Why do you need a vacation reserve?

The Labor Code of the Russian Federation gives all employees the right to annual paid leave. Therefore, every employer bears mandatory expenses for:

- vacation pay;

- or monetary compensation for unused days.

State employees plan vacations for all employees in advance. For this purpose, a special document is drawn up - a vacation schedule. The period during which an employee can rest is directly proportional to the time worked: the longer an employee works, the more vacation days there will be. Approximately 2 days accumulate in a month. Compensation for unused vacation days by the employee is paid upon dismissal. You can calculate the period and amount of compensation using the online calculator on our portal.

Therefore, the organization needs a reserve of money from which not only vacation pay or compensation will be paid, but also contributions to extra-budgetary funds. Such a stock is created in the current period and used in the future. For example, the vacation reserve for 2021 had to be formed in 2021. And currently, employers are reserving money for 2021.

Tax accounting

Answering the question of who is obliged to create reserves for vacations in tax accounting, let us turn to the provisions of the Tax Code of the Russian Federation contained in Article 324.1. In tax accounting, the creation of such an estimated liability is a right, not an obligation, of the company. But if you want to avoid taking into account temporary differences, then it makes sense to decide to provide for the accrual of a reserve for vacation pay in tax accounting. In this case, expenses also take into account contributions to the reserve, but do not take into account vacation pay and insurance premiums accrued on them.

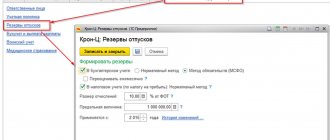

The creation procedure is described in the Tax Code in Article 324.1. If the company decides to form it, then the accounting policy must reflect:

- the very fact of making a decision;

- reservation method;

- maximum deduction for the current tax period;

- deduction percentage.

Calculate the deduction percentage using the formula:

Calculate monthly deductions as follows:

At the end of each year it is necessary to carry out an inventory of the estimated liability. For this:

- The number of unused rest days for each employee is determined.

- Based on the calculation of the average salary for the vacation reserve, the forecast value of the vacation pay amounts is determined.

- The estimate is compared with the actual balance received at the end of the year.

- If the actual accrued amount is less than the calculated amount, then it is additionally accrued, attributing the excess amount to labor costs.

- If the actual accrual turns out to be higher than the inventory estimate, then the excess portion is written off and included in non-operating income.

To facilitate accounting and minimize temporary differences, a decision should be made to create an estimated liability in tax accounting. Moreover, it is worth developing rules for its creation in accounting, similar to those established in the Tax Code.

The Ministry of Finance in 2012, in letter No. 03-03-06/4/29, expressed the opinion that compensation for unused vacation cannot be accrued from the reserve, but should be included in costs at the time of accrual. This position is controversial, since the amounts for which compensation is paid were already included in expenses when forming the estimated liability. Following it leads to overestimation of expenses, and also creates a temporary difference with accounting data.

How often should you do this?

The main task is to ensure that the organization always has money to pay vacation pay and compensation. Therefore, at the reporting date, the amount of money reserved should be equal to the amount that would have to be paid to employees if they went on vacation at the same time. But the reporting date could be:

- end of every month;

- end of each quarter;

- the end of the year.

The first of the listed options - the last day of the month - most accurately reflects the current state of affairs, but is also the most labor-intensive. The last one - December 31 - is the simplest, but also the least informative. It can only be used by those organizations that report only on year-end results. Experts believe that the best option would be to create a vacation reserve on the last day of each quarter.

The budgetary organization has the right to choose a convenient approach, after which the decision must be consolidated in the accounting policy.

Vacation reserve right or obligation?

In accounting, the formation of a vacation reserve became mandatory for all organizations with the entry into force of the Accounting Regulations “Estimated Liabilities, Contingent Liabilities and Contingent Assets” (PBU 8/2010), approved by Order of the Ministry of Finance of Russia dated December 13, 2010 N 167n.

Only small businesses, with the exception of issuers of publicly offered securities, as well as socially oriented non-profit organizations, may not create a reserve.

In accounting, a reserve for vacations, like a reserve for any other estimated liabilities, is created with the aim of uniformly including future expenses in the production or circulation costs of the reporting period.

With regard to tax accounting, an organization has the right to choose whether to form a reserve or not.

PBU 8/2010 does not directly indicate what exactly should be classified as estimated liabilities. The liability must be recognized as an estimate and created in accounting if certain conditions are met.

Let us briefly comment on each of the criteria to make sure that the vacation reserve is indeed an estimated liability.

Firstly, due to the provisions of labor legislation, the organization has a duty to its employees. After six months of continuous work, the employee has the right to annual paid leave, and the organization, accordingly, has the obligation to provide leave while maintaining the place of work (position) and average earnings (Article 114, Article 122 of the Labor Code of the Russian Federation). The employer cannot avoid fulfilling this obligation, otherwise he will be held accountable.

Secondly, the fulfillment of this obligation will lead to a certain outflow of funds; the organization will pay vacation pay to employees, i.e. will bear the costs.

Thirdly, the amount of this estimated liability - the reserve for vacations - can be reasonably estimated.

How exactly to evaluate this obligation is not specified in Russian accounting standards.

If the regulatory legal acts do not establish accounting methods for a specific issue, then when forming an accounting policy, the organization develops an appropriate method based on accounting provisions, as well as International Financial Reporting Standards (clause 7 of PBU 1/08).

Accordingly, companies have freedom of choice regarding the reserve formation methodology. The organization must develop its own methodology and prescribe it in the accounting policy or other local act of the organization.

The approved reserve formation methodology serves as documentary evidence of the validity of the reserve assessment. This will avoid questions and disputes with regulatory authorities.

The validity of the reserve being formed is also confirmed by the calculation of upcoming vacation expenses. It can be carried out automatically in the program or calculated manually. The calculation must be made on the basis of primary documents, for example, regulations on remuneration, staffing, vacation schedules, personnel records.

The estimated liability must be recognized in the organization's accounting records in an amount that reflects the most reliable monetary estimate of the expenses necessary to settle this liability.

The principal amount of the estimated vacation liability is calculated as the product of the number of vacation days unused by all employees of the organization at the end of the quarter (according to personnel records) by the average daily earnings for the organization for the last six months.

So, what exactly needs to be written down in the accounting policy?

First, you need to decide whether you will create a reserve for each employee or for all employees as a whole. In the first case, to determine the reserve for the entire organization, we sum up the reserves for all employees.

Secondly, it is necessary to establish in the accounting policy the frequency of deductions. There are two options:

· make periodic contributions – quarterly;

· create a reserve based on the number of vacation days not taken by employees at the end of each month.

Thirdly, it is worth specifying whether, when forming a reserve, you will increase the principal amount of the estimated liability by the amount of mandatory contributions to the Social Insurance Fund of the Russian Federation, the Pension Fund of the Russian Federation, for medical insurance and for insurance against industrial accidents.

Fourthly, you need to select the period for which the average daily earnings will be calculated and what payments will be taken into account in the calculation. In our opinion, the calculation should be carried out taking into account the established methodology for calculating average earnings.

Thus, at present, the organization still has the right to develop, depending on its capabilities and needs, the most optimal methodology for itself.

The ideal option would be to form a reserve at the end of each month for all employees based on the number of rest days they earned during that month and average earnings. But this is very labor-intensive.

Now programs are being created to automate this process, but this requires additional costs.

It is possible to establish in the accounting policy for accounting purposes the creation of upcoming expenses for vacation pay in accordance with Art. 324.1 of the Tax Code of the Russian Federation.

Based on the results of the reporting period, the actual accrued amounts of vacation pay may differ from the amount of the formed reserve for a given year.

Therefore, after the expiration of the reporting period, it is necessary to conduct an inventory of the vacation reserve.

Based on the inventory results, two options are possible:

1) vacation in the current year is not fully used by the employee - the amount of the reserve for the remaining days is transferred to the next year.

2) a lack of reserve is identified - it is necessary to make additional accruals and include them in labor costs.

Clarification is made based on the number of days of unused vacation, the average daily amount of labor costs.

Nazarenko Tatyana Alexandrovna

April 2015

View “Entire list”

Method 1: personalized calculation

If an organization decides to calculate the vacation reserve for each employee, the following formula is used:

RO = K × ZP,

Where:

- RO - vacation reserve;

- K - the balance of unused rest days by the employee;

- Salary is his average daily earnings.

IMPORTANT!

In all three cases, all data is taken on the day of calculation.

You also need to determine the amount of reserve to pay insurance premiums. The formula used for this is:

Рсв = К × ЗП × С,

Where:

- RSV - reserve of expenses for insurance premiums;

- C is the rate of insurance premiums.

Having summed up both obtained values, we get the amount that needs to be reserved to pay for the vacation.

How to determine the estimated value when creating a reserve for vacation pay?

Recommendations regarding the procedure for determining the estimated value when creating a reserve for vacation pay are contained in Letter of the Ministry of Finance of the Russian Federation dated May 20, 2015 No. 02-07-07/28998.

According to them, the estimated liability in the form of a reserve for vacation pay for time actually worked can be determined monthly, quarterly or annually, on the last day of the month, quarter or year, respectively, based on the number of days of unused vacation for all employees on a specified date (data provided by the personnel service) .

The reserve is calculated as the amount of vacation pay for employees for the time actually worked on the date of calculation and the amount of insurance contributions for compulsory health insurance, compulsory health insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, as well as contributions for injuries.

Officials recommend determining the amount of expenses to pay for upcoming vacations in one of the following ways:

1) based on the average salary calculated individually for each employee;

2) based on the average salary calculated for the institution as a whole;

3) based on the average salary calculated for individual categories of employees (personnel groups).

Let's look at each of them in more detail.

Method 1. It is used, as a rule, if the institution does not have many employees. When using this method, the calculation is made individually for each employee using the following formula:

P1 = K1 x ZP1, where:

P1 – the amount of contributions to the leave reserve for one employee in terms of wages; K1 – the number of vacation days not used by an employee for the period from the start of work to the calculation date (end of each month, quarter, year) for one employee; ZP1 – the average daily earnings of an employee, calculated according to the rules for calculating average earnings for vacation pay as of the date of calculation of the reserve.

To determine the total amount of the leave reserve in terms of wages, the amounts of contributions to the reserve for all employees are summed up using the formula:

Vacation reserve = P1 + P2 + Pn.

Method 2. This method is used, as a rule, if the institution has many employees. In this case, the average salary is calculated for the institution as a whole using the following formula:

Vacation reserve = K x Salary, where:

K – the total number of vacation days not used by all employees for the period from the start of work to the calculation date (the end of each month, quarter, year); ZPsr. – average salary for all employees of the institution as a whole.

Method 3. When using this method, the average salary is calculated for individual categories of employees (personnel groups) using the formula:

Vacation reserve = K1 x ZPsr.1 + K2 x ZPsr.2 + K3 x ZPsr.3, where:

K1, K2, K3 – the number of all days of unused vacation for each category of employees; ZPsr. 1, ZPsr. 2, ZPsr. 3 – average salary calculated for each category of workers.

The reserve for payment of insurance premiums is calculated taking into account the methodology for calculating the reserve for payment of vacations. That is, the amount of insurance premiums when forming a reserve can be calculated:

1) for each employee individually according to the formula:

P1 = K1 x ZP1 x C, where:

P1 – the amount of contributions to the vacation reserve for one employee in terms of insurance premiums; K1 – the number of vacation days not used by an employee for the period from the start of work to the calculation date (end of each month, quarter, year) for one employee; ZP1 – average daily earnings of an employee, calculated according to the rules for calculating average earnings for vacation pay as of the date of calculation of the reserve; C (hereinafter) – the rate of insurance premiums.

Accordingly, the amount of the reserve for insurance premiums for the institution as a whole is determined by summing up contributions to the reserve for each employee, in the same way as we determined the vacation reserve in terms of wages;

2) on average for the institution according to the formula:

Reserve of insurance premiums = K x ZPsr. x C;

3) for each category of workers according to the formula:

Reserve of insurance premiums = (K1 x ZPsr. 1 + K2 x ZPsr. 2 + K3 x ZPsr. 3) x C.

It must be taken into account that the amount of insurance premiums is calculated taking into account the maximum base for their calculation.

Example 1.

The accounting policy of the institution establishes that the estimated liability in the form of a reserve for vacation pay is determined annually (on the last day of the calendar year) based on the average salary and the number of days of unused vacation for the institution as a whole. As of 12/31/2019:

– the average daily wage is 950 rubles; – the total number of vacation days not used by employees is 190; – the number of vacation days planned in 2021 is 1,400.

To simplify the example, we do not consider the reserve in terms of insurance premiums.

The reserve for vacation pay as of December 31, 2019 will be:

– regarding unused vacation for previous periods – 180,500 rubles. (190 days x 950 rub.); – the amount of monthly contributions to the reserve is 110,833 rubles. ((1,400 days x 950 rub.) / 12 months).

Calculation example using method 1

Suppose there are three employees in an organization, the data on them is as follows:

- Ivanov: remaining vacation days - 5 calendar days, average daily earnings - 2000.00 rubles;

- Petrov: remaining days - 12 calendar days, average daily earnings - 1200.00 rubles;

- Sidorov: remaining days - 8 calendar days, average daily earnings - 1000.00 rubles.

First, we calculate vacation pay and contributions for each employee.

Insurance premium rates are:

- Pension Fund - 22%;

- Social Insurance Fund - 2.9%;

- FFOMS - 5.1%;

- FSS for injuries - 0.2%.

Thus, the total rate for calculation = 22 + 2.9 + 5.1 + 0.2 = 30.2%.

Calculation for Ivanov:

- Amount for reserve = 2000 rub. × 5 days = 10,000 rub.

- Insurance premiums = 10,000 × 0.302 = 3020 rubles.

In total, Ivanov will need 10,000 + 3020 = 13,020 rubles.

Similarly, we get the figures for Petrov (RUB 18,658.20) and Sidorov (RUB 10,416).

Let's sum up the values for all employees. Total you need to reserve 13,020 + 18,658.20 + 10,416 = 42,094.20 rubles.

Calculation example using method 3

Let the data for employee categories at the beginning of the year be as follows:

- for management personnel: rest of vacation days - 300 calendar days, average daily earnings - 2000.00 rubles.

- for business personnel: remaining days - 200 calendar days, average daily earnings - 1200.00 rubles.

Reserve amount = 2000 rub. × 300 days + 1200 rub. × 200 days = 840,000 rubles.

The total rate is also 30.2%, therefore, the amount to pay insurance premiums = 840,000 × 0.302 = 253,680 rubles.

In total, you need to reserve 840,000 + 253,680 = 1,093,680 rubles.

How to reflect in accounting

In budget accounting, the accrual of the reserve for vacation pay and all other operations with it are reflected in the following account correspondences:

| Contents of operation | accounting entry | |

| Debit | Credit | |

| Formation | ||

| For vacation pay | KRB.1.401.20.211 | KRB.1.401.60.211 |

| For insurance premiums | KRB.1.401.20.213 | KRB.1.401.60.213 |

| Accrued expenses | ||

| For vacation pay | KRB.1.401.60.211 | KRB.1.302.11.730 |

| For payment of insurance premiums | KRB.1.401.60.213 | KRB.1.303.00.730 |

| Refinement upwards (downwards using the “red reversal” method) | ||

| For vacation pay | KRB.1.401.20.211 | KRB.1.401.60.211 |

| For payment of insurance premiums | KRB.1.401.20.213 | KRB.1.401.60.213 |

Who is obliged to create

The obligation to create an estimated liability for vacations in accounting is prescribed by PBU 8/2010, approved by Order of the Ministry of Finance No. 167n dated December 13, 2010. What is a vacation reserve? It is an estimated monetary expression of the employer’s obligation to pay vacation pay to employees, formed as of a certain date.

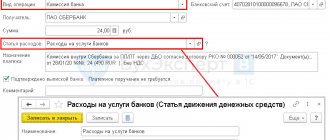

The organization determines the rules for its formation independently and provides for it in its accounting policies. When it is created, the amount of the estimated liability is recognized as expenses, and not the payment of vacation pay. The latter will be accrued at the expense of the estimated liability. To account for them, account 96 of the chart of accounts is used, to which a separate sub-account “Reserve for vacation pay” is opened.

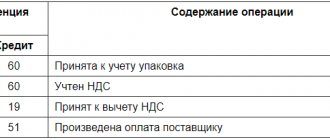

Reserve for vacation pay, postings:

| Operation | Debit | Credit |

| Funds have been reserved for future vacation pay | 20, 25, 26, 44 | 96 |

| Vacation pay accrued | 96 | 70 |

| Accrued amounts paid | 70 | 51, 50 |

Are all organizations required to create a reserve for vacation pay in their accounting? All companies are required to do this, with the exception of those who have the right to keep accounting in a simplified form. The right to conduct simplified accounting is established by the accounting law No. 402-FZ for the following organizations:

- small businesses;

- non-profit organizations;

- participants of the Skolkovo project.

ConsultantPlus experts have compiled a detailed guide on how to create and use a vacation reserve in an organization’s accounting. Use these instructions for free.

What wiring to use

In addition, the accountant who reflects the reserve for vacation pay will need postings.

For vacation pay and compensation:

- debit - 96 “Reserves for upcoming expenses”, subaccount “Reserve for vacation pay”;

- credit - 70 “Settlements with personnel for wages”.

For contributions:

- debit - 96 “Reserves for upcoming expenses”, subaccount “Reserve for vacation pay”;

- loan - 69 “Calculations for social insurance and security”.

What should the accounting policy disclose regarding the creation of a reserve for vacation pay?

If the rules for its reflection in accounting have not been established for any accounting object, the institution, in agreement with the founder and financial body of the public legal entity, defines them in its accounting policies (clause 7 of the GHS “Accounting policies, estimates and errors” "). In particular, accounting policies:

– the reporting date on which the reserve is formed (adjusted) must be determined (this can be the last day of each month, the last day of each quarter or the last day of the calendar year); – a methodology for determining the estimated value must be selected (personalized for each employee, for the institution as a whole, for individual groups of employees); – the working chart of accounts 0 401 60 000 “Reserves for future expenses” must be detailed.

It should be taken into account that the reserve for vacation pay is formed regardless of the source of financial support (Letter of the Ministry of Finance of the Russian Federation dated January 14, 2016 No. 02-07-10/604).