the wording of Articles 318 and 320 of the Tax Code of the Russian Federation, we can conclude that direct costs are those that have a clear connection with the process of production of goods (performance of work, provision of services). Indirect costs do not have such a direct connection.

Only those organizations that operate on the accrual basis should distribute expenses into direct and indirect ones. Taxpayers who determine income and expenses using the cash method do not make such divisions. Let's analyze the specifics of these financial indicators, dwell on the features of their reflection in accounting and in the Tax Code of the Russian Federation, and consider their impact on the amount of income tax.

A Belarusian organization received from a non-resident the dividends due minus withheld income tax, with the country of which there is no treaty on the elimination of double taxation (Greece). A certificate of payment of tax in the territory of this state is presented. The amount of tax paid in Greece is included in non-operating expenses. Did the organization do the right thing?

To determine what type of expenses such expenses belong to in tax accounting, you need to proceed from the “systematic” rule.

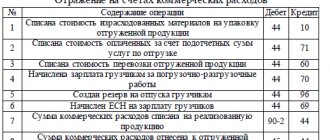

Composition of direct and indirect costs

The composition of direct and indirect costs differs for manufacturing and trading organizations.

Production of goods, works or services

You have the right to determine yourself which costs in the production of goods, works or services are classified as direct and which as indirect. The list of expenses is approved by the head of the organization and recorded in the accounting policy.

When making your choice, be guided by the following principles. As part of direct expenses, reflect those costs that are directly related to production or sales. In this case, you can focus on industry specifics and proceed from the specific features of the production process in the organization itself.

Typically, direct production costs include:

- material costs. In particular, the costs of purchasing raw materials and materials that will be used directly in production, as well as components undergoing installation, and semi-finished products that require additional processing;

- expenses for remuneration of employees engaged in production activities and social insurance contributions accrued from these amounts. The same applies to contributions for insurance against accidents and occupational diseases;

- depreciation of fixed assets that are used in the production of goods, works or services.

This follows from paragraph 1 of Article 318 of the Tax Code of the Russian Federation.

The remaining costs that are not directly related to production or, according to technical regulations, are not included in it, are classified as indirect. In addition to non-operating expenses, they are considered separately.

At the same time, recognize as indirect only those expenses that cannot be classified as direct for objective reasons. For example, the costs of raw materials and supplies, which are included in the cost of a unit of production, can only be classified as direct.

All this follows from Article 318 of the Tax Code of the Russian Federation. This is confirmed by letters from the departments - the Ministry of Finance of Russia dated February 7, 2011 No. 03-03-06/1/79 and the Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3 / [email protected] A similar position is expressed in the definition of the Supreme Arbitration Court RF dated May 13, 2010 No. VAS-5306/10 and resolution of the Federal Antimonopoly Service of the Ural District dated February 25, 2010 No. F09-799/10-S3.

Trade

For trade organizations, the list of direct expenses is fixed. It is given in Article 320 of the Tax Code of the Russian Federation. Direct costs include:

- purchase price of goods. How to calculate it, organizations have the right to determine independently. For example, you can include expenses that are associated with the purchase of goods. These are, in particular, expenses for packaging, warehouse and other costs paid by another organization. Fix the selected option in your accounting policy for tax purposes;

- costs of delivering goods to the buyer's warehouse (when they are considered separately from the cost of the goods themselves).

All other expenses (except for non-operating expenses provided for in Article 265 of the Tax Code of the Russian Federation) are considered indirect and reduce income from sales of the current month.

This procedure is provided for in Article 320 of the Tax Code of the Russian Federation.

Situation: can the costs of delivering goods from the supplier to your warehouse using your own transport be considered direct expenses when calculating income tax? The organization is engaged in trade.

Yes, you can.

The cost of delivering goods to the buyer’s warehouse should be included in direct costs by a trading organization. However, no separate conditions or restrictions have been established. This means that it does not matter whether the buyer pays for delivery to a third party or transports the goods on his own.

But the costs of maintaining your own vehicles used for transporting goods should be classified as indirect costs. They are not directly related to the purchase of goods. This follows from the provisions of Article 320 of the Tax Code of the Russian Federation. A similar opinion is expressed in the letter of the Ministry of Finance of Russia dated January 13, 2005 No. 03-03-01-04.

Situation: can a trade organization include as direct expenses when calculating income tax the costs of delivering goods that it ships to customers directly from manufacturers' warehouses? The organization is engaged in trade.

No, he can not.

Direct costs include the costs of delivering purchased goods (transportation costs) only to the organization’s warehouse, if they are not included in the purchase price. Since during transit trade the goods are shipped directly to the buyer, bypassing their own warehouse, the specified conditions are not met. Therefore, such transport costs should be considered as expenses associated not with the acquisition, but with the sale of goods.

Costs associated with the transportation of goods sold are indirect. At the same time, they reduce income from the sale of these particular goods. This procedure follows from the provisions of Article 286 and paragraph 3 of Article 320 of the Tax Code of the Russian Federation.

Non-operating expenses: what are they, where are they displayed?

An organization operating on a commercial basis must understand why it carries out certain expense transactions. According to the main rule in force in this area, all costs must be determined by an economic basis. In other words, the money spent should turn into profit in the future.

Therefore, determining expenses that are directly related to the main activities of the organization does not cause any difficulties. But non-operating expenses are another matter. Non-sales payments are payments that must also be made by the company, however, they are not directly related to the sale of the product it produces.

We’ll talk about what these expenses are later in the article.

Non-operating expenses

What areas of costs include non-operating expenses?

All expenses of an organization that can be classified as non-operating are taken into account when determining the amount of income tax separately. Each of these areas of costs is presented in Article 265 of the Tax Code of the Russian Federation. Let's look at them further in the list.

- material property objects leased.

- Interest paid on various loans and credits.

- Negative difference between exchange rates.

- Cash contributions to the reserve for doubtful debts.

- Expenses incurred during litigation.

- Expenses spent on paying for the services of a credit institution.

Sometimes this item is mistakenly attributed to indirect costs, but this is not the correct approach, since they are non-operating expenses. If the company sued someone to defend its honor, then the costs taken into account as legal costs will be classified as non-operating, since they were necessary for the company, but did not relate to the production or trade process - Losses incurred during previous annual operating periods that were discovered directly in the current reporting period.

- The amount of debts considered bad that are not covered by the reserve created to pay off doubtful debts.

- Shortages in inventories can also be included in this list, but only if the person responsible for their formation could not be identified, and, as a result, it was not possible to recover compensation from him.

- Losses incurred as a result of force majeure circumstances, as well as emergency situations.

- Monetary losses that occurred at the time of concluding an agreement on the assignment of the right of claim.

Extract from the Tax Code of the Russian Federation Article 265. Non-operating expenses

This list is designated, as we have already said, by the Tax Code of our country. However, this does not mean that it cannot be replenished with new items. On the contrary, the legislator admits and accepts that the tax base will begin to reflect other non-operating expenses that are not directly listed in the list.

Criteria for recognizing non-operating expenses

The main criteria for recognizing non-operating expenses are:

- data that has documentary evidence;

- indirect economic justification.

The main criteria for non-operating expenses can be considered indirect economic feasibility, as well as the availability of documents confirming them

Accounting for non-operating expenses

In the income tax report, non-operating expenses are reflected under separate lines in the second sheet of the declaration, which is subsequently submitted for verification to the Federal Tax Service.

Considering directly the nuances of filling out the declaration, it is also necessary to talk about the division into subcategories of non-operating expenses associated with the payment of income tax. So, the costs in this regard can be:

However, both of these subcategories are not non-sales; they are directly related to the expenditure of funds aimed at the production or sale of goods. The required division has nothing to do with Article No. 265 of interest to us, and is carried out in accordance with another part of the Tax Code - Article No. 318.

Tax Code of the Russian Federation Article 318. The procedure for determining the amount of expenses for production and sales

As for accounting, in this area even the very concept of non-operating expenses is absent. As a consequence, answering the question of which account they will belong to is not so simple.

The required category of payments may relate to non-operating payments from a tax point of view, and in accounting they can be recorded as others. As a result, in practice they will be reflected in the debit of account 91-2.

However, it cannot be said that non-operating and other expenses in each case will be the same according to the list of items. So, the list of other expenses in the accounting department will need to include payments related to the organization and implementation of:

- sports events;

- recreation;

- various entertainment events.

Accounting and tax accounting for non-operating expenses will be very different, simply because these are different areas, however, in both cases, the available data must be reflected

In tax accounting, these expenses are generally not taken into account as an element of the formula for calculating income tax; of course, this means that, in principle, they cannot be classified as non-operating.

That is why, when reflecting payments for designated activities in accounting and tax accounting, you will constantly notice the difference in the final result for the current period of time.

However, this is unlikely to be avoided, since you, as a representative of a commercial organization, simply do not have the right not to reflect any payments or receipts of funds in the accounting department, even in cases where this does not directly affect the calculation of the company’s tax liabilities.

Accounting for non-operating expenses is the responsibility of any organization engaged in commercial activities, since they must be displayed in the declaration to calculate the amount of income tax

Conclusion

Non-operating costs are those that cannot be directly attributed to the process of selling or producing a product created by an organization. Accounting for these expenses is mandatory both for the payment of income tax and in accounting.

However, it is necessary to understand that in the end these payments will be reflected in the documentation differently, and therefore it is best to hire a competent accountant who can clearly divide the same expenses into two categories and pay the money due to the state treasury for them funds, not forgetting to display all transactions in official documentation.

Unfortunately, many organizations that are obliged to pay appropriate taxes to the state treasury cannot always boast of well-established accounting. As a result, the tax authority, which does not receive payments on time, imposes sanctions on the company in the form of fines and penalties.

Unfortunately, violation of tax laws can lead to more serious consequences, and therefore, you need to try to find out as soon as possible how to pay tax penalties, having first calculated them. We will tell you more about this in a special article.

– Income tax: non-operating expenses

Source: https://yr-expert.com/vnerealizaczionnaye-rashody/

When to recognize expenses

Write off indirect expenses in full in the period to which they relate. That is, according to the rules of Article 272 of the Tax Code of the Russian Federation.

But direct costs will have to be distributed. That part of them that relates to the balances of work in progress or unsold goods cannot be recognized as current expenses. This can only be done as goods and works are sold, the cost of which includes such expenses.

This is stated in paragraph 2 of Article 318 of the Tax Code of the Russian Federation.

Direct costs do not need to be distributed between the costs of the current tax (reporting) period and the cost of services not accepted by customers at the end of this period. The reason is that a service for tax purposes is recognized as an activity whose results do not have material expression. Services are sold and consumed in the process of their provision. In this regard, there is no need to distribute all costs incurred, both direct and indirect, among services. You have the right to recognize them in the current period. This procedure for accounting for direct costs must be fixed in the accounting policy.

This follows from paragraph 5 of Article 38, Article 313 and paragraph 3 of paragraph 2 of Article 318 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated June 15, 2011 No. 03-03-06/1/348.

Expenses when there is no income

Situation: how to take into account direct and indirect expenses when calculating income tax using the accrual method if there is no income from sales in the reporting period. Is the organization not a newly created one?

If there is no income in the reporting period, the organization can only recognize indirect expenses.

The explanation is simple - you can recognize direct expenses only as goods, works or services are sold, the cost of which includes the costs. Direct expenses that relate to the balance of unsold products cannot be taken into account when calculating income tax.

As for indirect expenses, they are in no way tied to the revenue received. They can be taken into account in the current period. And expenses in tax accounting are recognized only as expenses that meet the following criteria:

- are aimed at generating income and are economically justified;

- documented.

These are the requirements of paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

Moreover, if a specific expense does not bring direct income to the organization, this does not mean that it is unreasonable. It is enough that it is necessary for the activity that will result in the income generated. Therefore, indirect expenses of an organization can be recognized even in the case when income has not yet been received in the reporting period. Such conclusions are expressed in letters of the Ministry of Finance of Russia dated August 25, 2010 No. 03-03-06/1/565, dated May 21, 2010 No. 03-03-06/1/341, dated December 8, 2006 No. 03 -03-04/1/821.